Академический Документы

Профессиональный Документы

Культура Документы

Leave Encash LTC

Загружено:

rana_57Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Leave Encash LTC

Загружено:

rana_57Авторское право:

Доступные форматы

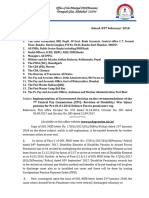

Imoortant Circular

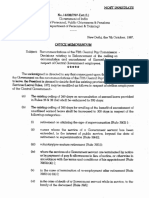

Office of the Controller General of Defence Accounts Ulan Batar Road, Palam, Delhi Cantt. New Delhi-ll00l0

No. AN/XIV/141G2/LTC

Dated 29 .12.2009.

To All PCsDA/CsDA Subject :- Clarification on encashement of leave alongwith LTC availed prior to 31.8.2009. The matters regarding whether encashment of leave on account of LTC availed

prior to 31st August 2008 under the old rates will be debited from the total EL at the

time of retirement and also be counted towards overall entitlements of 60 days or not, was referred to DoP&T for clarification. 2. DoP&T has since clarified that "Leave encashed alongwith LTC will not be

deducted from the maximum of EL encashable at the time of retirement w.e.f.. 01.9.2008 irrespective of whether the leave encashment with LTC was availed prior to 01.9.2008 or not. However, the ,maximum leave encashable alongwith LTC during

the entire career is 60 days".

.

3. For CDA (PD) Meerut only :- This disposes AN/III/Encashment of EL/LTC dated 20.01.2009.

off their letter No.

Dy CGDA(AN) has seen.

Copy to :1. AN-IV Section (Local) 2. AT-I,AT-II,AT-I~ AT-CoordSection (Local) 3. EDP Cell (Local) 4. Library (L.ocal) 5. MNB (AN-XIV). 6~P Centre- with a request to upload the circular on CGDA website.

Вам также может понравиться

- 47 - Social Security and DT of RetirementДокумент2 страницы47 - Social Security and DT of Retirementsusheel8143Оценок пока нет

- LTC Leave EncashmentДокумент4 страницыLTC Leave EncashmentvijayОценок пока нет

- 7 97-Estt (L)Документ3 страницы7 97-Estt (L)Sri Harsha ParupudiОценок пока нет

- Borromeo v. Civil Service Commission (1991) DoctrineДокумент3 страницыBorromeo v. Civil Service Commission (1991) Doctrinepoppy2890Оценок пока нет

- Staff BenefitДокумент27 страницStaff BenefitRobert ShortОценок пока нет

- General Entitlement of LeaveДокумент7 страницGeneral Entitlement of LeaveThirugnanam KandhanОценок пока нет

- Executive Retirement SchemeДокумент3 страницыExecutive Retirement SchemeVIKAS NIGAMОценок пока нет

- COA CIRCULAR NO. 88 288 April 6 1988Документ2 страницыCOA CIRCULAR NO. 88 288 April 6 1988Catherine Marie ReynosoОценок пока нет

- (Simmi R. Nakra) : Published On National Portal of India - Http://india - Gov.in/govt/paycommission - PHPДокумент0 страниц(Simmi R. Nakra) : Published On National Portal of India - Http://india - Gov.in/govt/paycommission - PHPadhityaОценок пока нет

- Circular 596 2Документ5 страницCircular 596 2tomarpragati85Оценок пока нет

- FAQ - Leave PDFДокумент8 страницFAQ - Leave PDFVIJAY KUMAR HEERОценок пока нет

- 1 2010-Estt.-LeaveДокумент3 страницы1 2010-Estt.-LeavePawan SalujaОценок пока нет

- ID: Office: Uilc: CCA - 2010071512490140 Number: 201030031 Release Date: 7/30/2010Документ1 страницаID: Office: Uilc: CCA - 2010071512490140 Number: 201030031 Release Date: 7/30/2010taxcrunchОценок пока нет

- Office MemorandumДокумент7 страницOffice MemorandumRekha guptaОценок пока нет

- Subject - Instruction On BondДокумент3 страницыSubject - Instruction On BondSuname PrasharОценок пока нет

- Leave Rules: Leave On Average PayДокумент10 страницLeave Rules: Leave On Average Payabhimanyutiwari1234Оценок пока нет

- CTA Flagmen Agreement (2018)Документ3 страницыCTA Flagmen Agreement (2018)Chicago Transit Justice CoalitionОценок пока нет

- 5 2019 Casual Labour OMДокумент8 страниц5 2019 Casual Labour OMKundan Singh100% (1)

- Annexure-A Leave Travel Concession Rules CL - No. Page NoДокумент27 страницAnnexure-A Leave Travel Concession Rules CL - No. Page NoShiv ShivaОценок пока нет

- Leave Rules1Документ13 страницLeave Rules1Bhabani Shankar NaikОценок пока нет

- CPCS 2021-005 Grant of Night Shift DifferentialДокумент3 страницыCPCS 2021-005 Grant of Night Shift DifferentialEdson Jude DonosoОценок пока нет

- TERMINATIONPOLICYДокумент2 страницыTERMINATIONPOLICYRandall GoodmanОценок пока нет

- Leave Rules 1982Документ104 страницыLeave Rules 1982NOOR AHMEDОценок пока нет

- On Retirement of Mr. Nagasaka During Pandemic 2020Документ4 страницыOn Retirement of Mr. Nagasaka During Pandemic 2020Karla MarieОценок пока нет

- Past Service Count RulesДокумент13 страницPast Service Count Rulesvkj5824100% (2)

- Estab 2Документ77 страницEstab 2Mayank GandhiОценок пока нет

- Leave Encashment Rule0001Документ12 страницLeave Encashment Rule0001Pankaj KambleОценок пока нет

- NTC Vs COAДокумент8 страницNTC Vs COARomy Ian LimОценок пока нет

- O.O 1831Документ1 страницаO.O 1831Samina KhatunОценок пока нет

- Lien DraftKdaDvДокумент12 страницLien DraftKdaDvankush goyalОценок пока нет

- Notification For Engagement of Consultants With Last Date of Submission of Application Till 24-05-2023 Along With Annexures - Case of AS LSAДокумент7 страницNotification For Engagement of Consultants With Last Date of Submission of Application Till 24-05-2023 Along With Annexures - Case of AS LSAAbhishek SambangiОценок пока нет

- CPCS 2021-002 Grant of Uniform&Clothing AllowanceДокумент4 страницыCPCS 2021-002 Grant of Uniform&Clothing AllowanceEdson Jude DonosoОценок пока нет

- Guideline For LTA Validation: Leave Travel AllowanceДокумент2 страницыGuideline For LTA Validation: Leave Travel AllowanceRishiMishraОценок пока нет

- A. Minimum Guarantee Amount: Existing RevisedДокумент2 страницыA. Minimum Guarantee Amount: Existing RevisedKabul DasОценок пока нет

- ECO RulesДокумент8 страницECO RulesDIPANKAR LALAОценок пока нет

- NotionalInc PDFДокумент6 страницNotionalInc PDFClayton MooreОценок пока нет

- CPCS 2021-009 Grant of 3 Yr Authorized Allowances, Benefits and IncentivesДокумент3 страницыCPCS 2021-009 Grant of 3 Yr Authorized Allowances, Benefits and IncentivesEdson Jude DonosoОценок пока нет

- Memorandum of Agreement: City of Kingston and CSEAДокумент13 страницMemorandum of Agreement: City of Kingston and CSEADaily FreemanОценок пока нет

- WAPDA Leave Rules 1982Документ99 страницWAPDA Leave Rules 1982Abdullah zeeshan50% (2)

- LTR 1022015Документ2 страницыLTR 1022015taxcrunchОценок пока нет

- Update On CEC MeetingДокумент4 страницыUpdate On CEC Meetingramineedi6Оценок пока нет

- Legal Opinion-Retirement BenefitsДокумент3 страницыLegal Opinion-Retirement BenefitsJimbo HotdogОценок пока нет

- All Rules of 80 CCD For CPS Employees Income Tax Deductions - APTEACHERS WebsiteДокумент7 страницAll Rules of 80 CCD For CPS Employees Income Tax Deductions - APTEACHERS Websitevinodtiwari808754Оценок пока нет

- PRB Reading MaterialДокумент77 страницPRB Reading MaterialGK TiwariОценок пока нет

- पुर्ण पगारावर पेन्शन अर्ज F1. pgpomanДокумент4 страницыपुर्ण पगारावर पेन्शन अर्ज F1. pgpomansochsolutions2017Оценок пока нет

- Policy - SeparationДокумент32 страницыPolicy - SeparationWarpgate100% (1)

- 4 2008-Estt. (A) - 1Документ1 страница4 2008-Estt. (A) - 1command2011Оценок пока нет

- R-54 (Unsigned)Документ6 страницR-54 (Unsigned)D.Nageshwar RaoОценок пока нет

- 196 Venture AДокумент90 страниц196 Venture AAnimesh Dabangg SadhukhanОценок пока нет

- Mcno 13Документ3 страницыMcno 13harjeetОценок пока нет

- Lydia Ochoa V CSCДокумент7 страницLydia Ochoa V CSCDat Doria PalerОценок пока нет

- Removal Service PDFДокумент5 страницRemoval Service PDFrana_57Оценок пока нет

- 7th Pay Commission Projected Pay ScalesДокумент8 страниц7th Pay Commission Projected Pay ScalesChandan KumarОценок пока нет

- Result X 2014Документ8 страницResult X 2014rana_57Оценок пока нет

- RanaДокумент8 страницRanarana_57Оценок пока нет

- Letter To Principals 6.6.14Документ3 страницыLetter To Principals 6.6.14rana_57Оценок пока нет

- RanaДокумент1 страницаRanarana_57Оценок пока нет

- Code Add ButtonДокумент1 страницаCode Add Buttonrana_57Оценок пока нет

- Book Selling ProhibitedДокумент1 страницаBook Selling Prohibitedrana_57Оценок пока нет

- 114 BДокумент2 страницы114 Brana_57Оценок пока нет

- Voter ListДокумент1 страницаVoter Listrana_57Оценок пока нет

- MailДокумент1 страницаMailrana_57Оценок пока нет

- Annexure-A Leave Travel Concession Rules CL - No. Page NoДокумент27 страницAnnexure-A Leave Travel Concession Rules CL - No. Page NoShiv ShivaОценок пока нет

- CCE REPORT CARD IX by R S RANAДокумент147 страницCCE REPORT CARD IX by R S RANArana_57Оценок пока нет