Академический Документы

Профессиональный Документы

Культура Документы

Prime Interest Rate in The State of Nevada

Загружено:

JossherОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Prime Interest Rate in The State of Nevada

Загружено:

JossherАвторское право:

Доступные форматы

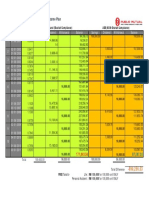

PRIME INTEREST RATE

NRS 99.040(1) requires: "When there is no express contract in writing fixing a different rate of interest, interest must be allowed at a rate equal to the prime rate at the largest bank in Nevada, as ascertained by the Commissioner of Financial Institutions, on January 1, or July 1, as the case may be, immediately preceding the date of the transaction, plus 2 percent, upon all money from the time it becomes due, . . . "* Following is the prime rate as ascertained by the Commissioner of Financial Institutions:

January 1, 2014 January 1, 2013 January 1, 2012 January 1, 2011 January 1, 2010 January 1, 2009 January 1, 2008 January 1, 2007 January 1, 2006 January 1, 2005 January 1, 2004 January 1, 2003 January 1, 2002 January 1, 2001 January 1, 2000 January 1, 1999 January 1, 1998 January 1, 1997 January 1, 1996 January 1, 1995 January 1, 1994 January 1, 1993 January 1, 1992 January 1, 1991 January 1, 1990 January 1, 1989 January 1, 1988 January 1, 1987

3.25% 3.25% 3.25% 3.25% 3.25% 3.25% 7.25% 8.25% 7.25% 5.25% 4.00% 4.25% 4.75% 9.50% 8.25% 7.75% 8.50% 8.25% 8.50% 8.50% 6.00% 6.00% 6.50% 10.00% 10.50% 10.50% 8.75% Not Available

July 1, 2013 July 1, 2012 July 1, 2011 July 1, 2010 July 1, 2009 July 1, 2008 July 1, 2007 July 1, 2006 July 1, 2005 July 1, 2004 July 1, 2003 July 1, 2002 July 1, 2001 July 1, 2000 July 1, 1999 July 1, 1998 July 1, 1997 July 1, 1996 July 1, 1995 July 1, 1994 July 1, 1993 July 1, 1992 July 1, 1991 July 1, 1990 July 1, 1989 July 1, 1988 July 1, 1987

3.25% 3.25% 3.25% 3.25% 3.25% 5.00% 8.25% 8.25% 6.25% 4.25% 4.00% 4.75% 6.75% 9.50% 7.75% 8.50% 8.50% 8.25% 9.00% 7.25% 6.00% 6.50% 8.50% 10.00% 11.00% 9.00% 8.25%

* Attorney General Opinion No. 98-20: If clearly authorized by the creditor, a collection agency may collect whatever interest on a debt its creditor would be authorized to impose. A collection agency may not impose interest on any account or debt where the creditor has agreed not to impose interest or has otherwise indicated an intent not to collect interest. Simple interest may be imposed at the rate established in NRS 99.040 from the date the debt becomes due on any debt where there is no written contract fixing a different rate of interest, unless the account is an open or store accounts as

discussed herein. In the case of open or store accounts, interest may be imposed or awarded only by a court of competent jurisdiction in an action over the debt.

Вам также может понравиться

- G.R. No. 181045 July 2, 2014 SPOUSES EDUARDO and LYDIA SILOS, Petitioners, Philippine National Bank, RespondentДокумент13 страницG.R. No. 181045 July 2, 2014 SPOUSES EDUARDO and LYDIA SILOS, Petitioners, Philippine National Bank, RespondentAbby EvangelistaОценок пока нет

- Ominvest Unsecured Perpetual Bonds - Prospectus - EnglishДокумент328 страницOminvest Unsecured Perpetual Bonds - Prospectus - EnglishMohamed IsmailОценок пока нет

- 046T BST130913-Monetory IndicatorsДокумент2 страницы046T BST130913-Monetory IndicatorspatilvrОценок пока нет

- Silos v. Philippine National Bank, G.R. No. 181045, July 2, 2014Документ23 страницыSilos v. Philippine National Bank, G.R. No. 181045, July 2, 2014noemi alvarezОценок пока нет

- G.R. No. 181045 July 2, 2014 SPOUSES EDUARDO and LYDIA SILOS, Petitioners, Philippine National Bank, RespondentДокумент3 страницыG.R. No. 181045 July 2, 2014 SPOUSES EDUARDO and LYDIA SILOS, Petitioners, Philippine National Bank, RespondentJuan FranciscoОценок пока нет

- Bucket 33 XS02544835961 66498 8332760Документ5 страницBucket 33 XS02544835961 66498 8332760Hyunjin ShinОценок пока нет

- BENEFITSДокумент9 страницBENEFITSSaurav TomarОценок пока нет

- Final TermsДокумент60 страницFinal Termsmaneaflr77Оценок пока нет

- Er 20130712 Bull Housing Finance MayДокумент4 страницыEr 20130712 Bull Housing Finance MayDavid SmithОценок пока нет

- Malaysia IS-LM AnalysisДокумент19 страницMalaysia IS-LM AnalysisR. Iwan Budhiarta100% (1)

- Callable Range Accrual Pricing SupplementДокумент8 страницCallable Range Accrual Pricing SupplementHilton GrandОценок пока нет

- Securities Transaction Tax: A.b.acharya Addl - Asst.directorДокумент7 страницSecurities Transaction Tax: A.b.acharya Addl - Asst.directorSantosh SarojОценок пока нет

- Financial Analyst G&M - Real Estate Test & Case StudyДокумент19 страницFinancial Analyst G&M - Real Estate Test & Case StudyDhruv ShahОценок пока нет

- A Couple of Terms Related To Financial ManagementДокумент23 страницыA Couple of Terms Related To Financial ManagementMou DeyОценок пока нет

- NSS 87Документ2 страницыNSS 87Mahalakshmi Susila100% (1)

- Fundamentals of Financial Markets and Institutions in Australia 1St Edition Valentine Solutions Manual Full Chapter PDFДокумент44 страницыFundamentals of Financial Markets and Institutions in Australia 1St Edition Valentine Solutions Manual Full Chapter PDFequally.ungown.q5sgg100% (12)

- Bond Guide 23mar 10Документ17 страницBond Guide 23mar 10Rodolfo FernandezОценок пока нет

- Bucket 33 XS0231918060 56471 8333108Документ4 страницыBucket 33 XS0231918060 56471 8333108Hyunjin ShinОценок пока нет

- Management of Interest Rate Risk in BanksДокумент6 страницManagement of Interest Rate Risk in BanksPratik NayakОценок пока нет

- FX Daily Report: Bell FX Currency OutlookДокумент1 страницаFX Daily Report: Bell FX Currency OutlookInternational Business Times AUОценок пока нет

- Spouses Silos v. Philippine National BankДокумент36 страницSpouses Silos v. Philippine National BankSamuel ValladoresОценок пока нет

- Federal Reserve StatementДокумент4 страницыFederal Reserve StatementTim MooreОценок пока нет

- Land Bank of The Philippines v. Onate, G.R. No. 192371, January 15, 2014Документ20 страницLand Bank of The Philippines v. Onate, G.R. No. 192371, January 15, 2014noemi alvarezОценок пока нет

- Terms and Conditions For Citibank Deposit VariantsДокумент1 страницаTerms and Conditions For Citibank Deposit VariantsAkshay MittalОценок пока нет

- Security Bank v. Regional Trial Court Makati - G.R. No. 113926, October 23, 1996Документ6 страницSecurity Bank v. Regional Trial Court Makati - G.R. No. 113926, October 23, 1996Tris LeeОценок пока нет

- Anz Research: Anz-Roy Morgan Consumer ConfidenceДокумент4 страницыAnz Research: Anz-Roy Morgan Consumer Confidencepathanfor786Оценок пока нет

- Woolworths Financial Prospectus PDFДокумент114 страницWoolworths Financial Prospectus PDFJoe HainОценок пока нет

- Yello-Save-Terms-Conditions RevisedДокумент3 страницыYello-Save-Terms-Conditions RevisedCharles MensahОценок пока нет

- DebenturesДокумент1 страницаDebenturesrizvinarjis339Оценок пока нет

- 2) Cash Flow at 16% Lump Sum PDFДокумент1 страница2) Cash Flow at 16% Lump Sum PDFfara yasidОценок пока нет

- Castle HoldCo 4, LTD - 5510Документ318 страницCastle HoldCo 4, LTD - 5510aheadsgОценок пока нет

- Directive Volume (Eng)Документ55 страницDirective Volume (Eng)water sevenОценок пока нет

- CMCA Legal Note - SI 127 of 2021Документ7 страницCMCA Legal Note - SI 127 of 2021kennie kennias shonhiwa chikwanhaОценок пока нет

- Economic Brief May 2023 - Monetary Policy Supplement (12 June 2023)Документ1 страницаEconomic Brief May 2023 - Monetary Policy Supplement (12 June 2023)Nigel GondoОценок пока нет

- 2006 - January 18 - Directives On AML StandardsДокумент2 страницы2006 - January 18 - Directives On AML StandardsLouis NoronhaОценок пока нет

- Funa V Duque IIIДокумент24 страницыFuna V Duque IIILoren SeñeresОценок пока нет

- rr98 10 PDFДокумент1 страницаrr98 10 PDFCliff DaquioagОценок пока нет

- REVENUE REGULATIONS NO. 10-98 Issued September 2, 1998 Prescribes The Regulations To ImplementДокумент1 страницаREVENUE REGULATIONS NO. 10-98 Issued September 2, 1998 Prescribes The Regulations To Implementandrea ibanezОценок пока нет

- rr98 10 PDFДокумент1 страницаrr98 10 PDFglenn fedillagaОценок пока нет

- RR 10-98 DigestДокумент1 страницаRR 10-98 DigestAndrea Nicole Paulino RiveraОценок пока нет

- RR 10-98 (Digest) PDFДокумент1 страницаRR 10-98 (Digest) PDFWayneNoveraОценок пока нет

- 2 Weeks Maturity DepositДокумент2 страницы2 Weeks Maturity DepositStorm CastleОценок пока нет

- Agreement: The Borrower and Lender Agree ThatДокумент3 страницыAgreement: The Borrower and Lender Agree ThatDay Day AmoyawОценок пока нет

- CIVMB T3-3 Preliminaryassessment v2Документ6 страницCIVMB T3-3 Preliminaryassessment v2Forin NeimОценок пока нет

- Security Bank V RTCДокумент4 страницыSecurity Bank V RTCZeline MarieОценок пока нет

- Studio A - Promo Price List As of 08302014Документ2 страницыStudio A - Promo Price List As of 08302014api-241706180Оценок пока нет

- The Dow Traded On Wednesday Below My Annual at 10,379 Then Above My Monthly Pivot at 10,439 Then Closed Between Them Yet Again.Документ4 страницыThe Dow Traded On Wednesday Below My Annual at 10,379 Then Above My Monthly Pivot at 10,439 Then Closed Between Them Yet Again.ValuEngine.comОценок пока нет

- 7.1.2.2) Non-Resident External Rupee (NRER) - Government Formulated NRIДокумент1 страница7.1.2.2) Non-Resident External Rupee (NRER) - Government Formulated NRINiraj KumarОценок пока нет

- Module 12 Real Property TaxationДокумент30 страницModule 12 Real Property TaxationRomeo ZeegbeanОценок пока нет

- GRP Tit ViiiДокумент8 страницGRP Tit ViiiWayne LundОценок пока нет

- Australian Dollar Outlook 20 June 2011Документ1 страницаAustralian Dollar Outlook 20 June 2011International Business Times AUОценок пока нет

- Jaka Vs CIRДокумент27 страницJaka Vs CIRVince ReyesОценок пока нет

- Liabilities and Owner's EquityДокумент24 страницыLiabilities and Owner's EquityDomin8021Оценок пока нет

- SPS. EDUARDO AND LYDIA SILOS v. PHILIPPINE NATIONAL BANKДокумент42 страницыSPS. EDUARDO AND LYDIA SILOS v. PHILIPPINE NATIONAL BANKKhate AlonzoОценок пока нет

- Monetary 20230201 A 1Документ4 страницыMonetary 20230201 A 1tamhid nahianОценок пока нет

- Topic 2: Financial Laws and Regulations: Introduction: All Actions of AnДокумент17 страницTopic 2: Financial Laws and Regulations: Introduction: All Actions of An255 nenoОценок пока нет

- KIBORДокумент17 страницKIBORmateenyunasОценок пока нет

- F78 BonDSДокумент7 страницF78 BonDSDawood Adel DhakallahОценок пока нет

- Tips For Effective Punctuation in Legal WritingДокумент12 страницTips For Effective Punctuation in Legal WritingJossherОценок пока нет

- Essentials of A Position PaperДокумент1 страницаEssentials of A Position Paperricky nebatenОценок пока нет

- Philippine Legal Citation Guide PDFДокумент17 страницPhilippine Legal Citation Guide PDFMasterboleroОценок пока нет

- Back From The Dead-Suing Dissolved Corporations in CaliforniaДокумент2 страницыBack From The Dead-Suing Dissolved Corporations in CaliforniaJossherОценок пока нет

- Carnelli v. Eighth Judicial DistrictДокумент15 страницCarnelli v. Eighth Judicial DistrictJossherОценок пока нет

- Red Notes: TaxДокумент41 страницаRed Notes: Taxjojitus100% (2)

- Red Notes: TaxДокумент41 страницаRed Notes: Taxjojitus100% (2)

- Nevada Prejudgment InterestДокумент57 страницNevada Prejudgment InterestJossherОценок пока нет