Академический Документы

Профессиональный Документы

Культура Документы

Audit-Of-Inventories - Highlights of Technical Clinic

Загружено:

api-256556206Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Audit-Of-Inventories - Highlights of Technical Clinic

Загружено:

api-256556206Авторское право:

Доступные форматы

CPA

36

Quality Assurance

or a manufacturing or

trading company, the

inventory balance is usually

a material item on the

balance sheet. This poses several

challenges to practitioners in the

audit of inventories. What are

some of these challenges? And

why is the deciency in the audit

of inventories a common practice

monitoring programme (PMP)

nding for rms which audit non-

public interest entities (non-PIE)?

These questions and more got an

airing in a technical clinic organised

by ICPAS. The three-hour session

was facilitated by Luar Eng Hwa,

Managing Partner, EH Luar & Co.

We bring you some of the highlights

of the discussion.

What are the difculties

faced by practitioners in

the audit of inventory? Why

is the audit of this nancial

statement area so tough?

A Inventory is generally considered

a high risk account balance because

it has a direct impact on prot. For

companies whose principal activities

are mainly trading, import or export

of goods and manufacturing, there

will be high volume of inventory

movements which creates the risk

of misstatement of this account

balance. It can get really

complicated when documents

and accounting records are not

properly maintained, especially

when the auditor has to attend to

year-end inventory count before or

F

AUDIT OF INVENTORIES

HIGHLIGHTS OF TECHNICAL CLINIC

CPA

37

ua||ty Assurance

Embracing Quality for Sustainability

P

H

O

T

O

C

O

R

B

I

S

physical inventory count to the

nancial year-end position need to

be performed by the management.

The auditor should then audit

this information provided by the

management.

One of the common audit

issues in the audit of

inventory is devising audit

procedures to test the unit cost.

There is always the issue of

inappropriate work being

performed by the auditor in this

area. Why is this so?

A To address this issue, the auditor

needs to know the costing method

adopted by the company. Is the

company using rst-in-rst-out

(FIFO) or weighted average cost

(WAC) to account for the cost

of inventory?

The FIFO method assumes that

the inventory items which were

purchased or produced rst are sold

rst, and consequently the items

remaining in the inventory at the

end of the period are those most

recently purchased or produced.

The WAC method determines the

cost of each item from the WAC of

similar items at the beginning of a

period, and the cost of similar items

purchased or produced during

the period.

In performing unit cost testing

for inventories under the FIFO cost

formula, other than test-checking

that the inventory items are moving

in FIFO manner, the auditor needs

to vouch to respective supplier

invoices for the unit cost stated

in the inventory list. If there are

discrepancies in the samples

tested for unit cost, the auditor

needs to consider projecting the

misstatement to the population

to obtain a broad view of the

scale of misstatement instead of

disregarding it as immaterial without

proper investigation into the reason

for misstatement.

stock, (c) ownership, (d) valuation,

and (e) presentation and disclosure

in nancial statements must be

carefully considered.

Will it then make sense if

the audit team obtained a

conrmation of inventory

balance at year-end and skip

the observation of inventory

count altogether?

A The answer is a denite

No! The main objectives in

observation of inventory count

are (1) to obtain evidence of the

existence and condition of the

inventory and the security of its

storage, (2) to observe how the

client company conducts the

inventory count, (3) to test the

accuracy of the counting, and

(4) to obtain information for

checking at later stages, such

as last goods received and

despatched documents.

The observation of inventory

count is to enable the auditor

to check whether the inventory

count procedures (provided by the

management) are properly followed,

and to conduct test counts to check

that the procedures and internal

controls over stock-take are

satisfactory. Without attending

the inventory count, how will

the auditor determine the

existence, completeness and

accuracy of the count records,

in particular those pertaining to

the high-value items?

As far as possible, the

management and auditor

should plan ahead for

inventory count to be

performed as at year-end date.

In the event the management

is unable to schedule inventory

count as at year-end date, the

auditor should highlight to the

management that roll-forward/

backward procedures on inventory

quantities test counted during the

THE AUDITOR

MUST MAKE

SURE THAT

ALL THE WORK

PERFORMED AS

WELL AS THE

DISCUSSIONS

ARE PROPERLY

DOCUMENTED

AND

REFERENCED TO

INDICATE THAT

WORK HAS

BEEN DONE.

after year-end which involves

multiple locations.

The audit of inventory does

not stop at inventory count. The

auditor is also required to check

the allocation and assignment of

costs to inventory based on the

managements inventory ow

assumption, identify obsolete or

slow-moving items, and test-check

that the inventory is stated at the

lower of cost and net realisable

value. An understanding of the

companys business operation

and the market condition for the

demand of the companys product

is therefore important for the

auditor to make that judgement

call. The key challenge arises when

the management and auditor are

embroiled in protracted debates as

to whether or not there is a need to

provide for inventory obsolescence

or to write-down the inventory

value and if so, by how much.

Therefore, every step to be

undertaken during the audit work

on inventories over (a) quantities,

(b) existence and condition of

CPA

38

Quality Assurance

EVERY STEP TO

BE UNDERTAKEN

DURING THE

AUDIT WORK ON

INVENTORIES

OVER QUANTITIES,

EXISTENCE AND

CONDITION

OF STOCK,

OWNERSHIP,

VALUATION AND

PRESENTATION

AND DISCLOSURE

IN FINANCIAL

STATEMENTS MUST

BE CAREFULLY

CONSIDERED.

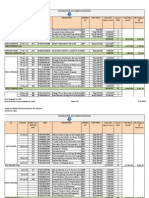

For the testing of inventories

under the WAC formula, the auditor

should request for the detailed

movements of inventories for

the selected

samples and

verify against

the relevant

supporting

documents such

as the supplier

invoices (for

purchases) and

sales invoices

(for sales) and

perform re-

computation

of the WAC

for those items

selected. Often,

companies

rely on their

inventory

systems to

calculate the

WAC of inventories. Unless the

integrity of the inventory system

has been tested and veried, the

auditor should not rely solely on

the WA costing generated by the

inventory system and deem it

appropriate.

Why is there a need to

check that the inventory is

stated at the lower of cost and

net realisable value? Can we not

just check that the samples

selected are stated at cost?

A No, because FRS 2 Inventories

paragraph 9 establishes that

inventories shall be measured

at the lower of cost and net

realisable value.

The cost of inventories includes

cost of purchase, cost of conversion

and other costs incurred in bringing

the inventories to their present

location and condition. The cost of

inventories may not be recoverable

if the inventories are damaged,

obsolete or if their selling price

original sample, by reviewing the

companys inventory ageing list and

discussing with the management

(preferably the sales manager

or sales director), and assess the

reasonableness of their assessment.

After considering all these, the

auditor must make sure that

all the work performed as well

as the discussions are properly

documented and referenced to

indicate that work has been done.

Remember, no documentation

equals no work done.

What are some of the

practical considerations to

the auditors when assessing the

adequacy and reasonableness

of inventories write-down and

allowance for inventory

obsolescence estimated by the

management in addressing the

valuation assertion?

A As part of the audit planning

and risk assessment procedures,

the auditor is required to gain

an understanding of industry

developments and changes in the

economic environment affecting the

inventories held by the company.

The demand by customers is usually

correlated with the prevailing

economic conditions and may be

signicantly affected during an

economic downturn, especially if the

demand for the product is elastic.

The nature of inventories is

also an important factor for the

auditor to consider when assessing

adequacy and reasonableness

of the allowance for inventory

obsolescence. Perishable products

like fresh fruits and vegetables

which have a relatively short shelf

life, and electronic products such

as computers and mobile phones

in a fast-changing technological

environment are subject to a

higher risk of obsolescence. On

the other hand, generic items like

spare parts of equipment generally

has fallen. The practice of writing

inventories down to net realisable

value is consistent with the view

that assets should not be carried in

excess of amounts

expected to be

realised from their

sale or use. The

auditor should

therefore check

sales after year-

end to make sure

inventories are

not carried at

more than its net

realisable value.

Having

considered

how to test unit

cost, what about

the testing of net

realisable value?

If there are no

subsequent year-

end sales for the samples

selected, can the auditor

consider tracing to current

years sales or consider

replacing the samples without

subsequent year-end sales to

complete the testing?

A When there is a long time lapse

from the year-end to audit report

date, tracing to current years sales

may not be appropriate as the

sample itself may suggest existence

of slow-moving inventory. The

auditor can choose an appropriate

alternative sample to replace the

original sample. This does not

mean that no work needs to be

performed on the original sample!

The original sample where there are

no subsequent sales are exceptions

noted and needs to be investigated,

and with the disposition properly

documented.

The auditor will need to

perform further work to analyse

whether there is any risk of stock

obsolescence other than the

CPA

39

ua||ty Assurance

Embracing Quality for Sustainability

have a longer shelf life and lower

risk of obsolescence if they are

properly stored and handled with

care, provided that the equipment

continues to be used in the market.

Special arrangement with

suppliers, if any, could also

mitigate the risk of inventory

obsolescence. An example would

be items purchased from a holding

company which can be returned

unconditionally if unsold.

Relating back to inventory count

observation, the auditor should

keep a look out for the condition

of the inventories during the

inventory count. Signs of inventory

obsolescence include discoloured,

dented, dusty, rusty or expired

goods and should be brought to the

attention of the management for

appropriate followup action.

The auditor, however, should be

mindful that observation of the

physical inventory usually only

provides limited evidence on the

valuation assertion.

If the management has an

internal provisioning policy

for slow-moving and obsolete

inventories, that is, it relies on

the inventory ageing report to

provide for obsolete inventory,

can the auditor then place

reliance on the management

representation without

corroborative work performed?

A By simply relying on the

management representation is not

sufcient work done. The auditor

is required to review and check the

reasonableness of the companys

internal provisioning policy.

The auditor should corroborate

audit evidence by checking the

accuracy of the inventories ageing

report, on a sample basis for each

ageing bracket, and check that

the underlying data provided by

the management are captured

accurately before evaluating the

managements assumptions on

the provision.

Additionally, the auditor should

check if provision is made for

inventories that are over 180 days

by the management. Why 180 days?

The management may explain it

thus, The assumption is based on

sales trend and inventory turnover

days for the past year. Merely

documenting the managements

representation is not sufcient

work done. The auditor should

corroborate the managements

representation by performing a

review of the past years sales trend

and inventory turnover days to

conclude on the reasonableness of

the managements assumption.

There is always this

dilemma among

practitioners. Can they not just

give a qualied audit opinion if

they cannot agree with the

view of the management or

are faced with the issue of

scope limitation?

A A qualied opinion should not

be the rst solution. The auditor

has to consider the extent of scope

limitation and whether alternative/

additional audit procedures can

be performed.

A common example would be a

scenario where the auditor is unable

to attend the stock-take because

the auditor was appointed after the

nancial year-end. At rst glance,

this seems like a scope limitation.

However, the auditor has to consider

if alternative/additional procedures

could be performed to ascertain the

inventory balance as at year-end.

An example of such a procedure is

observing a current physical stock-

take and test-checking the roll-

back reconciliation to the year-end

inventory quantities. The inventory

roll-back reconciliation should be

prepared by the management.

If the auditor is able to obtain

sufcient appropriate audit evidence

(as mentioned earlier) regarding

the year-end inventory balance, the

audit opinion need not be modied.

However, if the management is

unable to reconcile the current

physical inventory count with the

year-end inventory quantities, or

signicant time has lapsed since the

nancial year-end, the auditor may

have to modify the auditors report

as a result of the scope limitation.

To express a qualied opinion or a

disclaimer opinion is dependent on

the nancial impact of the scope

limitation, whether it is material and

pervasive to the overall nancial

statements. It is fair to say that

the auditor should have explored/

exhausted all possible solutions with

the management, before deciding to

issue a modied audit report.

The auditor shall promptly

communicate with those charged

with governance (TCWG) when

he expects to modify the audit

opinion. This enables the auditor

to give notice to TCWG the

intended modication and reasons

for modication, seek TCWGs

acknowledgement and for TCWG to

explain/provide further information

on the circumstances.

The auditor should also

inform TCWG of the ramications

of a modied report. Such

communication with the

management should be adequately

minuted with a copy provided to

TCWG. An ofcial letter highlighting

the reasons for a modied opinion,

type of opinion and ramications to

the directors should be furnished to

TCWG. For SMEs, TCWG would be

the directors of the company.

In conclusion, a qualied opinion is

never a short-cut to completing an

audit engagement. CPA

This article was written by Magdalene Ang,

Quality Assurance Manager, ICPAS.

Вам также может понравиться

- Comprehensive Problem 1Документ5 страницComprehensive Problem 1Coke Aidenry SaludoОценок пока нет

- Auditing The Inventory Management ProcessДокумент15 страницAuditing The Inventory Management ProcessGohar Mahmood100% (1)

- Auditing-Review Questions Chapter 12Документ4 страницыAuditing-Review Questions Chapter 12meiwin manihingОценок пока нет

- TUMAINI UNIVERSITY DAR ES SALAAM COLLEGE ACCT313 COURSE TEST 1Документ8 страницTUMAINI UNIVERSITY DAR ES SALAAM COLLEGE ACCT313 COURSE TEST 1Helena Thomas75% (4)

- ARIBA, Fretzyl Bless A. - Chapter 11 - Substantive Test of Inventories and Cost of Sales - ReflectionДокумент3 страницыARIBA, Fretzyl Bless A. - Chapter 11 - Substantive Test of Inventories and Cost of Sales - ReflectionFretzyl JulyОценок пока нет

- Receivables From An Audit Perspective?: 3.why Are Returns and Allowances Sensitive Issues in Receivables Audit?Документ7 страницReceivables From An Audit Perspective?: 3.why Are Returns and Allowances Sensitive Issues in Receivables Audit?Bekeri MohammedОценок пока нет

- Chapter 21 Solutions ManualДокумент28 страницChapter 21 Solutions ManualDewiair100% (3)

- Audit II 4newДокумент22 страницыAudit II 4newTesfaye Megiso BegajoОценок пока нет

- Arens Auditing16e SM 21Документ28 страницArens Auditing16e SM 21김현중Оценок пока нет

- AGS 4 Existence & Valuation of InventoriesДокумент11 страницAGS 4 Existence & Valuation of InventoriesAndreiОценок пока нет

- 4-Auditing 2 - Chapter FourДокумент8 страниц4-Auditing 2 - Chapter Foursamuel debebeОценок пока нет

- Chapter 3Документ7 страницChapter 3Jarra AbdurahmanОценок пока нет

- Fau 2020 Sep AДокумент10 страницFau 2020 Sep AddvadagdkWОценок пока нет

- Audit of Inventories, Investments, PpeДокумент14 страницAudit of Inventories, Investments, PpeconsulivyОценок пока нет

- The Audit of InventoriesДокумент6 страницThe Audit of InventoriesIftekhar Ifte100% (3)

- AC414 - Audit and Investigations II - Audit of InventoryДокумент29 страницAC414 - Audit and Investigations II - Audit of InventoryTsitsi AbigailОценок пока нет

- Audit of InventoryДокумент5 страницAudit of InventoryMa. Hazel Donita DiazОценок пока нет

- Auditing InventoriesДокумент8 страницAuditing Inventorieshabtamu tadesseОценок пока нет

- What Is An Inventory AuditДокумент4 страницыWhat Is An Inventory AuditJesse NgaliОценок пока нет

- Auditing Inventory Valuation and Cutoff ProceduresДокумент22 страницыAuditing Inventory Valuation and Cutoff ProceduressantaulinasitorusОценок пока нет

- Aeb SM CH21 1 PDFДокумент23 страницыAeb SM CH21 1 PDFAdi SusiloОценок пока нет

- AA Chapter21Документ28 страницAA Chapter21Jia Hui PekОценок пока нет

- Audit Inventory Warehousing CycleДокумент9 страницAudit Inventory Warehousing CycleREG.B/0115103003/ERSA KUSUMAWARDANIОценок пока нет

- Chapter 4 Auditing For Inventories and Cost of Goods SoldДокумент3 страницыChapter 4 Auditing For Inventories and Cost of Goods SoldsteveiamidОценок пока нет

- Topic 34 Substantive Audit Procedures InventoryДокумент10 страницTopic 34 Substantive Audit Procedures InventoryRafik BelkahlaОценок пока нет

- Inventory AuditДокумент26 страницInventory AuditTiffany SmithОценок пока нет

- Module 5 INVENTORIES AND RELATED EXPENSESДокумент4 страницыModule 5 INVENTORIES AND RELATED EXPENSESNiño Mendoza MabatoОценок пока нет

- Audit risk componentsДокумент6 страницAudit risk componentsMayurika DassaniОценок пока нет

- Qa Inventories Substantive TestingДокумент6 страницQa Inventories Substantive TestingAsniah M. RatabanОценок пока нет

- Audit of InventoriesДокумент35 страницAudit of InventoriesPau100% (2)

- Inv and CGSДокумент19 страницInv and CGSCOMMERCIAL OPERATIONОценок пока нет

- Audit ProceduresДокумент36 страницAudit ProceduresRoshaan AhmadОценок пока нет

- Inventory Audit Procedures - AccountingToolsДокумент2 страницыInventory Audit Procedures - AccountingToolsMd Rakibul HasanОценок пока нет

- Assignment 4 Wida Widiawati 19AKJ 194020034Документ6 страницAssignment 4 Wida Widiawati 19AKJ 194020034wida widiawatiОценок пока нет

- AS 16 Borrowing Cost FinalДокумент21 страницаAS 16 Borrowing Cost FinalNilesh MandlikОценок пока нет

- Stores Accounting & Stock VerificationДокумент8 страницStores Accounting & Stock VerificationDhanraj KumawatОценок пока нет

- Lecture 7-Internal Control & AssertionsДокумент6 страницLecture 7-Internal Control & AssertionsFadil RushОценок пока нет

- Aud ch4Документ9 страницAud ch4kitababekele26Оценок пока нет

- Auditing Inventories and Fixed AssetsДокумент10 страницAuditing Inventories and Fixed AssetsbeershebaОценок пока нет

- 2009-12-08 065812 LaramieДокумент2 страницы2009-12-08 065812 LaramieRezha Setyo100% (1)

- Auditing Guideline 405Документ6 страницAuditing Guideline 405EduSoftОценок пока нет

- The Audit of InventoriesДокумент7 страницThe Audit of InventoriesRae Alariao-CabicoОценок пока нет

- Chapter Four: 2. Audit of Inventory, Cost of Sales and Related AccountsДокумент8 страницChapter Four: 2. Audit of Inventory, Cost of Sales and Related AccountsZelalem HassenОценок пока нет

- Chapter Four-Auditing IIДокумент9 страницChapter Four-Auditing IIBantamkak FikaduОценок пока нет

- Audit II Week 7Документ15 страницAudit II Week 7EfratianKristisonОценок пока нет

- Understanding Audit Procedures for Inventory CountsДокумент35 страницUnderstanding Audit Procedures for Inventory CountszewdieОценок пока нет

- Purchasing Cycle: PurposeДокумент4 страницыPurchasing Cycle: PurposeEtnadia SuhartonoОценок пока нет

- Presentation4 - Audit of Inventories, Cost of Sales and Other Related AccountsДокумент19 страницPresentation4 - Audit of Inventories, Cost of Sales and Other Related AccountsRoseanne Dela CruzОценок пока нет

- Chapter 4 Audit of Inventory and CGSДокумент9 страницChapter 4 Audit of Inventory and CGSminichelОценок пока нет

- Auditing For Inventory CycleДокумент2 страницыAuditing For Inventory CycleKirena XavieryОценок пока нет

- Audit Program For Inventory Legal Company Name Client: Balance Sheet DateДокумент3 страницыAudit Program For Inventory Legal Company Name Client: Balance Sheet DateHannah TudioОценок пока нет

- AUDIT PROGRAM DESIGN PART IIДокумент3 страницыAUDIT PROGRAM DESIGN PART IImedril01Оценок пока нет

- Term Paper Production and Payroll Cycle-FinalДокумент32 страницыTerm Paper Production and Payroll Cycle-FinalcathyОценок пока нет

- Audit InventoryДокумент17 страницAudit InventoryjessaОценок пока нет

- Internal Control and Tests of Control For Inventory and Production CycleДокумент6 страницInternal Control and Tests of Control For Inventory and Production Cyclecriselda salazar100% (1)

- Audit of InventoryДокумент11 страницAudit of InventoryMr.AccntngОценок пока нет

- InventoryДокумент4 страницыInventoryPrio DebnathОценок пока нет

- Audit Program Design Part IIДокумент9 страницAudit Program Design Part IIBryce ManiscalcoОценок пока нет

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Bacolod Consolidated Final Count - For 3rd Recount Today Aug 6Документ1 страницаBacolod Consolidated Final Count - For 3rd Recount Today Aug 6api-256556206Оценок пока нет

- June 9-14 DCCДокумент2 страницыJune 9-14 DCCapi-256556206Оценок пока нет

- A Publisher RecommendationДокумент4 страницыA Publisher Recommendationapi-256556206Оценок пока нет

- Internal Audit Inventory Level Analysis ReportДокумент11 страницInternal Audit Inventory Level Analysis Reportapi-256556206Оценок пока нет

- Aging of Access Code - 5-14-14Документ1 страницаAging of Access Code - 5-14-14api-256556206Оценок пока нет

- WDD 2010-2013 Tolerable VariancesДокумент1 страницаWDD 2010-2013 Tolerable Variancesapi-256556206Оценок пока нет

- Aging of Indent Stock On Hand As of Mar 31-2014auditДокумент7 страницAging of Indent Stock On Hand As of Mar 31-2014auditapi-256556206Оценок пока нет

- Cepi 2014 Eexcutive Order - Indent GuidelinesДокумент8 страницCepi 2014 Eexcutive Order - Indent Guidelinesapi-256556206Оценок пока нет

- Tire City IncДокумент12 страницTire City Incdownloadsking100% (1)

- Problems in Production ManagementДокумент3 страницыProblems in Production Managementventhii100% (1)

- Homework 5 scantron submissionДокумент2 страницыHomework 5 scantron submissionChrissy DrakeОценок пока нет

- JDA Supply Chain Strategiest Hugh Hendry - SCS - L1Документ38 страницJDA Supply Chain Strategiest Hugh Hendry - SCS - L1AmitОценок пока нет

- Zara International: Fashion at Speed of LightДокумент16 страницZara International: Fashion at Speed of LightRITIKA DHOOTОценок пока нет

- Chapter 3 Internal Control Purchasing PMT Cycle OkДокумент79 страницChapter 3 Internal Control Purchasing PMT Cycle Oktrangalc123Оценок пока нет

- Sample PB CostДокумент4 страницыSample PB CostMich Elle CabОценок пока нет

- Jit and Lean MFGДокумент35 страницJit and Lean MFGEsha PandyaОценок пока нет

- Working Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerДокумент83 страницыWorking Capital Management Live Project Report by Pranay Jindal in Jindal Steel and PowerPranay Jindal71% (7)

- SUPPLY CHAIN ANALYTICS - Final ProjectДокумент19 страницSUPPLY CHAIN ANALYTICS - Final ProjectAksh RathodОценок пока нет

- Profile Options in INV PO OM MSДокумент48 страницProfile Options in INV PO OM MSMaqsood JoyoОценок пока нет

- Accounting - Inventory Test BankДокумент3 страницыAccounting - Inventory Test BankAyesha RGОценок пока нет

- Blending The Best of Lean Production and Six SigmaДокумент12 страницBlending The Best of Lean Production and Six SigmaMansoor AliОценок пока нет

- Batch Management Overview PDFДокумент66 страницBatch Management Overview PDFTran Thanh Nam100% (3)

- BOM 11i Training PresentationДокумент47 страницBOM 11i Training PresentationappsloaderОценок пока нет

- Sample of Risk RegisterДокумент4 страницыSample of Risk RegisterRadhitya Wirawan83% (6)

- Inventory Control Subject To Certain DemandДокумент112 страницInventory Control Subject To Certain DemandShubham GuptaОценок пока нет

- Chapter 5 - Plant LayoutДокумент22 страницыChapter 5 - Plant LayoutSuresh BhatОценок пока нет

- An Introduction To Management Science, 15e: Quantitative Approaches To Decision MakingДокумент43 страницыAn Introduction To Management Science, 15e: Quantitative Approaches To Decision MakingJudeОценок пока нет

- Unit 4 - Inventory Management 2021-22Документ22 страницыUnit 4 - Inventory Management 2021-22meena unnikrishnanОценок пока нет

- ABC analysis guide for inventory managementДокумент7 страницABC analysis guide for inventory managementBobОценок пока нет

- Inventory System DesignДокумент3 страницыInventory System Designbua bobsonОценок пока нет

- Chapter 11 Inventory ManagementДокумент8 страницChapter 11 Inventory ManagementarantonizhaОценок пока нет

- CompanyProfile ShakeysДокумент14 страницCompanyProfile ShakeysMARIO DIMAANOОценок пока нет

- CH 10 ImaimДокумент37 страницCH 10 ImaimBeatrice TehОценок пока нет

- Colin Drury 6e Chapter 2Документ18 страницColin Drury 6e Chapter 2Mohsin Ali TajummulОценок пока нет

- Business Events Data ElementsДокумент29 страницBusiness Events Data ElementsfaithcoupleОценок пока нет

- hm6 Module3Документ27 страницhm6 Module3Irene Asiong NagramaОценок пока нет

- FINAL HandbookProblems2023 2024Документ96 страницFINAL HandbookProblems2023 2024mr.rodri600Оценок пока нет

- FM Chapter 3Документ43 страницыFM Chapter 3mariam.khaled2003Оценок пока нет