Академический Документы

Профессиональный Документы

Культура Документы

Basic Leveraged Lease Example: NPV of Equity Cash Flows

Загружено:

catherinephilippouОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Basic Leveraged Lease Example: NPV of Equity Cash Flows

Загружено:

catherinephilippouАвторское право:

Доступные форматы

A

1

2

3

4

5

6

7

8

9

10

11

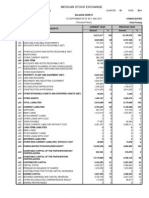

BASIC LEVERAGED LEASE EXAMPLE

Cost of asset

Lease term

Residual value

Equity

Debt

Interest

Annual debt payment

Annual rent received

Tax rate

Year

1,000,000

15

300,000 <-- Realized year 16

200,000

800,000 <-- 15-year term loan, equal payments of interest and principal

10%

105,179 <-- =PMT(B7,B3,-B6)

110,000

40%

Equity

Invested

Rental or

Depreciation

salvage

Principal

Loan

Repayment Cash flow to

at start

Interest

payment

of principal

equity

of year

-200,000

800,000 105,179 80,000

25,179

49,941

<-- =(1-tax)*C14+tax*D14-(1-tax)*G14-H14

774,821 105,179 77,482

27,697

89,774

747,124 105,179 74,712

30,467

60,666

716,657 105,179 71,666

33,513

39,487

683,144 105,179 68,314

36,865

23,827

646,280 105,179 64,628

40,551

22,352

605,728 105,179 60,573

44,606

20,730

561,122 105,179 56,112

49,067

1,186

512,056 105,179 51,206

53,973

-18,697

458,082 105,179 45,808

59,371

-20,856

398,711 105,179 39,871

65,308

-23,231

333,403 105,179 33,340

71,839

-25,843

261,565 105,179 26,156

79,023

-28,716

182,542 105,179 18,254

86,925

-31,877

95,617

105,179

9,562

95,617

-35,354

180,000

12

13

0

-200,000

14

1

110,000

142,800

15

2

110,000

244,900

16

3

110,000

174,900

17

4

110,000

125,000

18

5

110,000

89,200

19

6

110,000

89,200

20

7

110,000

89,200

21

8

110,000

44,800

22

9

110,000

23

10

110,000

24

11

110,000

25

12

110,000

26

13

110,000

27

14

110,000

28

15

110,000

29

16

300,000

30

31

32

33 Data table: NPV of leveraged lease cash flows

34

103,389 <-- =I13+NPV(A34,I14:I29) , table header

35

0%

103,389

36

1%

88,796

37

2%

76,064

38

3%

64,865

120,000

39

4%

54,936

100,000

40

5%

46,062

41

6%

38,068

80,000

42

7%

30,810

60,000

43

8%

24,173

40,000

44

9%

18,062

45

10%

12,397

20,000

46

12%

2,164

0

47

14%

-6,916

5%

10%

-20,000 0%

48

16%

-15,108

49

18%

-22,596

-40,000

50

20%

-29,509

-60,000

51

22%

-35,940

52

IRR of cash flows

12.46%

NPV of Equity Cash Flows

15%

20%

25%

<-- =IRR(I13:I29)

Cash flows from Leveraged Lease

180,000

160,000

140,000

120,000

100,000

80,000

60,000

40,000

20,000

Year

0

-20,000

-40,000

-60,000

-80,000

-100,000

-120,000

-140,000

-160,000

-180,000

-200,000

10

11

12

13

14

15

16

COMPUTING THE LOAN PAYMENTS

USING IPMT AND PPMT

1

2 Debt

3 Debt term (years)

4 Interest

5

Year

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

800,000

15

10%

=IPMT($B$4,A7,$B$3,-$B$2)

Interest

Debt principal

payment on

repayment

debt

80,000

25,179

77,482

27,697

74,712

30,467

71,666

33,513

68,314

36,865

64,628

40,551

60,573

44,606

56,112

49,067

51,206

53,973

45,808

59,371

39,871

65,308

33,340

71,839

26,156

79,023

18,254

86,925

9,562

95,617

=PPMT($B$4,A7,$B$3,-$B$2)

Total

payment

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

105,179

<-- =B7+C7

Are there Multiple IRRs? (No!)

This chart shows the NPV of the leveraged lease cash flows

for various discount rates

100,000

80,000

60,000

NPV

40,000

20,000

Discount rate

0

0%

-20,000

-40,000

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

22%

Pages 226, 228 top

0

1

2

3

4

5

IRR

1

2

3

4

5

8.097% <-- =IRR(B3:B8,0)

Attribution of cash flow

Investment at

Repayment

Cash flow at end of

beginning of

Income

of

year

period

investment

100,000

31,000

8,097

22,903 <-- =C15-D15

77,097

22,000

6,242

15,758

61,339

16,000

4,966

11,034

50,305

22,000

4,073

17,927

32,378

35,000

2,622

32,378

=B16-E16

=$B$10*B15

THE INVESTMENT AT THE BEGINNING OF EACH PERIOD IS THE

PRESENT VALUE (USING IRR AS DISCOUNT RATE) OF ALL FUTURE

CASH FLOWS

Year

24

25

26

27

28

29

CASH FLOW ATTRIBUTION TABLE

Year

23

Cash

flow

-100,000

31,000

22,000

16,000

22,000

35,000

Year

13

14

15

16

17

18

19

20

21

22

UNDERSTANDING THE IRR

1

2

3

4

5

6

7

8

9

10

11

12

1

2

3

4

5

Cash flow at

Investment at

end of year beginning of period

31,000

22,000

16,000

22,000

35,000

100,000 <-- =NPV($B$10,B25:$B$29)

77,097 <-- =NPV($B$10,B26:$B$29)

61,339

50,305

32,378

Page 5

Page 228, bottom

ATTRIBUTION OF LEVERAGED LEASE CASH FLOWS TO

INCOME AND REPAYMENT OF INVESTMENT

1

2 IRR

3

4

12.46% <-- =IRR(C6:C22)

Attribution of cash flow

Year

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

=$B$2*B7

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Investment at

beginning of

period

200,000

174,972

106,994

59,656

27,600

7,212

-14,242

-36,746

-42,510

-29,108

-11,878

9,873

36,945

70,264

110,894

160,062

Cash flow

-200,000

49,941

89,774

60,666

39,487

23,827

22,352

20,730

1,186

-18,697

-20,856

-23,231

-25,843

-28,716

-31,877

-35,354

180,000

Income

24,913

21,796

13,328

7,431

3,438

898

-1,774

-4,577

-5,295

-3,626

-1,480

1,230

4,602

8,753

13,814

19,938

Page 6

Repayment of

investment

25,028 <-- =C7-D7

67,978

47,338

32,056

20,389

21,454

22,504

5,763

-13,401

-17,230

-21,751

-27,073

-33,319

-40,630

-49,168

160,062

Page 230

ECONOMIC VALUE OF THE LEASE CASH FLOWS:

DISCOUNTING THE CASH FLOWS AT THE IRR

1

2 IRR

3

12.46% <-- =IRR(B5:B21)

Year

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Leveraged

lease cash

flows

-200,000

49,941

89,774

60,666

39,487

23,827

22,352

20,730

1,186

-18,697

-20,856

-23,231

-25,843

-28,716

-31,877

-35,354

180,000

Value of lease

cash flows at

beginning of

period

200,000 <-- =NPV($B$2,B6:$B$21)

174,972 <-- =NPV($B$2,B7:$B$21)

106,994 <-- =NPV($B$2,B8:$B$21)

59,656

27,600

Economic Value of Lease Cash Flows at Beginning o

215,000

7,212

-14,242

195,000

-36,746

175,000

-42,510

-29,108

155,000

-11,878

135,000

9,873

36,945

115,000

70,264

110,894

95,000

160,062

75,000

55,000

35,000

15,000

-5,000

-25,000

-45,000

Page 7

Page 230

1

2

3

4

5

6

7

8

9

10

Economic Value of Lease Cash Flows at Beginning of Period

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

286

8

10

12

14

29

30

31

32

33

16

Page 8

UN-4F

1

2 Q

3

MPM METHOD:ATTRIBUTION OF LEVERAGED LEASE CASH

FLOWSTO INCOME AND REPAYMENT OF INVESTMENT

12.00% <-- Possible MPM rate

=IF($B$2*B6>0,$B$2*B6,0)

MPM attribution of cash

flows

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

Investment at Leveraged

beginning of lease cash

period

flows

200,000

49,941

174,059

89,774

105,172

60,666

57,127

39,487

24,495

23,827

3,608

22,352

-18,312

20,730

-39,042

1,186

-40,228

-18,697

-21,531

-20,856

-675

-23,231

22,556

-25,843

51,105

-28,716

85,954

-31,877

128,146

-35,354

178,878

180,000

20,343

Income

24,000

20,887

12,621

6,855

2,939

433

0

0

0

0

0

2,707

6,133

10,314

15,378

21,465

Repayment of

investment

25,941 <-- =C6-D6

68,887

48,045

32,632

20,887

21,919

20,730

1,186

-18,697

-20,856

-23,231

-28,550

-34,849

-42,192

-50,732

158,535

UN-4F

1

2

B$2*B6>0,$B$2*B6,0)

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

UN-4F

1

2 Q

3

USING SOLVER TO FIND THE MULTIPLE PHASES METHOD (MPM)

RETURN ON A LEVERAGED LEASE

10.91% <-- Possible MPM rate

MPM attribution of cash

flows

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

Investment at Leveraged

beginning of lease cash

period

flows

200,000

49,941

171,881

89,774

100,862

60,666

51,201

39,487

17,301

23,827

-4,638

22,352

-26,990

20,730

-47,721

1,186

-48,906

-18,697

-30,210

-20,856

-9,354

-23,231

13,877

-25,843

41,234

-28,716

74,449

-31,877

114,450

-35,354

162,292

180,000

0

Income

21,822

18,754

11,005

5,587

1,888

0

0

0

0

0

0

1,514

4,499

8,123

12,488

17,708

Repayment of

investment

28,119 <-- =C6-D6

71,019

49,661

33,901

21,939

22,352

20,730

1,186

-18,697

-20,856

-23,231

-27,357

-33,216

-40,001

-47,842

162,292

Page 234

COMPARING THE MPM INCOME WITH THE IRR INCOME

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

IRR

MPM

income

income

24,913

21,822

21,796

18,754

13,328

11,005

7,431

5,587

3,438

1,888

898

0

-1,774

0

-4,577

0

-5,295

0

-3,626

0

-1,480

0

1,230

1,514

4,602

4,499

8,753

8,123

13,814

12,488

19,938

17,708

24,000

Comparing the MPM Income with the IRR

The IRR income is the true economic incom

19,000

14,000

IRR income

MPM income

9,000

4,000

-1,000 1

-6,000

Page 12

Page 234

H THE IRR

1 INCOME

2

3 with the IRR Income

MPM Income

ome is the true4 economic income

5

6

7

8

9

10

11

IRR income

12

MPM income

13

14

15

16

17

18

19

11

20 9

21

22

23

24

25

13

15

Page 13

Вам также может понравиться

- FM09-CH 10.... Im PandeyДокумент19 страницFM09-CH 10.... Im Pandeywarlock83% (6)

- Exhibits Radio OneДокумент4 страницыExhibits Radio Onefranky1000Оценок пока нет

- Sample ComplaintДокумент10 страницSample ComplaintStanley FordОценок пока нет

- NPV CalculationДокумент19 страницNPV CalculationmschotoОценок пока нет

- fm3 Chapter01Документ35 страницfm3 Chapter01catherinephilippouОценок пока нет

- Instructor: Võ H NG Đ C Group Members:: T Khánh LinhДокумент20 страницInstructor: Võ H NG Đ C Group Members:: T Khánh LinhMai Trần100% (1)

- Mayes 8e CH05 SolutionsДокумент36 страницMayes 8e CH05 SolutionsRamez AhmedОценок пока нет

- fm3 Chapter08Документ19 страницfm3 Chapter08catherinephilippouОценок пока нет

- fm3 Chapter01Документ35 страницfm3 Chapter01catherinephilippouОценок пока нет

- CT1 Assignment Chapter 14Документ5 страницCT1 Assignment Chapter 14Gaurav satraОценок пока нет

- Chapter 01Документ18 страницChapter 01mehta_mayurОценок пока нет

- BDP Financial Final PartДокумент14 страницBDP Financial Final PartDeepak G.C.Оценок пока нет

- Internal Rate of Return: Year Cash FlowДокумент10 страницInternal Rate of Return: Year Cash Flowhur_sayedОценок пока нет

- Ie463 CHP5 (2010-2011)Документ6 страницIe463 CHP5 (2010-2011)Gözde ŞençimenОценок пока нет

- FA II - Chapter 2 & 3 Part IIДокумент21 страницаFA II - Chapter 2 & 3 Part IISitra AbduОценок пока нет

- ExcelsДокумент45 страницExcelsPrashanthDalawaiОценок пока нет

- Heinz Family Foundation 2006 990Документ82 страницыHeinz Family Foundation 2006 990TheSceneOfTheCrimeОценок пока нет

- PerusahaanJasa KosongДокумент86 страницPerusahaanJasa KosongShandy NewgenerationОценок пока нет

- CAPCOST - 2008 Ethylene Oxide B6Документ16 страницCAPCOST - 2008 Ethylene Oxide B6'Arif Rukaini SufianОценок пока нет

- Cash Flow Statement of M/S.Abc CoДокумент4 страницыCash Flow Statement of M/S.Abc CoCacptCoachingОценок пока нет

- Joseph FMAДокумент119 страницJoseph FMAJoseph ThamОценок пока нет

- Non-Discounted Cash FlowДокумент9 страницNon-Discounted Cash FlowsedamyrulОценок пока нет

- Mini Case - Chapter 3Документ5 страницMini Case - Chapter 3shivam1992Оценок пока нет

- Project Report PDFДокумент13 страницProject Report PDFMan KumaОценок пока нет

- Unit7 e (A2)Документ10 страницUnit7 e (A2)punte77Оценок пока нет

- Chad-Cameroon Case AnalysisДокумент15 страницChad-Cameroon Case AnalysisPooja TyagiОценок пока нет

- Jawaban Kuis AK2Документ37 страницJawaban Kuis AK2clara_patricia_2Оценок пока нет

- Olive Branch Foundation 2007 990Документ25 страницOlive Branch Foundation 2007 990TheSceneOfTheCrimeОценок пока нет

- Chapter 6 ExhibitsДокумент8 страницChapter 6 ExhibitsKuntalDekaBaruahОценок пока нет

- Fundamentos de Ingenieria Economica, 2da Edicion 05Документ30 страницFundamentos de Ingenieria Economica, 2da Edicion 05Selomit BarrazaОценок пока нет

- LBO Valuation - Working File CV2Документ5 страницLBO Valuation - Working File CV2Ayushi GuptaОценок пока нет

- Hafiz Mahmood Ul Hassan Cash Flow StatementДокумент3 страницыHafiz Mahmood Ul Hassan Cash Flow StatementHafiz Mahmood Ul HassanОценок пока нет

- Assignment 3 SolutionsДокумент2 страницыAssignment 3 SolutionsHennrocksОценок пока нет

- Chapter 6Документ26 страницChapter 6dshilkarОценок пока нет

- Ever Gotesco: Quarterly ReportДокумент35 страницEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- Mexican Stock ExchangeДокумент43 страницыMexican Stock ExchangeortizdelavegaОценок пока нет

- Last Five Years Financial Performance 2021Документ1 страницаLast Five Years Financial Performance 2021Md AzizОценок пока нет

- 545 L2 (Projection of Income Statement, Balance Sheet and Cash Flow)Документ10 страниц545 L2 (Projection of Income Statement, Balance Sheet and Cash Flow)Äyušheë TŸagïОценок пока нет

- Corporate Finance Solution Chapter 6Документ9 страницCorporate Finance Solution Chapter 6Kunal KumarОценок пока нет

- Session 78 (Chap 12 of Wahlen, 2014)Документ9 страницSession 78 (Chap 12 of Wahlen, 2014)Thu Hiền KhươngОценок пока нет

- Chick-Fil-A 2009 Tax RecordsДокумент57 страницChick-Fil-A 2009 Tax RecordsSergio Nahuel CandidoОценок пока нет

- Z Smith Reynolds 586038145 - 200612 - 990PFДокумент61 страницаZ Smith Reynolds 586038145 - 200612 - 990PFA.P. DillonОценок пока нет

- Saving For Retirement: InvestmentsДокумент3 страницыSaving For Retirement: Investmentsnigam34Оценок пока нет

- Ex9 (Data Tables2)Документ4 страницыEx9 (Data Tables2)Mohammed ZubairОценок пока нет

- Olive Branch Foundation 2006 990Документ28 страницOlive Branch Foundation 2006 990TheSceneOfTheCrimeОценок пока нет

- GSK Financial FiguresДокумент35 страницGSK Financial FiguresKalenga CyrilleОценок пока нет

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Документ26 страницChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Swap of SharessДокумент5 страницSwap of Sharesszikril94Оценок пока нет

- Cash Flow Analysis: Planet Karaoke PubДокумент2 страницыCash Flow Analysis: Planet Karaoke PubJoshua SentosaОценок пока нет

- M C R E ,: Inicase: Onch Epublic LectronicsДокумент4 страницыM C R E ,: Inicase: Onch Epublic Lectronicsnara100% (3)

- Long-Term Construction ContractsДокумент12 страницLong-Term Construction Contractsblackphoenix303Оценок пока нет

- Cash Flow Projection 02Документ9 страницCash Flow Projection 02Raouf BoucharebОценок пока нет

- Capital Budgeting WorksheetДокумент2 страницыCapital Budgeting WorksheetImperoCo LLCОценок пока нет

- Cash FlowДокумент1 страницаCash FlowFirman SadikinОценок пока нет

- CapbudexercisesДокумент5 страницCapbudexercisesJhaister Ashley LayugОценок пока нет

- Bakiache CitiДокумент8 страницBakiache CitiMalevolent IncineratorОценок пока нет

- Ch6 SolutionsДокумент9 страницCh6 SolutionsKiều Thảo AnhОценок пока нет

- FIN304 (End-Sem Model Answer 2021)Документ9 страницFIN304 (End-Sem Model Answer 2021)sha ve3Оценок пока нет

- Amounts in Philippine PesoДокумент13 страницAmounts in Philippine PesoJesse KentОценок пока нет

- The Barbara Streisand Foundation 2006 990Документ31 страницаThe Barbara Streisand Foundation 2006 990TheSceneOfTheCrimeОценок пока нет

- Capital BudgetingДокумент38 страницCapital Budgetingvini2710Оценок пока нет

- Radio One - Exhibits1-4Документ8 страницRadio One - Exhibits1-4meredith12120% (1)

- 2010 LCCI Level 3 Series 2 Model Answers (Code 3012)Документ9 страниц2010 LCCI Level 3 Series 2 Model Answers (Code 3012)mappymappymappyОценок пока нет

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachОт EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachРейтинг: 3 из 5 звезд3/5 (3)

- Calculating The Efficient FrontierДокумент35 страницCalculating The Efficient FrontiercatherinephilippouОценок пока нет

- Deferred Taxes and Accelerated Depreciation An Example: Balance SheetДокумент14 страницDeferred Taxes and Accelerated Depreciation An Example: Balance SheetcatherinephilippouОценок пока нет

- Fm3 Chapter03 TemplateДокумент4 страницыFm3 Chapter03 TemplatecatherinephilippouОценок пока нет

- fm3 Chapter02Документ165 страницfm3 Chapter02catherinephilippouОценок пока нет

- Analysis of PELДокумент3 страницыAnalysis of PELHasham NaveedОценок пока нет

- Argon Dry Cleaners Is Owned and Operated by Kerry UlmanДокумент1 страницаArgon Dry Cleaners Is Owned and Operated by Kerry UlmanM Bilal SaleemОценок пока нет

- Yohanes TampubolonДокумент8 страницYohanes TampubolonTOT BandungОценок пока нет

- ENPSForm Amandeep KaurДокумент5 страницENPSForm Amandeep KaurManmohan SinghОценок пока нет

- Circular Flow of EconomyДокумент19 страницCircular Flow of EconomyAbhijeet GuptaОценок пока нет

- Basic Terminologies Used in Stock ExchangeДокумент2 страницыBasic Terminologies Used in Stock ExchangeAli AbbasОценок пока нет

- Fiscal Space Assessment Project 1Документ49 страницFiscal Space Assessment Project 1VincentОценок пока нет

- Richest Man in Babylon AnnotationДокумент10 страницRichest Man in Babylon Annotationmark jukicОценок пока нет

- BKAL1013 (A172) - ppt-T4Документ27 страницBKAL1013 (A172) - ppt-T4Heap Ke XinОценок пока нет

- Maynard Case 3 1 PDFДокумент2 страницыMaynard Case 3 1 PDFTating Bootan Kaayo YangОценок пока нет

- Ajio FL0103456324 1567171943102 PDFДокумент2 страницыAjio FL0103456324 1567171943102 PDFUmang ModiОценок пока нет

- Assignment 1 BAN 100 Edwin CastilloДокумент11 страницAssignment 1 BAN 100 Edwin CastilloEdwin CastilloОценок пока нет

- Europass CV 110625 IanaДокумент3 страницыEuropass CV 110625 IanaDorina BalanОценок пока нет

- Accounts List (Detail) : Account # Account Type DR/CR Header/Detail Level ChequeДокумент4 страницыAccounts List (Detail) : Account # Account Type DR/CR Header/Detail Level ChequeEka RatihОценок пока нет

- Management Advisory Services: This Accounting Materials Are Brought To You byДокумент3 страницыManagement Advisory Services: This Accounting Materials Are Brought To You byRed MendezОценок пока нет

- Chapter 8 Community Parlor Games and Different LettersДокумент50 страницChapter 8 Community Parlor Games and Different LettersMercado Panesa EthelОценок пока нет

- Naghmeh Panahi Vs Saeed AbediniДокумент24 страницыNaghmeh Panahi Vs Saeed AbediniLeonardo BlairОценок пока нет

- Earn Unlimited Income With Priado Wealth AllianceДокумент67 страницEarn Unlimited Income With Priado Wealth AlliancePeter M100% (1)

- Tutorial 4 QAsДокумент6 страницTutorial 4 QAsJin HueyОценок пока нет

- Chartbook For Level 3.13170409Документ65 страницChartbook For Level 3.13170409calibertraderОценок пока нет

- CS Section: Consulting ServicesДокумент7 страницCS Section: Consulting ServicesTyra Joyce RevadaviaОценок пока нет

- MBA-4th Sem. - 2013-14Документ25 страницMBA-4th Sem. - 2013-14archana_anuragiОценок пока нет

- Reverse Engineering Rsi PDF FreeДокумент7 страницReverse Engineering Rsi PDF FreeJitkaSamakОценок пока нет

- Audit of Cash Module 1Документ5 страницAudit of Cash Module 1calliemozartОценок пока нет

- Building A Sustainable Future: Annual Report 2020Документ177 страницBuilding A Sustainable Future: Annual Report 2020AaОценок пока нет

- GOI Department and MinistriesДокумент7 страницGOI Department and MinistriesgaderameshОценок пока нет

- ACC 291 Week 4 ProblemsДокумент8 страницACC 291 Week 4 ProblemsGrace N Demara BooneОценок пока нет

- Portfolio Monitoring TemplateДокумент11 страницPortfolio Monitoring Templateseragaki88Оценок пока нет