Академический Документы

Профессиональный Документы

Культура Документы

Allowable Deductions Vs Personal Exemptions

Загружено:

Bantogen Babantogen0 оценок0% нашли этот документ полезным (0 голосов)

9 просмотров1 страницаDeduction & Exemption

Оригинальное название

Allowable Deductions vs Personal Exemptions

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDeduction & Exemption

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

9 просмотров1 страницаAllowable Deductions Vs Personal Exemptions

Загружено:

Bantogen BabantogenDeduction & Exemption

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

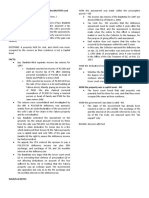

Allowable deductions vs Personal Exemptions ALLOWABLE Deductions PERSONAL Exemptions These are ACTUAL business or professional These are

ARBITRARY AMOUNTS EXPENES INCURRED in the pursuit of trade, REPRESENTING PERSONAL DAILY LIVNG business or profession EXPENSES allowed as a deduction by law to QUALIFIED individual taxpayers CAN be CLAIMED by INIDIVIDUAL or CAN be claimed by QUALIFIED INDIVIDUAL CORPORATE taxpayers taxpayers only Deductions MUST BE SUPPORTED with NO NEED of supporting receipts RECEIPTS They are allowed deductions to ENABLE the They are allowed to COVER PERSONAL, taxpayer to RECOUP HIS COST OF DOING FAMILY and LIVING EXPENSES BUSINESS

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Lyft 1099K 1239385631162661398 2019 PDFДокумент1 страницаLyft 1099K 1239385631162661398 2019 PDFJohn Matthew Cruel100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- How To File Federal Tax ReturnДокумент4 страницыHow To File Federal Tax ReturnDiana Bumbaru100% (1)

- Form 4506-T (Rev. 11-2021)Документ1 страницаForm 4506-T (Rev. 11-2021)keyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Seguro SocialДокумент2 страницыSeguro SocialTaina ColonОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Glacier Tax User GuideДокумент5 страницGlacier Tax User Guideinter4ever77Оценок пока нет

- People vs. CatbaganДокумент2 страницыPeople vs. CatbaganBantogen BabantogenОценок пока нет

- Payroll Calculator: Period Ending: Company NameДокумент1 страницаPayroll Calculator: Period Ending: Company NameIbrahim ElbrolosyОценок пока нет

- People vs. LucasДокумент2 страницыPeople vs. LucasBantogen BabantogenОценок пока нет

- 6-9-20 - OH - Initial Filing - MUUYC LLC PDFДокумент2 страницы6-9-20 - OH - Initial Filing - MUUYC LLC PDFMARIA KAMELIS ARIZA SILVA50% (2)

- People vs. GaffudДокумент2 страницыPeople vs. GaffudBantogen BabantogenОценок пока нет

- People vs. LarrañagaДокумент2 страницыPeople vs. LarrañagaBantogen BabantogenОценок пока нет

- People vs. LarrañagaДокумент2 страницыPeople vs. LarrañagaBantogen BabantogenОценок пока нет

- Agote vs. LorenzoДокумент2 страницыAgote vs. LorenzoBantogen BabantogenОценок пока нет

- People vs. LadjaalamДокумент2 страницыPeople vs. LadjaalamBantogen BabantogenОценок пока нет

- Valenzuela vs. PeopleДокумент1 страницаValenzuela vs. PeopleBantogen BabantogenОценок пока нет

- Valenzuela vs. PeopleДокумент1 страницаValenzuela vs. PeopleBantogen BabantogenОценок пока нет

- The Rules On Recovery of Tax Erroneously or Illegally Collected Can Be Found Under Section 229 of The Tax CodeДокумент2 страницыThe Rules On Recovery of Tax Erroneously or Illegally Collected Can Be Found Under Section 229 of The Tax CodeFrancisJosefTomotorgoGoingo100% (1)

- Abalos vs. Heirs of Vicente TorioДокумент3 страницыAbalos vs. Heirs of Vicente TorioBantogen BabantogenОценок пока нет

- Authorization For Reimbursement of Interim Assistance Initial Claim or Posteligibility Case SSP 14Документ2 страницыAuthorization For Reimbursement of Interim Assistance Initial Claim or Posteligibility Case SSP 14Harry TajyarОценок пока нет

- COLLECTOR of Internal Revenue vs. Pedro BAUTISTA and David TanДокумент1 страницаCOLLECTOR of Internal Revenue vs. Pedro BAUTISTA and David TanPouǝllǝ ɐlʎssɐОценок пока нет

- Batangas Laguna Tayabas Bus Company, Inc. Vs Court of AppealsДокумент1 страницаBatangas Laguna Tayabas Bus Company, Inc. Vs Court of AppealsBantogen BabantogenОценок пока нет

- Labor Law Part IДокумент104 страницыLabor Law Part IBantogen BabantogenОценок пока нет

- Church and StateДокумент2 страницыChurch and StateBantogen BabantogenОценок пока нет

- Bohol Land Transportation Co. vs. JureidiniДокумент1 страницаBohol Land Transportation Co. vs. JureidiniBantogen BabantogenОценок пока нет

- Midnight AppointmentДокумент16 страницMidnight AppointmentBantogen BabantogenОценок пока нет

- Francisco Vs OnrubiaДокумент1 страницаFrancisco Vs OnrubiaBantogen BabantogenОценок пока нет

- Rivera Vs PeopleДокумент2 страницыRivera Vs PeoplezelОценок пока нет

- Types of LossesДокумент2 страницыTypes of LossesBantogen BabantogenОценок пока нет

- People vs. FactaoДокумент2 страницыPeople vs. FactaoBantogen BabantogenОценок пока нет

- People vs. NangДокумент2 страницыPeople vs. NangBantogen BabantogenОценок пока нет

- Choa vs. ChiongsonДокумент1 страницаChoa vs. ChiongsonBantogen BabantogenОценок пока нет

- Estrada vs. SandiganbayanДокумент1 страницаEstrada vs. SandiganbayanBantogen BabantogenОценок пока нет

- Choa vs. ChiongsonДокумент1 страницаChoa vs. ChiongsonBantogen BabantogenОценок пока нет

- Choa vs. ChiongsonДокумент1 страницаChoa vs. ChiongsonBantogen BabantogenОценок пока нет

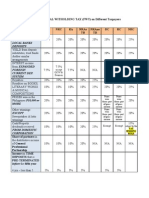

- Final Witholding Tax On Different TaxpayersДокумент2 страницыFinal Witholding Tax On Different TaxpayersBantogen BabantogenОценок пока нет

- Book III Powers of The PresidentДокумент10 страницBook III Powers of The PresidentBantogen BabantogenОценок пока нет

- MatrixДокумент1 страницаMatrixgod-winОценок пока нет

- Lag RevДокумент185 страницLag RevBantogen BabantogenОценок пока нет

- SpldigestДокумент4 страницыSpldigestihreОценок пока нет

- Form W-4 (2013) : Employee's Withholding Allowance CertificateДокумент2 страницыForm W-4 (2013) : Employee's Withholding Allowance Certificateapi-20374706Оценок пока нет

- 2011 Tax Guide: A Comprehensive Reference Guide To Your 2011 Tax Information StatementДокумент40 страниц2011 Tax Guide: A Comprehensive Reference Guide To Your 2011 Tax Information StatementGuruprasad SОценок пока нет

- Social Security & Supplemental Security Income (SSI) : WWW - Ssa.govДокумент5 страницSocial Security & Supplemental Security Income (SSI) : WWW - Ssa.govanon_26882226Оценок пока нет

- Employes's Name Position Monthly Rate Gross Pay Sss-Ee Phic-Ee Hdmf-Ee Tax Loans Total Deduction Net PayДокумент1 страницаEmployes's Name Position Monthly Rate Gross Pay Sss-Ee Phic-Ee Hdmf-Ee Tax Loans Total Deduction Net PayBon.AlastoyОценок пока нет

- Optional Standard DeductionДокумент3 страницыOptional Standard Deductionopep77Оценок пока нет

- Supplemental Security Income (Ssi) : Socialsecurity - GovДокумент16 страницSupplemental Security Income (Ssi) : Socialsecurity - Govtreb trebОценок пока нет

- 2019 TSP Catch-Up Contributions and Effective Date ChartДокумент1 страница2019 TSP Catch-Up Contributions and Effective Date ChartRayОценок пока нет

- Savvy Social Security Planning:: What Baby Boomers Need To Know To Maximize Retirement IncomeДокумент49 страницSavvy Social Security Planning:: What Baby Boomers Need To Know To Maximize Retirement IncomeTammara BandyОценок пока нет

- US Internal Revenue Service: f8923Документ1 страницаUS Internal Revenue Service: f8923IRSОценок пока нет

- Bir Forms: A Final Project in Tax 1 - Income TaxationДокумент2 страницыBir Forms: A Final Project in Tax 1 - Income TaxationgracilleОценок пока нет

- 02 Task Performance 2Документ4 страницы02 Task Performance 2Emperor SavageОценок пока нет

- W9Документ1 страницаW9chris2077Оценок пока нет

- Instructions For Form 8962Документ18 страницInstructions For Form 8962jim1234uОценок пока нет

- US Internal Revenue Service: n-03-59Документ2 страницыUS Internal Revenue Service: n-03-59IRSОценок пока нет

- Form IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsДокумент2 страницыForm IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsMorning32Оценок пока нет

- Deed in LieuДокумент33 страницыDeed in LieuSteven WhitfordОценок пока нет

- VT - Pharm Programs Handbook - 2019 - Final-2 (Somali) PDFДокумент21 страницаVT - Pharm Programs Handbook - 2019 - Final-2 (Somali) PDFnimco haamud100% (1)

- f6744 (2018)Документ208 страницf6744 (2018)Center for Economic Progress0% (2)

- Employee and Employer Taxes ExplanationДокумент1 страницаEmployee and Employer Taxes ExplanationKim KimОценок пока нет

- US Internal Revenue Service: I1040 - 2002Документ126 страницUS Internal Revenue Service: I1040 - 2002IRSОценок пока нет