Академический Документы

Профессиональный Документы

Культура Документы

Businesslicenseapp

Загружено:

api-2531341640 оценок0% нашли этот документ полезным (0 голосов)

70 просмотров2 страницыОригинальное название

businesslicenseapp

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

70 просмотров2 страницыBusinesslicenseapp

Загружено:

api-253134164Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

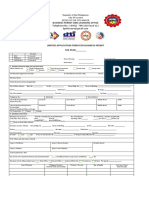

APPLICATION FOR BUSINESS LICENSE

CITY OF PASADENA LICENSE SECTION

100 N. GARFIELD AVENUE, ROOM N106

P.O. BOX 7115

PASADENA, CA 91109 (626) 744-4166

PLEASE COMPLETE THE INFORMATION REQUESTED. PURSUANT TO THE PUBLIC RECORDS ACT (CALIFORNIA GOVERNMENT CODE SECTION 6250 ET SEQ.)

CERTAIN CONFIDENTIAL INFORMATION FURNISHED OR SECURED AS A RESULT OF THIS APPLICATION WILL NOT BE SUBJECT TO PUBLIC INSPECTION

NAME OF OWNER/EACH PARTNER/CORPORATION

BUSINESS NAME

BUSINESS ADDRESS

street apt/unit city state zip code

MAILING ADDRESS

(if different from business) street apt/unit city state zip code

ATTENTION Phone ( ) Phone ( )

Fax ( ) Email Address:

* FEDERAL EMPLOYER I.D. NO OR * SOCIAL SECURITY NO.

* Federal employer identification number (FEIN), if the business is a partnership or corporation, or social security number for all others. State employer identification number (SEIN) may be used

in lieu of the Federal number (FEIN) if the Federal identification number is not known.

STATE EMPLOYER I.D. NO. STATE BOARD OF EQUALIZATION NO.

BUSINESS START DATE ALARM SYSTEM ON PREMISES? YES NO

DATE BUSINESS MOVED OR OWNERSHIP CHANGED (IF THIS IS A CHANGE OF OWNERSHIP)

BUSINESS DESCRIPTION

DO YOU SELL TOBACCO PRODUCTS OF ANY KIND? YES NO

CONTRACTOR INFORMATION: STATE LICENSE NUMBER EXPIRATION DATE

STATE CLASSIFICATION NUMBER(S) LOCATION OF JOB IN PASADENA

LICENSE PLATE NO. OF WORK VEHICLE(S) USED AT JOB SITE

HIGHEST STATE CLASSIFICATION DETERMINES AMOUNT OF TAX. ALL PASADENA BASED CONTRACTORS MUST APPLY FOR AN ANNUAL LICENSE. ONLY

NON-PASADENA BASED CONTRACTORS MAY APPLY FOR A 3 MONTH OR 6 MONTH LICENSE. 3 MO. LICENSE 6 MO. LICENSE ANNUAL LICENSE

IF A CORPORATION/PARTNERSHIP: NAME OF PERSON AUTHORIZED TO ACT ON BEHALF

OF CORPORATION/PARTNERSHIP TITLE

ADDRESS

PHONE NUMBER: ( ) ALTERNATE PHONE ( )

EMERGENCY CONTACT INFORMATION: NAME: PHONE NUMBER ( )

NAME: PHONE NUMBER ( )

NAME: PHONE NUMBER ( )

PROPERTY OWNER NAME

ADDRESS

CITY, STATE, ZIP CODE

TELEPHONE NO. ( )

No person shall knowingly or intentionally misrepresent to any employee of the City

any material fact in procuring a license, permit, duplicate license or metal plate. Any

person violating the provisions governing a business license tax is subject to

misdemeanor charges.

SIGNATURE

DATE TITLE

Do you wish to have your business name, address and telephone number forwarded to the Pasadena Chamber of Commerce? YES NO

FOR OFFICE USE ONLY

BASIC TAX.......................................................................................................................................................... $

NUMBER OF ADDITIONAL PROFESSIONALS @ $ EACH $

NUMBER OF NON-PROFESSIONAL EMPLOYEES @ $ EACH $

B.I.D. AREA FEES............................................................................................................................................. $

HEALTH DEPARTMENT FEES ........................................................................................................................... $

TOTAL ANNUAL TAX ......................................................................................................................................... $

PRORATION % ...................................................................................................................... $

PENALTIES OF 25% PER MONTH FOR MONTHS .......................................... $

INTEREST OF 1.5% PER MONTH FOR MONTHS .......................................... $

NON-COMPLIANCE INSPECTION FEE .......................................................................................... $

CODE COMPLIANCE OR H.O.P. INSPECTION FEES................................................................................... $

TOTAL AMOUNT NOW DUE.............................................................................................................................. $

RATE CODE S.I.C. CODE 1 S.I.C. CODE 2

TERRITORY GEO AREA B.I.D. AREA B.I.D. ZONE

DATE RECEIVED TAKEN BY

Business Alternate

BUSINESS TAX PERMIT EXPIRES

(See reverse side for additional information) WHITE - Original - City of Pasadena YELLOW - Applicant Copy

FIN0101 (Rev. 4/08)

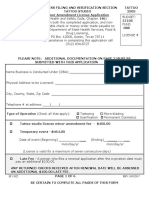

NEW BUSINESS SOLE PROPRIETORSHIP GENERAL

CHANGE OF BUSINESS NAME CORPORATION SERVICE

CHANGE OF OWNERSHIP PARTNERSHIP PROFESSIONAL

CHANGE OF BUSINESS ADDRESS LLC/LLP CONTRACTOR

CHANGE OF MAILING ADDRESS TRUST OTHER

PLEASE LIST ALL INDEPENDENT CONTRACTORS OR OPERATORS INVOLVED

IN THE OPERATION OF THE BUSINESS (i.e.; gardeners, janitorial service,

computer software)

__________________________________________________________________________

Name/Address

__________________________________________________________________________

Name/Address

__________________________________________________________________________

Name/Address

__________________________________________________________________________

Name/Address

MAKE A CHECK PAYABLE TO CITY OF PASADENA

ATTENTION LICENSE APPLICANT

I. BUSINESS LICENSE REQUIRED

Under Pasadena Municipal Code (Section 5.10.010), no person shall engage in any business in the City of Pasadena without having taken out the proper

license and paying an annual business license tax, in the amount prescribed, prior to the operation of that business.

II. TERMS OF LICENSE

A business license is valid for the license year fixed for such classification and must be renewed each year. The expiration date is noted on the front of

this document. A renewal notice is sent to the licensee at least ten (10) days prior to the due date and the licensee has thirty (30) days to pay without

penalty. If a notice is not received by the licensee, he/she is still responsible for payment by the due date. If the licensee changes his/her mailing address

during the year, he/she should contact the Business License Section in writing to report the change.

III. PENALTIES AND INTEREST

A penalty equivalent to 25% of the original amount due applies to all delinquent accounts unpaid after 30 days from the expiration date. An additional 25%

penalty is added on the first day of each month following the imposition of the initial 25% penalty if an outstanding balance remains unpaid, up to a maximum

of 100% of the original tax due. Additionally, interest charges will be assessed on all delinquent fee balances at a rate of 1.5% per month.

IV. NON-COMPLIANCE INSPECTION FEE

A non-compliance inspection fee will be levied against all accounts that require a personal visit by a representative of the License Section's staff to effect

business license compliance.

V. POSTMARK

The postmark will govern the determination of whether or not a tax payment is delinquent. A delinquent tax will be deemed a debt to the City, and the licensee

maybe liable for legal action if it remains unpaid.

VI. SEPARATE LICENSE FOR EACH PLACE OF BUSINESS

A separate business license must be obtained for each branch establishment or separate office or place carrying on any business located in the City of

Pasadena. (P.M.C. 5.10.20)

VII. MULTIPLE BUSINESS ACTIVITIES AT ONE LOCATION

When more than one business activity is engaged at the same location, and the activity falls into a classification other than the original license, the licensee

is required to obtain an additional license for each different business activity. (P.M.C. 5.10.020)

VIII. DEFINITION OF AN EMPLOYEE

For the purpose of business license taxation in the City of Pasadena, an employee is defined as: A person engaged in the operation or conduct of any business,

whether as owner, any member of the owner's family, partner, agent, manager, solicitor, and any and all other employed or working in connection with the

business. (P.M.C. 5.08.060)

IV. CHANGE OF LOCATION

Every person possessing a City of Pasadena business license shall advise the City of the business in writing prior to engaging in such business at the new

location and have the City endorse the new location on the license.

X. RIGHT TO AUDIT AND INSPECTION

Authorized agents of the City of Pasadena may examine all places of business in the City to ascertain compliance with business license tax regulations (P.M.C.

5.04.080, 5.04.090)

XI. DISPLAY OF LICENSE

Every person having a license shall prominently display the license at the place of business. If the business is operated from a vehicle, an identifying decal

issued by the City shall be affixed to the vehicle and the business license shall be carried by the licensee.

XII. SALES, OR USE TAX

Sales or Use Tax may apply to your business activities. You may seek written advice regarding the application of tax to your particular business by writing

to the nearest State Board of Equalization office.

XIII. STATE OF CALIFORNIA FRANCHISE TAX BOARD REGULATIONS

"Revenue and Taxation Code Section 19286.8 E 2 states any deputy, agent, clerk, officer, or employee of any entity described in the subdivision A or any

former officer or employee or other individual who in the course of his or her employment or duty has or had access to the information required to be furnished

under this section shall not disclose or make known in any manner that information except to the Franchise Tax Board." The following information is required:

1. BUSINESS NAME. 6. AMOUNT OF ANNUAL BUSINESS TAX.

2. BUSINESS & MAILING ADDRESS. 7. BASIS FOR TAX DETERMINATION.

3. OWNER'S NAME & ADDRESS. 8. FREQUENCY OF PAYMENT OF BUSINESS TAXES.

4. FEDERAL EMPLOYER IDENTIFICATION NUMBER, SOCIAL 9. DATE BUSINESS COMMENCED, CEASED, OR CHANGED

SECURITY NUMBER OR STATE EMPLOYER IDENTIFICA- OWNERSHIP.

TION NUMBER. 10. TYPE OF BUSINESS-USING STANDARD INDUSTRIAL

5. OWNERSHIP TYPE; e.g. SOLE PROPRIETORSHIP, CLASSIFICATION CODE (S.I.C.).

PARTNERSHIP, CORPORATION.

Вам также может понравиться

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Ebook Percuma Tfs Price Action TradingДокумент7 страницEbook Percuma Tfs Price Action TradingMUHAMMAD AL AMIN AZMANОценок пока нет

- City of Whittier Business License Application p4Документ2 страницыCity of Whittier Business License Application p4api-253134318Оценок пока нет

- Washington Business License ApplicationДокумент4 страницыWashington Business License ApplicationGreenpoint Insurance ColoradoОценок пока нет

- Tennessee Department of Revenue: Business Tax ReturnДокумент8 страницTennessee Department of Revenue: Business Tax ReturnwilliamОценок пока нет

- Nevada Business Registration Form InstructionsДокумент3 страницыNevada Business Registration Form InstructionstibymiaОценок пока нет

- BUSLIC Business Licence FormДокумент10 страницBUSLIC Business Licence Formcrew242Оценок пока нет

- Pa Enterprise Registration Form: Section 1 - Reason For This RegistrationДокумент3 страницыPa Enterprise Registration Form: Section 1 - Reason For This RegistrationtheclovermarketОценок пока нет

- Taxicab Franchise Application 2017 - 201703311006506648Документ9 страницTaxicab Franchise Application 2017 - 201703311006506648METANOIAОценок пока нет

- Loan Application: Company InformationДокумент8 страницLoan Application: Company InformationChristian AwukutseyОценок пока нет

- Food Truck in Miami, Florida: 10 Licenses RequiredДокумент95 страницFood Truck in Miami, Florida: 10 Licenses RequiredalejandroОценок пока нет

- Maryland Car Dealer License ApplicationДокумент16 страницMaryland Car Dealer License ApplicationBuySurety.comОценок пока нет

- Maryland Corporation Name ReservationДокумент2 страницыMaryland Corporation Name ReservationRocketLawyerОценок пока нет

- Business Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Документ2 страницыBusiness Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Ren Michelle Villaverde PaleracioОценок пока нет

- Bi New Bsf-1 April 2011 v4Документ6 страницBi New Bsf-1 April 2011 v4rogel_ganaОценок пока нет

- Form - 1 & 2Документ5 страницForm - 1 & 2Income TaxОценок пока нет

- TCTДокумент2 страницыTCTRene Jane RosendoОценок пока нет

- International Business or Company Tax Reg FormДокумент4 страницыInternational Business or Company Tax Reg FormNithinОценок пока нет

- Application For Taxpayer Identification Number For CompanyДокумент2 страницыApplication For Taxpayer Identification Number For Companysimon kinuthiaОценок пока нет

- Honda Cars, Rizal: Credit Application For Auto FinancingДокумент13 страницHonda Cars, Rizal: Credit Application For Auto FinancingalbertfrancoОценок пока нет

- Enhanced Gis Revised (Rohq RH) v.2013 081413Документ3 страницыEnhanced Gis Revised (Rohq RH) v.2013 081413goodboiОценок пока нет

- Business License ApplicationДокумент4 страницыBusiness License ApplicationPawPaul MccoyОценок пока нет

- Connecticut Certificate of IncorporationДокумент4 страницыConnecticut Certificate of IncorporationRocketLawyerОценок пока нет

- Used Dealer LicenseДокумент11 страницUsed Dealer Licensealeem87Оценок пока нет

- Occupational Limited License (Oll) Petition: (Type or Print Information)Документ6 страницOccupational Limited License (Oll) Petition: (Type or Print Information)Howard ShowersОценок пока нет

- (License Is Valid For A Maximum of Seven Consecutive Days) : EF 13022 REV 11/03/2017Документ6 страниц(License Is Valid For A Maximum of Seven Consecutive Days) : EF 13022 REV 11/03/2017Christiam ChacОценок пока нет

- Fictitious Business NamesДокумент4 страницыFictitious Business NamesPawPaul MccoyОценок пока нет

- Prepare The Required Documents For SEC RegistrationДокумент4 страницыPrepare The Required Documents For SEC RegistrationVanessa May Caseres GaОценок пока нет

- dl-180 PA DriverДокумент2 страницыdl-180 PA DriverMinting YuОценок пока нет

- Ather Energy Dealership Application FormДокумент6 страницAther Energy Dealership Application FormHarshit AggarwalОценок пока нет

- Business Registration Laws AppendixДокумент30 страницBusiness Registration Laws AppendixanirudhasОценок пока нет

- Declaration of GST Non-EnrollmentДокумент2 страницыDeclaration of GST Non-EnrollmentftasindiaОценок пока нет

- Terminate FormДокумент1 страницаTerminate FormTiffany DacinoОценок пока нет

- MS Vehicle Dealer LicenseДокумент6 страницMS Vehicle Dealer LicenseTerry GreenОценок пока нет

- Pilar Sorsogon Bpls-FormДокумент4 страницыPilar Sorsogon Bpls-FormKevin Albert Dela CruzОценок пока нет

- Cannabis Consumption Special Event License ApplicationДокумент6 страницCannabis Consumption Special Event License ApplicationBlackbeltJОценок пока нет

- Cra (2) DddaДокумент14 страницCra (2) DddadulmasterОценок пока нет

- Udyam RegistrationUdyog Aadhar OnlineMSME RegistrationДокумент1 страницаUdyam RegistrationUdyog Aadhar OnlineMSME Registrationasaf ahmadОценок пока нет

- Request For Information Template 39Документ4 страницыRequest For Information Template 39Fabricio LessaОценок пока нет

- Dti RequirementsДокумент8 страницDti Requirementslorena naveraОценок пока нет

- Draft CIS For MonetizerДокумент8 страницDraft CIS For MonetizerElwin arifin100% (1)

- Hat Is This FormДокумент7 страницHat Is This FormJoydev GangulyОценок пока нет

- Application Business-PermitДокумент2 страницыApplication Business-Permitklein uyОценок пока нет

- Forms App For Corp PartnershipДокумент2 страницыForms App For Corp PartnershipDarlene Tunggala MacararangaОценок пока нет

- Single Application Petro Canada.Документ8 страницSingle Application Petro Canada.Nicole BurkeОценок пока нет

- Candidate Information Sheet: Pepperidge Farm, Incorporated I. General Information DateДокумент4 страницыCandidate Information Sheet: Pepperidge Farm, Incorporated I. General Information DateRiyaz AhmadОценок пока нет

- BN Application Form (20110613)Документ2 страницыBN Application Form (20110613)Yourtv Inyourpc100% (6)

- PrintДокумент2 страницыPrintAnnie SabrieОценок пока нет

- Connecticut Articles of OrganizationДокумент3 страницыConnecticut Articles of OrganizationhowtoformanllcОценок пока нет

- Maryland Articles of IncorporationДокумент3 страницыMaryland Articles of IncorporationRocketLawyerОценок пока нет

- 500 Fictitious Business Name Statement and AOI PDFДокумент4 страницы500 Fictitious Business Name Statement and AOI PDFgeeОценок пока нет

- Used Dealer or Dealer Wholesale Only Application Checklist: InstructionsДокумент14 страницUsed Dealer or Dealer Wholesale Only Application Checklist: Instructionssara rudd100% (1)

- Assurity ContractДокумент11 страницAssurity ContractWilliam RowanОценок пока нет

- VAT Procedure in MaharashtraДокумент14 страницVAT Procedure in MaharashtraDeva DrillTechОценок пока нет

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditОт EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditОценок пока нет

- Everthing You Need To Know To Start An Auto DealershipОт EverandEverthing You Need To Know To Start An Auto DealershipРейтинг: 5 из 5 звезд5/5 (1)

- How to Start Your Own Cleaning Business: Low Start up Cost, Fast Growing and ProfitableОт EverandHow to Start Your Own Cleaning Business: Low Start up Cost, Fast Growing and ProfitableОценок пока нет

- HSBC ProjectДокумент48 страницHSBC ProjectPooja MishraОценок пока нет

- Mauldin July 30Документ10 страницMauldin July 30richardck61Оценок пока нет

- NCDDP AF Sub-Manual - Program Finance, Aug2021Документ73 страницыNCDDP AF Sub-Manual - Program Finance, Aug2021Michelle ValledorОценок пока нет

- 1BS0 01 Que 20211123Документ24 страницы1BS0 01 Que 20211123Omar BОценок пока нет

- Cbleacpu 01Документ10 страницCbleacpu 01Udaya RakavanОценок пока нет

- A Study On Technical Analysis As An Indicator For Investment Decision-MakingДокумент69 страницA Study On Technical Analysis As An Indicator For Investment Decision-MakingHarshil Sanghavi100% (1)

- Modelo Proof of Claim MaestroДокумент8 страницModelo Proof of Claim MaestroMetro Puerto RicoОценок пока нет

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceДокумент2 страницыAccount Statement: Date Value Date Description Cheque Deposit Withdrawal BalancesadhanaОценок пока нет

- Waterways Magazine Winter 2013Документ84 страницыWaterways Magazine Winter 2013Waterways MagazineОценок пока нет

- Quiz 9Документ3 страницыQuiz 9朱潇妤100% (1)

- Chapter 1. Introduction To Cost and ManagementДокумент49 страницChapter 1. Introduction To Cost and ManagementHARYATI SETYORINI100% (1)

- Dvs Minutes - September 19 2013Документ3 страницыDvs Minutes - September 19 2013api-124277777Оценок пока нет

- My Affidavit For LawyerДокумент4 страницыMy Affidavit For LawyerJohn GuillermoОценок пока нет

- 馬雲IPO上市路演英文演講稿Документ55 страниц馬雲IPO上市路演英文演講稿王中和Оценок пока нет

- Euro Currency Market (Unit 1)Документ27 страницEuro Currency Market (Unit 1)Manoj Bansiwal100% (1)

- Investment Chapter 7Документ3 страницыInvestment Chapter 7Bakpao CoklatОценок пока нет

- Final-Fall-2009 Mock SolutionДокумент16 страницFinal-Fall-2009 Mock SolutionmehdiОценок пока нет

- Mid AFA-II 2020Документ2 страницыMid AFA-II 2020CRAZY SportsОценок пока нет

- 2023 Riverside County Pension Advisory Review Committee ReportДокумент24 страницы2023 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comОценок пока нет

- Project Proposal by Nigah-E-Nazar FatimiДокумент8 страницProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- Vat Ec Fr-EnДокумент27 страницVat Ec Fr-EnDjema AntohiОценок пока нет

- Peabody BankruptcyДокумент30 страницPeabody BankruptcyZerohedgeОценок пока нет

- P5 FAC RTP June2013Документ105 страницP5 FAC RTP June2013AlankritaОценок пока нет

- Monetary Policy Statement October 2020Документ2 страницыMonetary Policy Statement October 2020African Centre for Media ExcellenceОценок пока нет

- IBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Документ19 страницIBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Zehra RizviОценок пока нет

- 2017 WOCCU International Operating PrinciplesДокумент2 страницы2017 WOCCU International Operating PrinciplesEllalaОценок пока нет

- Sample Quiz KEY1Документ6 страницSample Quiz KEY1ElaineJrV-IgotОценок пока нет

- ESPSДокумент2 страницыESPSNitin DevОценок пока нет

- HDFC Multi Cap Fund With App Form Dated November 2 2021Документ4 страницыHDFC Multi Cap Fund With App Form Dated November 2 2021hnevkarОценок пока нет