Академический Документы

Профессиональный Документы

Культура Документы

Porter's Five Forces Analysis of Coca-Cola

Загружено:

Ming EkpiyaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Porter's Five Forces Analysis of Coca-Cola

Загружено:

Ming EkpiyaАвторское право:

Доступные форматы

Porters Five Forces In Action: Sample Analysis of Coca-Cola

Since its introduction in 1979, Michael Porters Five Forces has become the de facto framework for industry analysis. The five forces measure the competitiveness of the market deriving its attractiveness. The analyst uses conclusions derived from the analysis to determine the companys risk from in its industry (current or potential). The five forces are (1) Threat of New Entrants, (2) Threat of Substitute Products or Services, (3) Bargaining Power of Buyers, (4) Bargaining Power of Suppliers, (5) Competitive Rivalry Among Existing Firms. The following is a Five Forces analysis of The Coca-Cola Company in relationship to its Coca-Cola brand. Threat of New Entrants/Potential Competitors: Median Pressure

Entry barriers are relatively low for beverage industry: there is almost 0 consumer switching cost and very low capital requirement. There are more and more new brands appearing in the market with usually lower price than Coke products However Coca-Cola is seen not only as a beverage but also as a brand. It has a very significant market share for a long time and loyal customers are not very likely to try a new brand beverage.

Threat of Substitute Products: Median to high pressure\

There are many kinds of energy drink and soda products in the market. Coca-cola doesnt really have a special flavor. In a blind taste test, people couldnt tell the difference between Coca-Cola coke and Pepsi coke.

The Bargaining Power of Buyers: Low pressure

The individual buyer has little to no pressure on Coca-Cola The main competitor, Pepsi is priced almost the same as Coca-Cola. Consumer could buy those new and less popular beverages with lower price but the flavor is different and the quality is not guaranteed. Large retailers, like Wal-Mart, have bargaining power because of the large order quantity, but the bargaining power is lessened because of the end consumer brand loyalty. There are many kinds of energy drink and soda products in the market. Coca-cola doesnt really have a special flavor. In a blind taste test, people couldnt tell the difference between Coca-Cola coke and Pepsi coke. People are getting concerns of negative effects of carbonated beverages. Increasing number of consumers begin to drink fruit juice, lemonade and tea instead of soda products.

The Bargaining Power of Suppliers: Low pressure

The main ingredients for soft drink include carbonated water, phosphoric acid, sweetener, and caffeine. The suppliers are not concentrated or differentiated. Any supplier would not want to lose a huge customer like Coca-Cola.

Rivalry Among Existing Firms: High Pressure

Currently, the main competitor is Pepsi which also has a wide range of beverage products under its brand. Both Coca-Cola and Pepsi are the predominant carbonated beverages and commit heavily to sponsoring outdoor festivals and activities. As Coca-Cola has a longer history, it is advertised in a more classical approach while Pepsi tried to attract younger generation by using pop stars as brand ambassadors. Currently Coca-Cola slightly topped Pepsi as the possessor of the most U.S market share. There are other soda brands in the market that become popular, like Dr. Pepper, because of their unique flavors.

Coca Cola has an enviable track record and there are countless millions of costumers the world over and with its five forces strategy it has succeeded remarkably in differentiating its products. Learn more about Coke's Porter's Five Force Model right here on Bright Hub.

It Started as a Proposal

In the year 1979, Michael Porter belonging to the Harvard Business School, proposed a business plan based on the five industry forces to do a SWOT analysis. The aim was to help business enterprises enlarge their market share and augment their profit. Michael Porter's plan was to make organizations understand their competition strengths and weaknesses and then devise suitable mechanisms to overcome competition. The plan studies the combined strength of five different market forces to achieve profitability goals. Coke, based on the above model, designed its own strategies for product differentiation. This is how Coke's Porter's Five Forces Model

came into execution.

Why is it Required?

The five forces plan is to assess the status of the industry in the open marketplace. It goes into the nature of competition, examines the external threats and identifies the opportunities to achieve competitive advantage.

SWOT Analysis Tool

www.Mindjet.com

Get a free 30 day Trial of Mindjet and create easily Swot Analysis.

Ads by Google

Generally, business competition negates profits if the organization has no competitive advantage over its business rivals. When a competitor acts in a particular fashion and others respond to counter-balance it, the rivalry only gets keener.

Coke's Porter's Five Force Model - Need of Standardized Strategies

Coke recognized that designing products, manufacturing processes and marketing strategies are to be internationally standardized. These factors are dictated by the scales of economy of different countries and the imperative need for cheaper means of production. Thus, Coke studied the five industry forces to evolve its competitive advantage over Pepsi. As per Porters formula, Cokes Porter's Five Force Model plan was to differentiate its frontline Cola product from its chief rival Pepsi by adopting certain operational methods. To heighten its competitive advantage, Coca Cola applied the Porter's formula

Business Rivalry

The first aspect was the low business rivalry. The market was essentially shared by Pepsi and Coca Cola, with a combined market share of 80 percent. The fact is Coca Cola owns two of the three soft beverages in the market, has few competitors and constantly striving for international presence. The second was to consider the bargaining power with suppliers that can be rated as low. The role of Coca Cola was to primarily supply either sucrose or fructose and undertake the bottling work. Sugar is commonly available and can be bought in the open market. If sugar became overly costly, the company could buy corn syrup instead. They even bought this substitute earlier during the early 1980s. As a matter of fact, Coca Cola buys high fructose corn syrup as its ingredient inside U.S. and sucrose only in countries other than US.

Bargaining Power

The third pertained to the bargaining power that can be rated as medium. The main distribution channels are supermarkets, large scale retail chains, fountain sales, sales through vending machines and convenience stores attached to gas stations. The fact is vending machines, convenience stores and super markets have low bargaining power as there are not many alternates.

Sales and Brand Loyalty

Other channels like large scale retail chains and fountain sales which are situated in fast-food outlets have a marginally higher bargaining power. They buy in large quantities and thus expect lower prices. However, in real terms, this segment hardly contributes to meaningful profits for

Coca Cola. Likewise, the fountain sales are also in the nature of paid sampling with negligible profits. They more serve to promote brand loyalty among clients and not increased profits. Finally, to consider the possible threats of substitutes that may again be rated as low. There are quite a few reasons why the threat of substitute is low particularly against Coca Cola. The foremost of them is brand loyalty. Coca Cola has an enviable track record and there are countless millions of costumers the world over, who would never abandon the brand and other Coca Cola products. There is no denying that Coca Cola has succeeded remarkably in differentiating its products.

Вам также может понравиться

- Solution Manual For Managerial Economics in A Global Economy 8th Edition by SalvatoreДокумент20 страницSolution Manual For Managerial Economics in A Global Economy 8th Edition by SalvatorePoonam Singh100% (8)

- Nike's CSR goals and challengesДокумент3 страницыNike's CSR goals and challengesmyra sashaОценок пока нет

- Coca-Cola (The Situation Analysis)Документ9 страницCoca-Cola (The Situation Analysis)oldboydannyОценок пока нет

- Coca-Cola USA PESTLE Analysis (Presentation)Документ8 страницCoca-Cola USA PESTLE Analysis (Presentation)anabia19Оценок пока нет

- International Strategy Coca-Cola ReportДокумент48 страницInternational Strategy Coca-Cola Reportapi-29798490683% (6)

- Beer Industry 5 ForcesДокумент4 страницыBeer Industry 5 ForcesmheeisnotabearОценок пока нет

- Lululemon Case Study Final Edit 2Документ6 страницLululemon Case Study Final Edit 2wanyzlkhflОценок пока нет

- Distribution Channel of PepsicoДокумент44 страницыDistribution Channel of PepsicoDevesh SharmaОценок пока нет

- Hemang Chauhan P40015 OSD AssignmentДокумент1 страницаHemang Chauhan P40015 OSD AssignmentMegaAppleОценок пока нет

- PESTEL Analysis of AppleДокумент4 страницыPESTEL Analysis of AppleHabib Memon100% (2)

- McDonalds Value Chain AnalysisДокумент33 страницыMcDonalds Value Chain Analysisshkadry86% (7)

- Five Forces Analysis of Coca ColaДокумент7 страницFive Forces Analysis of Coca ColaDela MelianaОценок пока нет

- PepsiCo's 10 Strategic OM Decisions for ProductivityДокумент2 страницыPepsiCo's 10 Strategic OM Decisions for ProductivityNica JeonОценок пока нет

- Presentation On ClarksДокумент28 страницPresentation On ClarksKamil Hasnain100% (2)

- Apple Inc 2012 Case AnalysisДокумент8 страницApple Inc 2012 Case AnalysisTran Duy Minh100% (2)

- Porters Five Forces For StarbucksДокумент5 страницPorters Five Forces For StarbucksJulien Tham0% (1)

- Apple Inc Harvard Case StudyДокумент4 страницыApple Inc Harvard Case StudySarah Al-100% (1)

- Internationalizing The Cola Wars (A)Документ9 страницInternationalizing The Cola Wars (A)dcphilОценок пока нет

- Aldi-The Dark Horse DiscounterДокумент2 страницыAldi-The Dark Horse DiscounterAshish Indolia100% (1)

- Apple Inc.: Managing Global Supply Chain: Case AnalysisДокумент9 страницApple Inc.: Managing Global Supply Chain: Case AnalysisPrateek GuptaОценок пока нет

- Case Study Coca ColaДокумент6 страницCase Study Coca ColaAndrej AndrejОценок пока нет

- 5 Forces & Vrine Apple and Starbucks CasesДокумент17 страниц5 Forces & Vrine Apple and Starbucks CasesIg Na0% (1)

- Strategic Analysis of Coca Cola Sandra Baah With Cover Page v2Документ22 страницыStrategic Analysis of Coca Cola Sandra Baah With Cover Page v2Ankita DhimanОценок пока нет

- Coca Cola Using Porters Theory 5Документ5 страницCoca Cola Using Porters Theory 5Tabitha Abie KargboОценок пока нет

- Interview Question AnswersДокумент2 страницыInterview Question AnswersSushilSinghОценок пока нет

- Five-Forces Analysis For CSD Cola Wars CДокумент2 страницыFive-Forces Analysis For CSD Cola Wars CasheОценок пока нет

- Assignment On Coca ColaДокумент11 страницAssignment On Coca ColaΛδΙτλά ΧοΗηηίε100% (2)

- Marketing Midterm - Mohamed Serageldin - PEPSIДокумент14 страницMarketing Midterm - Mohamed Serageldin - PEPSIHossam SamyОценок пока нет

- Case Study of AppleДокумент12 страницCase Study of AppleBhuvnesh Singh100% (1)

- Value Chain Analysis of CokeДокумент4 страницыValue Chain Analysis of CokeDeepak YadavОценок пока нет

- Competitive Forces and SWOT Analysis of Whole Foods MarketДокумент6 страницCompetitive Forces and SWOT Analysis of Whole Foods MarketsksinghicfaiОценок пока нет

- Group 7 - Microsoft's SearchДокумент3 страницыGroup 7 - Microsoft's SearchNandita BansalОценок пока нет

- Apple CSRДокумент2 страницыApple CSRamberriesОценок пока нет

- Apple Inc. PESTLE Analysis: Apple Inc. (NASDAQ: AAPL) Is One of The World's Most Visible and Recognizable ConsumerДокумент3 страницыApple Inc. PESTLE Analysis: Apple Inc. (NASDAQ: AAPL) Is One of The World's Most Visible and Recognizable ConsumerAmna KabeerОценок пока нет

- BCG Matrix-Theory & PracticeДокумент32 страницыBCG Matrix-Theory & PracticeYannis A. Pollalis100% (1)

- Project Report On PepsiДокумент15 страницProject Report On PepsiSumitGuhaОценок пока нет

- Vision Statement-Ben and Jerry'sДокумент2 страницыVision Statement-Ben and Jerry'sANnam SaiYed67% (3)

- Apple AnalysisДокумент10 страницApple AnalysisLe NganОценок пока нет

- Case Study WS MorrisonДокумент7 страницCase Study WS Morrisonida barrieОценок пока нет

- Nike's Supply-Chain Management: Ethical and SustainableДокумент25 страницNike's Supply-Chain Management: Ethical and SustainableMaandy PhamОценок пока нет

- Coca Cola IndiaДокумент19 страницCoca Cola IndiaParag67% (3)

- Coca-Cola Porter's Five Forces Analysis and Diverse Value-Chain Activities in Different AreasДокумент33 страницыCoca-Cola Porter's Five Forces Analysis and Diverse Value-Chain Activities in Different AreasRoula Jannoun67% (6)

- Brand HierarchyДокумент6 страницBrand HierarchyAshok GaurОценок пока нет

- Patagonia CaseДокумент1 страницаPatagonia CaseArmyandre Rossel SanchezОценок пока нет

- 4Ps Analysis of Pepsi and CocacolaДокумент22 страницы4Ps Analysis of Pepsi and CocacolaBrijesh Chandel86% (14)

- Value Chain Analysis ExplainedДокумент6 страницValue Chain Analysis Explainedresearcherss100% (1)

- Coca Cola A Report On Strategic ManagementДокумент47 страницCoca Cola A Report On Strategic ManagementMuhammad Yasir0% (1)

- Apple Inc. in 2012: SolutionДокумент5 страницApple Inc. in 2012: Solutionnish_d1100% (2)

- Industrial Visit Report Coca Cola: Institute of Management Sciences LucknowДокумент29 страницIndustrial Visit Report Coca Cola: Institute of Management Sciences Lucknowvishal kasaudhanОценок пока нет

- Group 3 - Aldens Products Inc.Документ6 страницGroup 3 - Aldens Products Inc.sunny singhОценок пока нет

- Apple Inc. Porter's Five Forces AnalysisДокумент6 страницApple Inc. Porter's Five Forces AnalysisMwangih LilianОценок пока нет

- Loblaw SWOT Analysis Canadian Grocery GiantДокумент4 страницыLoblaw SWOT Analysis Canadian Grocery GiantluckyroberthoОценок пока нет

- Procter and GambleДокумент13 страницProcter and GambleMirco GiammarresiОценок пока нет

- Coca-Cola Quality ConsistencyДокумент12 страницCoca-Cola Quality ConsistencyJosef Jiao100% (1)

- Gap Inc Strategic Audit PDFДокумент16 страницGap Inc Strategic Audit PDFRauf RiksibayevОценок пока нет

- Value Chain Analysis of Coco ColaДокумент3 страницыValue Chain Analysis of Coco Colashraddha261193% (14)

- Assignment LululemonДокумент28 страницAssignment Lululemonkidszalor141250% (2)

- Coca-Cola Porter's 5 ForcesДокумент2 страницыCoca-Cola Porter's 5 ForcesManpreet SinghОценок пока нет

- Porter's Five Forces Analysis of Coca-Cola Reveals Medium Industry CompetitionДокумент2 страницыPorter's Five Forces Analysis of Coca-Cola Reveals Medium Industry CompetitionKenVictorinoОценок пока нет

- Company Overview Coca ColaДокумент29 страницCompany Overview Coca ColaHeran SiparaОценок пока нет

- Cola Wars ContinueДокумент1 страницаCola Wars ContinueFarrukh Ali UqailiОценок пока нет

- Porter's Five Forces in Action: Sample Analysis of Coca-ColaДокумент3 страницыPorter's Five Forces in Action: Sample Analysis of Coca-ColaSachi SurbhiОценок пока нет

- SWOT Coke PepsiДокумент14 страницSWOT Coke PepsiMing Ekpiya0% (1)

- Ipad User Guide (iOS 6.1)Документ137 страницIpad User Guide (iOS 6.1)Binyamin GoldmanОценок пока нет

- Pepsi On Strategic ManagmentДокумент28 страницPepsi On Strategic ManagmentAkki Seht100% (4)

- HWChapter13 Queing 2012Документ8 страницHWChapter13 Queing 2012Ming EkpiyaОценок пока нет

- Chap 8Документ16 страницChap 8Nikhil DedhiaОценок пока нет

- Homework CobitДокумент3 страницыHomework CobitMing EkpiyaОценок пока нет

- Vanity Fair - July 2014 USA PDFДокумент120 страницVanity Fair - July 2014 USA PDFCarlLxxОценок пока нет

- For Types of SalesДокумент2 страницыFor Types of SalesHaris HasanОценок пока нет

- Jetronics IndiaДокумент17 страницJetronics IndiaShikha TОценок пока нет

- 6BE003 Assessment 1 Report 2040721Документ30 страниц6BE003 Assessment 1 Report 2040721Kisan BhagatОценок пока нет

- ABM Students Beautify School Plant Box with Project BBДокумент10 страницABM Students Beautify School Plant Box with Project BBMiss RonaОценок пока нет

- 03.03 NV-FL PDFДокумент3 страницы03.03 NV-FL PDFRoibu MarcelОценок пока нет

- Dampak Digitalisasi Terhadap Peran Front Office Dalam Bisnis PerbankanДокумент12 страницDampak Digitalisasi Terhadap Peran Front Office Dalam Bisnis PerbankanGSI indonesiaОценок пока нет

- Company Introduction Marketing Plan OfHCG & HMGДокумент29 страницCompany Introduction Marketing Plan OfHCG & HMGwk babar100% (2)

- Applied Company BrochureДокумент8 страницApplied Company BrochureKarthi KeyanОценок пока нет

- Week 6 Parts of A Business LetterДокумент22 страницыWeek 6 Parts of A Business LetterMc HernanОценок пока нет

- Dustbin SensorsДокумент12 страницDustbin SensorsNikitha PaulsonОценок пока нет

- CORPORATE INCOME TAX (Answer Key)Документ5 страницCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarОценок пока нет

- Key Roles and Life CycleДокумент4 страницыKey Roles and Life CycleAmanОценок пока нет

- Ho 52Документ84 страницыHo 52Lavern P. SipinОценок пока нет

- SponsorshipДокумент15 страницSponsorshipAndrew BruceОценок пока нет

- Logistics Expenses - Seminar Paper II.Документ8 страницLogistics Expenses - Seminar Paper II.PetraОценок пока нет

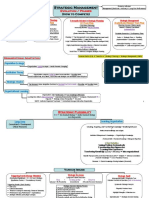

- Strategic Management - Chapter (1) - Modified Maps - Coloured - March 2021Документ4 страницыStrategic Management - Chapter (1) - Modified Maps - Coloured - March 2021ahmedgelixОценок пока нет

- Pleasantville v. Court of Appeals, G.R. No. 79688, February 1, 1996Документ2 страницыPleasantville v. Court of Appeals, G.R. No. 79688, February 1, 1996Al Jay MejosОценок пока нет

- RFP for AIIMS Guwahati Executing AgencyДокумент32 страницыRFP for AIIMS Guwahati Executing AgencyAmlan BiswalОценок пока нет

- 1 Fundamentals of Market Research 2 1Документ34 страницы1 Fundamentals of Market Research 2 1Reem HassanОценок пока нет

- Money TransДокумент30 страницMoney TransNataka NaturalОценок пока нет

- Comparative Valuation of Strides With Its Competitors Using Relative Valuation TechniqueДокумент26 страницComparative Valuation of Strides With Its Competitors Using Relative Valuation TechniqueVipin ChandraОценок пока нет

- FDI Advantages DisadvantagesДокумент4 страницыFDI Advantages DisadvantagesRaja Ahsan TariqОценок пока нет

- MM Elec 2Документ17 страницMM Elec 2juliesa villarozaОценок пока нет

- Critical Thinking Exercise: Page 216, Industrial Relations, C. S. Venkata RamanДокумент23 страницыCritical Thinking Exercise: Page 216, Industrial Relations, C. S. Venkata RamanPardeep DahiyaОценок пока нет

- Assignment On Labour Law PDFДокумент11 страницAssignment On Labour Law PDFTwokir A. Tomal100% (1)

- AUD 1206 Case Analysis RisksДокумент2 страницыAUD 1206 Case Analysis RisksRОценок пока нет

- MSTCONNECT 2023 National Technical SummitДокумент11 страницMSTCONNECT 2023 National Technical SummitElcie AldeaОценок пока нет