Академический Документы

Профессиональный Документы

Культура Документы

Sbux, Peet, and Pro-Forma Pete-Ddrx

Загружено:

fcfroicОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sbux, Peet, and Pro-Forma Pete-Ddrx

Загружено:

fcfroicАвторское право:

Доступные форматы

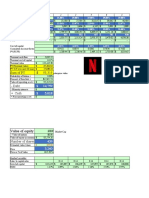

Starbucks vs. Peet's Coffee & Tea Inc. (incl.

Diedrich Coffee) - 10 y

SBUX

2008 2007 2006 2005 2004 2003 2002

Revenues $9,775 $10,383 $9,412 $7,787 $6,369 $5,294 $4,076

less: COGS 7,750 8,390 7,215 5,867 4,771 3,982 3,061

Gross Profit $2,025 $1,993 $2,196 $1,920 $1,598 $1,313 $1,015

less: SG&A 453 456 489 479 362 304 245

EBITDA $1,572 $1,537 $1,707 $1,441 $1,237 $1,008 $770

less: D&A 535 549 467 387 340 289 245

EBIT $1,037 $987 $1,240 $1,054 $896 $719 $525

less: Operating Leases 715 741 638 499 417 338 273

less: Taxes 168 144 384 325 302 232 167

NOPAT $154 $102 $218 $230 $178 $149 $85

Total Debt $550 $1,263 $1,261 $703 $281 $4 $5

PV of Operating Leases 4,389 5,098 5,017 3,893 3,097 2,609 2,259

Total Preferred Stock 0 0 0 0 0 0 0

Total Equity 3,046 2,491 2,284 2,229 2,090 2,470 2,071

Total Capital $7,984 $8,852 $8,562 $6,824 $5,468 $5,084 $4,336

ROIC 1.7% 1.2% 3.2% 4.2% 3.5% 3.4% 2.3%

Gross Margin 20.7% 19.2% 23.3% 24.7% 25.1% 24.8% 24.9%

EBITDA Margin 16.1% 14.8% 18.1% 18.5% 19.4% 19.0% 18.9%

EBIT Margin 10.6% 9.5% 13.2% 13.5% 14.1% 13.6% 12.9%

NOPAT Margin 1.6% 1.0% 2.3% 3.0% 2.8% 2.8% 2.1%

Debt/EBITDA 0.35x 0.82x 0.74x 0.49x 0.23x 0.00x 0.01x

Debt/Total Capital 6.9% 14.3% 14.7% 10.3% 5.1% 0.1% 0.1%

CFO $1,389 $1,259 $1,331 $1,132 $923 $863 $616

Capex 446 985 1,080 771 643 417 378

FCF $943 $274 $251 $360 $280 $446 $238

CFO / Revs 14.2% 12.1% 14.1% 14.5% 14.5% 16.3% 15.1%

Capex / Revs 4.6% 9.5% 11.5% 9.9% 10.1% 7.9% 9.3%

FCF / Revs 9.7% 2.6% 2.7% 4.6% 4.4% 8.4% 5.8%

Total Assets $5,577 $5,673 $5,344 $4,429 $3,514 $3,387 $2,779

Asset Turnover 1.75x 1.83x 1.76x 1.76x 1.81x 1.56x 1.47x

Issuance of Stock $57 $112 $177 $159 $164 $138 $107

Repurchase of Stock 0 (311) (997) (854) (1,114) (203) (76)

Net Repurchases $57 $424 $1,174 $1,013 $1,277 $341 $183

Dividends 0 0 0 0 0 0 0

Return of Capital $57 $424 $1,174 $1,013 $1,277 $341 $183

RoC/CFO 4.1% 33.7% 88.2% 89.5% 138.4% 39.5% 29.7%

PEET

2008 2007 2006 2005 2004 2003 2002

Revenues $285 $249 $210 $175 $146 $120 $104

less: COGS 134 118 99 81 68 55 48

Gross Profit $151 $131 $112 $94 $78 $65 $56

less: SG&A 23 23 21 13 11 10 11

EBITDA $129 $108 $91 $81 $66 $55 $45

less: D&A 13 11 9 7 6 5 5

EBIT $116 $97 $82 $74 $61 $50 $40

less: Operating Leases 15 12 10 8 8 6 5

less: Taxes 7 5 5 7 5 3 3

NOPAT $95 $80 $68 $59 $48 $40 $32

Total Debt $0 $0 $0 $0 $0 $0 $1

PV of Operating Leases 103 98 75 49 35 28 24

Total Preferred Stock 0 0 0 0 0 0 0

Total Equity 144 147 127 127 109 95 81

Total Capital $247 $246 $203 $176 $144 $124 $105

ROIC 38.6% 39.6% 38.5% 40.6% 38.6% 38.1% 59.7%

Gross Margin 53.1% 52.5% 53.0% 53.9% 53.5% 54.1% 53.7%

EBITDA Margin 45.2% 43.4% 43.2% 46.2% 45.6% 45.5% 42.9%

EBIT Margin 40.7% 39.1% 39.1% 42.1% 41.6% 41.4% 38.5%

NOPAT Margin 33.3% 32.2% 32.2% 33.4% 32.7% 33.5% 31.0%

Debt/EBITDA 0.00x 0.00x 0.00x 0.00x 0.00x 0.00x 0.02x

Debt/Total Capital 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.8%

CFO $25 $20 $18 $20 $20 $17 $12

Capex 26 31 44 14 15 10 9

FCF ($0) ($11) ($27) $5 $5 $7 $2

CFO / Revs 8.9% 8.1% 8.4% 11.1% 13.4% 13.9% 11.2%

Capex / Revs 9.1% 12.4% 21.1% 8.0% 10.3% 8.3% 9.0%

FCF / Revs (0.2%) (4.3%) (12.7%) 3.1% 3.2% 5.6% 2.2%

Total Assets $176 $178 $153 $149 $128 $110 $95

Asset Turnover 1.62x 1.40x 1.38x 1.18x 1.14x 1.08x 1.09x

Issuance of Stock $3 $7 $4 $8 $7 $6 $45

Repurchase of Stock (21) 0 (16) (5) (5) 0 0

Net Repurchases $24 $7 $20 $13 $12 $6 $45

Dividends 0 0 0 0 0 0 0

Return of Capital $24 $7 $20 $13 $12 $6 $45

RoC/CFO 93.4% 36.4% 111.5% 65.0% 62.3% 36.5% 386.4%

Coffee) - 10 years

2001 2000 1999 1998

$3,289 $2,649 $2,178 $1,687

2,457 1,981 1,667 1,291

$832 $668 $511 $396

235 180 110 90

$598 $488 $401 $306

211 164 130 98

$387 $325 $270 $208

225 171 131 97

126 108 66 62

$36 $47 $73 $49

$6 $6 $7 $8

2,011 1,655 1,039 805

0 0 0 0

1,723 1,376 1,148 961

$3,740 $3,037 $2,195 $1,774

1.2% 2.1% 4.1%

25.3% 25.2% 23.5% 23.5%

18.2% 18.4% 18.4% 18.1%

11.8% 12.3% 12.4% 12.3%

1.1% 1.8% 3.4% 2.9%

0.01x 0.01x 0.02x 0.03x

0.2% 0.2% 0.3% 0.4%

$497 $456 $319

394 384 316

$102 $72 $2

15.1% 17.2% 14.6%

12.0% 14.5% 14.5%

3.1% 2.7% 0.1%

$2,214 $1,847 $1,492

1.49x 1.43x 1.46x

$107 $60 $10

(52) (50) 0

$160 $109 $10

0 0 0

$160 $109 $10

32.2% 24.0% 3.2%

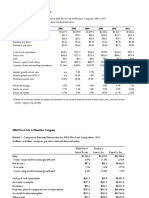

DDRX

2001 2000 1999 1998 2008 2007 2006 2005

$94 $84 $69 $60 Revenues $62 $40 $37 $31

45 41 34 30 less: COGS 48 33 24 19

$49 $44 $35 $29 Gross Prof $14 $7 $12 $12

11 12 9 7 less: SG&A 7 7 7 11

$38 $32 $26 $22 EBITDA $7 ($0) $6 $0

5 5 3 3 less: D&A 2 1 1 1

$33 $27 $23 $19 EBIT $5 ($1) $5 ($1)

5 4 3 3 less: Opera 1 1 4 4

1 (1) 0 0 less: Taxes (0) (0) (2) (1)

$27 $23 $19 $16 NOPAT $5 ($2) $3 ($5)

$3 $21 $16 $12 Total Debt $4 $2 $0 $0

22 24 24 24 PV of Oper 7 21 25 46

0 0 0 0 Total Prefe 0 0 0 0

29 9 11 11 Total Equit 14 9 23 24

$54 $54 $51 $47 Total Capi $25 $32 $49 $70

50.6% 45.7% 41.2% ROIC 14.3% (3.9%) 4.4% (7.0%)

51.9% 51.8% 51.3% 49.3% Gross Mar 23.1% 17.5% 33.8% 38.1%

40.2% 37.6% 38.2% 36.8% EBITDA Ma 11.5% (0.0%) 15.6% 0.7%

34.9% 32.1% 33.3% 32.3% EBIT Marg 8.5% (2.9%) 12.7% (3.1%)

29.1% 27.7% 28.2% 27.3% NOPAT Ma 7.3% (4.7%) 8.4% (14.7%)

0.09x 0.66x 0.59x 0.55x Debt/EBIT 0.60x (174.00x) 0.00x 0.00x

6.3% 38.4% 30.6% 25.7% Debt/Total 17.1% 5.5% 0.0% 0.0%

$6 $3 $6 CFO ($3) ($6) ($7) ($5)

7 6 10 Capex 1 4 2 1

($1) ($3) ($4) FCF ($4) ($10) ($9) ($6)

6.1% 3.2% 9.1% CFO / Rev (4.8%) (15.3%) (18.7%) (15.3%)

7.3% 6.9% 14.6% Capex / R 1.1% 10.8% 6.7% 4.1%

(1.1%) (3.7%) (5.5%) FCF / Rev (5.9%) (26.0%) (25.3%) (19.5%)

$41 $40 $35 Total Asse $27 $22 $33 $34

2.28x 2.12x 1.99x Asset Tur 2.31x 1.80x 1.10x 0.90x

$20 $0 $0 Issuance of $0 $0 $0 $0

0 0 0 Repurchase 0 0 0 0

$20 $0 $0 Net Repur $0 $0 $0 $0

0 0 0 Dividends 0 0 0 0

$20 $0 $0 Return of $0 $0 $0 $0

339.6% 0.4% 6.9% RoC/CFO 0.0% 0.0% 0.0% 0.0%

2004 2003 2002 2001 2000 1999 1998

$26 $51 $53 $62 $72 $74 $10

15 41 43 48 57 59 8

$11 $10 $10 $14 $15 $15 $2

10 10 9 10 11 16 2

$1 ($0) $1 $4 $4 ($1) ($0)

1 2 2 2 4 4 1

$0 ($2) ($2) $2 $0 ($5) ($1)

3 4 5 6 7 8 3

(2) (1) (1) 0 0 0 0

($2) ($5) ($6) ($4) ($7) ($13) ($4)

$0 $2 $4 $4 $7 $12 $4

33 30 15 18 20 31 9

0 0 0 0 0 0 0

32 16 16 18 17 15 4

$64 $48 $35 $40 $43 $58 $17

(3.5%) (15.8%) (14.0%) (9.1%) (12.3%) (76.8%)

42.7% 18.8% 18.6% 22.2% 21.0% 20.4% 18.9%

4.8% (0.1%) 1.3% 6.7% 6.2% (0.9%) (0.5%)

0.5% (4.7%) (2.9%) 2.8% 0.0% (6.7%) (12.2%)

(6.6%) (10.8%) (10.6%) (6.3%) (9.8%) (17.4%) (40.0%)

0.33x (30.60x) 5.58x 0.99x 1.46x (18.31x) (78.20x)

0.6% 3.2% 10.6% 10.5% 15.2% 20.4% 23.3%

($3) $4 $2 $0 ($0) ($1)

1 3 2 1 2 3

($4) $1 ($0) ($0) ($2) ($4)

(11.3%) 7.4% 2.9% 0.7% (0.3%) (0.9%)

5.6% 5.0% 3.7% 1.5% 2.4% 4.6%

(16.9%) 2.4% (0.8%) (0.8%) (2.7%) (5.5%)

$40 $25 $26 $28 $32 $40

0.64x 2.02x 2.02x 2.19x 2.26x 1.83x

$0 $0 $0 $0 $0 $0

0 0 0 0 0 0

$0 $0 $0 $0 $0 $0

0 0 0 0 0 0

$0 $0 $0 $0 $0 $0

0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

PEET & DDRX

2008 2007 2006 2005 2004 2003 2002

Revenues $347 $289 $247 $206 $171 $171 $157

less: COGS 181 151 123 100 83 96 91

Gross Profit $166 $138 $124 $106 $89 $74 $66

less: SG&A 30 30 27 25 21 20 20

EBITDA $136 $108 $97 $81 $68 $54 $45

less: D&A 15 12 10 8 7 7 7

EBIT $121 $96 $87 $73 $61 $47 $39

less: Operating Leases 15 13 14 12 11 10 10

less: Taxes 6 5 3 6 4 2 2

NOPAT $99 $78 $71 $54 $46 $35 $27

Total Debt $4 $2 $0 $0 $0 $2 $5

PV of Operating Leases 110 119 101 95 68 58 39

Total Preferred Stock 0 0 0 0 0 0 0

Total Equity 158 156 151 151 141 112 97

Total Capital $272 $277 $251 $246 $209 $172 $140

ROIC 35.8% 31.2% 28.7% 25.9% 26.8% 24.8% 28.5%

Gross Margin 47.7% 47.7% 50.2% 51.5% 51.8% 43.6% 41.9%

EBITDA Margin 39.2% 37.4% 39.1% 39.5% 39.5% 31.9% 28.9%

EBIT Margin 34.9% 33.3% 35.2% 35.3% 35.4% 27.7% 24.6%

NOPAT Margin 28.6% 27.1% 28.6% 26.3% 26.8% 20.3% 17.0%

Debt/EBITDA 0.03x 0.02x 0.00x 0.00x 0.01x 0.03x 0.10x

Debt/Total Capital 1.6% 0.6% 0.0% 0.0% 0.2% 0.9% 3.3%

CFO $22 $14 $11 $15 $17 $20 $13

Capex 27 35 47 15 16 12 11

FCF ($4) ($21) ($36) ($1) $0 $8 $2

CFO / Revs 6.5% 4.8% 4.4% 7.2% 9.7% 12.0% 8.4%

Capex / Revs 7.7% 12.1% 19.0% 7.4% 9.6% 7.3% 7.2%

FCF / Revs (1.2%) (7.3%) (14.5%) (0.2%) 0.1% 4.7% 1.2%

Total Assets $203 $200 $186 $183 $168 $136 $121

Asset Turnover 1.71x 1.45x 1.33x 1.13x 1.02x 1.26x 1.29x

Issuance of Stock $3 $7 $4 $8 $7 $6 $45

Repurchase of Stock (21) 0 (16) (5) (5) 0 0

Net Repurchases $24 $7 $20 $13 $12 $6 $45

Dividends 0 0 0 0 0 0 0

Return of Capital $24 $7 $20 $13 $12 $6 $45

RoC/CFO 106.0% 52.2% 181.3% 85.7% 73.1% 29.7% 340.9%

2001 2000 1999 1998

$156 $157 $143 $70

94 98 93 39

$63 $59 $51 $31

21 23 25 9

$42 $36 $26 $22

8 9 8 4

$35 $27 $18 $18

10 11 11 6

1 (1) 0 0

$24 $16 $7 $12

$8 $27 $27 $16

40 44 55 33

0 0 0 0

47 26 26 15

$94 $97 $109 $64

24.3% 15.0% 10.3%

40.2% 37.6% 35.3% 44.8%

27.0% 23.1% 18.0% 31.3%

22.2% 17.3% 12.6% 25.7%

15.1% 10.4% 4.6% 17.4%

0.18x 0.76x 1.06x 0.73x

8.0% 28.2% 25.2% 25.1%

$6 $2 $6

8 8 14

($2) ($5) ($8)

4.0% 1.6% 3.9%

5.0% 4.8% 9.4%

(1.0%) (3.3%) (5.5%)

$70 $72 $75

2.24x 2.19x 1.91x

$20 $0 $0

0 0 0

$20 $0 $0

0 0 0

$20 $0 $0

315.1% 0.4% 7.7%

Вам также может понравиться

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- BNI 111709 v2Документ2 страницыBNI 111709 v2fcfroicОценок пока нет

- Tire City Case AnalysisДокумент10 страницTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Оценок пока нет

- Lady M DCF TemplateДокумент4 страницыLady M DCF Templatednesudhudh100% (1)

- UST Debt Policy Spreadsheet (Reduced)Документ9 страницUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonОценок пока нет

- Bbby 4Q2014Документ3 страницыBbby 4Q2014RahulBakshiОценок пока нет

- FM and Dupont of GenpactДокумент11 страницFM and Dupont of GenpactKunal GarudОценок пока нет

- Lesson 3Документ29 страницLesson 3Anh MinhОценок пока нет

- Flash - Memory - Inc From Website 0515Документ8 страницFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Genzyme DCF PDFДокумент5 страницGenzyme DCF PDFAbinashОценок пока нет

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Документ18 страниц1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeОценок пока нет

- 07 12 Sensitivity Tables AfterДокумент30 страниц07 12 Sensitivity Tables Aftermerag76668Оценок пока нет

- 04 06 Public Comps Valuation Multiples AfterДокумент19 страниц04 06 Public Comps Valuation Multiples AfterShanto Arif Uz ZamanОценок пока нет

- Apple & RIM Merger Model and LBO ModelДокумент50 страницApple & RIM Merger Model and LBO ModelDarshana MathurОценок пока нет

- Mercury CaseДокумент23 страницыMercury Caseuygh gОценок пока нет

- Apple Case StudyДокумент2 страницыApple Case StudyPrakhar MorchhaleОценок пока нет

- $ in Millions, Except Per Share DataДокумент59 страниц$ in Millions, Except Per Share DataTom HoughОценок пока нет

- Income Statement and Balance Sheet AnalysisДокумент21 страницаIncome Statement and Balance Sheet AnalysisZeusОценок пока нет

- Revised ModelДокумент27 страницRevised ModelAnonymous 0CbF7xaОценок пока нет

- TN-1 TN-2 Financials Cost CapitalДокумент9 страницTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Tire City ExhibitsДокумент7 страницTire City ExhibitsAyushi GuptaОценок пока нет

- Case StudyДокумент9 страницCase Studyzahraa aabedОценок пока нет

- Análisis Equipo Nutresa Lina - Caso HanssenДокумент24 страницыAnálisis Equipo Nutresa Lina - Caso HanssenSARA ZAPATA CANOОценок пока нет

- Active Gear Historical Income Statement Operating Results Revenue Gross ProfitДокумент20 страницActive Gear Historical Income Statement Operating Results Revenue Gross ProfitJoan Alejandro MéndezОценок пока нет

- Declining Checks IndustryДокумент2 страницыDeclining Checks IndustryHEM BANSALОценок пока нет

- Solucion Caso Lady MДокумент13 страницSolucion Caso Lady Mjohana irma ore pizarroОценок пока нет

- Final Sheet DCF - With SynergiesДокумент4 страницыFinal Sheet DCF - With SynergiesAngsuman BhanjdeoОценок пока нет

- Cariboo Case StudyДокумент6 страницCariboo Case Studyzahraa aabedОценок пока нет

- Análisis Equipo Nutresa Lina - Caso Hanssen VFinalДокумент28 страницAnálisis Equipo Nutresa Lina - Caso Hanssen VFinalSARA ZAPATA CANOОценок пока нет

- Análisis Equipo Nutresa Lina - Caso Hanssen V2Документ27 страницAnálisis Equipo Nutresa Lina - Caso Hanssen V2SARA ZAPATA CANOОценок пока нет

- Woof-JunctionДокумент13 страницWoof-Junctionlauvictoria29Оценок пока нет

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Документ6 страницSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoОценок пока нет

- I. Income StatementДокумент27 страницI. Income StatementNidhi KaushikОценок пока нет

- Lenovo Intergration Plan Annual 2004 PresentationДокумент26 страницLenovo Intergration Plan Annual 2004 PresentationKelvin Lim Wei LiangОценок пока нет

- CLW Analysis 6-1-21Документ5 страницCLW Analysis 6-1-21HunterОценок пока нет

- Current Financial Analysis and ValuationДокумент30 страницCurrent Financial Analysis and ValuationAbhinav PandeyОценок пока нет

- Trabajo Final DireccionДокумент17 страницTrabajo Final DireccionAnani RomeroОценок пока нет

- ATH Technologies TemplateДокумент2 страницыATH Technologies TemplateamitОценок пока нет

- Raw Input Calculated Financial Projections and ValuationДокумент5 страницRaw Input Calculated Financial Projections and ValuationFırat ŞıkОценок пока нет

- Iblf Excel (Mehedi)Документ12 страницIblf Excel (Mehedi)Md. Mehedi HasanОценок пока нет

- Supplement Du Pont 1983Документ13 страницSupplement Du Pont 1983Eesha KОценок пока нет

- Class Exercise Fashion Company Three Statements Model - CompletedДокумент16 страницClass Exercise Fashion Company Three Statements Model - CompletedbobОценок пока нет

- Polaroid Corporation ENGLISHДокумент14 страницPolaroid Corporation ENGLISHAtul AnandОценок пока нет

- Harley-Davidson Motor Co.: Enterprise Software SelectionДокумент4 страницыHarley-Davidson Motor Co.: Enterprise Software Selectionjuan guerreroОценок пока нет

- Assumptions For Forecasting Model: Income StatementДокумент9 страницAssumptions For Forecasting Model: Income StatementRadhika SarawagiОценок пока нет

- Bakery Break-even Analysis and 5 Year Financial ProjectionsДокумент6 страницBakery Break-even Analysis and 5 Year Financial ProjectionsMOHIT MARHATTAОценок пока нет

- Amazon ValuationДокумент22 страницыAmazon ValuationDr Sakshi SharmaОценок пока нет

- Revenue: Mcdonald'S Corporation Income Statement Horizontal Analysis For The Year Ended December 31,2010 and 2012Документ11 страницRevenue: Mcdonald'S Corporation Income Statement Horizontal Analysis For The Year Ended December 31,2010 and 2012Reymark BaldoОценок пока нет

- Meerut Adventure Company CV1Документ9 страницMeerut Adventure Company CV1Ayushi GuptaОценок пока нет

- HBS Tire City Solution 1Документ5 страницHBS Tire City Solution 1Abhinav KumarОценок пока нет

- DPC Case SolutionДокумент11 страницDPC Case Solutionburiticas992Оценок пока нет

- Sample Business Plan Excel TemplateДокумент27 страницSample Business Plan Excel TemplateAndriyadi MardinОценок пока нет

- Netflix Financial StatementsДокумент2 страницыNetflix Financial StatementsGoutham RaoОценок пока нет

- Common Size Income StatementДокумент7 страницCommon Size Income StatementUSD 654Оценок пока нет

- Polaroid 1996 CalculationДокумент8 страницPolaroid 1996 CalculationDev AnandОценок пока нет

- Mercury Athletic Footwear Answer Key FinalДокумент41 страницаMercury Athletic Footwear Answer Key FinalFatima ToapantaОценок пока нет

- Wild Wood Case StudyДокумент6 страницWild Wood Case Studyaudrey gadayОценок пока нет

- Hill Country Snack Foods CompanyДокумент14 страницHill Country Snack Foods CompanyVeni GuptaОценок пока нет

- LORL Write UpДокумент5 страницLORL Write UpAIGswap100% (1)

- Dollar ThriftyДокумент80 страницDollar ThriftyfcfroicОценок пока нет

- The ATlAnTic CenTuryДокумент40 страницThe ATlAnTic CenTurywinfly9038Оценок пока нет

- Secondaries Q1 2010Документ4 страницыSecondaries Q1 2010fcfroicОценок пока нет

- CDO Meltdown Harvard PaperДокумент115 страницCDO Meltdown Harvard PaperpframpОценок пока нет

- Real Exchange Rates and Cap Flows 011011Документ34 страницыReal Exchange Rates and Cap Flows 011011fcfroicОценок пока нет

- Key Numbers CFO SurveyДокумент2 страницыKey Numbers CFO SurveyfcfroicОценок пока нет

- Solving The Present Crisis and Managing The Leverage Cycle: John GeanakoplosДокумент31 страницаSolving The Present Crisis and Managing The Leverage Cycle: John GeanakoplosfcfroicОценок пока нет

- Financial Crisis of 2007-2010Документ36 страницFinancial Crisis of 2007-2010fcfroic100% (2)

- Kahneman and Renshon Why Hawks WinДокумент6 страницKahneman and Renshon Why Hawks WinfcfroicОценок пока нет

- SEC OIG Report Stanford April 2010Документ159 страницSEC OIG Report Stanford April 2010lynch4814Оценок пока нет

- Tiffanys Measures of ProfitabilityДокумент1 страницаTiffanys Measures of ProfitabilityfcfroicОценок пока нет

- Singleton 1979 ForbesДокумент6 страницSingleton 1979 ForbesfcfroicОценок пока нет

- Serco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPДокумент4 страницыSerco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPfcfroicОценок пока нет

- Serco Ratio AnalysisДокумент4 страницыSerco Ratio Analysisfcfroic0% (1)

- Financing Affordable Housing in EuropeДокумент62 страницыFinancing Affordable Housing in EuropeUnited Nations Human Settlements Programme (UN-HABITAT)100% (2)

- Week 3 - Discussion 1Документ4 страницыWeek 3 - Discussion 1fcfroicОценок пока нет

- China Green Agriculture Working Capital AnalysisДокумент2 страницыChina Green Agriculture Working Capital AnalysisfcfroicОценок пока нет

- Recent Raytheon News 120209Документ1 страницаRecent Raytheon News 120209fcfroicОценок пока нет

- NVCA's 4-Pillar Plan To Restore Liquidity in The US VC IndustryДокумент3 страницыNVCA's 4-Pillar Plan To Restore Liquidity in The US VC IndustryfcfroicОценок пока нет

- Broadridge Financial Solutions: Company Most Recent Report DateДокумент12 страницBroadridge Financial Solutions: Company Most Recent Report DatefcfroicОценок пока нет

- GT Wakeup CallДокумент44 страницыGT Wakeup CallZerohedgeОценок пока нет

- Water Comps 2Q09 v23Документ739 страницWater Comps 2Q09 v23fcfroicОценок пока нет

- Risk MGMT and RailRoad IndustryДокумент6 страницRisk MGMT and RailRoad IndustryfcfroicОценок пока нет

- DHR Analysis 3Q09 vFINALДокумент83 страницыDHR Analysis 3Q09 vFINALfcfroicОценок пока нет

- Still Living Without The BasicsДокумент215 страницStill Living Without The BasicsfcfroicОценок пока нет

- Tci Final Testimony W AttachmentsДокумент41 страницаTci Final Testimony W Attachmentsfcfroic100% (1)

- Executive CompensationДокумент64 страницыExecutive CompensationfcfroicОценок пока нет

- Executive Pay: Regulation vs. Market Competition, Cato Policy Analysis No. 619Документ16 страницExecutive Pay: Regulation vs. Market Competition, Cato Policy Analysis No. 619Cato InstituteОценок пока нет

- How Is Efficient and Affordable Urban Mass Transport Key To The Rapid Economic Development in India?Документ2 страницыHow Is Efficient and Affordable Urban Mass Transport Key To The Rapid Economic Development in India?Zeba HasanОценок пока нет

- ARCHITECTURALДокумент117 страницARCHITECTURALElvis Felix fernandesОценок пока нет

- ICT SyllabusДокумент3 страницыICT SyllabusKayОценок пока нет

- Emaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementsДокумент52 страницыEmaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementssafSDgSggОценок пока нет

- Valuation Chapter 4 FinManДокумент40 страницValuation Chapter 4 FinManSteven Kyle PeregrinoОценок пока нет

- Accruals & Deferrals Errors AuditДокумент2 страницыAccruals & Deferrals Errors AuditHaidee Flavier SabidoОценок пока нет

- Talent Assessment Aptitude Tests JapanДокумент12 страницTalent Assessment Aptitude Tests JapanjboozeОценок пока нет

- KFC Resource Based Operation Strategy MatrixДокумент6 страницKFC Resource Based Operation Strategy MatrixRamalu Dinesh ReddyОценок пока нет

- Is It Wise To Challenge The Usefulness of Cost andДокумент3 страницыIs It Wise To Challenge The Usefulness of Cost andMomoh PessimaОценок пока нет

- Topic 5 Set 3 Week 4 Problem SolutionsДокумент11 страницTopic 5 Set 3 Week 4 Problem Solutionsjuan benitezОценок пока нет

- Introducing Dawlance Electronics Internationally and Upgrading to AIДокумент32 страницыIntroducing Dawlance Electronics Internationally and Upgrading to AISyed Huzayfah Faisal100% (1)

- Solution Manual For Accounting Information Systems 13th Edition Romney, SteinbartДокумент10 страницSolution Manual For Accounting Information Systems 13th Edition Romney, Steinbarta672546400100% (1)

- Green Marketing and Quality Brand as Predictors of Consumer Behavior and Its Impact on Purchase DecisionsДокумент21 страницаGreen Marketing and Quality Brand as Predictors of Consumer Behavior and Its Impact on Purchase DecisionsrizalОценок пока нет

- FINMANДокумент6 страницFINMANGwyneth W PaghinayanОценок пока нет

- Sai Computer Centre and Xerox: Add: XXXXXXXXX Dist. XXXXXXX, MaharashtraДокумент9 страницSai Computer Centre and Xerox: Add: XXXXXXXXX Dist. XXXXXXX, MaharashtraBalaji YadavОценок пока нет

- Trương Hoàng Bình Sơn - Reflection 2Документ11 страницTrương Hoàng Bình Sơn - Reflection 2Quoc Anh HaОценок пока нет

- Supply Chain Management For DummiesДокумент4 страницыSupply Chain Management For DummiesPrashant Anand50% (6)

- Individual AssignmentДокумент3 страницыIndividual AssignmentLoveness NyakurimwaОценок пока нет

- A Study On Sales Promotion Effectiveness: SRM UniversityДокумент70 страницA Study On Sales Promotion Effectiveness: SRM UniversityKavin KavinОценок пока нет

- Consumer Behavior Services Context: Services Marketing 7e, Global EditionДокумент35 страницConsumer Behavior Services Context: Services Marketing 7e, Global Editionlaith alakelОценок пока нет

- Learning & Development Activity Enrollment Form: Employee-Applicant DataДокумент17 страницLearning & Development Activity Enrollment Form: Employee-Applicant DataEvelyn dela CruzОценок пока нет

- Acc CH1Документ5 страницAcc CH1Trickster TwelveОценок пока нет

- Shipping Statistics and Market ReviewДокумент17 страницShipping Statistics and Market ReviewMiguel PachecoОценок пока нет

- Document 1Документ18 страницDocument 1tharaОценок пока нет

- Isuawealthyplace Com Guide To Start Affiliate Marketing in NigeriaДокумент20 страницIsuawealthyplace Com Guide To Start Affiliate Marketing in NigeriaLtc MineОценок пока нет

- Lehman - Index Arbitrage - A PrimerДокумент6 страницLehman - Index Arbitrage - A Primerleetaibai100% (1)

- Ensuring Supply Chain Quality Through CoordinationДокумент5 страницEnsuring Supply Chain Quality Through CoordinationJohn MwangiОценок пока нет

- Problem No. 1: Ap - 1Stpb - 05.07Документ10 страницProblem No. 1: Ap - 1Stpb - 05.07AnnОценок пока нет

- Business Model CanvasДокумент2 страницыBusiness Model CanvasRonald IpeОценок пока нет

- Homework Economics Chapter 3 Interdependence and The Gains From Trade Sept 21 2022 Ver 100Документ5 страницHomework Economics Chapter 3 Interdependence and The Gains From Trade Sept 21 2022 Ver 100叶睿阳Оценок пока нет