Академический Документы

Профессиональный Документы

Культура Документы

The Gold Solution Draft 1

Загружено:

api-232344608Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Gold Solution Draft 1

Загружено:

api-232344608Авторское право:

Доступные форматы

Running Head: THE GOLD SOLUTION

The Gold Solution Davon Long Rowan-Cabarrus Community College

THE GOLD SOLUTION

The Gold Solution Gold monetary policies are policies that establish a relationship between gold and a countries currency (Kenwood & Loughead, 2002). In the United States, several gold monetary policies were utilized from 1792 until 1971 (Paul, 2011). One specific form of gold monetary policy utilized in America was the gold standard, which connected the value of the nations currency supply to the exact weight and value of gold. Under this policy gold could be used directly or indirectly to purchase goods and services. The American economy under various forms of gold monetary policies experienced the lowest annual inflation and cost of living rates in history due to the long-term price stability that gold provided (White, 2008). The fact that gold is a limited resource means that it cannot be printed in mass quantities, which in turn keeps the demand for gold high and prevents the worldwide value of gold from decreasing dramatically. This characteristic of gold monetary policy restricts the rise of inflation, which is simply the reduction in the purchasing power of currency due to the rise in the price of goods and services. In 1971, all of the wonderful benefits of gold monetary policies were eliminated under the Nixon administration. President Nixons monetary policies severed all ties with gold and moved on to the current fiat monetary system, which regulates all American currency today. Under fiat monetary policies, all of the cash money or treasury notes in circulation are secured by the full faith and credit of the federal government (Elwell, 2011). Fiat money has no relationship to anything of extrinsic value and it can be printed at will. Forty-two years after the elimination of gold monetary polices the economy has deteriorated greatly. Gas prices have increased from 36 cents per gallon in 1971 to the current average of $3.63 cents per gallon.

THE GOLD SOLUTION

National public debt has risen to over sixteen trillion dollars and the real unemployment rate is at 14.3% (Diamond, 2013). Treasury notes or greenbacks have lost 80% of their value. The overall price of goods and services has skyrocketed by 1.4% over the past year. Everyday consumers like you and me are suffering from excess government spending and an inflated dollar. Based on this information and the historical records from the past it is very clear to me that the United States government must utilize gold monetary policies to contain the national debt and improve the economy. Implementing gold monetary policies can reduce the current inflation rates and disrupt the rise in consumer pricing. Analyzing inflation is one of the best ways to find out how weak or strong a nations economy is because it affects multiple economic elements such as the stock market, consumer goods, currency, unemployment, interest, and tax rates. In an extensive study, involving 15 countries financial experts at the Federal Reserve Bank of Minneapolis found that inflation rates where lower under gold monetary policies than under fiat monetary policies (Rolnick & Weber, 1998). The study revealed that annual inflation rates rose from 1.75 percent to 9.717 percent under the fiat money system. One reason for this is that gold monetary policies add extrinsic value to the dollar due to the fact the real price of gold remains steady worldwide (Paul, 2011). Connecting the value of gold to the value of the dollar prevents the long-term inflation of American currency because the purchasing power of gold cannot be manipulated by one country or government entity. Gold policies also reduce inflation by limiting the governments currency production to the percentage of all its gold reserves. Arthur J. Rolnick, former vice president of the Minneapolis Federal Reserve bank stated, that the correlation of currency growth to inflation under the fiat monetary system can only be attributed to the more liberal currency printing atmosphere that exist under this policy.

THE GOLD SOLUTION Utilizing gold monetary policies in America can strengthen the economy and reduce the real unemployment rate. Economic growth is defined as the increase in productivity of a

countries goods and services over time (Paul, 2011). Long-term economic growth is measured by a countrys gross domestic product, which is the total market value of all complete goods and services produced under a countries economic system. The Gross domestic product measurement tool is the king of all economic measurement strategies and has been in use by the federal government for over 69 years. Last year Charles Kadlec, a 30-year senior investment manager and former economic advisor to late Senator Jack Kemp conducted research on economic growth under the fiat and gold monetary systems. Statistics from the research revealed that the economy grew at a rate of 3.9% annually during the 179-year era of Americas gold monetary policies. Forty years under the fiat system has slowed economic growth to just 2.8% annually (Benko & Kadlec, 2012). This information is very significant because it reveals that the American economy is 8 trillion dollars smaller due to the negative effects of the fiat monetary system. Eight trillion dollars would have reduced the national debt by almost half. Economic experts also estimate that 8 trillion dollar would increase the median family income from fifty thousand dollars annually to seventy thousand dollars annually (Benko& Kadlec, 2012). The long-term price stability that gold monetary policies provide creates an environment where investors and companies feel relaxed and optimistic. Increased investment equates to increased employment. Former Presidential Candidate and Republican Senator Ron Paul conducted a study on unemployment in 1981 ten years after the end of gold monetary policies. In the study, it was found that the unemployment rate increased from 5.5% in 1971 to 8.9% in 1981 (Paul, 2011). High annual inflation and interest rates that are associated with credit-based currency creates an

THE GOLD SOLUTION environment where business executives feel they have to cut back on spending because of the decreased purchasing power of their capital. Returning to Gold monetary policies can stabilize the national debt and limit the federal governments ability to increase it. National debt is defined as the total amount of financial obligations owed by the federal government (Kenwood & Loughead, 2002). The financial obligations are created when the government sales interest bearing products such as bonds, treasury notes and treasury bills. The money raised from the sale of these instruments finances the government after it goes over any predetermined budget (Paul, 2011). Generally, the money raised is classified as nothing more than a huge loan that must be paid back with interest. Currently the government owes over sixteen trillion dollars in loans. From 1971 to 2003, financial experts found that the national debt increased from 406 billion dollars to 6.8 trillion dollars under the fiat monetary system. (Paul, 2011). Under certain gold monetary policies, the federal government currency printing would be limited to a percentage of gold reserves held in repositories nationwide. The restraints placed on currency printing would reduce the amount of treasury products sold due to the fact that American dollar is the primary means of purchasing government debt (Benko & Kadlec 2012) . A reduction in treasury products sold translates into the containment of the national debt. Critics of gold monetary policies believe that a well-managed fiat monetary system can restrain inflation better than a gold monetary system. This belief is based on the fiat monetary policy decisions of former Federal Reserve Chairman Paul Volker who reduced inflation from 13.5 % to 3.2% in 1983 (Makin, 2012). However, information discrediting this claim was disclosed earlier when a study revealed that inflation rates never increased more than 1.75% under gold monetary policies (Rolnick & Weber, 1998). Critics also say that under gold

THE GOLD SOLUTION monetary policies economic growth can outpace the currency supply since money cannot be

created and circulated until more gold is obtained to secure it. However, this can be countered by implementing gold monetary policies that only restrict government spending to a percentage of gold reserves instead of policies that require gold to determine the value of currency. The multitude of benefits that gold monetary policies have contributed to the American economy in the past cannot be denied. Historical records are full of evidence suggesting that gold monetary policies can fix the current strained economy and contain the national debt. It is clear that the current credit based monetary system in place is a product of greedy politicians and bankers who have no regard for the welfare of average working class citizens. Gold monetary policies must be implemented so that the American economy can experience strong economic growth, low inflation rates, reduced unemployment and reduced federal government debt.

THE GOLD SOLUTION References Benko, R ., & Kadlec , C . (2012). The 21st Century Gold Standard: For Prosperity, Security, and Liberty. Diamond, D. (2013). Why The Real Unemployment Rate Is Higher Than You Think. Forbes.Retreived from http://www.forbes.com/sites/dandiamond/2013/07/05/why-thereal-unemployment-rate-is-higher-than-you-think/ Elwell, K. (2011). Brief History of the Gold Standard in the United States. Congressional Research Service 2-18. Retrieved from http://gold-standard.procon.org/sourcefiles/crsbrief-history-of-gold-standard-in-us.pdf Kenwood, A. G., & Lougheed, A. L. (2002). The Growth of the International Economy 18202000: An Introductory Text. London: Routlege Makin, H., M. (2012). All That Glitters: A Primer on the Gold Standard. American Enterprise Institute for Public Policy Research 1-6. Retrieved from http://goldstandard.procon.org/sourcefiles/all-that-glitters-a-primer-on-the-gold-standard.pdf Paul, R. (2011). The Case for Gold A minority Report of the U.S. Gold Commission (2and ed.). Auburn, AL. Ludwig von Mises Institute Rolnick, J., A. & Weber, E., W. (1998). Money, Inflation, and Output Under Fiat and

Commodity Standards. Federal Reserve Bank of Minneapolis Quarterly Review. 22 (2) 28. Retrieved from http://goldstandard.procon.org/sourcefiles/money_inflation_output_fiat_commodity_rolnick.pdf White, H., W. (2008). Is the Gold Standard Still the Gold Standard among Monetary Systems? Cato institute 100, 2-8. Retrieved from http://goldstandard.procon.org/sourcefiles/gold_standard_still_gold_standard_white.pdf

THE GOLD SOLUTION

Вам также может понравиться

- Pre Draft Gold SolutionДокумент6 страницPre Draft Gold Solutionapi-232344608Оценок пока нет

- Fools Gold: Could Gold Perform Better Than The U.S. Dollar As A Currency?Документ9 страницFools Gold: Could Gold Perform Better Than The U.S. Dollar As A Currency?fbates3Оценок пока нет

- Emad A Zikry VAAM Opportunities in Non Dollar 2Документ4 страницыEmad A Zikry VAAM Opportunities in Non Dollar 2Emad-A-ZikryОценок пока нет

- TheRoleOfCurrencyRealignmentsInEli PreviewДокумент10 страницTheRoleOfCurrencyRealignmentsInEli PreviewmaumacОценок пока нет

- MonetarypolicyДокумент4 страницыMonetarypolicyapi-457232170Оценок пока нет

- Investment and Tax Planning Strategies For Uncertain Economic TimesДокумент16 страницInvestment and Tax Planning Strategies For Uncertain Economic TimesMihaela NicoaraОценок пока нет

- 3-20-12 Fed Liquidity: Good As GoldДокумент4 страницы3-20-12 Fed Liquidity: Good As GoldThe Gold SpeculatorОценок пока нет

- The High Cost of A Cheap Dollar: National Center For Policy AnalysisДокумент4 страницыThe High Cost of A Cheap Dollar: National Center For Policy AnalysisalphathesisОценок пока нет

- HRN 20121016 Part 01 Headline A Final and Total CatastropheДокумент14 страницHRN 20121016 Part 01 Headline A Final and Total CatastropheJim LetourneauОценок пока нет

- Group 6 - AM BДокумент14 страницGroup 6 - AM BABHAY KUMAR SINGHОценок пока нет

- Fools Gold: Could Gold Perform Better Than The U.S. Dollar As A Currency?Документ8 страницFools Gold: Could Gold Perform Better Than The U.S. Dollar As A Currency?fbates3Оценок пока нет

- Brazil Russia India China South AfricaДокумент3 страницыBrazil Russia India China South AfricaRAHULSHARMA1985999Оценок пока нет

- Why Financial Repression Will FailДокумент10 страницWhy Financial Repression Will FailRon HeraОценок пока нет

- Managing Inflation Expectations: Steve SavilleДокумент13 страницManaging Inflation Expectations: Steve Savillejothiraj1004Оценок пока нет

- Hoisington Q1 2015Документ9 страницHoisington Q1 2015CanadianValue0% (1)

- Outlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Документ16 страницOutlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Khalid S. AlyahmadiОценок пока нет

- 7-12-11 Too Big To FailДокумент3 страницы7-12-11 Too Big To FailThe Gold SpeculatorОценок пока нет

- 4-3-12 None So BlindДокумент5 страниц4-3-12 None So BlindThe Gold SpeculatorОценок пока нет

- Fools Gold: Could Gold Perform Better Than The U.S. Dollar As A Currency?Документ10 страницFools Gold: Could Gold Perform Better Than The U.S. Dollar As A Currency?Alexander AnconaОценок пока нет

- Daniel Barnes: 2010 Predictions RecapДокумент4 страницыDaniel Barnes: 2010 Predictions Recapbruced0812Оценок пока нет

- Macro Answer - ChaДокумент7 страницMacro Answer - Chashann hein htetОценок пока нет

- Us Debt and GoldДокумент16 страницUs Debt and Goldapi-240417748Оценок пока нет

- Currency Wars or Policy CoordinationДокумент9 страницCurrency Wars or Policy CoordinationRomana De Lemos AlmeidaОценок пока нет

- Kimberly Amadeo: Money SupplyДокумент3 страницыKimberly Amadeo: Money SupplytawandaОценок пока нет

- The Concept of I Inflation in IДокумент6 страницThe Concept of I Inflation in Idragonhell25Оценок пока нет

- Causes and Types of Inflation, Deflation, and Money Value ChangesДокумент9 страницCauses and Types of Inflation, Deflation, and Money Value ChangesRajat KumarОценок пока нет

- Monetary Policy.: Economic Money Credit InterestДокумент27 страницMonetary Policy.: Economic Money Credit Interestchemy_87Оценок пока нет

- How Does Inflation Affect The Exchange Rate Between Two Nations?Документ32 страницыHow Does Inflation Affect The Exchange Rate Between Two Nations?Shambhawi SinhaОценок пока нет

- Bob Chapman An Economy On Steroids US Poverty Levels Equal To The 1930s 12 3 2011Документ4 страницыBob Chapman An Economy On Steroids US Poverty Levels Equal To The 1930s 12 3 2011sankaratОценок пока нет

- Gold TruthДокумент3 страницыGold TruthKamal GuptaОценок пока нет

- The United States Should Return To A Gold StandardДокумент2 страницыThe United States Should Return To A Gold StandardBriAnna BauchamОценок пока нет

- Impact of U.S. Recession On India - An Empirical StudyДокумент22 страницыImpact of U.S. Recession On India - An Empirical StudyashokdgaurОценок пока нет

- Lane Asset Management Stock Market Commentary September 2011Документ10 страницLane Asset Management Stock Market Commentary September 2011eclaneОценок пока нет

- Bob Chapman Deepening Economic Crisis 23 4 2011Документ4 страницыBob Chapman Deepening Economic Crisis 23 4 2011sankaratОценок пока нет

- Check Against DeliveryДокумент20 страницCheck Against DeliveryManasvi MehtaОценок пока нет

- Bob Chapman Great Depression Debt and Economic Decline Ireland Portugal Greece US UK 23 1 2011Документ4 страницыBob Chapman Great Depression Debt and Economic Decline Ireland Portugal Greece US UK 23 1 2011sankaratОценок пока нет

- Economics Essay TaskДокумент11 страницEconomics Essay TaskHaris ZaheerОценок пока нет

- Reflation Is The Act Of: Stimulating Economy Money Supply Taxes Business Cycle DisinflationДокумент4 страницыReflation Is The Act Of: Stimulating Economy Money Supply Taxes Business Cycle Disinflationmeenakshi56Оценок пока нет

- Asset Allocation: Fall 2010: Olume CtoberДокумент30 страницAsset Allocation: Fall 2010: Olume Ctoberrichardck50Оценок пока нет

- Name Class Assignment DateДокумент6 страницName Class Assignment Datehyna_khanОценок пока нет

- Money in AssigmentДокумент6 страницMoney in AssigmentMussa AthanasОценок пока нет

- Drastic Currency Changes ExplainedДокумент5 страницDrastic Currency Changes ExplainedProkash MondalОценок пока нет

- Gold StandardsДокумент5 страницGold StandardsHaya AwanОценок пока нет

- Rising Commodity Prices Draft 3.9.11abst2Документ11 страницRising Commodity Prices Draft 3.9.11abst2Daniel C. CampanaОценок пока нет

- Factors Affecting The Gold PriceДокумент8 страницFactors Affecting The Gold PriceAjinkya AgrawalОценок пока нет

- (Economic and Financial Crisis)Документ9 страниц(Economic and Financial Crisis)Jiggu SivanОценок пока нет

- Chetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Документ5 страницChetana S Bachelor of Management Studies: Opic Name: Nadar Karthik Soundararajan. Roll NO.: 2138Karthik SoundarajanОценок пока нет

- Chapter 3Документ11 страницChapter 3perico1962Оценок пока нет

- The Effects of Monetary Policy On Inflation in Ghana.Документ9 страницThe Effects of Monetary Policy On Inflation in Ghana.Alexander DeckerОценок пока нет

- Inflation in VenezuelaДокумент3 страницыInflation in VenezuelaNhi Nguyễn YếnОценок пока нет

- Research Essay 3Документ13 страницResearch Essay 3api-609571634Оценок пока нет

- Acknowledgments and Case Study IntroductionДокумент17 страницAcknowledgments and Case Study Introductions_alimazharОценок пока нет

- Russia Shifts Half of External Transactions Away From Dollar and EuroДокумент7 страницRussia Shifts Half of External Transactions Away From Dollar and EuroDebre AllenОценок пока нет

- GDD InflatedДокумент7 страницGDD InflatedPawan NegiОценок пока нет

- Assignment 3 ECON 401Документ4 страницыAssignment 3 ECON 401aleena asifОценок пока нет

- Us Debt Ceiling Crisis 1Документ5 страницUs Debt Ceiling Crisis 1Prakriti GuptaОценок пока нет

- Gold: - A Commodity Like No OtherДокумент6 страницGold: - A Commodity Like No OtherVeeresh MenasigiОценок пока нет

- 6-26-12 Greed Is Good.Документ4 страницы6-26-12 Greed Is Good.The Gold SpeculatorОценок пока нет

- Unit 1 JournalДокумент1 страницаUnit 1 Journalapi-232344608Оценок пока нет

- Unit 3 PrewritingДокумент1 страницаUnit 3 Prewritingapi-232344608Оценок пока нет

- Process Essay DraftДокумент6 страницProcess Essay Draftapi-232344608Оценок пока нет

- Prewriting Unit 2Документ1 страницаPrewriting Unit 2api-232344608Оценок пока нет

- Unit 3 Progress JournalДокумент1 страницаUnit 3 Progress Journalapi-232344608Оценок пока нет

- Unit 3 Topic Selection JournalДокумент1 страницаUnit 3 Topic Selection Journalapi-232344608Оценок пока нет

- Unit 2 Publication JournalДокумент1 страницаUnit 2 Publication Journalapi-232344608Оценок пока нет

- Unit 2 Progress JournalДокумент1 страницаUnit 2 Progress Journalapi-232344608Оценок пока нет

- Snapshot Final DraftДокумент5 страницSnapshot Final Draftapi-232344608Оценок пока нет

- Snapshot Essay2Документ5 страницSnapshot Essay2api-232344608Оценок пока нет

- Snapshot EssayДокумент3 страницыSnapshot Essayapi-232344608Оценок пока нет

- Snapshot Essay PrewritingДокумент1 страницаSnapshot Essay Prewritingapi-232344608Оценок пока нет

- Benefits and Criticisms of the 4Ps ProgramДокумент7 страницBenefits and Criticisms of the 4Ps ProgramDavid Dueñas100% (5)

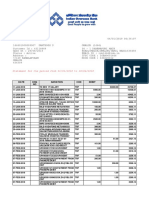

- Statement 166601000009907Документ5 страницStatement 166601000009907Nithiyandran RajОценок пока нет

- HR Policies of NBPДокумент35 страницHR Policies of NBPUmair Khan Niazi75% (4)

- Foreign Currency TransactionsДокумент40 страницForeign Currency TransactionsJuliaMaiLeОценок пока нет

- Internal Control and Cash: Learning ObjectivesДокумент75 страницInternal Control and Cash: Learning ObjectivesazertyuОценок пока нет

- Premium Bonds BrochureДокумент17 страницPremium Bonds BrochureantoniojueОценок пока нет

- Workbook Finance ApplicationsДокумент5 страницWorkbook Finance ApplicationsAditya BanerjeeОценок пока нет

- Determinants of Financial Performance of Commercial Banks in EthiopiaДокумент8 страницDeterminants of Financial Performance of Commercial Banks in Ethiopiamesfin DemiseОценок пока нет

- Trainee Assistant Officer: Prime ResponsibilitiesДокумент1 страницаTrainee Assistant Officer: Prime ResponsibilitiesimtiazbulbulОценок пока нет

- Web Technology and Commerce Unit-4 by Arun Pratap SinghДокумент60 страницWeb Technology and Commerce Unit-4 by Arun Pratap SinghArunPratapSinghОценок пока нет

- Business Studies Class XII Practice Paper Time: 3hrs M.M: 80Документ5 страницBusiness Studies Class XII Practice Paper Time: 3hrs M.M: 80Ashish GangwalОценок пока нет

- Bank Alfalah Q1 2012 Quarterly ReportДокумент66 страницBank Alfalah Q1 2012 Quarterly ReportShahid MehmoodОценок пока нет

- Chapter 1 Historical Perspective WorldwideДокумент19 страницChapter 1 Historical Perspective WorldwideJuvy Jane DuarteОценок пока нет

- Exercises For Bank Reconciliation and Proof of CashДокумент2 страницыExercises For Bank Reconciliation and Proof of CashAnnie RapanutОценок пока нет

- Swift Transfer # For Cibc BankДокумент5 страницSwift Transfer # For Cibc Bank1CRYPTICОценок пока нет

- Form 60Документ1 страницаForm 60AzImmОценок пока нет

- Arranger Fiduciary Duties and Fees in Syndicated LoansДокумент57 страницArranger Fiduciary Duties and Fees in Syndicated LoansLuka AjvarОценок пока нет

- B2 U5 Extra Grammar Practice ReinforcementДокумент1 страницаB2 U5 Extra Grammar Practice ReinforcementirinachircevОценок пока нет

- PPSCI vs. Equitable PCI BankДокумент4 страницыPPSCI vs. Equitable PCI BankAnonymous oDPxEkdОценок пока нет

- Effects of Demonetization in India: Ms - Asra Fatima, Anwarul UloomДокумент4 страницыEffects of Demonetization in India: Ms - Asra Fatima, Anwarul UloomubaidОценок пока нет

- Addis Ababa University: School of Graduate StudiesДокумент94 страницыAddis Ababa University: School of Graduate StudiesArefayne WodajoОценок пока нет

- Payday Loan Debts Killed Our Son, 18: Ollie's Train SuicideДокумент2 страницыPayday Loan Debts Killed Our Son, 18: Ollie's Train SuicideSimply Debt SolutionsОценок пока нет

- Inside The Santa Claus Fund BoxДокумент1 страницаInside The Santa Claus Fund BoxToronto StarОценок пока нет

- Barringer Chapter 1 PowerpointДокумент38 страницBarringer Chapter 1 PowerpointCiara Caldwell75% (4)

- Indian Tyre Industry OutlookДокумент6 страницIndian Tyre Industry OutlookSundeep TariyalОценок пока нет

- Cashless EconomyДокумент5 страницCashless EconomykumaresanОценок пока нет

- StatmentДокумент3 страницыStatmentAustin Shelton100% (4)

- OIS DiscountingДокумент25 страницOIS DiscountingAakash Khandelwal100% (1)

- TD Bank StatementДокумент1 страницаTD Bank StatementBaba d100% (2)

- CIF No. No. CIF: 2300351974 Statement Date Tarikh Penyata: 28/02/2022Документ4 страницыCIF No. No. CIF: 2300351974 Statement Date Tarikh Penyata: 28/02/2022ryedah musyairaОценок пока нет