Академический Документы

Профессиональный Документы

Культура Документы

Form No. 16-A

Загружено:

JayИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No. 16-A

Загружено:

JayАвторское право:

Доступные форматы

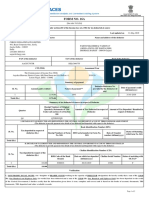

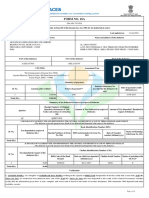

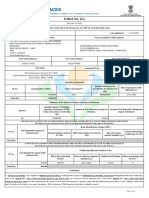

FORM NO. 16A.

Certificate of deduction of tax at source under section 203

Of the Income Tax Act, 1961.

[For interest on securities; dividends; interest other than “interest on securities”, winnings from lottery or crossword

puzzle; winning from horse race ; payments to contractors and sub-contractors, insurance commission; payments to

non-resident sportsmen/sports associations; payments in respect of deposits under National Savings Scheme; payments

on account of repurchase of units by Mutual Fund or Unit Trust of India; commission, remuneration or prize on sale

of lottery tickets; [rent] [fees for professional or technical services; income in respect of units;] [payment of

compensation on acquisition of certain immovable property;] other sums under section 195; income of foreign

companies referred to in section 196A(2); income from units referred to in section 196B; income from foreign currency

bonds or shares of an Indian company referred to in section 196C; income of Foreign Institutional Investors from

securities referred to in section 196D]

Name and address of the Acknowledgement Nos. of all Quarterly Name and address of the person to whom

person deducting tax Statements of TDS under sub-section (3) of payment made or in whose account it is

section 200 as provided by TIN Facilitation credited

Centre or NSDL web-site

Quarter Acknowledgement

No.

1

2

3

4

TAX DEDUCTION A/C. NATURE OF PAYMENT PAN/GIR NO. OF THE PAYEE

NO. OF THE DEDUCTOR

PAN/GIR NO.OF THE FOR THE PERIOD

DEDUCTOR TO

DETAILS OF PAYMENT, TAX DEDUCTION AND DEPOSIT OF TAX

INTO CENTRAL GOVERNMENT ACCOUNT

(The Deductor is to provide transaction-wise details of tax deducted and deposited)

Sr. Amount Date of TDS Sur Edu. Total Cheque/ BSR Code Date on Transfer

No. Paid/ Payment/ Rs. Char Cess Tax DD No. of Bank which tax voucher/

credited Credit ge Rs. deposite (if any) Branch deposited Challan

Rs. d Rs. (dd/mm/yy) identificat

ion No.

1.

2.

3.

4.

Certified that a sum of Rs.(in words)

ONLY has been deducted at source and paid to the credit of the Central Government as per

details given above.

Place : Ahmedabad

Date : Signature of person responsible for deduction of tax

Full Name :

Designation :

Вам также может понравиться

- Form 16 WORD FORMATEДокумент2 страницыForm 16 WORD FORMATEJay83% (46)

- CFA二级 财务报表 习题 PDFДокумент272 страницыCFA二级 财务报表 习题 PDFNGOC NHIОценок пока нет

- TDS Form 16 & 16AДокумент14 страницTDS Form 16 & 16AVaibhav NagoriОценок пока нет

- Form No 16Документ2 страницыForm No 16scorpio.vinodОценок пока нет

- Tds16a Revised As Per Notification No. 92010 Dated 18022010Документ1 страницаTds16a Revised As Per Notification No. 92010 Dated 18022010Sameer GanekarОценок пока нет

- Form No. 16A (See Rule31 (L) (B) )Документ4 страницыForm No. 16A (See Rule31 (L) (B) )Nirmal MalooОценок пока нет

- Form 16a - TDS - Blank 16aДокумент1 страницаForm 16a - TDS - Blank 16aJayОценок пока нет

- Form 16a New FormatДокумент2 страницыForm 16a New FormatJayОценок пока нет

- Bgupv5366d Q4 2019-20Документ2 страницыBgupv5366d Q4 2019-20Parth VaishnavОценок пока нет

- Form 16 Excel FormatДокумент4 страницыForm 16 Excel FormatAUTHENTIC SURSEZОценок пока нет

- 0002 Payment Certificate 2010Документ3 страницы0002 Payment Certificate 2010SreedharanPNОценок пока нет

- Welcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)Документ9 страницWelcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)SagarDaveОценок пока нет

- Form 16 AДокумент2 страницыForm 16 Asatyampandey7986659533Оценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rayon fashionОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NN Sarfaesi Solutions AgencyОценок пока нет

- (See Rule 31 (1) (B) )Документ2 страницы(See Rule 31 (1) (B) )B RОценок пока нет

- Form 16 AДокумент2 страницыForm 16 AParminderSinghОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghОценок пока нет

- BLFPN0819K 2021Документ4 страницыBLFPN0819K 2021anjana19780316Оценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rahul kumarОценок пока нет

- Aaqha9773c 2023Документ4 страницыAaqha9773c 2023Bhavesh JainОценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToSOUMYA RANJAN PATRAОценок пока нет

- Acfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaДокумент3 страницыAcfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaapi-564750164Оценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToPrakash PandeyОценок пока нет

- Cfa AccountsДокумент4 страницыCfa AccountsBhavesh SharmaОценок пока нет

- Akrpb2039b 2010Документ4 страницыAkrpb2039b 2010soujanya rajeshОценок пока нет

- Crzpb6128e 2021Документ4 страницыCrzpb6128e 2021PAMELAОценок пока нет

- Ay 2021-22Документ4 страницыAy 2021-22Aman JaiswalОценок пока нет

- A.Y. 2022-23Документ4 страницыA.Y. 2022-23LAXMI FINANCEОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ElvisPresliiОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ishita shahОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Subhransu SarangiОценок пока нет

- Asypj1551d 2023Документ4 страницыAsypj1551d 2023BIKRAM KUMAR BEHERAОценок пока нет

- Alasian Craft Aaufa3568m Fy201718Документ2 страницыAlasian Craft Aaufa3568m Fy201718SUDHIRОценок пока нет

- Form 16 BДокумент1 страницаForm 16 BSurendra Kumar BaaniyaОценок пока нет

- Vikas 26asДокумент4 страницыVikas 26asShivam MittalОценок пока нет

- Form 16 - Fy 2019-20Документ4 страницыForm 16 - Fy 2019-20CA SHOBHIT GoelОценок пока нет

- CGPPV3292L 2021Документ4 страницыCGPPV3292L 2021SANJAY KUMARОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ElvisPresliiОценок пока нет

- Tds FinalДокумент4 страницыTds FinalCharan KanthОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ManjunathОценок пока нет

- Deopb7997l 2021Документ4 страницыDeopb7997l 2021shryeasОценок пока нет

- Aecpv2564e 2019Документ4 страницыAecpv2564e 2019Quality CapitalОценок пока нет

- BCLPD4484R 2023Документ4 страницыBCLPD4484R 2023imt caОценок пока нет

- HBGPK3760R 2023Документ4 страницыHBGPK3760R 2023cadarshanshirodaОценок пока нет

- The Mumbai Bazaar 22 26ASДокумент4 страницыThe Mumbai Bazaar 22 26ASSanjeev RanjanОценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToDevasyrucОценок пока нет

- Prabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aДокумент2 страницыPrabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aankur maheshwariОценок пока нет

- 26AS of BJZPK9513P-2023Документ4 страницы26AS of BJZPK9513P-2023Satheesh CharyОценок пока нет

- Apzpr3785d 2024Документ4 страницыApzpr3785d 2024laskarmohinОценок пока нет

- Aaacl4159l Q3 2024-25Документ3 страницыAaacl4159l Q3 2024-25vbgrandvizagОценок пока нет

- Atypj5139q 2022Документ4 страницыAtypj5139q 2022Alliance CorporationОценок пока нет

- BDTPD4716P 2021Документ4 страницыBDTPD4716P 2021SANJAY KUMARОценок пока нет

- CGPPV3292L 2022Документ4 страницыCGPPV3292L 2022SANJAY KUMARОценок пока нет

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОт EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОценок пока нет

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- New PAN Application Form W.E.F. 1.11.2011Документ2 страницыNew PAN Application Form W.E.F. 1.11.2011JayОценок пока нет

- Budget Highlights 2011-12Документ2 страницыBudget Highlights 2011-12JayОценок пока нет

- Tandurasti Tamara HathmaДокумент43 страницыTandurasti Tamara HathmaJayОценок пока нет

- Business Women 2010Документ1 страницаBusiness Women 2010JayОценок пока нет

- Form 16a New FormatДокумент2 страницыForm 16a New FormatJayОценок пока нет

- Form 30 - RtoДокумент2 страницыForm 30 - RtoJayОценок пока нет

- Obtain Tpin NumberДокумент1 страницаObtain Tpin NumberJayОценок пока нет

- List of Useful Codes With Descriptions To Be Used As Reference Status of TaxpayerДокумент5 страницList of Useful Codes With Descriptions To Be Used As Reference Status of TaxpayerJayОценок пока нет

- Electricity Bill Calculation (Residential)Документ4 страницыElectricity Bill Calculation (Residential)JayОценок пока нет

- Electricity Bill Calculation (Residential)Документ4 страницыElectricity Bill Calculation (Residential)JayОценок пока нет

- How To Play SargamДокумент1 страницаHow To Play SargamJayОценок пока нет

- Organisation Chart Construction Project Manager Purchase/ Accounts Sales / AccountsДокумент3 страницыOrganisation Chart Construction Project Manager Purchase/ Accounts Sales / AccountsJay50% (2)

- PEM M C02: Operations Management: Post Graduate Programme in Project Engineering and ManagementДокумент63 страницыPEM M C02: Operations Management: Post Graduate Programme in Project Engineering and Managementchandanprakash30Оценок пока нет

- CA Solar Share 529 ProgramДокумент72 страницыCA Solar Share 529 Programd_fanthamОценок пока нет

- Skripsi Rifa'atul Mahmudah "Analisis Usaha Jamur Tiram"Документ89 страницSkripsi Rifa'atul Mahmudah "Analisis Usaha Jamur Tiram"Rifa'atul Mahmudah Al Masir100% (1)

- Cost SheetДокумент4 страницыCost SheetQuestionscastle FriendОценок пока нет

- Definition of Ricardian EquivalenceДокумент2 страницыDefinition of Ricardian Equivalencearbab buttОценок пока нет

- Cross Border Tax LeasingДокумент4 страницыCross Border Tax LeasingDuncan_Low_4659Оценок пока нет

- FAR - Learning Assessment 2 - For PostingДокумент6 страницFAR - Learning Assessment 2 - For PostingDarlene JacaОценок пока нет

- Pre-Test Entreprenuership Grade-12 Choose The Best AnswerДокумент5 страницPre-Test Entreprenuership Grade-12 Choose The Best AnswerMark Gil GuillermoОценок пока нет

- HMSP LK TW Iii 2020Документ92 страницыHMSP LK TW Iii 202022RETNO DWI PERMATA AJUSAОценок пока нет

- Double Taxation IДокумент16 страницDouble Taxation IReese Peralta100% (1)

- Cash BudgetДокумент11 страницCash BudgetPrateek SharmaОценок пока нет

- Accounting Equation - Part 2Документ48 страницAccounting Equation - Part 2Krrish BosamiaОценок пока нет

- 02 - Duties of An Accounts ClerkДокумент12 страниц02 - Duties of An Accounts ClerkJaripОценок пока нет

- AFM AssignmentДокумент3 страницыAFM AssignmentAin NsrОценок пока нет

- Skema Audit InternalДокумент4 страницыSkema Audit InternaligoeneezmОценок пока нет

- CVP Analysis No AnswerДокумент9 страницCVP Analysis No AnswerAybern BawtistaОценок пока нет

- Cash Flow Estimation and and Risk AnalysisДокумент4 страницыCash Flow Estimation and and Risk AnalysisUtsav Raj PantОценок пока нет

- H. Family IncomeДокумент29 страницH. Family IncomeFahad AkmadОценок пока нет

- Finnish TaxationДокумент217 страницFinnish TaxationTobi MemoryОценок пока нет

- Life Insurance in IndiaДокумент27 страницLife Insurance in Indiasoorbhiee100% (1)

- Inter IKEA Holding BV Annual Report FY20 03112020Документ56 страницInter IKEA Holding BV Annual Report FY20 03112020Евгений ЦеванОценок пока нет

- Assn #3 - SKДокумент2 страницыAssn #3 - SKRUBY SHARMAОценок пока нет

- Financial Analysis Cheat Sheet: by ViaДокумент2 страницыFinancial Analysis Cheat Sheet: by Viaheehan6Оценок пока нет

- Gross Estate InclusionДокумент4 страницыGross Estate InclusionAlaineОценок пока нет

- A Marketing Plan For HSBC NomanДокумент8 страницA Marketing Plan For HSBC Nomanhassan_MuqarrabОценок пока нет

- Capital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskДокумент23 страницыCapital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskCharming AshishОценок пока нет

- Accountancy XIДокумент8 страницAccountancy XIGurmehar Kaur100% (1)

- Midterm MMMДокумент2 страницыMidterm MMMasdfghjkl zxcvbnmОценок пока нет

- FI515 Homework1Документ5 страницFI515 Homework1andiemaeОценок пока нет