Академический Документы

Профессиональный Документы

Культура Документы

Case Study Solution of JSW Steel

Загружено:

Vishal Singh RajputОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Case Study Solution of JSW Steel

Загружено:

Vishal Singh RajputАвторское право:

Доступные форматы

JSW SHOPPE A UNIQUE DISTRIBUTION MODEL FOR BRANDED STEEL

Brief of Case

JSW is a manufacturing plant producing steel pipes, bends and sockets and was one of many low-cost steel producers in the world and favored bulk buyers. In April 2007, at Jindal Steel Works Ltd.s marketing headquarters in Mumbai, the sales and marketing team headed by Jayant Acharya (director marketing), Sharad Mahendra (vice-president) had a debate on how to boost the presence of Jindal Steel Works steel in the market. After much debate, the most promising idea was the development of an organized retail format. Steel was perceived as a business-to-business product. The companys objective was to create a distinctive impression in the minds of end-users to ensure that they knew about various applications of the different steel products manufactured by JSW Steel so that its involvement in this category could be enhanced. The challenge was to brand the whole distribution channel and simultaneously increase the visibility of the brand manifold. At one point, Jindal had considered the idea of forming an organized retail chain through which the, this could eliminate the role of middlemen and directly reach end-user customers. Furthermore, it would be possible to monitor the sales and performance of dealers, enable better logistics and supply chain management and give a clearer understanding of consumer preferences. Question was: what kind of model should be adopted for such a project. Keeping the branding of Tata Steel and Essar Steel in mind Mahindra had two primary decisions to make: firstly, should the company venture into retail on its own or should it collaborate with the existing dealers? After the cost analysis he concluded that it would be extremely expensive for the company to venture into retailing on its own. With 160 dealers he needed to choose a model that would be suitable to all kinds of markets and could be easily replicated in all regions of the country. A six-member task force (TF) was constituted with Mahendra heading the team. The team unanimously agreed that all JSW retail outlets should have a uniform look and feel, so the architecture and designing had to be centralized. Three names were considered for the outlets: JSW Shoppe, JSW Steel Bazaar and JSW Steel Emporium. Out of JSW Shoppe was finalized. Mahindra got the model report approved by Aacharya and also got an Enthusiastic Response at Jindal Mansion .Apart from the current business model Jindal asked Mahindra to start their own outlets. Mahindra opposed it by saying that it would cost us around Rs.75 lakhs to Rs.125 lakhs which would not allow for the necessary penetration into the market that we require. As we propose to double our production we need an exclusive distribution network to reach the more remote areas. In the past we have relied heavily on original equipment manufacturers (OEMs), but during the recent economic downturn, many OEMs cancelled their orders and we had to look for alternative buyers through other distribution channels.

Most of the dealers are not happy with the supply from steel manufacturers; if we promise them a steady supply of steel, then they would love to embrace this concept. Moreover, we will not have to offer the kind of discounts that we presently offer our OEM clientele. Through this model we are not targeting customers who will buy in tones; we are focusing on customers who buy in kilograms by assuring continuous supply of steel Execution of model was done in four phases. In the initial stage of execution, the company would aim for 50 outlets by making an initial offer to its existing dealers. It was anticipated that some dealers would be skeptical concerning legal issues while others would wish to continue with their existing business model. During the second phase a new target of 200 dealers while in the third and fourth stages the remaining 400 of the 600 total should be opened. After the meeting with Jindal, Mahendra and his team were ecstatic, but there were several challenges in front of them. Firstly, they needed to obtain the general acceptance within the company, i.e., of the sales and marketing workforce and the second issue was to obtain dealers acceptance of the model. Other challenges involved in this transition included designing a sophisticated ordering process for the Shoppes to ensure a steady supply of material, branding the supply chain, negotiating a cost- and revenue sharing model with the dealers and designing the floor layouts and standardized elements for the Shoppe. From the dealers perspective though the company had come up with an elaborate model to penetrate into the market and build strong and long-lasting ties, many dealers accepted this concept reluctantly. Some dealers were of the opinion that the company wanted to do away with the dealers in the long-run. Dealers also pointed out that the company was providing standardized products and that sometimes the customers were unhappy with this as they were not getting the customized products as quickly as before. Dealers perceived that there would be growing interference from JSW in their day-to-day affairs. They wanted the company to simply supply the product and leave the selling aspect to them. They did not like the inspection of the Shoppe by the company officials and found it difficult to maintain the management information system (MIS) as per the standards prescribed by the company. Many complained that they had never used computers, and asking them to handle sophisticated software to maintain the MIS Another issue put forward by the dealers was that the company was forcing them to sell all the products and expand their stock with new products: they said that it was very difficult to sell all the products because some high-end products were not easily saleable in some remote outlets. The company strategically targeted the new generation of dealers initially, as it believed that these young dealers would be more receptive and flexible to the idea. As the dealers were not aware of the companys rationale for choosing a select set of dealers there was no proper evaluation criterion one major issue from the dealers perspective was the success of the very idea of attracting the end consumer into their Shoppes

It was found that many dealers had parallel outlets through which they sold other manufacturers products. Also the dealers were not interested in investing in information technology (IT) infrastructure. Another grey area was the recruitment by the dealers of Shoppe executives who did not meet the companys standards. Using the trained executives for routine activities resulted in reduced morale of the executives. Dealers did not send the Shoppe executives for training since they had to pay the bill whereas the company on the other hand wanted to get involved in the recruitment and training of the executives the objective was to bring about a sense of professionalism and uniformity. The most critical issue was that there was no system in place to measure the performance of the dealers, and therefore no basis upon which to determine their incentives. This lack of transparency was also felt by the dealers. JSW also initiated some marketing efforts which helped them to make the customer aware about their product. As the time passed the first and second phases of the Shoppe plan had successfully come to an end and his team was geared up for the implementation of the third. With major players such as Tata Steel and Essar joining the race to open retail outlets on similar lines the dynamics of steel manufacturing and Distribution would change dramatically. Competition would demand new strategies so as to sustain in the market. Considering that frontline personnel at the Shoppes would play a key role. With great focus and

Different between Old and new distribution channel of JSW Steel OLD Generic distribution channel No cost sharing Business to business Middle man Order in direct Standardize Manual Generic No dealers development NEW Branded distribution channel costing Business to costumer Trained dealers customize Through channels Management information system Exclusive Dealers development

Channel selection

DRIVERS

Control Completion Demand and supply capacity Inventory and production synchronization Production Low differentiation Franchisee and business Effective touch point

JSW Steel has developed new DC for their own product that is core competent of company which provides huge market coverage for JSW Steel. There are some suggestions for better control of Distribution channel management.

Suggestions

1) JSW need to establish their branding most powerful and separated for effective supply chain management. Brief: JSW created their own a new model in the steel industry that is Shoppe. And its the core competent for JSW for better steel supply in the market. And it is completely implemented in the market. But there are new player came-up in the market with the strategy of same model (Tata steel, Essar steel). As per same model competition, a (Tata steel) reputed company gain the market share of steel Shoppe, due to their market value raise-up.

2) JSW need to implement system in place to measure the performance of the dealers, and therefore no basis upon which to determine their incentives. Brief: In the JSW steel Shoppe model there are major lacks in dealer performances measurement and the most critical issue was that there was no system in place to measure the performance of the dealers, and therefore no basis upon which to determine their incentives. This lack of transparency was also felt by the dealers.it is crib that some dealers are entering that illicit profit due to unusual response of performance measurement by JSW steel.

3) JSW need to make proper balance between dealer distribution supply and Shoppe distribution supply. Brief: A major contribution in JSW steel supply by older dealer for B2B model. The approach of shopper was necessary to reach end user and become a powerful brand in steel industry. But in the steel industry the major business have done concerned B2B. So for better DC JSW have to maintain proper balance between both models.

4) JSW needs to establish lithe hub-and-spoke model for the inorganic growth of steel industry.

Brief: Because of their core competitor somewhere JSW are failed to establish its hub-and-spoke model. If they want to escaped there self for the inorganic growth, they need to ensure a cost-effective and steady supply of material, the company was contemplating a hub-and-spoke distribution model by opening large warehouses across the country. The sales and distribution department as one wing of the company would be under greater focus and pressure and this could necessitate the hiving off of the department into a strategic business unit. While such moves offered great opportunities both for the individual as well as the organization, new challenges came with the changes: with the above refrence they can easily handle this inorganic growth.

5) JSW needs to implement a strong distribution network in growing cities. Brief: As per todays scenario The real estate sector in India assumed greater prominence with the liberalization of the economy, as the consequent increase in business opportunities and labor migration led to rising demand for commercial and housing space. Because every small cities are going to become metro cities in near future in India, so in this sector not only there are much chance of growth but also JSW can improve their distribution network applying this strategy towards to real estate sector.

Вам также может понравиться

- JSW Shoppe-A Unique Distribution Model For Branded Steel: Case PresentationДокумент11 страницJSW Shoppe-A Unique Distribution Model For Branded Steel: Case Presentationbaz chacko0% (1)

- JSW ShoppeДокумент4 страницыJSW ShoppeDiv Kabra100% (1)

- Issues and Challenges Faced by JSW in Implementing New Business ModelДокумент3 страницыIssues and Challenges Faced by JSW in Implementing New Business Modelagarwaldia28Оценок пока нет

- Usha Martin: Competitive Advantage Through Vertical IntegrationДокумент9 страницUsha Martin: Competitive Advantage Through Vertical IntegrationsafwanhossainОценок пока нет

- The Coop Case Discussion QuestionsДокумент3 страницыThe Coop Case Discussion QuestionsFernando Barbosa0% (1)

- Pashu Khadya Company LimitedДокумент4 страницыPashu Khadya Company Limitedgogana93Оценок пока нет

- PKCL Assignment Analyzes Logistics Costs and OptionsДокумент6 страницPKCL Assignment Analyzes Logistics Costs and OptionsParesh KotkarОценок пока нет

- Note On The CCR FrameworkДокумент4 страницыNote On The CCR Frameworkamitbharadwaj7Оценок пока нет

- Sunwind AB - Group 8 - Section HДокумент5 страницSunwind AB - Group 8 - Section HNiyati GargОценок пока нет

- Indian Food Specialities Ltd.Документ10 страницIndian Food Specialities Ltd.mayankj_147666100% (3)

- Maruti Manesar Lockout: People Management Case StudyДокумент7 страницMaruti Manesar Lockout: People Management Case Studymanik singh100% (1)

- Asian ToysДокумент2 страницыAsian ToysHbbekn jjdbhh100% (1)

- Sunwind AB Case StudyДокумент6 страницSunwind AB Case StudyTanmoy BoseОценок пока нет

- Case Study NucorДокумент2 страницыCase Study NucorHarshal GadgeОценок пока нет

- Ramesh and GargiДокумент9 страницRamesh and Gargijayavignesh0% (5)

- Case Study - SKF Bearing (A)Документ5 страницCase Study - SKF Bearing (A)ramprasadbecivil100% (1)

- SCM Karnataka Engineering CaseДокумент6 страницSCM Karnataka Engineering CaseJSОценок пока нет

- Group-1Документ15 страницGroup-1Andrew Walker100% (1)

- Om Case Kulicke and Soffa Industries, IncДокумент11 страницOm Case Kulicke and Soffa Industries, Incsili core100% (1)

- Case Study of D.LIGHT DESIGN IN INDIAДокумент10 страницCase Study of D.LIGHT DESIGN IN INDIAKRook NitsОценок пока нет

- Logistics - Karnataka Engineering CaseДокумент9 страницLogistics - Karnataka Engineering CaseVamsee Krishna Vyas B0% (1)

- (OM - Group Assignment - Sunwind) (Group No. 3)Документ6 страниц(OM - Group Assignment - Sunwind) (Group No. 3)Sambit Patra100% (2)

- Pashu Khadya Company Limited (PKCL)Документ6 страницPashu Khadya Company Limited (PKCL)Rahul GandhiОценок пока нет

- Unilever in India: Hindustan Lever S Project Shakti - Marketing FMCG To The Ruralconsumer Case AnalysisДокумент5 страницUnilever in India: Hindustan Lever S Project Shakti - Marketing FMCG To The Ruralconsumer Case Analysismahtaabk100% (4)

- Marketing 3 - Group 3 - Soren Chemicals - Case AnalysisДокумент2 страницыMarketing 3 - Group 3 - Soren Chemicals - Case Analysispuneet100% (1)

- AddonsДокумент11 страницAddonsShreyas Marulkar100% (1)

- Respuestas Amore PacificДокумент7 страницRespuestas Amore Pacificlaura rОценок пока нет

- House of TataДокумент14 страницHouse of TataDipanjan BhattacharyaОценок пока нет

- SecB Group7 ODD CaseДокумент2 страницыSecB Group7 ODD CaseKanuОценок пока нет

- RCI Group7Документ9 страницRCI Group7RafayОценок пока нет

- Cumberland Metal IndustriesДокумент2 страницыCumberland Metal IndustrieskakriakartikОценок пока нет

- Summary and AnswersДокумент9 страницSummary and Answersarpit_nОценок пока нет

- House of TataДокумент8 страницHouse of TataDhiraj KhatriОценок пока нет

- Dominion Motors AnalysisДокумент4 страницыDominion Motors AnalysisUday Kiran100% (1)

- Sharma Industries structural dilemma case studyДокумент7 страницSharma Industries structural dilemma case studyRohanОценок пока нет

- Suzuki Samurai Case Analysis GROUP 03Документ52 страницыSuzuki Samurai Case Analysis GROUP 03Maddala Srinivasa Rao50% (2)

- Classic Knitwear Case (Section-B Group-1)Документ5 страницClassic Knitwear Case (Section-B Group-1)Swapnil Joardar100% (1)

- Case 4 Group 4Документ3 страницыCase 4 Group 4KshitizОценок пока нет

- Tanishq Case Analysis: Capturing the Indian Women's MarketДокумент4 страницыTanishq Case Analysis: Capturing the Indian Women's MarketDebmalya DuttaОценок пока нет

- SKF BearingsДокумент12 страницSKF BearingsKartik GuptaОценок пока нет

- ECSR Assignment Group 12Документ3 страницыECSR Assignment Group 12Prashant JhakarwarОценок пока нет

- BPOLANDДокумент7 страницBPOLANDDivya SharmaОценок пока нет

- Jamcracker Case Study AnalysisДокумент2 страницыJamcracker Case Study AnalysisAshutosh Jha100% (1)

- Opening The Valve - From Software To HardwareДокумент2 страницыOpening The Valve - From Software To Hardwarebhoomi80% (10)

- "Sands Corporation": Managerial Communication - IДокумент6 страниц"Sands Corporation": Managerial Communication - IMUGHALU K YEPTHOОценок пока нет

- Understanding From Case: Marketing Brand Aava: Not As Simple As WaterДокумент4 страницыUnderstanding From Case: Marketing Brand Aava: Not As Simple As Waterdebashreeta swainОценок пока нет

- Case Study of SG Cowen New RecruitsДокумент4 страницыCase Study of SG Cowen New RecruitsAshutosh100% (12)

- K&S Supply Chain LocationДокумент8 страницK&S Supply Chain LocationRohanОценок пока нет

- Sales SoftДокумент19 страницSales Softsaurabhdhingra948950% (4)

- House of TATA,1995: The Next Generation Group 2, Section A, PGP22Документ7 страницHouse of TATA,1995: The Next Generation Group 2, Section A, PGP22satyakidutta007100% (1)

- Case Submission - Dell Computers (A)Документ3 страницыCase Submission - Dell Computers (A)Anmol YadavОценок пока нет

- BA AssignmentДокумент2 страницыBA AssignmentkeshavОценок пока нет

- Bharti Airtel in Africa CaseДокумент3 страницыBharti Airtel in Africa CaseSreeda Perikamana50% (4)

- Case Study Tea Shall Not Be ServedДокумент2 страницыCase Study Tea Shall Not Be ServedshwetajhambОценок пока нет

- Interface RaiseДокумент17 страницInterface RaiseAyush DharnidharkaОценок пока нет

- What Are The Issues and Challenges That Arose When JSW Moved Away From A Traditional Distribution Model (Dealers) To An Organized Retailing Format of Franchising?Документ4 страницыWhat Are The Issues and Challenges That Arose When JSW Moved Away From A Traditional Distribution Model (Dealers) To An Organized Retailing Format of Franchising?Priyank ToliaОценок пока нет

- Jswshoppe 161208155424Документ13 страницJswshoppe 161208155424PrathameshNarkarОценок пока нет

- Tata Steelium Case SolutionДокумент9 страницTata Steelium Case SolutionShailav Prakash100% (1)

- Sales, Distribution and Retail Management: Final Project On Tata SteelДокумент8 страницSales, Distribution and Retail Management: Final Project On Tata SteelJaatBudhi GaminGОценок пока нет

- Analyzing Brand Awareness of SMW Ispat Pvt. LtdДокумент13 страницAnalyzing Brand Awareness of SMW Ispat Pvt. LtdPrajakt PaithankarОценок пока нет

- Candidates Provisionally Shortlisted for Assistant Engineer InterviewsДокумент22 страницыCandidates Provisionally Shortlisted for Assistant Engineer InterviewsVishal Singh RajputОценок пока нет

- Theories of International Trade: Theory of Absolute AdvantageДокумент9 страницTheories of International Trade: Theory of Absolute AdvantageVishal Singh RajputОценок пока нет

- Theories of International Trade: Theory of Absolute AdvantageДокумент9 страницTheories of International Trade: Theory of Absolute AdvantageVishal Singh RajputОценок пока нет

- Indian Money Market: Market Structure, Covered Parity and Term StructureДокумент12 страницIndian Money Market: Market Structure, Covered Parity and Term StructureSoumava PaulОценок пока нет

- Dog Care ProductДокумент14 страницDog Care ProductVishal Singh RajputОценок пока нет

- Beyond the Last Blue Mountain book reviewДокумент2 страницыBeyond the Last Blue Mountain book reviewVishal Singh Rajput0% (1)

- Time Value of MoneyДокумент13 страницTime Value of MoneyVishal Singh RajputОценок пока нет

- Inventory Management Project Main2Документ30 страницInventory Management Project Main2Vishal Singh RajputОценок пока нет

- Inventory Management of NCLДокумент69 страницInventory Management of NCLVishal Singh RajputОценок пока нет

- Infosys Team and Their HistoryДокумент24 страницыInfosys Team and Their Historysonu_saisОценок пока нет

- JSW Steel Deluxe - LowResolutionДокумент196 страницJSW Steel Deluxe - LowResolutionChiranjit RoyОценок пока нет

- A Critical Study of The Steel Industry &: Working Capital ManagementДокумент11 страницA Critical Study of The Steel Industry &: Working Capital ManagementTanya MendirattaОценок пока нет

- India's Second Largest Steel Producer JSW Steel LtdДокумент41 страницаIndia's Second Largest Steel Producer JSW Steel LtdJACOB ANTONYОценок пока нет

- Mks Metal Roofing Tiruchirappalli JSW Colour Sheets ManufacturersДокумент10 страницMks Metal Roofing Tiruchirappalli JSW Colour Sheets ManufacturersMohammed NizarОценок пока нет

- Mining - Report - May 2021Документ14 страницMining - Report - May 2021ShivaОценок пока нет

- Archana Tata SteelДокумент66 страницArchana Tata SteelSanjay VeerabhadrakumarОценок пока нет

- JSW Steel Annual Report 2015-16 Full PDFДокумент257 страницJSW Steel Annual Report 2015-16 Full PDFRusheel ChavaОценок пока нет

- Sub-Regional Office Industries and Facilities ReportДокумент12 страницSub-Regional Office Industries and Facilities Reportviraj thaleОценок пока нет

- JSW Steel LTD: "Bringing Alive A Billion Dreams"Документ14 страницJSW Steel LTD: "Bringing Alive A Billion Dreams"anik duttaОценок пока нет

- JSW Steel Limited: Long-Term Rating Upgraded To (ICRA) AA (Stable) Short-Term Rating Reaffirmed at (ICRA) A1+Документ11 страницJSW Steel Limited: Long-Term Rating Upgraded To (ICRA) AA (Stable) Short-Term Rating Reaffirmed at (ICRA) A1+purvi jainОценок пока нет

- JSW Steel LTDДокумент5 страницJSW Steel LTDgandhi_jytОценок пока нет

- Hot Rolled Steel CoilsДокумент39 страницHot Rolled Steel CoilsPachyiappanОценок пока нет

- Original Kalyani ReportДокумент70 страницOriginal Kalyani ReportRahul Yargattikar100% (1)

- Minerals and Metal Review July 2012 - 3Документ20 страницMinerals and Metal Review July 2012 - 3Sundaravaradhan IyengarОценок пока нет

- R.K Steel Udyog PVT - LTD: Test Certificate For High Strength Deformed Steel Bars and Wires For Concrete ReinforcementДокумент2 страницыR.K Steel Udyog PVT - LTD: Test Certificate For High Strength Deformed Steel Bars and Wires For Concrete Reinforcementnanda kishopre100% (4)

- JSW Steel AR 21-22 - 2607Документ472 страницыJSW Steel AR 21-22 - 2607the crazy laughersОценок пока нет

- Minerals and Metal Review August 2012 - 4Документ20 страницMinerals and Metal Review August 2012 - 4Sundaravaradhan IyengarОценок пока нет

- Comparative Analysis of Public and Private Sector Steel Companies in IndiaДокумент47 страницComparative Analysis of Public and Private Sector Steel Companies in IndiaGaurav TripathiОценок пока нет

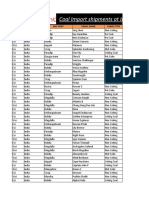

- Coal Import Shipments at India's 32 Major Ports Updated As On 25 Nov, 2020Документ17 страницCoal Import Shipments at India's 32 Major Ports Updated As On 25 Nov, 2020vinod mandalОценок пока нет

- Sandur Manganese Equity ReportДокумент10 страницSandur Manganese Equity ReportAmitabh VatsyaОценок пока нет

- Comparative Study of Financial Performance of Indian Steel Companies Under GlobalizationДокумент8 страницComparative Study of Financial Performance of Indian Steel Companies Under GlobalizationTJPRC PublicationsОценок пока нет

- JindalДокумент12 страницJindalsunny10119Оценок пока нет

- Debt J-LДокумент576 страницDebt J-LmerrylmorleyОценок пока нет

- JSW Steel - AR 2020 FinalДокумент368 страницJSW Steel - AR 2020 FinalRitika Chavhan0% (1)

- Inventory ManagementДокумент78 страницInventory ManagementRasna PareekОценок пока нет

- Project Report in JSWДокумент44 страницыProject Report in JSWmohd arif khan71% (14)

- Introduction LetterДокумент1 страницаIntroduction LetterShankey JAlanОценок пока нет

- JSW STEEL LTD Depot-Palwal, Ja: GALVANNEALED/18-19/0000981653Документ1 страницаJSW STEEL LTD Depot-Palwal, Ja: GALVANNEALED/18-19/0000981653asОценок пока нет

- 17-18-JSW Steels's Ispat Acquisition-The SetbackДокумент2 страницы17-18-JSW Steels's Ispat Acquisition-The SetbackKAVVIKAОценок пока нет

- SuccessfulAuctionDetails11092020 PDFДокумент4 страницыSuccessfulAuctionDetails11092020 PDFTapas PadhiОценок пока нет