Академический Документы

Профессиональный Документы

Культура Документы

Merger Model

Загружено:

cyberdevil321Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Merger Model

Загружено:

cyberdevil321Авторское право:

Доступные форматы

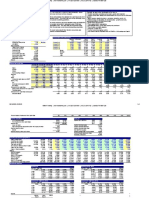

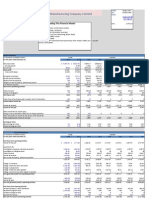

Basic Merger Model ($ in Millions Except Per Share Amounts) Transaction Assumptions Purchase Price: % Cash: % Debt: % Stock:

Foregone Cash Interest Rate: Buyer - Financial Profile Share Price: Shares Outstanding: Market Cap: Tax Rate: Buyer - Income Statement Year 1 $200 $40 $80 $80 $10 $90 $36 $54 $0.54 Year 2 $250 $50 $90 $110 $10 $120 $48 $72 $0.72 $10.00 100.0 $1,000 40% $600 33.3% 33.3% 33.3% 4.0%

Cash Used: Debt Issued: New Shares Issued: Debt Interest Rate: Seller - Financial Profile Share Price: Shares Outstanding: Market Cap: Tax Rate: Seller - Income Statement

Revenue: Cost of Goods Sold: Operating Expenses: Operating Income: Interest Income / (Expense): Pre-Tax Income: Income Taxes: Net Income: Earnings Per Share (EPS): Combined Income Statement

Revenue: Cost of Goods Sold: Operating Expenses: Operating Income: Interest Income / (Expense): Pre-Tax Income: Income Taxes: Net Income: Earnings Per Share (EPS):

Year 1 Combined Revenue: Cost of Goods Sold: Operating Expenses: Operating Income: Interest Income / (Expense): Foregone Interest on Cash:

Year 2

Interest Paid on New Debt: Pre-Tax Income: Income Tax Provision: Net Income: Earnings Per Share (EPS): Shares Outstanding: Accretion / Dilution: Accretion / Dilution %:

$200 $200 20.0 9.0%

$10.00 50.0 $500 35%

Year 1 $100 $30 $30 $40 $0 $40 $14 $26 $0.52

Year 2 $110 $32 $33 $45 $0 $45 $16 $29 $0.59

Вам также может понравиться

- Valuation Spreadsheet DCFДокумент8 страницValuation Spreadsheet DCFHilal MilmoОценок пока нет

- Apple LBO ModelДокумент34 страницыApple LBO ModelShawn PantophletОценок пока нет

- Core Lbo ModelДокумент25 страницCore Lbo Modelsalman_schonОценок пока нет

- Private Equity Buy Side Financial Model and ValuationДокумент19 страницPrivate Equity Buy Side Financial Model and ValuationBhaskar Shanmugam100% (3)

- Lbo W DCF Model SampleДокумент43 страницыLbo W DCF Model SamplePrashantK100% (1)

- Simple LBO ModelДокумент14 страницSimple LBO ModelProfessorAsim Kumar MishraОценок пока нет

- Income Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueДокумент10 страницIncome Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueAleksandar ZvorinjiОценок пока нет

- DCF Analysis JBДокумент10 страницDCF Analysis JBNoah100% (3)

- $ in Millions, Except Per Share DataДокумент59 страниц$ in Millions, Except Per Share DataTom HoughОценок пока нет

- Multifamily Acquisition ModelДокумент4 страницыMultifamily Acquisition Modelw_fibОценок пока нет

- IPO Valuation ModelДокумент10 страницIPO Valuation ModelJason McCoyОценок пока нет

- Investment Banking LBO ModelДокумент4 страницыInvestment Banking LBO Modelkirihara95100% (1)

- Apple Model - FinalДокумент32 страницыApple Model - FinalDang TrangОценок пока нет

- Startup Financial ModelДокумент136 страницStartup Financial ModelChinh Lê ĐìnhОценок пока нет

- Template Financial Forecast ModelДокумент46 страницTemplate Financial Forecast ModelMLastTry100% (2)

- Equity Valuation DCFДокумент28 страницEquity Valuation DCFpriyarajan26100% (1)

- Wind Valuation ModelДокумент87 страницWind Valuation ModelprodiptoghoshОценок пока нет

- Full Merger Model Kraft-Kellogg - ShellДокумент9 страницFull Merger Model Kraft-Kellogg - ShellGeorgi VankovОценок пока нет

- Investment Feasibility AssessmentДокумент27 страницInvestment Feasibility Assessmentad001Оценок пока нет

- 06 06 Football Field Walmart Model Valuation BeforeДокумент47 страниц06 06 Football Field Walmart Model Valuation BeforeIndrama Purba0% (1)

- Complete Private Equity ModelДокумент16 страницComplete Private Equity ModelMichel MaryanovichОценок пока нет

- Valuation Model - Comps, Precedents, DCF, Football Field - BlankДокумент10 страницValuation Model - Comps, Precedents, DCF, Football Field - BlankNmaОценок пока нет

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationДокумент49 страницMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaОценок пока нет

- IB Merger ModelДокумент12 страницIB Merger Modelkirihara95100% (1)

- Free Cash Flow To Firm DCF Valuation Model Base DataДокумент3 страницыFree Cash Flow To Firm DCF Valuation Model Base DataTran Anh VanОценок пока нет

- JPM Proforma & Valuation Work - 2.20.16Документ59 страницJPM Proforma & Valuation Work - 2.20.16bobo411Оценок пока нет

- Financial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inДокумент43 страницыFinancial Modeling Using Excel Mergers and Acquisitions: WWW - Yerite.co - inUJJWALОценок пока нет

- Lbo DCF ModelДокумент36 страницLbo DCF ModeljtmoniiiОценок пока нет

- Axial Discounted Cash Flow Valuation CalculatorДокумент4 страницыAxial Discounted Cash Flow Valuation CalculatorUdit AgrawalОценок пока нет

- Operating Model Build v33Документ22 страницыOperating Model Build v33chandan.hegdeОценок пока нет

- AAPL DCF ValuationДокумент12 страницAAPL DCF ValuationthesaneinvestorОценок пока нет

- CEC Revenue ModelДокумент10 страницCEC Revenue ModelLukas SavickasОценок пока нет

- Lbo DCF ModelДокумент36 страницLbo DCF ModelVarun VermaОценок пока нет

- Neptune Model CompleteДокумент23 страницыNeptune Model CompleteChar_TonyОценок пока нет

- Merger Model (Excel File)Документ3 страницыMerger Model (Excel File)cyberdevil321Оценок пока нет

- Merger Model (Excel File)Документ3 страницыMerger Model (Excel File)cyberdevil321Оценок пока нет

- LBO ModelДокумент13 страницLBO ModelSonali Dash100% (1)

- 50 13 Pasting in Excel Full Model After HHДокумент64 страницы50 13 Pasting in Excel Full Model After HHcfang_2005Оценок пока нет

- J Crew LBOДокумент15 страницJ Crew LBOTom HoughОценок пока нет

- Financial Model Flow ChartДокумент1 страницаFinancial Model Flow ChartTallal Mughal100% (1)

- Case AnalysisДокумент29 страницCase AnalysisLiza NabiОценок пока нет

- Apple & RIM Merger Model and LBO ModelДокумент50 страницApple & RIM Merger Model and LBO ModelDarshana MathurОценок пока нет

- My Patent Valuation Tool 3Документ6 страницMy Patent Valuation Tool 3BobbyNicholsОценок пока нет

- 300 GMAT CR Questions With Best SolutionsДокумент186 страниц300 GMAT CR Questions With Best Solutionscyberdevil321100% (1)

- Cheniere Energy Valuation ModelДокумент11 страницCheniere Energy Valuation Modelngarritson1520100% (1)

- Financial ModelДокумент22 страницыFinancial ModelRobert MascharanОценок пока нет

- REPE Case 02 Boston Office Value Added AcquisitionДокумент282 страницыREPE Case 02 Boston Office Value Added AcquisitionDavid ChikhladzeОценок пока нет

- Stanford University - Resume GuideДокумент80 страницStanford University - Resume Guidecyberdevil321Оценок пока нет

- 22 22 YHOO Merger Model Transaction Summary AfterДокумент101 страница22 22 YHOO Merger Model Transaction Summary Aftercfang_2005Оценок пока нет

- DCF ModelДокумент6 страницDCF ModelKatherine ChouОценок пока нет

- LBO Model - TemplateДокумент9 страницLBO Model - TemplateByron FanОценок пока нет

- Must GMAT ProblemsДокумент52 страницыMust GMAT ProblemsRajya Vardhan MishraОценок пока нет

- Financial Model Projections For A Web StartupДокумент30 страницFinancial Model Projections For A Web Startupanteras100% (5)

- LBO Test - 75Документ84 страницыLBO Test - 75conc880% (1)

- 03 Financial ModelДокумент32 страницы03 Financial Modelromyka0% (1)

- Hammond Manufacturing Company Limited: Guide of Reading This Financial ModelДокумент4 страницыHammond Manufacturing Company Limited: Guide of Reading This Financial ModelHongrui (Henry) Chen100% (1)

- LBO Valuation Model 1 ProtectedДокумент14 страницLBO Valuation Model 1 ProtectedYap Thiah HuatОценок пока нет

- Randalls Departmental StoreДокумент30 страницRandalls Departmental Storecyberdevil321Оценок пока нет

- LOreal Brandstorm 2014 - Case Study PDFДокумент4 страницыLOreal Brandstorm 2014 - Case Study PDFcyberdevil321100% (1)

- Habib Bank Limited - Financial ModelДокумент69 страницHabib Bank Limited - Financial Modelmjibran_1Оценок пока нет

- CAT ValuationДокумент231 страницаCAT ValuationMichael CheungОценок пока нет

- Merger Model PP Allocation BeforeДокумент100 страницMerger Model PP Allocation BeforePaulo NascimentoОценок пока нет

- Valuation Cash Flow A Teaching NoteДокумент5 страницValuation Cash Flow A Teaching NotesarahmohanОценок пока нет

- 01 03 Accretion Dilution AfterДокумент3 страницы01 03 Accretion Dilution AfterДоминик КоббОценок пока нет

- Assumptions Interview QuestionsДокумент4 страницыAssumptions Interview QuestionsNathan LuongОценок пока нет

- CH 07Документ29 страницCH 07varunragav85Оценок пока нет

- Zero Touch Ordering - Powered by PaytmДокумент15 страницZero Touch Ordering - Powered by Paytmcyberdevil321100% (1)

- Know Your Inspiring Alumni !: Leena Nair (PMIR '92)Документ1 страницаKnow Your Inspiring Alumni !: Leena Nair (PMIR '92)cyberdevil321Оценок пока нет

- Case Studies On Strategy (Catalogue I)Документ71 страницаCase Studies On Strategy (Catalogue I)dhimk100% (1)

- Cherry Valley Tool ProjectДокумент6 страницCherry Valley Tool Projectcyberdevil321Оценок пока нет