Академический Документы

Профессиональный Документы

Культура Документы

The Banking Ombudsman

Загружено:

Tejashree WazeОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Banking Ombudsman

Загружено:

Tejashree WazeАвторское право:

Доступные форматы

Project Report On THE BANKING OMBUDSMAN Bachelor of Commerce Banking & Insurance Semester V Submitted By FREDDY SAVIO DSOUZA

A Roll No. 45 BIRLA COLLEGE OF ARTS, SCIENCE & COMMERCE Murbad Road Kalyan (W) UNIVERSITY OF M UMBAI (2009-2010)

Project on THE BANKING OMBUDSMAN Bachelor of Commerce Banking & Insurance Semester V (2009-2010) Submitted In partial fulfillment of requirement for the Award of Degree of Bache lor of Commerce (Banking & Insurance) By FREDDY SAVIO DSOUZA Roll No. 45 BIRLA COLLEGE OF ARTS, SCIENCE & COMMERCE Murbad Road Kalyan (W)

BIRLA COLLEGE OF ARTS, SCIENCE, & COMMERCE, KALYAN (Conducted by Kalyan Citizens Education Society) (Affiliated by University of Mum bai) BACHELOR OF BANKING AND INSURANCE CERTIFICATE This is to certify that MR. FREDDY SAVIO DSOUZA of T.Y.B.Com. Banking & Insurance (V Semester) has successfully completed the project on THE BANKING OMBUDSMAN, und er the guidance of MS. HEMA TAHILRAMANI. Project Guide Course Co-ordinator Internal Examiner External Examiner Principal

TO WHOM IT MAY CONCERN This is to certify that Mr. Freddy Savio Dsouza, Student of Birla College, Kalyan (West), pursuing Bachelor of Commerce (Banking & Insurance), fifth semester, ha d visited our bank situated at Kalyan. He had successfully completed his Project on The Banking Ombudsman. We wish him best luck for his future. Akshai Kumar, Asst. Manager, IDBI Bank Ltd. Kalyan Nivara Complex, Opposite Mahalakshmi Temple, Tilak Chowk, Kalyan (West), Thane 4 21301. Tel.: 91-0251-2203327. Fax: 91-0521-2201738 IDBI Tower, WTC, Complex, Cuf fe Parade, Mumbai 400 005. Website: www.idbi.com

DECLARATION I, MR. FREDDY SAVIO DSOUZA, student of T.Y.B.Com (Banking & Insurance) Semester V (2009-2010) hereby declare that I have completed the project on BANKING OMBUDSMA N. I further declare that the information contained in this project report is gen uine, true & fair to the best of my knowledge. Signature of Student (Mr. Freddy Savio Dsouza)

ACKNOWLEDGEMENT Its gives me immense pleasure to present this project on THE BANKING OMBUDSMAN It is the most pleasant part of any project to express gratitude towards all tho se who helped me out to complete this project. My deepest thanks to my project g uide Prof. Hema Tahilramani for guiding and correcting various documents of mine with attention and care. She has taken pain to go through the project and make necessary correction as and when needed. I equally wish to extend my appreciatio n and thanks to Mrs. Bhanu Vasudevan the Assistant General Manager of the Bankin g Ombudsman who provide me valuable information as the guidance of my project. I thank Mr. Anil Narkende the Branch Manager of IDBI Bank, Kalyan Branch for bein g instrumental in the completion of the project with his complete guidance. I wo uld be failing in my duty if I do not mention here the tremendous cooperation an d support I received from my family members in the completion of this book. I wo uld also like to thank to all those who supported me directly or indirectly in c ompleting this project.

INDEX Ch. No. Executive Summary Preface 1. Introduction to dressal 2. Introduction to Banking Ombudsman man 3. 4. 5. 6. Banking Ombudsman Scheme The ng Ombudsman Scheme, 2006 Difference Between & 2006 7. Policy for Grievance Redressal in liography Wibliography Annexure A Annexure 10-19 01-09 Content Page No.

Banking Types of Banks Grievance Re Duties, & Functions Types of Ombuds Consumer Protection Act, 1986 Banki Banking Ombudsman Scheme 1995, 2002 IDBI Bank Case Study Conclusion Bib B 65-70 71-73 74 20-33 34-40 41-56 57-64

EXECUTIVE SUMMARY The aim of this project is to introduce the reader to the topic of THE BANKING OM BUDSMAN. The project also deals with the policy adopted by the RBI and the excess of case laws. The ability of the banking industry to achieve the socio-economic objectives and in the process bringing more and more customers into its fold wi ll ultimately depend on the satisfaction of the customers. Banks have a strong b elief that a satisfied customer is the foremost factor in developing our busines s. This project is focused in understanding the essentiality of the Banking Ombu dsman in regards to the public interest and the interest of the banking policies to enable resolution of complaints related to deficiency in banking services. S ensing the need for a easy, expeditious and inexpensive mechanism for redressal of unresolved grievances of customers, the RBI initially formulated the Scheme o f Ombudsman, 1995, which became operational in June 1995, providing an instituti onal and legal framework to bank customers to resolve all their complaint The sc heme is applicable to all scheduled commercial banks having business in India an d scheduled primary co-operative banks except Regional Rural Banks. Fifteen offi ces of Banking Ombudsman at important centres were set up to cover the entire co untry. The Banking Ombudsman offers customers the opportunity to resolve dispute s with their banks without needing to resort to the Courts.

PREFACE OBJECTIVES

To present Banking Ombudsman Scheme & how does it works. To present the services of the Banking Ombudsman offered to the customer. To show how the Banking Ombud sman deals with customer complaints. To explain the duties, functions & powers o f the Ombudsman. METHODLOGY The methodology includes the information of the features of the Ombudsman in the form of primary data that had been received from the Branch Managers of the ban ks and the officers of the RBI. It also includes the informations from the relate d books & the related websites.

INTRODUCTION The basic services a bank provides are checking accounts, which can be used like money to make payments and purchase goods and services; savings accounts and ti me deposits that can be used to save money for future use; loans that consumers and businesses can use to purchase goods and services; and basic cash management services such as check cashing and foreign currency exchange. Four types of ban ks specialize in offering these basic banking services: commercial banks, saving s and loan associations, savings banks, and credit unions. A broader definition of a bank is any financial institution that receives, collects, transfers, pays, exchanges, lends, invests, or safeguards money for its customers. This broader definition includes many other financial institutions that are not usually thoug ht of as banks but which nevertheless provide one or more of these broadly defin ed banking services. These institutions include finance companies, investment co mpanies, investment banks, insurance companies, pension funds, security brokers and dealers, mortgage companies, and real estate investment trusts. Banking serv ices are extremely important in a free market economy such as that found in Cana da and the United States. Banking services serve two primary purposes. First, by supplying customers with the basic mediums-of-exchange (cash, checking accounts , and credit cards), banks play a key role in the way goods and services are pur chased. Without these familiar methods of payment, goods could only be exchanged by barter (trading one good for another), which is extremely time-consuming and inefficient. Second, by accepting money deposits from savers and then lending t he money to borrowers, banks encourage the flow of money to productive use and i nvestments. This in turn allows the economy to grow. Without this flow, savings would sit idle in someones safe or pocket, money would not be available to borrow , people would not be able to purchase cars or houses, and businesses would not be able to build the new factories the

economy needs to produce more goods and grow. Enabling the flow of money from sa vers to investors is called financial intermediation, and it is extremely import ant to a free market economy. Banking institutions include commercial banks, sav ings and loan associations (SLAs), savings banks, and credit unions. The major d ifferences between these types of banks involve how they are owned and how they manage their assets and liabilities. Assets of banks are typically cash, loans, securities (bonds, but not stocks), and property in which the bank has invested. Liabilities are primarily the deposits received from the banks customers. They a re known as liabilities because they are still owned by, and can be withdrawn by , the depositors of the financial institution.

TYPES OF BANKS There are various types of banks which operate in our country to meet the financ ial requirements of different categories of people engaged in agriculture, busin ess, profession, etc. On the basis of functions, the banking institutions in Ind ia may be divided into the following types: TYPES OF BANKS CENTRAL BANKS DEVELOPMENT BANKS SPECIALIZED BANKS COMMERCIAL BANKS CO-OPERATIVE BANKS Public Sector Banks Private Sectors Banks Foreign Banks Primary Credit Societies Central Co-operative Banks State Co-operative Banks

1. Central Banks A bank which is entrusted with the functions of guiding and regulating the banki ng system of a country is known as its Central bank. Such a bank does not deal w ith the general public. It acts essentially as Governments banker; maintain depos it accounts of all other banks and advances money to other banks, when needed. T he Central Bank provides guidance to other banks whenever they face any problem. It is therefore known as the bankers bank. It advises the Government on monetary and credit policies and decides on the interest rates for bank deposits and ban k loans. Another important function of the Central Bank is the issuance of curre ncy notes, regulating their circulation in the country by different methods. No other bank than the Central Bank can issue currency. 2. Commercial Banks Commercial Banks are banking institutions that accept deposits and grant shortte rm loans and advances to their customers. In addition to giving short-term loans , commercial banks also give medium-term and long-term loan to business enterpri ses. Commercial banks are of three types:

Public Sector Banks These are banks where majority stake is held by the Government of India or Reser ve Bank of India. Examples of public sector banks are: State Bank of India, Corp oration Bank, Bank of Baroda and Dena Bank, etc

Private Sectors Banks In case of private sector banks majority of share capital of the bank is held by private individuals. These banks are registered as companies with limited liabi lity. For example: The Jammu and Kashmir Bank Ltd., Bank of Rajasthan Ltd., Deve lopment Credit Bank Ltd, Lord Krishna Bank Ltd., Bharat Overseas Bank Ltd., Glob al Trust Bank, Vysya Bank, etc.

Foreign Banks These banks are registered and have their headquarters in a foreign country but operate their branches in our country. Some of the foreign banks operating in ou r country are Hong Kong and Shanghai Banking Corporation (HSBC), Citibank, Ameri can Express Bank, Standard & Chartered Bank, Grindlays Bank, etc. The number of f oreign banks operating in our country has increased since the financial sector r eforms of 1991. 3. Development Banks Business often requires medium and long-term capital for purchase of machinery a nd equipment, for using latest technology, or for expansion and modernization. S uch financial assistance is provided by Development Banks. They also undertake o ther development measures like Public Sector Banks comprise 19 nationalized bank s and State Bank of India and its 7 associate banks. Industrial Finance Corporat ion of India (IFCI) and State Financial Corporations (SFCs) are examples of devel opment banks in India. 4. Co-Operative Banks People who come together to jointly serve their common interest often form a coo perative society under the Co-operative Societies Act. When a co-operative socie ty engages itself in banking business it is called a Co-operative Bank. The soci ety has to obtain a license from the Reserve Bank of India before starting banki ng business. Any co-operative bank as a society is to function under the overall supervision of the Registrar, Co-operative Societies of the State. As regards b anking business, the society must follow the guidelines set and issued by the Re serve Bank of India. There are three types of co-operative banks operating in ou r country:

Primary Credit Societies These are formed at the village or town level with borrower and non-borrower mem bers residing in one locality. The operations of each society are restricted to a small area so that the members know each other and are able to watch over the activities of all members to prevent frauds.

Central Co-operative Banks These banks operate at the district level having some of the primary credit soci eties belonging to the same district as their members. These banks provide loans to their members (i.e., primary credit societies) and function as a link betwee n the primary credit societies and state co-operative banks.

State Co-operative Banks These are the apex (highest level) co-operative banks in all the states of the c ountry. They mobilize funds and help in its proper channelization among various sectors. The money reaches the individual borrowers from the state co-operative banks through the central co-operative banks and the primary credit societies. 5. Specialized Banks There are some banks, which cater to the requirements and provide overall suppor t for setting up business in specific areas of activity. EXIM Bank, SIDBI and NA BARD are examples of such banks. They engage themselves in some specific area or activity and thus, are called specialized banks.

Export Import Bank of India (EXIM Bank) If you want to set up a business for exporting products abroad or importing prod ucts from foreign countries for sale in our country, EXIM bank can provide you t he required support and assistance. The bank grants loans to exporters and impor ters and also provides information about the international market.

Small Industries Development Bank of India (SIDBI) If you want to establish a small-scale business unit or industry, loan on easy t erms can be available through SIDBI. It also finances modernization of small-sca le industrial units, use of new technology and market activities. The aim and fo cus of SIDBI is to promote, finance and develop small-scale industries.

National Bank for Agricultural and Rural Development (NABARD) It is a central institution for financing agricultural and rural sectors. If a p erson is engaged in agriculture or other activities like handloom weaving, fishi ng, etc. NABARD can provide credit, both short-term and long-term, through regio nal rural banks. It provides financial assistance, especially, to co-operative c redit, in the field of agriculture, small scale industries, cottages and village industries in rural areas.

POLICY FOR THE GRIEVANCES REDRESSAL OF THE CUSTOMER COMPLAINTS In the present scenario of competitive banking, excellence in customer service i s the most important tool for sustained business growth. Customer complaints are part of the business life of any corporate entity. This is more so for banks be cause banks are service organizations. As a service organization, customer servi ce and customer satisfaction should be the prime concern of any bank. The bank b elieves that providing prompt and efficient service is essential not only to att ract new customers, but also to retain existing ones. This policy document aims at minimizing instances of customer complaints and grievances through proper ser vice delivery and review mechanism and to ensure prompt redressal of customer co mplaints and grievances. The review mechanism should help in identifying shortco mings in product features and service delivery. Customer dissatisfaction would s poil banks name and image. The Banks policy on grievance redressal follows the und er noted principles:

Customers be treated fairly at all times Complaints raised by customers are deal t with courtesy and on time Customers are fully informed of avenues to escalate their complaints/grievances within the organization and their rights to alternative re medy, if they are not fully satisfied with the response of the bank to their com plaints.

Bank will treat all complaints efficiently and fairly as they can damage the ban ks reputation and business if handled otherwise. The Bank employees must work in good faith and without prejudice to the interests of the customer.

In order to make banks redressal mechanism more meaningful and effective, a struc tured system needs to be built up towards such end. Such system would ensure tha t the redressal sought is just and fair and is within the given frame-work of ru les and regulation. The policy document would be made available at all branches. All employees of the Bank should be made aware about the Complaint handling pro cess

The customer complaint arises due to: The attitudinal aspects in dealing with customers Inadequacy of the functions/ar rangements made available to the customers or gaps in standards of services expe cted and actual services rendered.

The customer is having full right to register his complaint if he is not satisfi ed with the services provided by the bank. He can give his complaint in writing, orally or over telephone. If customers complaint is not resolved within given ti me or if he is not satisfied with the solution provided by the bank, he can appr oach Banking Ombudsman with his complaint or other legal avenues available for g rievance redressal.

INTRODUCTION An ombudsman is a person who has been appointed to look into complaints about an organization. Using an ombudsman is a way of trying to resolve a complaint with out going to court. Banking Ombudsman is a quasi judicial authority functioning under Indias Banking Ombudsman Scheme, and the authority was created pursuant to the a decision by the Government of India to enable resolution of complaints of customers of banks relating to certain services rendered by the banks. The Banki ng Ombudsman Scheme was first introduced in India in 1995, and was revised in 20 02 and 2006. In the wake of the failure in the efficient services of the banks, the RBI brought a scheme for the prompt, efficient and courteous services and al so to protect the rights of the customers. The Banking Ombudsman is an official authority to investigate the complaint from the customers and address the compla int and thereby bring the solution among the aggrieved parties. So the Banking O mbudsman plays the role of a mediator and serves the purpose of reconciliation. The Banking Ombudsman has been defined under clause 4 of the Banking Ombudsman S cheme, 2006. APPOINTMENT & TENNURE The Reserve Bank may appoint one or more of its officers in the rank of Chief Ge neral Manager or General Manager to be known as Banking Ombudsmen to carry out t he functions entrusted to them by or under the Scheme. The appointment of Bankin g Ombudsman under the above Clause may be made for a period not exceeding three years at a time.

CHARACTERISTICS OF BANKING OMBUDSMAN The Banking Ombudsman is a quasi judicial authority. It has power to summon both the parties - bank and its customer, to facilitate resolution of complaint thro ugh mediation.

All Scheduled Commercial Banks, Regional Rural Banks and Scheduled Primary Co-op erative Banks are covered under the Scheme. The Banking Ombudsman has power to c onsider complaints from NonResident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank-related matters.

The Banking Ombudsman does not charge any fee for resolving customers complaints. Complaint can be made before a Banking Ombudsman on the same subject matter for which any proceedings before any court, tribunal or arbitrator or any other foru m is pending or a decree or award or a final order, has already been passed by a ny such competent court, tribunal, arbitrator or forum. DUTIES & FUNCTIONS OF OMBUDSMAN The Ombudsman shall enquire into and investigate in accordance with the provisio ns of the Act, and take action or steps as may be prescribed by the Act and conc erningPractices and actions by persons, enterprises and other private institutions where complaints allege that violations of fundamental rights and f reedoms have taken place.

All instances or matters of alleged or suspected corruption and the misappropriation of public moneys or other public property by officials.

Without derogating from the provisions, any request or complaint in respect of i nstances or matters referred to in that provisions, may include any instance or matter in respect of which the Ombudsman has reason to suspectThat the provisions of any law or under the authority of the State or by any person in its employment, or that any practice is so followed, in a manner w hich is not in the public interest. That the powers, duties or functions which vest in the State or, body or institution, or any person in its employment are exercised or performed in an ir regular manner.

That moneys forming part of the funds of the State or body or institution, or re ceived or held by or on behalf of the State or body or institution are being or have been dealt with an irregular manner.

Any person wishing to lay any instance or matter referred to in provisions befor e the Ombudsman shall do so in such manner as the Ombudsman may determine or all ow.

The Ombudsman shall not be required to investigate any instance or matter referr ed to in the provisions which has been laid before him or her under the provisio ns when the grounds on account of which the inquiry is desired is in the opinion of the Ombudsman. The provisions shall not apply in respect of any decision taken in or in connect ion with any civil or criminal case by a court of law.

TYPES OF OMBUDSMAN TYPES OF OMBUDSMAN Banking Ombudsman S.E.B.I. Ombudsman Electricity Ombudsman Telecom Ombudsman Income Tax Ombudsman Insurance Ombudsman

Banking Ombudsman The Reserve Bank of India (RBI) first introduced the Banking Ombudsman Scheme In 1995, which has been revised in 2002 and 2005. The latest revised Scheme has com e into force from 1st Jan 2006.

S.E.B.I. Ombudsman The Securities Exchange Board of India (SEBI) under section 30 read with subsect ion (1) of section 11 of the SEBI Act, 1992, has framed the SEBI (Ombudsman) Reg ulations, 2003, which were notified on 21st August 2003. The Regulations provide d for the establishment of the office of Ombudsman to redress the Grievance of i nvestors in securities and connected matters. The listed companies and registere d stock intermediaries have to disclose the name address and other particulars o f ombudsman in their for the benefit of the investors.

Electricity Ombudsman The Electricity Regulatory Commission, under section 181 read with sub-section ( 5) of section 42 of the Electricity Act, 2003, issues guidelines for establishme nt of forum and Ombudsman for redressal of grievances of Electricity consumers. The Delhi Regulatory Commission (DERC) vide its Notification dated 11th March, 2 006 has issued DERC (Guidelines for establishment of Forum of redressal of griev ance of the consumer and Ombudsman) Regulations, 2003. It may be noted that the Ombudsman is the APPELLATE Authority under the Electricity Act 2003, and the DER C Regulations, 2003 and therefore an electricity consumer has to first approach the Consumer Grievance Redressal Forum established under the DERC Regulations, 2 003.

Telecom Ombudsman The Telecom Regulatory Authority of India Act, 1997, empowers the Telecom Regula tory Authority of India Act 1997, empowers the Telecom Regulatory Authority of I ndia (TRAI) to make the recommendations on laying down the standards of quality of services to be provided by the services providers and conduct the interest of the periodical surveys of Telecom services so as to protect the interest of the consumers. The telecom operators frequently threaten to disconnects the phones and with draw the numbers given t o subscribers if the deadline for payment is m issed by a day or there is miscalculation of the tiniest amount. The TRAI is, ho wever, neither empowered to look into the grievances of individual customers nor take action against the operators who do not meet quality of standards As there is no specialized body to redress the grievance of telecom customers, they have to approach consumer forum setup under THE Consumer Protection Act, 1986, or ci vil courts for Resolutions adjudication of disputes.

Income Tax Ombudsman The government is considering creating an office of Income Tax Ombudsman to prot ect individual taxpayers right. The Ombudsman will identify issues that increase the compliance burden or create problems for taxpayers and bring those issues to the attention of the ministry of Finance. The Ombudsman will make appropriate l egislative proposal where necessary and send periodical reports to the Departmen t of Revenue, suggesting appropriate action. It is proposed to initially setup o ffices of Ombudsman at Delhi, Mumbai, Kolkata and Chennai.

Insurance Ombudsman The Government of India, Minister of Finance, Department of Economics Affairs, I nsurance Division under section 114 (1) of Insurance Act, 1938, has framed the Re dressal of Public Grievance Rules, 1998, for appointment of Insurance Ombudsman, which comes into force with effect from 11th November 1998. The Insurance Ombuds man has started functioning from 1999, to provide for efficient, cost effective and impartial settlement of claims and grievance of any person against a Life r General Insurance in Public and private sector. The meaning of expression any oth er person is wider than consumer and therefore, even third party having grievance w ith respect to an Insurance contract can approach the Ombudsman.

GROUNDS OF CUSTOMERS COMPLAINTS CONSIDERED BY BANKING OMBUDSMAN The Banking Ombudsman can receive and consider any complaint relating to the fol lowing deficiency in banking services (including internet banking): non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc.; non-acceptance, without sufficient cause, of small denomination notes tendered for any purpose, and for charging of commission in respect thereof; non-acceptan ce, without sufficient cause, of coins tendered and for charging of commission i n respect thereof; non-payment or delay in payment of inward remittances ; failu re to issue or delay in issue of drafts, pay orders or bankers cheques; non-adher ence to prescribed working hours ; failure to provide or delay in providing a ba nking facility (other than loans and advances) promised in writing by a bank or its direct selling agents; complaints from Non-Resident Indians having accounts in India in relation to their remittances from abroad, deposits and other bank-r elated matters; levying of charges without adequate prior notice to the customer ; non-adherence by the bank or its subsidiaries to the instructions of Reserve B ank on ATM/Debit card operations or credit card operations; refusal to accept or delay in accepting payment towards taxes, as required by Reserve Bank/Governmen t; refusal to issue or delay in issuing, or failure to service or delay in servi cing or redemption of Government securities;

forced closure of deposit accounts without due notice or without sufficient reas on; refusal to close or delay in closing the accounts; non-observance of Reserve Bank guidelines on engagement of recovery agents by banks; and non-observance o f Reserve Bank Directives on interest rates; delays in sanction, disbursement or non-observance of prescribed time schedule for disposal of loan applications; n on-acceptance of application for loans without furnishing valid reasons to the a pplicant; and GROUNDS OF CUSTOMERS COMPLAINTS NOT . CONSIDERED BY BANKING OMBUDSMAN Ones complaint will not be considered if: One has not approached his bank for re dressal of his grievance first. One has not made the complaint within one year f rom the date one has received the reply of the bank or if no reply is received i f it is more than one year and one month from the date of representation to the bank. The subject matter of the complaint is pending for disposal / has already been dealt with at any other forum like court of law, consumer court etc. Frivol ous or vexatious. The institution complained against is not covered under the sc heme. The subject matter of the complaint is not within the ambit of the Banking Ombudsman. If the complaint is for the same subject matter that was settled thr ough the office of the Banking Ombudsman in any previous proceedings.

PROCEDURE FOR FILING COMPLAINT Any person who has a grievance against a bank on any one or more of the grounds mentioned above, may, himself or through his authorized representative (other th an an advocate), make a complaint to the Banking Ombudsman within whose jurisdic tion the branch or office of the bank complained against is located. Complaints arising out of the operations of credit cards, shall be filed before the Banking Ombudsman within whose territorial jurisdiction the billing address of the card holder is located and not the place where the bank concerned or the credit card processing unit is located. The complaint shall be made in writing duly signed by the complainant or his authorized representative and shall as far as possible be in the form and shall contain such particulars as specified in the Scheme. T he complainant shall file along with the complaint, copies of the documents, if any, which he proposes to rely upon and also a declaration that the complaint is maintainable as per clause 9(3) of the Scheme.. A complaint can also be made th rough electronic means. The complainant shall before making a complaint to the B anking Ombudsman, make a written representation to the bank. The complaint can b e filed if the bank has rejected the complaint or the complainant had not receiv ed any reply within a period of one month after the bank received his representa tion or if the complainant is not satisfied with the reply given to him by the b ank. The complaint to the Banking Ombudsman is to be made not later than one yea r after the complainant has received the reply of the bank to his representation or, where no reply is received, not later than one year and one month after the date of the representation to the bank. The complaint should not be in respect of the same subject matter which was settled or dealt with on merits by the Bank ing Ombudsman in any previous proceedings whether or not received from the same complainant or along with one or more complainants or one or more of the parties concerned with the subject matter.

The complaint should not pertain to the same subject matter, for which any proce edings before any court, tribunal or arbitrator or any other forum is pending or a decree or Award or order has been passed by any such court, tribunal, arbitra tor or forum. The complaint should not be frivolous or vexatious in nature. The complaint should be made before the expiry of the period of limitation prescribe d under the Indian Limitation Act, 1963 for such claims.

INTRODUCTION The Banking Ombudsman Scheme, 1995 was notified by RBI on June 14, 1995 in terms of the powers conferred on the Bank by Section 35A of the Banking Regulation Ac t, 1949 to provide for a system of redressal of grievances against banks. The Sc heme sought to establish a system of expeditious and inexpensive resolution of c ustomer complaints. The Scheme is in operation since 1995 and has been revised d uring the years 2002 and 2006. The Scheme is being executed by Banking Ombudsmen appointed by Reserve Bank at 15 centers covering the entire country. As mandate d by the Banking Ombudsman Scheme, the Banking Ombudsmen submit an Annual Report on the functioning of their offices every year. Based on such reports, an Annua l Report for the Banking Ombudsman Scheme in a whole is prepared at Reserve Bank of India, Central Office. As is being the practice, the Annual Report covers th e last five-year period with focus on the current year. Further, as a result of computerization of the functioning of Banking Ombudsman Offices through the Comp laint Tracking Software, detailed analysis was possible on the information perta ining to year 2006-07. With the decision to merge the Banking Ombudsman Offices with that of RBI offices, the accounting period for the Banking Ombudsman Office s was changed from April 1-March 31 to July 1-June 30 to be in congruent with th at of RBI offices. Accordingly, the information analysed for the year 2006-07 pe rtains to the period July 1, 2006 to June 30, 2007. GENERAL PARTICULARS ON THE SCHEME The word Ombudsman in general means a grievance man, a public official who is appoin ted to investigate complaints against the administration. He is to intervene for the ordinary citizen in his dealings with the complex machinery of the establis hment. In India, any person whose grievance against a bank is not

resolved to his satisfaction by that bank within a period of one month can appro ach the Banking Ombudsman if his complaint pertains to any of the matters specif ied in the Scheme. Banking Ombudsmen have been authorized to look into complaint s concerning deficiency in banking service , sanction of loans and advances in s o far as they relate to non-observance of the Reserve Bank directives on interes t rates, delay in sanction or non-observance of prescribed time schedule for dis posal of loan applications or nonobservance of any other directions or instructi ons of the Reserve Bank as may be specified for this purpose, from time to time, and such other matters as may be specified by the Reserve Bank. The Scheme envi sages expeditious and satisfactory disposal of customer complaints in a time bou nd manner. The Banking Ombudsman on receipt of any complaint endeavors to promot e a settlement of the complaint by agreement between the complainant and the ban k named in the complaint through conciliation or mediation. For the purpose of p romoting a settlement of the complaint, the Banking Ombudsman has been allowed t o follow such procedures as he may consider appropriate and he is not bound by a ny legal rule of evidence. If a complaint is not settled by agreement within a p eriod of one month from the date of receipt of the complaint or such further per iod as the Banking Ombudsman may consider necessary, he may pass an Award after affording the parties reasonable opportunity to present their case. He shall be guided by the evidence placed before him by the parties, the principles of banki ng law and practice, directions, instructions and guidelines issued by the Reser ve Bank from time to time and such other factors, which in his opinion are neces sary in the interest of justice.

SCOPE OF THE SCHEME The Banking Ombudsman Scheme, 2002 covered all the Regional Rural Banks in addit ion to all Commercial Banks and Scheduled Primary Co-operative Banks, which were already covered by earlier Banking Ombudsman Scheme, 1995. There is no change i n this regard in the Banking Ombudsman Scheme, 2006. In 2006, the Reserve Bank o f India announced the revised Banking Ombudsman Scheme with enlarged scope that included customer complaints on certain new areas, such as, credit card complain ts, deficiencies in providing the promised services even by banks sales agents, levying service charges without prior notice to the customer and non adherence to the fair practices code as adopted by individual banks. The important new gro unds of complaints added include credit card issues, failure in providing the pr omised facilities, non-adherence to fair practices code, levying of excessive ch arges without prior notice and issues pertaining to accepting payment towards ta xes and issuing/servicing of Government securities. The grounds of complaints ha ve been enumerated in Clause 8 of the Banking Ombudsman Scheme, 2006. OPERATIONALISATION Reserve Bank of India operationalised the Banking Ombudsman Scheme by establishi ng Banking Ombudsman Offices at 15 centers all over the country. The names, addr esses and area of operation of the Banking Ombudsmen have been given in to Annex ure A. Reserve Bank frames the guidelines for operationalizing the Scheme and supe rvises the running of the Scheme. It also supervises the running of the Scheme a nd administrative arrangements, budget and expenditure of the Banking Ombudsman Offices.

PERFORMANCE OMBUDSMAN OF THE OFFICES OF BANKING The performance of the Offices of the Banking Ombudsman was analyzed on the aspe cts such as the quantum of complaints handled by them, the timeliness in handlin g the issues, and appropriateness of the decisions given against the complaints.

Number of Complaints Received The number of complaints received by the Banking Ombudsman Offices had constantl y increased in the last five years. There was more than threefold increase in th e number of complaints received in the year 2006-07 from the previous year after the Banking Ombudsman Scheme, 2006 was notified. The increasing receipt was als o observed in the year 2007-08 with a 24% increase from the year 2006-07. The av erage number of complaints received per Banking Ombudsman Office has also increa sed from 550 in 2003-04 to 3192 in 2007-08. Number of complaints received by the Banking Ombudsman Offices

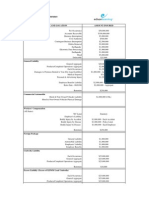

Period No of Offices of Banking Ombudsman Complaints received during the year No. Change from Previous year Average No. of complaints per office 2003-04 2004-05 2005-06 2006-07 2007-08 15 15 15 15 15 8246 10560 31732 38638 47887 +53% +28% +200% +22% +24% 550 704 2115 2576 3192 The increase in the number of complaints received during the years 2005-06 and20 06-07 can be attributed to new areas such as credit card complaints included and to facilitation of complaint submission by allowing complaint submission in any form including by online and by email allowed in the Banking Ombudsman Scheme, 2006. Per month receipt in the number of complaints received under the BO Scheme 2006 was more than thrice the number of complaints received under the Banking O mbudsman Scheme, 2002. The increase in the number of complaints received under t he Banking Ombudsman Scheme 2006 as compared to the previous scheme clearly indi cates the extent to which the scheme has benefited larger sections of the bankin g customers. The comparative effects of the Banking Ombudsman Schemes 2002 and 2 006 in complaint receipt are given as below:

Number of complaints received in 2005-06 and 2006-07 Period Scheme running No. of complaints From To Total received From To Total Total Per month 01.04.2005 31.12.2005 9 months BO Scheme, 2002 BO Scheme, 2006 9723 1080 01.01.2006 30.06.2007 18 months 60647 3370

Disposal of Complaints During the year 2007-08, the Banking Ombudsman Offices disposed of 49100 complai nts (including from the complaints pending at the beginning of the year and thos e received during the year). Of these, 21747 complaints (49%) were settled to th e satisfaction of the complainants, 15914 complaints (36%) could not be consider ed under the scheme owing to several reasons like being outside the purview of t he scheme, time-barred, without sufficient cause, frivolous, pending in other fo ra, etc. A sample analysis of 756 complaints that could not be considered under the scheme disclosed that 42% of such complaints fell outside the purview of the scheme and 23% were first resort complaints and could not be taken up by the Ba nking Ombudsmen. In 11% of the complaints, deficiency of service could not be es tablished and the remaining 24% complaints could not be considered for reasons l ike they were pending in other fora or the complaints required

consideration of elaborate documentary and oral evidence etc. Details of disposa l of complaints over the last five years are furnished in the following table: Disposal of Complaints by Banking Ombudsman Offices Particulars 2003-04 2004-05 2005-06 2006-07 2007-08 Total complaints dealt with during the year Complaints settled to the satisfacti on of complainants (a) Complaints that could not be considered under the scheme (b) Total number of complaints disposed of (a+b) Complaints under process 9483 12034 33363 44766 54992 3998 (42%) 5440 (45%) 14931 (45%) 21747 (49%) 29365 (53%) 4011 (42%) 4963 (41%) 12304 (37%) 15914 (36%) 19735 (36%) 8009 (84%) 10403 (86%) 27235 (82%) 37661 (84%) 49100 (89%) 1474 (16%)

1631 (14%) 6128 (18%) 7105 (16%) 5892 (11%)

Mode of Disposal of Complaints The Banking Ombudsmen disposed of complaints, other than the complaints that cou ld not be considered, either by mutual settlement or by issuing an Award. During the period reviewed, the ratio of complaints disposed by settlement to the comp laints disposed by award was around 99:1 clearly indicating the effectiveness of the Banking Ombudsmen in arriving at mutually agreed consensus between bankers and complainants. During the period above, only 563 awards were issued which for med less than 2% of the total 49,253 complaints disposed of. From the year 200607, the number of awards issued and the percentage of disposal through award iss uance have come down despite huge increase in the complaints received. Details a re as given table below. The fact that the Banking Ombudsmen could dispose of mo re than 98% of the complaints by mutual settlement between the complainant and t he concerned banks to their satisfaction indicates that they took appropriate de cisions taking into consideration all the relevant and extant legal and banking instructions and practice. Mode of disposal of complaints (Other than complaints that could not be consider ed) Sr. No. Year No. of complaints disposed of Disposal by Award No. % Disposal by settlement No. % 1. 2. 3. 4. 5. 2003-2004 2004-2005 2005-2006 2006-2007 2007-2008 3998 5440 14931 21747 29365 121 165 146 84 70 2.21 3.03 0.98 0.39 0.24 3877 5275 14785 21662 29295 97.78 96.97 99.02 99.61 99.76

Analysis of Complaints: Analysis of Complaints dealt with - Category-Wise The analysis of complaints received at the Banking Ombudsman offices includes an alysis of subject category of complaints and the bank-groups against which the c omplaints were made. Computerization of the functioning of Banking Ombudsman Off ices through the Complaint Tracking Software has enabled detailed analysis in th is regard. The maximum number of complaints dealt with during the last five-year period pertained to complaints regarding deposit accounts, deficiency in servic ing of loans and advances and delay in collection of cheques/bills, etc, besides the miscellaneous complaints. The details are given in the following table:

Analysis of complaints dealt with - category-wise Category Deposit Accounts Loans and Advances Collection of cheques/bills Others 2002-03 1789 (27%) 1651 (25%) 908 (14%) 2158 (34%) 2003-04 2500 (26%) 1226 (13%) 1001 (11%) 4756 (50%) 9483 2004-05 3239 (27%) 2291 (19%) 1245 (10%) 5259 (44%) 12034 2005-06 6733 (20%) 5215 (16%) 3058 (9%) 18357 (55%) 33363 2006-07 5803 (15%) 5151 (13%) 4058 (11%) 23626 (61%) 38638 Total 6506 However, during the year 2006-07, the maximum number of complaints received pert ained to credit cards at 20%. Complaints pertaining to deposit accounts, loans a nd advances and remittances occupied the next three places in the number of comp laints received. The details are shown below.

Complaints received in 2007-08: Category-wise

Complaints received in 2006-07 & 2007-08: Category-wise Sr.No. Nature of complaint Received during 2006-07 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Deposit accounts Remittances Credit cards Loa ns and advances - General Loans and advances - Housing Charges without notice Pe nsion Failure on commitments made DSAs and recovery agents Notes and coins Other s Total 5803 4058 7688 4442 709 2594 1070 1469 1039 130 9636 38638 2007-08 5612 5213 10129 5297 757 3740 1582 6388 3128 141 5900 47887

Analysis of complaints-Bank-group-wise Group-wise, the majority of the complaints pertain to the Nationalized Banks fol lowed by the State Bank Group. However, over the years, the percentage of compla ints against public sector banks, including the SBI Group, showed a decline vis-vis the number of complaints received against private sector banks and foreign b anks. Break-up of complaints dealt with - Bank-group-wise Bank group 200304 200405 200506 200607 200708 Total No. % 30 Nationalized Banks SBI Group Private Sector Banks Foreign Banks Scheduled Primar y Coop. Banks RRB Others 4049 5124 10137 10543 12033 45031 2779 1325 3359 1863 9892 6754 11117 9036 13532 14077 42593 33773 29 23 406 577

2997 3803 6126 14222 10 166 256 198 313 295 1340 1 232 526 359 496 794 2591 536 3290 826 998 2780 8127 2 5

Total 9483 12034 33363 38638 47887 147911 100 COST DETAILS OF RUNNING THE SCHEME The costs of the Scheme include the revenue expenditure and capital expenditure incurred in running the Banking Ombudsman offices. The revenue expenditure inclu des the establishment items like salary and allowances of the staff attached to Banking Ombudsman offices and non-establishment items such as rent, taxes, insur ance, law charges, postage and telegram charges, printing and stationery expense s, publicity expenses, depreciation and other miscellaneous items. The capital e xpenditure items include the furniture, electrical installations, computers/related equipments, telecommunication equipments and motor vehicle. Cost details of Banking Ombudsman Offices Period Total Cost (Rs. Cr) No. of Complaints dealt Cost per Complaint (Rs) 2003-04 2004-05 2005-06 2006-07 2007-08 7.03 7.60 10.16 9.81 12.50 9,483 12,034 33,363 38,638 47,887 7,413 6,315 3,045 2,538 2,611

THE CONSUMER PROTECTION ACT, 1986 The consumer protection Act, 1986 is the history of socio-economic legislation i n the country. It is one of the most progressive and comprehensive piece of legi slations enacted for the protection of consumers. It was enacted after in-depth study of consumer protection laws in a number of countries and in consultation w ith representatives of consumers, trade and industry and extensive discussions w ithin the Government. The Aim of Consumer Protection Act (CPA) is to address the grievances of the consumers and protecting them from the unethical practices/ b ehavior or unfair trade practices of the manufacturer/ supplier. All the provisi ons of the Act have come into force from 1 July 1987. The Act was amended in 199 1 and 1993. To make the Consumer Protection Act more functional and purposeful, a comprehensive amendment was carried out in December 2002 and brought into forc e from 15 March 2003. As a sequel, the Consumer Protection Rules, 1987 were also amended and notified on 5 March 2004. Earlier though there were several legisla tions to protect the consumer, but the same never proved adequate to protect con sumer and compensate them for their compliances. The act not only enhances the a wareness and educate the consumer but also provide compensation to them by summa ry and inexpensive proceedings. Unlike existing laws which are punitive or preve ntive in nature, the provisions of this Act are compensatory in nature. The act is intended to provide simple, speedy and inexpensive redressal to the consumers grievances, and relief of a specific nature and award of compensation wherever appropriate to the consumer. It confers upon consumers eight rights i.e.: basic needs, safety, information, choice, representation, redress, consumer education , healthy environment. It provides remedies to the aggrieved customer in form Re place, Remove, Refund, Redress.

CONSUMER Consumer means any person who,Buy any goods for a consideration which has been pai d or promised or partly paid and partly promised, or under any system of deferre d payment and includes any user of such goods other than the person who buys suc h goods for consideration paid or promised or partly paid or partly promised or under any system of deferred payment when such use is made with the approval of such person, but does not include a person who obtains such goods for resale or for any commercial purpose, or Hires any services for a consideration which has been paid or promised or partly paid and partly promised, or under any system of deferred payment and includes any beneficiary of such services other than the p erson who hires the services for consideration paid or promised, or partly paid and partly promised, or under any system of deferred payment, when such services are availed of with the approval of the first mentioned person. COMPLAINT Complaint means any allegation in writing made by a complaint that: As a result of any unfair trade practice adopted by any trader, the complainant has suffered l oss or damage. The goods mentioned in the complaint suffer from one or more defe cts. The services mentioned in the complaint suffer from deficiency in any respe ct. A trader has charged for the goods mentioned in the complaint a price in exc ess of the price fixed by or under any law for the time being in force or displa yed on the goods or any package containing such goods, with a view to obtaining any relief provided by this Act.

Remedies Granted under the Consumer Protection Act, 1986 against unfair Trade Pr actices. The District Forum / State Commission / National Commission may pass one or more of the following orders to grant relief to the aggrieved consumer :1. to remove the defects pointed out by the appropriate laboratory from goods in question; 2 . to replace the goods with new goods of similar description which shall be free from any defect; 3. to return to the complainant the price, or, as the case may be, the charges paid by the complainant; 4. to pay such amount as may be awarde d by it as compensation to the consumer for any loss or injury suffered by the c onsumer due to negligence of the opposite party; 5. 6. to remove the defects or deficiencies in the services in question; to discontinue the unfair trade practi ce or the restrictive trade practice or not to repeat them; 7. 8. 9. not to offe r the hazardous goods for sale: to withdraw the hazardous goods from being offer ed for sale to cease manufacture of hazardous goods and to desist from offering services which are hazardous in nature; 10. to pay such sum as may be determined by it if it is of the opinion that loss or injury has been suffered by a large number of consumers who are not identifiable conveniently:

11. to issue corrective advertisement to neutralize the effect of misleading adv ertisement at the cost of the opposite party responsible for issuing such mislea ding advertisement; 12. to provide for adequate costs to parties. RIGHTS OF CONSUMERS Right to Safety Right to be Heard Right to Information Right to Choice Rights of Right to Redress Consumers Right to Safe Environment Right to Basic Needs Right to Consumer Education

Right to Safety The right to be protected against the marketing of goods and services which are hazardous to life and property Consumer right to safety applies to all possible consumption patterns and to all goods and services. In the context of the new ma rket economy and rapid technological advances affecting the market, the right to safety has become a pre-requisite quality in all products and services. For e.g . some Indian products carry the ISI mark, which is a NB symbol of satisfactory quality of a product? Similarly, the FPO and AGMARK symbolize standard quality o f food products. Right to Information Right to information means the right to be given the facts needed to make an inf ormed choice or decision about factors like quality, quantity, potency, purity s tandards and price of product or service. The right to information now goes beyo nd avoiding deception and protection against misleading advertising, improper la beling and other practices. For e.g. when you buy a product or utilize a service , you should be informed about; a) How to consume a product. b) The adverse heal th effects of its consumption. c) Whether the ingredients used are environmentfriendly or not etc. Right to Redress The right to seek redressal against unfair trade practices or restrictive trade practices or unscrupulous exploitation of consumers. It is to protect consumer i nterests that consumers have been given the right to obtain redress. In India, w e have a redress machinery called Consumer Courts constituted under the Consumer Protection Act (1986), functioning at national state and district levels. But i t has

not been made complete use of under due to lack of awareness of basic consumer r ights among consumers themselves. While in the developed world, right to redress is perhaps the most commonly exercised consumer right, in developing countries, consumers are still wary of getting involved in legal redress system. There are consumer courts in India where any consumer can lodge a case if s/he thinks he or she has been cheated. Right to Consumer Education Consumer education empowers consumers to exercise their consumer rights. It mean s the right to acquire the knowledge and skill to be informed consumer throughou t life. The right to consumer education incorporates the right to the knowledge and skills needed for linking action and influences factors which affect consume r decisions. It is the single most powerful tool that can take consumers from th eir present disadvantageous position to one of strength in the marketplace. Cons umer education is dynamic, participatory and is mostly acquired by hands-on and practical experience. Right to Basic Needs This right is the right to basic goods and services which guarantee dignified li ving. It includes adequate food, clothing, health care, drinking water and sanit ation, shelter, education, energy and transportation. Access to food, water and shelter are the basis of any consumer s life. Without these fundamental amenitie s, life cannot exist. The right to basic needs means that availability of articl es which are the basic need of every consumer must be ensured.

Right to Safe Environment It means the right to a physical environment that will enhance the quality of li fe. It includes protection against environmental damage. It acknowledges the nee d to protect and improve the environment for future generations as well. This ri ght involves protection against environmental problems over which the individual consumer has control. It acknowledges the need to protect and improve the envir onment for present and future generations. Right to Choice The right is to be assured, wherever possible, access to a variety of products a nd services at competitive prices. It means the right to have access to a variet y of products and services at competitive prices and in the case of monopolies, to have an assurance of satisfactory quality and service at a fair price. The ri ght to choose has been reformulated to read: the right to basic goods and servic es. This is because the unrestrained right of a minority to choose can mean for the majority a denial of its fair share. Right to be Heard This means the right to be represented so that consumers interests receive full a nd sympathetic consideration in the formulation and execution of economic policy . This right is being broadened to include the right to be heard and represented in the development of products and services before they are produced or set up; it also implies a representation, not only in government policies, but also in those of other economic powers.

THE BANKING OMBUDSMAN SCHEME, 2006 The Scheme is introduced with the object of enabling resolution of complaints re lating to certain services rendered by banks and to facilitate the satisfaction or settlement of such complaints. SHORT TITLE, COMMENCEMENT, EXTENT AND APPLICATION 1) This Scheme may be called the Banking Ombudsman Scheme, 2006. 2) It shall com e into force on such date as the Reserve Bank may specify. 3) It shall extend to the whole of India. 4) The Scheme shall apply to the business in India of a ban k as defined under the Scheme. SUSPENSION OF THE SCHEME 1) The Reserve Bank, if it is satisfied that it is expedient so to do, may by or der suspend for such period as may be specified in the order, the operation of a ll or any of the provisions of the Scheme, either generally or in relation to an y specified bank. 2) The Reserve Bank may, by order, extend from time to time, t he period of any suspension ordered as aforesaid by such period, as it thinks fi t. DEFINITIONS 1) Award means an award passed by the Banking Ombudsman in accordance with the Sch eme. 2) Appellate Authority means the Deputy Governor in charge of the Department of the Reserve Bank implementing the Scheme. 3) Authorized representative means a person duly appointed and authorized by a complainant to act on his behalf and r epresent him in the proceedings

under the Scheme before a Banking Ombudsman for consideration of his complaint. 4) Banking Ombudsman means any person appointed under Clause 4 of the Scheme. 5) Ba nk means a banking company, a corresponding new bank, a Regional Rural Bank, State Ba of India a Subsidiary Bank as defined in Section 5 of the Banking Regulation Act, 1 949 (Act 10 of 1949), or a Primary Co-operative Bank as defined in clause (c) of S ection 56 of that Act and included in the Second Schedule of the Reserve Bank of India Act, 1934 (Act 2 of 1934), having a place of business in India, whether s uch bank is incorporated in India or outside India. 6) Complaint means a represent ation in writing or through electronic means containing a grievance alleging def iciency in banking service as mentioned in clause 8 of the Scheme. 7) Reserve Ban k means the Reserve Bank of India constituted by Section 3 of the Reserve Bank of India Act, 1934 (2 of 1934). 8) The scheme means the Banking Ombudsman Scheme, 20 06. 9) Secretariat means the office constituted as per sub-clause (1) of clause 6 of the Scheme. 10)Settlement means an agreement reached by the parties either by c onciliation or mediation under clause 11 of the Scheme.

ESTABLISHMENT OF OFFICE OF BANKING OMBUDSMAN APPOINTMENT & TENURE 1) The Reserve Bank may appoint one or more of its officers in the rank of Chief General Manager or General Manager to be known as Banking Ombudsmen to carry ou t the functions entrusted to them by or under the Scheme. 2) The appointment of Banking Ombudsman under the above Clause may be made for a period not exceeding three years at a time. LOCATION OF OFFICE AND TEMPORARY HEADQUARTERS 1) The office of the Banking Ombudsman shall be located at such places as may be specified by the Reserve Bank. 2) In order to expedite disposal of complaints, the Banking Ombudsman may hold sittings at such places within his area of jurisd iction as may be considered necessary and proper by him in respect of a complain t or reference before him. SECRETARIAT 1) The Reserve Bank shall depute such number of its officers or other staff to t he office of the Banking Ombudsman as is considered necessary to function as the secretariat of the Banking Ombudsman. 2) The cost of the Secretariat shall be b orne by the Reserve Bank.

JURISDICTION, POWERS AND DUTIES OF BANKING OMBUDSMAN POWERS AND JURISDICTION 1) The Reserve Bank shall specify the territorial limits to which the authority of each Banking Ombudsman appointed under Clause 4 of the Scheme shall extend. 2 ) The Banking Ombudsman shall receive and consider complaints relating to the de ficiencies in banking or other services filed on the grounds mentioned in clause 8 and facilitate their satisfaction or settlement by agreement or through conci liation and mediation between the bank concerned and the aggrieved parties or by passing an Award in accordance with the Scheme. 3) The Banking Ombudsman shall exercise general powers of superintendence and control over his Office and shall be responsible for the conduct of business thereat. 4) The Office of the Bankin g Ombudsman shall draw up an annual budget for itself in consultation with Reser ve Bank and shall exercise the powers of expenditure within the approved budget on the lines of Reserve Bank of India Expenditure Rules, 2005. 5) The Banking Om budsman shall send to the Governor, Reserve Bank, a report, as on 30th June ever y year, containing a general review of the activities of his Office during the p receding financial year and shall furnish such other information as the Reserve Bank may direct and the Reserve Bank may, if it considers necessary in the publi c interest so to do, publish the report and the information received from the Ba nking Ombudsman in such consolidated form or otherwise as it deems fit.

PROCEDURE FOR REDRESSAL OF GRIEVANCE GROUNDS OF COMPLAINT 1) Any person may file a complaint with the Banking Ombudsman having jurisdictio n on any one of the following grounds alleging deficiency in banking including i nternet banking or other services. a) Non-payment or inordinate delay in the pay ment or collection of cheques, drafts, bills etc; b) Non-acceptance, without suf ficient cause, of small denomination notes tendered for any purpose, and for cha rging of commission in respect thereof; c) Non-acceptance, without sufficient ca use, of coins tendered and for charging of commission in respect thereof; d) Non -payment or delay in payment of inward remittances; e) Failure to issue or delay in issue of drafts, pay orders or bankers cheques; f) Non-adherence to prescribe d working hours; g) Failure to provide or delay in providing a banking facility (other than loans and advances) promised in writing by a bank or its direct sell ing agents; h) Delays, non-credit of proceeds to parties accounts, non-payment of deposit or non-observance of the Reserve Bank directives, if any, applicable to rate of interest on deposits in any savings, current or other account maintai ned with a bank; i) Complaints from Non-Resident Indians having accounts in Indi a in relation to their remittances from abroad, deposits and other bank related matters; j) Refusal to open deposit accounts without any valid reason for refusa l; k) Levying of charges without adequate prior notice to the customer;

l) Non-adherence by the bank or its subsidiaries to the instructions of Reserve Bank on ATM/Debit card operations or credit card operations; m) Non-disbursement or delay in disbursement of pension (to the extent the grievance can be attribu ted to the action on the part of the bank concerned, but not with regard to its employees); n) Refusal to accept or delay in accepting payment towards taxes, as required by Reserve Bank/Government; o) Refusal to issue or delay in issuing, o r failure to service or delay in servicing or redemption of Government securitie s; p) Forced closure of deposit accounts without due notice or without sufficien t reason; q) Refusal to close or delay in closing the accounts; r) Non-adherence to the fair practices code as adopted by the bank; s) Non-adherence to the prov isions of the Code of Bank s Commitments to Customers issued by Banking Codes an d Standards Board of India and as adopted by the bank ; t) Non-observance of Res erve Bank guidelines on engagement of recovery agents by banks; and u) Any other matter relating to the violation of the directives issued by the Reserve Bank i n relation to banking or other services. 2) A complaint on any one of the follow ing grounds alleging deficiency in banking service in respect of loans and advan ces may be filed with the Banking Ombudsman having jurisdiction: a) Non-observan ce of Reserve Bank Directives on interest rates; b) Delays in sanction, disburse ment or non-observance of prescribed time schedule for disposal of loan applicat ions;

c) Non-acceptance of application for loans without furnishing valid reasons to t he applicant; and d) Non-adherence to the provisions of the fair practices code for lenders as adopted by the bank or Code of Banks Commitment to Customers, as t he case may be; e) Non-observance of Reserve Bank guidelines on engagement of re covery agents by banks; and f) Non-observance of any other direction or instruct ion of the Reserve Bank as may be specified by the Reserve Bank for this purpose from time to time. 3) The Banking Ombudsman may also deal with such other matte r as may be specified by the Reserve Bank from time to time in this behalf.

PROCEDURE FOR FILING COMPLAINT 1) Any person who has a grievance against a bank on any one or more of the groun ds mentioned in Clause 8 of the Scheme may, himself or through his authorized re presentative (other than an advocate), make a complaint to the Banking Ombudsman within whose jurisdiction the branch or office of the bank complained against i s located. 3Provided that a complaint arising out of the operations of credit ca rds and other types of services with centralized operations, shall be filed befo re the Banking Ombudsman within whose territorial jurisdiction the billing addre ss of the customer is located. 2) a) The complaint in writing shall be duly sign ed by the complainant or his authorized representative and shall be, as far as p ossible, in the form specified in Annexure A or as near as thereto as circumstance s admit, stating clearly: i. ii. The name and the address of the complainant, Th e name and address of the branch or office of the bank against which the complai nt is made, iii. iv. v. The facts giving rise to the complaint, The nature and e xtent of the loss caused to the complainant, and The relief sought for. b) The c omplainant shall file along with the complaint, copies of the documents, if any, which he proposes to rely upon and a declaration that the complaint is maintain able under sub-clause (3) of this clause. c) A complaint made through electronic means shall also be accepted by the Banking Ombudsman and a print out of such c omplaint shall be taken on the record of the Banking Ombudsman.

d) The Banking Ombudsman shall also entertain complaints covered by this Scheme received by Central Government or Reserve Bank and forwarded to him for disposal . 3) No complaint to the Banking Ombudsman shall lie unless:a) The complainant h ad, before making a complaint to the Banking Ombudsman, made a written represent ation to the bank and the bank had rejected the complaint or the complainant had not received any reply within a period of one month after the bank received his representation or the complainant is not satisfied with the reply given to him by the bank; b) The complaint is made not later than one year after the complain ant has received the reply of the bank to his representation or, where no reply is received, not later than one year and one month after the date of the represe ntation to the bank; c) The complaint is not in respect of the same cause of act ion which was settled or dealt with on merits by the Banking Ombudsman in any pr evious proceedings whether or not received from the same complainant or along wi th one or more complainants or one or more of the parties concerned with the cau se of action ; d) The complaint does not pertain to the same cause of action, fo r which any proceedings before any court, tribunal or arbitrator or any other fo rum is pending or a decree or Award or order has been passed by any such court, tribunal, arbitrator or forum; e) The complaint is not frivolous or vexatious in nature; and f) The complaint is made before the expiry of the period of limitat ion prescribed under the Indian Limitation Act, 1963 for such claims.

POWER TO CALL FOR INFORMATION 1) For the purpose of carrying out his duties under this Scheme, a Banking Ombud sman may require the bank against whom the complaint is made or any other bank c oncerned with the complaint to provide any information or furnish certified copi es of any document relating to the complaint which is or is alleged to be in its possession. Provided that in the event of the failure of a bank to comply with the requisition without sufficient cause, the Banking Ombudsman may, if he deems fit, draw the inference that the information if provided or copies if furnished would be unfavorable to the bank. 2) The Banking Ombudsman shall maintain confi dentiality of any information or document that may come into his knowledge or po ssession in the course of discharging his duties and shall not disclose such inf ormation or document to any person except with the consent of the person furnish ing such information or document. Provided that nothing in this clause shall pre vent the Banking Ombudsman from disclosing information or document furnished by a party in a complaint to the other party or parties to the extent considered by him to be reasonably required to comply with any legal requirement or the princ iples of natural justice and fair play in the proceedings.

SETTLEMENT OF COMPLAINT BY AGREEMENT 1) As soon as it may be practicable to do, the Banking Ombudsman shall send a co py of the complaint to the branch or office of the bank named in the complaint, under advice to the nodal officer referred to in sub-clause (3) of clause 15, an d endeavor to promote a settlement of the complaint by agreement between the com plainant and the bank through conciliation or mediation. 2) For the purpose of p romoting a settlement of the complaint, the Banking Ombudsman may follow such pr ocedure as he may consider just and proper and he shall not be bound by any rule s of evidence. 3) The proceedings before the Banking Ombudsman shall be summary in nature. AWARD BY THE BANKING OMBUDSMAN 1) If a complaint is not settled by agreement within a period of one month from the date of receipt of the complaint or such further period as the Banking Ombud sman may allow the parties, he may, after affording the parties a reasonable opp ortunity to present their case, pass an Award or reject the complaint. 2) The Ba nking Ombudsman shall take into account the evidence placed before him by the pa rties, the principles of banking law and practice, directions, instructions and guidelines issued by the Reserve Bank from time to time and such other factors w hich in his opinion are relevant to the complaint. 3) The award shall state brie fly the reasons for passing the award.

4) The Award passed under sub-clause (1) shall contain the direction/s, if any, to the bank for specific performance of its obligations and in addition to or ot herwise, the amount, if any, to be paid by the bank to the complainant by way of compensation for any loss suffered by the complainant, arising directly out of the act or omission of the bank. 5) Notwithstanding anything contained in sub-cl ause (4), the Banking Ombudsman shall not have the power to pass an award direct ing payment of an amount which is more than the actual loss suffered by the comp lainant as a direct consequence of the act of omission or commission of the bank , or ten lakh rupees whichever is lower. 6) In the case of complaints, arising o ut of credit card operations, the Banking Ombudsman may also award compensation not exceeding Rs 1 lakh to the complainant, taking into account the loss of the complainant s time, expenses incurred by the complainant, harassment and mental anguish suffered by the complainant. 7) A copy of the Award shall be sent to the complainant and the bank. 8) An award shall lapse and be of no effect unless th e complainant furnishes to the bank concerned within a period of 30 days from th e date of receipt of copy of the Award, a letter of acceptance of the Award in f ull and final settlement of his claim. Provided that no such acceptance may be f urnished by the complainant if he has filed an appeal under sub. clause (1) of c lause 14. 9) The bank shall, unless it has preferred an appeal under sub. clause (1) of clause 14, within one month from the date of receipt by it of the accept ance in writing of the Award by the complainant under sub-clause (8), comply wit h the Award and intimate compliance to the Banking Ombudsman.

REJECTION OF THE COMPLAINT The Banking Ombudsman may reject a complaint at any stage if it appears to him t hat the complaint made is; a) Not on the grounds of complaint referred to in cla use 8 or otherwise not in accordance with sub clause (3) of clause 9; or b) Beyo nd the pecuniary jurisdiction of Banking Ombudsman prescribed under clause 12 (5 ) and 12 (6) or c) Requiring consideration of elaborate documentary and oral evi dence and the proceedings before the Banking Ombudsman are not appropriate for a djudication of such complaint; or d) Without any sufficient cause; or e) That it is not pursued by the complainant with reasonable diligence; or f) In the opini on of the Banking Ombudsman there is no loss or damage or inconvenience caused t o the complainant. APPEAL BEFORE THE APPELLATE AUTHORITY: 1) Any person aggrieved by an Award under clause 12 or rejection of a complaint for the reasons referred to in sub clauses (d) to (f) of clause 13, may within 3 0 days of the date of receipt of communication of Award or rejection of complain t, prefer an appeal before the Appellate Authority; Provided that in case of app eal by a bank, the period of thirty days for filing an appeal shall commence fro m the date on which the bank receives letter of acceptance of Award by complaina nt under sub. clause (6) of clause 12;

Provided that the Appellate Authority may, if he is satisfied that the applicant had sufficient cause for not making the appeal within time, allow a further per iod not exceeding 30 days; Provided further that appeal may be filed by a bank o nly with the previous sanction of the Chairman or, in his absence, the Managing Director or the Executive Director or the Chief Executive Officer or any other o fficer of equal rank. 2) The Appellate Authority shall, after giving the parties a reasonable opportunity of being heard a) Dismiss the appeal; or b) Allow the a ppeal and set aside the Award; or c) Remand the matter to the Banking Ombudsman for fresh disposal in accordance with such directions as the Appellate Authority may consider necessary or proper; or d) Modify the Award and pass such directio ns as may be necessary to give effect to the Award so modified; or e) Pass any o ther order as it may deem fit. 3) The order of the Appellate Authority shall hav e the same effect as the Award passed by Banking Ombudsman under clause 12 or th e order rejecting the complaint under clause 13, as the case may be.

BANKS TO DISPLAY SALIENT FEATURES OF THE SCHEME FOR COMMON KNOWLEDGE OF PUBLIC 1) The banks covered by the Scheme shall ensure that the purpose of the Scheme a nd the contact details of the Banking Ombudsman to whom the complaints are to be made by the aggrieved party are displayed prominently in all the offices and br anches of the bank in such manner that a person visiting the office or branch ha s adequate information of the Scheme. 2) The banks covered by the Scheme shall e nsure that a copy of the Scheme is available with the designated officer of the bank for perusal in the office premises of the bank, if anyone, desires to do so and notice about the availability of the Scheme with such designated officer sh all be displayed along with the notice under sub-clause (1) of this clause and s hall place a copy of the Scheme on their websites. 3) The banks covered by the S cheme shall appoint Nodal Officers at their Regional/Zonal Offices and inform th e respective Office of the Banking Ombudsman under whose jurisdiction the Region al/Zonal Office falls. The Nodal Officer so appointed shall be responsible for r epresenting the bank and furnishing information to the Banking Ombudsman in resp ect of complaints filed against the bank. Wherever more than one zone/region of a bank are falling within the jurisdiction of a Banking Ombudsman, one of the No dal Officers shall be designated as the Principal Nodal Officer for such zones or regions.

REMOVAL OF DIFFICULTIES If any difficulty arises in giving effect to the provisions of this Scheme, the Reserve Bank may make such provisions not inconsistent with the Banking Regulati on Act, 1949 or the Scheme, as it appears to it to be necessary or expedient for removing the difficulty. APPLICATION OF THE BANKING OMBUDSMAN SCHEMES, 1995 AND 2002 The adjudication of pending complaints and execution of the Awards already passe d, before coming into force of the Banking Ombudsman Scheme, 2006, shall continu e to be governed by the provisions of the respective Banking Ombudsman Schemes a nd instructions of the Reserve Bank issued there under.

DIFFERENCE BETWEEN BANKING OMBUDSMAN SCHEME 1995, 2002 & 2006 The Ombudsmans task is to provide citizens with a means of redress for maladminis tration. By performing this role, the Ombudsman helps, first, to relieve the bur dens of litigation by promoting friendly settlement and making recommendations t o avoid the need for proceedings in courts; and second, to promote the effective implementation of citizen s rights. The Ombudsman is impartial and has a concil iatory approach. In India, any person whose grievances against a bank are not re solved to his satisfaction by that bank within a period of two months then he ca n approach the Banking Ombudsman for redressal. This is however subject to the c omplaint pertaining to any of the matters specified in the Banking Ombudsman Sch eme. Reserve Bank of India (RBI) which assumes the role similar to that of quasi -legal machinery as it is established by a competent authority to provide for an additional but optional legal remedy for effective, expeditious and inexpensive redressal of customer grievances. Towards effective compliance of this optional legal remedy it introduced the Banking Ombudsmen Scheme in 1995 and got it furt her amended in 2002 and in 2006. The Reserve Bank of India notified the revised Banking Ombudsman Scheme, 2006 which came into effect from January 1, 2006. The new scheme widens its scope thereby to include customer complaints on certain ar eas like credit card complaints, deficiencies in providing the promised services even by banks sales agents, levying service charges without prior notice to the customer and nonadherence to the fair practices code as adopted by the individua l banks. It is made applicable to all commercial banks, regional rural banks and scheduled primary cooperative banks whose principal place of business is in Ind ia.