Академический Документы

Профессиональный Документы

Культура Документы

Break Even Point Computation For Hotel

Загружено:

Agustinus Agus PurwantoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Break Even Point Computation For Hotel

Загружено:

Agustinus Agus PurwantoАвторское право:

Доступные форматы

www.hotelskonsultan.webs.

com

BEST PRACTICE

HOTEL BREAK‐EVEN POINT

Drs. Agusttinus Agus Purwanto, MM

2/11/2009

This document is prepared to analysis Budget Year 2009 being proposed to Hotel’s Owner, the objective to

compute Break – even Point is to ensure the Monthly breakdown was objective and achievable. To see

which month is bad performance and best performance. As Director of Finance will be assist Sales &

Marketing to analyze by increasing and reducing the Room Rate when requested

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 0

www.hotelskonsultan.webs.com

Hotel Room Division

Break-even Point

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 1

www.hotelskonsultan.webs.com

BEST PRACTICE

HOTEL BREAK-EVENT POINT

1. Formula

What is hotel break-even point computed by, the hotel is complex in business operation according

to which Departmental Profit we want to compute the “Break-even Point” will meet the difficutly to

follow “Break-Even Point” method as following without to know the caracteristic of expenses:

Formula A BE=FC/ (1-VC %)

BE Break Even Point

FC Fixed Costs

VC Variable Costs

Formula B BEP = break-even point (units of

production)

TFC = total fixed costs,

VCUP = variable costs per unit of

production,

SUP = selling price per unit of

production

Formula C 1. Break-even point (in units) =

fixed expenses

unit contribution margin

2. Contribution-margin ratio =

unit contribution margin

unit sales price

3. Break-even point (in sales dollars) =

fixed expenses

contribution-margin ratio

Formula D Classic Spread Sheet from Consolidated

Budget

Other Formula Still many other formulas like as

Mathematic Equation etc.

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 2

www.hotelskonsultan.webs.com

2. Hotel Departmental Profit

In the hotel business has many types of Departmental Profit to follow Uniform System of

Account for Hotel. These departmental profit can be minimized into three profit center as

follow:

a. Room Division Departmental Profit

b. Food and Beverage Division Departmental Profit, and

c. Other Operated Departmental Profit

2.1 Room Divison Departmental Profit

The main core business is services but is not really pure services business, because we also

supply some operation supplies into the room for free to our guests.

Cost and Expenses in the Room Divison Department ussualy categoried as follow:

a. Payroll in this Best Practice is Fixed Cost, in the Consuldated Room Division Budget

appear constant as Fixed Cost

b. Provision in this Best Practice is Fixed Cost, but you can calculate this expenses by

percentage of Sales and then become as Vaiable Cost

c. Other Expenses in this Best Practice can be Fixed Cost or Variable Cost depend how you

calculated in the budget, when is constant every month will be Fixed Cost and when the

expenses based on the room occupancy, total sales or number of guest will categoried as

Variable Cost

If you are not following this method the Break – Even Point figures will be big differences

when you are computing with another FORMULA.

2.2 Food and Beverage Division Departmental Profit

The main core business is not services, but combination between service and production /

manufacturer, so you have to use different Formula to Food and Beverage Departmental

Profit. Which will be analysis on the next Best Practice.

Cost and Expenses in the Food and Beverage Departmental Profit different with Room

Division Departmental Profit. This Cost and Expensres ussualy categoried as follow:

a. Payroll in this Best Practice is Fixed Cost, in the Consuldated Food and Beverage

Departmental Budget appear constant as Fixed Cost

b. Cost of Sales – In Food and Beverage Departmental Profit has Cost of Sales but in the

Room Departmental Profit is not, this expense in this Best Practice as Variable Cost

c. Provision in this Best Practice is Fixed Cost, but you can calculate this expenses by

percentage of Sales and then become as Vaiable Cost

d. Other Expenses in this Best Practice can be Fixed Cost or Variable Cost depend how you

calculated in the budget, when is constant every month will be Fixed Cost and when the

expenses based on total sales or number of cover will categoried as Variable Cost

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 3

www.hotelskonsultan.webs.com

2.3 Other Operated Departmental Profit

The main core business is also not really service, this is combined between service and

production, the formula can use the same with Food and Beverage Division Department Profit.

When you are using Classic Spread Sheet Break-even Point Analysis will some expenses

different classification. Mean in the Food and Beverage Departmental Profit as Variable Cost

but in the Other Operated Departmental Profit as Fixed Cost.

3. Classic Spread Sheet Break-even Point Analysis for Room Division

The Classic Spread Sheet Break-even Point Analysis is the easier way to calculate Room

Divison Departmental Profit Break-even Point. This method can be prepared by following

steps:

a. STEP ONE

Prepare Consulidated Operating Budget Summary and Monthly

b. STEP TWO

Move the expenses to Fixed Cost for constant expenses and move to Variable Cost for

non constant expenses, all exepses calculated based on Occupied Room, Number

Guest, Number Cover or Percentage of Sales

c. STEP THREE

Calculate the Contribution Margin the simple formula as bellow:

(S – VC)/S

Sales – Variable Cost divided by Sales

d. STEP FOUR

Calculate the Break-even Sales Volume the simple formula as below:

FC/CM

Fixed Cost divided by Contribution Margin

e. STEP FIVE

Do calculation the Break-even Point Analysis by using the Classic Spread Sheet as

sample

f. STEP SIX

Do test with one of the formula as above or other furmula do you have

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 4

www.hotelskonsultan.webs.com

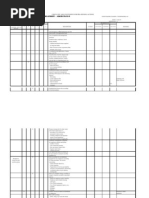

Example: MONTHLY BREAKDOWN OF CONSOLIDATED ROOM DIVISION BUDGET

Based on Proposed Budget 2009

BUDGET FOR 2009 - MONTH BY MONTH

Yearly Total

% of

Break-Even Analysis Sales

Descriptions Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09

Sales 239,986.00 226,089.00 210,177.00 244,581.00 306,720.00 327,720.00 365,324.00 362,475.00 325,616.00 254,896.00 253,186.00 273,228.00 $3,389,998.00

Fixed Costs

Payroll 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 19,718.37 $236,620.50 6.98%

Provision 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 1,550.00 $18,600.00 0.55%

In House Movie/Satellite TV 230.00 230.00 230.00 230.00 230.00 230.00 230.00 230.00 230.00 230.00 230.00 230.00 $2,760.00 0.08%

Music Entertainment 250.00 250.00 250.00 250.00 250.00 250.00 250.00 250.00 250.00 250.00 250.00 250.00 $3,000.00 0.09%

Reservation Expenses 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 $900.00 0.03%

Subscription - Newspaper 266.67 266.67 266.67 266.67 266.67 266.67 266.67 266.67 266.67 266.67 266.67 266.67 $3,200.00 0.09%

Administration & General 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 12,393.85 $148,726.15 4.39%

Human Resources 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 1,960.78 $23,529.41 0.69%

Sales & Marketing 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 6,907.19 $82,886.30 2.45%

P.O.M.E.C 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 3,592.61 $43,111.33 1.27%

Interest Charges 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 22,800.00 273,600.00 8.07%

Other Fixed Charges 764.00 764.00 764.00 764.00 764.00 764.00 764.00 764.00 764.00 764.00 764.00 764.00 $9,168.00 0.27%

Depreciation 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 39,520.00 $474,240.00 13.99%

Total Fixed Costs 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 $1,320,341.69 38.95%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 5

www.hotelskonsultan.webs.com

Variable Costs

T/A Commission 540.06 414.36 678.90 730.06 471.44 542.16 762.40 569.70 452.98 570.98 746.93 569.62 $7,049.58 0.21%

Flower & Decorations 669.03 835.44 114.79 591.77 507.76 80.12 1,063.45 496.81 386.10 348.25 255.97 321.75 $5,671.24 0.17%

Guest Supplies - F & B 1,853.42 1,768.94 1,758.42 2,030.68 2,618.88 2,646.66 3,287.18 2,862.61 1,960.76 2,266.48 2,211.38 2,056.24 $27,321.65 0.81%

Guest Supplies - Amenities 3,774.11 3,267.14 2,302.50 2,893.18 3,465.25 4,706.52 4,923.64 4,289.34 6,294.50 3,795.38 3,564.17 3,146.36 $46,422.10 1.37%

Guest Relocations 524.95 428.82 (76.12) 113.78 569.03 890.43 834.36 320.53 1,361.89 551.78 435.15 836.98 $6,791.57 0.20%

Laundry Operation - Linen 3,578.73 3,353.71 3,307.23 4,035.15 4,843.78 5,313.00 6,307.01 5,005.79 5,630.77 4,605.13 4,360.30 3,919.69 $54,260.29 1.60%

Laundry Uniform 361.87 360.74 383.48 384.01 360.31 364.88 383.09 367.77 359.97 367.92 386.73 361.74 $4,442.49 0.13%

Printing & Stationery 1,132.69 1,136.84 1,101.48 1,137.57 1,693.84 1,397.94 1,929.05 1,853.35 2,277.12 1,378.54 1,411.59 1,437.46 $17,887.47 0.53%

Cleaning Supplies & Tools 1,521.84 1,489.94 1,452.48 1,598.45 2,195.18 2,020.74 2,626.22 2,354.40 1,088.17 1,891.84 1,880.31 1,832.26 $21,951.85 0.65%

Entertainment 1,671.88 1,470.33 2,434.81 1,937.67 1,804.79 1,397.83 2,149.47 2,387.38 207.69 1,753.67 2,402.20 2,071.10 $21,688.82 0.64%

Telephone & Fax 472.10 387.72 635.26 638.19 441.14 507.31 633.14 533.08 423.86 534.28 652.93 470.10 $6,329.11 0.19%

Transportation 1,021.84 989.94 452.48 848.45 1,445.18 1,520.74 1,126.22 1,354.40 1,088.17 1,891.84 1,880.31 1,832.26 $15,451.85 0.46%

Other Operating Supplies 193.94 159.28 260.97 262.17 181.22 208.40 260.09 218.99 174.12 219.48 268.23 193.12 $2,600.00 0.08%

Administration & General 7,560.18 6,550.61 10,196.03 8,781.62 7,339.83 7,318.03 9,403.26 10,139.29 4,491.62 7,607.79 9,591.61 7,870.43 $96,850.27 2.86%

Human Resources 1,650.91 1,369.34 2,206.28 1,893.35 1,566.33 1,559.11 1,949.78 2,201.35 950.65 1,593.72 2,100.34 1,819.13 $20,860.30 0.62%

Sales & Marketing 6,980.17 6,820.66 7,682.28 7,350.93 6,995.86 6,983.66 7,499.89 7,681.00 6,264.44 7,150.01 7,702.12 7,199.22 $86,310.24 2.55%

P.O.M.E.C 21,888.00 19,706.39 24,273.37 22,720.16 24,899.02 25,957.27 30,433.83 31,363.97 22,046.48 23,159.12 26,362.42 24,314.27 $297,124.32 8.76%

Management Fees 11,225.11 9,952.46 11,831.75 11,543.21 14,076.06 15,026.07 17,729.37 18,236.86 13,192.61 12,085.93 13,545.64 13,065.34 $161,510.42 7.84%

Total Variable Costs 66,620.81 60,462.65 70,996.38 69,490.39 75,474.91 78,440.86 93,301.47 92,236.64 68,651.90 71,722.15 79,758.32 73,317.08 $900,523.57 26.56%

Income from Operations 63,336.72 55,597.87 29,152.15 65,062.14 121,216.61 139,250.66 161,994.06 160,209.89 146,935.63 73,095.38 63,399.21 89,882.45 1,169,132.76 34.49%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 6

www.hotelskonsultan.webs.com

Income from Operations

Analysis

Contribution Margin 72.24% 73.26% 66.22% 71.59% 75.39% 76.06% 74.46% 74.55% 78.92% 71.84% 68.50% 73.17% 73.44%

Break-Even Sales Volume 152,310.24 150,194.87 166,154.27 153,696.84 145,940.11 144,651.22 147,767.33 147,582.94 139,424.27 153,152.19 160,629.89 150,381.28 1,797,952.05 53.04%

Sales Volume Above Break-

Even

87,675.76 75,894.13 44,022.73 90,884.16 160,779.89 183,068.78 217,556.67 214,892.06 186,191.73 101,743.81 92,556.11 122,846.72 1,592,045.95 46.96%

Room Available 6,200 5,200 6,200 6,000 6,200 6,000 6,200 6,200 6,000 6,200 6,000 6,200 72,600

Room Sold 2,660 2,566 2,479 2,652 3,581 3,959 4,198 4,165 3,984 2,929 2,874 3,101 39,148

Average Room Rate $90.22 $88.09 $88.09 $84.79 $92.22 $85.64 $82.78 $87.02 $87.03 $81.73 $87.02 $88.08 86.00

Income from Operations

Analysis

Average Room Rate $90.22 $88.09 $88.09 $84.79 $92.22 $85.64 $82.78 $87.02 $87.03 $81.73 $87.02 $88.08 $86.00

1,705 1,887 1,813 1,583 1,690 1,786 1,696 1,602 1,874 1,846 1,708 20,907

Breakeven Room Night 1,689

% Occupancy Breakeven 27.2% 32.8% 30.4% 30.2% 25.5% 28.2% 28.8% 27.4% 26.7% 30.2% 30.8% 27.5% 28.8%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 7

www.hotelskonsultan.webs.com

4. TEST USE FORMULA A

We do test the Classic Spread Sheet Break-even Point with the formula A as per page 1

with the formula as bellow:

BE=FC/ (1-VC %)

BE Break Even Point

FC Fixed Costs

VC Variable Costs

We do test for January 2009 for Room Division as follow:

JANUARY 2009 BREAK-EVEN POINT:

Fixed Cost: $110,028.47

VC%: 27.760290%

Solution on Break-even point of January 2009 Room Division as bellow:

BE = $110,028.47/(1-27.760290%)

BE = $110,028.47/72.2397%

BE = $110,028/0.722397

BE = $152,310.24 compare with Classic Spread Sheet is $ 152,310.24

We do test for Total 2009 for Room Division as follow:

TOTAL 2009 BREAK-EVEN POINT:

Fixed Cost: $1,320,341.69

VC%: 26.564132%

Solution on Break-even point of Total 2009 Room Division as bellow:

BE = $1,320,341.69/(1-26.564132%)

BE = $1,320,341.69/73.4359%

BE = $1,320.341.69/0.734359

BE = $1,797,952.28 compare with Classic Spread Sheet is $ 1,797,952.28

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 8

www.hotelskonsultan.webs.com

5. TEST USE EQUATION

The result of Classic Spread Sheet Break-even Point also can be proved by using “Equation

Method” as following:

Sales = Variable Cost + Fixed Cost + Profit

To prove January 2009 Result of Classic Spread Sheet Break-even Point for Room Division:

Information we got as follow:

Average Room Rate = $90.22

Sales = $236,986

Room Sold = 2660

Fixed Cost = $110,028.47

Variable Cost = $66,620.81

Proved:

Variable Cost per Occupied = $66,620.81 / 2660 = $ 25.045

$90.22Q = $25.045Q + $110,028.47 + $0

65.175Q = 110,028.47

Q = 1,688.21 ronded 1,689 R/N compare with Classic Spread Sheet BEP 1,689 R/N

You can do test the other months and in Yearly Total with this Equation Method

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 9

www.hotelskonsultan.webs.com

6. BREAKEVEN CHART

This is Breakeven Chart for January 2009, you are free to do for another month within the

Classic Spread Sheet Break-even Point:

Breakeven Chart

350,000.00

300,000.00

250,000.00

Money

200,000.00

150,000.00

100,000.00

50,000.00

-

- 563.00 1,126.00 1,689.00 2,252.00 2,815.00 3,378.00

Operating Surplus (110,028.47) (73,335.18) (36,641.89) 51.40 36,744.69 73,437.98 110,131.27

Variable Costs - 14,100.57 28,201.14 42,301.71 56,402.28 70,502.85 84,603.42

Fixed Costs 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47 110,028.47

Business Revenue - 50,793.86 101,587.72 152,381.58 203,175.44 253,969.30 304,763.16

Total Costs 110,028.47 124,129.04 138,229.61 152,330.18 166,430.75 180,531.32 194,631.89

Room Sold

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 10

www.hotelskonsultan.webs.com

Hotel F & B Division

Break-even Point

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 11

www.hotelskonsultan.webs.com

7. Hotel F & B Departmental Profit

1.1. Food and Beverage Payroll

Payroll in this Best Practice is Fixed Cost, in the Consuldated Food and Beverage

Departmental Budget appear constant as Fixed Cost

1.2. Food and Beverage Cost of Sales

Cost of Sales – In Food and Beverage Departmental Profit has Cost of Sales but in the Room

Departmental Profit is not, this expense in this Best Practice as Variable Cost

1.3. Provision of Food and Beverage

Provision in this Best Practice is Fixed Cost, but you can calculate this expenses by

percentage of Sales and then become as Vaiable Cost

1.4. Other Expenses

Other Expenses in this Best Practice can be Fixed Cost or Variable Cost depend how you are

calculated in the budget, when is constant every month will be Fixed Cost and when the

expenses based on total sales or number of cover will categoried as Variable Cost

You are never can to compute by using formula directly without to identify the expenses caracter,

because the Fixed Cost such as Administration, Human Resources, Sales & Marketing and

Property Operation & Energy Cost (P.O.M.E.C) share with Room Division and Other Operated

Department. In this case you can splite based on Revenue percentage.

Your operation Break-even Point will be wrong when you don’t split the above Expenses, also

you will to find difficulties when you are not moving your expenses into the two categories

expense i.e., Fixed Cost and Variable Cost.

Do not confusing with Cost of Sales, because this expenses should be categoried by Variable

Cost because these expenses will be increase or decrease paralel to the Food and Beverage

Sales.

Remember to compute Break-even Point, you only need Fixed Cost and Variable Cost. The Cost

of Sales is the presentation in the Profit and Loss format.

So, to get the Calculation you can follow the steaps as bellow:

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 12

www.hotelskonsultan.webs.com

8. Classic Spread Sheet Break-even Point Analysis

The Classic Spread Sheet Break-even Point Analysis is the easier way to calculate Food and

Beverage Divison Departmental Profit Break-even Point. This method can be prepared by

following steps:

a. STEP ONE

Prepare Consulidated Operating Budget Summary and Monthly

b. STEP TWO

Move the expenses to Fixed Cost for constant expenses and move to Variable Cost for

non constant expenses, all exepses calculated based on Number Guest, Number Cover or

Percentage of Sales

c. STEP THREE

Calculate the Contribution Margin the simple formula as bellow:

(S – VC)/S

Sales – Variable Cost divided by Sales

d. STEP FOUR

Calculate the Break-even Sales Volume the simple formula as below:

FC/CM

Fixed Cost divided by Contribution Margin

e. STEP FIVE

Do calculation the Break-even Point Analysis by using the Classic Spread Sheet as

sample

f. STEP SIX

Do test with one of the formula as above or other furmula do you have

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 13

www.hotelskonsultan.webs.com

Example: MONTHLY BREAKDOWN OF CONSOLIDATED FOOD AND BEVERAGE DIVISION BUDGET

Based on Proposed Budget 2009

BUDGET FOR 2009 - MONTH BY MONTH

Break-Even Analysis Year 1

% of

1/09 2/09 3/09 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 Sales

Sales 134,835.30 114,123.67 188,093.22 137,513.67 132,954.15 133,924.07 168,622.04 183,069.25 83,046.27 142,083.21 185,996.77 145,738.38 $1,750,000

Fixed Costs

Payroll 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 17,704.57 $212,455 12.14%

Provision 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 1,950.00 $23,400 1.34%

Administration & General 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 6,400.77 $76,809 4.39%

Human Resources 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 1,012.64 $12,152 0.69%

Sales & Marketing 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 3,567.20 $42,806 2.45%

P.O.M.E.C 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 1,855.39 $22,265 1.27%

Depreciation $20,410 $20,410 $20,410 $20,410 $20,410 $20,410 $20,410 $20,410 $20,410 $20,410 $20,410 $20,410 $244,920 14.00%

Total Fixed Costs $52,901 $52,901 $52,901 $52,901 $52,901 $52,901 $52,901 $52,901 $52,901 $52,901 $52,901 $52,901 $634,807 36.27%

Variable Costs

Cost of Sales 38,790.29 32,757.48 53,989.27 39,020.77 38,162.44 38,440.86 48,400.38 52,547.25 23,837.18 40,782.81 53,387.56 41,831.97 $501,948 28.68%

Kitchen Fuel 1,884.84 1,431.42 2,479.78 2,068.20 1,642.43 1,968.57 2,430.12 2,318.75 1,303.33 1,960.72 2,530.50 1,879.23 $23,898 1.37%

Laundry Linen 460.58 581.27 750.80 242.32 676.75 326.70 406.91 778.86 115.88 547.76 723.95 736.41 $6,348 0.36%

Music Entertainment 2,666.00 2,064.00 3,400.00 3,234.00 2,390.00 2,671.00 3,409.00 3,247.00 1,926.00 2,793.00 3,495.00 2,725.00 $34,020 1.94%

Cleaning Supplies 609.66 599.64 986.39 547.69 718.46 582.85 751.41 1,015.01 271.23 639.35 900.37 715.96 $8,338 0.48%

Guest Supplies F & B 1,153.04 954.07 1,622.75 1,195.61 1,112.18 1,173.34 1,466.74 1,570.56 711.03 1,202.41 1,595.00 1,211.65 $14,968 0.86%

Printing & Stationery 580.20 617.95 1,002.09 524.07 748.78 534.10 700.99 1,058.03 203.89 608.78 883.91 718.21 $8,181 0.47%

Decorations 172.41 112.18 201.41 225.44 124.61 186.89 226.40 175.83 139.19 178.21 219.85 156.89 $2,119 0.12%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 14

www.hotelskonsultan.webs.com

Menu & Wine List 47.88 31.15 55.93 62.61 34.61 51.90 62.88 48.83 38.66 49.49 61.06 43.57 $589 0.03%

Spoilage 61.91 40.28 72.33 80.96 44.75 67.11 81.30 63.14 49.98 63.99 78.95 56.34 $761 0.04%

Telephone & Fax 86.28 56.14 100.79 112.81 62.36 93.52 113.29 87.99 69.66 89.18 110.02 78.51 $1,061 0.06%

Laundry Uniforms 663.54 675.88 1,097.12 633.44 808.57 625.28 810.81 1,146.99 263.57 697.86 987.64 792.23 $9,203 0.53%

F & B Promotions 208.79 135.85 243.91 273.01 150.91 226.32 274.17 212.93 168.57 215.81 266.24 189.99 $2,567 0.15%

Bar Supplies 21.01 13.67 24.55 27.47 15.19 22.78 27.59 21.43 16.96 21.72 26.79 19.12 $258 0.01%

Banquet Expenses 106.90 69.55 124.88 139.78 77.26 115.88 140.38 109.02 86.31 110.50 136.32 97.28 $1,314 0.08%

Entertainment 61.88 40.26 72.28 80.91 44.72 67.07 81.25 63.10 49.96 63.96 78.90 56.31 $761 0.04%

Miscellaneous 75.49 49.07 87.90 98.40 54.72 80.98 98.30 76.42 60.26 77.47 95.81 67.81 $923 0.05%

Administration & General 3,904.43 3,383.04 5,265.71 4,535.24 3,790.63 3,779.38 4,856.29 5,236.41 2,319.68 3,929.02 4,953.56 4,064.66 $50,018 2.86%

Human Resources 852.61 707.19 1,139.43 977.82 808.92 805.20 1,006.96 1,136.88 490.96 823.07 1,084.71 939.49 $10,773 0.62%

Sales & Marketing 3,604.89 3,522.51 3,967.49 3,796.37 3,612.99 3,606.69 3,873.30 3,966.83 3,235.25 3,692.60 3,977.74 3,718.02 $44,575 2.55%

P.O.M.E.C 11,304.00 10,177.31 12,535.92 11,733.77 12,859.04 13,405.56 15,717.47 16,197.84 11,385.85 11,960.47 13,614.80 12,557.04 $153,449 8.77%

Total Variable Costs $67,317 $58,020 $89,221 $69,611 $67,940 $68,832 $84,936 $91,079 $46,743 $70,508 $89,209 $72,656 $876,071 50.06%

Income from Operations $14,618 $3,203 $45,972 $15,002 $12,113 $12,191 $30,786 $39,090 ($16,598) $18,674 $43,888 $20,182 $239,122 13.66%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 15

www.hotelskonsultan.webs.com

Income from Operations Analysis

Contribution Margin 50.07% 49.16% 52.57% 49.38% 48.90% 48.60% 49.63% 50.25% 43.71% 50.38% 52.04% 50.15% 49.94%

Break-Even Sales Volume $105,643 $107,608 $100,637 $107,132 $108,182 $108,841 $106,591 $105,277 $121,015 $105,013 $101,659 $105,492 $1,271,170 72.64%

Sales Volume Above Break-Even $29,192 $6,516 $87,456 $30,382 $24,772 $25,083 $62,031 $77,792 ($37,969) $37,071 $84,338 $40,246 $478,830 27.36%

Guest 5,191 4,885 4,847 5,180 7,076 7,728 8,368 8,274 7,827 5,754 5,691 6,077 76,898

Cover 11,063 10,030 15,033 12,814 11,928 11,577 14,785 15,862 7,512 10,809 10,910 11,700 144,023

Capture Rate 213.1% 205.3% 310.2% 247.4% 168.6% 149.8% 176.7% 191.7% 96.0% 187.9% 191.7% 192.5% 187.3%

Income from Operations Analysis

Average Room Rate $12.19 $11.38 $12.51 $10.73 $11.15 $11.57 $11.40 $11.54 $11.06 $13.14 $17.05 $12.46 $12.15

Breakeven Cover 8,668 9,457 8,043 9,983 9,706 9,409 9,346 9,122 10,946 7,989 5,963 8,469 104,616

Breakeven Capture Rate 167.0% 193.6% 165.9% 192.7% 137.2% 121.7% 111.7% 110.2% 139.9% 138.8% 104.8% 139.4% 136.0%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 16

www.hotelskonsultan.webs.com

9. TEST USE FORMULA A

We do test the Classic Spread Sheet Break-even Point with the formula A as per page 1

with the formula as bellow:

BE=FC/ (1-VC %)

BE Break Even Point

FC Fixed Costs

VC Variable Costs

We do test for January 2009 Food and Beverage Division as follow:

JANUARY 2009 BREAK-EVEN POINT:

Fixed Cost: $52,900.58

VC%: 49.925%

Solution on Break-even point of January 2009 Food and Beverage Division as bellow:

BE = $52,900.58/(1-49.925%)

BE = $52,900.58/50.07492%

BE = $52,900/0.5007492

BE = $105,642.86 compare with Classic Spread Sheet is $ 105,642.86

We do test for Total 2009 as follow:

TOTAL 2009 BREAK-EVEN POINT:

Fixed Cost: $634,806.98

VC%: 50.061217%

Solution on Break-even point of Total 2009 Food and Beverage Division as bellow:

BE = $634,806.98/(1-50.0612%)

BE = $634,806.98/49.938783%

BE = $634,806.94/0.49938783

BE = $1,271,170.30 compare with Classic Spread Sheet is $ 1,271,170.29

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 17

www.hotelskonsultan.webs.com

10. TEST USE EQUATION

The result of Classic Spread Sheet Break-even Point also can be proved by using “Equation

Method” as following:

Sales = Variable Cost + Fixed Cost + Profit

To prove January 2009 Result of Classic Spread Sheet Break-even Point:

Information we got as follow:

Average Per Cover = $12.19

Sales = $134,835.30

Cover = 11,063

Fixed Cost = $52,900.58

Variable Cost = $67,316.63

Proved:

Variable Cost per Cover = $67,316.63 / 11,063 = $ 6.084844

$12.19Q = $6.085Q + $52,900.58 + $0

6.105Q = 52,900.58

Q = 8,665.12 ronded 8,666 Covers compare with Classic Spread Sheet BEP 8,668 Cover

You can do test the other months and in Yearly Total with this Equation Method

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 18

www.hotelskonsultan.webs.com

11. BREAKEVEN CHART FOR FOOD AND BEVERAGE DIVISION

Breakeven Chart

200,000.00

150,000.00

100,000.00

Money

50,000.00

(50,000.00)

(100,000.00)

- 2,167 4,334 6,501 8,668 10,835 13,002

Fixed Cost 52,900.58 52,900.58 52,900.58 52,900.58 52,900.58 52,900.58 52,900.58

Variable Cost - 13,185.86 26,371.71 39,557.57 52,743.43 65,929.29 79,115.14

Operating Surplus (52,900.58) (39,675.15) (26,449.71) (13,224.28) 1.15 13,226.59 26,452.02

Total Cost 52,900.58 66,086.44 79,272.30 92,458.15 105,644.01 118,829.87 132,015.72

Revenue - 26,411.29 52,822.58 79,233.87 105,645.16 132,056.45 158,467.74

Cover Food and Beverage

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 19

www.hotelskonsultan.webs.com

Hotel Minor Operated

Department

Break-even Point

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 20

www.hotelskonsultan.webs.com

12. Hotel Minor Operated Departmental Profit

12.1 Minor Operated Department Payroll

Payroll in this Best Practice is Fixed Cost, in the Consuldated Minor Operated Departmental

Budget appear constant as Fixed Cost

12.2 Minor Operated Department Cost of Sales

Cost of Sales – In Minor Operated Departmental Profit also has Cost of Sales but in the

Room Departmental Profit is not, this expense in this Best Practice as Variable Cost

12.3 Provision of Minor Operated Department

Provision in this Best Practice is Fixed Cost, but you can calculate this expenses by

percentage of Sales and then become as Vaiable Cost

12.4 Other Expenses

Other Expenses in this Best Practice can be Fixed Cost or Variable Cost depend how you

are calculated in the budget, when is constant every month will be Fixed Cost and when the

expenses based on total sales or number of cover will categoried as Variable Cost

You are never can to compute the Minor Operated Department by using formula directly without

to identify the expenses caracter, because the Fixed Cost such as Administration, Human

Resources, Sales & Marketing and Property Operation & Energy Cost (P.O.M.E.C) share with

Room Division and Food and Beverage Division. In this case you can splite based on Revenue

percentage.

Same with Room Division and Food Beverage Division, Other Operated Department Break-even

Point will be wrong when you don’t split the above Expenses, also you will to find difficulties when

you are not moving your expenses into the two categories expense i.e., Fixed Cost and Variable

Cost.

Again do not confusing with Cost of Sales, because this expenses should be categoried by

Variable Cost because these expenses will be increase or decrease paralel to the Minor

Operated Department Sales.

Remember to compute Break-even Point, you only need Fixed Cost and Variable Cost. The Cost

of Sales is the presentation in the Profit and Loss format only.

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 21

www.hotelskonsultan.webs.com

13. Classic Spread Sheet Break-even Point Analysis

The Classic Spread Sheet Break-even Point Analysis is the easier way to calculate Minor

Operated Departmental Profit Break-even Point. This method can be prepared by following steps:

a. STEP ONE

Prepare Consulidated Operating Budget Summary and Monthly

b. STEP TWO

Move the expenses to Fixed Cost for constant expenses and move to Variable Cost for

non constant expenses, all exepses calculated based on Number Guest, Percentage of

Sales

c. STEP THREE

Calculate the Contribution Margin the simple formula as bellow:

(S – VC)/S

Sales – Variable Cost divided by Sales

d. STEP FOUR

Calculate the Break-even Sales Volume the simple formula as below:

FC/CM

Fixed Cost divided by Contribution Margin

e. STEP FIVE

Do calculation the Break-even Point Analysis by using the Classic Spread Sheet as

sample

f. STEP SIX

Do test with one of the formula as above or other furmula do you have

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 22

www.hotelskonsultan.webs.com

Example: MONTHLY BREAKDOWN OF CONSOLIDATED MINOR OPERATED DEPARTMENT BUDGET

Based on Proposed Budget 2009

BUDGET FOR 2009 - MONTH BY MONTH

Break-Even Analysis Year 1

% of

1/09 2/09 3/09 4/09 5/09 6/09 7/09 8/09 9/09 10/09 11/09 12/09 Sales

Sales 32,854.00 28,628.00 45,141.00 37,098.00 32,719.00 32,951.00 41,295.00 44,769.00 21,540.00 34,913.00 45,426.00 35,791.00 $433,125.00

Fixed Costs

Payroll 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 7,899.00 $94,787.97 21.88%

Provision 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 1,196.00 $14,352.00 3.31%

Cleaning Supplies 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 25.00 $300.00 0.07%

Guest Supplies FB 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 75.00 $900.00 0.21%

Administration & General 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 1,590.00 $19,080.00 4.41%

Human Resources 251.55 251.55 251.55 251.55 251.55 251.55 251.55 251.55 251.55 251.55 251.55 251.55 $3,018.58 0.70%

Sales & Marketing 886.12 886.12 886.12 886.12 886.12 886.12 886.12 886.12 886.12 886.12 886.12 886.12 $10,633.44 2.46%

P.O.M.E.C 460.89 460.89 460.89 460.89 460.89 460.89 460.89 460.89 460.89 460.89 460.89 460.89 $5,530.73 1.28%

Depreciation $5,070 $5,070 $5,070 $5,070 $5,070 $5,070 $5,070 $5,070 $5,070 $5,070 $5,070 $5,070 $60,840.00 14.05%

Total Fixed Costs 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 $209,442.71 48.36%

Variable Costs

Cost of Sales 6,120.54 5,010.32 8,908.09 6,962.60 6,004.34 6,055.41 7,883.52 8,644.07 3,376.19 6,486.13 8,799.38 6,679.82 $80,930 18.69%

Laundry Uniforms 111.07 105.36 129.49 111.58 111.19 108.33 470.16 595.67 87.99 110.99 127.89 116.18 $2,186 0.50%

Telephone & Fax 44.34 42.10 49.95 46.03 44.10 44.20 47.88 49.41 38.81 45.07 49.73 45.46 $547 0.13%

Printing & Stationery 90.18 83.14 107.87 95.53 89.44 89.76 101.36 106.19 72.75 92.49 107.16 93.71 $1,130 0.26%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 23

www.hotelskonsultan.webs.com

Laundry Supplies 90.00 75.00 119.00 120.00 83.00 95.00 119.00 100.00 80.00 100.00 123.00 88.00 $1,192 0.28%

Laundry Operation Linen 1,233.42 973.46 1,967.00 1,480.15 1,219.04 1,235.15 1,436.25 1,538.16 947.69 1,350.05 1,966.27 1,398.33 $16,745 3.87%

Miscellaneous 53.00 54.00 55.00 56.00 55.00 54.00 53.00 53.00 54.00 53.00 54.00 53.00 $647 0.15%

Administration & General 969.89 840.37 1,308.04 1,126.59 941.62 938.83 1,206.34 1,300.76 576.23 976.00 1,230.50 1,009.69 $12,425 2.87%

Human Resources 211.79 175.67 283.04 242.90 200.94 200.02 250.14 282.41 121.96 204.46 269.45 233.38 $2,676 0.62%

Sales & Marketing 895.48 875.02 985.56 943.05 897.49 895.93 962.16 985.39 803.66 917.27 988.10 923.58 $11,073 2.56%

P.O.M.E.C 2,808.00 2,528.12 3,114.02 2,914.76 3,194.28 3,330.04 3,904.34 4,023.67 2,828.33 2,971.07 3,382.02 3,119.26 $38,118 8.80%

Total Variable Costs 12,627.71 10,762.57 17,027.06 14,099.19 12,840.46 13,046.68 16,434.14 17,678.74 8,987.60 13,306.52 17,097.50 13,760.42 $167,668.60 38.71%

Income from Operations 2,772.73 411.87 10,660.38 5,545.26 2,424.98 2,450.76 7,407.30 9,636.71 (4,901.16) 4,152.92 10,874.94 4,577.02 $56,013.69 12.93%

Income from Operations Analysis

Contribution Margin 61.56% 62.41% 62.28% 61.99% 60.76% 60.41% 60.20% 60.51% 58.27% 61.89% 62.36% 61.55% 61.29%

Break-Even Sales Volume 28,350.20 27,968.01 28,024.21 28,153.28 28,727.62 28,893.84 28,991.15 28,843.51 29,950.43 28,202.48 27,987.56 28,355.14 $341,731.73 78.90%

Sales Volume Above Break-

Even 4,503.80 659.99 17,116.79 8,944.72 3,991.38 4,057.16 12,303.85 15,925.49 (8,410.43) 6,710.52 17,438.44 7,435.86 $91,393.27 21.10%

Guest 5,191 4,885 4,847 5,180 7,076 7,728 8,368 8,274 7,827 5,754 5,691 6,077 76,898

Income from Operations Analysis

Average Price for MOD $6.33 $5.86 $9.31 $7.16 $4.62 $4.26 $4.93 $5.41 $2.75 $6.07 $7.98 $5.89 $5.63

Breakeven Guest 4,479 4,772 3,009 3,931 6,213 6,776 5,875 5,331 10,883 4,648 3,506 4,814 60,672

Breakeven Capture Rate 86.3% 97.7% 62.1% 75.9% 87.8% 87.7% 70.2% 64.4% 139.1% 80.8% 61.6% 79.2% 78.9%

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 24

www.hotelskonsultan.webs.com

14. TEST USE FORMULA A

We do test the Classic Spread Sheet Break-even Point with the formula A as per page 1 with the

formula as bellow:

BE=FC/ (1-VC %)

BE Break Even Point

FC Fixed Costs

VC Variable Costs

We do test for January 2009 Minor Operated Department as follow:

JANUARY 2009 BREAK-EVEN POINT:

Fixed Cost: $17,453.56

VC%: 38.43585%

Solution on Break-even point of January 2009 Minor Operated Department as bellow:

BE = $17,453.56/(1-38.43585%)

BE = $17,453.56/61.56415%

BE = $17.453.56/0.6156415

BE = $28,350.20 compare with Classic Spread Sheet is $ 28,350.20

We do test for Total 2009 Minor Operated Department as follow:

TOTAL 2009 BREAK-EVEN POINT:

Fixed Cost: $209,442.71

VC%: 38.711365%

Solution on Break-even point of Total 2009 Minor Operated Department as bellow:

BE = $209,442.71/(1-38.711365%)

BE = $209,442.71/61.288634%

BE = $209,442.71/0.61288634

BE = $341,731.73 compare with Classic Spread Sheet is $ 341,731.73

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 25

www.hotelskonsultan.webs.com

15. TEST USE EQUATION

The result of Classic Spread Sheet Break-even Point also can be proved by using “Equation Method” as

following:

Sales = Variable Cost + Fixed Cost + Profit

To prove January 2009 Minor Operated Department Result of Classic Spread Sheet Break-even Point:

Information we got as follow:

Average Per Guest = $6.33

Sales = $32,854.00

No Of Guest = 5,191

Fixed Cost = $17,453.56

Variable Cost = $12,627.71

Proved:

Variable Cost per Guest = $12,627.71 / 5,161 = $ 2.4326

$6.33Q = $2.4326Q + $17,453.56 + $0

3.8974Q = 17,453.56

Q = 4,478.26 ronded 4,479 Covers compare with Classic Spread Sheet BEP 4,479 Cover

You can do test the other months and in Yearly Total with this Equation Method

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 26

www.hotelskonsultan.webs.com

16. BREAKEVEN CHART FOR MINOR OPERATED DEPARTMENT

Breakeven Chart

50,000.00

40,000.00

30,000.00

20,000.00

Money

10,000.00

(10,000.00)

(20,000.00)

(30,000.00)

- 1,120 2,240 3,360 4,479 5,599 6,719

Fixed Cost 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56 17,453.56

Variable Cost - 2,724.53 5,449.06 8,173.59 10,895.69 13,620.22 16,344.75

Operating Surplus (17,453.56) (13,089.58) (8,725.59) (4,361.61) (1.52) 4,362.46 8,726.45

Total Cost 17,453.56 20,178.09 22,902.62 25,627.15 28,349.25 31,073.78 33,798.31

Revenue - 7,088.51 14,177.03 21,265.54 28,347.73 35,436.24 42,524.76

Number Guest of Minor Operated Department

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 27

www.hotelskonsultan.webs.com

Hotel Operation

Break-even Point

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 28

www.hotelskonsultan.webs.com

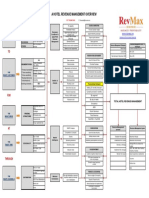

17. HOTEL OPERATION BREAK-EVEN PINT

To compute Hotel Operation Break-event Point can do just added all Sales Volume Break-even Point or by

using Break-even Analysis with Multiple Products as bellow:

Example Sales Break-even Point for January – December 2009

Description Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09

Room Division 152,310.24 150,194.87 166,154.27 153,696.84 145,940.11 144,651.22

F & B Division 105,642.86 107,607.96 100,637.10 107,131.59 108,182.42 108,840.61

Minor Op. Dept. 28,350.20 27,968.01 28,024.21 28,153.28 28,727.62 28,893.84

Total Sales BEP 286,303.30 285,770.84 294,815.58 288,981.71 282,850.15 282,385.67

Description Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09

Room Division 147,767.33 147,582.94 139,424.27 153,152.19 160,629.89 150,381.28

F & B Division 106,591.24 105,277.25 121,015.07 105,012.66 101,658.55 105,492.07

Minor Op. Dept. 28,991.15 28,843.51 29,950.43 28,202.48 27,987.56 28,355.14

Total Sales BEP 283,349.72 281,703.70 290,389.77 286,367.33 290,276.00 284,228.49

Remember, the hotel operation is unique compare to manufactures or other business and we now about

“Break-even Analysis with Multiple Products” is far different under than the above break-even point. Let

we try to compute

HOTEL XYZOTEL XYZ

Description Room Division F & B Division M.O. D Total

Sales 239,986.00 100.0% 134,835.30 100.0% 32,854.00 100.0% 407,675.30 100.0%

Less Variable Expenses 66,620.81 27.8% 67,316.63 49.9% 12,627.71 38.4% 146,565.15 36.0%

Contribution Margin 173,365.19 72.2% 67,518.67 50.1% 20,226.29 61.6% 261,110.15 64.0%

Less Fixed Expenses 110,028.47 52,900.58 17,453.56 180,382.61

Net Operating Income 80,727.54

Computation of Break-even Point:

Fixed Cost / Overall Contribution Margin

180,382.61 / 0.64 = 281,847.83

Different: 286,303.30 – 281,847.83 = 4,455.47 under than calculation

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 29

www.hotelskonsultan.webs.com

18. CONCLUTION:

18.1 Hotel Operation is unique

The hotel operation is unique not like normal manufactures, there is many departmental profit that can be

computed the break-even point. Those departmental profits has different characteristic of operations.

18.2 Computation Break-even Point of Hotel

Because every departmental profit is different in operations also the expenses structures are different, so

to calculate the break-even point is better use this example.

18.3 Common Formula used

Common Break-even formula still used to calculate departmental profits, but overall hotel operation will

have big different.

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 30

www.hotelskonsultan.webs.com

GLOSSARY OF TERMS

Break-even point the break-even point is the point at which the supplier of a service

or goods has covered all fixed and variable costs, to that point.

After that point, the supplier can begin to make a profit, because

the contribution is now to profit and not to fixed costs. For more

detail see the toolkit on developing a financing strategy.

Contribution Margin A cost accounting concept that allows a company to determine the

profitability of individual products.

It is calculated as follows:

Product Revenue - Product Variable Costs

Product Revenue

The phrase "contribution margin" can also refer to a per unit

measure of a product's gross operating margin, calculated simply

as the product's price minus its total variable costs..

Payroll dependent upon usage, can mean a. the total amount of money

paid in wages; b. a list of employees and their salaries; or, c. the

department that determines the amounts of wage or salary due to

each employee.

Consolidated Budget is the budget that accounts for all operating accounts of a parent

and all subsidiaries presented.

Fixed Cost is operating expenses that are incurred to provide facilities and

organization that are kept in readiness to do business without

regard to actual volumes of production and sales. Fixed costs

remain relatively constant until changed by managerial decision.

Within general limits they do not vary with business volume.

Examples of fixed costs consist of rent, property taxes, and

interest expense.

Variable Cost are those costs associated with production that changes directly

with the amount of production, e.g., the direct material or labour

required to complete the build or manufacturing of a product.

End of Best Practice of Hotel Room Division Departmental Profit

See you for Best Practice of Hotel F & B Division Departmental Profit

Developed by: Drs. Agustinus Agus Purwanto, MM Page: 31

Вам также может понравиться

- Hotel Manager On Duty Report 2 TemplateДокумент1 страницаHotel Manager On Duty Report 2 TemplateAgustinus Agus Purwanto80% (5)

- Food and Beverage Sequence of ServiceДокумент11 страницFood and Beverage Sequence of ServiceAgustinus Agus Purwanto97% (36)

- 2013 Standards of Operating ProceduresДокумент145 страниц2013 Standards of Operating ProceduresYadia Vergara Rubatino70% (10)

- F & B Inspection Check List FormatДокумент2 страницыF & B Inspection Check List FormatAgustinus Agus Purwanto88% (17)

- Hotel Accounting Standard Manual PDFДокумент291 страницаHotel Accounting Standard Manual PDFAgustinus Agus Purwanto100% (3)

- Uniform System of Accounts For The Lodging IndustryДокумент10 страницUniform System of Accounts For The Lodging IndustryRose Samson100% (1)

- Manager On Duty Check ListДокумент3 страницыManager On Duty Check ListEko Anom PurboyantoОценок пока нет

- Hotel Cash ManagementДокумент58 страницHotel Cash ManagementAgustinus Agus Purwanto94% (33)

- Food Cost ManualДокумент105 страницFood Cost ManualVivek Sharma100% (12)

- Hotel Front Office DepartmentДокумент43 страницыHotel Front Office DepartmentAgustinus Agus Purwanto92% (26)

- TaskBob Group5 BandC PDFДокумент14 страницTaskBob Group5 BandC PDFNidhi ShahОценок пока нет

- Marketing Plan Vinasoy CollagenДокумент24 страницыMarketing Plan Vinasoy CollagenNguyễn Ngọc Quỳnh AnhОценок пока нет

- Hotel Accounting StandardsДокумент38 страницHotel Accounting StandardsCalvawell Muzvondiwa100% (1)

- F&B Cost ControlДокумент4 страницыF&B Cost Controlzuldvsb100% (1)

- HotelДокумент72 страницыHotelSakkarai ManiОценок пока нет

- Hotel Revenue Management - From Theory To PracticeДокумент205 страницHotel Revenue Management - From Theory To PracticeStanislav Ivanov100% (11)

- Hotel Accounting Procedures HS-3Документ79 страницHotel Accounting Procedures HS-3shivdas kaleОценок пока нет

- Draft Manning GuideДокумент8 страницDraft Manning Guidedazinc100% (2)

- Guest Group Contract Rate TemplateДокумент7 страницGuest Group Contract Rate TemplateAgustinus Agus Purwanto100% (7)

- Housekeeping Training - Basic StandardДокумент35 страницHousekeeping Training - Basic StandardAgustinus Agus Purwanto100% (22)

- Hotel Laundry TrainingДокумент27 страницHotel Laundry TrainingAgustinus Agus Purwanto100% (17)

- Hotel Marketing Plan TemplateДокумент44 страницыHotel Marketing Plan TemplateAgustinus Agus Purwanto93% (15)

- 01 - Revenue Management - A Financial Perspective PDFДокумент21 страница01 - Revenue Management - A Financial Perspective PDFAnca MilasanОценок пока нет

- Check List and Countdown For Pre-Opening ActionsДокумент10 страницCheck List and Countdown For Pre-Opening Actionstaola100% (1)

- 5.04 Job Descriptions - Engineering 44 PagesДокумент4 страницы5.04 Job Descriptions - Engineering 44 PagesorientalhospitalityОценок пока нет

- TUNE HOTEL - Sample ProjectДокумент13 страницTUNE HOTEL - Sample ProjectJulius Fernan Vega100% (1)

- Hotel Management Fees Miss The MarkДокумент9 страницHotel Management Fees Miss The MarkMiguel RiveraОценок пока нет

- Dokument - Pub 11th Edition Uniform Accounting Converted Flipbook PDFДокумент317 страницDokument - Pub 11th Edition Uniform Accounting Converted Flipbook PDFWahyu KusumaОценок пока нет

- Concept of Hotel AccountancyДокумент27 страницConcept of Hotel AccountancyDrAnisha satsangiОценок пока нет

- Hotel Expense AccountingДокумент7 страницHotel Expense AccountingPj Sorn100% (1)

- A Hotel Revenue Management Overview - v4Документ1 страницаA Hotel Revenue Management Overview - v4Tó GonçalvesОценок пока нет

- F&B Cost Controller ProfileДокумент4 страницыF&B Cost Controller ProfileAhamed ZaahidОценок пока нет

- Restaurant Project PlanningДокумент19 страницRestaurant Project Planningmanishpandey1972Оценок пока нет

- Hotel Manual 02Документ83 страницыHotel Manual 02Joydeep Majumdar100% (2)

- Food Control CycleДокумент16 страницFood Control CycleOm Singh90% (10)

- Checklist HotelДокумент2 страницыChecklist HotelWicaksono Dwijaya50% (2)

- Organizational Structure: OutlineДокумент26 страницOrganizational Structure: OutlineMary Cri100% (3)

- HOSPA Finance Community USALI PDFДокумент56 страницHOSPA Finance Community USALI PDFVanjB.Payno100% (1)

- The Hotel Revenue Managers Essential Guide To SegmentationДокумент18 страницThe Hotel Revenue Managers Essential Guide To SegmentationAmalia L StefanОценок пока нет

- 051 Core and Shell Ach Ce Ing SC 030 0Документ101 страница051 Core and Shell Ach Ce Ing SC 030 0Đức Huấn ĐỗОценок пока нет

- Hotel Management Contract Trends in The GulfДокумент9 страницHotel Management Contract Trends in The GulfLala KakaОценок пока нет

- HOTEL Technical Advisory OfferДокумент3 страницыHOTEL Technical Advisory OfferzuldvsbОценок пока нет

- Key Performance Indicators HousekeepingДокумент11 страницKey Performance Indicators Housekeepingseduct3ur100% (2)

- Hotel Marketing and Advertisement Plan TemplateДокумент39 страницHotel Marketing and Advertisement Plan TemplateAli Azeem RajwaniОценок пока нет

- Hotel Sales & Marketing PlanДокумент29 страницHotel Sales & Marketing PlanScott Bellingham100% (3)

- Standards of PerformanceДокумент97 страницStandards of PerformancetaolaОценок пока нет

- Hotel 88 Food and BeverageДокумент12 страницHotel 88 Food and BeverageCarlos DungcaОценок пока нет

- Hotel Budgeting Project Report 4635Документ22 страницыHotel Budgeting Project Report 4635Seenu DineshОценок пока нет

- 013 Kitchen Book 2 - Cuisine UPДокумент10 страниц013 Kitchen Book 2 - Cuisine UPĐức Huấn ĐỗОценок пока нет

- Mas CVP AnalysisДокумент7 страницMas CVP AnalysisVanessa Arizo ValenciaОценок пока нет

- Chapter 1 CVP AnalysisДокумент8 страницChapter 1 CVP AnalysisBenol MekonnenОценок пока нет

- Kinney 8e - CH 09Документ17 страницKinney 8e - CH 09Ashik Uz ZamanОценок пока нет

- Unit2 ModuleДокумент29 страницUnit2 ModuleJasper John NacuaОценок пока нет

- Cost Acc Chapter 4Документ5 страницCost Acc Chapter 4ElleОценок пока нет

- CVP Analysis (Theory Math)Документ28 страницCVP Analysis (Theory Math)Ariyan ShantoОценок пока нет

- Financial Mathematics AssignmentДокумент8 страницFinancial Mathematics AssignmentIrmadela N.Оценок пока нет

- M5 Cost-Volume Profit Analysis As Managerial Planing ToolДокумент6 страницM5 Cost-Volume Profit Analysis As Managerial Planing Toolwingsenigma 00Оценок пока нет

- Topic 1.1 Cost BehaviorДокумент51 страницаTopic 1.1 Cost BehaviorGaleli PascualОценок пока нет

- Mas 1.2.2 Assessment For-PostingДокумент4 страницыMas 1.2.2 Assessment For-PostingJustine CruzОценок пока нет

- Study Guide For CVP AnalysisДокумент22 страницыStudy Guide For CVP AnalysisJaylou AguilarОценок пока нет

- Cost II Chapter1Документ9 страницCost II Chapter1Dureti NiguseОценок пока нет

- Test Bank For Cost Accounting Foundations and Evolutions 9th Edition Full DownloadДокумент67 страницTest Bank For Cost Accounting Foundations and Evolutions 9th Edition Full Downloadmatthewjacksonstjfaixoyp100% (19)

- 8 - Operating and Financial LeverageДокумент15 страниц8 - Operating and Financial LeverageClariz VelasquezОценок пока нет

- CVP AnalysisДокумент26 страницCVP AnalysisChandan JobanputraОценок пока нет

- Unit 2 Acct312-UnlockedДокумент16 страницUnit 2 Acct312-UnlockedTilahun GirmaОценок пока нет

- Cost II-ch 1 - CVPДокумент45 страницCost II-ch 1 - CVPYitera SisayОценок пока нет

- 334 - Resource - 2. CVP AnalysisДокумент32 страницы334 - Resource - 2. CVP AnalysisSaloni Aman SanghviОценок пока нет

- Variable and Absorption CostingДокумент2 страницыVariable and Absorption CostingLaura OliviaОценок пока нет

- 03 Cost Volume Profit AnalysisДокумент6 страниц03 Cost Volume Profit AnalysisPhoebe WalastikОценок пока нет

- Costing MethodsДокумент15 страницCosting MethodsLailane RamosОценок пока нет

- Beverage Knowledge Book TwoДокумент104 страницыBeverage Knowledge Book TwoAgustinus Agus Purwanto100% (4)

- Credit Card Authorization FormДокумент2 страницыCredit Card Authorization FormAgustinus Agus PurwantoОценок пока нет

- Book One Beverage KnowledgeДокумент113 страницBook One Beverage KnowledgeAgustinus Agus Purwanto100% (2)

- Front Office Management FunctionДокумент34 страницыFront Office Management FunctionAgustinus Agus Purwanto83% (6)

- Hotel Sales OfficeДокумент14 страницHotel Sales OfficeAgustinus Agus PurwantoОценок пока нет

- Hotel Engineering Training HVAC SystemДокумент14 страницHotel Engineering Training HVAC SystemAgustinus Agus Purwanto100% (2)

- F&B Restaurant Manager Job Specification TemplateДокумент3 страницыF&B Restaurant Manager Job Specification TemplateAgustinus Agus Purwanto100% (2)

- Explanation of Goodbelly Sales Spreadsheet: Variable Definitions 1 2 3 4 5 6 7 8 9Документ38 страницExplanation of Goodbelly Sales Spreadsheet: Variable Definitions 1 2 3 4 5 6 7 8 9nkjhlhОценок пока нет

- Notes of IBSA (Maria Ali-22563)Документ3 страницыNotes of IBSA (Maria Ali-22563)Syeda Maria AliОценок пока нет

- Applied EconomicsM3 - Lapeceros, Mary Anntoneth R. BSTM 2-AДокумент14 страницApplied EconomicsM3 - Lapeceros, Mary Anntoneth R. BSTM 2-Amaryie lapecerosОценок пока нет

- AENT220218Документ12 страницAENT220218Asbini SitharamОценок пока нет

- SBB Business Plan TemplateДокумент13 страницSBB Business Plan TemplateNisherrie HoopsОценок пока нет

- A Project Study Report "A Study On Customer Awareness and Perception About Roadside Assistance" OFДокумент51 страницаA Project Study Report "A Study On Customer Awareness and Perception About Roadside Assistance" OFAnkur mittalОценок пока нет

- Reading 40 - Fixed Income Markets Issuance Trading and FundingДокумент40 страницReading 40 - Fixed Income Markets Issuance Trading and FundingAllen AravindanОценок пока нет

- Porters Analysis For ITC Cigarette IndustryДокумент8 страницPorters Analysis For ITC Cigarette IndustryRajesh KumarОценок пока нет

- Masters in Business Administration-MBA Semester-4 MF0007 - Treasury Management - 2 Credits Assignment Set-1Документ9 страницMasters in Business Administration-MBA Semester-4 MF0007 - Treasury Management - 2 Credits Assignment Set-1kipokhriyalОценок пока нет

- Activity # 3: Corporate Strategies: Questions 5.1Документ5 страницActivity # 3: Corporate Strategies: Questions 5.1Jonela LazaroОценок пока нет

- Journal of CompetitivenessДокумент127 страницJournal of CompetitivenessShifat HasanОценок пока нет

- Costco RatioДокумент2 страницыCostco RationiteshranjanОценок пока нет

- Consumer EthicsДокумент22 страницыConsumer EthicsNanthini RaoОценок пока нет

- Report On ConsolidationДокумент463 страницыReport On ConsolidationJosephandjessica SutherlandОценок пока нет

- FISH SMOKING, Business PlanДокумент21 страницаFISH SMOKING, Business PlanLandoОценок пока нет

- Company Analysis PDFДокумент31 страницаCompany Analysis PDFang pauОценок пока нет

- Barila Spa - Ans-1 & Ans-3Документ2 страницыBarila Spa - Ans-1 & Ans-3SiddharthОценок пока нет

- 2 - International Parity ConditionsДокумент116 страниц2 - International Parity ConditionsMUKESH KUMARОценок пока нет

- Email Marketing and AutomationДокумент40 страницEmail Marketing and AutomationAMAN SОценок пока нет

- Swisher Mower CompanyДокумент7 страницSwisher Mower CompanyblockeisuОценок пока нет

- Brand Centric Transformation - Brand LadderДокумент23 страницыBrand Centric Transformation - Brand LadderGabriela SiquieroliОценок пока нет

- Relative Valuations FINALДокумент44 страницыRelative Valuations FINALChinmay ShirsatОценок пока нет

- 2023 Practice Problems Investment in AssociateДокумент2 страницы2023 Practice Problems Investment in AssociateEnola HeitsgerОценок пока нет

- The Role of Risk Management and ControlsДокумент4 страницыThe Role of Risk Management and ControlsaryanalynnОценок пока нет

- CapmДокумент51 страницаCapmlathachilОценок пока нет

- Adobe Scan 05 May 2022Документ22 страницыAdobe Scan 05 May 2022NamitaОценок пока нет

- Introduction To Agricultural and Natural ResourcesДокумент29 страницIntroduction To Agricultural and Natural ResourcesBlessing Grace SaetОценок пока нет

- The Contemporary World M6T4Документ13 страницThe Contemporary World M6T4joint accountОценок пока нет