Академический Документы

Профессиональный Документы

Культура Документы

Ch5 Capacity Planning

Загружено:

Jess JerinnАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ch5 Capacity Planning

Загружено:

Jess JerinnАвторское право:

Доступные форматы

BBN

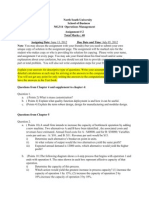

Chapter V Capacity Planning for Products and Services

Capacity: Capacity refers to an upper limit on the load that an operating unit can handle. The operating unit can be a plant, department, machine, store, or worker. Importance of Capacity Planning: The goal of strategic capacity planning is to achieve a match between the long-term supply capabilities of an organization and the predicted level of long-term demand. Organizations plans capacity for various reasons. Among the major reasons are changes in demand, changes in technology, changes in environment, and recognized threats or opportunities. A gap between current and desired capacity will result in capacity that is out of balance. Overcapacity causes operating costs that are too high, while undercapacity causes damaged resources and possible loss of customer. For a number of reasons capacity decisions are among the most fundamental of all the design decisions. They are as follows: (i) Capacity decisions have a real impact on the ability of the organization to meet future demands for products and services. Capacity essentially limits the rate of output possible. (ii) Capacity decisions affect operating costs. If the capacity and demand matches, the operating cost decreases. (iii) Capacity is a major determinant of initial cost. The greater the capacity the greater its initial cost. (iv) Capacity decisions involve long-term commitment of resources. Once these decisions are implemented, it may be difficult or impossible to modify them without incurring major cost. (v) Capacity decisions can affect competitiveness. Defining and measuring capacity: In selecting a measure of capacity, it is important to choose one that does not require updating. For example, dollar amounts are often a poor measure of capacity because price changes necessitate updating of that measure. The measure of capacity must be tailored to the situation. Keeping this in mind, we define the capacity by two ways: (i) Design capacity: It is the maximum rate of output achieved under ideal conditions. (ii) Effective capacity: Design capacity minus allowances (such as personal time, maintenance). It is usually less than design capacity owing to realities of changing product mix, the need for periodic maintenance of equipment, lunch break, coffee breaks, etc. Measures of system effectiveness: Above different measures of capacity are useful in defining two measures of system effectiveness: (a) Efficiency: Efficiency is the ratio of actual output to effective capacity. actual output Efficiency = 100% effective capacity

BBN (b) Utilization: Capacity utilization is the ratio of actual output to design capacity. actual output utilization = 100% design capacity Example: Given the information bellow, compute the efficiency and the utilization of the vehicle repair department. Design capacity = 50 trucks per day Effective capacity = 40 trucks per day Actual output = 36 tracks per day Solution: Efficiency = actual output 36 = 100% = 90% effective capacity 40

actual output 36 = 100% = 72% design capacity 50 Compared to the effective capacity of 40 units per day, 36 unit per day looks pretty good. However, compared to the design capacity of 50 units per day, 36 unit per day is much less impressive although probably more meaningful. Increasing utilization depends on being able to increase effective capacity and this requires a knowledge of what is constraining effective capacity. utilization = Example 2: Determine efficiency and utilization for a loan processing operation that processes an average of 7 loans per day. The operation has a design capacity of 10 loans per day and an effective capacity of 8 loans per day. Example 3: In a job shop, effective capacity is only 50% of the design capacity, and actual output is 80% of effective output. What design capacity would be needed to achieve an actual output of eight jobs per week? Determinants of effective capacity: Many decisions about system design have an impact on capacity. The main factors relate to 1. Facilities 4. Operational factors 2. Product or service process 5. Supply chain 3. Human considerations 6. External

1. Facilities: Among the design of facilities location factors such as transportation costs, distance to market, labor supply, and energy sources are important. Also, layout of the work area often determines how smoothly work can be performed. Environmental factors such as heating, lighting, and ventilation also play an important role in determining whether personnel can perform effectively. 2. Product and service factors: Product and service design have a tremendous influence on capacity. For example, when items are similar, the ability of the system to produce those items is generally much greater than when successive items differ. 3. Human factors: The tasks that make up a job, the variety of activities involved, and the training, skill and experience required to perform a job all have an impact on the 2

BBN potential and actual output. Also motivation of employee has an important impact on capacity. 4. Operational factors: Scheduling, inventory stocking decisions, purchasing requirements, quality inspection and control have impact on effective capacity. 5. Supply chain factors: It should be taken into account in capacity planning if substantial capacity changes are involved. Ex. If the capacity increases, will the elements of supply chain be able to handle the increase? 6. External factors: Product standards, safety regulations, pollution control have impact on capacity planning. Facilities: (i) design location (ii) layout (iii) environment 4. Operational (i) Scheduling (ii) Quality assurance (iii) Purchasing 2. Product/ service (i) Design (ii) Product /service mix 5. External (i) Product standard (ii) Safety regulations (iii) Pollution control 3. Human factors (i) Job content (ii) Training (iii) Motivation

Factors that determine effective capacity. Steps in Capacity planning process: 1. Estimate future capacity requirements. 2. Evaluate existing capacity and facilities and identify gaps. 3. Identify alternatives for meeting requirements. 4. Conduct financial analysis of each alternative. 5. Asses key qualitative issues for each alternative. 6. Select one alternative to pursue. 7. Implement the selected alternative. 8. Monitor results. Developing capacity alternatives: To improve capacity management the followings can be done: 1. Design flexibility in the systems: Provision for future expansion in the original design of structure frequently can be obtained at a small price compared to what it would cost to remodel an existing structure. Example: If water lines, power hookups, and waste disposal lines are put in place initially, the modification to this structure can be minimized. 2. Take stages of life cycles into account: Capacity requirements are often closely linked to the stage of the life cycle (introduction phase, growth phase, maturity phase, ) that a product or service is in.

BBN At introduction phase, it is difficult to determine both market size and the organizations share of that market. So the organization should be cautious in making inflexible capacity investment. In growth phase, the overall market may experience rapid growth. In the maturity phase, the size of the market levels off and the organizations tend to have stable market share. 3. Take a big picture approach to capacity changes: When developing capacity alternatives, it is important to consider how parts of the system interrelate? 4. Prepare to deal with capacity chunks: Capacity increases are often acquired in large chunks rather than smooth increments, making it difficult to achieve a match between desired capacity and feasible capacity. Ex. if the desired capacity of an operation is 55 units/ hr but the machine is able to produce 40 units/hr. So one machine causes 15 unit/hr short but two machine cause 25 units/hr excess. 5. Attempt to smooth out requirements: Unevenness in capacity requirements create certain problems. Ex. during bad weather public transportation ridership tends to increase compare to that of good weather. 6. Identify the optimal operating level: At the optimal level cost per unit is the lowest for that production unit. If the output rate is less than the output level, increasing the output rate will result in decreasing average unit costs. This is called economics of scale. But if the output is increased beyond the optimal level, average unit costs will be larger. This is called diseconomies of scales. Evaluating alternatives: An organization needs to examine alternatives for future capacity from different perspectives. Most obvious are economic considerations. Less obvious is possible negative public opinion. Techniques used evaluating capacity alternatives are: (i) Cost-Volume analysis (ii) financial analysis and (iii) decision theory

Cost-Volume analysis: It is a relation between cost, revenue, and volume of output. It estimates the income of an organization under different operating conditions. It is useful as a tool for comparing capacity alternatives. Formulation: Step 1: Identify all costs related to the production of a product. Step 2: Designate them as fixed (remain constant) cost (Ex. equipment cost, property taxes) or variable costs (vary with volume of output, Ex. material cost and labor cost). Total cost = Fixed cost + total variable cost. If we define, total cost, fixed cost, and total variable cost by TC, FC, VC, then TC = FC + VC . VC = Q v , where v variable cost per unit and Q is the quantity or volume of output. But

BBN

TC=VC+FC

TR

Amount ($) () FC

VC

Amount ($) ()

0

Q (Volume in units)

0

Q (Volume in units)

Similarly, if revenue per unit is R and total revenue is TR then, TR = R Q Then profit, P = TR TC = R Q ( FC + v Q ) = Q( R v ) FC . Therefore, the required volume P + FC Q needed to generate a specified profit is, Q = Rv QBEP , the volume of output at which total cost = total revenue. The break-event (BEP) FC QBEP = R v

Profit TR

TC

Amount ($) ()

Loss

BEP Units Q (Volume in units)

Break-even point (BEP): The volume at which total cost = total revenue. When volume is less than the break-even point, there is a loss and when volume is greater than the break-even point, there is a profit. Example: The owner of a old-fashioned berry pies, is considering adding a new line of pies, which will require leasing new equipment for a monthly payment of $6,000. Variable costs would be $2 per pie and revenue is $7 per pie. (a) How many pies must be sold in order to break even? (b) What would the profit or loss be if 1,000 pies made and sold in a month? (c) How many pies must be sold to realize a profit of $4,000? (d) If 2,000 pies can be sold, and a profit target is $5,000, what price should be charged per pie? Solution: 5

BBN Given, FC = $6,000, (a) QBEP = VC = $2 per pie, R = $7 per pie.

FC 6000 = = 1,200 pies per month. R VC 7 2

(b) For Q = 1000 , P = Q( R v ) FC = 1000( 7 2 ) 6000 = $1000. (c) For P = $4000 , Q = P + FC $4000 + $6000 = = 2,000 pies Rv $7 $2

(d) P = Q( R v ) FC 5000 = 2000( R 2 ) 6000 R = $7.50 Example 2: A manager has the option of purchasing 1, 2, or 3 machines. Fixed cost and potential volumes are as follows No. of Total Corresponding Machines fixed costs range of output 1 $9,600 0 to 300 2 $15,000 301 to 600 3 $20,000 601 to 900 Variable cost is $10 per unit, and revenue is $40 per unit. Determine the break-even point for each range. (b) If projected annual demand is between 580 to 660 unit, how many machines should the manager purchase? Solution: (a) QBEP1 = QBEP 2 = QBEP 3 = FC 9600 = = 320 units. (Out side the range 0 300, so, no break-even point). R VC 40 10

(a)

FC 15000 = = 500 units. (Inside the range 301 600, so, a break-even point). R VC 40 10

FC 20000 = = 666.67 units. (Inside the range 601 900, so, a break-even point). R VC 40 10 b) From the break-even points we see that in the second range, the break-even point is 500 which is in 301 - 600. This means that even if the demand is at the low end of the range (580 - 660), it would be above the break-even point and thus yield a profit. But in the 3rd range, the break-even point is 666.67 which is in 601 - 900. This means that even if the demand is at the upper end of the range (580 - 660), the volume would still be less than the break-even point and thus yield no profit. Hence the manager should choose to purchase two machines.

BBN

3

2 1 300 600 900

Financial analysis: A problem that is universally encountered by managers is how to allocate limited funds. A common approach is to apply financial analysis to rank investment proposals. Cash flow and present value are two important terms used in financial analysis. Cash flow is the difference between the cash received from sales and the cash outflow for labor, materials, and taxes. Present value expresses in current value the sum of all future cash flows of an investment proposal. Three common methods in financial analysis are: (i) Payback (ii) present value (iii) internal rate of return Payback: It focuses on the length of time it will take for an investment to return its original cost. Example: An investment with an original cost of $6,000 and a monthly net cash flow of $1,000 has a payback period of six months. Payback ignores the time value of money. Present value: The present value method summaries the initial cost of an investment, its estimated annual cash flows, and any expected salvage value (save money or recover money) in a single value called equivalent current value taking into account the time value (e.g. interest rates) of money. Internal rate of return: It summaries the initial cost, expected annual cash flows and estimated salvage value of an investment proposal in an equivalent interest rate. Decision theory: Decision theory is used for financial comparison of alternatives under conditions of risk or uncertainty. Example: A firms manager must decide whether to make or buy a certain item used in the production of vending machines. Making would involve annual lease costs of $150,000. Cost and volume estimates are as follows. Make Buy Annual fixed cost $150,000 None Variable cost per unit $60 $80 Annual volume (units) 12,000 12,000 (a) Should the firm buy or make this item? (b) There is a possibility that volume could change in the future. At what volume would the manager be indifferent between making and buying? Solution: 7

BBN (a) Annual cost to make the item= 150,000 + 12,000 60 = $870,000 Annual cost to buy the item = 0 + 12,000 80 = $960,000 So, the manager would choose to make the item. (b) TC make = TC buy 150,000 + Q 60 = 0 + Q 80 Q = 7,500 Example: A small firm produces and sells automotive items in a five state area. The firm expects to combine assembly of its battery chargers line at a single location. Currently, operations are in three widely scattered locations. The leading candidate for location will have a monthly fixed cost of $42,000 and variable costs of $3 per charger. Chargers sell for $7 each. Prepare a table that shows total profits, fixed costs, variable costs, and revenues for monthly volumes of 10,000, 12,000, and 15,000 units. What is the break-even point? Also determine profit when volume equals 22,000 units. Example: A produces of pottery is considering the addition of a new plant to absorb the backlog of demand that now exists. The primary location being considered, will have fixed costs of $9,200 per month and variable costs of $0.7 per unit produced. Each item is sold at a price that averages $0.9. (i) What volume per month is required in order to break-even? (ii) What profit would be realized on a monthly volume of 61,000 per month? (iii) What volume is needed to obtain a profit of $16,000 per month? (iv) What volume is needed to provide a revenue of $23,000 per month?

Вам также может понравиться

- Chapter 4 and 5: Responsibility CentersДокумент30 страницChapter 4 and 5: Responsibility CentersRajat SharmaОценок пока нет

- Capacity Planning: Supplement 7Документ20 страницCapacity Planning: Supplement 7Kylie TarnateОценок пока нет

- StudentДокумент16 страницStudentJayne Carly CabardoОценок пока нет

- Operations Management: Aggregate PlanningДокумент16 страницOperations Management: Aggregate PlanningArun MishraОценок пока нет

- Productivity and Reliability-Based Maintenance Management, Second EditionОт EverandProductivity and Reliability-Based Maintenance Management, Second EditionОценок пока нет

- Chapter 2: Operations Strategy and CompetitivenessДокумент3 страницыChapter 2: Operations Strategy and CompetitivenessMarie GonzalesОценок пока нет

- Assignment 5 - Capacity PlanningДокумент1 страницаAssignment 5 - Capacity Planningamr onsyОценок пока нет

- Group A AssignmentДокумент18 страницGroup A Assignmenttaohid khan100% (1)

- Chap 010Документ107 страницChap 010sucusucu3Оценок пока нет

- Capacity Planning ProblemsДокумент6 страницCapacity Planning Problemsvita sarasi100% (1)

- MGT 3200 CH 1 and 2 Study GuideДокумент7 страницMGT 3200 CH 1 and 2 Study GuideJuan David Torres TellezОценок пока нет

- Operations Management: William J. StevensonДокумент35 страницOperations Management: William J. StevensonJitesh JainОценок пока нет

- Homework For Supply Chain ManagementДокумент2 страницыHomework For Supply Chain ManagementNothing was0% (1)

- Sample Test Questions For EOQДокумент5 страницSample Test Questions For EOQSharina Mhyca SamonteОценок пока нет

- Indvi Assignment 2 Investment and Port MGTДокумент3 страницыIndvi Assignment 2 Investment and Port MGTaddisie temesgen100% (1)

- Assignment 2: Problem 1Документ3 страницыAssignment 2: Problem 1musicslave960% (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- Opm 301 PDFДокумент5 страницOpm 301 PDFJasonSpringОценок пока нет

- Operations Management: For Competitive AdvantageДокумент47 страницOperations Management: For Competitive AdvantagedurgaselvamОценок пока нет

- The Forsite Company Is Screening Three New Product IdeasДокумент2 страницыThe Forsite Company Is Screening Three New Product Ideasnaqash sonuОценок пока нет

- Exam With SolutionsДокумент19 страницExam With Solutionsطه احمدОценок пока нет

- Productivity ProblemsДокумент4 страницыProductivity ProblemsMohit MehndirattaОценок пока нет

- Busi411hw1 CH4Документ3 страницыBusi411hw1 CH4Asma Yousuf67% (3)

- Definition of Operation Management 2Документ24 страницыDefinition of Operation Management 2Ros A LindaОценок пока нет

- Chap 13 Inventory ManagementДокумент43 страницыChap 13 Inventory ManagementAcyslz50% (2)

- Chapter 1Документ11 страницChapter 1Areef Mahmood IqbalОценок пока нет

- CH 13Документ20 страницCH 13zyra liam stylesОценок пока нет

- Capacity: Critical Thinking ExercisesДокумент6 страницCapacity: Critical Thinking ExercisesJennysanОценок пока нет

- OM CH6,7,8,10 QuestionsДокумент17 страницOM CH6,7,8,10 Questionsxuzhu5100% (1)

- Relevant Costs 4Документ6 страницRelevant Costs 4Franklin Evan PerezОценок пока нет

- Chapter 4: The Master Schedule Discussion Questions and ProblemsДокумент3 страницыChapter 4: The Master Schedule Discussion Questions and ProblemsAmeen Mohamed AlameenОценок пока нет

- Chapter - 9.pdf Filename UTF-8''Chapter 9 PDFДокумент37 страницChapter - 9.pdf Filename UTF-8''Chapter 9 PDFJinky P. RefurzadoОценок пока нет

- Module 1 - Introduction and Management Decision Making - Homework SolutionsДокумент4 страницыModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelОценок пока нет

- TBChap006 Selecting Employees and Placing Them in JobsДокумент100 страницTBChap006 Selecting Employees and Placing Them in Jobskevin.hdkОценок пока нет

- Master Production ScheduleДокумент2 страницыMaster Production ScheduleklintОценок пока нет

- MGMT 432 - Operations Management AssignmentДокумент10 страницMGMT 432 - Operations Management AssignmentYohannes SharewОценок пока нет

- Problems: Week Crew Size Yards InstalledДокумент2 страницыProblems: Week Crew Size Yards Installedfarnaz afshariОценок пока нет

- Major Plant RenovationДокумент1 страницаMajor Plant RenovationgeorgecheboОценок пока нет

- MGT 3332 Sample Test 1Документ3 страницыMGT 3332 Sample Test 1Ahmed0% (1)

- A Missouri Job Shop Has Four Departments Machining M DippingДокумент1 страницаA Missouri Job Shop Has Four Departments Machining M DippingAmit PandeyОценок пока нет

- Facility LayoutДокумент2 страницыFacility LayoutOsama0% (1)

- 8.chapter 5b Aggregate Production Planning-1Документ34 страницы8.chapter 5b Aggregate Production Planning-1opio jamesОценок пока нет

- Demand Forecasting in A Supply Chain: Chopra and Meindl, Chapter 4Документ43 страницыDemand Forecasting in A Supply Chain: Chopra and Meindl, Chapter 4Girish Dey0% (1)

- Chapter 08Документ10 страницChapter 08Fardin Sabahat KhanОценок пока нет

- Chapter - 7.pdf Filename UTF-8''Chapter 7-1Документ33 страницыChapter - 7.pdf Filename UTF-8''Chapter 7-1Jinky P. RefurzadoОценок пока нет

- Template For Breakout Activity 2Документ6 страницTemplate For Breakout Activity 2M Rahman0% (3)

- Krm8 Ism Ch11Документ34 страницыKrm8 Ism Ch11Saif Ullah Qureshi100% (2)

- 7.0 Inventory ManagementДокумент24 страницы7.0 Inventory Managementrohanfyaz00Оценок пока нет

- Assignment Sir Tariq QuesДокумент4 страницыAssignment Sir Tariq QuesSahar Batool QaziОценок пока нет

- Operations and Production Management-Chapter 2. 9th Edition SolutionДокумент6 страницOperations and Production Management-Chapter 2. 9th Edition Solutionspurtbd100% (1)

- Tme 601Документ14 страницTme 601dearsaswatОценок пока нет

- Production & Operations Management: Unit - 1Документ148 страницProduction & Operations Management: Unit - 1Sumatthi Devi Chigurupati100% (1)

- Assignment #2Документ2 страницыAssignment #2dip_g_007Оценок пока нет

- CH 1 OM&CompetitivenessДокумент22 страницыCH 1 OM&CompetitivenessNatarajan AncОценок пока нет

- Layout Strategies Powerpoint PresentationДокумент29 страницLayout Strategies Powerpoint PresentationstanisОценок пока нет

- SMChap 007Документ86 страницSMChap 007Huishan Zheng100% (5)

- 19 KRM Om10 Ism ch16Документ36 страниц19 KRM Om10 Ism ch16OPMANG100% (1)

- CH 1-5 OMДокумент71 страницаCH 1-5 OMAbu DadiОценок пока нет

- Corporate Financial Analysis with Microsoft ExcelОт EverandCorporate Financial Analysis with Microsoft ExcelРейтинг: 5 из 5 звезд5/5 (1)

- 3 Departmental AccountsДокумент13 страниц3 Departmental AccountsJayesh VyasОценок пока нет

- EFim 05 Ed 3Документ23 страницыEFim 05 Ed 3bia070386100% (1)

- Clarification Regarding Service Tax On Delayed Payment Charges CollectedДокумент2 страницыClarification Regarding Service Tax On Delayed Payment Charges Collectedpr_abhatОценок пока нет

- Residential Valuation Sydney SampleДокумент6 страницResidential Valuation Sydney SampleRandy JosephОценок пока нет

- Fin Statement AnalysisДокумент22 страницыFin Statement AnalysisJon MickОценок пока нет

- Deemed Export BenefitДокумент37 страницDeemed Export BenefitSamОценок пока нет

- Internship Report ON Foreign Exchange & Remittance Activities of Al-Arafah Islami Bank Limited''Документ64 страницыInternship Report ON Foreign Exchange & Remittance Activities of Al-Arafah Islami Bank Limited''Mounota MandalОценок пока нет

- Prop OutlineДокумент22 страницыProp OutlinekmsilvermanОценок пока нет

- Refinery Operating Cost: Chapter NineteenДокумент10 страницRefinery Operating Cost: Chapter NineteenJuan Manuel FigueroaОценок пока нет

- Fixed Income Trading Strategies 2007Документ106 страницFixed Income Trading Strategies 2007Ben Boudraf100% (1)

- 4 - 5882075308076565519Fx Traders HandbookДокумент71 страница4 - 5882075308076565519Fx Traders HandbookDaniel ObaraОценок пока нет

- Act of 3135, As Amended by RДокумент20 страницAct of 3135, As Amended by RRalph ValdezОценок пока нет

- Retail Banking An Over View of HDFC BankДокумент69 страницRetail Banking An Over View of HDFC BankPrashant Patil0% (1)

- Monmouth Case SolutionДокумент19 страницMonmouth Case Solutiondave25% (4)

- HP Analyst ReportДокумент11 страницHP Analyst Reportjoycechan879827Оценок пока нет

- Operation Profile: Basic DataДокумент13 страницOperation Profile: Basic DataAlan GarcíaОценок пока нет

- Blaw Review QuizДокумент34 страницыBlaw Review QuizRichard de Leon100% (1)

- Krishna Singh RBI AssignmentДокумент8 страницKrishna Singh RBI AssignmentJNU BSCAGОценок пока нет

- The Founder Group Oto July Notes 2022Документ20 страницThe Founder Group Oto July Notes 2022Dirio FregosiОценок пока нет

- 12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadДокумент6 страниц12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadAřúń .jřОценок пока нет

- Lilac Flour Mills - FinalДокумент9 страницLilac Flour Mills - Finalrahulchohan2108Оценок пока нет

- Islamic Law and Finance Oleh TohirinДокумент23 страницыIslamic Law and Finance Oleh TohirinbashideОценок пока нет

- El Paso County 2016 Code of EthicsДокумент16 страницEl Paso County 2016 Code of EthicsColorado Ethics WatchОценок пока нет

- Project Review and Administrative AspectsДокумент22 страницыProject Review and Administrative Aspectsamit861595% (19)

- Tex Lee Mason Trust 26 Feb 2015Документ11 страницTex Lee Mason Trust 26 Feb 2015joe100% (9)

- Huaneng Inc. Case Study Submission 1994Документ4 страницыHuaneng Inc. Case Study Submission 1994dkaterpillar_4417527Оценок пока нет

- Ratio and Fs AnalysisДокумент74 страницыRatio and Fs AnalysisRubie Corpuz SimanganОценок пока нет

- McKinsey Profile Up1 1201Документ94 страницыMcKinsey Profile Up1 1201007003sОценок пока нет

- VSA Cheat SheetДокумент1 страницаVSA Cheat Sheetne30n250% (2)

- KPMG - Newsletter Loi de Finances 2024 (English Version)Документ6 страницKPMG - Newsletter Loi de Finances 2024 (English Version)boukhlefОценок пока нет