Академический Документы

Профессиональный Документы

Культура Документы

Expected Value Worksheet

Загружено:

ImperoCo LLCАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Expected Value Worksheet

Загружено:

ImperoCo LLCАвторское право:

Доступные форматы

WHITE CELLS ARE ADJUSTABLE Kristoffer Burnett - Certified Management Accountant, 2009-2011

Expected Value Worksheet

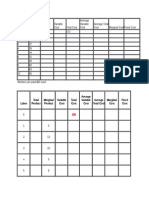

Input Decision A Purchase 2 new pieces of machinery $ 400,000 1 Probability Dollar Impact Expected Value 17.5% $ 1,450,000 $ 183,750 22.5% 870,000 105,750 35.0% 290,000 (38,500) 15.0% (60,000) 10.0% (290,000) (69,000) $ 122,000 Decision B Purchase 1 new piece of machinery $ 250,000 Probability Dollar Impact Expected Value 15.0% $ 1,450,000 $ 180,000 20.0% 870,000 124,000 30.0% 290,000 12,000 20.0% (50,000) 15.0% (290,000) (81,000) $ 185,000 Decision C Purchase no new machinery $ -

These are the options facing the organization, of which only one can be selected

Investment amount Scenario Cut OH costs by 50% Cut OH costs by 30% Cut OH costs by 10% Keep OH costs the same Increase OH costs by 10% Total expected value

Probability Dollar Impact Expected Value 0.0% $ 1,450,000 $ The scenario, probability, and dollar impact are all variable and unique to each decision. They may vary wildly or not at all 0.0% 870,000 0.0% 290,000 100.0% 0.0% (290,000) $ -

Output Outcome desired Optimum decision Expected value Maximize expected value Purchase 1 new piece of machinery $ 185,000

$200,000

Expected Values

$180,000

$160,000

$140,000

$120,000

Total expected value

$100,000

$80,000

$60,000

$40,000

$20,000

$0

Notes: 1 The expected value equals (the payoff - the investment amount) * the probability.

Вам также может понравиться

- CPA Review Notes 2019 - BEC (Business Environment Concepts)От EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Рейтинг: 4 из 5 звезд4/5 (9)

- Never Can Say Goodbye Katherine JacksonДокумент73 страницыNever Can Say Goodbye Katherine Jacksonalina28sept100% (5)

- MIL Q3 Module 5 REVISEDДокумент23 страницыMIL Q3 Module 5 REVISEDEustass Kidd68% (19)

- CVP Analysis Review Problem SolutionДокумент3 страницыCVP Analysis Review Problem SolutionSUNNY BHUSHANОценок пока нет

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОт EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОценок пока нет

- Product Design and DevelopmentДокумент14 страницProduct Design and Developmentajay3480100% (1)

- Finals SolutionsДокумент9 страницFinals Solutionsi_dreambig100% (3)

- A Guide To Conducting A Systematic Literature Review ofДокумент51 страницаA Guide To Conducting A Systematic Literature Review ofDarryl WallaceОценок пока нет

- Monte Carlo Simulation ExampleДокумент1 страницаMonte Carlo Simulation ExampleImperoCo LLCОценок пока нет

- Fouts Federal LawsuitДокумент28 страницFouts Federal LawsuitWXYZ-TV DetroitОценок пока нет

- Section C Part 2 MCQДокумент344 страницыSection C Part 2 MCQSaiswetha BethiОценок пока нет

- Operating Budget ExampleДокумент10 страницOperating Budget ExampleImperoCo LLCОценок пока нет

- Lecture 10 Relevant Costing PDFДокумент49 страницLecture 10 Relevant Costing PDFShweta Sridhar57% (7)

- Activity Based Costing ExampleДокумент3 страницыActivity Based Costing ExampleImperoCo LLCОценок пока нет

- Long Run and Short Run (Final)Документ39 страницLong Run and Short Run (Final)subanerjee18Оценок пока нет

- Job Order Costing ExampleДокумент3 страницыJob Order Costing ExampleImperoCo LLCОценок пока нет

- Revenue Variance ExampleДокумент1 страницаRevenue Variance ExampleImperoCo LLCОценок пока нет

- Long-Term Construction ContractsДокумент12 страницLong-Term Construction Contractsblackphoenix303Оценок пока нет

- Capital Budgeting WorksheetДокумент2 страницыCapital Budgeting WorksheetImperoCo LLCОценок пока нет

- Chapter 7Документ10 страницChapter 7Eki OmallaoОценок пока нет

- Case 1 AnswerДокумент10 страницCase 1 AnswerEdwin EspirituОценок пока нет

- InvestMemo TemplateДокумент6 страницInvestMemo TemplatealiranagОценок пока нет

- FInal Exam KeyДокумент27 страницFInal Exam KeyQasim AtharОценок пока нет

- Paper T7 Planning Control and Performance Management: Sample Multiple Choice Questions - June 2009Документ152 страницыPaper T7 Planning Control and Performance Management: Sample Multiple Choice Questions - June 2009GT Boss AvyLara50% (4)

- Solutions To Week 3 Practice Text ExercisesДокумент6 страницSolutions To Week 3 Practice Text Exercisespinkgold48Оценок пока нет

- Capital Budgeting ProblemsДокумент9 страницCapital Budgeting ProblemsSugandhaShaikh0% (1)

- Consider All Consider RelevantДокумент38 страницConsider All Consider RelevantPhuong TranОценок пока нет

- 326 Chapter 9 - Fundamentals of Capital BudgetingДокумент20 страниц326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifОценок пока нет

- FInal Exam KeyДокумент27 страницFInal Exam KeyQasim AtharОценок пока нет

- FInal Exam KeyДокумент27 страницFInal Exam KeyQasim AtharОценок пока нет

- Additional - Chapter 13Документ12 страницAdditional - Chapter 13Gega XachidEОценок пока нет

- Managerial AccountingДокумент25 страницManagerial AccountingBelle SaenyeaОценок пока нет

- Alternative Choices and DecisionsДокумент29 страницAlternative Choices and DecisionsAman BansalОценок пока нет

- A. Budgeting Decisions: Original BudgetДокумент3 страницыA. Budgeting Decisions: Original Budgetnhatuyen2410Оценок пока нет

- CVP Analysis Class Exercise SolutionsДокумент4 страницыCVP Analysis Class Exercise Solutionsaryan bhandariОценок пока нет

- FM Paper Solution (2012)Документ6 страницFM Paper Solution (2012)Prreeti ShroffОценок пока нет

- Case Study On LeveragesДокумент5 страницCase Study On LeveragesSantosh Kumar Roul100% (2)

- DepreciationДокумент9 страницDepreciationAnn Kristine TrinidadОценок пока нет

- Lecture 9Документ21 страницаLecture 9Hồng LêОценок пока нет

- P1 - Performance Operations: Operational Level PaperДокумент14 страницP1 - Performance Operations: Operational Level PapermavkaziОценок пока нет

- Key Answer Isom 351Документ14 страницKey Answer Isom 351Yijia QianОценок пока нет

- Chapter 26Документ15 страницChapter 26Sanh NguyệtОценок пока нет

- Accounting Ch5Документ5 страницAccounting Ch5sparts23Оценок пока нет

- Application of Marginal Costing in Decision Making-Questions Example 1: Make or BuyДокумент3 страницыApplication of Marginal Costing in Decision Making-Questions Example 1: Make or BuyDEVINA GURRIAHОценок пока нет

- SCM Lec 2Документ67 страницSCM Lec 2Star KerenzaОценок пока нет

- Relevant Cost-DruryДокумент3 страницыRelevant Cost-Drurymaxev92106Оценок пока нет

- Test 2 Sample Questions With Correct AnswersДокумент8 страницTest 2 Sample Questions With Correct AnswersBayoumy ElyanОценок пока нет

- Flexible Budget Practical Problems & Solutions - Explanation & DiscussionДокумент14 страницFlexible Budget Practical Problems & Solutions - Explanation & DiscussionahmedОценок пока нет

- University of StrathclydeДокумент14 страницUniversity of StrathclydeAbhinav KumarОценок пока нет

- Quiz Week 2 NewДокумент4 страницыQuiz Week 2 NewMuhammad M BhattiОценок пока нет

- Managerial Accounting Jiambalvo Text Homework: CHP 4,5,6: Estimate of Variable CostДокумент3 страницыManagerial Accounting Jiambalvo Text Homework: CHP 4,5,6: Estimate of Variable Costwj68Оценок пока нет

- Total Product Marginal Product Variable Cost Total Cost Average Variable Cost Average Total Cost Marginal Cost Fixed CostДокумент2 страницыTotal Product Marginal Product Variable Cost Total Cost Average Variable Cost Average Total Cost Marginal Cost Fixed CostJayson QuinonesОценок пока нет

- Acct 2 0Документ9 страницAcct 2 0Kamran HaiderОценок пока нет

- Management Accounting: Page 1 of 6Документ70 страницManagement Accounting: Page 1 of 6Ahmed Raza MirОценок пока нет

- ACG 2071, Test 2-Sample QuestionsДокумент11 страницACG 2071, Test 2-Sample QuestionsCresenciano MalabuyocОценок пока нет

- 1244 - Roshan Kumar Sahoo - Assignment 2Документ3 страницы1244 - Roshan Kumar Sahoo - Assignment 2ROSHAN KUMAR SAHOOОценок пока нет

- MFA - Assessment - 2 - SolutionДокумент12 страницMFA - Assessment - 2 - Solutionvishnu kanthОценок пока нет

- Application of Marginal Costing TechniqueДокумент7 страницApplication of Marginal Costing TechniqueKumardeep SinghaОценок пока нет

- Given Information:: I I CC OM IДокумент3 страницыGiven Information:: I I CC OM IhareshОценок пока нет

- MCS Question BankДокумент4 страницыMCS Question BankVrushali P.Оценок пока нет

- Marginal Costing & Breakeven Analysis - QДокумент6 страницMarginal Costing & Breakeven Analysis - QManav MaistryОценок пока нет

- Final Solution Winter 2017Документ27 страницFinal Solution Winter 2017sunkenОценок пока нет

- Decision Regarding Alternative ChoicesДокумент29 страницDecision Regarding Alternative ChoicesrhldxmОценок пока нет

- Multiple Choice Answers and SolutionsДокумент11 страницMultiple Choice Answers and SolutionsLaraОценок пока нет

- Pricing Decisions and Cost ManagementДокумент18 страницPricing Decisions and Cost ManagementAmrit PrasadОценок пока нет

- Tutorial 4Документ6 страницTutorial 4FEI FEIОценок пока нет

- Chapter 5 CVPДокумент56 страницChapter 5 CVPLegogie Moses AnoghenaОценок пока нет

- Bafahawdaauf Daid AdsjaДокумент2 страницыBafahawdaauf Daid AdsjaSteve GdogОценок пока нет

- Case Bill FrenchДокумент3 страницыCase Bill FrenchROSHAN KUMAR SAHOOОценок пока нет

- Longman F24 (Key)Документ10 страницLongman F24 (Key)Thomas Kong Ying LiОценок пока нет

- Class Exercise CH 10Документ5 страницClass Exercise CH 10Iftekhar AhmedОценок пока нет

- Resource Utilization ExampleДокумент4 страницыResource Utilization ExampleImperoCo LLCОценок пока нет

- Matching Demand ExampleДокумент1 страницаMatching Demand ExampleImperoCo LLCОценок пока нет

- Managing Variability ExampleДокумент2 страницыManaging Variability ExampleImperoCo LLCОценок пока нет

- Excessive Inventory AnalysisДокумент23 страницыExcessive Inventory AnalysisImperoCo LLCОценок пока нет

- Managing Investments WorksheetДокумент7 страницManaging Investments WorksheetImperoCo LLCОценок пока нет

- Break Even Analysis WorksheetДокумент2 страницыBreak Even Analysis WorksheetImperoCo LLCОценок пока нет

- Flexible Budget ExampleДокумент2 страницыFlexible Budget ExampleImperoCo LLCОценок пока нет

- Weighted Average Cost of Capital WorksheetДокумент2 страницыWeighted Average Cost of Capital WorksheetImperoCo LLCОценок пока нет

- Managing Current Assets ExampleДокумент2 страницыManaging Current Assets ExampleImperoCo LLCОценок пока нет

- Direct Material Variance ExampleДокумент1 страницаDirect Material Variance ExampleImperoCo LLCОценок пока нет

- Direct Labor Variance ExampleДокумент1 страницаDirect Labor Variance ExampleImperoCo LLCОценок пока нет

- Overhead Variance ExampleДокумент1 страницаOverhead Variance ExampleImperoCo LLCОценок пока нет

- Forecasting WorksheetДокумент2 страницыForecasting WorksheetImperoCo LLCОценок пока нет

- Linear Programming ExampleДокумент1 страницаLinear Programming ExampleImperoCo LLCОценок пока нет

- Departmental Expense Breakdown: Process Costing ExampleДокумент5 страницDepartmental Expense Breakdown: Process Costing ExampleImperoCo LLCОценок пока нет

- Financial Budget Example: White Cells Are AdjustableДокумент5 страницFinancial Budget Example: White Cells Are AdjustableImperoCo LLCОценок пока нет

- Failure of Composite Materials PDFДокумент2 страницыFailure of Composite Materials PDFPatrickОценок пока нет

- Universal Prayers IIДокумент3 страницыUniversal Prayers IIJericho AguiatanОценок пока нет

- French Legal SystemДокумент3 страницыFrench Legal SystemGauravChoudharyОценок пока нет

- Iver Brevik, Olesya Gorbunova and Diego Saez-Gomez - Casimir Effects Near The Big Rip Singularity in Viscous CosmologyДокумент7 страницIver Brevik, Olesya Gorbunova and Diego Saez-Gomez - Casimir Effects Near The Big Rip Singularity in Viscous CosmologyDex30KMОценок пока нет

- Prayer For Stages On The PathДокумент6 страницPrayer For Stages On The PathEijō JoshuaОценок пока нет

- AMBROSE PINTO-Caste - Discrimination - and - UNДокумент3 страницыAMBROSE PINTO-Caste - Discrimination - and - UNKlv SwamyОценок пока нет

- m100 Resume Portfolio AssignmentДокумент1 страницаm100 Resume Portfolio Assignmentapi-283396653Оценок пока нет

- Future Dusk Portfolio by SlidesgoДокумент40 страницFuture Dusk Portfolio by SlidesgoNATALIA ALSINA MARTINОценок пока нет

- USA V Rowland - Opposition To Motion To End Probation EarlyДокумент12 страницUSA V Rowland - Opposition To Motion To End Probation EarlyFOX 61 WebstaffОценок пока нет

- Catalyst 3750 Series Switches TroubleshootДокумент19 страницCatalyst 3750 Series Switches TroubleshootSugumar DuraisamyОценок пока нет

- Text Mapping: Reading For General InterestДокумент17 страницText Mapping: Reading For General InterestIndah Rizki RamadhaniОценок пока нет

- EnglishFile4e Intermediate TG PCM Vocab RevДокумент1 страницаEnglishFile4e Intermediate TG PCM Vocab RevB Mc0% (1)

- Exercise Reported SpeechДокумент3 страницыExercise Reported Speechapi-241242931Оценок пока нет

- Comprehensive Compressed Air Assessments: The 5-Step ProcessДокумент8 страницComprehensive Compressed Air Assessments: The 5-Step ProcessANDRESОценок пока нет

- IC HDL Lab ManualДокумент82 страницыIC HDL Lab ManualRakshitha AngelОценок пока нет

- JKSSB Panchayat Secretary Adfar NabiДокумент3 страницыJKSSB Panchayat Secretary Adfar NabiSHEIKHXUNIОценок пока нет

- Chapter 8 Review QuestionsДокумент2 страницыChapter 8 Review QuestionsSouthernGurl99Оценок пока нет

- Seerat Mujaddid Alf-e-Sani (Urdu)Документ518 страницSeerat Mujaddid Alf-e-Sani (Urdu)Talib Ghaffari100% (12)

- Educational Psychology EDU-202 Spring - 2022 Dr. Fouad Yehya: Fyehya@aust - Edu.lbДокумент31 страницаEducational Psychology EDU-202 Spring - 2022 Dr. Fouad Yehya: Fyehya@aust - Edu.lbLayla Al KhatibОценок пока нет

- Sales Purchases Returns Day BookДокумент8 страницSales Purchases Returns Day BookAung Zaw HtweОценок пока нет

- Knut - Fleur de LisДокумент10 страницKnut - Fleur de LisoierulОценок пока нет

- Characters: Philadelphia Here I Come! by Brian FrielДокумент4 страницыCharacters: Philadelphia Here I Come! by Brian FrielDominic LenihanОценок пока нет

- AIW Unit Plan - Ind. Tech ExampleДокумент4 страницыAIW Unit Plan - Ind. Tech ExampleMary McDonnellОценок пока нет

- Second Unit Test 2022: Radha Madhav Public School BareillyДокумент4 страницыSecond Unit Test 2022: Radha Madhav Public School BareillyRaghav AgarwalОценок пока нет