Академический Документы

Профессиональный Документы

Культура Документы

Due Dates For Filing Various Statutory Returns ACT Due Date Particulars TDS

Загружено:

Mandira KollaliИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Due Dates For Filing Various Statutory Returns ACT Due Date Particulars TDS

Загружено:

Mandira KollaliАвторское право:

Доступные форматы

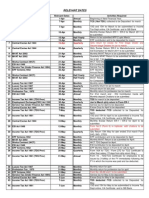

DUE DATES FOR FILING VARIOUS STATUTORY RETURNS ACT TDS DUE DATE 7th of Every Month 15th

July 15th October 15th January 15th June 21st of Every Month 21st of Every Month 11th November 12th May 15th of Every Month 25th of Every Month 30th April 20th of Every Month PARTICULARS TDS Challan remittance to Bank. 1st Quarter e-TDS Return Filing 2nd Quarter e-TDS Return Filing 3rd Quarter e-TDS Return Filing 4th Quarter e-TDS Return Filing Monthly Challan remittance to Bank Monthly ESI Returns ESI 1st Half yearly Returns ESI 2nd Half yearly Returns Monthly Challan remittance to Bank Monthly PF Returns Yearly Returns Monthly Challan Remittance

ESI

PF

PT

STATUTORY RETURNS AND FORMS ACT TDS Particulars Monthly TDS Challans Quarterly e-TDS returns for Salaries Acknowledgement for e-TDS Return To be issued to all Employees at the year end Details of Perquisites required to be issued to Employees ESI Monthly ESI remittance Challan Half yearly ESI Returns Half yearly ESI register of Employees Monthly Challan remittance to Bank Returns of Newly joined Employees Returns of Left Employees Monthly Summary Statement of PF Payable Yearly Individual Employees Contribution Summary Yearly Company Summary PT Bonus Monthly Challan Remittance Summary of Bonus Paid Details Form Number ITNS 281 24 Q 27 A Form 16 12 BA ESI Challan Form 5 Form 6 PF Challan Form 5 Form 10 Form 12 A Form 3 A Form 6 A PT Challan Form C

PF

Downloaded From: www.skmc.in

Вам также может понравиться

- Contributions Payment Form-SSSДокумент6 страницContributions Payment Form-SSSrhev63% (8)

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionОт EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionОценок пока нет

- Calamansi: Soil and Climatic RequirementsДокумент4 страницыCalamansi: Soil and Climatic Requirementshikage0100% (1)

- Figs Taste Scale of Selected Varieties From Hawaiifruit-Net PDFДокумент4 страницыFigs Taste Scale of Selected Varieties From Hawaiifruit-Net PDFHanafizar Hanafi Napi AtanОценок пока нет

- Do RememberДокумент6 страницDo RememberRohit KariwalaОценок пока нет

- Financial Calendar 2011-12Документ3 страницыFinancial Calendar 2011-12Delma SebastianОценок пока нет

- Important Financial Date(s) Reminder For Fin. Year-2014-2015Документ16 страницImportant Financial Date(s) Reminder For Fin. Year-2014-2015SureshArigelaОценок пока нет

- Due Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSДокумент1 страницаDue Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSsanyu1208Оценок пока нет

- Compliance Due Date Event Name: Compliance Calender For The Month of November 2012Документ6 страницCompliance Due Date Event Name: Compliance Calender For The Month of November 2012kumar_anil666Оценок пока нет

- PF NotesДокумент15 страницPF NotesAbdul KhadhirОценок пока нет

- 12 Compliance ChartДокумент19 страниц12 Compliance CharttabrezullakhanОценок пока нет

- Relevant Dates: 15-Apr QuarterlyДокумент6 страницRelevant Dates: 15-Apr Quarterlysanyu1208Оценок пока нет

- JCI Compliance ChecklistДокумент2 страницыJCI Compliance ChecklistSumitBaradiaОценок пока нет

- Work ScheduleДокумент12 страницWork ScheduleDonesh VarshneyОценок пока нет

- 25 - MCQ Late Filing Fees and PenaltyДокумент12 страниц25 - MCQ Late Filing Fees and PenaltyParth UpadhyayОценок пока нет

- Task List: Pay Roll AdministrationДокумент2 страницыTask List: Pay Roll AdministrationNipun ChathurangaОценок пока нет

- Terms of State Bank of IndiaДокумент5 страницTerms of State Bank of IndiaexperinmentОценок пока нет

- Monthly PayslipДокумент42 страницыMonthly PayslipVenkatesh ChowdaryОценок пока нет

- Key Dates November 2014 DUE Dates Particulars Form / Challan NumberДокумент2 страницыKey Dates November 2014 DUE Dates Particulars Form / Challan NumberAnkur AroraОценок пока нет

- Office PPT Template 001Документ9 страницOffice PPT Template 001Arman MuhammadОценок пока нет

- What Is Payroll?Документ12 страницWhat Is Payroll?vishnukant mishraОценок пока нет

- SN Vertical Due Dates Particular Consequence of Non ComplianceДокумент1 страницаSN Vertical Due Dates Particular Consequence of Non ComplianceNikhil KasatОценок пока нет

- Employment Law (HRM 657)Документ18 страницEmployment Law (HRM 657)Lia AliaaОценок пока нет

- Rap2x Love Taka SobraДокумент18 страницRap2x Love Taka SobraRalph Christer MaderazoОценок пока нет

- Investment Declaration Form - 1314 - IshitaДокумент5 страницInvestment Declaration Form - 1314 - IshitaIshita AwasthiОценок пока нет

- Non Trading ConcernsДокумент27 страницNon Trading ConcernsMuhammad Salim Ullah Khan0% (1)

- Tax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableДокумент1 страницаTax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableCA Arpit YadavОценок пока нет

- Due Dtaes Chart by MeДокумент4 страницыDue Dtaes Chart by MezydusОценок пока нет

- Subject: Financial Accounts: Topic: Financial Statements of Not For Profit OrganizationsДокумент5 страницSubject: Financial Accounts: Topic: Financial Statements of Not For Profit OrganizationsQuestionscastle FriendОценок пока нет

- Financial Details Modification Form PDFДокумент1 страницаFinancial Details Modification Form PDFbvdasОценок пока нет

- HR OPs - List of ActivitiesДокумент2 страницыHR OPs - List of ActivitiesDhanalaxmi VenkatОценок пока нет

- Office of The Principal Accountant General (A & E) Odisha, BhubaneswarДокумент2 страницыOffice of The Principal Accountant General (A & E) Odisha, BhubaneswarmilucoolОценок пока нет

- Venkateswara Rao Chinimilli: Contact No: 09176322333/09133954333 EmailДокумент3 страницыVenkateswara Rao Chinimilli: Contact No: 09176322333/09133954333 EmailBrahmam AkumallaОценок пока нет

- Salary Master.D.valid.1.9.2010Документ2 737 страницSalary Master.D.valid.1.9.2010Shashi Bhushan SonbhadraОценок пока нет

- Employees' Provident Fund Scheme: (0.18 %)Документ9 страницEmployees' Provident Fund Scheme: (0.18 %)Shubhabrata BanerjeeОценок пока нет

- Tax Alert June 11Документ1 страницаTax Alert June 11nightsaraОценок пока нет

- Sample FlowChartДокумент1 страницаSample FlowChartvirag_shahsОценок пока нет

- Yohanes TampubolonДокумент8 страницYohanes TampubolonTOT BandungОценок пока нет

- 10 PGH-40 InstructionsДокумент9 страниц10 PGH-40 InstructionsGruntholomew HanscombeОценок пока нет

- Inos Sss Contribution FormДокумент6 страницInos Sss Contribution FormYeye TanОценок пока нет

- (See Rules 11 (4) and 80 of Central Government Account (Receipts & Payments) Rules, 1983)Документ2 страницы(See Rules 11 (4) and 80 of Central Government Account (Receipts & Payments) Rules, 1983)Y S ChakradharОценок пока нет

- Tax Declaration Form For 2012-13Документ1 страницаTax Declaration Form For 2012-13Sharique NisarОценок пока нет

- Email Verification (Abid)Документ32 страницыEmail Verification (Abid)Ali XafarОценок пока нет

- BL ChecklistДокумент7 страницBL ChecklistshaikhОценок пока нет

- DSCN - Shree AutomotiveДокумент24 страницыDSCN - Shree AutomotiveNikhilesh BhattacharyyaОценок пока нет

- Form CДокумент2 страницыForm Cnimoakalanka100% (1)

- 1604-CFДокумент8 страниц1604-CFmamasita25Оценок пока нет

- Calender 09 Service TaxДокумент4 страницыCalender 09 Service TaxkingindiaОценок пока нет

- Memo - Ciap Submission of 2016 ReportsДокумент2 страницыMemo - Ciap Submission of 2016 ReportsHoven MacasinagОценок пока нет

- Icici Doc ReqdДокумент2 страницыIcici Doc ReqdSagar SoniОценок пока нет

- Due Dates April 2014Документ1 страницаDue Dates April 2014Ramesh KrishnanОценок пока нет

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Документ28 страницModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyОценок пока нет

- Checklist-Various Statutory Compliances SR - No. Statue DescriptionДокумент3 страницыChecklist-Various Statutory Compliances SR - No. Statue Descriptionmanan3466Оценок пока нет

- SSS R5 - AdmiralДокумент6 страницSSS R5 - AdmiralKaye LadsОценок пока нет

- COA Acctg Cir Let 2007-001Документ4 страницыCOA Acctg Cir Let 2007-001Misc EllaneousОценок пока нет

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsДокумент4 страницыFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiОценок пока нет

- July 2015Документ1 страницаJuly 2015api-276245255Оценок пока нет

- Economic & Budget Forecast Workbook: Economic workbook with worksheetОт EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetОценок пока нет

- 21St Century Computer Solutions: A Manual Accounting SimulationОт Everand21St Century Computer Solutions: A Manual Accounting SimulationОценок пока нет

- Tele ConferencingДокумент2 страницыTele ConferencingMandira KollaliОценок пока нет

- Marketing Mix of The Hotel IndustryДокумент11 страницMarketing Mix of The Hotel IndustryMandira KollaliОценок пока нет

- CA Firms - ArticleshipДокумент1 страницаCA Firms - ArticleshipMandira KollaliОценок пока нет

- Deductions 80E 80UДокумент10 страницDeductions 80E 80UMandira KollaliОценок пока нет

- Auditing of Substantive CyclesДокумент7 страницAuditing of Substantive CyclesMandira KollaliОценок пока нет

- Deductions Under Chapter Vi-AДокумент8 страницDeductions Under Chapter Vi-AMandira KollaliОценок пока нет

- Chem Sba 2019-2020Документ36 страницChem Sba 2019-2020Amma MissigherОценок пока нет

- Morita Therapy For Depression and AnxietyДокумент13 страницMorita Therapy For Depression and AnxietyPedro GuimarãesОценок пока нет

- Radiesthesia and The Major ArcanaДокумент72 страницыRadiesthesia and The Major ArcanaStere Stere67% (3)

- Dolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Документ5 страницDolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Alejandro RuizОценок пока нет

- 13 Unit 5 PainДокумент4 страницы13 Unit 5 PainAndres SalazarОценок пока нет

- Guia Laboratorio Refrigeración-2020Документ84 страницыGuia Laboratorio Refrigeración-2020soniaОценок пока нет

- Business-Plan (John Lloyd A Perido Grade 12-Arc)Документ4 страницыBusiness-Plan (John Lloyd A Perido Grade 12-Arc)Jaypher PeridoОценок пока нет

- Food DirectoryДокумент20 страницFood Directoryyugam kakaОценок пока нет

- Question Bank Chemistry (B.Tech.) : Solid StateДокумент10 страницQuestion Bank Chemistry (B.Tech.) : Solid StatenraiinОценок пока нет

- Water Quantity Estimation PDFДокумент3 страницыWater Quantity Estimation PDFOladunni AfolabiОценок пока нет

- A Guide To LU3 PDFДокумент54 страницыA Guide To LU3 PDFMigs MedinaОценок пока нет

- R. Raghunandanan - 6Документ48 страницR. Raghunandanan - 6fitrohtin hidayatiОценок пока нет

- Exercise 6Документ2 страницыExercise 6Satyajeet PawarОценок пока нет

- DefibrillatorДокумент2 страницыDefibrillatorVasanth VasanthОценок пока нет

- Methods For The Assessment of Productivity of Small Hold FarmsДокумент49 страницMethods For The Assessment of Productivity of Small Hold FarmsMonaliz NagrampaОценок пока нет

- Schengen Certificate ExampleДокумент2 страницыSchengen Certificate ExampleGabriel Republi CanoОценок пока нет

- Theory of Accounts On Business CombinationДокумент2 страницыTheory of Accounts On Business CombinationheyОценок пока нет

- Ciac - HW Brochure Seer 16Документ2 страницыCiac - HW Brochure Seer 16Tatiana DiazОценок пока нет

- 13 Ed Gulski PraesentationДокумент45 страниц13 Ed Gulski Praesentationcarlos vidalОценок пока нет

- Profile of RespondentsДокумент36 страницProfile of RespondentsPratibha SharmaОценок пока нет

- JIDMR SCOPUS Ke 4 Anwar MallongiДокумент4 страницыJIDMR SCOPUS Ke 4 Anwar Mallongiadhe yuniarОценок пока нет

- Eaton Current Limiting FusesДокумент78 страницEaton Current Limiting FusesEmmanuel EntzanaОценок пока нет

- Case Analysis of Vishal Jeet V. Union of India Trafficking of Women and ChildrenДокумент7 страницCase Analysis of Vishal Jeet V. Union of India Trafficking of Women and ChildrenTrishani NahaОценок пока нет

- Raffles Hotel Jakarta Pricelist 2020Документ2 страницыRaffles Hotel Jakarta Pricelist 2020kielachela aaОценок пока нет

- MODEL 1332 MODEL 1432: Slide LengthДокумент8 страницMODEL 1332 MODEL 1432: Slide LengthFabian FragosoОценок пока нет

- 134.4902.06 - DM4170 - DatasheetДокумент7 страниц134.4902.06 - DM4170 - DatasheetVinicius MollОценок пока нет

- Good Laboratory Practice GLP Compliance Monitoring ProgrammeДокумент17 страницGood Laboratory Practice GLP Compliance Monitoring ProgrammeamgranadosvОценок пока нет

- Dyestone Blue MX SDS SA-0186-01Документ5 страницDyestone Blue MX SDS SA-0186-01gede aris prayoga mahardikaОценок пока нет