Академический Документы

Профессиональный Документы

Культура Документы

Class Exercise 8-Breakeven

Загружено:

vietanh069Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Class Exercise 8-Breakeven

Загружено:

vietanh069Авторское право:

Доступные форматы

BREAK-EVEN ANALYSIS

What is firm's profit? Fixed Cost Variable Cost Selling Price Unit Sold Profit 100,000 7 per unit 12 per unit 50,000 units 150,000

How many units should be sold to break-even?

Profit = SP . n - (FC + VC . n) Profit = 0 0 = SP.n - FC -VC.n n = FC / (SP-VC) 20,000 units need to be sold to make profit = 0 20000

d be sold to break-even?

to be sold to make profit = 0

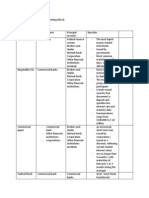

INCOME STATEMENT Sales COGS Gross Profit Less: Operating Expenses Selling Expenses SGA Expenses Depreciation Expenses Fixed Expenses Total Operating Expenses Net Operating Income Other Income EBIT Less: Interest Expnese Interest on ST Debt Interest on LT Debt Total Interst Expenses EBT Less: Taxes 40% Net Earnings Less: Preferred Dividend Earning Available for Common Stock EPS @ 100 K shares Retained Earning Dividend Pmt

3358.71 1500 1859 275 225 100 75 675 1184 20 1204 10 50 60 1144 457 686 95 591 5.91 220 121

Selling Price Unit Sold COGS/Sale

1. Find the number of unit so 2. Find the expected selling p 3. When COGS increases to 1, the unit selling price to maxim 4. Firm would like to control C 1500 while want to maximize expect Selling Price and Unit

profit l noi den earning before tax vs inte

25.75 32.97375 100 101.8601 44.66% cau 1: 50.1753 selling =27.828 ( max/min profit nghia la noi den max/min EBIT) selling =33.57.. sua selling price va unit sold

ind the number of unit sold to make EBIT = 0 ind the expected selling price to earn 4$/share When COGS increases to 1,500. What would be unit selling price to maximize EBIT? irm would like to control COGS somewhere less than 00 while want to maximize its EBIT, what would it pect Selling Price and Unit Sold?

n earning before tax vs interest

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Book 1Документ2 страницыBook 1vietanh069Оценок пока нет

- Group 2: Phan Kiều Trang Thái Thị Kiều Trinh Nguyễn Thị Thanh Hương Phạm Chí Trung Nguyễn Thị Kiều Anh Võ Thị Hoài ThươngДокумент18 страницGroup 2: Phan Kiều Trang Thái Thị Kiều Trinh Nguyễn Thị Thanh Hương Phạm Chí Trung Nguyễn Thị Kiều Anh Võ Thị Hoài Thươngvietanh069Оценок пока нет

- Comparison of Money Market ToolsДокумент3 страницыComparison of Money Market Toolsvietanh069Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Chapter 9 - Operation and Supply ManagementДокумент5 страницChapter 9 - Operation and Supply Managementvietanh069Оценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Operations Management 4 Questions TotalДокумент3 страницыOperations Management 4 Questions Totalvietanh069Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)