Академический Документы

Профессиональный Документы

Культура Документы

Anexo Ii Tabela de Alíquotas Por Códigos Fpas

Загружено:

maislon2010Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Anexo Ii Tabela de Alíquotas Por Códigos Fpas

Загружено:

maislon2010Авторское право:

Доступные форматы

15/07/13

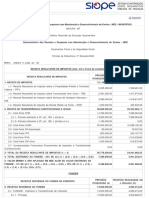

ANEXO II TABELA DE ALQUOTAS POR CDIGOS FPAS

ANEXO II

TABELA DE ALQUOTAS POR CDIGOS FPAS

Alterado pela Instruo Normativa RFB n 1.238/2012 (DOU de 12.01.2012) - vigncia a partir de 12.01.2012 Redao anterior

ALQUOTAS (%)

Prev .

SalrioFundo

Total

GILRAT

INCRA SENAI SESI SENAC SESC SEBRAE DPC

SENAR SEST SENAT SESCOOP

Social

Educao

Aerov irio

CDIGO DO

FPAS

Outras

Ent.

---

---

0001

0002

0004 0008 0016

0032

0064

0128

0256

0512 1024 2048

4096

507

20

Varivel

2,5

0,2

1,0

1,5

---

---

0,6

---

---

---

---

---

---

Ou

Fundos

5,8

507 Cooperativa

20

Varivel

2,5

0,2

---

---

---

---

0,6

---

---

---

---

---

2,5

5,8

515

20

Varivel

2,5

0,2

---

---

1,0

1,5

0,6

---

---

---

---

---

---

5,8

515 Cooperativa

20

Varivel

2,5

0,2

---

---

---

---

0,6

---

---

---

---

---

2,5

5,8

523

20

Varivel

2,5

0,2

---

---

---

---

---

---

---

---

---

---

---

2,7

531

20

Varivel

2,5

2,7

---

---

---

---

---

---

---

---

---

---

---

5,2

540

20

Varivel

2,5

0,2

---

---

---

---

---

2,5

---

---

---

---

---

5,2

558

20

Varivel

2,5

0,2

---

---

---

---

---

---

2,5

---

---

---

---

5,2

566

20

Varivel

2,5

0,2

---

---

---

1,5

0,3

---

---

---

---

---

---

4,5

566 Cooperativa

20

Varivel

2,5

0,2

---

---

---

---

0,3

---

---

---

---

---

2,5

5,5

574

20

Varivel

2,5

0,2

---

---

---

1,5

0,3

---

---

---

---

---

---

4,5

574 Cooperativa

20

Varivel

2,5

0,2

---

---

---

---

0,3

---

---

---

---

---

2,5

5,5

582

20

Varivel

---

---

---

---

---

---

---

---

---

---

---

---

---

---

590

20

Varivel

2,5

---

---

---

---

---

---

---

---

---

---

---

---

2,5

604

---

---

2,5

0,2

---

---

---

---

---

---

---

---

---

---

---

2,7

612

20

Varivel

2,5

0,2

---

---

---

---

0,6

---

---

---

1,5

1,0

---

5,8

612 Cooperativa

20

Varivel

2,5

0,2

---

---

---

---

0,6

---

---

---

---

---

2,5

5,8

620

20

---

---

---

---

---

---

---

---

---

---

---

1,5

1,0

---

2,5

639

---

---

---

---

---

---

---

---

---

---

---

---

---

---

---

---

647

---

---

2,5

0,2

---

---

---

1,5

0,3

---

---

---

---

---

---

4,5

655

20

Varivel

2,5

---

---

---

---

---

---

---

---

---

---

---

---

2,5

680

20

Varivel

2,5

0,2

---

---

---

---

---

2,5

---

---

---

---

---

5,2

736

22,5 Varivel

2,5

0,2

---

---

---

---

---

---

---

---

---

---

---

2,7

736

Cooperativa(1)

22,5 Varivel

2,5

0,2

---

---

---

---

---

---

---

---

---

---

---

2,7

0,2

744 Seg. Especial

2,0

0,1

---

---

---

---

---

---

---

---

---

0,2

---

---

---

744 Pessoa Fsica

2,0

0,1

---

---

---

---

---

---

---

---

---

0,2

---

---

---

0,2

744 Pes. Jurdica

2,5

0,1

---

---

---

---

---

---

---

---

---

0,25

---

---

---

0,25

744 Agroindstria

2,5

0,1

---

---

---

---

---

---

---

---

---

0,25

---

---

---

0,25

779

5,0

---

---

---

---

---

---

---

---

---

---

---

---

---

---

---

787

20

Varivel

2,5

0,2

---

---

---

---

---

---

---

2,5

---

---

---

5,2

787Cooperativa(1)

20

Varivel

2,5

0,2

---

---

---

---

---

---

---

---

---

---

2,5

5,2

795 Cooperativa

20

Varivel

2,5

2,7

---

---

---

---

---

---

---

---

---

---

2,5

7,7

825

---

---

2,5

2,7

---

---

---

---

---

---

---

---

---

---

---

5,2

833

---

---

2,5

0,2

1,0

1,5

---

---

0,6

---

---

---

---

---

---

5,8

876

20

Varivel

---

---

---

---

---

---

---

---

---

---

---

---

---

---

Nota (1): At 24/09/2007 as cooperativas de crdito enquadravam-se no cdigo FPAS 736. ( 11 do art. 72 da Instruo

Normativa RFB n 971 de 13 de novembro de 2009) e, a partir de 01/01/2008, por fora do disposto no art. 10 da Lei n

11.524, de 24 de setembro de 2007, e do principio da anualidade, passaram a contribuir para o SESCOOP, em

substituio contribuio patronal adicional de 2,5%, com enquadramento no cdigo FPAS 787 ( 12 do art. 72 e 2

do art. 109-F da Instruo Normativa RFB n 971, de 2009). As demais cooperativas que desenvolvam atividades do

cdigo FPAS 736, sujeitam-se contribuio patronal adicional devida Seguridade Social de 2,5%, sem contribuio

para o SESCOOP, por no estarem abrangidas pelo inciso I do caput e pelo 2 do art. 10 da Medida Provisria n

2.168-40, de 24 de agosto de 2001.

www.econeteditora.com.br/bdi/in/09/in971_rfb_2009_anexoii.php

1/1

Вам также может понравиться

- Contabilidade - Apostila Guia de Lançamentos Contábeis - Plano de ContasДокумент154 страницыContabilidade - Apostila Guia de Lançamentos Contábeis - Plano de ContasContaconta100% (202)

- Atividade Reflexiva Pratica 2Документ2 страницыAtividade Reflexiva Pratica 2Raissa Martins Santos100% (2)

- DOS010 - UNIMED - ERP-0528 - Integração SOC X Protheus - v5Документ12 страницDOS010 - UNIMED - ERP-0528 - Integração SOC X Protheus - v5luisclauОценок пока нет

- Formulas Do Valor Agregado Explicacoes e Calculo v5Документ14 страницFormulas Do Valor Agregado Explicacoes e Calculo v5M. GinezОценок пока нет

- Tabela de Alíquotas Por FPASДокумент1 страницаTabela de Alíquotas Por FPASRicardo AlmeidaОценок пока нет

- Imprimir: FundebДокумент6 страницImprimir: FundebAna Paula LiesenfeldОценок пока нет

- FGTSДокумент15 страницFGTSTracy SantosОценок пока нет

- RREO Estadual 41 6 2020Документ6 страницRREO Estadual 41 6 2020natali.rosarioОценок пока нет

- Relatório Analítico de GPSДокумент1 страницаRelatório Analítico de GPSMaxwell Pereira XavierОценок пока нет

- Sefip 05.2022Документ9 страницSefip 05.2022lucianaОценок пока нет

- 01-Planilha Atacadista - 01-2014Документ4 страницы01-Planilha Atacadista - 01-2014Gustavo Leite100% (1)

- Plano de Governo Mateus Bandeira (Formatado)Документ128 страницPlano de Governo Mateus Bandeira (Formatado)Paulo Homero CruzОценок пока нет

- Barrinha 2010Документ5 страницBarrinha 2010Raul Freitas LimaОценок пока нет

- Relatório de Avaliação de Receitas e Despesas PrimáriasДокумент9 страницRelatório de Avaliação de Receitas e Despesas PrimáriasatfonsecaОценок пока нет

- Tabela de Alíquotas Por Códigos FpasДокумент2 страницыTabela de Alíquotas Por Códigos FpasVinicios SantosОценок пока нет

- Guia Pratico EFD GoiasДокумент42 страницыGuia Pratico EFD GoiaswreisОценок пока нет

- Tira Dúvidas: Esocial SimplificadoДокумент28 страницTira Dúvidas: Esocial SimplificadoJuliana Pedrete de CastroОценок пока нет

- Relatório Analítico de GPSДокумент1 страницаRelatório Analítico de GPSDANIEL OLIVEIRA DE ALMEIDAОценок пока нет

- DT - Ato - Cotepe - 44 - 2015 - DIFAL - Apuração - e - SPED - Fiscal - Linha Datasul PDFДокумент8 страницDT - Ato - Cotepe - 44 - 2015 - DIFAL - Apuração - e - SPED - Fiscal - Linha Datasul PDFOtavio AraújoОценок пока нет

- FGTS Recalculado 11.2023Документ11 страницFGTS Recalculado 11.2023jesuscarvalhojaciaraОценок пока нет

- PVA Tabela de MensagensДокумент29 страницPVA Tabela de MensagensBLM0Оценок пока нет

- Extr CC213179Документ2 страницыExtr CC213179kamilla5552132Оценок пока нет

- Avaliacao 2 Bimestre Apresentacao Coletiva 20mai2022Документ14 страницAvaliacao 2 Bimestre Apresentacao Coletiva 20mai2022Carlos Estênio BrasilinoОценок пока нет

- DP Objetivo - Atribuições CNAE - 2320-6 - 00Документ6 страницDP Objetivo - Atribuições CNAE - 2320-6 - 00taffarel SilvaОценок пока нет

- Relação de Tomador - Obra - RETДокумент3 страницыRelação de Tomador - Obra - RETJuliane GonçalvesОценок пока нет

- Relação de Tomador - Obra - RETДокумент2 страницыRelação de Tomador - Obra - RETelton rochaОценок пока нет

- Relatório Analítico de GPSДокумент1 страницаRelatório Analítico de GPSRonaldoSilvaОценок пока нет

- Nota Fiscal Eletronica - Especificações Técnicas - Ato 69 Cotepe-IcmsДокумент1 страницаNota Fiscal Eletronica - Especificações Técnicas - Ato 69 Cotepe-IcmsEdivaldo MatiasОценок пока нет

- Relatório de GPS Com Valor Entre R$ 0,00 e R$ 28,99Документ1 страницаRelatório de GPS Com Valor Entre R$ 0,00 e R$ 28,99Juliane GonçalvesОценок пока нет

- COMUNIQUE 29-09 MergedДокумент15 страницCOMUNIQUE 29-09 MergedDiron SantosОценок пока нет

- Relatório REДокумент6 страницRelatório REelton rochaОценок пока нет

- Principais AlteraçõesДокумент16 страницPrincipais AlteraçõesPinheiroRochaОценок пока нет

- Relação de Tomador - Obra - RET 32020Документ26 страницRelação de Tomador - Obra - RET 32020Rodrigo100% (1)

- 7.21.2 FID PPM (PPM - Braskem.com - BR)Документ5 страниц7.21.2 FID PPM (PPM - Braskem.com - BR)Átila Rafael CarvalhoОценок пока нет

- 17 - Gfip - JulhoДокумент35 страниц17 - Gfip - JulhoTadrio TabosaОценок пока нет

- RREO Estadual 13 5 2023Документ8 страницRREO Estadual 13 5 2023RODRIGO BONIFACIO DE SOUZA PAVANIОценок пока нет

- NF Roraima ExtintoresДокумент1 страницаNF Roraima Extintorescamila rendeiroОценок пока нет

- DeclaraçãoДокумент1 страницаDeclaraçãonotyvirОценок пока нет

- 14 - GRF - JulhoДокумент4 страницы14 - GRF - JulhoTadrio TabosaОценок пока нет

- Relatório Analítico Da GRF 32020Документ1 страницаRelatório Analítico Da GRF 32020RodrigoОценок пока нет

- ComprovanteBB - 2020-09-01-144338Документ2 страницыComprovanteBB - 2020-09-01-144338Luis Gustavo FariaОценок пока нет

- RH - Linha Protheus - GPE - Informações e Atualizações Sobre A DIRF 2023 - Ano Calendário 2022 - Central de Atendimento TOTVSДокумент5 страницRH - Linha Protheus - GPE - Informações e Atualizações Sobre A DIRF 2023 - Ano Calendário 2022 - Central de Atendimento TOTVSAnderson LibarinoОценок пока нет

- CROSS Segmentos - TOTVS Backoffice Linha Protheus - FIS - Como Configurar Base Dupla ICMS ST Recolhida Por Diferencial Aliquotas, Conv 52/91?Документ5 страницCROSS Segmentos - TOTVS Backoffice Linha Protheus - FIS - Como Configurar Base Dupla ICMS ST Recolhida Por Diferencial Aliquotas, Conv 52/91?Silas CarvalhoОценок пока нет

- Responde Esocial Març2021Документ32 страницыResponde Esocial Març2021Jailson PereiraОценок пока нет

- Comprovante PDFДокумент1 страницаComprovante PDFamaurygemaqueОценок пока нет

- Bling - Proposta Comercial #205493 (FORTALEZA GESTAO COMERCIAL DE JOIAS FOLHEADAS LTDA)Документ5 страницBling - Proposta Comercial #205493 (FORTALEZA GESTAO COMERCIAL DE JOIAS FOLHEADAS LTDA)Jessica NascimentoОценок пока нет

- A1135P0175Документ48 страницA1135P0175BlazeNewt7 (Noturninho)Оценок пока нет

- Sap Note 3093561 - e - 20230705Документ7 страницSap Note 3093561 - e - 20230705Thiago RochaОценок пока нет

- Patch01spvs05 90Документ6 страницPatch01spvs05 90carlos silvaОценок пока нет

- Relatório Analítico Da GRFДокумент1 страницаRelatório Analítico Da GRFAndre LuisОценок пока нет

- DCI-SN - Instrues de PreenchimentoДокумент52 страницыDCI-SN - Instrues de PreenchimentoJustino CóОценок пока нет

- D.O 28.190 Prorrogação Do LeilãoДокумент1 страницаD.O 28.190 Prorrogação Do LeilãoJohn ItalloОценок пока нет

- Taf-Ecf P12Документ160 страницTaf-Ecf P12Flavio FernandesОценок пока нет

- Exclusão ICMS Do Montante Base PIS e COFINS (TAXBRA)Документ4 страницыExclusão ICMS Do Montante Base PIS e COFINS (TAXBRA)Thiago RochaОценок пока нет

- Projeto de Lei Complementar N° 55/2020. Deputado RooseveltДокумент2 страницыProjeto de Lei Complementar N° 55/2020. Deputado Rooseveltrequerimento rooseveltОценок пока нет

- VisualizadorДокумент1 страницаVisualizadorcarinassantanaОценок пока нет

- Comunicado 2022 - 01 Jan 2a CotaДокумент4 страницыComunicado 2022 - 01 Jan 2a CotaWagner TorresОценок пока нет

- Aula 132 - Principais Mudanças IN RFB N°2121-2022 PIS COFINSДокумент18 страницAula 132 - Principais Mudanças IN RFB N°2121-2022 PIS COFINSRenataОценок пока нет

- Tutorial Sped ContabilДокумент15 страницTutorial Sped ContabilBrunna LinharesОценок пока нет

- Propo Stade CCT 2024Документ45 страницPropo Stade CCT 2024nathan.aleixo19Оценок пока нет

- Apresentacao - Apresentação de LocalizaçãoДокумент127 страницApresentacao - Apresentação de LocalizaçãolsgmelloОценок пока нет

- ManualДокумент109 страницManualmaislon2010Оценок пока нет

- DelphiДокумент48 страницDelphiAndré Luiz Pavão LimaОценок пока нет

- Apostila SQLДокумент46 страницApostila SQLMarcos Abrão MarcelloОценок пока нет

- Apostila SQLДокумент46 страницApostila SQLMarcos Abrão MarcelloОценок пока нет

- Resolucao Plenaria 002 2016 SiteДокумент105 страницResolucao Plenaria 002 2016 Sitemaislon2010Оценок пока нет

- Apostila Planejamento Fiscal 2016Документ62 страницыApostila Planejamento Fiscal 2016maislon2010Оценок пока нет

- Inconsistencias SpedДокумент5 страницInconsistencias Spedmaislon2010Оценок пока нет

- Exame Suficiencia 2013 1 Resolvida e ComentadaДокумент69 страницExame Suficiencia 2013 1 Resolvida e Comentadathiago_bssОценок пока нет

- Exportação Passo A Passo 2012Документ269 страницExportação Passo A Passo 2012evandro7129Оценок пока нет

- BENEFÍCIOS de PIS - COFINS - Produtos Sem NCM Definida em Leis e Decretos InfolexДокумент3 страницыBENEFÍCIOS de PIS - COFINS - Produtos Sem NCM Definida em Leis e Decretos Infolexmaislon2010Оценок пока нет

- Perguntas e Respostas EC87-Versao 14012016Документ8 страницPerguntas e Respostas EC87-Versao 14012016maislon2010Оценок пока нет

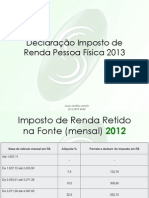

- Irpf 2013Документ30 страницIrpf 2013maislon2010Оценок пока нет

- Apostila Contabilidade Custos PDFДокумент234 страницыApostila Contabilidade Custos PDFMarcos Alexandre Amaral RamosОценок пока нет

- VT Ag Fe 11-15 PDFДокумент93 страницыVT Ag Fe 11-15 PDFmaislon2010Оценок пока нет

- Apostila Cathedra - Contabilidade de CustosДокумент167 страницApostila Cathedra - Contabilidade de Custosresolvidos50% (2)

- Material 3149Документ7 страницMaterial 3149maislon2010Оценок пока нет

- Dre TrabalhoДокумент1 страницаDre Trabalhomaislon2010Оценок пока нет

- Tabela de Incidencia de Ir Inss Fgts 2013Документ2 страницыTabela de Incidencia de Ir Inss Fgts 2013maislon2010Оценок пока нет

- 8856 Aula 8 - CustosДокумент20 страниц8856 Aula 8 - Custosmaislon2010Оценок пока нет

- 8856 Aula 8 - CustosДокумент20 страниц8856 Aula 8 - Custosmaislon2010Оценок пока нет

- Apostila ContabInternacional Enfase IFRS US GAAP e BR GAAPДокумент122 страницыApostila ContabInternacional Enfase IFRS US GAAP e BR GAAPevanilucio5213Оценок пока нет

- As Testemunhas de JeováДокумент5 страницAs Testemunhas de Jeovámaislon2010Оценок пока нет

- 1º TimóteoДокумент10 страниц1º TimóteoCaminho da Graça | blog67% (3)

- Cartilha Bdi Crea EsДокумент40 страницCartilha Bdi Crea EsFranc2011100% (1)

- ARTIGO - Ritmo - O Início Do Curso de MúsicaДокумент10 страницARTIGO - Ritmo - O Início Do Curso de Músicamaislon2010Оценок пока нет

- 2011 DemonstracoesContabeis CRCДокумент65 страниц2011 DemonstracoesContabeis CRCeduardoborgesdocarmoОценок пока нет

- Excel 2007 AvancadoДокумент50 страницExcel 2007 AvancadoRômulo AmaralОценок пока нет

- Gestão de CustosДокумент56 страницGestão de Custosmaislon2010Оценок пока нет

- Apresentacaocursoretencaofonte2009 100106045551 Phpapp01Документ274 страницыApresentacaocursoretencaofonte2009 100106045551 Phpapp01maislon2010Оценок пока нет

- STOCK, M J 2005 VelhosENovosAtoresPoliticos PartidosEMovim SociaisДокумент160 страницSTOCK, M J 2005 VelhosENovosAtoresPoliticos PartidosEMovim SociaisLise TeixeiraОценок пока нет

- Manual de Auditoria e Controles Internos TCEДокумент121 страницаManual de Auditoria e Controles Internos TCEIvair M Passarinho100% (1)

- Peça Tributário OAB 36Документ2 страницыPeça Tributário OAB 36Tayna CarvalhoОценок пока нет

- Oficio Gab Seduc N 963 2024 UndimeДокумент6 страницOficio Gab Seduc N 963 2024 UndimeElisete BinelloОценок пока нет

- O Principe Eo MendigoДокумент92 страницыO Principe Eo MendigoJackson Da Silveira DóriaОценок пока нет

- Legislação Educacional 16.05Документ3 страницыLegislação Educacional 16.05Thais Moura dos SantosОценок пока нет

- Daniel 4 - Deus Quer Te Dar VidaДокумент31 страницаDaniel 4 - Deus Quer Te Dar VidaEvelina Gizel Salomão MonteiroОценок пока нет

- Meu Planner 2022 - ProfessoraДокумент51 страницаMeu Planner 2022 - ProfessoraTatiane ReginaОценок пока нет

- A Produção de Sentidos e Significados Matemáticos Por EstudantesДокумент121 страницаA Produção de Sentidos e Significados Matemáticos Por EstudantesGrazonarqОценок пока нет

- Apresentação 1Документ12 страницApresentação 1gustavojorОценок пока нет

- BoletoДокумент1 страницаBoletoJhessyca Rodrigues BorgesОценок пока нет

- Anna Tsing - Viver Nas Ruínas - Cap - 1Документ21 страницаAnna Tsing - Viver Nas Ruínas - Cap - 1Jaime De Jesus SantanaОценок пока нет

- Re 351.487-RRДокумент37 страницRe 351.487-RRErilson FonsecaОценок пока нет

- Cultura e Identidade SurdaДокумент18 страницCultura e Identidade SurdaErnanda GarciaОценок пока нет

- Procedimentos em Atenção PrimáriaДокумент19 страницProcedimentos em Atenção PrimáriaMariana OliveiraОценок пока нет

- GorongosaДокумент61 страницаGorongosaFrancisco Jose NorisОценок пока нет

- 56 Cartas de Paulo (Reduzido)Документ33 страницы56 Cartas de Paulo (Reduzido)Laury de JesusОценок пока нет

- FAQ DVIDASFREQUENTES SampPДокумент43 страницыFAQ DVIDASFREQUENTES SampParthurmartinsleite1Оценок пока нет

- Sensores Magnéticos (BR) (1) BALUFFДокумент20 страницSensores Magnéticos (BR) (1) BALUFFKarina RickenОценок пока нет

- TEXTO - O Que Voc Est Lendo Neste Dia Do LeitorДокумент8 страницTEXTO - O Que Voc Est Lendo Neste Dia Do LeitorMike FelipeОценок пока нет

- Toruk FerroVerdeДокумент3 страницыToruk FerroVerdeRenato Renan SantosОценок пока нет

- Exercicios PedologiaДокумент3 страницыExercicios PedologiaBruno Delvequio Zequin80% (5)

- Resolução n07 - 2021 DG - DNITДокумент69 страницResolução n07 - 2021 DG - DNITmarcelobiologoОценок пока нет

- Elementos Plautinos em o Santo e A Porca, de Ariano SuassunaДокумент18 страницElementos Plautinos em o Santo e A Porca, de Ariano SuassunaJéssica Liara RicarteОценок пока нет

- Onhb13 - Fase - 3 - para ImpressaoДокумент37 страницOnhb13 - Fase - 3 - para ImpressaoJulia não seiОценок пока нет

- Morangosmofados PDFДокумент14 страницMorangosmofados PDFCristiano Da Silveira PereiraОценок пока нет

- Filosofia SocialДокумент208 страницFilosofia SocialThiago D VieiraОценок пока нет

- 1 PDFДокумент32 страницы1 PDFWênio AlencarОценок пока нет