Академический Документы

Профессиональный Документы

Культура Документы

A Study On Working Capital Management of Eicher Motors LTD

Загружено:

sarjeetsharma1991Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

A Study On Working Capital Management of Eicher Motors LTD

Загружено:

sarjeetsharma1991Авторское право:

Доступные форматы

A STUDY ON WORKING CAPITAL MANAGEMENT

INTRODUCTION TO THE STUDY

FINANCE is the lifeblood and nerve system of any business organization. just as

circulation of blood is necessary in human body to maintain life, finance is very essential to the organization for smooth running of the business.

Kenneth midgely and Ronald bums define financing as a process of organizing the flow of funds so that a business can carry out its objectives in the most efficient manner and meet its obligations as they fall due

FINANCE, thus, can be considered to be set of activities dealing with the management of funds. More specifically, it is the decision of the collection and use of funds. It is a branch of economics that studies the management of money and other assets.

Financial management involves managerial activities concerned with the acquisition of fund for business purposes. The finance function does with procurement of money taking into consideration today as well as future needs and finance is required to purchase a machinery and raw materials to pay salaries and wages and also for day-to-day expenses.

Management of working capital refers to the management of current assets as well as current liabilities. The major trust is of course, on the management of current assets. This is understandable because current liabilities arise in the context of current assets. Its importance stems from two reasons. Investment in current assets represents a substantial portion of total investment.

Investment in current assets and level of current liabilities has to be geared quickly to changes in sales. Page 1

A STUDY ON WORKING CAPITAL MANAGEMENT

The importance in working capital management is reflected in the fact that financial managers spend a great deal of time in managing the current assets and current liabilities. Arranging short term financing, negotiating favorable credit terms, controlling the movement of cash, administering the accounts receivable and monitoring the investment in inventories consumes a great deal of time of financial managers liabilities.

The study is carried out at Eicher Motors which manufactures a range of reliable, fuel-efficient commercial vehicles of cotemporary technology. The unit manufactures and markets commercial vehicle with Gross Vehicle Weight (GVW) ranging from 5-25 tons.

The study was conducted in Eicher Motors, to assess the financial position and also was aimed at the application of theoretical knowledge to the practical working of finance department in the company. Page 2

A STUDY ON WORKING CAPITAL MANAGEMENT

INDUSTRY PROFILE

Eicher Motor is one of the prominent commercial vehicle manufacturers in India. The companies origins date back to 1948, when Goodearth Company was established for the distribution and service of imported tractors. In 1959 the Eicher Tractor Corporation of India Private Ltd. was established, Jointly with the Gebr. Eicher company, a German tractor manufacturer. In 1960 the first tractor ever produced in India was put on the market. Since 1965 Eicher In India has been completely owned by Indian shareholders. The German Eicher tractor being part of Massey-Ferguson from 1970 when they bought 30% before buying the German company out in 1973. In 2005, Eicher Motors Ltd sold the Tractors & Engines business to TAFE, (Tractors And Farm Equipment Ltd), of Chennai, India, the Indian licencee of Massey Ferguson tractors. German car manufacturer Daimler holds a 20% stake in Eicher Motors. Eicher Motors began its business operations in 1959 in India with the roll out of Indias first tractor. Today the Eicher Group is a significant player in the Indian auto mobile industry with a gross sales turnover of over INR 19,000 million ($424 million (US)) in the year 2005-06.

GROUP STRUCTURE

The Eicher Group has diversified business interests in design & development, manufacturing and local/ international marketing of Trucks & Buses, Motorcycles, Automotive Gears and components. In addition to this, Eicher has also invested in the Page 3

A STUDY ON WORKING CAPITAL MANAGEMENT

potential growth areas of Management Consultancy Services, Customised Engineering Solutions, City Maps & Travel Guides.

The activities of the Group are divided into the following business units covering all the business interests.

Eicher Goodearth Limited Eicher Motors Limited

o o o

Eicher Motors - Commercial Vehicles Royal Enfield - Motorcycles Eicher Engineering Components - Gears

Eicher Limited - Investments in Group companies Eicher Engineering Solutions - Customised Engineering Solutions Good Earth Publications - City Maps & Travel Guides ECS Limited - Management Consulting

The Eicher company has around 2500 employees located in 4 manufacturing facilities and 49 marketing & area offices all around India. The Group has around 600 suppliers of components and sub-assemblies. The Groups products are supplied by a network of around 381 dealers distributed across India. Eicher is present in over 40 other countries across the world

Page 4

A STUDY ON WORKING CAPITAL MANAGEMENT

Introduction to working capital

Working Capital means the amount of funds necessary to cover the cost of operating the enterprise. Working Capital is the amount of capital required for the smooth and uninterrupted functioning of normal business operations of a company ranging from the procurement of the raw-material, converting the same into finished products for sale and realizing cash along with the profit from the accounts receivable that arise from the sale of finished goods on credit.

Capital required for a business can be classified under two categories:

1) 2)

Fixed Capital Working Capital

Every business needs funds for two purposes for its establishments and to carry out its day-to-day operations. Long term funds are required to create production facilities through the purchase of fixed assets. Funds are also needed for short term purposes for the purchase of raw materials and other day-to-day expenses. These funds are known as Working Capital

Page 5

A STUDY ON WORKING CAPITAL MANAGEMENT

Concepts of Working Capital:There are two concepts of working capital:

1. Gross Working Capital:

The Gross Working Capital is a capital invested in total current asset of an enterprise.

2. Net Working Capital:

Net Working Capital is the excess of current assets over current liabilities.

Net Working Capital = Current Assets Current Liabilities

Types of Working Capital:1) Permanent Working Capital:

It means the minimum amount of investment in all current assets, which is regarded as necessary at all times to carry out minimum level of business. The operating cycle is a continuous process and thus the maintenance of current assets is needed. Current Assets increases and decreases over time. This minimum level of current assets is known as Permanent Working Capital or Fixed Working Capital.

2) Temporary Working Capital:

This is called as Fluctuating or Variable working capital. The amount of working capital keeps on changing depending upon the changes in production and sales. The extra working capital required to support the changing production and sales activities is known as Temporary Working Capital. Page 6

A STUDY ON WORKING CAPITAL MANAGEMENT

3) Gross Working Capital:

It is the amount of working capital invested in the various components of current assets.

4) Net Working Capital:

It is the difference between the current assets and current liabilities. The concept of net working capital enables the firm to determine the exact amount available as its disposal for operational requirements.

5) Negative Working Capital:

When the current liabilities exceed current assets, negative working capital emerges. Such a situation occurs when a firm is nearing crisis of some magnitude.

Working Capital Cycle:

The duration of the time required to complete the following cycle of events in a firm is called the working capital cycle. 1. 2. 3. 4. 5. Conversion of cash into raw materials. Conversion of raw materials into work in process. Conversion of work in process into finished goods. Conversion of finished goods into bills receivables through sales. Conversion of debtors and bills receivables into cash.

Management of Working Capital:

Management of working capital is concerned with the problems arising in attempting to manage the current assets/current liabilities and the interrelationships existing between them.

Page 7

A STUDY ON WORKING CAPITAL MANAGEMENT

Principles of Working Capital Management Policy:

The following are the principles of a sound working capital management policy: Principles of risk variation. Principles of cost of capital. Principles of equity position. Principles of maturity of payments.

The working capital requirements of concern can be classified as: Permanent or Fixed working capital. Temporary or Variable working capital.

The fixed proportion of working capital should be generally financed from fixed capital sources while the temporary or variable working capital requirements of a concern may be from the short term sources of capital.

Financing of Permanent or Fixed Working Capital:

Shares: Issue of shares is the most important source of raising long term capital. A company can issue various types of shares such as equity, preference and deferred shares. A company should try to raise the maximum amount by issue of shares. Debentures: A debenture is an instrument issued by a company acknowledging its debt to its holders. The firm issuing debentures enjoys a number of benefits such as trading on equity, retention of benefits, tax controls, etc.

Page 8

A STUDY ON WORKING CAPITAL MANAGEMENT

Public Deposits: Public Deposits are the fixed deposits by a business enterprise directly from the public. According to The Reserve Bank of India, a non-banking concern cannot borrow by the way of public deposits more than 25% of the paid up capital and free reserves.

Ploughing back of profits: It means the reinvestment by a concern of its surplus earnings in the business. It is an internal source of finance and is more suitable for an established firm for its expansions.

Loans: Financing Institutions like commercial banks, Life Insurance Corporation provide short term, long term loans. This source of finance is more suitable to meet the medium term demands of the working capital.

Financing of Temporary or Variable Working Capital:

Commercial banks:

The different forms of loans provided by commercial banks are as follows:

1. Loans 2. Cash Credit 3. Over Drafts 4. Purchasing and Discounting of bills.

Indigenous Bankers: It refers to private money lenders and other country bankers. The interest rates are very high in such cases. Page 9

A STUDY ON WORKING CAPITAL MANAGEMENT

Trade Creditors: It refers to the credit extended by the suppliers of goods in the normal course of business. When a firm delays payment beyond the due date, it is called Stretching.

Installment Credit: It is a method by which assets are purchased and the possession of goods is taken immediately but the payment is made in installment over a period of time.

Factoring: A commercial bank may provide finance by discounting the bills or invoice to its customers. Thus a firm gets immediate payment for sale made on credit. A factor is a financial institution, which offers services relating to management and financial debts arising out of credit sales.

Commercial Papers: It represents unsecured promissory notes issued by the firms to raise short term funds. The Reserve Bank of India introduced commercial paper India on recommendations from VAGHUL COMMITTEE.

Security Required In Bank Finance:

Following are the most important modes of security requirements

1. Hypothecation: Under this agreement, bank provides working capital against the security of moveable property usually inventories. The borrower does not give the possession of the property to the bank. Page 10

A STUDY ON WORKING CAPITAL MANAGEMENT

2. Pledge: Under this agreement the borrower is required to transfer the possession of the property or goods to the bank as security.

3. Mortgage: It is a transfer of a legal or equitable interest in a specific immovable property for the payment of debt. The possession of the property remains with the borrower but the total legal title is transferred to the lender.

Importance of Working Capital:

Working Capital is the life blood and nerve system of any business organization. Just as circulation of blood is necessary in human body to maintain life, working capital is very essential to the business organization for smooth running of the business. No business can run successfully without and adequate working capital. The main advantage of maintaining adequate amount of working capital is as follows:1. Solvency of the business: Adequate working capital helps in maintaining solvency of the business by providing uninterrupted flow of production. 2. Goodwill: Sufficient working capital enables a business concern to make prompt payments and hence helps in creating and marinating goodwill. 3. Easy Loans: A concern having adequate working capital, high solvency and good credit standing can arrange loans from banks and other financial institutions on easy and favorable terms.

Page 11

A STUDY ON WORKING CAPITAL MANAGEMENT

4. Cash Discounts: Adequate working capital also enables a concern to avail cash discounts on the purchase and hence it reduces cost.

5. Regular Supply of Raw Materials: Sufficient working capital ensures regular supply of raw materials and continuous production.

6. Regular Payment of Salaries, Wages And Day-to-Day Commitments: A company which had ample working capital can make regular payment of salaries, increase their efficiency, reduces wastage costs and enhances production and profile.

7. Exploitation of Favorable Market Conditions: Only concerns with adequate working capital can exploit favorable market condition such as purchasing its requirements in bulk when the prices are lower and by holding its inventories for higher prices.

8. Ability to Face Crises: Adequate working capital enables a concern to face business crisis in emergencies such as depreciation because during such periods, generally, there is much presence on working capital.

9. Quick and Regular Return On Investment: Every investor wants a quick and regular return on his investments. Sufficient working capital enables a concern to pay quick dividends to its investors as there may not be much pressure to plough back profit. This gains the confidence of its investors and creates favorable markets to raise additional markets to raise additional funds in future. Page 12

A STUDY ON WORKING CAPITAL MANAGEMENT

10. High Morale: Adequacy of working capital creates an environment of securities, confidence and high morale and creates overall efficiency in business.

Need or Objectives of Working Capital:

The need for working capital arises to run day-to-day business activities of production and sales. Firms differ in their requirement of the working capital. To maximize shareholders wealth, a firm should earn sufficient returns from its operations. Earnings a steady amount of profit require successful sales activity. Current assets are needed because sales do not convert into cash immediately. There is always an Operating Cycle involved in the conversion of sales into cash.

Thus working capital is needed for the following purposes: 1. 2. 3. For the purchase of raw materials, components and spares. To pay wages, salaries, etc... To incur day-to-day expenses and overhead costs such as fuel, power, office

expenses, etc 4. 5. To meet the selling cost such as packaging, transport, advertising, etc. To provide credit facilities to customers.

For studying the need of working capital in business, one has to study the business under varying circumstances such as new concern, as a growing concern and as one, which has attained maturity. A new concern requires a lot of livid funds to meet initial expenses like promotion, formation, etc. these expenses are called Preliminary Expenses and are capitalized. The amount needed as working in a new concern depends primarily upon its size and ambitions of its promoters. Generally, the working capital needed goes on

Page 13

A STUDY ON WORKING CAPITAL MANAGEMENT

increasing with the growth and expansion business till it attains maturity. At maturity, the amount of working capital needed is called Normal Working Capital.

ESTIMATION OF WORKING CAPITAL REQUIREMENTS:

The working capital requirements of a concern depend upon a number of factors such as size of the business unit, the length of production cycles the character of their operation, the rate of stock turnover and the state of economic situation. It is not possible to rank them because all such factors generally influence the working capital requirements.

1. Nature of the business: The nature of the business affects the working capital requirements of a concern to a great extent. For instance, public utilities like railways, electricity companies, etc need very little working capital, because they need not hold inventories and their operations are mostly on cash basis. On the other hand, ordinary manufacturing and trading firms requires large working capital as they have to invest substantially.

2. Scale of operations: The scale of operations affects the working capital requirements of a concern. Concern carrying on small activities needs less working capital. On the other hand, a concern undertaking activities on large scale needs large amount of working capital.

3. Growth and expansion of business: The growth and expansion of business also affects the working capital requirements. When there is growth and expansion in the business of a firm, the working capital needs of the firm increases.

Page 14

A STUDY ON WORKING CAPITAL MANAGEMENT

4. Manufacturing Process: In manufacturing business the requirement of working capital increases in proportion to length of manufacturing process. Longer the process period of manufacturer, larger the amount of working capital required. The longer the manufacturing time, the raw material and other supplies have to be carried out for a longer period in the process with progressive increment of labor and service cost before the finished product finally obtained. Therefore the process with the shortest production period should be chosen.

5. Production Policies: The production policies followed by a firm will also affect the working capital requirement. For example, a capital intensive industry requires more of fixed capital and vice versa.

6. Rapidity of turnover: There is a high degree of co-relation between rapidity of turnover and the amount of working capital requirements. Generally firms having a high rate of turnover need lower amount of working capital than the firm having a low rate turnover.

7. Seasonal fluctuations in demand: Seasonal fluctuations in demand for the products affect the amount of working capital requirements of a concern. For instance, the demand of goods for woolen cloths increases during winter and decreases in summer. As a result its working capital need will increase during winter and decrease during summer. Similarly, cyclical factors also affect the amount of working capital of a concern.

Page 15

A STUDY ON WORKING CAPITAL MANAGEMENT

8. Fluctuation in supplies: Fluctuation on supplies affects the working capital requirement of a firm. For instance, certain raw materials may be available only during certain seasons. Such materials have to be necessarily be obtained and stored in large quantities to provide for periods when supplies will not be available. This will cause fluctuation in the working capital requirements. 9. Operating efficiency: The operating efficiency of a firm affects its working capital requirements. A firm enjoying operating efficiency has reduced working capital needs. On the other hand, the firm which does not enjoy operating efficiency has more wastage and thus, needs more working capital.

10. Credit Policy: The credit policy of a firm affects its working capital requirements. A firm, which allows more credit to its customer, requires more working capital compared to a firm which allows less credit. The credit facilities enjoyed by a firm from its creditors also affect the working capital requirement of a firm. A firm enjoying liberal credit facilities from its suppliers or creditors will need lower working capital than a firm that does not enjoy liberal credit facilities from its suppliers.

Management of Working Capital

Working Capital is essentially the difference between current assets and current liabilities. There are two broad sources of capital fixed capital represented by investments made in fixed assets like plant, machinery, land, buildings, furniture, etc. working capital, on the other hand, is for short term and is used for meeting regular operating expenditures or commitments to suppliers, government dues and other short term liabilities. Efficiency of working capital is judged using following ratiosPage 16

A STUDY ON WORKING CAPITAL MANAGEMENT

1) 2) 3) 4) 5) 6)

Current Ratio Liquid Ratio (Acid Test Ratio) Sales to Working Capital Ratio Finished Goods Turnover Cash to Average Daily Cost Of Sales Bank Finance as % of Working Capital

Management of working capital is concerned with the problems that arise in attempting to manage the current assets, current liabilities and the inter-relationship that exits between them. It sees to it that there is neither excess nor inadequate working capital. Working Capital management is the most critical issue in any company. Companies have seasonality in their sales or revenues find it much more challenging to meet liquidity requirements compared to firms have non-seasonal businesses. Financing working capital is yet another aspect of working capital management. There are various ways of financing it-trade credit, bank finance, cash credit, overdraft, export financing (letter of credit), bank guarantees. As per RBI guidelines, working capital loans are granted on the basis of certain calculations/ analysis submitted by companies to banks/ financial institutions. The formats in which these reports are given are as per CMA format, and the financing methodology is known as Maximum Permissible Bank Finance (MPBF).

Page 17

A STUDY ON WORKING CAPITAL MANAGEMENT

Principles Working Capital Management

The following are the principle of a sound working capital management policy:

Principle of Risk Variation:

There is an inverse relationship between the degree of risk and profitability. A consecutive management prefers less risk by maintaining a high level of current assets, while a liberal management assumes greater risk by having low working capital.

Principle of Cost of Capital:

The various source of raising working capital have different cost of capital and risk involved. Generally, higher the risk lower is the cost of capital and lower the risk higher the cost of capital.

Page 18

A STUDY ON WORKING CAPITAL MANAGEMENT

Principle of Equity Position:

According to this principle, the amount of working capital invested in each component should be adequately justified by a firms equity position. Every rupee invested in current assets should contribute to the net worth of the firm.

Principle of Maturity Payment:

According to this principle, a firm should make every effort to relate maturities of payment to its flow of internally generated funds.

Importance of working capital

Even though the skill of maintaining the working capital are somewhat unique, the goal are the same-viz.to make an efficient use of funds for minimizing the risk of loss to attain profit objectives.

Firstly, the adequate of working capital contributes a lot in raising the credit standing of a corporation in terms of favorable rates of interest on bank loan, better terms on goods purchased, reduced cost of production on account of the receipt of cash discount etc.

Secondly, a company with sufficient working capital is always in a position to take advantage of any favorable opportunity either to purchase raw material or to execute a special order or to wait for better market position.

In the third place, the ability to meet all reasonable demands for cash without inordinate delay is a great psychological factor to improve the all rounds efficiency of the business.

Page 19

A STUDY ON WORKING CAPITAL MANAGEMENT

Lastly, during slump the demand for working capital, instead of coming down, shoots up. A good amount of working capital is locked up in the inventories and book debts. Concern having ample resources can tide over that period of depression. Thus, working capital is regarded as one of the conditioning factors in the long run operations of the firm, which is often inclined to treat it is an issue of short-run analysis and decision making.

Page 20

A STUDY ON WORKING CAPITAL MANAGEMENT

Working Capital Measurement

The analysis of working capital can be conducted through a number of devices such as:

RATIO ANALYSIS:

A ratio is a simple arithmetical expression of the relationship of one number to another. The technique of ratio analysis can be employed for measuring short-term liquidity or working capital position of a firm. The following ratios may be calculated for this purpose:

Current Ratio. Acid Test Ratio. Absolute Liquid Ratio or Cash Position Ratio. Inventory Turnover Ratio. Receivables Turnover Ratio. Payables Turnover Ratio. Working Capital Ratio. Ratio of Current Liabilities to Tangible Net Worth.

FUND FLOW ANALYSIS:

Fund flow analysis is a technical device designated to study the resources from which additional funds were derived and the use to which these resources were put. It is an effective management tool to study changes in the financial position (working capital) of a business enterprise between beginning and ending financial statement dates. It consists of preparing schedule of changes of working capital, statement of sources and application of funds.

Page 21

A STUDY ON WORKING CAPITAL MANAGEMENT

WORKING CAPITAL BUDGET:

Working capital budget is a part of total budgeting process of a business, is prepared estimating future long term and short term working capital needs and the sources of finance them, and then comparing the budgeted figures with the actual performance for calculating the variances, if any, so the corrective actions may be taken in the future.

CASH MANANGEMENT

In United States banking, cash management, or treasury management, is a marketing term for certain services offered primarily to larger business customers. It may be used to describe all bank accounts (such as checking accounts) provided to businesses of a certain size, but it is more of an used to describe specific services such as cash concentration, zero balance

Accounting and automated clearing house facilities. Sometimes, private banking customers are given cash management services. Cash management deals with the following:

Cash inflows and outflows. Cash flows within the firm. Cash balances held by the firm at a point of time.

RECEIVABLES MANAGEMENT

Accounts receivable are unpaid customer invoices, and any other money owed to the organization by customers. The sum of all customer accounts receivable is listed as a current assets on balance sheet.

Page 22

A STUDY ON WORKING CAPITAL MANAGEMENT

RESEARCH DESIGN

Page 23

A STUDY ON WORKING CAPITAL MANAGEMENT

Introduction to Design:

What is Research Design?

Research design can be thought of as the structure of research it is the glue that holds all the elements in a research project together. We often describe a design using a concise notation that enables us to summarize a complex design structure efficiently. What are the elements that a design includes? They are:

Title of the study

A study of Working Capital Management at, EICHER MOTORS Ltd, using ratio analysis.

Statement of the Problem

The study is done to review the Working Capital Management at EICHER MOTORS Ltd. Working Capital is considered as the life blood of the business. The firm should maintain a sound working capital position and should have an adequate working capital to run its business operations.

An appropriate level of working capital is to be maintained to run the business smoothly as excessive working capital interrupts the smooth flow of the business.

Page 24

A STUDY ON WORKING CAPITAL MANAGEMENT

Objectives of the Study

The following are the objectives of the study conducted:

1)

To compare the financial position of the company for the past 3 years with the

help of ratios concerned with the working capital and turnover. 2) 3) funds. 4) 5) To identify, understand and interpret the problem and put forward suggestions. To make a proper analysis of the gross and net working capital through proper To identify liquidity, turnover in terms of stock and working capital. To study the method of financing of working capital and to find the flow of

scrutiny.

Research Methodology

3 years of Balance Sheet and Profit and Loss a/c were used stated in the Annual Reports for analysis. Working Capital and concerned ratios used as a tool of analysis. Based on the computation, the financial position and performance of the business was evaluated and suggestions were made. Regarding the financing of working capital, both the methods were evaluated by extracting information from the Balance Sheet for 3 years, then the best alternative was chosen and based on the companys position regarding the financing of working capital was known.

Page 25

A STUDY ON WORKING CAPITAL MANAGEMENT

Reference Period

The study period in this case study is for 3 financial years i.e., from 2008 to 2010.

Scope of the Study

The study of analysis of working capital management is limited to the specific bank, EICHER MOTORS Ltd.

Data collection

The required data has been collected from secondary sources of information such as the Balance Sheet and Profit and Loss a/c. the secondary data has also been collected from business journals, magazines, internet, and other published information. The analysis has been made by referring to the secondary data and also under the guidance of my guide and the manager of EICHER MOTORS Ltd. There was a use of primary data in the case of financing of working capital through the use paper work and discussion held with the senior financial management.

Tools of Analysis

Working capital cycles, schedule of changes in working capital, composition of current assets & liabilities, gross & net working capital and ratio analysis were used as a tool of analysis. The data analyzed is presented in the form of tables and charts. Further, ratios and percentages are used to interpret the data.

Page 26

A STUDY ON WORKING CAPITAL MANAGEMENT

Limitations of the Study

The study was subjected to following limitations:

1).The information is availed from the statements, annual reports and records of the company. 2).One of the constraints of the study was that of the time factor, which was very short. 3). The focus is only on working capital of the company 4). The datas are randomly selected from the annual reports.

Page 27

A STUDY ON WORKING CAPITAL MANAGEMENT

COMPANY PROFILE

Page 28

A STUDY ON WORKING CAPITAL MANAGEMENT

EICHER MOTORS:

Eicher Motor is one of the prominent commercial vehicle manufacturers in India. The success and growth of this unit is a result of various customer-driven strategies. The manufacturing facility is situated in Central India Pithampur, Madhya Pradesh. Eicher Motors has stepped into the Heavy Commercial Vehicle segment with its state-of-the-art HCV, the "Eicher 20.16", the first commercial vehicle designed and developed indigenously. Recently, Eicher Motors has emerged with Volvo to form another HCV.

Eicher Motors functions through a strong three-tier service network consisting of authorized distributors, service centers and company trained private mechanics. The vehicles are sold and serviced through a network of over 576 Authorized Contact Points all over India, supported by service centers and over 4500 company trained private mechanics, which are close at hand on all major highways throughout India to provide initial "first aid" to the vehicles if required. Eicher Motors has acquired formidable expertise in designing and developing commercial vehicles. It has a world-class R&D centre manned by a team of brilliant engineers and equipped with latest Computer Aided Design (CAD) and Computer Aided Engineering facilities like NASTRAN, FEM analysis packages. Leveraging its in-house expertise, this unit has successfully developed a wide range of commercial vehicles to meet varying customer needs. The product range includes Trucks : Eicher 10.50, Eicher 10.75, Eicher 10.90, Eicher 11.10, Eicher 20.16 & 30.25; Buses: Eicher Skyline, Eicher Cruiser and Eicher School Bus range of buses. Besides the basic models, it offers over 85 models of ready-to-use custom-built vehicles for various specialized applications. Eicher Motors products have been well accepted in the market. This is also demonstrated by significant sales of its commercial vehicles in export markets where the company competes with reputed international brands. Page 29

A STUDY ON WORKING CAPITAL MANAGEMENT

EICHER MOTORS: COMPANY HISTORY

1948 1959 1952 - 1957 1958 Apr. 24, 1959 Sept.3, 1960 1965 - 1975 1980 1982 Oct. 4, 1982 Oct. 14, 1982 1985 1986 Dec., 1987 Feb. 2, 1990 1991 1991 Apr.1, 1991 Aug.24, 1993 Mar. 1994 Jun. 23, 1994 Dec.20, 1995 1996 The Company, Goodearth was set up to sell and service imported tractors. First indigenous Eicher tractor built. Goodearth imported and sold about 1500 tractors in India. Incorporation of Eicher Tractor Corporation of India Ltd. Eicher launched the first indigenously built tractor from its Faridabad factory. Changed name to Eicher Tractors India Ltd. 100% indigenization achieved in Eicher Tractors. Eicher Goodearth Limited name given to Eicher. Collaboration with Mitsubishi. Collaboration agreement for the manufacture of Light Commercial Vehicles signed with Mitsubishi in Tokyo. Eicher Motors Limited was incorporated. Silver Jubilee Year for Eicher. Eicher Motors Limited springs into operation. Eicher Tractors went public. Eicher Goodearth buys 26% equity stake in Enfield India Ltd. ECS launched Eicher takes over Ramon & Demm Formal launch of Management Consulting division of Eicher - ECS Eicher acquires majority stake in Enfield India (60% equity shareholding) End of the technical assistance Agreement with Mitsubishi after successful transfer of technology and achieving total indigenization. Enfield India Limited changed its name to Royal Enfield Motors Limited Eicher City Map - Delhi launched Eicher Tractors Limited amalgamated with Royal Enfield Motors to form Eicher Limited on Jun. 1, 2005.

Page 30

A STUDY ON WORKING CAPITAL MANAGEMENT

Jun. 1, 2005

Eicher Motors Limited disinvested the businesses of Tractors & Engines to TAFE Motors and Tractors Limited (TMTL)

Apart from the above table: The company has entered into a technical collaboration agreement with the FINLAND based VALTRA Inc. for the manufacture of 61 and higher to HP tractors. The company has been awarded Certificate of Merit for improving the overall productivity in the Automobile sector by the National Productivity Council of Government of India. Eicher has tied up with Volkswagen to enter the passenger car segment. In 2003, UBI tied up with Eicher and L&T for financing equipments and farm vehicles. In 2005, Eicher acquired DESIGN, USA. Eicher buys US Design company for $2.5m. In 2006, Eicher joined hands with WIPRO to source Hydraulic Kits. Board of Directors: S Sandilya Chairman Siddhartha Lal Managing Director & Chief Executive Officer P N Vijay Director Priya Brat Director M J Subbaiah Director Page 31

A STUDY ON WORKING CAPITAL MANAGEMENT

PRODUCT RANGE:

Leveraging its in house expertise, Eicher Motors has successfully developed a wide range of commercial vehicles to meet the varying customer needs. These vehicles deliver value by providing low cost of ownership and increased profitability to our customers. The range offered include fully built up trucks ranging from 6T to 25T, buses and chassis. All these products can be offered in BSII compatible options. Eicher Motors arguably have the best CNG technology in the world.

Page 32

A STUDY ON WORKING CAPITAL MANAGEMENT

SERVICE AND MAINTAINANCE:

Eicher has an extensive service reach and no matter the problem is, Eicher service is never too far away. Eicher provides its customer the benefit of an extensive sale and service network, customized solutions and an efficient cost of ownership. Our manufacturing capabilities are backed by a sales and service network of our 950 contact points across India and over 8000 private mechanics trained Eicher ensuring that your vehicle is in safe hands.

SERVICE INITIATIVES:

Eicher Genuine Spares available across all Eicher authorized representatives, service centers, spares distributors, satellite service outlets and retail outlets. Fully equipped modern workshops for quick and quality service. Driver training for drivers to impart safe driving skills and to enhance fuel efficiency. Regular free check up and service camps. Regular customer needs and contacts. A comprehensive service Audit System, which oversees the physical infrastructure and service quality of Eicher service network. Highway check up campaigns. Eicher Motors is the first company in the Commercial Vehicle industry to introduce warranty operation through Electronic Media.

Page 33

A STUDY ON WORKING CAPITAL MANAGEMENT

MANUFATURING FACILITIES:

The manufacturing facility of Eicher Motors is located in PITAMPUR, MADHYA PRADESH. This is a state of the art plant which has a total area of 72 acres with 18000 sq.mts as the covered area. The plant houses some top of the line equipment, a robust infrastructure and has an annual production capacity of 30000 vehicles.

Page 34

A STUDY ON WORKING CAPITAL MANAGEMENT

SPARES:

Eicher products are engineered to perfections, incorporating the best of technology and the state of the art manufacturing facilities. It is thus a privilege itself to maintain any product in a perfect condition. This can be done by using specified Eicher Genuine Parts, which meets the required engineering precision standards. The most important element of this new light blue color packaging is the bright hologram which glitters. When viewed from angles, the hologram reflects different colors providing a 3-dimensional feel, thus giving it a more professional and user-satisfactory results.

Page 35

A STUDY ON WORKING CAPITAL MANAGEMENT

DATA ANALYSIS AND INTERPRETATION

Page 36

A STUDY ON WORKING CAPITAL MANAGEMENT

RATIO ANALYSIS FINANCIAL ANALYSIS

Financial analysis is the process of identifying the financial strengths and weaknesses of the firm and establishing relationship between the items of the balance sheet and profit & loss account. Financial ratio analysis is the calculation and comparison of ratios, which are derived from the information in a companys financial statements. The level and historical trends of these ratios can be used to make inferences about a companys financial condition, its operations and attractiveness as an investment. The information in the statements is used by Trade creditors, to identify the firms ability to meet their claims i.e. liquidity position of the company. Investors, to know about the present and future profitability of the company and its financial structure. Management, in every aspect of the financial analysis. It is the responsibility of the management to maintain sound financial condition in the company.

RATIO ANALYSIS

The term Ratio refers to the numerical and quantitative relationship between two items or variables. This relationship can be exposed as Percentages Fractions Proportion of numbers

Ratio analysis is defined as the systematic use of the ratio to interpret the financial statements. So that the strengths and weaknesses of a firm, as well as its historical Page 37

A STUDY ON WORKING CAPITAL MANAGEMENT

performance and current financial condition can be determined, Ratio reflects a quantitative relationship helps to form a quantitative judgment

STEPS IN RATIO ANALYSIS

The first task of the financial analysis is to select the information relevant to the decision under consideration from the statements and calculates appropriate ratios. To compare the calculated ratios with the ratios of the same firm relating to the pas6t or with the industry ratios. It facilitates in assessing success or failure of the firm. Third step is to interpretation, drawing of inferences and report writing conclusions are drawn after comparison in the shape of report or recommended courses of action.

BASIS OR STANDARDS OF COMPARISON

Ratios are relative figures reflecting the relation between variables. They enable analyst to draw conclusions regarding financial operations. They use of ratios as a tool of financial analysis involves the comparison with related facts. This is the basis of ratio analysis. The basis of ratio analysis is of four types. Past ratios, calculated from past financial statements of the firm. Competitors ratio, of the some most progressive and successful competitor firm at the same point of time. Industry ratio, the industry ratios to which the firm belongs to. Projected ratios, ratios of the future developed from the projected or pro forma financial statements

Page 38

A STUDY ON WORKING CAPITAL MANAGEMENT

INTERPRETATION OF THE RATIOS

The interpretation of ratios is an important factor. The inherent limitations of ratio analysis should be kept in mind while interpreting them. The impact of factors such as price level changes, change in accounting policies, window dressing etc., should also be kept in mind when attempting to interpret ratios. The interpretation of ratios can be made in the following ways. Single absolute ratio Group of ratios Historical comparison Projected ratios

Inter-firm comparison

GUIDELINES OR PRECAUTIONS FOR USE OF RATIOS

The calculation of ratios may not be a difficult task but their use is not easy. Following guidelines or factors may be kept in mind while interpreting various ratios are: Accuracy of financial statements Objective or purpose of analysis Selection of ratios Use of standards

Page 39

A STUDY ON WORKING CAPITAL MANAGEMENT

IMPORTANCE OF RATIO ANALYSIS

Aid to measure general efficiency Aid to measure financial solvency Aid in forecasting and planning Facilitate decision making Aid in corrective action Aid in intra-firm comparison Act as a good communication Evaluation of efficiency Effective tool

LIMITATIONS OF RATIO ANALYSIS

Differences in definitions Limitations of accounting records Lack of proper standards No allowances for price level changes Changes in accounting procedures Quantitative factors are ignored Limited use of single ratio Background is over looked Limited use Page 40

A STUDY ON WORKING CAPITAL MANAGEMENT

CLASSIFICATIONS OF RATIOS

The use of ratio analysis is not confined to financial manager only. There are different parties interested in the ratio analysis for knowing the financial position of a firm for different purposes. Various accounting ratios can be classified as follows: 1. Traditional Classification 2. Functional Classification 3. Significance ratios

1. Traditional Classification It includes the following. Balance sheet (or) position statement ratio: They deal with the relationship between two balance sheet items, e.g. the ratio of current assets to current liabilities etc., both the items must, however, pertain to the same balance sheet. Profit & loss account (or) revenue statement ratios: These ratios deal with the relationship between two profit & loss account items, e.g. the ratio of gross profit to sales etc., Composite (or) inter statement ratios: These ratios exhibit the relation between a profit & loss account or income statement item and a balance sheet items, e.g. stock turnover ratio, or the ratio of total assets to sales.

Page 41

A STUDY ON WORKING CAPITAL MANAGEMENT

2. Functional Classification These include liquidity ratios, long term solvency and leverage ratios, activity ratios and profitability ratios.

3. Significance ratios Some ratios are important than others and the firm may classify them as primary and secondary ratios. The primary ratio is one, which is of the prime importance to a concern. The other ratios that support the primary ratio are called secondary ratios.

IN THE VIEW OF FUNCTIONAL CLASSIFICATION THE RATIOS ARE:

1. Liquidity ratio 2. Leverage ratio 3. Activity ratio 4. Profitability ratio

Page 42

A STUDY ON WORKING CAPITAL MANAGEMENT

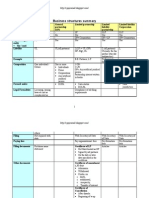

TABLE REPRESENTING COMPOSITION OF CURRENT ASSETS

(Rs. In millions) Table 4.1

ELEMENTS

MAR 2010

MAR 2009

MAR 2008

INVENTORIES DEBTORS CASH & BANK BALANCE OTHER CURRENT ASSETS LOAN ADVANCES TOTAL

1612.3 1176 261

33.28 27.28 5.39

1612.5 1580.8 310.4

31.15 30.53 6.00

1262.5 1549.3 331.5

29.06 35.6 7.63

77

1.59

1718.1

35.47

1547.1

32.32

1014

27.65

4844.4

100

5050.8

100

4157.3

100

Page 43

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF COMPOSITION OF CURRENT ASSETS

Graph 4.1

1800 1600 1400 1200 1000 800 600 400 200 0 2010 2009 2008 inventories debtors cash&bank balance other current assets loans and advances

Page 44

A STUDY ON WORKING CAPITAL MANAGEMENT

TABLE REPRESENTING COMPOSITION OF CURRENT LIABILITIES

(Rs. In millions)

Table 4.2 ELEMENTS MARCH 2010 % MARCH 2009 % MARCH 2008 %

CURRENT LIABILITIES

2902.3

74.11

3666.4

80.41

2689.8

80.47

PROVISIONS TOTAL

1014.1 3916.4

25.89 100

893.1 4559.5

19.59 100

652.9 3342.7

19.53 100

Page 45

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF COMPOSITION OF CURRENT LIABILITIES

Graph 4.2

4000 3500 3000 2500 2000 1500 1000 500 0 2008 2009 2010

Page 46

A STUDY ON WORKING CAPITAL MANAGEMENT

TABLE REPRESENTING WORKING CAPITAL CYCLE FOR 2010

WORKING CAPITAL CYCLE (2010)

TABLE 4.3

ELEMENTS Raw Materials Storage Period Conversion Period Finished Goods Storage Period Average Collection Period Average Payment Period

DAYS 49 3 14 27 73

ANALYSIS

From the above table it can be observed that the company stores its raw material for 49 days before it is converted into finished goods, and then the company takes 3 days for conversion of raw material into finished products, it takes 14 days to store the finished goods before it is delivered to the final consumer. Next it shows the average collection period from debtors was 27 days and average payment period to creditors was 73 days.

Page 47

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF WORKING CAPITAL CYCLE FOR 2010(in days)

GRAPH 4.3

80 70 60 50 40 30 20 10 0 R.M.S.P C.P F.G.S.P A.C.P 3 14 27 49

73

Working Capital Cycle(2010)

A.P.P

Page 48

A STUDY ON WORKING CAPITAL MANAGEMENT

TABLE REPRESENTING WORKING CAPITAL CYCLES

TABLE 4.4

YEAR Raw materials storage period (days A) Conversion period (days B) Finished goods storage period (days C) Average collection period (days D) Gross working capital cycle (days A+B+C+D = X) Average payment period (days E)

2010 49

2009 37

2008 32

14

27

26

24

93

75

66

73

64

62

Page 49

A STUDY ON WORKING CAPITAL MANAGEMENT

ANAYLSIS

The proper analysis of the working capital management can be made through the proper study of working capital cycles which help to ascertain the no of days the company takes to complete once such cycle. It can be observed from the table and the chart that the Gross working capital cycle has been increasing every year for the years 2007 2010. Thus it has an increasing trend. Also, from the table it can be noticed that the raw materials storage period have been increasing for the years 2008 2010. It can also be observed from the table and the chart that the Net Working Capital Cycle has been increasing every year for the years 2007 2010. Thus it has an increasing trend. Moreover, from the table we can see that the average payment period have been increasing for the years 2008 2010.

Page 50

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF GROSS WORKING CAPITAL CYCLE (in days)

Graph 4.4

100 90 80 70 60 50 40 30 20 10 0

93 75 66

2010

2009

2008

Page 51

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF NET WORKING CAPITAL (in days)

Graph 4.5

20 20 18 16 14 12 10 8 6 4 2 0 2010 11

2009

2008

INFERENCE

From the table and the charts, it can be seen that the Gross Working Capital cycles as well as raw material storage period have been increasing over the financial years, thus showing an increasing trend. This is not good from the companys point of view because more is being blocked in the storage of raw materials rather than the finished goods storage period. When compared among the three financial years, it can be observed that the Net Working Capital cycle as well as the average payment period shows an increase in trend. This proves that good for the company, but not from the creditors point of view.

Page 52

A STUDY ON WORKING CAPITAL MANAGEMENT

TABLE REPRESENTING VARIOUS TRENDS

(Rs. In millions) Table 4.5

PARTICULARS Inventories Sundry Debtors Cash & Bank Balances

2010 1612.3 1176 261

2009 1612.5 1580.8 310.3

2008 1262.5 1549.3 331.5

Creditors

2350.5

2846.9

2446.3

ANALYSIS

It can be observed from the table and the chart that the trends for inventories, sundry debtors and creditors has been increasing and decreasing alternatively for the years 2008 2010, whereas, cash and bank balance has a decreasing trend. The proper scrutiny of this trend is of at most important because this constitute the working capital of the company and have a direct bearing on its level.

Page 53

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF VARIOUS TRENDS

Graph 4.6

3000 2500 2000

2010

1500 1000 500 0

Inventories Sundry Debtors Cash & Bank Balances Creditors

2009 2008

INFERENCE

From the data above i.e. the table and the chart, its seen the inventories, sundry debtors and creditors fluctuate over the financial years, whereas cash and bank balance shows a decreasing trend. An appropriate inspection should be done as the entire result shows upon the working capital of the company.

Page 54

A STUDY ON WORKING CAPITAL MANAGEMENT

DEBTORS TREND

(Rs. In millions) TABLE 4.6

YEAR

2010

2009

2008

DEBTORS

1176

1580.8

1549.3

ANALYSIS

It can be observed from the table and the chart that the debtors balance For Eicher Motors was 1549.3 in the year 2008, 1580.8 in the year 2009 and 1176 in the year 2010. The debtors balance marginally increased in 2009 but has decreased considerably in 2010 which is really good for the company.

Page 55

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPH 4.7

2000

1580.8 1549.3

1500 1000 500 0

1176

AMOUNT

2010

2009

2008

INFERENCE

It can be observed here, that in the last financial year the debtors balance is showing a decreasing trend. This gives a positive note to the company as the debtors or receivables imply credit sales and the decrease in debtors balance shows that the company has now shifted its focus on making more of cash sales which helps it to recover its money in a lesser period of time.

Page 56

A STUDY ON WORKING CAPITAL MANAGEMENT

INVENTORIES TREND

(Rs. In million)

TABLE 4.7

YEAR

2010

2009

2008

INVENTORIES

1612.3

1612.5

1262.5

ANALYSIS

It can be observed from the table and the chart that the inventories of Eicher Motors was 1262.5 in 2008, 1612.5 in 2009 and 1612.3 in 2010. the inventories balance has increased remarkably from 2008 to 2010, which does not prove to be good as the operation of the company might show problems in functioning.

Page 57

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPH 4.8

2000 1612.3 1500 1262.5 1000 500 0 2010 2009 2008 INVENTORIES 1612.5

INFERENCE

Although inventories involve blocking of a firms funds and the costs of storage and handling but every business enterprise has to maintain certain level of inventories to facilitate uninterrupted production and smooth running of business. Here the data shows the rapid increase in 2009 as compared to 2008 and the stability of inventories between 2009 and 2010, which is not good for the company as more funds are now blocked in inventories in the form of raw materials and work in progress.

Page 58

A STUDY ON WORKING CAPITAL MANAGEMENT

CASH AND BANK BALANCE TREND

(Rs. In million)

TABLE 4.8

YEAR

2010

2009

2008

CASH AND BANK BALANCE

261

310.4

331.5

ANALYSIS

From the table and the chart it can be seen that the trend of cash and bank balances of Eicher Motors shows a decrease trend. It was 331.5 in the year 2008, 310.4 in 2009 and 261 in 2010. In a more optimistic way, this shows a significant mindset of the company as the money is not being kept idle, but instead they are invested in areas such as production, etc for incurring profit.

Page 59

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPH 4.9

400 300 200 100 0 2010 2009 2008 CASH AND BANK BALANCE 261 310.4 331.5

INFERENCE

Cash and bank balances are important assets to the company because they are the best form of liquid assets and thus, play an important role in fulfilling the working capital requirements of the company. It further helps to smoothen the functioning of the company. Moreover, it shows a decreasing trend which is again good for the company since they are utilizing more of their funds for the production.

Page 60

A STUDY ON WORKING CAPITAL MANAGEMENT

CREDITORS TREND

(Rs. In million)

TABLE 4.9

YEAR

2010

2009

2008

CREDITORS

2350.5

2846.9

2446.3

ANALYSIS

It can be observed from the table and the chart that the creditors balance for Eicher Motors was 2446.3 in 2008, 2846.9 in 2009 and 2350.5 in 2010. This is not a good sign as it cannot afford to block its capital by making cash purchases.

Page 61

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPH 5.0

3000 2500 2000 1500 1000 500 0 2010

2350.5

2846.9 2446.3

CREDITORS

2009

2008

INFERENCE

Creditors form one of the most important components of liabilities of the company. The creditors balance has been increasing and decreasing over the past years. The creditors balance imply credit purchase and has decreased in 2010 which is not good for the company and thus, needs to revamp its purchase policy because it cannot afford to block up its capital by making cash purchases. But for creditors point of view, it is good for the company since it is dealing more in cash which is obviously more viable for the creditors as they would like to deal with the company.

Page 62

A STUDY ON WORKING CAPITAL MANAGEMENT

WORKING CAPITAL RATIOS CURRENT RATIO

This ratio is a rough indication of a firms liability to service its current obligations. Generally, the higher is the current ratio, the greater the cushion between current obligations and a firms ability to pay them. The stronger ratio reflects a numerical superiority of current assets over current liabilities. However, the composition and quality of current assets is a crucial factor in the analysis of an individual firms liquidity.

Current Ratio = Total Current Assets Total Current Liabilities

TABLE REPRESENTING CURRENT RATIO

(Rs. In million) TABLE 5.0 YEAR Current Assets Current Liabilities Current Ratio 2010 4844.4 3916.4 1.237 2009 5050.8 4559.5 1.108 2008 4157.3 3342.7 1.244

ANALYSIS

It can be observed from the table and the chart that the current ratio for Eicher Motors was 1.237 in 2010, 1.108 in 2009 and 1.244 in 2008. The current ratio has been decreasing and increasing alternatively for the period 2008 2010. Page 63

A STUDY ON WORKING CAPITAL MANAGEMENT

Graphical Representation of Current Ratio

GRAPH 5.1

1.25 1.2 1.15 1.1 1.05 1

1.237

1.244

1.108

2010

2009

2008

INFERENCE

The ideal current ratio for the company is 2: 1. Eicher Motors has not been able to reach this value from 2008 to 2010. Though there has been increase in the ratio in 2008 compared to previous year but still the company has not been able to maintain its current assets and liabilities.

Page 64

A STUDY ON WORKING CAPITAL MANAGEMENT

QUICK RATIO

Quick Ratio is also known as ACID RATIO. It is a more severe conservative measure of liquidity. The ratio expresses the degree to which a companys quick liabilities are covered by the quick assets. The quick ratio is a form of derivative. It excludes inventories from the current assets, considering only assets which are most swiftly realizable. Quick Liabilities refer to all the current liabilities except for bank overdraft.

Quick Ratio = Quick Assets Quick Liabilities

TABLE REPRESENTING QUICK RATIO

(Rs. In million) TABLE 5.1 YEAR QUICK ASSETS QUICK LIABILITIES QUICK RATIO 2010 3232.5 3916.4 0.83 2009 3438.3 4559.5 0.75 2008 2894.8 3342.7 0.87

ANALYSIS

It can be observed from the table and the chart that the quick ratio for Eicher Motors was 0.87 in 2008, 0.75 in 2009 and 0.83 in 2010. The quick ratio has increased and decreased alternatively for the period 2008 2010.

Page 65

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF QUICK RATIO

GRAPH 5.2

0.9 0.85 0.8 0.75 0.7 0.65 2010 2009 2008 0.75 Quick Ratio 0.83 0.87

INFERENCE

The ideal quick ratio for any company is 1:1. Eicher Motors has never been able this value during the past three years. In all the three years the company hasnt managed to reach the ideal level. Thus, it becomes important for the company to maintain more liquid assets as any further decline in the years to come may prove detrimental to the growth for the company.

Page 66

A STUDY ON WORKING CAPITAL MANAGEMENT

ABSOLUTE LIQUID RATIO

The ratio is also known as super quick ratio or cash ratio. In calculating this ratio, both inventories and receivables are deducted from current assets to arrive at absolute liquid assets such as cash and easily marketable securities.

Absolute Liquid Ratio = Cash & its Equivalent Current Liabilities

TABLE REPRESENTING ABSOLUTE LIQUID RATIO

(Rs. In millions) TABLE 5.2 YEAR Cash & its equivalent Current Liabilities Absolute Liquid Ratio 2010 261 2009 310.4 2008 331.5

3916.4

4559.5

3342.7

0.067

0.068

0.099

ANALYSIS

It cab be observed from the table and the chart the absolute quick ratio for Eicher Motors was 0.099 for the year 2008, 0.068 fir the year 2009 and 0.067 for the year 2010. The quick ratio has decreased steadily over the past three years. Page 67

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF ABSOLUTE LIQUID RATIO

GRAPH 5.3

0.1 0.08 0.06 0.04 0.02 0 2010 2009 0.067 0.068

0.099

Absolute Liquid Ratio

2008

INFERENCE

Higher the absolute quick ratio, higher is the cash liquidity. A low ratio is not a serious matter because the company can always borrow from the bank for short term requirements.

Page 68

A STUDY ON WORKING CAPITAL MANAGEMENT

INVENTORY TO WORKING CAPITAL RATIO

This ratio is calculated to prevent over stocking. Increase in volume of sales results in increase in size of inventories. But from a sound financial point of view, inventory should not exceed amount of working capital.

Inventory to Working Capital Ratio = Inventories Net Working Capital

TABLE REPRESENTING INVENTORY TO WORKING CAPITAL RATIO

(Rs .In million) TABLE 5.3 YEAR Inventories Net Working Capital Inventory to Working Capital Ratio 2010 1612.3 928 2009 1612.5 491.3 2008 1262.5 814.6

1.74

3.28

1.55

ANALYSIS

It can be observed from the table and chart that the Inventory to Working Capital Turnover Ratio for Eicher Motors was 1.55 in 2008, 3.28 in 2009 and 1.74 in 2010. The inventory to stock turnover ratio has been increasing and decreasing alternatively between the periods 2008 to 2010. Page 69

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF INVENTORY TO WORKING CAPITAL RATIO

GRAPH 5.4

4 3.28 3 2 1 0 2010 2009 2008 1.74 1.55 Inventory to Working Capital Ratio

INFERENCE

In the last three years the ratio has been more than the ideal ratio of 1:1. This indicates positive signals about the firm with respect to its capability of managing its inventory levels. Though there has been a great reduction in the ratio from the previous year, it still is good for the company.

Page 70

A STUDY ON WORKING CAPITAL MANAGEMENT

INVENTORY TURNOVER RATIO

This ratio measures the number of times inventory is turned over during the year. High inventory turnover can indicate a shortage of needed inventory for sales. Low inventory turnover can indicate poor liquidity, possible overstocking and obsolescence or in contrast to these negative interpretations, a planned inventory buildup in the case of material shortages. Inventory Turnover Ratio = Cost of Sales Inventory

TABLE REPRESENTING INVENTORY TURNOVER RATIO

(Rs.In millions) TABLE 5.4 YEAR Cost of Goods Sold Average Stock Inventory Turnover Ratio 2010 15779.6 1612.4 2009 18684.8 1437.5 2008 12627.1 811.5

9.79

13

15.56

ANALYSIS

It can be observed from the table and the chart that the inventory turnover ratio for Eicher Motors was 15.56 in 2008, 13 in 2009 and 9.79 in 2010. The inventory turnover ratio has shown a decreasing trend for the period 2008 to 2010 which does not prove good for the company.

Page 71

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF INVENTORY TURNOVER RATIO

GRAPH 5.5

20 15 10 5 0 2010 2009 2008 9.79 Inventory Turnover Ratio 13 15.56

INFERENCE

The inventory turnover ratio was the highest for the year 2008 and has decreased every year but has still maintained a good ratio, though it is very essential for the company to exercise more control over its inventory management.

Page 72

A STUDY ON WORKING CAPITAL MANAGEMENT

DEBTORS TURNOVER RATIO

This ratio indicates the relationship between the credit sales and trade debtors. It shows the rate at which cash is generated by the turnover of debtors. It is computed as follows:Debtors Turnover Ratio = Credit Sales Average Debtors

If sales increase, debtors will increase and conversely, if sales decrease, debtors will decrease. Normally, a collection period of 45 days is considered satisfactory.

TABLE REPRESENTING DEBTORS TURNOVER RATIO

(Rs. In million) TABLE 5.5 YEAR Net Credit Sales Average Debtors Debtors Turnover Ratio 2010 16448.9 2009 19825.6 2008 13647

1176

1580.8

1549.3

13.99

12.54

8.81

ANALYSIS

It can be observed from the table and the chart that the Debtors Turnover Ratio is 8.81 in 2008, 12.54 in 2009 and 13.99 in 2010. The debtors turnover ratio has increased every year from 2008 to 2010.

Page 73

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF DEBTORS TURNOVER RATIO

GRAPH 5.6

14 12 10 8 6 4 2 0

13.99 12.54

8.81

Debtors Turnover Ratio

2010

2009

2008

INFERENCE

There is a big increase in Debtors Turnover Ratio in 2009 compared to 2008 and a steady increase in 2010 as compared to 2009, which proves to be very effective. Thus it can be seen that the management of debtors has been good for the company and has been improving over the period of time.

Page 74

A STUDY ON WORKING CAPITAL MANAGEMENT

CREDITORS TURNOVER RATIO

This ratio expresses the relationship between credit purchase and the liability as creditors. It can be stated as the number of days the credit purchases are carried on in the books. Credit Turnover Ratio = Credit Purchases Average Creditors

Note that non-credit purchases (salaries) and non cash expenses (depreciation) need to be excluded from the credit purchases and any provisions need to be excluded from creditors.

There is no need to pay the creditors before payment is due. The departments objective should be to make effective use of this source of free credit, while maintaining a good relationship with the creditors.

Credit purchases should not be carried on the books for more than an average of 45 days. If payment is withheld within 60 days or more it is likely that the creditors will become impatient and impose stricter and less convenient trading terms, for example, cash on delivery, etc.

The public finance act 1989 (section 49) places a legal constraint on the amount of credit allowed to a department. It restricts to a maximum of 90 days the purchase of goods and services through the use of credit card or suppliers credit.

Page 75

A STUDY ON WORKING CAPITAL MANAGEMENT

TABLE REPRESENTING CREDITORS TURNOVER RATIO

(Rs. In million)

TABLE 5.6 YEAR Credit Purchases Average Creditors Credit Turnover Ratio 2010 12662.8 2350.5 2009 14924.8 2846 2008 9585.3 2446.3

4.87

5.64

5.77

ANALYSIS

It can be observed from the table and the chart that the Creditors Turnover Ratio for Eicher Motors was 5.77 in 2008, 5.64 in 2009 and 4.87 in 2010. The credit turnover ratio has been showing a decreasing trend for the time period between 2008 2010.

Page 76

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF CREDIT TURNOVER RATIO

GRAPH 5.7

6 5.64 5.5 5 4.5 4 2010 2009 2008 4.87 Credit Turnover Ratio 5.77

INFERENCE

There has been a steady decrease in the Creditors Turnover Ratio in the period 2008 2010 which is not quite good for the company. Thus it is seen that the management has not been improving the company for the year 2008 2010.

Page 77

A STUDY ON WORKING CAPITAL MANAGEMENT

WORKING CAPITAL TURNOVER RATIO

This ratio indicates the efficiency or inefficiency in the utilization of working capital in making sales. A high working capital turnover ratio shows the effective utilization of working capital in generating sales. A low ratio, on the other hand, may indicate excess of net working capital. This ratio, thus, shows whether the working capital is efficiently utilized or not. Working Capital Turnover Ratio = Cost of Sales Net Working Capital

TABLE REPRESENTING WORKING CAPITAL TURNOVER RATIO (Rs. In million)

TABLE 5.7 YEAR Cost of Goods Sold Net Working Capital Working Capital Turnover Ratio 2010 15779.6 928 2009 18684.8 491.3 2008 12627.1 814.6

17

38.03

15.5

ANALYSIS

It can be observed from the table and the chart that the Working Capital Turnover Ratio was 15.5 in 2008, 38.03 in 2009 and 17 in the year 2010. The working capital turnover ratio has shown an increasing and decreasing trend over the period between 2008 and 2010.

Page 78

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF WORKING CAPITAL TURNOVER RATIO

GRAPH 5.8

40 30 20 10 0 2010 17

38.03

15.5

Working Capital Turnover Ratio

2009

2008

INFERENCE

There has been a great decrease in the working capital turnover ratio of the company in 2010 which shows that the working capital is not efficiently utilized. This indicates that there has been an excess of net working capital in 2010.

Page 79

A STUDY ON WORKING CAPITAL MANAGEMENT

CURRENT ASSETS TO FIXED ASSETS RATIO

This ratio cannot be standardized as it differs from industry to industry. A decrease in this ratio may point out that the trading is slack or mechanization has been adopted. An increase in this ratio may reveal that inventories or debtors have unduly increased or fixed assets have been intensively used. An increase in the ratio, accompanied by increase in the profits indicates that the business is expanding Current Assets to Fixed Assets Ratio = Current Assets Fixed Assets

TABLE REPRESENTING CURRENT ASSETS TO FIXED ASSETS RATIO

(Rs. In million) TABLE 5.8 YEAR Current Assets Fixed Assets Current Assets to Fixed Assets Ratio 2010 4844.4 3024.7 1.60 2009 5050.8 3886.2 1.30 2008 4157.3 3667.4 1.13

ANALYSIS

It can be observed from the table and the chart that the Current Assets to Fixed Assets Ratio is 1.13 in 2008, 1.30 in 2009 and 1.60 in the year 2010. Thus, it shows that there is an increasing trend in the ratio for the period 2008 to 2010.

Page 80

A STUDY ON WORKING CAPITAL MANAGEMENT

GRAPHICAL REPRESENTATION OF CURRENT ASSETS TO FIXED ASSETS RATIO

GRAPH 5.9

2 1.6 1.5 1 0.5 0 2010 2009 2008 Current Assets to Fixed Assets Ratio 1.3 1.13

INFERENCE

The ratio has been on a continuous uptrend over the past three years indicating that there is a continuous increase in current assets but not proportionate increase in fixed assets. This indicates that the firm has used its funds more towards carrying out its day-to-day operations and not so much on its fixed assets.

Page 81

A STUDY ON WORKING CAPITAL MANAGEMENT

STATEMENT SHOWING CHANGES IN WORKING CAPITAL OF EICHER MOTORS FOR THE YEAR 2009 2010

(Rs. In millions)

PARTCULARS CURRENT ASSETS

2009

2010

Changes in Working Capital Increase Decrease 0.2 404.8 49.4 -

Inventories Sundry Debtors Cash & Bank Other Current Assets Loans & Advances Total Current Assets (A) CURRENT LIABILITIES Current Liabilities Provisions Total Current Liabilities (B) Net Working Capital (A-B) Increase in Net Working Capital TOTAL

1612.5 1580.8 310.4 1547.1 5050.8

1612.3 1176 261 77 77 1718.1 171 4844.4

3666.4 893.1 4559.5 491.3

2902.3 764.1 1014.1 3916.4 928 121 -

436.7 928

928

1012.1

436.7 1012.1

Page 82

A STUDY ON WORKING CAPITAL MANAGEMENT

ANALYSIS

It can be observed from the table that Net Working Capital was 491.3 million in 2009 and 928 in 2010. Thus there has been an increase in the Net Working Capital of 436.7 in 2010 compared to 2009. This is good for the company as it has more surplus funds for carrying out its operations and it can invest its surplus funds for new operations.

INFERENCE

From the table it can be observed that the debtors balance has decreased which is good for the company as it shows that it is able to get all its payment on time. Cash & Bank balance has decreased which is again good for the company as it shows that the cash is not being kept idle. Loans and Advances have increased which also proves to be good as extra cash has been utilized and since it bears interest, it adds to extra revenue to the company. Current Liabilities have decreased which is good for the company as it shows that the company pays its dues on time, thus, enhancing the goodwill of the company.

Page 83

A STUDY ON WORKING CAPITAL MANAGEMENT

STATEMENT SHOWING CHANGES IN WORKING CAPITAL OF EICHER MOTORS FOR THE YEAR 2008 2009

(Rs. In million)

PARTCULARS CURRENT ASSETS

2008

2009

Changes in Working Capital Increase Decrease 21.1 -

Inventories Sundry Debtors Cash & Bank Other Current Assets Loans & Advances Total Current Assets (A) CURRENT LIABILITIES Current Liabilities Provisions Total Current Liabilities (B) Net Working Capital (A-B) Decrease in Net Working Capital TOTAL

1262.5 1549.3 331.5 1014 4157.3

1612.5 350 1580.8 31.5 310.4 1547.1 533.1 5050.8

2689.8 652.9 3342.7 814.6

3666.4 893.1 4559.5 493.1 240.2 976.6

814.6

323.3 814.6

323.3 1237.9

1237.9

Page 84

A STUDY ON WORKING CAPITAL MANAGEMENT

ANALYSIS

It can be observed from the table that Net Working Capital was 814.6 million in 2008 and 491.3 million in 2009. Thus, there has been a decrease in Net Working Capital of 323.3 in 2009 when compared to 2008. This is bad for the company as it has fewer funds for carrying out its operations.

INFERENCE

From the table it can be observed that the inventories has increased which is bad for the company as more of its funds are blocked in raw materials and work-in-progress which does not have any output for the company. Debtors balances have marginally increased which does not bear any effect, though it is high in both the years. Cash & Bank balance have decreased which is good for the company as it is not keeping its cash idle. Loans & Advances have increased which is good as extra cash is utilized and since it bears interest, thus it adds extra revenue for the company as it affects the goodwill of the company as the company fails to pay within the timeframe.

Page 85

A STUDY ON WORKING CAPITAL MANAGEMENT

STATEMENT SHOWING CHANGES IN WORKING CAPITAL OF EICHER MOTORS FOR THE YEAR 2007 2008

(Rs. In million)

PARTCULARS CURRENT ASSETS

2007

2008

Changes in Working Capital Increase Decrease -

Inventories Sundry Debtors Cash & Bank Other Current Assets Loans & Advances Total Current Assets (A) CURRENT LIABILITIES Current Liabilities Provisions Total Current Liabilities (B) Net Working Capital (A-B) Decrease in Net Working Capital TOTAL

360.5 518.7 9.2 269.1 1157.5

1262.5 902 1549.3 1030.6 331.5 322.3 1014 744.9 4157.3

940.8 149.2 1090 67.5

2689.8 652.9 3342.7 814.6 503.7 1749

747.1 814.6

814.6

2999.8

747.1 2999.8

Page 86

A STUDY ON WORKING CAPITAL MANAGEMENT

ANALYSIS

It can be observed from the table that Net Working Capital was 67.5 million in 2007 and 814.6 in 2008. Thus there has been an increase in the Net Working Capital of 747.1 in 2008 as compared to 2007. This is good for the company as it has more surplus funds for carrying out its operation and can invest its surplus funds for new operations.

INFERENCE

From the table it can be observed that all balances have increased in 2008 which shows that there has been an expansion in the company and thus the working capital requirements has also increased. Both, the current asset and current liabilities has increased up to a large extent showing the larger use of funds for production.

Page 87

A STUDY ON WORKING CAPITAL MANAGEMENT

SUMMARY

Page 88

A STUDY ON WORKING CAPITAL MANAGEMENT

SUMMARY

This chapter covers the summary and findings from the balance sheet of the company for three financial years.

Succeeding the analysis, the following was found using various data analysis tools:

FINANCIAL RATIO:

It can be observed that the current ratio for the last three financial years is less than the conventional 2:1 ratio which is not good for the company. The investment in current assets has increased in the year 2009 but again decreased in the 2010. Moreover, the current liabilities increased in 2009, but decreased in 2008. But this decrease is not in proportion to the decrease in current assets. Moreover, the decrease in current assets is a lot higher than the decrease in current liabilities and thus, brings the ratio further down. This might have a bad impact on the liquidity and to the goodwill of the company.

But analyzing the quick ratio it is found that the ratio for all three years has not been satisfactory and has been less than the standard norm of 1:1. There has been a considerable fall in the quick assets. On the account of such low ratios, the business may find itself in serious financial difficulties.

As observed from the absolute liquid ratio calculated, it is clear the absolute liquid ratio has decreased from the financial year 2008 2010. This indicates that less cash is available for discharging the current liabilities. This is possible only because of substantial decrease in cash and bank balance over the three years. Page 89

A STUDY ON WORKING CAPITAL MANAGEMENT

The desirable ratio of inventory to working capital is 1:1. The ratio has been more than the desirable ratio in all the three financial years. In the year 2009, it has shown a ratio of 3.28 which is very good for the company, thus, showing the efficiency in the functioning of the company.

From the current asset to fixed ratio it has been observed that the company is using more of its funds in current assets instead of fixed assets, which shows the company uses most of its funds in day-to-day operations.

ACTIVITY RATIO: