Академический Документы

Профессиональный Документы

Культура Документы

Certificate NG

Загружено:

chander_prakash20000 оценок0% нашли этот документ полезным (0 голосов)

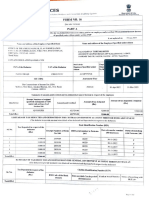

42 просмотров1 страницаThe document is a certificate for a non-gazetted staff pay bill for the month. It certifies that the amount being drawn is in accordance with rules and that no amounts over 3 months old are outstanding. It also certifies that amounts drawn in the previous 1-2 months are being refunded through deductions. The amount of the pay bill is Rs. 156718.00.

Исходное описание:

Оригинальное название

Certificate Ng

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document is a certificate for a non-gazetted staff pay bill for the month. It certifies that the amount being drawn is in accordance with rules and that no amounts over 3 months old are outstanding. It also certifies that amounts drawn in the previous 1-2 months are being refunded through deductions. The amount of the pay bill is Rs. 156718.00.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

42 просмотров1 страницаCertificate NG

Загружено:

chander_prakash2000The document is a certificate for a non-gazetted staff pay bill for the month. It certifies that the amount being drawn is in accordance with rules and that no amounts over 3 months old are outstanding. It also certifies that amounts drawn in the previous 1-2 months are being refunded through deductions. The amount of the pay bill is Rs. 156718.00.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

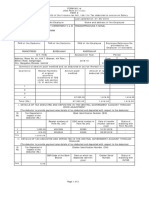

CERTIFICATES

1. Received the contents of this bill.

2. Certified that the amount being drawn in this bill is in accordance with rules as ammended from time to time.

3. Certified That no amounts drawn previously more than 3 months old is lying undisbursed and amounts drawn 1/2/3 months

previous this dates are being refunded by deductions as per given below.

Name Period Amount Draw vide try.vrs. & date

Non-Gazetted staff pay bill for the month of Rs. 156718.00 Stamp & Signature

For Treasury Only

DISTRICT TOWN PLANNER

ENFORCEMENT, FARIDABAD

Signature of D.D.O. with seal and

Code No. 1

(TO BE FILLED BY TRASURY OFFICE)

Pay Rs. 156718.00 (In words)

Date ………………………………… (Treasury Officail) (Asstt. Supdt. Treasury) (Treasury Officers)

Amount to be classified by T.O

1. Cash Rs. ……………………..

2. G.I.S. Rs. ……………………..

3. L.I.C. Rs. ……………………..

4. P.L.I. Rs. ……………………..

5. House rent Rs. ……………………..

6. Income Tax Rs. ……………………..

7. Surcharge Rs. ……………………..

8. Miscellaneous Rs. ……………………..

Total Rs. ……………………..

TO BE USED BY ACCOUNTANT GENERAL OFFICE

Initials of S.O./A.A.O. TOKEN OF

B.O

Admitted Rs. ……………

Objects Rs. …………….

Check of classification Auditor

1. All red line should be drawn right across the sheet after each section of establishment and GRAND TOTALS should be shown in red Ink

2. All deduction should be supported by schedules in appropriate from. There should be separate schedules G.P.F. Account No. be entered there in asceding order.

3. Recovery of house rent should be supportd by rent Rolls in duplicate form the PWD/ESTATE OF ICERS. Deduction adjustable by B.T.

Should be supported by duplicate schedules

4. Due care should be taken to give a connuct code numbers wherever specified.

Вам также может понравиться

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1От EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Оценок пока нет

- White Hats Strategic OverviewДокумент4 страницыWhite Hats Strategic OverviewTheWhiteHats100% (1)

- Series: Safety, Operation, and Procedure Instructions For The PTS Series of DC Hipot/MegohmmetersДокумент37 страницSeries: Safety, Operation, and Procedure Instructions For The PTS Series of DC Hipot/MegohmmetersBarajiux100% (1)

- FVC UniformДокумент2 страницыFVC UniformMahaveer SinghОценок пока нет

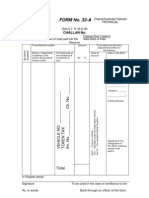

- PtchallanДокумент2 страницыPtchallanBijay Bogi100% (1)

- TA Adjestment Bill For StaffДокумент5 страницTA Adjestment Bill For StaffAnonymous m4CnyeKpОценок пока нет

- Form AR 37Документ1 страницаForm AR 37sriparna rishiОценок пока нет

- Form 16 - Fy 2019-20Документ4 страницыForm 16 - Fy 2019-20CA SHOBHIT GoelОценок пока нет

- Contengency BillДокумент1 страницаContengency BillRahul ChhimpaОценок пока нет

- Form5 PTДокумент2 страницыForm5 PTShilpa KapoorОценок пока нет

- Employees' Provident Fund Scheme, 1952: Form-19Документ2 страницыEmployees' Provident Fund Scheme, 1952: Form-19Anonymous vsiAEfSWОценок пока нет

- Contingent Bill of The ................................................................ DepartmentДокумент1 страницаContingent Bill of The ................................................................ DepartmentrhengongОценок пока нет

- Bill FormsДокумент12 страницBill FormsVeerapandianОценок пока нет

- GAR 6 ChallanДокумент2 страницыGAR 6 ChallanvikeyiesolehoОценок пока нет

- Abstract Contingent Bill T.R.31 GlnqyjДокумент2 страницыAbstract Contingent Bill T.R.31 GlnqyjHassan raxaОценок пока нет

- Itchellan KeralaДокумент2 страницыItchellan KeralaAiju ThomasОценок пока нет

- GFR2017 4Документ48 страницGFR2017 4PatrickОценок пока нет

- Currency Exchnage FormatДокумент1 страницаCurrency Exchnage FormatSarvjeet SinghОценок пока нет

- Anspg5953f 2018-19Документ3 страницыAnspg5953f 2018-19virajv1Оценок пока нет

- Welcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)Документ9 страницWelcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)SagarDaveОценок пока нет

- Rtgs - Cbi (Scan)Документ1 страницаRtgs - Cbi (Scan)Prabhjot S ChandhokОценок пока нет

- Form27d Applicable From 01.04Документ2 страницыForm27d Applicable From 01.04sudhrengeОценок пока нет

- Form No. 16-AДокумент1 страницаForm No. 16-AJay100% (6)

- Cash and Stamp BalanceДокумент10 страницCash and Stamp BalancesuriОценок пока нет

- Form No 16 - Ay0607Документ4 страницыForm No 16 - Ay0607api-3705645100% (1)

- MRC Sec17q September2020 Signed10.28.20Документ29 страницMRC Sec17q September2020 Signed10.28.20Jullian Paul GregorioОценок пока нет

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Документ2 страницы(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarОценок пока нет

- WCT ChallanДокумент5 страницWCT ChallanPravin ShiroleОценок пока нет

- Professional Tax Jan 2023 PDFДокумент1 страницаProfessional Tax Jan 2023 PDFRaghavendra GandodiОценок пока нет

- Bgupv5366d Q4 2019-20Документ2 страницыBgupv5366d Q4 2019-20Parth VaishnavОценок пока нет

- 0002 Payment Certificate 2010Документ3 страницы0002 Payment Certificate 2010SreedharanPNОценок пока нет

- 0.00 Verification: TotalДокумент4 страницы0.00 Verification: TotalKesava KesОценок пока нет

- Last Pay Certificate of Retirement Uncle TolheisangДокумент2 страницыLast Pay Certificate of Retirement Uncle Tolheisangsanjoythokchom1993Оценок пока нет

- (See Rule 31 (1) (A) ) : Form No. 16Документ8 страниц(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeОценок пока нет

- TD Commission PDF For BoДокумент1 страницаTD Commission PDF For BoJayesh Chavarkar67% (3)

- Attpp2455j 2021-22Документ2 страницыAttpp2455j 2021-22Aditya PLОценок пока нет

- 1 - Form16 - 218 - FY 2021-22Документ9 страниц1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaОценок пока нет

- Arr Bill OuterДокумент1 страницаArr Bill Outermahesh070Оценок пока нет

- FORMTR12 Chalan FormДокумент2 страницыFORMTR12 Chalan FormvineethkmenonОценок пока нет

- TNTC 100Документ1 страницаTNTC 100Chandrasekar PeriyasamyОценок пока нет

- Form 32A DtoДокумент1 страницаForm 32A Dtoapi-19912235Оценок пока нет

- GISreportДокумент2 страницыGISreportGouri Sankar MahapatraОценок пока нет

- Form No 16Документ4 страницыForm No 16Md ZhidОценок пока нет

- HSRPM9590K Q3 2023-24Документ3 страницыHSRPM9590K Q3 2023-24jishna mathewОценок пока нет

- Ramesh GPF Old StatementДокумент2 страницыRamesh GPF Old StatementSHARANUОценок пока нет

- Voucher For Deposit RepaymentДокумент2 страницыVoucher For Deposit RepaymentYuga Sunder GogoiОценок пока нет

- Adobe Scan 01 Aug 2023Документ6 страницAdobe Scan 01 Aug 2023Soffiya SoffiyaОценок пока нет

- 110773Документ6 страниц110773asheesh kumarОценок пока нет

- Oriental Bank of Commerce RTGS NEFT RTGS and DDДокумент2 страницыOriental Bank of Commerce RTGS NEFT RTGS and DDDasharath Patel67% (3)

- PF Form 19Документ2 страницыPF Form 19vasudevanОценок пока нет

- The Fallout of War: The Regional Consequences of the Conflict in SyriaОт EverandThe Fallout of War: The Regional Consequences of the Conflict in SyriaОценок пока нет

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesОт EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesОценок пока нет

- Jeag Gabriel Final123Документ29 страницJeag Gabriel Final123Jessa MaeОценок пока нет

- Ipcc Tax Practice Manual PDFДокумент651 страницаIpcc Tax Practice Manual PDFshakshi gupta100% (1)

- PF Form 15GДокумент1 страницаPF Form 15GSorabh BhargavОценок пока нет

- Financial Accounting Project: TATA Steel Ltd. JSW Steel LTDДокумент17 страницFinancial Accounting Project: TATA Steel Ltd. JSW Steel LTDSanju VisuОценок пока нет

- Indonesias Oil and Gas Laws (Oentoeng Suria)Документ20 страницIndonesias Oil and Gas Laws (Oentoeng Suria)upiОценок пока нет

- Chapter 6: Self-Test Taxation Discussion QuestionsДокумент9 страницChapter 6: Self-Test Taxation Discussion QuestionsUnnamed homosapienОценок пока нет

- Contract To SellДокумент15 страницContract To SellMarlouieV.BatallaОценок пока нет

- Acc f125 Bir Computation 2019Документ33 страницыAcc f125 Bir Computation 2019AlliyahLynneUlepCorcueraОценок пока нет

- Group Assignment - April 23Документ16 страницGroup Assignment - April 23DIVA RTHINIОценок пока нет

- 1.RFP For Solu CorridorДокумент90 страниц1.RFP For Solu CorridorSami UlhaqОценок пока нет

- Text of RA9162Документ18 страницText of RA9162Juan Luis LusongОценок пока нет

- Valuation of GoodwillДокумент15 страницValuation of Goodwillbtsa1262013Оценок пока нет

- Find Buyers For Your Export BusinessДокумент2 страницыFind Buyers For Your Export BusinessЛилия ХовракОценок пока нет

- SWOT Analysis: S - Strength W - Weakness O - OpportunitiesДокумент9 страницSWOT Analysis: S - Strength W - Weakness O - Opportunitieswaqas AzizОценок пока нет

- BL1 Individual Activity 1 AGДокумент1 страницаBL1 Individual Activity 1 AGSamantha Reynolds-SОценок пока нет

- Principles of Taxation Study Guide 2018 PDFДокумент42 страницыPrinciples of Taxation Study Guide 2018 PDFIssa BoyОценок пока нет

- Payment ReceiptДокумент1 страницаPayment Receiptkutra chawlaОценок пока нет

- CMC Global - Offer Letter - Mr. Nguyen Huu Phuoc - 170122Документ1 страницаCMC Global - Offer Letter - Mr. Nguyen Huu Phuoc - 170122kamusuyurikunОценок пока нет

- Introduction of A Speaker SINGCULANДокумент2 страницыIntroduction of A Speaker SINGCULANRonna Mae DungogОценок пока нет

- Chapter 8 Adjusting EntriesДокумент19 страницChapter 8 Adjusting EntriesBLANKОценок пока нет

- SRO Report: Law Enforcement in Minnesota SchoolsДокумент111 страницSRO Report: Law Enforcement in Minnesota SchoolsUrbanYouthJusticeОценок пока нет

- Invoice IFBДокумент1 страницаInvoice IFBarindam kumarОценок пока нет

- SPOUSES CONSTANTE FIRME AND AZUCENA E. FIRME Vs - UKAL ENTERPRISES AND DEVELOPMENT CORPORATIONДокумент12 страницSPOUSES CONSTANTE FIRME AND AZUCENA E. FIRME Vs - UKAL ENTERPRISES AND DEVELOPMENT CORPORATIONRenz Aimeriza AlonzoОценок пока нет

- Mechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaДокумент20 страницMechanisms and Incentives To Promote The Use and Storage of Co2 in The North SeaTilo ObashОценок пока нет

- ROI - Return On InvestmentДокумент5 страницROI - Return On InvestmentrazashahacaОценок пока нет

- Commission: 979197/895-HS Talha Ahmed ButtДокумент1 страницаCommission: 979197/895-HS Talha Ahmed ButtGooglo FanОценок пока нет

- Annual Internal Audit Plan ReportДокумент23 страницыAnnual Internal Audit Plan ReportEva JulioОценок пока нет

- 01multiple ChoiceДокумент12 страниц01multiple ChoicePRINCESS MAY ADAMОценок пока нет