Академический Документы

Профессиональный Документы

Культура Документы

FTHB Credit

Загружено:

NevadaHomes0 оценок0% нашли этот документ полезным (0 голосов)

24 просмотров2 страницыFirst time home buyer's credit $8000 ends December 1.

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документFirst time home buyer's credit $8000 ends December 1.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

24 просмотров2 страницыFTHB Credit

Загружено:

NevadaHomesFirst time home buyer's credit $8000 ends December 1.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

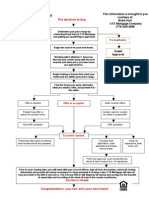

First-Time Homebuyer Tax Credit

‘One of the most exciting provisions of the Housing and Economic Recovery Act of 2008 was the

First-Time Homebuyer Tax Credit. The credit was expanded as part of the most recent economic

‘stimulus bill (The American Recovery and Reinvestment Act of 2009). The credit is designed to

‘encourage first time home buyers to go ahead and make the leap to purchase thelr first homes.

Combine this tax credit with the fact that home prices and interest rates are at historical lows, and

itis indeed an ideal time for many first-time homebuyers to purchase a home!

Here are some things to keep in mind:

+ A first time home buyer is defined as someone who has not owned a home in the last three

years

+ Single taxpayers with incomes up to $75,000 and married couples with incomes up to $150,000 qualify for the full

tax credit

+ You cannot purchase the home from a related party like a spouse, direct ancestor, or direct lineal descendent

{child or grandchild); however, you can still qualify for the credit if you purchase a property from siblings, nephews,

nieces, and others

+ If you are married, both spouses must be first-time home buyers

+ If more than one unmarried individual i buying the property, the credit can be split up among all the individuals

who quaify. However, the total credit taken cannot exceed $7,500 for homes purchased in 2008 and $8,000 for

homes purchased in 2009

For Homes Purchased Between April 9, 2008 and December 31, 2008

+ The credit amounts to 10% of the purchase price of the home not to exceed $7,500

+ The tax credit works like an interest free loan and must be repaid over a 15 year period

For Homes Purchased Between January 1, 2009 and December 1, 2009

+ The credit amounts to 10% of the purchase price of the home not to exceed $8,000

+ The tax credit does not need to be paid back if you continue living in the home as your primary residence for three

years without selling it

First-Time Homebuyer Tax Credit IP:

How does a tax credit work?

‘A tax credit is a special provision that reduces income tax labllty on a dollar for dollar basis. When filing a tax return,

‘you must include income items, deduction tems and the number of exemptions, among other things, to figure your total

tax liability. For example, if your total tax lability for the year is $8,000, and you qualify forthe full $8,000 tax credit, this

credit would wipe out all ofthe tax due. If your employer already deducted the $8,000 from your pay checks throughout

the year, you would receive a tax refund of $8,000. If you owe less than $8,000 in taxes forthe year, you are stil eligible

for the full $8,000 credit when you file your tax returns. In that case, the IRS will write you a check forthe difference

between $8,000 and your actual tax bil

For more information about the first-time home buyer tax credit or other recent updates to the mortgage and real estate

markets, just give me a call. would be happy to assist you with your mortgage in the purchase of your new home!

To ensure compliance with requirements imposed by the Intemal Revenue Service, we inform you that any U.S. federal

tax advice contained in this communication (including any attachments) was not intended or written to be used, and

cannot be used, by any person for the purpose of (i) avoiding fax-related penaities or (i) promoting, marketing or

recommending to another person any transaction or mattor addressed in this communication. Also, itis important to

note that | am providing this information to you as your mortgage planner, in order to make you aware of some of

interesting ideas that may benefit you. lam not an iavestment, tax, or legal advisor, and this information does not

constitute legal, tax or investment advice. I definitely recommend that you consult with properly licensed legal, tax and

investment advisors for specitic advice pertaining to your individual situation.

Brent Hart, CMPS”

PrimeLending, A PlainsCapital Company

6900 8, MeCartan Blvd, Suite 2020

eno, NV 89509

829-3085 direct

848-6406 alternate

866-712-9379 fax

bhart@primelending.com

buipi/vww.BRENTHART.com

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- April 2011 Special EventsДокумент1 страницаApril 2011 Special EventsNevadaHomesОценок пока нет

- Northern Nevada Economic and Market Watch Report 3rd Quarter 2010Документ14 страницNorthern Nevada Economic and Market Watch Report 3rd Quarter 2010NevadaHomesОценок пока нет

- March 2011 Special EventsДокумент1 страницаMarch 2011 Special EventsNevadaHomesОценок пока нет

- Washoe County 4th Quarter 2010 Market ReportДокумент1 страницаWashoe County 4th Quarter 2010 Market ReportNevadaHomesОценок пока нет

- Feb 2011 Special EventsДокумент1 страницаFeb 2011 Special EventsNevadaHomesОценок пока нет

- Economic and Market Watch Report: 1st Quarter, 2009Документ14 страницEconomic and Market Watch Report: 1st Quarter, 2009NevadaHomesОценок пока нет

- Economic and Market Watch ReportДокумент15 страницEconomic and Market Watch ReportNevadaHomesОценок пока нет

- Economic and Market Watch ReportДокумент14 страницEconomic and Market Watch ReportNevadaHomesОценок пока нет

- Economic and Market Watch Report: 4th Quarter, 2008Документ15 страницEconomic and Market Watch Report: 4th Quarter, 2008NevadaHomesОценок пока нет

- Northern Nevada Third Quarter 2008 Economic and Market Watch ReportДокумент15 страницNorthern Nevada Third Quarter 2008 Economic and Market Watch ReportNevadaHomesОценок пока нет

- Special Events March 08Документ1 страницаSpecial Events March 08NevadaHomesОценок пока нет

- Home Buying Process Flow ChartДокумент1 страницаHome Buying Process Flow ChartNevadaHomes100% (5)

- Economic and Market Watch Report: 2nd Quarter, 2008Документ14 страницEconomic and Market Watch Report: 2nd Quarter, 2008NevadaHomesОценок пока нет

- Economic and Market Watch Report: 1st Quarter, 2008Документ15 страницEconomic and Market Watch Report: 1st Quarter, 2008NevadaHomesОценок пока нет

- MarketWatchQ42007 Washoe CountyДокумент15 страницMarketWatchQ42007 Washoe CountyNevadaHomes100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)