Академический Документы

Профессиональный Документы

Культура Документы

Quice Foods

Загружено:

khawarsherАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Quice Foods

Загружено:

khawarsherАвторское право:

Доступные форматы

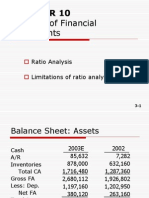

Ratio Analysis

Current Ratio Current Assets / Current Liabilities 0.543357 The current ratio is very low, this shows that the company cannot even meet half of its short term obligations, raising serious concerns weather this is a going concern or not. Quick Ratio Current assets (less Inventories and prepaid expenses) / Current Liabilities 21534156 (1350389+19304866+878901) (21534156/60747573) 0.354486 The quick ratio presents even a worse picture as compared to the current ratio, again posting an existential question for the firm Total Debt Ratio Total Debt / Total Assets 0.541077 The company has an ordinate amout of assets which are funded by debt, but the figure of assets are inflated by 100 Million of intangible asset, which is highly questionalbe taking out that figure changes the value of this ratio to. (92500073)/(170955622-100000000) 1.303633 Which means that the total assets cannot cover the total liabilities of the company. The debt is about 30% more than the actual worth of all the tangible assets of the company, including the account recivables which the company hopes to realize in the near future. Basic Earning per Share The financial statements show the earnings per share ratio, which is: 5894627/10687500 0.551544 This ratio shows that the company is having an earning on a per share basis, but in actual the company has a huge carried forward loss, which if factored in shows that the company proabably wont be able to give out a divident for atleast next 3 years. (Assuming the current profits %age growth is maintained) Gross Profit Ratio Gross profit ratio is: 13,630,954/52,158,800 0.261336 Net profit to sales ratio: The net profit to sales ratio is: 5,894,627/52,158,800 0.113013 11% net profit ratio is a normal profit ratio, but at this rate, it would take the company atleast 3 to 4 years to get rid of all the accumilated losses on its balance sheet.

ROI:

The ROI given by the company is: 5,894,627/170,955,622 3.448045 A rate of return that low does not even match with the simple deposit rate being offered by commercial banks in our economy, therefore investors might be tempted to withdraw their investments in the company. Inventory Turn over ratio: The inventory turnover ratio shows that at what speed assets are being converted into sales. It is given by: Cost of goods sold / Avg inventory at cost 52158800/((7145692+8052151)/2) 6.863974 This is a very low inventory turnover ratio for a company which manufactures products which can be considered in the FMCG sector. Total asset turn over: This ratio gives us an estimate of the firms assets in generating cash or revenues for the firm It is given by : Sales / Total Assets 52158800/170955622 0.305101 This shows that the company has a low turover, which is due to its very low capacity utilization.

able to

Вам также может понравиться

- Working Capital & Dividend PolicyДокумент9 страницWorking Capital & Dividend PolicyLipi Singal0% (1)

- Understanding Financial Ratios of Top FMCG CompaniesДокумент15 страницUnderstanding Financial Ratios of Top FMCG CompaniesVivek MaheshwaryОценок пока нет

- Analyzing Financial Ratios of JSW SteelДокумент17 страницAnalyzing Financial Ratios of JSW SteelPriyanka KoliОценок пока нет

- Finance Coursework FinalДокумент7 страницFinance Coursework FinalmattОценок пока нет

- Current Ratio / Working Capital Ratio: Law of Office Management and Accounting Accounting Ratios 6 December, 2005Документ4 страницыCurrent Ratio / Working Capital Ratio: Law of Office Management and Accounting Accounting Ratios 6 December, 2005Shazard MohammedОценок пока нет

- Fiancial AnalysisДокумент5 страницFiancial AnalysisLorena TudorascuОценок пока нет

- CH 13 SM FAF5eДокумент48 страницCH 13 SM FAF5eSonora Nguyen100% (1)

- Analysis On Nestlé Financial Statements 2017Документ8 страницAnalysis On Nestlé Financial Statements 2017Fred The FishОценок пока нет

- Analysis of Growth and Sustainable EarningsДокумент28 страницAnalysis of Growth and Sustainable EarningsJatin NandaОценок пока нет

- Tata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & InterpretationДокумент31 страницаTata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & Interpretationaditya_sanghviОценок пока нет

- Fundamentals of Financial Management Chapter 03Документ51 страницаFundamentals of Financial Management Chapter 03khurramОценок пока нет

- Profitability AnalysisДокумент9 страницProfitability AnalysisAnkit TyagiОценок пока нет

- Workbook On Ratio AnalysisДокумент9 страницWorkbook On Ratio AnalysisZahid HassanОценок пока нет

- Analyzing Financial Ratios of a CompanyДокумент35 страницAnalyzing Financial Ratios of a Companyfrasatiqbal100% (1)

- Financial Analysis of Idea: Case Studies in Telecom BusinessДокумент8 страницFinancial Analysis of Idea: Case Studies in Telecom BusinessKrishnakant NeekhraОценок пока нет

- Financial Analysis of L&TДокумент7 страницFinancial Analysis of L&TPallavi ChoudharyОценок пока нет

- Return On EquityДокумент6 страницReturn On EquitySharathОценок пока нет

- Financial Ratios Liquidity Ratios: Working CapitalДокумент9 страницFinancial Ratios Liquidity Ratios: Working CapitalLen-Len CobsilenОценок пока нет

- Case FinalДокумент11 страницCase FinalshakeelsajjadОценок пока нет

- APM. A4. 1200 WordsДокумент9 страницAPM. A4. 1200 WordsSadiaОценок пока нет

- Financial Analysis of HABIB BANK 2006-2008Документ17 страницFinancial Analysis of HABIB BANK 2006-2008Waqas Ur RehmanОценок пока нет

- Ratios Gross Profit MarginДокумент7 страницRatios Gross Profit MarginBrill brianОценок пока нет

- Financial Management AssignmentДокумент16 страницFinancial Management AssignmentNishant goyalОценок пока нет

- Financial AnalysisДокумент8 страницFinancial AnalysisHANIS NAZIRAHОценок пока нет

- Financial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosДокумент15 страницFinancial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosdjmondieОценок пока нет

- Ratio Analysis of ItcДокумент3 страницыRatio Analysis of ItcprateekОценок пока нет

- National Bank of Pakistan: InterpretationДокумент3 страницыNational Bank of Pakistan: InterpretationAhsan QaisraniОценок пока нет

- Reasons For Collapse of BanksДокумент25 страницReasons For Collapse of BanksMichael VuhaОценок пока нет

- Ratio Analysis - TMДокумент14 страницRatio Analysis - TMsathishKumarОценок пока нет

- Debt Ratios: Interest Coverage RatioДокумент26 страницDebt Ratios: Interest Coverage RatioShivashankar KarakalleОценок пока нет

- PNB Ratio AnalysisДокумент15 страницPNB Ratio AnalysisNiraj SharmaОценок пока нет

- NPV, IRR and Financial Evaluation for Waste Collection ContractДокумент9 страницNPV, IRR and Financial Evaluation for Waste Collection ContractTwafik MoОценок пока нет

- Types of Ratio Analysis Explained in DepthДокумент4 страницыTypes of Ratio Analysis Explained in DepthkonyatanОценок пока нет

- Analysis On Nestlé Financial Statements 2017Документ7 страницAnalysis On Nestlé Financial Statements 2017Putu DenyОценок пока нет

- Measuring and Evaluating Financial PerformanceДокумент12 страницMeasuring and Evaluating Financial PerformanceNishtha SisodiaОценок пока нет

- An Analysis of The Financial Statement of Godrej India LTDДокумент8 страницAn Analysis of The Financial Statement of Godrej India LTDSachit MalikОценок пока нет

- Liquidity Solvency Profitability RatiosДокумент10 страницLiquidity Solvency Profitability RatiosMark Lyndon YmataОценок пока нет

- Return On Assets (ROA) : ROA Is An Indicator of How Profitable A Company Is Relative To ItsДокумент4 страницыReturn On Assets (ROA) : ROA Is An Indicator of How Profitable A Company Is Relative To ItsTanya RahmanОценок пока нет

- AmgenДокумент15 страницAmgenDavid Rivera0% (1)

- Ulas in Customer Financial Analysis: Liquidity RatiosДокумент9 страницUlas in Customer Financial Analysis: Liquidity RatiosVarun GandhiОценок пока нет

- Types of Financial Ratios: Their Analysis and Interpretation - Penpoin.Документ17 страницTypes of Financial Ratios: Their Analysis and Interpretation - Penpoin.John CollinsОценок пока нет

- Ratio Analysis of Sainsbury PLCДокумент4 страницыRatio Analysis of Sainsbury PLCshuvossОценок пока нет

- Godrej ratio analysis reveals financial risksДокумент14 страницGodrej ratio analysis reveals financial risksdhaksh saranОценок пока нет

- Task (3.4) Calculate RatiosДокумент7 страницTask (3.4) Calculate RatiosAnonymous xOqiXnW9Оценок пока нет

- Analyze key financial ratios to assess business performanceДокумент18 страницAnalyze key financial ratios to assess business performanceAhmed AdelОценок пока нет

- Anamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaДокумент24 страницыAnamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaAnamika ChakrabartyОценок пока нет

- Ratio AnalysisДокумент11 страницRatio Analysisdanita88Оценок пока нет

- Solutions To Chapter 12Документ8 страницSolutions To Chapter 12Luzz LandichoОценок пока нет

- Financial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedДокумент41 страницаFinancial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedGovindraj PrabhuОценок пока нет

- Feeding The Chinese Via ReutersДокумент40 страницFeeding The Chinese Via Reutersshawn2207Оценок пока нет

- Ratio AnalysisДокумент8 страницRatio AnalysisikramОценок пока нет

- Ratio Analysis Interview QuestionsДокумент4 страницыRatio Analysis Interview QuestionsMuskanDodejaОценок пока нет

- Ratios and Formulas in Customer Financial AnalysisДокумент10 страницRatios and Formulas in Customer Financial Analysisxmuhammad_ali100% (1)

- ISM Chapter 05Документ40 страницISM Chapter 05Maliha JahanОценок пока нет

- Fortune TellerДокумент3 страницыFortune TellerbharatОценок пока нет

- Long-Term Financial Planning and Growth: Answers To Concepts Review and Critical Thinking Questions 1Документ33 страницыLong-Term Financial Planning and Growth: Answers To Concepts Review and Critical Thinking Questions 1RabinОценок пока нет

- Financial Ratio AnalysisДокумент6 страницFinancial Ratio AnalysishraigondОценок пока нет

- 03 CH03Документ41 страница03 CH03Walid Mohamed AnwarОценок пока нет

- 58 Ratio Analysis Techniques PDFДокумент8 страниц58 Ratio Analysis Techniques PDF9raahuulОценок пока нет

- Yunnan Baiyao by Khawar SherДокумент1 страницаYunnan Baiyao by Khawar SherkhawarsherОценок пока нет

- Comparing Retail AttributesДокумент3 страницыComparing Retail AttributeskhawarsherОценок пока нет

- SPSSДокумент8 страницSPSSkhawarsherОценок пока нет

- COSO implementation and the role of compliance functionДокумент39 страницCOSO implementation and the role of compliance functionkhawarsher100% (1)

- Assign 3, CB Fall 2012, Self Analysis, Zaid NizamiДокумент4 страницыAssign 3, CB Fall 2012, Self Analysis, Zaid NizamikhawarsherОценок пока нет

- Ch8 000Документ83 страницыCh8 000khawarsherОценок пока нет

- Ch8 000Документ83 страницыCh8 000khawarsherОценок пока нет

- COSO Update Sept 2008Документ22 страницыCOSO Update Sept 2008khawarsherОценок пока нет

- Contingencies and CommitmentsДокумент3 страницыContingencies and CommitmentskhawarsherОценок пока нет

- Slavery in PakistanДокумент14 страницSlavery in PakistankhawarsherОценок пока нет

- SPSS Exercise - Case StudyДокумент22 страницыSPSS Exercise - Case StudykhawarsherОценок пока нет

- Case Study AnalysisДокумент21 страницаCase Study AnalysiskhawarsherОценок пока нет

- Leading Quitely Book ReviewДокумент10 страницLeading Quitely Book ReviewkhawarsherОценок пока нет

- Zaid NizamiДокумент18 страницZaid NizamikhawarsherОценок пока нет

- Zaid NizamiДокумент18 страницZaid NizamikhawarsherОценок пока нет

- SM-Case Analysis OutlineДокумент2 страницыSM-Case Analysis OutlinekhawarsherОценок пока нет

- Zaid NizamiДокумент18 страницZaid NizamikhawarsherОценок пока нет

- Zaid NizamiДокумент18 страницZaid NizamikhawarsherОценок пока нет

- Market Segmentation, Frozen FoodsДокумент5 страницMarket Segmentation, Frozen FoodskhawarsherОценок пока нет

- Leading Quitely Book ReviewДокумент10 страницLeading Quitely Book ReviewkhawarsherОценок пока нет