Академический Документы

Профессиональный Документы

Культура Документы

A Research Project On Impact of FII: On Money Market

Загружено:

samruddhi_khale0 оценок0% нашли этот документ полезным (0 голосов)

229 просмотров9 страницThis research project examines the impact of foreign institutional investments (FII) on the Indian money market. It analyzes changes in FII investment trends and how they affect the Indian economy. Money market instruments are characterized by short-term borrowing and lending with low credit risk and high liquidity. The data presented shows FII purchase and sale activity in Indian debt and equity markets from 1999-2008, with higher net investments generally during periods of economic growth.

Исходное описание:

fii's impact on indian stock market

Оригинальное название

finance assignment

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis research project examines the impact of foreign institutional investments (FII) on the Indian money market. It analyzes changes in FII investment trends and how they affect the Indian economy. Money market instruments are characterized by short-term borrowing and lending with low credit risk and high liquidity. The data presented shows FII purchase and sale activity in Indian debt and equity markets from 1999-2008, with higher net investments generally during periods of economic growth.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

229 просмотров9 страницA Research Project On Impact of FII: On Money Market

Загружено:

samruddhi_khaleThis research project examines the impact of foreign institutional investments (FII) on the Indian money market. It analyzes changes in FII investment trends and how they affect the Indian economy. Money market instruments are characterized by short-term borrowing and lending with low credit risk and high liquidity. The data presented shows FII purchase and sale activity in Indian debt and equity markets from 1999-2008, with higher net investments generally during periods of economic growth.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

A Research Project on

Impact of FII: On Money

Market

Guided By Submitted By

Prof. Rekha Acharya Samruddhi Khale

MBA(FS) I Sem

Introduction

This assignment in a way reveals the dependence

of Indian Money Markets on FII investments. The

project deals with changes in investment trends

in the Indian money market with respect to

changes in policies of government regarding FII

investments, and thereby determines what affects the

Indian economy and how it does so.

Foreign Institutional Investor (FII) is used to denote

an investor - mostly of the form of an institution or

entity, which invests money in the financial markets of

a country different from the one where in the institution

or entity was originally incorporated.

Characteristics of Money Market

Instruments:

Short-term borrowing

and lending.

Low credit risk.

High liquidity.

High volume of

lending and

borrowing.

Market volatility leads investors to favor money

market funds:

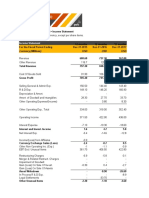

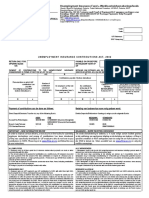

Reporting Debt/Equity Gross Gross Net Net

Purchases(Rs Sales(Rs Investment Investment

Date Crores) Crores) (Rs Crores) US($) million

01-DEC-2008 Equity 2157.60 1738.20 419.40 104.00

Debt 285.80 0.00 285.80 70.80

02-DEC-2008 Equity 1663.30 1509.40 153.90 38.10

Debt 322.30 573.60 (251.30) (62.30)

03-DEC-2008 Equity 855.90 1175.50 (319.60) (79.20)

Debt 401.90 166.40 235.50 58.40

04-DEC-2008 Equity 875.50 1362.10 (486.60) (120.60)

Debt 174.50 193.60 (19.10) (4.70)

05-DEC-2008 Equity 1779.50 1331.20 448.30 111.10

Debt 897.50 255.70 641.70 159.10

08-DEC-2008 Equity 1182.10 1130.90 51.20 12.70

Debt 151.90 315.70 (163.80) (40.60)

Total for Equity 8513.90 8247.30 266.60 66.10

December Debt 2233.90 1505.00 728.80 180.70

Total for 2008 Equity 698764.90 753235.50 (54470.60) (13502.90)

Debt 41298.10 29424.10 11874.00 2943.50

Grand Total Equity 2843081.40 2614083.70 228997.80 52826.20

Debt 115681.00 87957.60 27723.60 6568.80

FII sale/purchase activity for the past years on an

annual basis

Date Equity Debt

Gross Gross Sales Net Invest. Gross Gross Sales Net Invest.

Purchase (Rs. Cr) (Rs. Cr) Purchase (Rs. Cr) (Rs. Cr)

(Rs. Cr) (Rs. Cr)

2007 807511.90 737427.9 70084.00 31014.30 21957.30 9057.00

475181.60 438788.50 36393.10 8693.20 5937.30 2755.90

2006

284354.10 237642.20 46711.90 6890.90 12418.00 -5525.10

2005

184608.40 146396.00 38212.40 12478.70 10572.10 1906.60

2004

94122.20 63385.10 30737.10 10956.90 6363.90 4593.00

2003

46854.10 43272.80 3581.30 2970.60 2540.83 429.77

2002

47340.60 34558.30 12752.90 5346.90 4828.30 518.80

2001

74791.50 68421.60 6509.90 2834.80 2735.40 106.00

2000

36395.50 29817.10 6578.10 817.70 698.80 118.60

1999

Conclusion

The debt market is often considered to be

a better indicator of the economy than the

equity market.

During times of economic uncertainty and high

market volatility, investors tend to prefer money

market funds, because they are relatively low

risk and have lower advisory fees than equity

funds.

Market volatility and falling interest rates in

2007 contributed to a 36% increase in money

market mutual funds.

Вам также может понравиться

- Financial Ratio Analysis - BMДокумент18 страницFinancial Ratio Analysis - BMKrishnamoorthy VijayalakshmiОценок пока нет

- For The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsДокумент5 страницFor The Year Ended Year 1 Year 2 Year 3 Year 4: Income Statement ParticularsTanya SinghОценок пока нет

- Idea InnovationДокумент14 страницIdea Innovationnilufar nourinОценок пока нет

- Amdocs LTDДокумент4 страницыAmdocs LTDsommer_ronald5741Оценок пока нет

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Документ11 страницWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalОценок пока нет

- ASghar Ali OD Final ProjectДокумент10 страницASghar Ali OD Final ProjectAbdul HadiОценок пока нет

- Consolidated Balance Sheet (Rs. in MN)Документ24 страницыConsolidated Balance Sheet (Rs. in MN)prernagadiaОценок пока нет

- SBM Asts SummanryДокумент2 страницыSBM Asts SummanryMohammed FazlullahОценок пока нет

- Maruti Suzuki Financial StatementДокумент5 страницMaruti Suzuki Financial StatementMasoud AfzaliОценок пока нет

- Equity 1Документ6 страницEquity 1venkyquietОценок пока нет

- Maruti Suzuki (Latest)Документ44 страницыMaruti Suzuki (Latest)utskjdfsjkghfndbhdfnОценок пока нет

- Balancee SheetДокумент2 страницыBalancee SheetKarthik KarthikОценок пока нет

- I Practice of Horizontal & Verticle Analysis Activity IДокумент3 страницыI Practice of Horizontal & Verticle Analysis Activity IZarish AzharОценок пока нет

- I Practice of Horizontal & Verticle Analysis Activity IДокумент3 страницыI Practice of Horizontal & Verticle Analysis Activity IZarish AzharОценок пока нет

- Afa Assignment: Ratio AnalysisДокумент7 страницAfa Assignment: Ratio AnalysisKathir VelОценок пока нет

- Kshitij Goyal FM Ass 1 MARUTI SUZUKI INDIA LTDДокумент7 страницKshitij Goyal FM Ass 1 MARUTI SUZUKI INDIA LTDAngle PriyaОценок пока нет

- Project On JSW Financial Statement AnalysisДокумент24 страницыProject On JSW Financial Statement AnalysisRashmi ShuklaОценок пока нет

- Chapter Iv - Data Analysis and Interpretation: Property #1Документ32 страницыChapter Iv - Data Analysis and Interpretation: Property #1karthiga312Оценок пока нет

- Chapter Iv - Data Analysis and Interpretation: Property #1Документ12 страницChapter Iv - Data Analysis and Interpretation: Property #1karthiga312Оценок пока нет

- Bharti Airtel - Consolidated Balance Sheet Telecommunications - Service Consolidated Balance Sheet of Bharti Airtel - BSE: 532454, NSE: BHARTIARTLДокумент2 страницыBharti Airtel - Consolidated Balance Sheet Telecommunications - Service Consolidated Balance Sheet of Bharti Airtel - BSE: 532454, NSE: BHARTIARTLrohansparten01Оценок пока нет

- Capital StructureДокумент4 страницыCapital StructureBindiya SinhaОценок пока нет

- Grace PresentationДокумент21 страницаGrace PresentationLeonardus FelixОценок пока нет

- Friday November 26, 2010: Total Turnover (RS.)Документ14 страницFriday November 26, 2010: Total Turnover (RS.)Don Nuwan DanushkaОценок пока нет

- BhartiAndMTN FinancialsДокумент10 страницBhartiAndMTN FinancialsGirish RamachandraОценок пока нет

- Project Title: Financial Modeling and Analysis of 50 Flats Housing Project in Gurgaon, Haryana INДокумент13 страницProject Title: Financial Modeling and Analysis of 50 Flats Housing Project in Gurgaon, Haryana INw_fibОценок пока нет

- All Number in Thousands)Документ7 страницAll Number in Thousands)Lauren LoshОценок пока нет

- Fungsi 2005 2006 2007 2008 2009: Anggaran Pendapatan Dan Belanja Negara (Miliar Rupiah)Документ3 страницыFungsi 2005 2006 2007 2008 2009: Anggaran Pendapatan Dan Belanja Negara (Miliar Rupiah)Berta Westi PanjaitanОценок пока нет

- Financial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak AggarwalДокумент6 страницFinancial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak Aggarwalsehrawat009mОценок пока нет

- Financial Management-Ii Assignment: Submitted by Nishant Kumar (47) Priyanka Dwivedi (48) Nitish RoyДокумент6 страницFinancial Management-Ii Assignment: Submitted by Nishant Kumar (47) Priyanka Dwivedi (48) Nitish RoyNishant KumarОценок пока нет

- Oct2010 Question 2Документ3 страницыOct2010 Question 2Izzah AmalinОценок пока нет

- Area 12 Appraisal CalculationsДокумент6 страницArea 12 Appraisal Calculationslusayo06Оценок пока нет

- Maruti-SuzukiДокумент20 страницMaruti-Suzukihena02071% (7)

- Weekly Special Report of CapitalHeight 23 July 2018Документ11 страницWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalОценок пока нет

- Financial Statement AnalysisДокумент25 страницFinancial Statement AnalysisAldrin CustodioОценок пока нет

- Vedanta DCFДокумент50 страницVedanta DCFmba23subhasishchakrabortyОценок пока нет

- Cab Case StudyДокумент7 страницCab Case StudyPriyanka GoenkaОценок пока нет

- 2012-Noman TextileДокумент3 страницы2012-Noman TextileShahadat Hossain ShahinОценок пока нет

- Maruti Suzuki Financial Statment NewДокумент4 страницыMaruti Suzuki Financial Statment NewMasoud Afzali100% (1)

- Daily Report 01 10 4Документ87 страницDaily Report 01 10 4Gihan PereraОценок пока нет

- PWC Challenge 2020 Round 1 Cure& DatasetДокумент5 страницPWC Challenge 2020 Round 1 Cure& Datasetsagar vaziraniОценок пока нет

- Account Managing .WIPROДокумент4 страницыAccount Managing .WIPROshradddhaОценок пока нет

- Fa - Assignment LaxmiДокумент36 страницFa - Assignment Laxmilaxmi joshiОценок пока нет

- Analisis Lap Keu LPK (New)Документ24 страницыAnalisis Lap Keu LPK (New)mccanmarinaОценок пока нет

- Madoff Statements of Financial Condition For Fiscal Years Ended 10/31/02 To 10/31/07Документ4 страницыMadoff Statements of Financial Condition For Fiscal Years Ended 10/31/02 To 10/31/07jpeppard100% (2)

- Flow Valuation, Case #KEL778Документ20 страницFlow Valuation, Case #KEL778SreeHarshaKazaОценок пока нет

- Financial Ratio AnalysisДокумент6 страницFinancial Ratio AnalysisSatishОценок пока нет

- Pertemuan 45 2-3.b.-NERACAДокумент24 страницыPertemuan 45 2-3.b.-NERACAMuna RismaОценок пока нет

- DR Reddy Lab 5 Year DataДокумент4 страницыDR Reddy Lab 5 Year Datashishir5087Оценок пока нет

- Akshat SarvaiyaДокумент36 страницAkshat SarvaiyaAchal SharmaОценок пока нет

- Call OI Strike Put OI Call Value Put Value Total StrikeДокумент4 страницыCall OI Strike Put OI Call Value Put Value Total Striked_narnoliaОценок пока нет

- Sales and Profits - 2018 First HalfДокумент97 страницSales and Profits - 2018 First HalfSharli GuptaОценок пока нет

- Naztech - 27.01.2021 - IrrДокумент81 страницаNaztech - 27.01.2021 - IrrRashan Jida ReshanОценок пока нет

- Financial ReportДокумент441 страницаFinancial ReportJosé Manuel EstebanОценок пока нет

- Assignment Data UsagesДокумент2 страницыAssignment Data UsagesjgukykОценок пока нет

- Data Bodie Industrial Supply V1Документ10 страницData Bodie Industrial Supply V1Giovani R. Pangos RosasОценок пока нет

- Daily Report 31.12Документ59 страницDaily Report 31.12Prabu DoraisamyОценок пока нет

- Trend of Deposit March 2017Документ16 страницTrend of Deposit March 2017Md. ZubaerОценок пока нет

- Bharti Airtel BalsheetДокумент2 страницыBharti Airtel BalsheetBrock LoganОценок пока нет

- Multi-Party and Multi-Contract Arbitration in the Construction IndustryОт EverandMulti-Party and Multi-Contract Arbitration in the Construction IndustryОценок пока нет

- Human Resource ManagementДокумент34 страницыHuman Resource Managementsamruddhi_khale100% (3)

- Human Resource ManagementДокумент14 страницHuman Resource Managementsamruddhi_khale100% (3)

- Human Resource ManagementДокумент18 страницHuman Resource Managementsamruddhi_khale67% (3)

- Monetary Policies by Rbi in RecessionДокумент21 страницаMonetary Policies by Rbi in Recessionsamruddhi_khaleОценок пока нет

- Alabama LawsuitДокумент8 страницAlabama LawsuitSteveОценок пока нет

- Fortimanager Cli 520 PDFДокумент243 страницыFortimanager Cli 520 PDFMarcelo Rodriguez CattalurdaОценок пока нет

- American Rubber V CIR, 1975Документ12 страницAmerican Rubber V CIR, 1975Rald RamirezОценок пока нет

- Chapter 04 - Consolidated Financial Statements and Outside OwnershipДокумент21 страницаChapter 04 - Consolidated Financial Statements and Outside OwnershipSu EdОценок пока нет

- NJDEP Data MinerДокумент3 страницыNJDEP Data Minermariner12Оценок пока нет

- Pcd!3aportal Content!2fcom - Sap.portal - Migrated!2ftest!2fcom - ril.RelianceCard!2fcom - RilДокумент16 страницPcd!3aportal Content!2fcom - Sap.portal - Migrated!2ftest!2fcom - ril.RelianceCard!2fcom - Rildynamic2004Оценок пока нет

- 4 Equatorial Realty Development, Inc. vs. Mayfair Theater, Inc.Документ2 страницы4 Equatorial Realty Development, Inc. vs. Mayfair Theater, Inc.JemОценок пока нет

- Position, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inДокумент6 страницPosition, Appointment & Powers of Directors Under Companies Act, 2013 - Taxguru - inamrit singhОценок пока нет

- HALILI, Danielle Marie, G: Syllabus IssueДокумент2 страницыHALILI, Danielle Marie, G: Syllabus IssueadeeОценок пока нет

- State vs. Johnny Church (Drew Blahnik)Документ15 страницState vs. Johnny Church (Drew Blahnik)Michael Howell100% (1)

- SBD Apparel Limited v. A7 Fitness - ComplaintДокумент22 страницыSBD Apparel Limited v. A7 Fitness - ComplaintSarah Burstein100% (1)

- Re-Engaging The Public in The Digital Age: E-Consultation Initiatives in The Government 2.0 LandscapeДокумент10 страницRe-Engaging The Public in The Digital Age: E-Consultation Initiatives in The Government 2.0 LandscapeShefali VirkarОценок пока нет

- Womens Voting Rights Sign On LetterДокумент4 страницыWomens Voting Rights Sign On LetterMatthew HamiltonОценок пока нет

- Electronic Reservation Slip (ERS) : 4236392455 12704/falaknuma Exp Ac 2 Tier Sleeper (2A)Документ2 страницыElectronic Reservation Slip (ERS) : 4236392455 12704/falaknuma Exp Ac 2 Tier Sleeper (2A)SP BabaiОценок пока нет

- The Impact On Small Business of LegislatДокумент329 страницThe Impact On Small Business of LegislatKamal JaswalОценок пока нет

- Application of ATCCДокумент3 страницыApplication of ATCCmayur_lanjewarОценок пока нет

- Form - U17 - UIF - Payment AdviceДокумент2 страницыForm - U17 - UIF - Payment Advicesenzo scholarОценок пока нет

- David Misch Probable Cause AffidavitДокумент2 страницыDavid Misch Probable Cause AffidavitNational Content DeskОценок пока нет

- RangeRover P38Документ75 страницRangeRover P3812logapoloОценок пока нет

- Doing BusinessДокумент99 страницDoing Businesscmsc1Оценок пока нет

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceДокумент29 страницPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceBowthen BoocОценок пока нет

- Ellen G. White's Writings - Their Role and FunctionДокумент108 страницEllen G. White's Writings - Their Role and FunctionAntonio BernardОценок пока нет

- Agael Et - Al vs. Mega-Matrix (Motion For Reconsideration)Документ5 страницAgael Et - Al vs. Mega-Matrix (Motion For Reconsideration)John TorreОценок пока нет

- Auditing Theory: All of TheseДокумент7 страницAuditing Theory: All of TheseKIM RAGAОценок пока нет

- New YESДокумент345 страницNew YESnaguficoОценок пока нет

- MtknfcdtaДокумент1 страницаMtknfcdtaMuzaffar HussainОценок пока нет

- Lucidchart OctubreДокумент2 страницыLucidchart OctubreHenry M Gutièrrez SОценок пока нет

- PROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsДокумент2 страницыPROBLEM 1: How Should The 100,000 Be Distributed To The Following CreditorsMitch Tokong MinglanaОценок пока нет

- Yambao Vs ZunigaДокумент2 страницыYambao Vs ZunigaMaria Cherrylen Castor QuijadaОценок пока нет

- Deed of Sale of Large CattleДокумент3 страницыDeed of Sale of Large CattleSean Arcilla100% (3)