Академический Документы

Профессиональный Документы

Культура Документы

Chapter 20

Загружено:

Rahila RafiqИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 20

Загружено:

Rahila RafiqАвторское право:

Доступные форматы

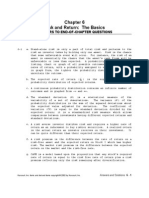

COST ACCOUNTING 9TH EDITION

Chapter 20

Page 94

COST ACCOUNTING 9TH EDITION

CHAPTER 20 EXERCISES

Exercise 20.1 Woliver Company Fixed Cost C.M Per Unit Break Even in Units= Break Even in Dollars= 6000 1.2 5000 10000 Units Dollars

2*60% 6000/1.2 6000/.6

Exercise 20.2 Sales Variable Cost 1 Contribution Margin Fixed Cost Profit 2 3 Contribution Margin Ratio Break Even point in Dollars

$ 7640000 4736800 2903200 2451000 452200 2903200/7640000 2451000/.38 38 6E+06 %

Exercise 20.3 Sale Price per unit Variable Cost Contribution Margin Contribution Margin Ratio Fixed Cost 1 2 3 Break Even Point in Dollars= Break Even Pint in Units= Target Sales=

2.5 1.675 0.825 .825/2.5 4290 4290/.33 4290/.825 4290+8250/.825

33

13000 5200 38000

Dollars Units Dollars

Exercise 20.4 Sale Price per unit Variable Cost Contribution Margin Contribution Margin Ratio Fixed Cost 1 2 3 4 Break Even Point in Dollars= Break Even Pint in Units= Target Units to be sold= Target Sales=

5 3 2 2/5 26000 26000/.4 26000/2 26000+10000/2 26000+10000/.4 65000 13000 18000 90000 Dollars Units Units Dollars 0.4 %

Exercise 20.9 At 100 Capacity Units= Variable Cost=

350 742

Chapter 20

Page 95

COST ACCOUNTING 9TH EDITION

Variable Cost at 90%= Fixed Cost Total Cost Unit Cost 667.8 1008 1675.8 5.32 per Unit 315 Units

Exercise 20.10 Fixed Cost Fixed FOH Fixed Marketing Exp Fixed Admn Exp Total Fixed Cost Variable Cost Direct Labour Direct Material Variable FOH Variable Marketing Variable Admin Total Variable Cost Sales Contribution C.M Ratio 1 2 Break Even Point in Units Incrase in Sales Increase in Variable Cost Contribution Margin Fixed Cost Profit Break Even Point in Dollars 2990/46 10000*125% 5400*125% 1500 1400 1000 1000 500 5400 10000 4600 46 65 % Units 12500 6750 5750 2990 2760 8000 Dollars 990 1000 1000 2990

2990+690/.46

Exercise 20.5 Margin of Safety= Margin of Safety Ratio

2000000-1500000 (20000001500000)/2000000*100

500000

Dollars

25

Exercise 20.6 Fixed Cost= CM Ratio= Break Even Sales= Actual Sales=

9300 62% 9300/.62 15000*100/75 15000 20000 Dollars Dollars

Profit For The Month= Sales Variable Cost

20000 7600

Chapter 20

Page 96

COST ACCOUNTING 9TH EDITION

Contribution Margin Fixed Cost Profit 12400 9300 3100 15.500%

Or Profit Ratio= Margin of safety Ratio* CM Ratio 20000*15.5% 3100

Exercise 20.7 Fixed Cost= CM Ratio= Break Even Sales= Actual Sales=

30000 60% 30000/.6 50000*100/80 50000 62500 Dollars Dollars

Profit For The Month= Sales 62500 Variable Cost 25000 Contribution Margin 37500 Fixed Cost 30000 Profit 7500 Or Profit Ratio= Margin of safety Ratio* CM Ratio 62500*12% 7500

12.000%

Exercise 20.8 Sales Variable Cost Contribution Margin Fixed Cost Planned Profit Exercise 20.11

A 100000*4 400000 280000 200000*3

B 600000 480000

Total 1000000 760000 240000 100000 140000

Table Sale Price of Package 60*1 Variable Cost of Package 35*1 Contribution Margin of Package Total Fixed Cost C.M Ratio 45/120 60 35 30*2 20*2

Chair 60 40

Total 120 75 45 675000

37.5

Break Even Point in Dollars Break Even point in Units

675000/.375 675000/45 Tables Chairs

1800000 15000 60 30

Dollars Package 900000 900000 1800000

15000 30000

Exercise 20.12 L Sale Price of Package 20*2 Variable Cost of Package 12*2 Contribution Margin of Package Total Fixed Cost 40 24 15*3 10*3 M 45 30 Total 85 54 31 372000

Chapter 20

Page 97

COST ACCOUNTING 9TH EDITION

C.M Ratio 31/85 36.47059 0.364706 372000/.3647 372000/31 L M %

1 2

Break Even Point in Dollars Break Even point in Units

1020000 12000 20 15

Dollars Package 480000 540000 1020000 Dollars Packages 600000 675000 1275000

24000 36000

3 4

Target Sales Target Units

372000+93000/.364 372000+93000/31 L M

1275000 15000 20 15

30000 45000

Chapter 20

Page 98

Вам также может понравиться

- Margin 60% 50,000 Interest Cost (20,000)Документ7 страницMargin 60% 50,000 Interest Cost (20,000)hijab zaidiОценок пока нет

- Caso Bill FrenchДокумент3 страницыCaso Bill Frenchplito21Оценок пока нет

- S2 CMA c02 Cost-Volume-Profit AnalysisДокумент25 страницS2 CMA c02 Cost-Volume-Profit Analysisdiasjoy67Оценок пока нет

- Ke Toan Quan Tri FinalДокумент13 страницKe Toan Quan Tri Finalkhanhlinh.vuha02Оценок пока нет

- 12-9 Levin Co.: A. Break Even in Units/Q ($ 9.75 - 6.75) (Contribution Margin Per Unit)Документ5 страниц12-9 Levin Co.: A. Break Even in Units/Q ($ 9.75 - 6.75) (Contribution Margin Per Unit)Hijab ZaidiОценок пока нет

- Assignment No. 4 Managers of Accountants: Mrs. Manu KaliaДокумент14 страницAssignment No. 4 Managers of Accountants: Mrs. Manu KaliaBilal AhmadОценок пока нет

- Chapter 21Документ4 страницыChapter 21Rahila RafiqОценок пока нет

- ACCCOB3Документ10 страницACCCOB3Jenine YamsonОценок пока нет

- Principles of Managerial AccountingДокумент4 страницыPrinciples of Managerial AccountingMohammed AwadОценок пока нет

- Cost-Volume-Profit Analysis: ACCT112: Management AccountingДокумент36 страницCost-Volume-Profit Analysis: ACCT112: Management AccountingSwastik AgarwalОценок пока нет

- 08 02 12 2022 Q 6 7Документ9 страниц08 02 12 2022 Q 6 7Pragathi SundarОценок пока нет

- Cost Volume Profit Analysis Cost Accounting 2022 P1Документ6 страницCost Volume Profit Analysis Cost Accounting 2022 P1jay-an DahunogОценок пока нет

- QUESTION 4 (20 Marks) Solution CVPДокумент5 страницQUESTION 4 (20 Marks) Solution CVPcytan828Оценок пока нет

- The Contribution Margin Ratio Will DecreaseДокумент7 страницThe Contribution Margin Ratio Will DecreaseSaeym SegoviaОценок пока нет

- Solution For Chapter 22 - Part2Документ4 страницыSolution For Chapter 22 - Part2Dương Xuân ĐạtОценок пока нет

- Solution AccountДокумент12 страницSolution Accountbikaspatra89Оценок пока нет

- Cost Management Accounting Assignment Bill French Case StudyДокумент5 страницCost Management Accounting Assignment Bill French Case Studydeepak boraОценок пока нет

- Before-Tax and After-Tax Profit: AnswersДокумент6 страницBefore-Tax and After-Tax Profit: AnswersAhamd AliОценок пока нет

- Module 2 HWДокумент5 страницModule 2 HWdrgОценок пока нет

- Slo 02 Acc230 08 TestДокумент5 страницSlo 02 Acc230 08 TestSammy Ben MenahemОценок пока нет

- MA Assignment 3Документ3 страницыMA Assignment 3SumreeenОценок пока нет

- CHAPTER 11 Answer KeyДокумент8 страницCHAPTER 11 Answer KeyEnsot Soriano33% (3)

- 2-Contribution Margin:: - WithДокумент6 страниц2-Contribution Margin:: - WithAlyn AlconeraОценок пока нет

- Break Even AnalysisДокумент37 страницBreak Even Analysissidra khanОценок пока нет

- Bill French Google Docs Group 5Документ7 страницBill French Google Docs Group 5Jay Florence DalucanogОценок пока нет

- Financial Exercises, KP #1 - 9Документ15 страницFinancial Exercises, KP #1 - 9Bhavik MohanlalОценок пока нет

- CH 5 HWДокумент8 страницCH 5 HWCha Chi BossОценок пока нет

- Marginal CostingДокумент39 страницMarginal CostingMeet LalchetaОценок пока нет

- CVP AnalysisДокумент11 страницCVP AnalysisPratiksha GaikwadОценок пока нет

- Strama Activity 2 SolmanДокумент7 страницStrama Activity 2 SolmanPaupauОценок пока нет

- Chapter 5 (2) CVPДокумент11 страницChapter 5 (2) CVPInocencio TiburcioОценок пока нет

- Chapter 22Документ14 страницChapter 22Nguyên BảoОценок пока нет

- CVP AnalysisДокумент3 страницыCVP AnalysisTERRIUS AceОценок пока нет

- Exercise Chapter 6Документ15 страницExercise Chapter 6thaole.31221026851Оценок пока нет

- Tutorial 3 - Student AnswerДокумент7 страницTutorial 3 - Student AnswerDâmDâmCôNươngОценок пока нет

- Chapter-05 CVP RelationshipДокумент29 страницChapter-05 CVP RelationshipShahinul Kabir100% (4)

- Costing For Decision-Making: Cost Defined As Total ExpenseДокумент44 страницыCosting For Decision-Making: Cost Defined As Total ExpenseUttam Kr PatraОценок пока нет

- 1 CVPДокумент38 страниц1 CVPLouie De La TorreОценок пока нет

- Multiple Choice Answers and Solutions: Realized Gross Profit, 2008 P 675,000Документ26 страницMultiple Choice Answers and Solutions: Realized Gross Profit, 2008 P 675,000Kristine Astorga-NgОценок пока нет

- Depreciation ExercisesДокумент21 страницаDepreciation Exercisesgiezele ballatan100% (2)

- CHAPTER-9 Advance Accounting SolmanДокумент26 страницCHAPTER-9 Advance Accounting SolmanShiela Gumamela100% (1)

- Assignment Bill FrenchДокумент5 страницAssignment Bill Frenchrahulchohan2108Оценок пока нет

- Chapter 10Документ9 страницChapter 10Patrick Earl T. PintacОценок пока нет

- Management Accounting: Page 1 of 6Документ70 страницManagement Accounting: Page 1 of 6Ahmed Raza MirОценок пока нет

- Chapter 9Документ22 страницыChapter 9Glynes NaboaОценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)От EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Оценок пока нет

- Actuarial Finance: Derivatives, Quantitative Models and Risk ManagementОт EverandActuarial Finance: Derivatives, Quantitative Models and Risk ManagementОценок пока нет

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОт EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОценок пока нет

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsОт EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsОценок пока нет

- CPA Review Notes 2019 - BEC (Business Environment Concepts)От EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Рейтинг: 4 из 5 звезд4/5 (9)

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueОт EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueРейтинг: 1 из 5 звезд1/5 (1)

- Notes PDFДокумент80 страницNotes PDFRahila Rafiq100% (5)

- Chapter 20 NotesДокумент17 страницChapter 20 NotesRahila RafiqОценок пока нет

- Chapter 21Документ4 страницыChapter 21Rahila RafiqОценок пока нет

- Chapter 17Документ6 страницChapter 17Rahila RafiqОценок пока нет

- Chapter 16Документ8 страницChapter 16Rahila RafiqОценок пока нет

- Chapter 15Документ7 страницChapter 15Rahila RafiqОценок пока нет

- Chapter 12Документ7 страницChapter 12Rahila RafiqОценок пока нет

- Cost Accounting 9 EditionДокумент19 страницCost Accounting 9 EditionRahila RafiqОценок пока нет

- Cost Accounting 9 EditionДокумент5 страницCost Accounting 9 EditionRahila RafiqОценок пока нет

- Chapter 11Документ3 страницыChapter 11Rahila RafiqОценок пока нет

- Chapter 1Документ28 страницChapter 1Rahila RafiqОценок пока нет

- Cost Accounting 9 EditionДокумент11 страницCost Accounting 9 EditionRahila RafiqОценок пока нет

- Cost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSДокумент16 страницCost Accounting 9 Edition: Muhammad Shahid Mba (Finance) UOSRahila Rafiq0% (1)

- Haleeb ReportДокумент28 страницHaleeb ReportAnas AliОценок пока нет

- Assignment 5Документ4 страницыAssignment 5Sachin A Khochare67% (3)

- A) Business Plan OutlineДокумент13 страницA) Business Plan Outlinedurga_9Оценок пока нет

- Brand Mantras Rationale Criteria and ExamplesДокумент11 страницBrand Mantras Rationale Criteria and ExamplesBrownbrothaMОценок пока нет

- HSC Business Studies Simplified SyllabusДокумент8 страницHSC Business Studies Simplified SyllabusTom LuoОценок пока нет

- Invoice - No - 1181 - DT - 03112022 Original For RecipientДокумент1 страницаInvoice - No - 1181 - DT - 03112022 Original For RecipientAshwani SharmaОценок пока нет

- Anti Money Laundering (Part 4)Документ86 страницAnti Money Laundering (Part 4)Brian Shanny0% (1)

- The Taste of Nationalism Food Politics in Postsocialist MoscowДокумент26 страницThe Taste of Nationalism Food Politics in Postsocialist MoscowDariaAtlasОценок пока нет

- Dissertation Topics in Finance IndiaДокумент6 страницDissertation Topics in Finance IndiaWriteMyPaperCollegeUK100% (1)

- Ambuja Cements BrandДокумент17 страницAmbuja Cements BrandVipin KvОценок пока нет

- SL5298284 Additional Docs 3Документ7 страницSL5298284 Additional Docs 3prnali.vflОценок пока нет

- Adventure 16 United StatesДокумент435 страницAdventure 16 United StatesDataGroup Retailer AnalysisОценок пока нет

- Unit-15 Sales Forecasting and Sales Quotas PDFДокумент8 страницUnit-15 Sales Forecasting and Sales Quotas PDFbhar4tp100% (1)

- Economics Usa 8th Edition Behravesh Test BankДокумент19 страницEconomics Usa 8th Edition Behravesh Test Banktimothyleonnsfaowjymq100% (12)

- Stock Valuation: A Case Study of Texas Instruments: Brinwa Michelle Kra, Brisa Marner, Diana Ruiz, and Mitchell WolfeДокумент7 страницStock Valuation: A Case Study of Texas Instruments: Brinwa Michelle Kra, Brisa Marner, Diana Ruiz, and Mitchell Wolfesaeed ansariОценок пока нет

- Brochure Foundation of Stock Market InvestingДокумент10 страницBrochure Foundation of Stock Market InvestingRahul SharmaОценок пока нет

- Dar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Документ5 страницDar Es Salaam Stock Exchange: Market Report Wednesday, 10 ʰ June 2020Hanzuruni RashidiОценок пока нет

- Ch06 Solations Brigham 10th EДокумент32 страницыCh06 Solations Brigham 10th ERafay HussainОценок пока нет

- UNIQLO AssignmentДокумент2 страницыUNIQLO AssignmentWiselyОценок пока нет

- NC Concept MapДокумент3 страницыNC Concept MapMitch MindanaoОценок пока нет

- Corporate Growth StrategiesДокумент7 страницCorporate Growth Strategiesstephen mwendwaОценок пока нет

- Aata PresentationДокумент20 страницAata PresentationFiroz Ahamed100% (1)

- CH 06Документ4 страницыCH 06vivien100% (1)

- Goni MahwashДокумент27 страницGoni MahwashChandan ChoudharyОценок пока нет

- China National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseДокумент2 страницыChina National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseMd Abdur RahmanОценок пока нет

- Cost ConceptsДокумент19 страницCost ConceptsPrabha Karan100% (1)

- NPD Module 5 PDFДокумент36 страницNPD Module 5 PDFSai RamОценок пока нет

- BET430 Lecture 10Документ5 страницBET430 Lecture 10sacoОценок пока нет

- Nasdaq Composite White PaperДокумент8 страницNasdaq Composite White PaperavaresearchОценок пока нет

- Mona Mohamed, Menna Selem, Mariam, ManalДокумент8 страницMona Mohamed, Menna Selem, Mariam, ManalMenna HamoudaОценок пока нет