Академический Документы

Профессиональный Документы

Культура Документы

Hero Honda Demerger Case Study

Загружено:

Amit JainАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hero Honda Demerger Case Study

Загружено:

Amit JainАвторское право:

Доступные форматы

India Equity Retail Research | Automobile

HERO HONDA MOTORS LIMITED

Growth All Around!!!

INR: 1804

HOLD

Price Outlook (INR): 1988

Market Data Shares outs (Cr) Equity Cap (Rs. Cr) Mkt Cap (Rs. Cr) 52 Wk H/L (Rs) Face Value (Rs) Bloomberg Code Market Info: SENSEX NIFTY Price Performance

130 125 120 115 110 105 100 95 90 85 Nov-10 Jan-10 Jun-10 Jul-10 Feb-10 Mar-10 May-10 Aug-10 Sep-10 Oct-10 Dec-10 Jan-11 Apr-10

Company: Hero Honda Motors Ltd. is the world's largest manufacturer of two wheelers, based in India. The company is a joint venture between India's Hero Group and Honda Motor Company, Japan that began in 1984. Hero Honda is a world leader because of its excellent manpower, proven management, extensive dealer network, efficient supply chain and world-class products with cutting edge technology from Honda Motor Company, Japan. The teamwork and commitment are manifested in the highest level of customer satisfaction, and this goes a long way towards reinforcing its leadership status. Key Rationale: Continuously Improving Performance: Hero Honda has posted its strongest sales volumes of all time. It achieved sales of 5 lakh plus units twice in this fiscal. This has come at a time when the company was entangled in major controversies. The Q3FY11 performance has been the best quarter in terms of sales volumes Smooth separation: The promoters of the company have announced their split wherein the Hero group will buyout Hondas stake in the company. This is a major positive for the company in many aspects like exposure to export market and gradual decline then nil payment of royalty. The Hero group had been in talks with Honda from a long time since the earlier agreement had restricted Hero Honda motors from exporting in markets where Honda had a presence. Exports to Boost volumes: When the buyout is complete and agreement signed, Hero Honda will have access to export markets which it didnt have earlier. Currently Hero Honda exports only to South Asia and some part of Latin America. Export will start adding only in the long term after detail analysis of potential markets. but the companys competition views this as a major threat and have already started to make plans to aggressively market their products in the export markets. Valuations & Views: With festive season buying and adding clarity over the termination of JV issue the outlook for Hero Honda remains positive. At the CMP of Rs 1804, Hero Honda is trading at 18x its FY11E EPS of Rs 100 and at 14.7x its FY12E EPS of Rs 122. With the target price at Rs. 1988 using target multiple of 16.3xFY12E, we recommend Hold on the stock. Exhibit 1 : Key Financials

Particulars Sales EBITDA PAT EPS OPM NPM P/E P/BV EV/EBITDA ROE (%) ROCE (%) FY09 12319 1710 1282 64 14% 10% 18 9 20 32% 43% FY10 15861 2768 2232 112 18% 14% 17 10 12 62% 76% FY11E 18173 2317 2006 100 13% 6% 18 8 14 44% 53% FY12E 20535 3234 2440 122 16% 7% 15 6 11 37% 51%

Jan 10, 2010 19.97 39.94 36,035 2094/1497 2 HH IN

19224 5762

Hero Honda

BSE SENSEX

Share Holding pattern (%)

Particulars Promoters Institutions FIIs Public & Others Total Source: BSE Sep10 52.21 5.80 31.75 10.24 100 Jun10 52.21 5.99 31.16 10.64 100 Chg 0% -3.1% 1.9% -3.8%

Analyst : Dhruv Joshi dhruv.joshi@krchoksey.com 91-22-6696 5555

www.krchoksey.com 91-22-6696 5203 91-22-6691 9569

Source: Company Data, KRC Research

KRC Research is also available on Bloomberg KRCS<GO>, Thomson First Call, Reuters, Factset and Capital IQ

Hero Honda Motors Ltd.

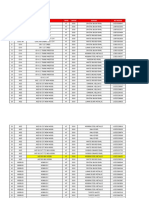

Highlights of New MoU Signed Between the Promoters: Existing Products to Continue: Hero Honda will retain its existing product portfolio till the end of the JV i.e. till 2014. This means that the Hero Group will continue to sell their blockbuster products like Passion and Splendor, which to date contribute about 70%-80% of the companys sales. Freedom To Export: Under the new understanding hero Honda will be able to export its products to other countries of interest. Earlier hero Honda was restricted to not export its products where Honda had a presence. Currently Hero Honda exports its products to South America and South-East Asia. Henceforth the company will be able to sell its products in its potential export markets. but exports will only begin after detailed study and understanding of different markets. Independence to set Up Own R&D: Hero Honda will have the freedom to set up its own R&D facilities to develop new products. It will also be able to buy technology from others which it cannot right now. Currently it only gets technology and products that Honda supplies under the original agreement. Whether it will set up its own R&D centre or buy technology and design from others it still unknown. Brand Name to Change Over Time: According to the new MoU, Hero Honda will be branded by a separate by a different name in years to come. But the approximate time frame is still very unclear. Royalty Payments to subside then end: Royalty payment to Honda will reduce from the coming quarter onwards. This was made clear after many had speculated that the royalty payments to Honda would increase to around 6%-8% from the current 2%-3%. The management also stated that royalty payments will stop very soon without specifying any particular timeframe. Exhibit 2 : Q2FY11 Result Snapshot

Particulars Volumes Net Sales Total Expenditure Raw Material Consumed Stock Adjustment Employee Expenses Other Expenses EBIDTA (Excl OI) Operating Margin Other Income EBIDTA (Incl OI) Operating Margin Interest Depreciation PBT Tax Tax Rate Reported Profit After Tax Net Profit Margin EPS Source: Company, KRC Research Q2FY11 1285944 4552 3944 3386 -76 150 484 608 13% 78 686 15% -2 61 627 122 19% 505 11% 25.32 Q2FY10 1183235 4059 3316 2769 -5 139 413 743 18% 69 812 20% -6.1 50 768 172 22% 596 15% 30

(Rs In Crore)

Y-o-Y 9% 12% 19% 22% 1420% 8% 17% -18% -495 bps 13% -16% -493 bps -67% 22% -18% -29% -294 bps -15% -359 bps -16% Q1FY11 1234039 4296 3694 3084 -25 145 490 602 14% 53 655 15% -3 48 610 119 20% 491 11% 24.63 Q-o-Q 4% 6% 7% 10% 204% 3% -1% 1% -66 bps 47% 5% -18 bps -33% 27% 3% 3% -5 bps 3% -34 bps 3% Significant drop in profit due to increase in expenses. Margins impacted mainly due to increase in raw material prices. Increase in RM expenses due to increase of prices of commodities. Comment Good Growth seen in volumes despite controversies.

Exhibit 3: Quarterly Volume Growth

Segment Total Q2FY11 1285944 Q2FY10 1183235 Y-o-Y 33% Q1FY11 1234039 M-o-M 19% YTD FY11 3948013 YTD FY10 3413594 Y-o-Y 16%

KRChoksey - Retail Research

Hero Honda Motors Ltd.

Other Key Rationales: Volume Growth To Continue: Significant growth has been observed sales volumes and this is likely to continue since most of the concerns that customer were facing due to a foggy image that they had about the JV have all been cleared by the management. With Hero Honda continuing to get products and technology from Honda as well as the clause that will allow Hero Honda to purchase technology form other technology suppliers also the option to set up its own R&D facility only means more options and choices for the customers. Exhibit 4 : Volume Trend (Financial Year)

600000 500000 400000 300000 200000 100000 0 April

August

2010-2011

2009-2010

2008-2009

Source: Company, KRC Research

To Remain Market Leader: Hero Honda will remain the market leader in the two wheeler segment even after the Hero group buys out its partners stake in the JV. The buyout will not affect the companys sales in near terms. But Hero Hondas R&D has always been the key cause of concern for most investor. Thus by making it clear that the company will be able to purchase technology from other supplier as well the company has placed itself in a safe position. Exhibit 4 : Market Share, YTDFY11

6% 13%

40%

15%

Hero Honda

Bajaj Auto

26%

TVS Motor

HMSI

Others

KRChoksey - Retail Research

M arch

M ay

July

N ov

Sep

June

Oct

Jan

Feb

Dec

Hero Honda Motors Ltd.

Technicals

Last Price 14 50 day EMA day EMA 1798 1896 1878 1891

C 200 day EMA

The stock is moving rangebound. The support for the stock exists at around 1730 levels. The MACD indicator for the stock is moving sideways in Positive zone. Investors can buy the stock at declines.

Disclaimer : This publication has been prepared solely for information purpose and does not constitute a solicitation to any person to buy or sell a security. While the information contained therein has been obtained from sources believed to be reliable, investors are advised to satisfy themselves before making any investments. Kisan Ratilal Choksey Shares & Sec Pvt Ltd., does not bear any responsibility for the authentication of the information contained in the reports and consequently, is not liable for any decisions taken based on the same. Further, KRC Research Reports only provide information updates and analysis. All opinion for buying and selling are available to investors when they are registered clients of KRC Investment Advisory Services. As a matter of practice, KRC refrains from publishing any individual names with its reports. As per SEBI requirements it is stated that,Kisan Ratilal Choksey Shares & Sec Pvt Ltd., and/or individuals thereof may have positions in securities referred herein and may make purchases or sale thereof while this report is in circulation.

Kisan Ratilal Choksey Shares and Securities Pvt. Ltd. 1102, Stock Exchange Tower, Dalal Street, Mumbai 400 001. Head-Off Phone : 91-22-66535000 Fax : 66338060 Branch-Off Phone : 91-22-66965555 Fax : 66919576

Members: BSE & NSE www.krchoksey.com

KRChoksey - Retail Research

Вам также может понравиться

- Car Fleet Management Lite - V2.3 - With SamplesДокумент288 страницCar Fleet Management Lite - V2.3 - With SamplesAzizi AbdullahОценок пока нет

- Honda All Motorcycle Product Codes Chart ManualДокумент6 страницHonda All Motorcycle Product Codes Chart ManualFlavio D BragaОценок пока нет

- Fuse DiagramДокумент10 страницFuse DiagramCaleb ConradОценок пока нет

- OD - Group 3 - Hero - ReportДокумент19 страницOD - Group 3 - Hero - ReportEncore GamingОценок пока нет

- HondaДокумент26 страницHondaMuhammad Danil100% (1)

- Turnaround Management Project On Industrial SicknessДокумент17 страницTurnaround Management Project On Industrial Sicknessalokrai1638Оценок пока нет

- Omohi: Made in ApanДокумент26 страницOmohi: Made in ApanWilmer VasquezОценок пока нет

- Honda ActivaДокумент79 страницHonda Activagoswamiphotostat100% (1)

- Honda Shuttle User Manual PDFДокумент2 страницыHonda Shuttle User Manual PDFSan Shwe11% (9)

- Honda BreakerДокумент5 страницHonda BreakerMaribel Bonite PeneyraОценок пока нет

- Strategic Management by Ford Motor CompanyДокумент12 страницStrategic Management by Ford Motor CompanyAbdul Hakim75% (4)

- Ancillary Services Provided by BankersДокумент17 страницAncillary Services Provided by BankersLogan Davis100% (2)

- Hero Honda DemergerДокумент11 страницHero Honda DemergerNupur AggarwalОценок пока нет

- Social Security and Unorganized SectorДокумент95 страницSocial Security and Unorganized SectorKeshav Pant100% (1)

- Assignment On The Hindustan Unilever LimitedДокумент30 страницAssignment On The Hindustan Unilever LimitedPrince Sachdeva33% (3)

- 2MBA-027 (GBL V Coke)Документ8 страниц2MBA-027 (GBL V Coke)Anonymous ofr6kiAwОценок пока нет

- Janhavi Share Market ProjectДокумент57 страницJanhavi Share Market ProjectKunal PawarОценок пока нет

- Use of Internet EnglishДокумент29 страницUse of Internet EnglishSudarshan SinghОценок пока нет

- Hero Honda - Post DemergerДокумент49 страницHero Honda - Post DemergerVivek Kumar Bhagbole0% (1)

- CromaДокумент3 страницыCromaTHE_ATGОценок пока нет

- Consumer Protection Act 2019 - LMДокумент10 страницConsumer Protection Act 2019 - LMVedika SinghОценок пока нет

- Case Study On BCCIДокумент2 страницыCase Study On BCCIYash Mangal100% (1)

- 2 Forms of BusinessДокумент10 страниц2 Forms of BusinessAbhishek PatelОценок пока нет

- Rural Marketing ResearchДокумент25 страницRural Marketing ResearchashilОценок пока нет

- GAIL India CompanyAnalysis923492384Документ11 страницGAIL India CompanyAnalysis923492384yaiyajieОценок пока нет

- Cipla V Roche Case Note FINALДокумент3 страницыCipla V Roche Case Note FINALPreeti Wavikar-PanhaleОценок пока нет

- BSNL Project Organization BehaviourДокумент32 страницыBSNL Project Organization BehaviourPrashantqmarОценок пока нет

- A Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofДокумент88 страницA Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofAkash SinghОценок пока нет

- Marketing Environment of AirtelДокумент7 страницMarketing Environment of AirtelTakauv-thiyagi Thiyagu0% (1)

- 2G Spectrum ScamДокумент12 страниц2G Spectrum ScamVivek DhandeОценок пока нет

- Competition Law Answer SheetДокумент12 страницCompetition Law Answer SheetAnirudh SoodОценок пока нет

- Telecom Industry in IndiaДокумент21 страницаTelecom Industry in IndiaVaibhav PatelОценок пока нет

- Insider Trading and Whistle BlowingДокумент20 страницInsider Trading and Whistle Blowingthangam100% (2)

- Final Memo - Respondent SideДокумент28 страницFinal Memo - Respondent Sidesonam1992Оценок пока нет

- Banking Sector Reforms in IndiaДокумент8 страницBanking Sector Reforms in IndiaJashan Singh GillОценок пока нет

- PROJECT REPORT ON IplДокумент37 страницPROJECT REPORT ON Iplgupta006100% (1)

- Saranya Project ReportДокумент42 страницыSaranya Project ReportParikh RajputОценок пока нет

- Research PaperДокумент18 страницResearch Paperapi-317623686Оценок пока нет

- Industrial Policy PDFДокумент15 страницIndustrial Policy PDFSubbareddyОценок пока нет

- TOPIC: Case Analysis of Chloro Controls P. Ltd. v. Severn Trent Water Purification Inc. & OrsДокумент11 страницTOPIC: Case Analysis of Chloro Controls P. Ltd. v. Severn Trent Water Purification Inc. & OrsPayal RajputОценок пока нет

- Case Analysis: Hero HondaДокумент3 страницыCase Analysis: Hero HondanikhilОценок пока нет

- FInal PPT For AmalgamationДокумент16 страницFInal PPT For Amalgamationmyjio100% (2)

- LAB-2 CP ActДокумент26 страницLAB-2 CP ActArun KanadeОценок пока нет

- Role of Govn in Settlement of Industrial DisputeДокумент8 страницRole of Govn in Settlement of Industrial DisputeRanjani1904100% (1)

- The Impact of GST On The Indian Economy and Its Effect On The Banking SectorДокумент7 страницThe Impact of GST On The Indian Economy and Its Effect On The Banking SectorEditor IJTSRDОценок пока нет

- A Study of Dematerialisation in Banking SectorДокумент65 страницA Study of Dematerialisation in Banking SectorUmesh SoniОценок пока нет

- Chapter-I: 1.1. Indian Two-Wheeler SectorДокумент32 страницыChapter-I: 1.1. Indian Two-Wheeler SectorPrithvi BarodiaОценок пока нет

- Merger of Vodafone and HutchДокумент19 страницMerger of Vodafone and HutchNivedita Misra83% (6)

- Comparative Study Into Sales & Distribution of AMUL DAIRY & PARAG DAIRYДокумент124 страницыComparative Study Into Sales & Distribution of AMUL DAIRY & PARAG DAIRYViraj WadkarОценок пока нет

- Comparison of Tata and MahindraДокумент61 страницаComparison of Tata and MahindraKaran ChaudharyОценок пока нет

- Sony Corporation vs. K. SelvamurthyДокумент2 страницыSony Corporation vs. K. SelvamurthyAnagha ShelkeОценок пока нет

- Asset Reconstruction CompaniesДокумент4 страницыAsset Reconstruction CompaniesPari ShahОценок пока нет

- Management of MNCt200813 PDFДокумент303 страницыManagement of MNCt200813 PDFshivam tiwariОценок пока нет

- Rural Marketing Final Paper...Документ52 страницыRural Marketing Final Paper...Eapsita PahariОценок пока нет

- Cases IntraДокумент2 страницыCases Intrasamridhi chhabraОценок пока нет

- Lawyersclubindia Article - Law of Maintenance in India Under Personal Laws - An Analysis PDFДокумент18 страницLawyersclubindia Article - Law of Maintenance in India Under Personal Laws - An Analysis PDFDebashish DashОценок пока нет

- Sales Promotion and Requirement of Buses in School Eicher-MotorsДокумент77 страницSales Promotion and Requirement of Buses in School Eicher-MotorsBrijesh Kumar100% (1)

- Consumer Disputes Redressal Mechanism in IndiaДокумент18 страницConsumer Disputes Redressal Mechanism in IndiaSiddharthОценок пока нет

- Project On Hero Motor CropДокумент21 страницаProject On Hero Motor CropRoshan FriendsforeverОценок пока нет

- LockerДокумент6 страницLockerMausam PanchalОценок пока нет

- Working Capital of HulДокумент36 страницWorking Capital of Hulsaikripa121100% (1)

- Unit 10 Institutional Mechanisms For Wage Determination: ObjectivesДокумент11 страницUnit 10 Institutional Mechanisms For Wage Determination: Objectivessayal96amritОценок пока нет

- CSR Report GodrejДокумент11 страницCSR Report GodrejmithunchauhanОценок пока нет

- Summer Project Report in HCL Infosystems LimitedДокумент53 страницыSummer Project Report in HCL Infosystems Limitedram kishore mishra75% (4)

- Initiating Coverage Hero MotoCorpДокумент10 страницInitiating Coverage Hero MotoCorpAditya Vikram JhaОценок пока нет

- Hero Moto CorpДокумент13 страницHero Moto CorpamutthaОценок пока нет

- Capstone-Interim Hero Honda Break-UpДокумент23 страницыCapstone-Interim Hero Honda Break-UpAshwini KJОценок пока нет

- Project Report Two Wheeler IndustryДокумент7 страницProject Report Two Wheeler IndustrysouravОценок пока нет

- Dewal Jindal - 10IB-027 Dhruv Kapoor - 10FN - 038 Joel Abreo - 10DM-066 Kapil Daga - 10DM-069 Neha Gupta - 10DM-091 Yogesh Gadre - 10DM-048Документ22 страницыDewal Jindal - 10IB-027 Dhruv Kapoor - 10FN - 038 Joel Abreo - 10DM-066 Kapil Daga - 10DM-069 Neha Gupta - 10DM-091 Yogesh Gadre - 10DM-048Dewal JindalОценок пока нет

- IndiNivesh Best Sectors Stocks Post 2014Документ49 страницIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayОценок пока нет

- 11 Mei 2019 Stock HasДокумент30 страниц11 Mei 2019 Stock HasAbrom AbdurrahmanОценок пока нет

- Worldwide Wholesale ListДокумент33 страницыWorldwide Wholesale ListBruno Halfeld DutraОценок пока нет

- Sample A Comparative Analysis of Car Features HONDA TOYOTA and BMWДокумент12 страницSample A Comparative Analysis of Car Features HONDA TOYOTA and BMWMudassar Gul Bin AshrafОценок пока нет

- Disusun Oleh: Panitia Pembina Keselamatan & Kesehatan Kerja PT Honda Prospect MotorДокумент2 страницыDisusun Oleh: Panitia Pembina Keselamatan & Kesehatan Kerja PT Honda Prospect Motor16607089Оценок пока нет

- Indus Motor Compnay - Strategic ManagementДокумент17 страницIndus Motor Compnay - Strategic ManagementHammad SiddiquiОценок пока нет

- HondaДокумент11 страницHondapinkstar_usОценок пока нет

- HONDA CR-V 2014 BrochureДокумент13 страницHONDA CR-V 2014 BrochurefptstopОценок пока нет

- Atlas FeasibilityДокумент2 страницыAtlas Feasibilitykhalid QamarОценок пока нет

- Japan's Most Successful Automobile Brand - Case StudyДокумент3 страницыJapan's Most Successful Automobile Brand - Case StudyElie Abi JaoudeОценок пока нет

- Honda TodayДокумент2 страницыHonda Todayashwini patilОценок пока нет

- How Honda Localizes Its Global Strategy (Fernando)Документ3 страницыHow Honda Localizes Its Global Strategy (Fernando)Tu Anh NguyenОценок пока нет

- Made in McDowellДокумент36 страницMade in McDowellMarshaGreeneОценок пока нет

- Honda Civic 92-95 Workshop Manual 62sr300bДокумент893 страницыHonda Civic 92-95 Workshop Manual 62sr300biraklitosp83% (6)

- File ListДокумент8 страницFile ListCurtis TrevinoОценок пока нет

- Presentation Honda AmazeДокумент22 страницыPresentation Honda AmazeUpama SahaОценок пока нет

- Stock Sls 115Документ2 страницыStock Sls 115Ayub RudiniОценок пока нет

- Gaikindo 3Документ3 страницыGaikindo 3Kholis WatiОценок пока нет

- HONDA - Complete Exhaust Systems: BOLT-ON / SLIP-ON - LineДокумент43 страницыHONDA - Complete Exhaust Systems: BOLT-ON / SLIP-ON - LineThomas LebenОценок пока нет

- 02.25.16 The NickelДокумент16 страниц02.25.16 The Nickelliz6085Оценок пока нет

- PESTLE Analysis: Political Factors: Economic FactorsДокумент2 страницыPESTLE Analysis: Political Factors: Economic FactorsWaleed KhalidОценок пока нет