Академический Документы

Профессиональный Документы

Культура Документы

CCFM, CH 02, Problem

Загружено:

Khizer SikanderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CCFM, CH 02, Problem

Загружено:

Khizer SikanderАвторское право:

Доступные форматы

A 1 02problem 2 3 Chapter 2.

4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 Problem 2-13

D

7/28/2013 4:13

G 6/1/2010

Solution to End-of-Chapter Comprehensive/Spreadsheet Problem

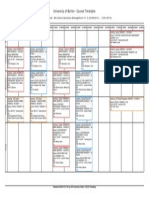

Sinotronics December 31 Balance Sheets (in thousands of dollars) 2008 Assets Cash and cash equivalents Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities and equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained Earnings Total common equity Total liabilities and equity $ 102,850 103,365 38,444 244,659 67,165 311,824 $ 2007 89,725 85,527 34,982 210,234 42,436 252,670

$ $

$ $

$ $

$ $

30,761 30,477 16,717 77,955 76,264 154,219 100,000 57,605 157,605 311,824

$ $

$ $

23,109 22,656 14,217 59,982 63,914 123,896 90,000 38,774 128,774 252,670

a. Sales for 2008 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciation and amortization amounted to 11% of net fixed assets, interest was $8,575,000, the corporate tax rate was 40%, and Sinotronics pays 40% of its net income in dividends. Given this information, construct Sinotronics 2008 income statement. The input information required for the problem is outlined in the "Key Input Data" section below. Using this data and the balance sheet above, we constructed the income statement shown below. KEY INPUT DATA: Laiho Industries Sales EBITDA as a percentage of sales Depr. as a % of fixed assets Tax rate Interest expense Dividend payout ratio $455,150 15% 11% 40% $8,575 40%

46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72

A B Sinotronics Income Statement (in thousands of dollars)

Sales Expenses excluding depreciation and amortization EBITDA Depreciation and amortization EBIT Interest expense EBT Taxes (40%) Net Income Common dividends Addition to retained earnings

2008 $455,150 386,878 Found after finding EBITDA $68,273 Found this first 7,388 $60,884 8,575 $52,309 20,924 $31,386 $12,554 $18,831

b. Construct the statement of stockholders' equity for the year ending December 31, 2008, and the 2008 statement of cash flows. Statement of Stockholders' Equity (in thousands of dollars) Balance of Retained Earnings, December 31, 2007 Add: Net Income, 2008 Less: Common dividends paid, 2008 Balance of Retained Earnings, December 31, 2008 $38,774 $31,386 (12,554) $57,605

73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112

A B Statement of Cash Flows (in thousands of dollars)

Operating Activities Net Income Depreciation and amortization Increase in accounts payable Increase in accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in investing activities Financing Activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common dividends Net cash provided by financing activities Summary Net increase/decrease in cash Cash balance at the beginning of the year Cash balance at the end of the year

$31,386 7,388 7,652 7,821 (17,838) (3,462) $32,947

($32,117) ($32,117)

$2,500 12,350 10,000 (12,554) $12,295

$13,125 89,725 $102,850

c. Calculate 2007 and 2008 net working capital and 2008 free cash flow. Net Working Capital (must be financed by external sources) NWC07 = current assets (A/P and accruals) NWC07 = $210,234 $45,765 NWC07 = $164,469 NWC08 = NWC08 = NWC08 = current assets $244,659 $183,421 (A/P and accruals) $61,238

Free Cash Flow Capital expenditures $32,117 Increase in NWC $18,952

113 FCF08 = 114 FCF08 = 115 FCF08 = 116

EBIT (1 - T) $36,531 -$7,150

+ +

Depreciation $7,388

+ +

117 118 119 120 121 122 123

A B C D E F G H d. If Sinotronics increased its dividend payout ratio, what effect would this have on its corporate taxes paid? What effect would this have on the taxes paid by the company's shareholders? An increase in the firm's dividend payout ratio would have no effect on its corporate taxes paid because dividends are paid with after-tax dollars. However, the company's shareholders would pay additional taxes on the additional dividends they would receive. As of 10/08, dividends are generally taxed at a maximum rate of 15% in the United States.

Вам также может понравиться

- Bill of ConveyanceДокумент3 страницыBill of Conveyance:Lawiy-Zodok:Shamu:-El80% (5)

- Hardened Concrete - Methods of Test: Indian StandardДокумент16 страницHardened Concrete - Methods of Test: Indian StandardjitendraОценок пока нет

- Accounting for Non-Current LiabilitiesДокумент39 страницAccounting for Non-Current LiabilitiesIris MaОценок пока нет

- LW 311 Business Law Chap5Документ35 страницLW 311 Business Law Chap5Khizer SikanderОценок пока нет

- Quantitative TechiniquesДокумент7 страницQuantitative TechiniquesJohn Nowell DiestroОценок пока нет

- Activity 3 CAMINGAWAN BSMA 2B PDFДокумент7 страницActivity 3 CAMINGAWAN BSMA 2B PDFMiconОценок пока нет

- Chapter 3 Problems - Ia Part 2Документ16 страницChapter 3 Problems - Ia Part 2KathleenCusipagОценок пока нет

- Department Order No 05-92Документ3 страницыDepartment Order No 05-92NinaОценок пока нет

- Parent, Inc Actual Financial Statements For 2012 and OlsenДокумент23 страницыParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyОценок пока нет

- Proposal A Proposal B Proposal CДокумент6 страницProposal A Proposal B Proposal CMaha HamdyОценок пока нет

- 21st Century LiteraciesДокумент27 страниц21st Century LiteraciesYuki SeishiroОценок пока нет

- Local Media7735387659572366861Документ3 страницыLocal Media7735387659572366861heynuhh gОценок пока нет

- Assignment 7Документ6 страницAssignment 7eric stevanusОценок пока нет

- Group 4 HR201 Last Case StudyДокумент3 страницыGroup 4 HR201 Last Case StudyMatt Tejada100% (2)

- P&G Supply Chain Finance Example Table BreakdownДокумент37 страницP&G Supply Chain Finance Example Table BreakdownKunal Mehta100% (2)

- This Study Resource Was: Assessment Task 3Документ5 страницThis Study Resource Was: Assessment Task 3maria evangelistaОценок пока нет

- Petite Company Reported The Following Current Assets On December 31Документ1 страницаPetite Company Reported The Following Current Assets On December 31Katrina Dela CruzОценок пока нет

- Pre-Test 9Документ3 страницыPre-Test 9BLACKPINKLisaRoseJisooJennieОценок пока нет

- Earnings Per ShareДокумент2 страницыEarnings Per Sharehae1234Оценок пока нет

- INVESTMENTSДокумент9 страницINVESTMENTSKrisan RiveraОценок пока нет

- Sabina Company Quiz #1 Questions and SolutionsДокумент6 страницSabina Company Quiz #1 Questions and SolutionsJames Daniel SwintonОценок пока нет

- CH 15Документ46 страницCH 15Indah SucitraОценок пока нет

- Cash FlowДокумент6 страницCash FlowKailaОценок пока нет

- 07 Interim Reporting FinalДокумент3 страницы07 Interim Reporting FinalMakoy BixenmanОценок пока нет

- Equity Investments Guide: Key Accounting ConceptsДокумент4 страницыEquity Investments Guide: Key Accounting ConceptsmerryОценок пока нет

- Problem 7 - 22Документ3 страницыProblem 7 - 22Jao FloresОценок пока нет

- INVESTMENT PROPERTY CHAPTERДокумент8 страницINVESTMENT PROPERTY CHAPTERPacifico HernandezОценок пока нет

- Ias 28 Investment in Associate IllustrationДокумент6 страницIas 28 Investment in Associate IllustrationVatchdemonОценок пока нет

- IA Problem 17 4Документ8 страницIA Problem 17 4nenzzmariaОценок пока нет

- Impairment of Assets PDFДокумент4 страницыImpairment of Assets PDFKentaro Panergo NumasawaОценок пока нет

- Silver Company Provided The Following Information at Year-EndДокумент1 страницаSilver Company Provided The Following Information at Year-EndKatrina Dela CruzОценок пока нет

- Current Liabilities - QuizДокумент4 страницыCurrent Liabilities - QuizArvin PaculanangОценок пока нет

- FIN1S Prelim ExamДокумент7 страницFIN1S Prelim ExamYu BabylanОценок пока нет

- Finance Quiz 1Документ3 страницыFinance Quiz 1brnycОценок пока нет

- Periodic or Perpetual (Same) : Specific IdentificationДокумент10 страницPeriodic or Perpetual (Same) : Specific Identificationhoneyjoy salapantanОценок пока нет

- Prelim ExamДокумент13 страницPrelim ExamNah HamzaОценок пока нет

- Receivables AssignmentДокумент24 страницыReceivables AssignmentRhona RamosОценок пока нет

- Exercise - Part 2Документ5 страницExercise - Part 2lois martinОценок пока нет

- Assignment 2Документ3 страницыAssignment 2Sajid RulesОценок пока нет

- Gross Profit & Retail Method ProblemsДокумент2 страницыGross Profit & Retail Method ProblemsMary Dale Joie Bocala0% (1)

- Practice Questions On Fin AcctgДокумент6 страницPractice Questions On Fin AcctgMateen HashmiОценок пока нет

- Chapter 17Документ3 страницыChapter 17Michael CarlayОценок пока нет

- Assignment On LCNRV and GP MethodДокумент6 страницAssignment On LCNRV and GP MethodAdam CuencaОценок пока нет

- 1.3.2.1 Elaborate Problem Solving AssignmentДокумент17 страниц1.3.2.1 Elaborate Problem Solving AssignmentYess poooОценок пока нет

- Chapter 5 - Adv Acc 1Документ18 страницChapter 5 - Adv Acc 1Maurice AgbayaniОценок пока нет

- Chapter 8Документ10 страницChapter 8Vip BigbangОценок пока нет

- Chapter 34Документ17 страницChapter 34Mike SerafinoОценок пока нет

- Assign 1 Answer Valuation of Contributions of Partners Millan 2021Документ4 страницыAssign 1 Answer Valuation of Contributions of Partners Millan 2021mhikeedelantarОценок пока нет

- Group Quiz InstructionsДокумент9 страницGroup Quiz InstructionsRaidenhile mae VicenteОценок пока нет

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableДокумент6 страницPrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaОценок пока нет

- Exemplar Company Statement of Financial Position As of December 31, 2017Документ3 страницыExemplar Company Statement of Financial Position As of December 31, 2017Rey Joyce AbuelОценок пока нет

- Examination About Investment 7Документ3 страницыExamination About Investment 7BLACKPINKLisaRoseJisooJennieОценок пока нет

- Tutorial 2: Exercise 12.2 Calculation of Current TaxДокумент13 страницTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresОценок пока нет

- Chap 013Документ667 страницChap 013Rhaine ArimaОценок пока нет

- IygfigДокумент52 страницыIygfigDelfiaОценок пока нет

- Armhyla Olivar FM Taxation 8Документ4 страницыArmhyla Olivar FM Taxation 8Grace Umbaña YangaОценок пока нет

- Intacc Employee BenefitДокумент8 страницIntacc Employee BenefitJoyce ManaloОценок пока нет

- Pre-Test 7Документ3 страницыPre-Test 7BLACKPINKLisaRoseJisooJennieОценок пока нет

- Fair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final ExamДокумент2 страницыFair Value Model: Home My Courses ACC211 - 6387 - 2021-2022 - 2NDSEM-SEM - CAE 5th To 8th Examinations/Assessments Final Examkaeya alberichОценок пока нет

- Module 13 Present ValueДокумент10 страницModule 13 Present ValueChristine Elaine LamanОценок пока нет

- Solution and AnswerДокумент4 страницыSolution and AnswerMicaela EncinasОценок пока нет

- Practice Set Review - Current LiabilitiesДокумент12 страницPractice Set Review - Current LiabilitiesKayla MirandaОценок пока нет

- Intermediate Accounting - Petty Cash Journal EntriesДокумент2 страницыIntermediate Accounting - Petty Cash Journal EntriesSean Lester S. NombradoОценок пока нет

- Accounting for Retained EarningsДокумент2 страницыAccounting for Retained EarningsJoy ConsigeneОценок пока нет

- Easy Problem Chapter 5Документ5 страницEasy Problem Chapter 5Natally LangfeldtОценок пока нет

- Financial Statements and Financial AnalysisДокумент42 страницыFinancial Statements and Financial AnalysisAhmad Ridhuwan AbdullahОценок пока нет

- 7.victoria and Albert Museum: 6. The Natural History Museum Cromwell Road London SW7 5BDДокумент1 страница7.victoria and Albert Museum: 6. The Natural History Museum Cromwell Road London SW7 5BDKhizer SikanderОценок пока нет

- Topic - 7 Security, System Control, and AuditДокумент14 страницTopic - 7 Security, System Control, and AuditKhizer SikanderОценок пока нет

- Executive Secretary RequiredДокумент1 страницаExecutive Secretary RequiredKhizer SikanderОценок пока нет

- Chapter 2: Literature Review: 2.1.1 The Competitiveness of NationsДокумент20 страницChapter 2: Literature Review: 2.1.1 The Competitiveness of NationsKhizer SikanderОценок пока нет

- Topic - 4 System Selection, Implementation and ReviewДокумент11 страницTopic - 4 System Selection, Implementation and ReviewKhizer SikanderОценок пока нет

- 1 Full Annual Report 2013Документ154 страницы1 Full Annual Report 2013Jeferson LopesОценок пока нет

- v4 MKT3001 Assessment One S1 2014-15 Student ViewДокумент4 страницыv4 MKT3001 Assessment One S1 2014-15 Student ViewKhizer SikanderОценок пока нет

- 6 StakeholdersДокумент31 страница6 StakeholdersKhizer SikanderОценок пока нет

- 282 688 1 SMДокумент5 страниц282 688 1 SMKhizer SikanderОценок пока нет

- Group E, The Brewers: Didier Acevedo, Justin Martel, Daiskue Takesako & Jonas WongsriskulchaiДокумент12 страницGroup E, The Brewers: Didier Acevedo, Justin Martel, Daiskue Takesako & Jonas WongsriskulchaiKhizer SikanderОценок пока нет

- University of Bolton, Immigration and Welfare Officers Tier 4 Students Attendance CensusДокумент1 страницаUniversity of Bolton, Immigration and Welfare Officers Tier 4 Students Attendance CensusKhizer SikanderОценок пока нет

- Topic - 4 System Selection, Implementation and ReviewДокумент11 страницTopic - 4 System Selection, Implementation and ReviewKhizer SikanderОценок пока нет

- The Concept of Marketing, Borden (1984)Документ7 страницThe Concept of Marketing, Borden (1984)cristiurseaОценок пока нет

- v4 MKT3001 Assessment One S1 2014-15 Student ViewДокумент4 страницыv4 MKT3001 Assessment One S1 2014-15 Student ViewKhizer SikanderОценок пока нет

- My Part of Assignment of Corporate Business StrategyДокумент9 страницMy Part of Assignment of Corporate Business StrategyRakesh RoshanОценок пока нет

- ICT Lecture StudentsДокумент41 страницаICT Lecture StudentsKhizer SikanderОценок пока нет

- 1 s2.0 S0167739X10002554 MainДокумент10 страниц1 s2.0 S0167739X10002554 MainBRED_25Оценок пока нет

- L6 - Analytical Tools in Strategic ManagementДокумент12 страницL6 - Analytical Tools in Strategic ManagementKhizer SikanderОценок пока нет

- Research ActivityДокумент3 страницыResearch ActivityKhizer SikanderОценок пока нет

- Topic - 1 The Changing Role of The ComputerДокумент12 страницTopic - 1 The Changing Role of The ComputerKhizer SikanderОценок пока нет

- Digital Economy 1Документ11 страницDigital Economy 1Khizer SikanderОценок пока нет

- Cloud Computing For Education A New Dawn 2010 International Journal of Information ManagementДокумент8 страницCloud Computing For Education A New Dawn 2010 International Journal of Information ManagementKhizer SikanderОценок пока нет

- Cloud Computing For Education A New Dawn 2010 International Journal of Information ManagementДокумент8 страницCloud Computing For Education A New Dawn 2010 International Journal of Information ManagementKhizer SikanderОценок пока нет

- Corse Time TableДокумент1 страницаCorse Time TableKhizer SikanderОценок пока нет

- Week 5 Recruitment and Selection Powerpoint FinalДокумент25 страницWeek 5 Recruitment and Selection Powerpoint FinalKhizer SikanderОценок пока нет

- Oral PresentationДокумент34 страницыOral PresentationKhizer SikanderОценок пока нет

- AaaДокумент5 страницAaaKhizer SikanderОценок пока нет

- MHR9 e PPT07Документ57 страницMHR9 e PPT07Khizer SikanderОценок пока нет

- LW 311 Business Law Chap18Документ30 страницLW 311 Business Law Chap18Khizer SikanderОценок пока нет

- TX Set 1 Income TaxДокумент6 страницTX Set 1 Income TaxMarielle CastañedaОценок пока нет

- Gps Anti Jammer Gpsdome - Effective Protection Against JammingДокумент2 страницыGps Anti Jammer Gpsdome - Effective Protection Against JammingCarlos VillegasОценок пока нет

- DHPL Equipment Updated List Jan-22Документ16 страницDHPL Equipment Updated List Jan-22jairamvhpОценок пока нет

- Tata Chemicals Yearly Reports 2019 20Документ340 страницTata Chemicals Yearly Reports 2019 20AkchikaОценок пока нет

- E2 PTAct 9 7 1 DirectionsДокумент4 страницыE2 PTAct 9 7 1 DirectionsEmzy SorianoОценок пока нет

- Royalty-Free License AgreementДокумент4 страницыRoyalty-Free License AgreementListia TriasОценок пока нет

- MiniQAR MK IIДокумент4 страницыMiniQAR MK IIChristina Gray0% (1)

- Las Q1Документ9 страницLas Q1Gaux SkjsjaОценок пока нет

- BRD TemplateДокумент4 страницыBRD TemplateTrang Nguyen0% (1)

- MsgSpec v344 PDFДокумент119 страницMsgSpec v344 PDFqweceОценок пока нет

- POS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFДокумент23 страницыPOS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFNguyễn Duy QuangОценок пока нет

- Case Study - Soren ChemicalДокумент3 страницыCase Study - Soren ChemicalSallySakhvadzeОценок пока нет

- Arizona Supreme CT Order Dismisses Special ActionДокумент3 страницыArizona Supreme CT Order Dismisses Special Actionpaul weichОценок пока нет

- SAP ORC Opportunities PDFДокумент1 страницаSAP ORC Opportunities PDFdevil_3565Оценок пока нет

- Dairy DevelopmentДокумент39 страницDairy DevelopmentHemanth Kumar RamachandranОценок пока нет

- Elementary School: Cash Disbursements RegisterДокумент1 страницаElementary School: Cash Disbursements RegisterRonilo DagumampanОценок пока нет

- Ayushman BharatДокумент20 страницAyushman BharatPRAGATI RAIОценок пока нет

- UKIERI Result Announcement-1Документ2 страницыUKIERI Result Announcement-1kozhiiiОценок пока нет

- Fundamental of Investment Unit 5Документ8 страницFundamental of Investment Unit 5commers bengali ajОценок пока нет

- Civil Aeronautics BoardДокумент2 страницыCivil Aeronautics BoardJayson AlvaОценок пока нет

- Applicants at Huye Campus SiteДокумент4 страницыApplicants at Huye Campus SiteHIRWA Cyuzuzo CedricОценок пока нет

- Week 3 SEED in Role ActivityДокумент2 страницыWeek 3 SEED in Role ActivityPrince DenhaagОценок пока нет

- Gary Mole and Glacial Energy FraudДокумент18 страницGary Mole and Glacial Energy Fraudskyy22990% (1)

- Safety QualificationДокумент2 страницыSafety QualificationB&R HSE BALCO SEP SiteОценок пока нет

- Spouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsДокумент11 страницSpouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsRobyn JonesОценок пока нет