Академический Документы

Профессиональный Документы

Культура Документы

The Impact of Credit Risk On Bank Alfalah Upload

Загружено:

Shahnoor Shafi0 оценок0% нашли этот документ полезным (0 голосов)

299 просмотров21 страницаThis report analyzes the impact of credit risk on bank Alfalah’s profitability over 14 years from 2000-2013.

Оригинальное название

The Impact of Credit Risk on Bank Alfalah Upload

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis report analyzes the impact of credit risk on bank Alfalah’s profitability over 14 years from 2000-2013.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

299 просмотров21 страницаThe Impact of Credit Risk On Bank Alfalah Upload

Загружено:

Shahnoor ShafiThis report analyzes the impact of credit risk on bank Alfalah’s profitability over 14 years from 2000-2013.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 21

2014

Shah Amir Akbar S.

1/6/2014

The Impact of Credit Risk on

Bank Alfalahs Profitability

1 | P a g e

Table of Contents

PREFACE ........................................................................................................................................................ 2

EXECUTIVE SUMMARY .................................................................................................................................. 3

ABOUT BANK AL FALAH ................................................................................................................................ 4

CREDIT RISK ................................................................................................................................................... 5

LITERATURE REVIEW ..................................................................................................................................... 6

ARTICLE #1 ................................................................................................................................................ 6

ARTICLE #2 ................................................................................................................................................ 7

ARTICLE #3 ................................................................................................................................................ 8

ARTICLE #4 ................................................................................................................................................ 9

ARTICLE #5 .............................................................................................................................................. 10

ARTICLE #6 .............................................................................................................................................. 11

ARTICLE #7 ............................................................................................................................................. 12

RESEARCH OBJECTIVE ................................................................................................................................. 13

METHODOLOGY .......................................................................................................................................... 13

DATA COLLECTION .................................................................................................................................. 13

DATA ANALYSIS ....................................................................................................................................... 13

DEPENDENT VARIABLE ............................................................................................................................ 13

INDEPENDENT VARIABLE ........................................................................................................................ 13

STATISTICAL TOOL ................................................................................................................................... 14

EMPIRICAL RESULTS & ANALYSIS OF FINDINGS .......................................................................................... 14

CONCLUSION AND RECOMMENDATIONS ................................................................................................... 18

BIBLOGRAPHY ............................................................................................................................................. 19

APPENDIX .................................................................................................................................................... 20

2 | P a g e

PREFACE

This report analyzes the impact of credit risk on bank Alfalahs profitability over 14 years

from 2000-2013.

With the esteem depth of my heart, I am thankful to my Treasury and Fund

Management Instructor, Maqbool-ur-Rehman, for the valuable guidance and advice. He

inspired me greatly to work on this report. His willingness to motivate me contributed

tremendously to my report.

It has been a privilege to work on this report and I have put in my utmost effort to

prepare a comprehensive report on this topic. If you will be having any queries

regarding this report I will be happy to discuss it with you.

3 | P a g e

EXECUTIVE SUMMARY

The study investigated the impact of credit risk on the profitability of Bank

Alfalah. The data collected are for the periods of 2000 2013 from the Annual Reports.

From the findings it is concluded that banks profitability is inversely influenced by

the levels of loans and advances, non-performing loans and deposits thereby

exposing them to great risk of illiquidity and distress.

4 | P a g e

ABOUT BANK AL FALAH

Bank Alfalah Limited was launched on June 21, 1997 as a public limited company under

the Companies Ordinance 1984. The bank commenced its operations on November 1,

1997. The bank introduced commercial banking and related services as defined in the

Banking companies ordinance, 1962. Bank Alfalah is the 6th largest bank of Pakistan

with 576 branches.

After a few years, the bank introduced its new identity of H.C.E.B after the privatization

in 1997. The management of the bank had implemented strategies and policies so the

bank would become a major player in the market. With a partnership with the Abu Dhabi

Group the position of the bank became stronger which allowed the bank to invest more

in technology to increase its range of products and services.

Vision

To be a premier financial services organization, operating both locally and globally,

offering a complete range of financial products and services to diverse segments under

one umbrella.

Mission

To develop & deliver the most innovative products and deliver exceptional service

quality which contribute to strengthening brand equity strength and maximize value for

the stakeholders of the Bank

5 | P a g e

CREDIT RISK

Credit risk is the current and prospective risk to earnings or capital arising from an

obligors failure to meet the terms of any contract with the Bank or otherwise to perform

as agreed. Credit risk is found in all activities in which success depends on

counterparty, issuer, or borrower performance. It arises any time bank funds are

extended, committed, invested, or otherwise exposed through actual or implied

contractual agreements, whether reflected on or off the balance sheet.

The potential for loss due to failure of a borrower to meet its contractual obligation to

repay a debt in accordance with the agreed terms

Commonly also referred to as default risk

Credit events include bankruptcy, failure to pay, loan restructuring, loan moratorium,

accelerated loan payments

For banks, credit risk typically resides in the assets in its banking book (loans and

bonds held to maturity)

Credit risk can arise in the trading book as counterparty credit risk

6 | P a g e

LITERATURE REVIEW

ARTICLE #1

JOURNAL

ARTICLE

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN

BUSINESS.

CREDIT RISK AND THE PERFORMANCE OF NIGERIAN BANKS.

(NOVEMBER 2012)

AUTHOR Muhammad Nawaz, Shahid Munir, Shahid Ali Siddiqui, Tahseen-Ul-

Ahad, Faisal Afzal, Muhammad Asif, Muhammad Ateeq.

IMPACT FACTOR No impact

RESEARCH OBJECTIVE CREDIT RISK AND THE PERFORMANCE OF NIGERIAN BANKS

RESEARCH DESIGN DEPENDENT VARIABLES:

ROA= Return on Assets

INDEPENDENT VARIABLES:

NPL/LA = Ratio of Non-performing loan to loan & Advances)

LA/TD = Ratio of Loan & Advances to Total deposit)

METHODOLOGY Multiple regression models which adopt Ordinary Least Square (OLS)

model in estimating the parameter of the model and is expressed as:

ROA = 0 + NPL/LA + LA/TD

DATA COLLECTION Data collected are for the periods of 2004 2008 from the Annual

Reports and Accounts of the chosen banks.

CONCLUSION The regression result of the study model suggests that all the

independent variables have negative impact on profitability. This study

shows that there is a significant relationship between bank performance

(in terms of profitability) and credit risk management (in terms of loan

performance). Loans and advances and non-performing loans are major

variables in determining asset quality of a bank. These risk items are

important in determining the profitability of banks in Nigeria.

ROA = 1.634046 - 0.515976 NPL/LA 2.519801 LA/TD

7 | P a g e

ARTICLE #2

JOURNAL

ARTICLE

University of Gothenburg. School of business, economics and law

Credit Risk Management and Profitability in Commercial Banks in

Sweden. (24th of May 2009)

AUTHOR Ara Hosna, Bakaeva Manzura and Sun Juanjuan

IMPACT FACTOR No Impact

RESEARCH OBJECTIVE The purpose of the research is to describe the impact level of credit risk

management on profitability in four commercial banks in Sweden.

RESEARCH DESIGN DEPENDENT VARIABLE:

ROE = Return on equity

INDEPENDENT VARIABLE:

NPLR is defined as NPLs divided by TLs

CAR is regulatory capital requirement (Tier 1 + Tier 2) as the percentage

of RWAs.

METHODOLOGY The method of our study is quantitative. We use regression model to

analyze data collected from the annual reports of the sample banks.

Based on the regression outputs we conduct the analyses and answer

our research question. The analyses are presented by using descriptive

approach. Since we only describe the regression results without

providing further explanation on the issues.

We have employed the multivariate regression model which is

presented below:

ROE= +1NPLR+ 2CAR+

DATA COLLECTION We have selected four major commercial banks in Sweden: Nordea,

SEB, Svenska Handelsbanken and Swedbank. We have used annual

reports from 2000 to 2008 of each bank to collect the data. Therefore,

there are total 36 observations in the regression analysis.

CONCLUSION The big four banks together have a strong position in the Swedish

financial market. The regression outputs of all four banks show that

NPLR has negative and significant effect on ROE compared to CAR. It

indicates that profitability is fairly affected by credit risk management

in this banking group. The results obtained from the regression model

show that there is an effect of credit risk management on profitability on

reasonable level with 25,1% possibility of NPLR and CAR in predicting the

variance in ROE.

8 | P a g e

ARTICLE #3

JOURNAL

ARTICLE

International Journal of Business and Public Management (April 2012)

The impact of credit risk management on the financial performance of

Banks in Kenya for the period 2000 2006

AUTHOR Danson Musyoki, Adano Salad Kadubo

IMPACT FACTOR No Impact

RESEARCH OBJECTIVE The objective of study was to assess various parameters pertinent to

credit risk management as it affects banks financial performance. Such

parameters covered in the study were; default rate, bad debts costs

and cost per loan asset.

RESEARCH DESIGN DEPENDENT VARIABLE:

Return on Assets (ROA)

INDEPENDENT VARIABLE:

Default rate ratio (DR )= Non Performing Loans/ Total loan

Bad debt costs ratio (BDC )= Bad debt cost/ Total cost.

Cost per loan asset (CLA) = Total Operating Cost/ Total amount of loans.

METHODOLOGY The research design used for the study was a descriptive

research design. We have employed the multivariate regression model

which is presented below:

Y= +1X1+ 2X2+ 3X3+

DATA COLLECTION The study covered the period between 2000 and 2006 of the banks

operating in Nairobi; ten banks were involved in the study.

CONCLUSION The result of the showed that credit risk

management is an important predictor of bank financial

performance thus success of bank performance depends on risk

management to the extent of around 36%. Default Rate management is

the single most important predictor of the bank performance

since it influences 54% of the total credit risk influence on bank

performance. Risk management indicators such as Bad Debt Cost and

Cost per Loan Asset are not significant predictors of bank

performance.

9 | P a g e

ARTICLE #4

JOURNAL

ARTICLE

Asian Transactions on Basic and Applied Sciences

Effectiveness of Credit Risk Management of Saudi Banks in the Light of Global Financial Crisis: A Qualitative

Study

AUTHOR Dr. Khalil Elian Abdelrahim

IMPACT FACTOR No Impact

RESEARCH OBJECTIVE (1) To identify the characteristics of credit risk management of Saudi Banks.

(2) To investigate the determinants of effectiveness of credit risk

management of Saudi Banks.

(3) To find out the most serious challenges facing the effectiveness of credit risk management of Saudi Banks.

(4) To explore the development methods of effectiveness of credit risk

management of Saudi Banks.

RESEARCH DESIGN DEPENDENT VARIABLE: Effectiveness Of Credit Risk Management

INDEPENDENT VARIABLES:

1.Capital Adequacy Ratio (C) 2.Assets Quality (A) 3.Management Soundness (M) 4. Earnings of Credit Facility

(E) 5. Liquidity (L) 6.Bank Size(S)

METHODOLOGY H0 1: There is no statistically significant relation between capital adequacy and effectiveness of credit risk

management in Saudi Banks.

H0 2: There is no statistically significant relation between asset quality and the effectiveness of credit risk

management in Saudi Banks.

H0 3:There is no statistically significant relation between management soundness and effectiveness of credit

risk management in Saudi Banks.

H0 4:There is no statistically significant relation between bank's earning and effectiveness of credit risk

management in Saudi Banks.

H0 5: There is no statistically significant relation between liquidity and the effectiveness of credit risk

management in Saudi Banks.

H0 6:There is no statistically significant relation between bank Size and the effectiveness of credit risk

management in Saudi Banks.

The tools of analysis are: frequency distribution, mean, standard deviation for descriptive analysis, besides the

use of regression analysis to test research hypotheses and the use of t-statistics to detect differences in the

answers of respondents.

CONCLUSION The study recommends an overall strategy for effective credit risk management of Saudi Banks

based on enhancing capital adequacy, upgrading asset quality, strenghthening management

soundness, increasing earnings, having adequate liquidity and reducing sensitivity to market risk

besides hedging credit risk; having adequate provisions for doubtful credit; renegotiating loan terms,

transferring credit risk to a third party, extending credit maturity and lowering interest rate on

insolvent loan.

10 | P a g e

ARTICLE #5

JOURNAL

ARTICLE

Annals of the University of Petroani, Economics,

THE IMPACT OF EFFECTIVE CREDIT RISK MANAGEMENT ON BANK

SURVIVAL

AUTHOR KOSMAS NJANIKE

IMPACT FACTOR No Impact

RESEARCH OBJECTIVE The study seeks to evaluate the extent to which failure to effectively

manage credit risk led to Zimbabwes banks demise in 2003/2004 bank

crisis. It also seeks to establish other factors that led to the banking crisis

and to outline the components of an effective credit risk management

system.

METHODOLOGY The researcher chose the survey as the appropriate research design for

the study, and as such, questionnaires and interviews were used as

research instruments. Some unclear or hanging issues in the

questionnaires were clarified in interviews.

DATA COLLECTION The research data was collected over six months

to June 2009. A sample of 10 commercial banks randomly chosen was

used in this analysis. Twenty questionnaires were used to gather data

with two for each commercial bank chosen. A total of 10 interviews were

held with the heads of credit or senior managers from those banks.

CONCLUSION The results obtained from the research clearly support the assertion that

poor credit risk management contributed to a greater extent to the bank

failures in Zimbabwe. Therefore effective credit risk management is

important in banks and allows them to improve their performance and

prevent bank distress. The success of the systems depends critically

upon a positive risk culture. Banks should have in place a comprehensive

credit risk management process to identify, measure, monitor and

control credit risk and all material risks and where appropriate, hold

capital against these risks.

11 | P a g e

ARTICLE #6

ARTICLE

Department of accounting Faculty of Administration Ahmadu Bello

University, Zaria Nigeria

JULY, 2011

CREDIT RISK AND THE PERFORMANCE OF NIGERIAN BANKS

AUTHOR Hamisu Suleiman Kargi

IMPACT FACTOR No Impact

RESEARCH

OBJECTIVE

The study considers the extent of relationship that exists between the core variables

constituting Nigerian Bank default risk and the profitability. It therefore seek to examine the

impact of credit risk on the profitability of Nigerian banking system and identifies the

relationships between the non-performing loans and banks profitability and evaluate the

effect of loan and advance on banks profitability on Nigerian banks.

RESEARCH DESIGN DEPENDENT VARIABLE:Ratio of profit after tax to total assets.

INDEPENDENT VARIABLE:

NPL/LA = Ratio of Non-performing loan to loan & Advances).

LA/TD = Ratio of Loan & Advances to Total deposit).

METHODOLOGY The pooled data was analysed using correlation and multiple regression models which adopt

Ordinary Least Square (OLS) method in estimating the parameter of the model and is

expressed as;

ROA = 0 + 1NPL/LA + 2LA/TD

DATA COLLECTION The study is both historical and descriptive as it seeks to describe the pattern of credit risk of

Nigerian banks in the past.

The sample size is based on the following criteria;

a)The availability of consistent data-set over the period.

b) The banks were not involved in any merger during the study period and were not involved

in any merger during the study period with at least a branch in all states of the federation.

c) The banks are listed and quoted on the Nigeria Stock Exchange.

Considering the above criteria, six out of twenty four banks in Nigeria were selected (Appendix

I) and data collected are for the periods of 2004 2008 from the Annual Reports and Accounts

of the chosen banks.

CONCLUSION This study shows that there is a significant relationship between bank performance (in terms

of profitability) and credit risk management (in terms of loan performance). Loans and

advances and non performing loans are major variables in determining asset quality of a bank.

These risk items are important in determining the profitability of banks in Nigeria. Where a

bank does not effectively manage its risk, its profit will be unstable.

12 | P a g e

ARTICLE #7

ARTICLE

BCBS (1999)

IMPACT FACTOR No Impact

CONCLUSION

BCBS (1999) observed that banks are increasingly facing credit risk (or

counterparty risk) in various financial instruments other than loans, including

acceptances, interbank transactions, trade financing foreign exchange

transactions, financial futures, swaps, bonds, equities, options, and in the

extension of commitments and guarantees, and the settlement of transaction.

Anthony (1997) asserts that credit risk arises from non-performance by a

borrower. It may arise from either an inability or an unwillingness to perform in

the pre-committed contracted manner. Brownbridge (1998) claimed that the

single biggest contributor to the bad loans of many of the failed local banks was

insider lending. He further observed that the second major factor contributing

to bank failure were the high interest rates charged to borrowers operating in

the high-risk. The most profound impact of high non-performing loans in banks

portfolio is reduction in the bank profitability especially when it comes to

disposals.

13 | P a g e

RESEARCH OBJECTIVE

The objective of the research is to describe the impact of credit risk on the profitability of

bank Alfalah in Pakistan.

METHODOLOGY

DATA COLLECTION

The data collected are for the periods of 2000 2013 from the Annual Reports.

Therefore, there are total 14 observations in the regression analysis. Theoretically, the

number of observations should be 14:1 (14 observations per one independent variable)

in the regression analysis. The data includes Loans and Advances, Non-performing

Loan, total deposits, Profit after Tax and total assets of the sampled banks. In this study

the ratio of Non-performing loan to loan & Advances and ratio of Total loan & Advances

to Total deposit were used as indicators of credit risk while the ratio of Profit after Tax to

total asset known as return on asset (ROA) indicates performance.

DATA ANALYSIS

I have used multiple regression analysis in this study: the relation of one dependent

variable to multiple independent variables. The regression outputs are obtained by

using SPSS.

DEPENDENT VARIABLE

Return on Assets

An indicator of how profitable a company is relative to its total assets. ROA gives an

idea as to how efficient management is at using its assets to generate earnings.

INDEPENDENT VARIABLE

I have chosen two independent variables namely NPL/LA = Ratio of Non-performing

loan to loan & Advances) and LA/TD = Ratio of Loan & Advances to Total deposit)

because these two are the indicators of credit risk which affect the profitability of banks.

NPL/LA = Ratio of Non-performing loan to loan & Advances)

LA/TD = Ratio of Loan & Advances to Total deposit)

14 | P a g e

STATISTICAL TOOL

The pooled data was analyzed using multiple regression models which adopt Ordinary

Least Square (OLS) model in estimating the parameter of the model and is expressed

as:

ROA = 0 + NPL/LA + LA/TD

EMPIRICAL RESULTS & ANALYSIS OF FINDINGS

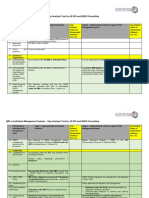

Model Summary

b

Mod

el R

R

Square

Adjusted R

Square

Std. Error

of the

Estimate

Change Statistics

Durbin-

Watson

R Square

Change

F

Change df1 df2

Sig. F

Change

1 .519

a

.269 .137 .51998 .269 2.029 2 11 .178 2.596

a. Predictors: (Constant), LATD, NPLLA

b. Dependent Variable: ROA

ANOVA

b

Model Sum of Squares df Mean Square F Sig.

1 Regression 1.097 2 .549 2.029 .178

a

Residual 2.974 11 .270

Total 4.071 13

a. Predictors: (Constant), LATD, NPLLA

b. Dependent Variable: ROA

15 | P a g e

Coefficients

a

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) .526 1.293

.406 .692

NPLLA -51.425 27.146 -.489 -1.894 .085

LATD .012 .021 .143 .555 .590

a. Dependent Variable: ROA

REGRESSION EQUATION:

ROA = 0 + NPL/LA + LA/TD

ROA = Ratio of profit after tax to total assets.

0 - 2 = Coefficients

NPL/LA = Ratio of Non-performing loan to loan & Advances).

LA/TD = Ratio of Loan & Advances to Total deposit).

Descriptive Statistics

Mean Std. Deviation N

ROA .8593 .55962 14

NPLLA .007093 .0053249 14

LATD 59.6407 6.85067 14

16 | P a g e

APPLYING THE REGRESSION MODEL (LEAST SQUARE MODEL)

ROA = 0.526 -0.489NPL/LA -0.143LA/TD

S.E = 1.293 27.146 0.021

T= 0.406 -1.894 0.555

P= 0.692 0.085 0.590

R

2

= 0.269 , R

2

adjusted

= 0.137

The least square method shows that a negative relationship exist between ROA and the

independent variables NPL/LA and LA/TD.

The result show that the ratio Non-performing loan to loan & Advances negatively relate

to profitability though not significant The parameters shows that increase in the level of

loan & advances to total deposit significantly decrease profitability of the banks by

14.3%, however, increase in non-performing loans decreases profitability (ROA) by

48.9%, this expose them to higher risk level. The study shows that there is a direct but

inverse relationship between profitability (ROA) and the ratio of non-performing loan to

loan & Advances and the ratio of loan & advances to total deposit.

The model further explains that 13.7% variation in the ROA is explained by NPL/ LA and

LA/TD while the remaining 86.3% is unexplained. The mean of the data are ROA

(0.8693), NPL/LA (0.007093) and LA/TD (59.647) while the standard deviations of the

data are ROA (0.55962), NPL/LA (0.0053249) and LA/TD (6.85067).

The test of overall significance of regression implies testing the null hypotheses. The

overall significance of the regression is tested using Fishers statistics. In this study the

calculated F* value of 2.029 is significant at 5%. It is therefore, concluded that linear

relationship exist between the dependent and the independent variables of the model.

The evidence established that the independent explanatory variables (credit risk

indicators) have individual and combine impact on the return of asset of banks.

This study shows that there is a significant relationship between bank performance (in

terms of profitability) and credit risk management (in terms of loan performance). Loans

and advances and non performing loans are major variables in determining asset

quality of a bank. These risk items are important in determining the profitability of banks.

Where a bank does not effectively manage its risk, its profit will be unstable. This means

that the profit after tax has been responsive to the credit policy of bank Alfalah. The

17 | P a g e

deposit structure also affects profit performance. Many highly profitability banks hold a

large volume of core deposits. The growth of loan has been relatively fast for the past

few years and which is not fully covered by the deposit base. Banks become more

concerned because loans are usually among the riskiest of all assets and therefore may

threatened their liquidity position and lead to distress. Better credit risk management

results in better bank performance. Thus, it is of crucial importance for bank Alfalah to

practice prudent credit risk management to safeguard their assets and protect the

investors interests.

18 | P a g e

CONCLUSION AND RECOMMENDATIONS

The study investigated the impact of credit risk on the profitability of Bank Alfalah. From

the findings it is concluded that banks profitability is inversely influenced by the levels of

loans and advances, non-performing loans and deposits thereby exposing them to great

risk of illiquidity and distress.

Therefore, management need to be cautious in setting up a credit policy that will not

negatively affects profitability and also they need to know how credit policy affects the

operation of the bank to ensure judicious utilization of deposits and maximization of

profit. Improper credit risk management reduce the bank profitability, affects the quality

of its assets and increase loan losses and non-performing loan which may eventually

lead to financial distress.

One direct way is to assess the degree of credit crunch by isolating the impact of supply

side of loan from the demand side taking into account the opinion of the firms about

banks lending attitude.

Finally, strengthening the securities market will have a positive impact on the overall

development of the banking sector by increasing competitiveness in the financial sector.

When the range of portfolio selection is wide people can compare the return and

security of their investment among the banks and the securities market operators. As a

result banks remain under some pressure to improve their financial soundness.

19 | P a g e

BIBLOGRAPHY

BANK ALFALAH OFFICIAL WEBSITE

http://www.bankalfalah.com/about-us/financials-results/

THE IMPACT OF CREDIT RISK MANAGEMENT ON THE FINANCIAL PERFORMANCE OF BANKS IN

KENYA FOR THE PERIOD 2000=2006

http://mku.ac.ke/journals/images/Vol2/The%20impact%20of%20credit%20risk%20managem

ent%20on%20the%20financial%20performance%20of%20Banks%20in%20Kenya%20for%20th

e%20period%202000%20%E2%80%93%202006.pdf

EFFECTIVENESS OF CREDIT RISK MANAGEMENT OF SAUDI BANKS IN THE LIGHT OF GLOBAL

FINANCIAL CRISIS: A QUALITATIVE STUDY

http://www.asian-transactions.org/Journals/Vol03Issue02/ATBAS/ATBAS-10305028.pdf

THE IMPACT OF EFFECTIVE CREDIT RISK MANAGEMENT ON BANK SURVIVAL

http://rmr.lixin.edu.cn/files/100134/1110/109_1392b787e1b.pdf

20 | P a g e

APPENDIX

14 YEARS DATA

ROA NPL LA NPL/LA LA/TD

2000 0.89 103950 15242317 0.0068 72.42

2001 0.9 13705 19131494 0.0007 63.33

2002 0.85 53619 28319401 0.0019 54.79

2003 2.59 87091 49216120 0.0018 64.17

2004 0.86 370208 88931400 0.0042 68.56

2005 0.84 402298 118864010 0.0034 53.46

2006 0.67 697690 149999325 0.0047 62.63

2007 1.04 2370867 171198992 0.0138 62.67

2008 0.38 2035997 191790988 0.0106 63.77

2009 0.24 3694546 188042438 0.0196 57.9

2010 0.24 2243687 207152546 0.0108 58.52

2011 0.8 1864510 198468512 0.0094 49.46

2012 0.91 1848535 233933358 0.0079 51.18

2013 0.82 954563 260779850 0.0037 52.11

KEY

ROA RETURN ON ASSETS

NPL NON-PERFORMING LOANS

LA LOANS AND ADVANCES

TD TOTAL DEPOSITS

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Disaster Risk Reduction GuideДокумент129 страницDisaster Risk Reduction GuideMarilyn Castro Laquindanum100% (1)

- IMS Gap Anaysisis Check 290919 1Документ11 страницIMS Gap Anaysisis Check 290919 1Gunasegaraj RОценок пока нет

- IT Security Access ReportДокумент18 страницIT Security Access ReportAtiya SharfОценок пока нет

- Construction DisputesДокумент19 страницConstruction DisputesB Ravindu Kasudul CoorayОценок пока нет

- Risk Management and InsuranceДокумент38 страницRisk Management and InsuranceNepali Bikrant Shrestha RaiОценок пока нет

- Machine Guard Guide 2009Документ62 страницыMachine Guard Guide 2009Said A Attia100% (1)

- TAKAFUL BASIC EXAMINATION TUTORIAL PRESENTATION OUTLINEДокумент380 страницTAKAFUL BASIC EXAMINATION TUTORIAL PRESENTATION OUTLINESyed Isa100% (1)

- Business ValuationДокумент431 страницаBusiness ValuationAnonymous 7zUBWZZfy50% (2)

- PMO in A Box PresentationДокумент28 страницPMO in A Box PresentationArpit Agarwal100% (4)

- SIP Crafting Guide 2023Документ74 страницыSIP Crafting Guide 2023sharminegastador13100% (1)

- 01 - (COBIT2019) Framework-Introduction and MethodologyДокумент64 страницы01 - (COBIT2019) Framework-Introduction and Methodologyalexender100% (1)

- Toc 18R-97Документ6 страницToc 18R-97gian93100% (1)

- Executive Order No. 2020-08Документ5 страницExecutive Order No. 2020-08LGU LezoОценок пока нет

- Case Study Best Value Procurement Performance Information Procurement System DevelopmentДокумент36 страницCase Study Best Value Procurement Performance Information Procurement System DevelopmentCharles BinuОценок пока нет

- Outsourcing PolicyДокумент13 страницOutsourcing PolicyShahzad SalimОценок пока нет

- The Genres of Social WorkДокумент7 страницThe Genres of Social WorkErinFinley100% (1)

- Template - 1.6 Brgy Level Hazard InventoryДокумент4 страницыTemplate - 1.6 Brgy Level Hazard InventoryOMPDC BAAOОценок пока нет

- Final Rwanda Hospital Accreditation Standards Performance Assessment 3 Edition 2022Документ168 страницFinal Rwanda Hospital Accreditation Standards Performance Assessment 3 Edition 2022john peter BamporikiОценок пока нет

- Itday TufinДокумент28 страницItday TufinpdiarraОценок пока нет

- Lesson 2 Risk and Risk ManagementДокумент31 страницаLesson 2 Risk and Risk ManagementSustainability PSSBОценок пока нет

- 4418 Strategic & Governance Risk SpecialistДокумент2 страницы4418 Strategic & Governance Risk SpecialistHosam GomaaОценок пока нет

- A Security Risk Management Approach For E-CommerceДокумент7 страницA Security Risk Management Approach For E-CommerceVic KyОценок пока нет

- Sha Yee YongДокумент17 страницSha Yee YongJenny YipОценок пока нет

- Summer InternshipДокумент17 страницSummer InternshipAnkit PalОценок пока нет

- TLE Carpentry 2nd Quarter ExamДокумент1 страницаTLE Carpentry 2nd Quarter ExamAngely A. Florentino100% (1)

- Case Study RMWG-05 - Packaging Line Optimization PDFДокумент4 страницыCase Study RMWG-05 - Packaging Line Optimization PDFiabureid7460Оценок пока нет

- Ey-First-Line-Risk-Controls 1,5 LineДокумент11 страницEy-First-Line-Risk-Controls 1,5 LinePablo Cuevas CalvettiОценок пока нет

- Cyber Security Risk Assessment Methods for SCADA and DCS NetworksДокумент12 страницCyber Security Risk Assessment Methods for SCADA and DCS NetworkschrisalexoОценок пока нет

- Solomon Islands National Infrastructure Investment Plan 2013Документ260 страницSolomon Islands National Infrastructure Investment Plan 2013ThePRIFОценок пока нет

- SoohooДокумент100 страницSoohooDaniella LazarescuОценок пока нет