Академический Документы

Профессиональный Документы

Культура Документы

RF1 FORM - Phil Health

Загружено:

jtravelИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RF1 FORM - Phil Health

Загружено:

jtravelАвторское право:

Доступные форматы

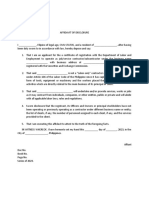

Republic of the Philippines

RF-1

REVISED JAN 2002

PHILIPPINE HEALTH INSURANCE CORPORATION

EMPLOYER'S QUARTERLY

F O R P H I L H E A L T H U S E

REMITTANCE REPORT Date Screened: Action Taken: Date Screened: Action Taken:

1

PHILHEALTH NO. - - By: By:

EMPLOYER TIN - - - Signature over Printed Name Signature over Printed Name

2 3 EMPLOYER TYPE 4 TYPE OF REPORT 5 APPLICABLE QUARTER

COMPLETE EMPLOYER NAME Regular EMPLOYER'S SSS NO. Regular RF-1 Quarter Ending Mar 200

COMPLETE MAILING ADDRESS Private - - Addition to previous RF-1 Quarter Ending Jun 200

TELEPHONE NO. Government EMPLOYER'S SSS/GSIS POLICY NO. Deduction to previous RF-1 Quarter Ending Sep 200

Household Quarter Ending Dec 200

6 7 8 9 NHIP PREMIUM CONTRIBUTIONS 10 REMARKS

NAME OF EMPLOYEE/S MONTHLY 1st Month 2nd Month 3rd Month S - Separated, NE - No Earning, NH - Newly Hired

PhilHealth ID COMPENSATION

No./SSS ID No./GSIS BRACKET Date of

Surname Given Name M.I. Policy No. PS ES PS ES PS ES 1st Month 2nd Month 3rd Month

1st 2nd 3rd

Effectivity

Month Month Month

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

11 ME-5 SUMMARY OF CONTRIBUTION PAYMENTS 12 13 Certified Correct:

(PS + ES)

Month/Quarter Total Contribution ME-5 Reconcilation No. Date Paid No. of Employees SUBTOTAL

1st Month SIGNATURE OVER PRINTED NAME

2nd Month (To be accomplished on every page)

3rd Month OFFICIAL DESIGNATION

GRAND TOTAL (PS + ES)

(To be accomplished on every page) DATE

PLEASE READ INSTRUCTIONS (FOR EACH NUMBERED BOX) AT THE BACK BEFORE ACCOMPLISHING THIS FORM 14 Page of Pages

I N S T R U C T I O N S

Note: The corresponding instructions per numbered-box are enumerated below.

Box 1: Write the COMPLETE Employer TIN and PhilHealth No. in corresponding boxes. Box 12: Add all contributions in the personal share (PS) column and employer share (ES) column, for each month and reflect

the sum in the "Subtotal" box for each page. Consequently, add all Subtotals/Page totals and reflect sum in the "Grand Total"

Box 2: Write the COMPLETE Employer Name, Address and Telephone No. DO NOT ABBREVIATE. box in the last sheet of the accomplished RF-1 to indicate total amount of contributions paid for the applicable quarter.

Box 3: Check applicable box for Employer Type. Indicate the Employer's SSS No. for regular private employers. For government employers,

ensure that the Employer TIN in Box 1 is filled-up. For Household employers, write Employer's SSS No./GSIS Policy No. Box 13: Affix signature and print complete name, designation and date of certification of authorized officer certifying the

report.

Box 4: Check the applicable box for Type of Report. For adjustment on remittance report of previous quarter, use a separate RF-1 form and

check the box corresponding to "Addition to Previous RF-1" or "Deduction to Previous RF-1", as the case may be. Write only the names of Box 14: Always indicate page number and total number of pages at each page of the form.

the additional employees that were not declared or name of employees to be deleted if they were erroneously declared in the previous report.

If an underpayment results due to this correction, please remit the amount due to PhilHealth . Use separate/different set of RF-1 form for Submit Orignal Copy of this duly accomplished form every quarter ending March, June, September and December

each quarter when reporting previous payments or for late payments made on previous quarter(s). with the corresponding copies of the validated ME-5 to the Contribution Accounts Management Department for

payors within the NCR or to Service Offices/PhilHealth Regional Offices (PROs) for payors outside NCR. The

Box 5: Always indicate the applicable quarter and year, of premium contributions paid by checking the box opposite the applicable quarter Duplicate Copy of this form shall be the Payor's Copy. Deadline of payment of contributions shall be on the 10th day

ending. The month coverage in the RF-1 should correspond with the month coverage indicated in the ME-5. Eg., Ms. D remitted P375 for of the month following the applicable month. Employers who fail to comply with the above requirements shall be

premium due for January 2000, P375 for February 2000, and P375 for March 2000, check the box opposite the quarter ending March and subjected to the penalties provided under Article X, R.A. 7875. Please submit this report every quarter ending only.

indicate the amount of contribution for each column (i.e., amount remitted for January in the 1st Month; February for the 2nd month & March

for the 3rd Month) in Box 9.

COPY DISTRIBUTION SUBMISSION OF FORMS

Box 6: Print the names of Employees/Househelpers in Alphabetical order, surname first. Write Family Names as they are pronounced. For Form No. of Copies 1st 2nd 3rd 4th Appicable Quarter Deadline of Submission

instance, the names JULIAN DELA CRUZ, LILIA DELOS SANTOS and MARIA DE GUIA should be written as DELA CRUZ, JULIAN; DELOS RF-1 2 PHIC Payor X X January - March April 15

SANTOS, LILIA and DE GUIA, MARIA. Also, names with suffixes such as Jr., Sr., III, etc. should always be written after the family name. Do ME-5 4 Payor PHIC PHIC Bank April - June July 15

not skip lines when listing down their names. Write "NOTHING FOLLOWS" on the line immediately following the last listed July - September October 15

employee/househelper. October - December January 15

Box 7: Indicate the corresponding PhilHealth Identification No. (PIN) opposite the respective names of your employees/househelpers to

ensure that all contributions paid will be credited to them. IF WITHOUT PIN, INDICATE THEIR SSS/GSIS NO. 2000 NHIP MONTHLY PREMIUM CONTRIBTUION SCHEDULE & MONTHLY COMPENSATION

BRACKET

Box 8: The monthly premium contribution of an employee is based on his actual monthly compensation. Write your employees' respective Monthly Salary Monthly Salary Range Salary Base Total Monthly Personal Share (PS)

Monthly Compensation Bracket according to their actual monthly compensation for the given quarter. The monthly compensation bracket, is Bracket (SB) Contribution (PS=SB x 1.25%)

determined by the monthly salary range, the employee's actual monthly compensation belongs. Please refer to the Revised NHIP Monthly 1 P 3,499.99 and below P3,000.00 P 75.00 P 37.50

Contribution Schedule. Ex., Ms. R received P4,350.00 for October 2000, P4,750 for November 2000 and P4,350.00 for December 2000 so 2 3,500.00 to 3,999.99 3,500.00 87.50 43.75

her compensation for the 1st month (October) falls in bracket 3, falls in bracket 4 for Novemberand falls in bracket 3 for December. 3 4,000.00 to 4,499.99 4,000.00 100.00 50.00

4 4,500.00 to 4,999.99 4,500.00 112.50 56.25

5 5,000.00 to 5,499.99 5,000.00 125.00 62.50

Box 9: Indicate corresponding Personal Share (PS) and Employer Share (ES) on the boxes provided per monthly remittance . The total 6 5,500.00 to 5,999.99 5,500.00 137.50 68.75

premium contribution (PS + ES) for each month must fall within the prescribe salary bracket. Ex. If Ms J's monthly compensation bracket for 7 6,000.00 to 6,499.99 6,000.00 150.00 75.00

the months of October, November and December are 4, 4, and 5 respectively, her Personal Share (PS) for October should be P56.25, 8 6,500.00 to 6,999.99 6,500.00 162.50 81.25

P56.25 for November and 62.50 for December.The Employer Share (ES) shall also be P56.25 for October, P56.25 for November and P62.50 9 7,000.00 to 7,499.99 7,000.00 175.00 87.50

for December. 10 7,500.00 to 7,999.99 7,500.00 187.50 93.75

11 8,000.00 to 8,499.99 8,000.00 200.00 100.00

Box 10: In the "REMARKS" column indicate "S" if employee is separated, "NE" if with no earnings and "NH" if employee is newly hired 12 8,500.00 to 8,999.99 8,500.00 212.50 106.25

including date of separation, period/date when the employee had no earnings and date of hiring respectively. 13 9,000.00 to 9,499.99 9,000.00 225.00 112.50

14 9,500.00 to 9,999.99 9,500.00 237.50 118.75

Box 11: Supply needed information on the "ME-5 Summary of Contribution Payments". Indicate the corresponding ME-5 Reconciliation No., 15 10,000.00 and up 10,000.00 250.00 125.00

found in the lower left portion of the ME-5 form, for each month. Total monthly premium to be indicated opposite the applicable month

coverage in the ME-5 should also tally with the amount reflected in the RF-1. THIS FORM MAY BE REPRODUCED

Вам также может понравиться

- AutoPay Output Documents PDFДокумент2 страницыAutoPay Output Documents PDFAnonymous QZuBG2IzsОценок пока нет

- 72rr03 26anxaДокумент2 страницы72rr03 26anxaRenEleponioОценок пока нет

- Request SEC name reservationДокумент1 страницаRequest SEC name reservationsyutuc11Оценок пока нет

- Annex F RR 11-2018Документ1 страницаAnnex F RR 11-2018Andoy Domingo Carullo100% (2)

- BIR Form No. 1900Документ2 страницыBIR Form No. 1900Aldrin Laloma100% (1)

- BPI - Secretary's Certificate TemplateДокумент3 страницыBPI - Secretary's Certificate TemplatemaureenОценок пока нет

- MB Spreads in USДокумент14 страницMB Spreads in USVienna1683Оценок пока нет

- Letter For LOAДокумент1 страницаLetter For LOAmaeОценок пока нет

- SEC Philippines e-mail and mobile submission formДокумент1 страницаSEC Philippines e-mail and mobile submission formMMH ACCTGОценок пока нет

- Ahlens Realty Quarterly Tax Returns ReportДокумент2 страницыAhlens Realty Quarterly Tax Returns ReportTe Amo Guid100% (1)

- Municipal Council of Iloilo v. EvangelistaДокумент2 страницыMunicipal Council of Iloilo v. EvangelistaWinterBunBunОценок пока нет

- Annex C.1: Sworn Application For Tax ClearanceДокумент1 страницаAnnex C.1: Sworn Application For Tax Clearancekenneth june reyes100% (1)

- SEC Cover SheetДокумент1 страницаSEC Cover SheetAya PulidoОценок пока нет

- Legal requirements for international marriageДокумент1 страницаLegal requirements for international marriagemaria fe moncadaОценок пока нет

- Authority To PracticeДокумент2 страницыAuthority To Practiceanthony singzon86% (7)

- AMLA Annex C - BlankДокумент1 страницаAMLA Annex C - BlankCGCruz100% (1)

- Affidavit of Non-Holding of MeetingДокумент1 страницаAffidavit of Non-Holding of MeetingChanine Mae Cruz100% (1)

- CTA ProcedureДокумент60 страницCTA ProcedureNori LolaОценок пока нет

- Special Power AttorneyДокумент1 страницаSpecial Power AttorneyMGB LEGAL100% (1)

- Annex C.1: Sworn Application For Tax ClearanceДокумент1 страницаAnnex C.1: Sworn Application For Tax ClearanceKrizza MadridОценок пока нет

- Signage Permit Application FormДокумент1 страницаSignage Permit Application FormDenise LorejoОценок пока нет

- Affidavit Closure DTIДокумент1 страницаAffidavit Closure DTIAurora Saralde MatienzoОценок пока нет

- Fillable Word - MOA STP As of 11.2.21 LegalДокумент20 страницFillable Word - MOA STP As of 11.2.21 Legaljoycelyn juradoОценок пока нет

- Letter For Delisting BIRДокумент2 страницыLetter For Delisting BIRFreann Sharisse AustriaОценок пока нет

- Requirements for securing tax clearanceДокумент1 страницаRequirements for securing tax clearanceDenzel Edward Cariaga100% (2)

- Affidavit of Undertaking For BIR-PRESERVE BOOKS-TEMPLATEДокумент1 страницаAffidavit of Undertaking For BIR-PRESERVE BOOKS-TEMPLATEMHILET BasanОценок пока нет

- Certificate of Gross SalesДокумент1 страницаCertificate of Gross SalesJlj ChuaОценок пока нет

- JG Summit Holdings Vs CA September 24, 2003 PDFДокумент2 страницыJG Summit Holdings Vs CA September 24, 2003 PDFErvin Franz Mayor CuevillasОценок пока нет

- Affidavit of UndertakingДокумент1 страницаAffidavit of UndertakingYani DaquisОценок пока нет

- BIR Bound Book Extension RequestДокумент1 страницаBIR Bound Book Extension RequestPat Dela CruzОценок пока нет

- Contractor's License Amnesty Application RequirementsДокумент11 страницContractor's License Amnesty Application RequirementsArlyn JarabeОценок пока нет

- Secretary Certificate For Manual Loose LeafДокумент1 страницаSecretary Certificate For Manual Loose LeafkatjocsonОценок пока нет

- SSSForm Member Loan Payment ReturnДокумент1 страницаSSSForm Member Loan Payment Returnrhod_bspt3251Оценок пока нет

- Undertaking To File A Separate Final/Adjustment ReturnДокумент1 страницаUndertaking To File A Separate Final/Adjustment ReturnAndrei Anne Palomar100% (1)

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Документ7 страницAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegОценок пока нет

- PhilGEPS Sworn StatementДокумент2 страницыPhilGEPS Sworn Statementsevera martinОценок пока нет

- CPRS Affidavit-Revised.11-22-16Документ2 страницыCPRS Affidavit-Revised.11-22-16Rosalie Padilla100% (2)

- Employer'S Authorized Approving Officer Change of Information FormДокумент2 страницыEmployer'S Authorized Approving Officer Change of Information FormJames BoloОценок пока нет

- PEOPLE Vs DE GRANOДокумент2 страницыPEOPLE Vs DE GRANOLoiseОценок пока нет

- DOLE Sworn Disclosure 174Документ1 страницаDOLE Sworn Disclosure 174Roedl Roedl100% (1)

- GCash - Sec CertДокумент1 страницаGCash - Sec CertDessa QuitasolОценок пока нет

- Director's Certificate - Dissolution of CorporationДокумент1 страницаDirector's Certificate - Dissolution of CorporationCatherine Habla-Rasing100% (1)

- An Assignment On The Bangladesh Studies: Submitted ToДокумент16 страницAn Assignment On The Bangladesh Studies: Submitted ToTarun Kr Das100% (1)

- Philippines affidavit gross salesДокумент1 страницаPhilippines affidavit gross salesRyan UyОценок пока нет

- Annex CДокумент1 страницаAnnex CAileen TeoОценок пока нет

- Directors' Certificate: Know All Men by These Presents: We, The Undersigned Directors of Inc., Do Hereby Certify ThatДокумент3 страницыDirectors' Certificate: Know All Men by These Presents: We, The Undersigned Directors of Inc., Do Hereby Certify ThatRex Atabay TadenaОценок пока нет

- Annex "D": Securities and Exchange CommissionДокумент4 страницыAnnex "D": Securities and Exchange CommissionaileenОценок пока нет

- Request Letter For Compromise - KbindustrialДокумент1 страницаRequest Letter For Compromise - KbindustrialJedah Ibarra VillaflorОценок пока нет

- Affidavit of ConsentДокумент1 страницаAffidavit of ConsentRoger L. Salvania100% (1)

- SEC Cover Sheet For AFS 1Документ2 страницыSEC Cover Sheet For AFS 1janex92Оценок пока нет

- Sample - Amended SEC Articles, Change AddressДокумент10 страницSample - Amended SEC Articles, Change AddressJimmelyn CalejesanОценок пока нет

- DO 18A Checklist of RequirementsДокумент2 страницыDO 18A Checklist of RequirementsRobin RubinaОценок пока нет

- Authorisation LetterДокумент1 страницаAuthorisation LetterLalaine MarianoОценок пока нет

- Letter For Correction of SSS ContributionsДокумент1 страницаLetter For Correction of SSS ContributionsFreann Sharisse Austria100% (1)

- CTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceДокумент74 страницыCTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceJerwin DaveОценок пока нет

- Philippines Province Leyte Health Office submits BIR Form 2305 for employeesДокумент1 страницаPhilippines Province Leyte Health Office submits BIR Form 2305 for employeesSylvia EnovisoОценок пока нет

- Annex C.1Документ1 страницаAnnex C.1Eric OlayОценок пока нет

- BIR Ruling on Informer's RewardДокумент4 страницыBIR Ruling on Informer's RewardAnonymous fnlSh4KHIgОценок пока нет

- Affidavit of Partial RetirementДокумент2 страницыAffidavit of Partial RetirementEsther DilleraОценок пока нет

- Secretary's Certificate for Board Resolution on International Business EndorsementДокумент2 страницыSecretary's Certificate for Board Resolution on International Business EndorsementTina UyОценок пока нет

- 43735rmc No 5-2009 Annex CДокумент1 страница43735rmc No 5-2009 Annex CJM GapisaОценок пока нет

- Secretary's certificate for vehicle saleДокумент1 страницаSecretary's certificate for vehicle saleRobert marollanoОценок пока нет

- RF 1Документ4 страницыRF 1sweetviolet0303Оценок пока нет

- Philhealth Id Layout 2008 FormДокумент2 страницыPhilhealth Id Layout 2008 FormRaymond DomingoОценок пока нет

- RF 1Документ2 страницыRF 1ahnica100% (5)

- RF 1Документ2 страницыRF 1State Of SurvivalОценок пока нет

- Employer'S Remittance Report: Tri-Silver Builders IncorporatedДокумент1 страницаEmployer'S Remittance Report: Tri-Silver Builders Incorporatedabby santosОценок пока нет

- Philippine Health Insurance Employer Remittance FormДокумент1 страницаPhilippine Health Insurance Employer Remittance FormEarlinne LacabaОценок пока нет

- QUINTIN May 2006 PDFДокумент1 страницаQUINTIN May 2006 PDFMaybel MaligayaОценок пока нет

- E-Way Bill: Government of IndiaДокумент1 страницаE-Way Bill: Government of IndiaVIVEK N KHAKHARAОценок пока нет

- DiplomacyДокумент8 страницDiplomacyRonnald WanzusiОценок пока нет

- Caroline Lang: Criminal Justice/Crime Scene Investigator StudentДокумент9 страницCaroline Lang: Criminal Justice/Crime Scene Investigator Studentapi-405159987Оценок пока нет

- Forms of Business OwnershipДокумент26 страницForms of Business OwnershipKCD MULTITRACKSОценок пока нет

- Javellana Vs TayoДокумент1 страницаJavellana Vs TayoEman EsmerОценок пока нет

- Unit 1 IntroductionДокумент17 страницUnit 1 Introductionanne leeОценок пока нет

- Paramedical CouncilДокумент2 страницыParamedical CouncilSachin kumarОценок пока нет

- AutoText Technologies, Inc. v. Apple, Inc. Et Al - Document No. 3Документ2 страницыAutoText Technologies, Inc. v. Apple, Inc. Et Al - Document No. 3Justia.comОценок пока нет

- How Do You Compute The Assessed Value?: Assessed Value Fair Market Value X Assessment LevelДокумент7 страницHow Do You Compute The Assessed Value?: Assessed Value Fair Market Value X Assessment Leveljulie anne mae mendozaОценок пока нет

- Case Study On Cinderella Flora Farms PVT LTDДокумент1 страницаCase Study On Cinderella Flora Farms PVT LTDTosniwal and AssociatesОценок пока нет

- 5 PNB v. Asuncion G.R. No. L 46095Документ2 страницы5 PNB v. Asuncion G.R. No. L 46095Najmah DirangarunОценок пока нет

- VII World Human Rights Moot Court Competition 8-10 December 2015 Geneva, SwitzerlandДокумент52 страницыVII World Human Rights Moot Court Competition 8-10 December 2015 Geneva, SwitzerlandShobhit ChaudharyОценок пока нет

- KATIBAДокумент145 страницKATIBAmaliki20 saidiОценок пока нет

- Leave & License AgreementДокумент2 страницыLeave & License AgreementThakur Sarthak SinghОценок пока нет

- Rajesh V Choudhary Vs Kshitij Rajiv Torka and OrsMH201519091519125799COM279936Документ23 страницыRajesh V Choudhary Vs Kshitij Rajiv Torka and OrsMH201519091519125799COM279936Shubhangi SinghОценок пока нет

- Twitter's Objection To Public AccommodationДокумент10 страницTwitter's Objection To Public AccommodationSensa VerognaОценок пока нет

- CRIM 1 Syllabus As of 24 August 2020Документ19 страницCRIM 1 Syllabus As of 24 August 2020AmicahОценок пока нет

- Examen de Competenţă Lingvistică - Model Test Grilă Limba Engleză DOMENIUL: DreptДокумент11 страницExamen de Competenţă Lingvistică - Model Test Grilă Limba Engleză DOMENIUL: DreptNicolae NistorОценок пока нет

- People Vs CA and Maquiling (Re GAD)Документ13 страницPeople Vs CA and Maquiling (Re GAD)Vern CastilloОценок пока нет

- 494 Supreme Court Reports Annotated: People vs. OlarteДокумент10 страниц494 Supreme Court Reports Annotated: People vs. OlartebudappestОценок пока нет

- Cyber PdpaДокумент30 страницCyber PdpaSyafiq AffandyОценок пока нет