Академический Документы

Профессиональный Документы

Культура Документы

Week 10 Tutorial Problem 1) : Income Statement For Years Ended 30 June

Загружено:

Hasan MahfoozИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Week 10 Tutorial Problem 1) : Income Statement For Years Ended 30 June

Загружено:

Hasan MahfoozАвторское право:

Доступные форматы

Week 10 Tutorial Problem 1)

To complete the comprehensive exercise in the handout.

Problem 2) Textbook exercises

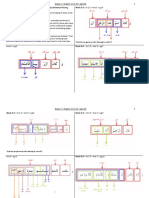

The following are the financial statements for Nailsea plc for the years ended 30 June 2008 and 2009. All amounts are in million pounds.

Revenues Operating expenses Depreciation Operating profit Interest payable Profit before taxation Taxation Profit for the year

Income statement for years ended 30 June 2010 1,230 (722) (270) 238 238 (110) 128 Statements of financial position as at 30 June 2008

2011 2,280 (1,618) (320) 342 (27) 315 (140) 175

2009

Assets Non-current assets: Land and buildings Plant and machinery Current assets: Inventories Trade receivables Bank Total assets Equity and liabilities Equity: Share capital ( 1 Par value) Share premium Reatined earnings

1,500 810 2,310 275 100 375 2,685

1,900 740 2,640 450 250 118 818 3,458

1,400 200 828 2,428

1,600 300 958 2,858

Non-current liabilities: Borrowings-9% Loan notes Current liabilities: Short term borrowings Trade payables Taxes payable Total equity and liabilities

300

32 170 55 257 2,685

230 70 300 3,458

Additional information: 1- There was no disposal of non-current assets in either year. 2- Dividends were paid in 2008 and 2009 of 40 million and 45 million, respectively. Required: Prepare a statement of cash flows for Nailsea plc for the year ended 30 June 2009 using the indirect method.

Вам также может понравиться

- Cement & Concrete Building Components World Summary: Market Values & Financials by CountryОт EverandCement & Concrete Building Components World Summary: Market Values & Financials by CountryОценок пока нет

- Solution Past Paper Higher-Series4-08hkДокумент16 страницSolution Past Paper Higher-Series4-08hkJoyce LimОценок пока нет

- Revision QuestionsДокумент3 страницыRevision QuestionsKA Mufas100% (1)

- 2009-Financial Reporting Main EQP and CommentariesДокумент46 страниц2009-Financial Reporting Main EQP and CommentariesBryan SingОценок пока нет

- t11 Additional Workshop QuestionsДокумент4 страницыt11 Additional Workshop QuestionsEe Yern NgОценок пока нет

- Martin Engegren Sony Ericsson q1 2009Документ9 страницMartin Engegren Sony Ericsson q1 2009martin_engegrenОценок пока нет

- Adagio PLC Profit and Loss Account For The Year Ended 31st May 2010Документ1 страницаAdagio PLC Profit and Loss Account For The Year Ended 31st May 2010zahid_mahmood3811Оценок пока нет

- Press Release Sony Ericsson Reports Second Quarter Results: July 16, 2009Документ11 страницPress Release Sony Ericsson Reports Second Quarter Results: July 16, 2009it4728Оценок пока нет

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingДокумент6 страницSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasОценок пока нет

- Exchequer Final Statement JuneДокумент5 страницExchequer Final Statement JunePolitics.ieОценок пока нет

- Genting Singapore PLCДокумент22 страницыGenting Singapore PLCHQ Li Ying SoonОценок пока нет

- Directors Report Year End: Mar '10: Explore Tata Steel ConnectionsДокумент15 страницDirectors Report Year End: Mar '10: Explore Tata Steel ConnectionsChetan PatelОценок пока нет

- Ucb (Report)Документ3 страницыUcb (Report)Shruti VasudevaОценок пока нет

- 2012 Dec QCF QДокумент3 страницы2012 Dec QCF QMohamedОценок пока нет

- Study Unit 15 - Solution Q 1, 2 3Документ5 страницStudy Unit 15 - Solution Q 1, 2 3dumisaniОценок пока нет

- Case Studies Program: Advanced Accounting CourseДокумент4 страницыCase Studies Program: Advanced Accounting CourseLoik-mael NysОценок пока нет

- Capital Allowance QuestionsДокумент8 страницCapital Allowance QuestionsTIMOREGH100% (2)

- Financial Statements (2) TutorialДокумент2 страницыFinancial Statements (2) TutorialLeya De'ReBorn MomoОценок пока нет

- Albion Technology & General VCT PLCДокумент70 страницAlbion Technology & General VCT PLCalbionventuresОценок пока нет

- Insert Source Booklet Jan 09 6001Документ12 страницInsert Source Booklet Jan 09 6001Yue Ying0% (1)

- Sebi MillionsДокумент2 страницыSebi MillionsNitish GargОценок пока нет

- Financial Accounting: Formation 2 Examination - April 2008Документ11 страницFinancial Accounting: Formation 2 Examination - April 2008Luke ShawОценок пока нет

- 1st Half Report - June 30, 2010Документ75 страниц1st Half Report - June 30, 2010PiaggiogroupОценок пока нет

- Question P1Документ3 страницыQuestion P1John ElliottОценок пока нет

- IFRS For SME's Financial Statements TemplateДокумент27 страницIFRS For SME's Financial Statements TemplatemrlskzОценок пока нет

- ICAEW Financial Accounting Past Papers Combined 2010-2013Документ130 страницICAEW Financial Accounting Past Papers Combined 2010-2013Ahmed Raza Tanveer100% (3)

- Coimisiún Na Scrúduithe Stáit State Examinations Commission: Leaving Certificate 2008Документ19 страницCoimisiún Na Scrúduithe Stáit State Examinations Commission: Leaving Certificate 2008Talent MuparuriОценок пока нет

- 2010 LCCI Bookkeeping and Accounts Series 3Документ8 страниц2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- F6UK 2012 Dec AnsДокумент9 страницF6UK 2012 Dec AnsamirahimiОценок пока нет

- 2010 LCCI Level 3 Series 2 Model Answers (Code 3012)Документ9 страниц2010 LCCI Level 3 Series 2 Model Answers (Code 3012)mappymappymappyОценок пока нет

- News Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsДокумент25 страницNews Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsRobert Edward BallОценок пока нет

- Roadshow Canada Ackermann 19 - 20 FebДокумент54 страницыRoadshow Canada Ackermann 19 - 20 FebEyal BarОценок пока нет

- Exchequer Final Statement March 2012Документ5 страницExchequer Final Statement March 2012Politics.ieОценок пока нет

- Model Answers Series 2 2010Документ17 страницModel Answers Series 2 2010Jack Tsang100% (1)

- Notice To Shareholders Audited Financial Results For Twelve Months Ended 30 September 2012Документ1 страницаNotice To Shareholders Audited Financial Results For Twelve Months Ended 30 September 2012AMH_AdsОценок пока нет

- Nokia in 2010Документ126 страницNokia in 2010bilaliahmadОценок пока нет

- Rupees in 000: Page 1 of 6Документ6 страницRupees in 000: Page 1 of 6Royal XpreSsОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ8 страницStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Enel Risultati FinanziariДокумент46 страницEnel Risultati FinanziariEnrico BenassiОценок пока нет

- Annual Report: Registered OfficeДокумент312 страницAnnual Report: Registered OfficeDОценок пока нет

- Mlabs Systems BerhadДокумент4 страницыMlabs Systems BerhadMary FlmОценок пока нет

- Martin Engegren Sony Ericsson q4 2009Документ11 страницMartin Engegren Sony Ericsson q4 2009martin_engegrenОценок пока нет

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Документ1 страницаStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaОценок пока нет

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Документ8 страниц2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyОценок пока нет

- Punch International Doubles Its Turnover and Achieves Spectacular Increase in Profit Compared With The First Half of Last YearДокумент4 страницыPunch International Doubles Its Turnover and Achieves Spectacular Increase in Profit Compared With The First Half of Last YearEduardo Yagüe GomezОценок пока нет

- Source Booklet Jan 09 6001Документ12 страницSource Booklet Jan 09 6001MashiatUddinОценок пока нет

- QuestionsДокумент7 страницQuestionsMyra RidОценок пока нет

- 2010 June Financial Reporting L1Документ90 страниц2010 June Financial Reporting L1Dixie Cheelo0% (1)

- Pak Elektron Limited: Condensed Interim FinancialДокумент16 страницPak Elektron Limited: Condensed Interim FinancialImran ArshadОценок пока нет

- P1 - Corporate Reporting August 10Документ18 страницP1 - Corporate Reporting August 10IrfanОценок пока нет

- Exchequer Final Statement January 2012Документ5 страницExchequer Final Statement January 2012Politics.ieОценок пока нет

- Accounting Level 3/series 2 2008 (Code 3001)Документ16 страницAccounting Level 3/series 2 2008 (Code 3001)Hein Linn Kyaw67% (3)

- Trial Q - V & PMДокумент4 страницыTrial Q - V & PMANISAHMОценок пока нет

- 494.Hk 2011 AnnReportДокумент29 страниц494.Hk 2011 AnnReportHenry KwongОценок пока нет

- Financial Accounting December 2009 Exam PaperДокумент10 страницFinancial Accounting December 2009 Exam Paperkarlr9Оценок пока нет

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryОт EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Commercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryОт EverandCommercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Fii BalaaT Hiraql With Lexical and Grammatical NotesДокумент64 страницыFii BalaaT Hiraql With Lexical and Grammatical NotesHasan MahfoozОценок пока нет

- Work and Production in IslamДокумент21 страницаWork and Production in IslamHasan MahfoozОценок пока нет

- Maintaining A Just Economy Through Belief in The HereafterДокумент21 страницаMaintaining A Just Economy Through Belief in The HereafterHasan MahfoozОценок пока нет

- Lost Islamic History Reclaiming Muslim Ci - FirasДокумент203 страницыLost Islamic History Reclaiming Muslim Ci - FirasAbu Abbas Al-Hanafi Al-Athari89% (9)

- Qasas1 All Box Diagrams 1st Story Chap1-16 Pg6-26Документ12 страницQasas1 All Box Diagrams 1st Story Chap1-16 Pg6-26Hasan Mahfooz100% (3)

- The Etiquette of Seeking KnowledgeДокумент96 страницThe Etiquette of Seeking KnowledgeHasan MahfoozОценок пока нет

- TasheelatUrduSharhSabaulMuallaqat PDFДокумент216 страницTasheelatUrduSharhSabaulMuallaqat PDFHasan MahfoozОценок пока нет

- DR Abdur Rahim Ahadith Sahlah With Iraab and NotesДокумент116 страницDR Abdur Rahim Ahadith Sahlah With Iraab and NotesHasan Mahfooz100% (6)

- Arabic VocabularyДокумент7 страницArabic VocabularyHasan MahfoozОценок пока нет

- Terminology Used in Introductory TheoryДокумент6 страницTerminology Used in Introductory TheoryHasan MahfoozОценок пока нет

- Business CardДокумент1 страницаBusiness CardHasan MahfoozОценок пока нет

- MicrofinanceДокумент2 страницыMicrofinanceHasan MahfoozОценок пока нет

- Business CardДокумент1 страницаBusiness CardHasan MahfoozОценок пока нет

- Previous Students Notes Module 1-10Документ34 страницыPrevious Students Notes Module 1-10Hasan MahfoozОценок пока нет

- Ukba S Student Visa Checklist-2Документ3 страницыUkba S Student Visa Checklist-2nirajingtech100% (2)

- Answers To Allegations Against IslaamДокумент83 страницыAnswers To Allegations Against IslaamHasan MahfoozОценок пока нет

- Financial Accounting-Foundation - Lesson 2Документ23 страницыFinancial Accounting-Foundation - Lesson 2Hasan MahfoozОценок пока нет

- Grammatical AnalysisДокумент4 страницыGrammatical AnalysisMaryamInstituteОценок пока нет

- Tony Buzan-Speed MemoryДокумент163 страницыTony Buzan-Speed MemoryV1rtusОценок пока нет

- Arabic VocabularyДокумент7 страницArabic VocabularyHasan MahfoozОценок пока нет

- Book1 Handouts Corrected 001 CoverДокумент1 страницаBook1 Handouts Corrected 001 CoverAhmed KhanОценок пока нет

- Types of KhabarДокумент1 страницаTypes of KhabarsilverpenОценок пока нет

- En The Amazing QuranДокумент60 страницEn The Amazing QuranRafeek KhanОценок пока нет

- Meaning of Abun and WaalidunДокумент1 страницаMeaning of Abun and WaalidunHasan MahfoozОценок пока нет

- Al Mawrid PDFДокумент1 257 страницAl Mawrid PDFislamimedya100% (6)

- Arabic GemsДокумент57 страницArabic GemsHalim Hearst HelmsleyОценок пока нет

- With Emphasis With Emphasis Emphasis Via Emphasis ViaДокумент1 страницаWith Emphasis With Emphasis Emphasis Via Emphasis ViaHasan MahfoozОценок пока нет

- VerbTable Perfect Arabic PracticeДокумент1 страницаVerbTable Perfect Arabic PracticeHasan MahfoozОценок пока нет

- Quran A Short Journey by One ReasonДокумент52 страницыQuran A Short Journey by One ReasonOneReasonOrg100% (2)