Академический Документы

Профессиональный Документы

Культура Документы

Hberg Budget 2010

Загружено:

nlvlogicАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hberg Budget 2010

Загружено:

nlvlogicАвторское право:

Доступные форматы

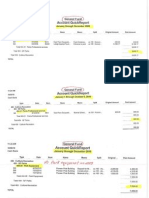

HEIDELBERG TOWNSHIP TOTAL FUNDS

HEIDELBERG TOWNSHIP

TOTAL ALL FUNDS

Actual Actual Actual Budget Budget Year Budget

01 GENERAL FUND 2005 2006 2007 2008 2009 to Date 2010

REVENUES $ 841,614 $ 831,872 $ 1,022,526 $ 875,839 $1,071,227 $769,924 $1,015,370

EXPENDITURES $ 818,275 $ 887,286 $ 930,813 $ 1,060,844 $1,071,227 $826,133 $1,041,727

DIFFERENCE $ 23,339 $ (55,414) $ 91,713 $ (185,005) $ (0) $ (56,209) $ (26,357)

Actual Actual Actual Budget Budget Year Budget

04 SPECIAL REVENUE 2005 2006 2007 2008 2009 to Date 2010

REVENUES $ 47,011 $ 27,549 $ 60,833 $ 14,719 $ 9,217 $ 41,490 $ 37,923

EXPENDITURES $ - $ 500 $ 59,481 $ 6,300 $ - $ 9,217 $ 37,923

DIFFERENCE $ 47,011 $ 27,049 $ 1,352 $ 8,419 $ 9,217 $ 32,273 $ -

Actual Actual Actual Budget Budget Year Budget

05 RECREATION FUND 2005 2006 2007 2008 2009 to Date 20fo---

REVENUES $ 2,005 $ 2,006 $ - $ - $ - $ - $ 4,860

EXPENDITURES $ 133 $ 540 $ 13,996 $ 31,235 $ 7,431 $ 7,431 $ 4,860

DIFFERENCE $ 1,872 $ 1,466 $ (13,996) $ (31,235) $ (7,431 ) $ (7,431 ) $ -

Actual Actual Actual Budget Budget Year Budget

18 HUNTERS HILL BRIDGE FUND 2005 2006 2007 2008 2009 to Date 2010

REVENUES $ - $ - $ - $ 94,636 $ 94,201 $ 94,201 $ 91,000

EXPENDITURES $ - $ - $ - $ 94,636 $ 2,429 $ 2,429 $ 91,000

DIFFERENCE $ - $ - $ - $ - $ 91,772 $ 91,772 $ -

Actual Actual Actual Budget Budget Year Budget

35 LIQUID FUELS FUND 2005 2006 2007 2008 2009 to Date 2010

REVENUES $ 163,366 $ 172,402 $ 192,499 $ 214,854 $ 214,854 $181,316 $ 169,141

EXPENDITURES $ 135,757 $ 123,519 $ 170,860 $ 214,854 $ 214,854 $182,656 $ 169,141

DIFFERENCE $ 27,609 $ 48,883 $ 21,640 $ - $ - $ (1,340) $ ° page1 of 1

11/18/2009

Prepared by D. Stonehouse

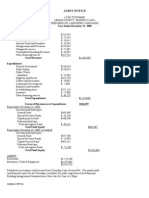

HEIDELBERG TOWNSHIP GENERAL FUND

HEIDELBERG TOWNSHIP

GENERAL FUND (01) TOTAL

EOM October

Actual Actual Actual Budget Budget Year Budget Year

2005 2006 2007 2008 2009 to Date 2010 Increase

REVENUES $ 841,614 $ 831,872 $1,022,426 $ 875,739 $ 1,071,227 $ 769,924 $ 1,015,370 94.79%

EXPENDITURES $ 818,275 $ 887,286 $ 930,813 $ 1,060,844 $ 1,071,227 $ 826,133 $ 1,041,727 97.25%

DIFFERENCE $ 23,339 $ (55,414) $ 91,613 $ (185,105) $ (0) $ (56,209) $ (26,357)

Revenue Difference from previous year $ (55,857>-

Tax increase $ 6,183

RE Transfer Tax $ (8,000)

CATV Franchise $ 5,400

Fed Grants - Truck $ 33,000 New Truck

Expenditure Difference from previous year $ (29,500)

EIT Tax Salary $ (4,838)

EIT Employee withholding $ (338)

SecfTreas Withholding $ (64)

Admin/Sec Withholding $ (309)

Debt Service $ 11,500 Truck

Highway Withholding $ 86

Road Materials $ -

Anti Skid Materials $ 5,448

Snow Withholding $ 1

Vehicle Fuel $ (10,500) 11/18/2009

Prepared by D. Stonehouse

HEIDELBERG TOWNSHIP 2010 Assessed Value = $77,134,850

GENERAL FUND (011 REVENUES 2 mills = 154,268

Actual Actual Actual Actual Budget Budget Year Budget Annual

REAL ESTATE TAXES 2005 2006 2007 2008 2008 2009 to Date 2010 Difference

301.100 REAL ESTATETAXES-CURENT $ 122,571 $ 124,897 $ 129,073 $ 145,232 $ 145,000 $ 145,000 $ 144,049 $ 151,183 $ 6,183

301.200 REAL ESTATE TAXES -PRIOR $ 2,251 $ 2,234 $ 2,217 $ 2,100 $ 2,200 $ 2,200 $ 1,672 $ 2,200 $ -

301.400 REAL ESTATE TAXES -DELlNQU $ 3,261 $ 2,985 $ 2,214 $ 2,246 $ 2,500 $ 2,500 $ 2,474 $ 2,500 $ -

301.600 REAL ESTATE TAXES - INTERIM $ 874 $ 1,426 $ 1,550 $ 500 $ 1,000 $ 500 $ 406 $ 500 $ -

TOTAL $ 128,957 $ 131,542 $ 135,054 $ 150,078 $ 150,700 $ 150,200 $ 148,600 $ 156,383 $ 6,183

Actual Actual Actual Actual Budget Budget Year Budget

LOCAL TAX ENABLING ACT (AC 2005 2006 2007 2008 2008 2009 to Date 2010

310.010 PER CAPITA $ 1,050 $ 10,500

310.020 PER CAPITA DELINQUENT $ 919 $ 968 $ 1,040 $ 1,045 $ 1,000 $ 50 $ 105 $ 75 $ 25

310.100 REAL ESTATE TRANSFER TAX $ 64,854 $ 41,231 $ 60,233 $ 46,280 $ 45,000 $ 32,000 $ 17,525 $ 24,000 $ (8,000)

310.210 EIT- CURRENT YEAR $ 357,531 $ 375,106 $ 409,602 $ 391,856 $ 375,000 $ 420,000 $ 303,906 $ 400,000 $ (20,000)

310.230 EIT - REIMBURSEMENT $ 104,855 $ 110,986 $ 126,148 $ 124,548 $ 110,000 $ 132,000 $ 114,375 $ 136,000 $ 4,000

TOTAL $ 528,159 $ 528,291 $ 597,023 $ 564,779 $ 541,500 $ 584,050 $ 435,911 $ 560,075 $ (23,975)

Actual Actual Actual Actual Budget Budget Year Budget

LICENSES AND PERMITS 2005 2006 2007 2008 2008 2009 to Date 2010

321.320 JUNK YARD LICENSE $ - $ 100 $ 100 $ 100 $ 100 $ 100 $ -

321.600 CONTRACTOR LICENSES $ 800 $ 725 $ 650 $ 525 $ 600 $ 50 $ (600)

321.800 CATV FRANCHISE PAYMENTS $ - $ 32,192 $ 34,258 $ 35,865 $ 32,000 $ 34,600 $ 29,986 $ 40,000 $ 5,400

TOTAL $ 800 $ 32,917 $ 34,908 $ 36,390 $ 32,000 $ 35,200 $ 30,136 $ 40,100 $ 4,800

Actual Actual Actual Actual Budget Budget Year Budget

FINES 2005 2006 2007 2008 2008 2009 to Date 2010

331.120 ORDINANCE VIOLATIONS $ 3,000 $ 2,644 $ 2,501 $ 1,461 $ 1,666 $ 1,000 $ 1 $ 100 $ (900)

331.320 FINES FROM COUNTY $ 3,000 $ 2,644 $ 2,500 $ 849 $ 1,667 $ 1,000 $ 1,056 $ 1,500 $ 500

331.330 FINES FROM COMMONWEALTH $ 3,187 $ 2,645 $ 2,500 $ 8,310 $ 1,667 $ 5,000 $ 2,813 $ 3,500 $ (1,500)

TOTAL $ 9,187 $ 7,933 $ 7,501 $ 10,620 $ 5,000 $ 7,000 $ 3,870 $ 5,100 $ (1,900)

11/18/2009

Page 1 of 5

Prepared by D. Stonehouse

Actual Actual Actual Actual Budget Budget Year Budget

INTEREST EARNINGS AND DIVn 2005 2006 2007 2008 2008 2009 to Date 2010

341.000 BANK INTEREST EARNINGS $ 5,854 $ 8,019 $ 8,180 $ 6,748 $ 5,000 $ 5,000 $ 864 $ 1,000 $ (4,000)

341.100 OTHER BANK INTEREST $ 750 $ (750)

341.200 INTEREST FROM TAX COLLECTOR $ 91 $ 75 $ 33 $ 50 $ (25)

341.300 INSURANCE DIVIDENDS $ 100 $ 424 $ 500 $ 400

TOTAL $ 5,854 $ 8,019 $ 8,271 $ 6,748 $ 5,000 $ 5,925 $ 1,320 $ 1,550 $ (4,375)

Actual Actual Actual Actual Budget Budget Year Budget

RENTS AND ROYALTIES 2005 2006 2007 2008 2008 2009 to Date 2010

342.200 EIT OFFICE $ 7,500 $ 7,500 $ 7,500 $ 7,500 $ 7,500 $ 8,000 $ 8,000 $ 8,500 $ 500

342.530 CELL TOWER $ 39,069 $ 10,592 $ 9,910 $ 15,800 $ 12,000 $ 12,000 $ 8,332 $ 11,109 $ (891)

TOTAL $ 46,569 $ 18,092 $ 17,410 $ 23,300 $ 19,500 $ 20,000 $ 16,332 $ 19,609 $ (391)

Actual Actual Actual Actual Budget Budget Year Budget

FEDERAL GRANTS 2005 2006 2007 2008 2008 2009 to Date 2010

351.030 FEDERAL GRANTS $ 43,624 $ 50,000 $ 33,500 $ (16,500)

TOTAL $ - $ - $ - $ 43,624 $ - $ 50,000 $ - $ 33,500 $ (16,500)

Actual Actual Actual Actual Budget Budget Year Budget

STATE GRANTS 2005 2006 2007 2008 2008 2009 to Date 2010

354.010 STATE GRANTS $ 38,319 $ 40,718 $ 39,079 $ 55,508 $ 40,000 $ 6,000 $ 4,543 $ 6,000

TOTAL $ 38,319 $ 40,718 $ 39,079 $ 55,508 $ 40,000 $ 6,000 $ 4,543 $ 6,000 $ -

Actual Actual Actual Actual Budget Budget Year Budget

STATE SHARED REVENUES 2005 2006 2007 2008 2008 2009 to Date 2010

355.010 PURTATAXES $ 921 $ 829 $ 824 $ 900 $ 825 $ 832 $ 832 $ 7

355.040 ALCOHOLIC BEVERAGE L1CENC $ 300 $ 300 $ 300 $ 300 $ 300 $ 300 $ 300 $ 300 $ -

355.050 STATE PENSION CONTRIBUTION $ 16,205 $ 20,100 $ 20,100 $ 17,916 $ 19,000 $ (1,100)

355.070 FIREMAN'S RELIEF $ 22,874 $ 23,618 $ 24,000 $ 21,694 $ 22,500 $ (1,500)

355.090 RECYCLING GRANTS $ 332 $ 16,059 $ 3,700 $ 3,000 $ 3,300 $ 3,000 $ (300)

TOTALi $ 300 $ 1,553 $ 56,267 $ 48,542 $ 4,200 $ 48,525 $ 40,742 $ 45,632 $ (2,893) 11/18/2009

Page 2 of 5

Prepared by O. Stonehouse

Actual Actual Actual Actual Budget Budget Year Budget

STATE PAYMENTS 2005 2006 2007 2008 2008 2009 to Date 2010

356.020 STATE PAYMENTS IN UEU OF TAXES $ 643 $ 3,216 $ 1,929 $ 3,000 $ 3,000 $ 1,929 $ 2,000 State Gam

TOTAL $ - $ 643 $ 3,216 $. 1,929 s 3,000 $ 3,000 $ 1,929 $ 2,000

Actual Actual Actual Actual Budget Budget Year Budget

LOCAL GOVERNMENT GRANTS 2005 2006 2007 2008 2008 2009 to Date 2010

357.010 GENERAL GOVERNMENT $ 3,000 $ 1,000 $ - $ 2,500 Trees

357.040 ENVIRONMENTAL ADVISORY COMM $ 5 $ 13 $ 9,000 $ 15 $ 500

TOTAL $ - $ - $ 5 $ 3,013 $ 9,000 $ 1,000 $ 15 $ 3,000

Actual Actual Actual Actual Budget Budget Year Budget

CHARGES FOR SERVICES 2005 2006 2007 2008 2008 2009 to Date 2010

361.311 SALDO PLAN FEES $ 2,900 $ 6,100 $ 4,205 $ 2,120 $ 3,000 $ 2,200 $ 1,650 $ 2,200 Average

361.330 ZONING/U&O PERMITS $ 2,530 $ 3,492 $ 2,450 $ 3,916 $ 2,000 $ 2,400 $ 755 $ 1,250 Average

361.340 ZONING HEARING BOARD FEES $ 1,500 $ 2,000 $ 2,300 $ 3,350 $ 2,200 $ 1,250 Average

361.500 SALES OF MAPS AND ORDINANCES $ 100 $ 150 $ 200

361.710 PHOTOCOPYING FEES $ 50 $ 158 $ 150

361.721 GENERAL OFFICE RECEIPTS $ 284 $ 100 $ 4,452 $ 500

361.722 RETURNED CHECK FEE $ 100 $ 30 $ 50

TOTAL $ 6,930 $ 11,592 $ 8,955 $ 9,669 $ 5,000 $ 7,150 $ 7,194 $ 5,600

Actual Actual Actual Actual Budget Budget Year Budget

PUBLIC SAFETY 2005 2006 2007 2008 2008 2009 to Date 2010

362.410 BUILDING PERMIT FEES $ 25,173 $ 20,873 $ 18,038 $ 22,453 $ 25,000 $ 21,000 $ 34,441 $ 15,000 Average

362.420 ELECTRICAL PERMIT FEES $ 850 $ 650 $ 3,070 $ 4,960 $ 2,400 $ 1,605· $ 2,000 Average

362.430 PLUMBING PERMIT FEES $ 3,620 $ 1,930 $ 1,365 $ 2,550 $ 2,300 $ 125 $ 500 Average

362.440 SEWAGE PERMIT FEES $ 19,470 $ 14,031 $ 16,358 $ 4,895 $ 15,000 $ 10,000 $ 4,820 $ 5,750

362.441 STATE REIMBURSEMENT - SEPTIC WORK $ 1,800 $ 3,230 $ 3,500

362.450 DRIVEWAY PERMIT FEES $ 4,885 $ 6,340 $ 1,100 $ 2,580 $ 1,000 $ 1,000 $ 1,175 $ 1,500 Average

TOTAL s 53,998 $ 43,824 $ 39,931 $ 37,438 $ 41,000 $ 38,500 $ 45,396 $ 28,250 11/18/2009

Page 30f5

Prepared by D. Stonehouse

Actual Actual Actual Actual Budget Budget Year Budget

HIGHWAY MAINTENANCE 2005 2006 2007 2008 2008 2009 to Date 2010

363.900 STREET LIGHTING $ 739 $ 739 $ 739 $ 741 $ 739 $ 1,071 $ 1,045 $ 1,071

363.998 REIMBURSEMENTS FROM NWLSD $ 500 $ 500

364 MISCELLANEOUS REVENUE $ 9 $ 12,906 $ 2,000 $ 2,970 $ 672 $ 1,000

TOTAL $ 739 $ 748 $ 739 $ 13,647 $ 2,739 $ 4,541 $ 1,717 $ 2,571

Actual Actual Actual Actual Budget Budget Year Budget

OTHER UNCLASSIFIED REVENL 2005 2006 2007 2008 2008 2009 to Date 2010

389.000 MISCELLANEOUS REVENUE $ 12,802 $ 22,085 $ 3,030 $ 4,000 $ 4,000 $ 1,500

389.200 ROAD MAl NTENANCE FEES $ 4,500 $ 6,000 $ 10,500 $ 3,000 $ 1,500 $ 1,500 $ 1,000

389.202 RECREATION FEES $ 6,000 $ 1,000 $ 6,200 Increase b"

TOTAL $ 17,302 $ 6,000 $ 32,585 $ 12,030 $ 5,500 $ 5,500 $ 1,000 $ 8,700

Actual Actual Actual Actual Budget Budget Year Budget

INTERFUND OPERATING TRAN~ 2005 2006 2007 2008 2008 2009 to Date 2010

392.035 TRANSFER FROM LIQUID FUELS $ 500 $ -

392.040 TRANSFER FROM SPECIAL REVENUE $ 32,481 $ 1,000 $ 6,300 $ 5,000 $ 9,218 $ 1,500

392.050 TRANSFER FROM RECREATION $ 4,500 $ - $ 9,000 $ 4,500 $ 5,300 $ 4,500 $ 22,002 $ 4,800

392.180 TRANSFER FROM HH BRIDGE FUND $ 6,811 $ 94,636 $ 91,000

TOTAL $ 4,500 $ - $ 41,481 $ 12,311 $ 11,600 $ 104,636 $ 31,220 $ 97,300

TOTAL REVENUES $ 841,614 $ 831,872 $1,022,426 $1,029,625 $ 875,739 $ 1,071,227 $ 769,924 $ 1,015,370 94.8% 11/18/2009

Page 4 of 5

Prepared by D. Stonehouse

2010 Assessed Value = $77,134,850

Assume 98% collection rate Assessed Collection Revenue

Assessed Value = $77,134,850 Mills Value Rate 98% Increase

1.00 $ 77,134,850 $ 75,592

Current 2.00 $ 77,134,850 $ 151,184

2.10 $ 77,134,850 $ 158,744 $ 7,559

2.20 $ 77,134,850 $ 166,303 $ 15,118

2.25 $ 77,134,850 $ 170,082 $ 18,898

2.30 $ 77,134,850 $ 173,862 $ 22,678

2.35 $ 77,134,850 $ 177,642 $ 26,457

2.40 $ 77,134,850 $ 181,421 $ 30,237

2.45 $ 77,134,850 $ 185,201 $ 34,016

Average home Average Assessed Tax

Assessed Value Home Value Taxes Increase

Current 2 mills $ 150,000 $ 75,000 $ 150.00

2.1 mills $ 150,000 $ 75,000 $ 157.50 $ 7.50

2.2 mills $ 150,000 $ 75,000 $ 165.00 $ 15.00

2.25 mills $ 150,000 $ 75,000 $ 168.75 $ 18.75

2.3 mills $ 150,000 $ 75,000 $ 172.50 $ 22.50

2.4 miffs $ 150,000 $ 75,000 $ 180.00 $ 30.00

.

A.1 mill increase equals an average $7.50 increase in property taxes

but brings in about $7400 in additional revenue 11/18/2009

Page 5 of 5

Prepared by D. Stonehouse

Вам также может понравиться

- Ls R Feinour PacketДокумент19 страницLs R Feinour PacketnlvlogicОценок пока нет

- Bill 2012-35 LehighДокумент13 страницBill 2012-35 LehighnlvlogicОценок пока нет

- Lynn Township Board of Supervisors Meeting Minutes of June 3, 2004Документ2 страницыLynn Township Board of Supervisors Meeting Minutes of June 3, 2004nlvlogicОценок пока нет

- Feinour Preprimary Report Color WhiteoutДокумент4 страницыFeinour Preprimary Report Color WhiteoutnlvlogicОценок пока нет

- Lynnwood DocumentsДокумент8 страницLynnwood DocumentsnlvlogicОценок пока нет

- Benyo 06082011Документ2 страницыBenyo 06082011nlvlogicОценок пока нет

- Bipartisan Joint Statement of Lynn Township Supervisor CandidatesДокумент2 страницыBipartisan Joint Statement of Lynn Township Supervisor CandidatesnlvlogicОценок пока нет

- Year To Date Comparison 12 Vs 11Документ18 страницYear To Date Comparison 12 Vs 11nlvlogicОценок пока нет

- 30 Day NoticeДокумент2 страницы30 Day NoticenlvlogicОценок пока нет

- Pa Open Records: Feinour v. Lynn TownshipДокумент6 страницPa Open Records: Feinour v. Lynn TownshipnlvlogicОценок пока нет

- Solicitor's Memorandum of Law Arguing Against Release of SFI InfoДокумент3 страницыSolicitor's Memorandum of Law Arguing Against Release of SFI InfonlvlogicОценок пока нет

- 20121009160334Документ1 страница20121009160334nlvlogicОценок пока нет

- LCA Proposed Project FinancingДокумент2 страницыLCA Proposed Project FinancingnlvlogicОценок пока нет

- RightToKnowResolution2008 25Документ11 страницRightToKnowResolution2008 25nlvlogicОценок пока нет

- GFengineer 09 Vs 10Документ1 страницаGFengineer 09 Vs 10nlvlogicОценок пока нет

- Budget Summary 2011 1st DraftДокумент2 страницыBudget Summary 2011 1st DraftnlvlogicОценок пока нет

- GFparkexp 09 Vs 10Документ4 страницыGFparkexp 09 Vs 10nlvlogicОценок пока нет

- Deptof Ag Dog Law Liz JonesДокумент4 страницыDeptof Ag Dog Law Liz JonesnlvlogicОценок пока нет

- Parkexp 09 Vs 10Документ5 страницParkexp 09 Vs 10nlvlogicОценок пока нет

- Lynn Township Audit Notice 2009Документ1 страницаLynn Township Audit Notice 2009nlvlogicОценок пока нет

- Commonwealth Court Brief For The Intervenor Wal-MartДокумент44 страницыCommonwealth Court Brief For The Intervenor Wal-MartnlvlogicОценок пока нет

- PSATS2010 ProposedresolutionsДокумент7 страницPSATS2010 ProposedresolutionsnlvlogicОценок пока нет

- News ReleaseДокумент1 страницаNews ReleasenlvlogicОценок пока нет

- Najarian v. North Whitehall Township, R2K OOR DecisionДокумент16 страницNajarian v. North Whitehall Township, R2K OOR DecisionnlvlogicОценок пока нет

- Unemployment Amount DueДокумент2 страницыUnemployment Amount DuenlvlogicОценок пока нет

- Commonwealth CT Brief For AppellantsДокумент67 страницCommonwealth CT Brief For AppellantsnlvlogicОценок пока нет

- Animal Control Guidelines 2010Документ4 страницыAnimal Control Guidelines 2010nlvlogicОценок пока нет

- Sidewalk Map 2Документ1 страницаSidewalk Map 2nlvlogicОценок пока нет

- Sidewalk Grant ApplicationДокумент15 страницSidewalk Grant ApplicationnlvlogicОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)