Академический Документы

Профессиональный Документы

Культура Документы

Tax Question

Загружено:

K V RamanathanИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Question

Загружено:

K V RamanathanАвторское право:

Доступные форматы

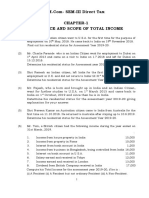

Answer any Three 1) Short notes on: a) House Rent allowance (With Provision) b) Rent free unfurnished accommodation

(with Provisions) b) List out any 8 items fully exempted income form House property. 2) Calculate Taxable House Property income. Mr. Suresh owns a house in Mumbai. From the following particulars computes the incomes from house property for the AY 2012-2013 i) Actual Rent (Per Month) Rs. 15,000 ii) Municipal Value Rs. 1,50,000 iii) Fair Rent Rs. 1,65,000 iv) Municipal Tax Paid (PA) Rs. 15,000 v) Expenses on repairs Rs. 8,000 vi) Interest on borrowed capital Rs. 20,250 3) Short Notes on: A) Previous Year B) Assessment Year C) Meaning of Recognized Provident fund D) Meaning of Income form other sources E) Explain what are the difference between Revenue and capital Expenditure? 4) Calculate Net Salary: Mr. Edvin, an employee of the ABC (P) Ltd receives the following salary and perquisites from his employer during the A.Y 2012-2013. 1) Basic pay Rs. 15,000 PM 2) D.A 20 % of Basic Pay ( 75% forming Part) 3) City Compensation allowance Rs. 1,200 P.M 4) Entertainment allowance Rs. 500 P.M 5) Hostel education allowance for three children Rs. 12,000 P.A 6) Bonus Rs. 12,000 P.A 7) HRA Rs. 5,000 P.M ( Rent Paid Rs. 6,500 at Delhi ) 8) Conveyance allowance Rs. 800 P.M ( 70% Personal Use) 9) Free gift to him fully automatic washing machine worth Rs. 25,000. 10) Profession tax paid by employee Rs. 1,000 PM

Вам также может понравиться

- BC 501 Income Tax Law 740766763 PDFДокумент15 страницBC 501 Income Tax Law 740766763 PDFSakshi JainОценок пока нет

- Business Taxation MBA III 566324802Документ5 страницBusiness Taxation MBA III 566324802mohanraokp2279Оценок пока нет

- Income Tax - I Subj - Code:113020 Section-AДокумент3 страницыIncome Tax - I Subj - Code:113020 Section-AThiru VenkatОценок пока нет

- +++C$C, CCC$ CДокумент7 страниц+++C$C, CCC$ CKomal Damani ParekhОценок пока нет

- CFP Sample Paper Tax PlanningДокумент4 страницыCFP Sample Paper Tax PlanningamishasoniОценок пока нет

- CFP Sample Paper Tax PlanningДокумент8 страницCFP Sample Paper Tax Planningchaitanya_koli2611Оценок пока нет

- iNCOME TAX MODEL Q.PДокумент3 страницыiNCOME TAX MODEL Q.PAndalОценок пока нет

- September: (CBCS) (F +R) (2016-17 and Onwards)Документ7 страницSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeОценок пока нет

- Finance Management Specialisation - Ii 304 - B: Direct TaxationДокумент3 страницыFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarОценок пока нет

- Direct - Tax - Laws Model QuestionsДокумент8 страницDirect - Tax - Laws Model QuestionsAlexis ParrisОценок пока нет

- BBAHDSE504Документ4 страницыBBAHDSE504shen kinoОценок пока нет

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATДокумент8 страницThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariОценок пока нет

- Tax Planning CasesДокумент68 страницTax Planning CasesHomework PingОценок пока нет

- Mba E307 - Mbe E332 - MBF C303Документ4 страницыMba E307 - Mbe E332 - MBF C303Shashank TripathiОценок пока нет

- 18222rtp PCC May10 Paper5Документ37 страниц18222rtp PCC May10 Paper5Kamesh IyerОценок пока нет

- OSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05Документ5 страницOSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05mehaik patwa , 20Оценок пока нет

- House PropertyДокумент36 страницHouse PropertyRahul Tanver0% (1)

- QB Ipu 2024Документ2 страницыQB Ipu 2024uditnarayan8721663Оценок пока нет

- Income Tax Question BankДокумент8 страницIncome Tax Question Banksurya.notes19Оценок пока нет

- 28 5 Income TaxДокумент50 страниц28 5 Income Taxemmanuel JohnyОценок пока нет

- Capii Income Tax and Vat July2015Документ15 страницCapii Income Tax and Vat July2015casarokarОценок пока нет

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Документ10 страницReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGОценок пока нет

- Tax AssignmentДокумент4 страницыTax AssignmentkaRan GUptД100% (1)

- Tax Management ModelДокумент17 страницTax Management ModelZacharia VincentОценок пока нет

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆДокумент8 страницBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarОценок пока нет

- Scanner Ipcc Paper 4Документ34 страницыScanner Ipcc Paper 4Meet GargОценок пока нет

- Eco 11Документ4 страницыEco 11ps5927510Оценок пока нет

- Sample MCQs Income Tax - DEAДокумент15 страницSample MCQs Income Tax - DEACrick CompactОценок пока нет

- Eco 11Документ4 страницыEco 11Deepak GautamОценок пока нет

- Direct Taxes Sem-Iii-20Документ22 страницыDirect Taxes Sem-Iii-20Pranita MandlekarОценок пока нет

- 3 - BAF - Direct Tax IДокумент3 страницы3 - BAF - Direct Tax Isid pjОценок пока нет

- Tax Planning & Financial Reporting 2nd Mid TermДокумент6 страницTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharОценок пока нет

- Ad Account Question PaperДокумент3 страницыAd Account Question PaperAbdul Lathif0% (1)

- Direct Tax QB 30-9-2016-1Документ46 страницDirect Tax QB 30-9-2016-1Sriji VijayОценок пока нет

- Income Tax 1 - 20223Документ3 страницыIncome Tax 1 - 20223nimalpes21Оценок пока нет

- Incidence of Tax - IllustrationДокумент16 страницIncidence of Tax - IllustrationAnirban ThakurОценок пока нет

- Assignment MBA III: Business Taxation: TH THДокумент4 страницыAssignment MBA III: Business Taxation: TH THShubham NamdevОценок пока нет

- Income Tax Law and PracticeДокумент4 страницыIncome Tax Law and PracticeShruthi VijayanОценок пока нет

- I.TAx 302Документ4 страницыI.TAx 302tadepalli patanjaliОценок пока нет

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100Документ8 страницTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100TejTejuОценок пока нет

- ITLP Question BankДокумент9 страницITLP Question BankRitik SinghОценок пока нет

- CA Inter N22 - Tax Model QPДокумент14 страницCA Inter N22 - Tax Model QPNAVEEN SURYA MОценок пока нет

- Cim 8682 Taxation Question Paper (Ahemadabad)Документ3 страницыCim 8682 Taxation Question Paper (Ahemadabad)Pomi ShiyaОценок пока нет

- Income Tax - I 2020Документ3 страницыIncome Tax - I 2020nimalpes21Оценок пока нет

- Taxtion II Nov Dec 2014Документ5 страницTaxtion II Nov Dec 2014Md HasanОценок пока нет

- Questions 34nosДокумент21 страницаQuestions 34nosAshish TomsОценок пока нет

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaДокумент11 страницMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalОценок пока нет

- Question Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or FalseДокумент69 страницQuestion Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or Falselakshit_gupta100% (1)

- Income Tax Model PaperДокумент5 страницIncome Tax Model PaperSrinivas YerrawarОценок пока нет

- Q.P. Voc-I Direct TaxДокумент4 страницыQ.P. Voc-I Direct TaxNitin DhawleОценок пока нет

- TLP-MCQ 100Документ16 страницTLP-MCQ 100ankur100% (1)

- Mba 3 Sem Tax Planning and Management Jan 2019Документ3 страницыMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhОценок пока нет

- TLP-MCQ 100Документ16 страницTLP-MCQ 100PriyankaGuptaОценок пока нет

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Документ36 страницCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanОценок пока нет

- Numericals of SalaryДокумент7 страницNumericals of SalaryAnas ShaikhОценок пока нет

- PFTP - Unit II - Income From Salary - Short SumsДокумент3 страницыPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974Оценок пока нет

- HP MCQДокумент7 страницHP MCQ887 shivam guptaОценок пока нет

- CFP Mock Test Tax PlanningДокумент8 страницCFP Mock Test Tax PlanningDeep Shikha67% (3)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)От EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- 12 Days SPSS WorkshopДокумент6 страниц12 Days SPSS WorkshopK V RamanathanОценок пока нет

- Faculty Development ProgrammeДокумент2 страницыFaculty Development ProgrammeK V RamanathanОценок пока нет

- UGC NET Training Paper - IДокумент2 страницыUGC NET Training Paper - IK V RamanathanОценок пока нет

- Paper 1.5 Advanced Financial ManagementДокумент15 страницPaper 1.5 Advanced Financial ManagementK V RamanathanОценок пока нет

- Management Development ProgrammeДокумент2 страницыManagement Development ProgrammeK V RamanathanОценок пока нет

- Two Days WorkshopДокумент2 страницыTwo Days WorkshopK V RamanathanОценок пока нет

- Final Dubai Conference InvitationДокумент4 страницыFinal Dubai Conference InvitationK V RamanathanОценок пока нет

- One Day International Conference at ThailandДокумент2 страницыOne Day International Conference at ThailandK V RamanathanОценок пока нет

- Impact Factor SitesДокумент3 страницыImpact Factor SitesK V RamanathanОценок пока нет

- One Day WorkshopДокумент2 страницыOne Day WorkshopK V RamanathanОценок пока нет

- IIFCДокумент1 страницаIIFCK V RamanathanОценок пока нет

- One Day National SeminarДокумент2 страницыOne Day National SeminarK V RamanathanОценок пока нет

- Workshop Broucher Madurai Final FileДокумент2 страницыWorkshop Broucher Madurai Final FileK V RamanathanОценок пока нет

- Registration Form For Data AnalysisДокумент2 страницыRegistration Form For Data AnalysisK V RamanathanОценок пока нет

- Model No.1Документ14 страницModel No.1K V RamanathanОценок пока нет

- Model No.1Документ14 страницModel No.1K V RamanathanОценок пока нет

- Enquirey For JOBДокумент1 страницаEnquirey For JOBK V RamanathanОценок пока нет

- Workshop On Data Analysis Using SPSS and AMOSДокумент2 страницыWorkshop On Data Analysis Using SPSS and AMOSK V RamanathanОценок пока нет

- Model No.1Документ14 страницModel No.1K V RamanathanОценок пока нет

- BankДокумент1 страницаBankK V RamanathanОценок пока нет

- 27Документ13 страниц27K V RamanathanОценок пока нет

- Mock GD and Personal Interview Feedback: Students Name Content of Standard Description 5 4 3 2 1Документ2 страницыMock GD and Personal Interview Feedback: Students Name Content of Standard Description 5 4 3 2 1K V RamanathanОценок пока нет

- Industry VistДокумент3 страницыIndustry VistK V RamanathanОценок пока нет