Академический Документы

Профессиональный Документы

Культура Документы

INCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per Year

Загружено:

pintoo23Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

INCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per Year

Загружено:

pintoo23Авторское право:

Доступные форматы

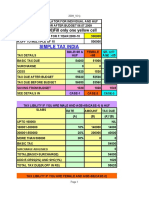

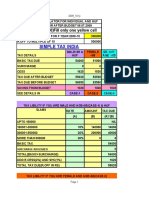

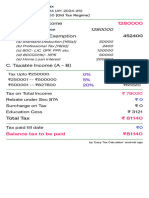

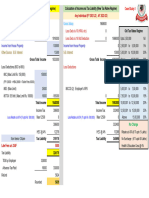

INCOME TAX CALCULATION for Year 2008-2009

TAXABLE STANDARD TAXABLE Others Rs. Male

PERKS per Year PERKS per Year

BASIC 57250 INCENTIVE (Appx) 13500

HRA 19620 LTA 0

SPECIAL ALLOWANCE 68640 TAXABLE MEDICAL

PERFORMANCE BONUS 15000 Other Income 0

Total 160510 13500

57250 160510 13500

TOTAL INCOME 174010

ACCOMODATION Own 0

Rent Receipt (Total Year) 0

TOTAL TAXABLE INCOME -68700 174010

171610

DEDUCTION (Annualy) Amount BALANCE

HOUSING LOAN INTEREST PAID(VI-A) 0 171610

Investment in Tax Savings Schemes 12000 159610 12000

Medical Insurance Premium (sec 80D) 0 159610

Medical Insurance Premium (Perents) 0 159610

NET TAXABLE INCOME 159610

Tax Slabs

Taxable income From To Tax rate Appl Amt Tax

0 150000 0% 150000 0

150001 300000 10% 9610 961

300001 500000 20% 0 0

500001 > 500001 30% 0 0

Tax on Income 961

Education Cess 29

Total Income Tax Liability for a year 08-09 990

Profassonal Tax 2400

Income Tax + Prof Tax / Month = 282

prshah@essar.com

Вам также может понравиться

- Income Tax Calculation SheetДокумент8 страницIncome Tax Calculation SheetArajrubanОценок пока нет

- Tax Calculator Version 2Документ4 страницыTax Calculator Version 2SoikotОценок пока нет

- 1 - Payslip - July 2020Документ2 страницы1 - Payslip - July 2020B.GOUTHAM SABARIESОценок пока нет

- Letters p1 Individual and Company Nil Estimate 3Документ3 страницыLetters p1 Individual and Company Nil Estimate 3Mark SilbermanОценок пока нет

- Ques. Defered TaxДокумент40 страницQues. Defered TaxKALYANI JAYAKRISHNAN 2022155Оценок пока нет

- Month Net Taxable Income Tax Slabs Tax RateДокумент2 страницыMonth Net Taxable Income Tax Slabs Tax RateBhargav ChintalapatiОценок пока нет

- N2K Info Systems Private Limited: Payslip For The Month of April - 2019Документ1 страницаN2K Info Systems Private Limited: Payslip For The Month of April - 2019Munna ShaikОценок пока нет

- 12lpa Tax ComputationДокумент1 страница12lpa Tax ComputationSai KrishnaОценок пока нет

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellДокумент4 страницыSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellPradip ShawОценок пока нет

- Tax Calculator AY 09-10Документ4 страницыTax Calculator AY 09-10madhuamsОценок пока нет

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellДокумент4 страницыSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellRaj PatilОценок пока нет

- Easy TaxДокумент1 страницаEasy TaxSiva GaneshОценок пока нет

- For Holders: Automated Income Tax CalculationДокумент16 страницFor Holders: Automated Income Tax Calculationmaruf048Оценок пока нет

- Computation of Total Income: Zenit - A KDK Software Software ProductДокумент2 страницыComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryОценок пока нет

- PaySlip MSR Sept2021Документ3 страницыPaySlip MSR Sept2021B.GOUTHAM SABARIESОценок пока нет

- Income Tax CalculatorДокумент2 страницыIncome Tax CalculatorVINOD KAОценок пока нет

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureДокумент1 страницаPersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikОценок пока нет

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureДокумент1 страницаPersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikОценок пока нет

- Luminous Power Technologies Private Limited: Earnings DeductionsДокумент1 страницаLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kОценок пока нет

- Sols-Dr RajniДокумент5 страницSols-Dr Rajnialex breymannОценок пока нет

- Payslip - May - 2020 PDFДокумент1 страницаPayslip - May - 2020 PDFchanduОценок пока нет

- Income Tax Calculator Fy 2021 22 v2Документ11 страницIncome Tax Calculator Fy 2021 22 v2yuvirocksОценок пока нет

- Tax Answerrs and QuestionsДокумент33 страницыTax Answerrs and QuestionsoluwafunmilolaabiolaОценок пока нет

- 1663274292-Tax Cals-1Документ1 страница1663274292-Tax Cals-1Kriti GandhiОценок пока нет

- R2. TAX (M.L) Solution CMA May-2023 ExamДокумент5 страницR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudОценок пока нет

- ICRRS - Practice Sheet - Financials & Assumptions - ABC Textile Mills LimitedДокумент4 страницыICRRS - Practice Sheet - Financials & Assumptions - ABC Textile Mills LimitedOptimistic EyeОценок пока нет

- Quikchex CTC CalculatorДокумент8 страницQuikchex CTC CalculatoriamgodrajeshОценок пока нет

- Xxbkash Final Salinctx CertДокумент1 страницаXxbkash Final Salinctx Certsatish1981Оценок пока нет

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Документ3 страницыComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARОценок пока нет

- Income TAX: Particular Case 1 Case 2Документ15 страницIncome TAX: Particular Case 1 Case 2Shekh SalmanОценок пока нет

- 1 Payslip July 2020Документ4 страницы1 Payslip July 2020B.GOUTHAM SABARIESОценок пока нет

- Taxation AssignmentДокумент4 страницыTaxation AssignmentBhanumati BhunjunОценок пока нет

- Payslip MSR Augt2021Документ3 страницыPayslip MSR Augt2021B.GOUTHAM SABARIESОценок пока нет

- Head Description: Income Tax Ratio Gross Income/Tax LiabilityДокумент4 страницыHead Description: Income Tax Ratio Gross Income/Tax LiabilityGhodawatОценок пока нет

- M F S N: Make Sure That Status Has Been Selected CorrectlyДокумент8 страницM F S N: Make Sure That Status Has Been Selected Correctlysrinivasallam_259747Оценок пока нет

- 157salaryslip g5sxl3g6Документ1 страница157salaryslip g5sxl3g6Shakti NaikОценок пока нет

- Tax Calculator 2018-19 (Farrukh Iqbal Khan)Документ2 страницыTax Calculator 2018-19 (Farrukh Iqbal Khan)FarrukhОценок пока нет

- EMP23 Tax Sheet Report202311152219Документ2 страницыEMP23 Tax Sheet Report202311152219SoumyaranjanОценок пока нет

- CrystalReportViewer1 3Документ1 страницаCrystalReportViewer1 3Mehedi HasanОценок пока нет

- Sol 1Документ1 страницаSol 1alex breymannОценок пока нет

- 1 BTAXREV Week 2 Income TaxationДокумент48 страниц1 BTAXREV Week 2 Income TaxationgatotkaОценок пока нет

- Tax-Liability-Calculator-2324 - Old RegimeДокумент2 страницыTax-Liability-Calculator-2324 - Old RegimeluckyОценок пока нет

- Anwar Group of IndustriesДокумент1 страницаAnwar Group of IndustriesMoment RevealersОценок пока нет

- Tax Calculator AY 2021-22Документ1 страницаTax Calculator AY 2021-22mehedi hasanОценок пока нет

- Tax Planning For IndividualДокумент2 страницыTax Planning For IndividualJaynil ShahОценок пока нет

- Motilal Excel PlanДокумент8 страницMotilal Excel Plansourajit kunduОценок пока нет

- Particulars Amount Exemption Net AmountДокумент29 страницParticulars Amount Exemption Net AmountDead Beat's RandomОценок пока нет

- Case Study 2Документ2 страницыCase Study 2Anil NagarajОценок пока нет

- Activity 13 May 2023 Key To CorrectionДокумент1 страницаActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangОценок пока нет

- Income Tax Calculator FY 2014 15Документ2 страницыIncome Tax Calculator FY 2014 15Pardeep KumarОценок пока нет

- Income Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeДокумент4 страницыIncome Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeKamlesh ChauhanОценок пока нет

- Faq'S & Guidlines On Income TaxДокумент50 страницFaq'S & Guidlines On Income TaxRavikarthik GurumurthyОценок пока нет

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Документ1 страницаKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- Computation Sheet 2022-11Документ4 страницыComputation Sheet 2022-11Harsha KumarОценок пока нет

- Chapter 12 - Computation of Total Income and Tax Payable - NotesДокумент54 страницыChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoОценок пока нет

- Answer 1Документ5 страницAnswer 1mayetteОценок пока нет

- Tax Calculator 2008-09Документ1 страницаTax Calculator 2008-09sukumarsukumaranОценок пока нет

- Tax Computation 10 2021Документ2 страницыTax Computation 10 2021prashanth kumarОценок пока нет

- 2023 WSO IB Working Conditions SurveyДокумент46 страниц2023 WSO IB Working Conditions SurveyHaiyun ChenОценок пока нет

- Payroll SampleДокумент6 страницPayroll Samplepedpalina100% (15)

- GPF CPS FormatДокумент6 страницGPF CPS FormatSuganya LokeshОценок пока нет

- Cash and CE Problems ExercisesДокумент3 страницыCash and CE Problems ExercisesMa. Erika Charisse DacerОценок пока нет

- Eftnet 17593053999Документ2 страницыEftnet 17593053999saimohan SubudhiОценок пока нет

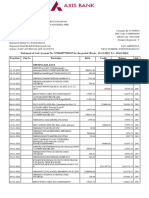

- Account STMT XX6767 20032024Документ4 страницыAccount STMT XX6767 20032024jaidev DamarajuОценок пока нет

- Debt Reduction Calculator - 20CRДокумент7 страницDebt Reduction Calculator - 20CRSuhailОценок пока нет

- Thomas Frank's Budget Modeler Template!Документ13 страницThomas Frank's Budget Modeler Template!Andreas FosshaugОценок пока нет

- Real Estate MortgageДокумент2 страницыReal Estate Mortgagemarydalem86% (7)

- 2 Ibc 2016Документ8 страниц2 Ibc 2016Jinal SanghviОценок пока нет

- Real Estate Mortgage AgreementДокумент3 страницыReal Estate Mortgage AgreementClint M. Maratas100% (4)

- 7Документ19 страниц7Maria G. BernardinoОценок пока нет

- Brief Discussion On The Deed of ReConveyanceДокумент2 страницыBrief Discussion On The Deed of ReConveyance83jjmackОценок пока нет

- Payments Statistics: Methodological NotesДокумент966 страницPayments Statistics: Methodological NotesdanoeОценок пока нет

- Case DigestДокумент2 страницыCase Digestlawdocs pinasОценок пока нет

- Wa0005.Документ11 страницWa0005.Ivan RushmerОценок пока нет

- Quizz 6Документ6 страницQuizz 6Vy HàОценок пока нет

- Staff Retirement BenefitsДокумент2 страницыStaff Retirement BenefitsEthan LynnОценок пока нет

- For MandateДокумент3 страницыFor MandateCA KUSHAL JAISWALОценок пока нет

- Genius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21Документ2 страницыGenius: Income-Tax Computation of ARVIND KUMAR 984 A.Y.2020-21darshilОценок пока нет

- Bank Recon PDFДокумент1 страницаBank Recon PDFCristy Martin YumulОценок пока нет

- InvLecture - W10-11 Capital BudgettingДокумент264 страницыInvLecture - W10-11 Capital BudgettingJuan Camilo Gómez RobayoОценок пока нет

- SI CI (1) Simple Interest, Compound InterstДокумент3 страницыSI CI (1) Simple Interest, Compound Interstdiksahu wfeeОценок пока нет

- Noi Notice LTD PDFДокумент13 страницNoi Notice LTD PDFuncleadolphОценок пока нет

- Fast-Isd 0169007900148617 Fast-Isd 0169007900148617: Faysal Bank Limited Faysal Bank LimitedДокумент1 страницаFast-Isd 0169007900148617 Fast-Isd 0169007900148617: Faysal Bank Limited Faysal Bank LimitedWyrmОценок пока нет

- Spbu 24.306.139Документ6 страницSpbu 24.306.139fernandotariganОценок пока нет

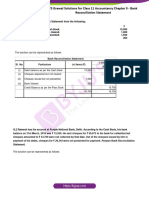

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankДокумент34 страницыTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9Оценок пока нет

- W2 Taco BellДокумент3 страницыW2 Taco BellJuan Diego Velandia DuarteОценок пока нет

- Affidavit1 17398Документ1 страницаAffidavit1 17398Mahitha ManiОценок пока нет

- Customer Accounts - UnlockedДокумент183 страницыCustomer Accounts - UnlockedMac SharmaОценок пока нет