Академический Документы

Профессиональный Документы

Культура Документы

Bond Pricing - Basics

Загружено:

api-37631380 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров2 страницыАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров2 страницыBond Pricing - Basics

Загружено:

api-3763138Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

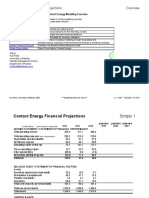

BOND PRICING Basics Annual Percentage Rate

Inputs

Rate Convention: 1 = EAR, 0 = APR 0

Annual Coupon Rate (CR) 5.0%

Yield to Maturity (Annualized) (y) 9.0%

Number of Payments / Year (NOP) 2

Number of Periods to Maturity (T) 8

Face Value (FV) $1,000

Outputs

Discount Rate / Period (RATE) 4.5%

Coupon Payment (PMT) $25

Calculate Bond Price using the Cash Flows

Period 0 1 2 3 4 5 6

Time (Years) 0.0 0.5 1.0 1.5 2.0 2.5 3.0

Cash Flows $25.00 $25.00 $25.00 $25.00 $25.00 $25.00

Present Value of Cash Flow $23.92 $22.89 $21.91 $20.96 $20.06 $19.20

Bond Price $868.08

Calculate Bond Price using the Formula

Bond Price $868.08

Calculate Bond Price using the PV Function

Bond Price $868.08

Calculate Bond Price using the PRICE Function (under APR)

Bond Price $868.08

7 8

3.5 4.0

$25.00 $1,025.00

$18.37 $720.76

Вам также может понравиться

- 2.2) APR and EARДокумент4 страницы2.2) APR and EARCody Alan SmithОценок пока нет

- Bond Convexity - BasicsДокумент2 страницыBond Convexity - Basicsapi-3763138Оценок пока нет

- Bond Duration - BasicsДокумент2 страницыBond Duration - Basicsapi-3763138Оценок пока нет

- Chapter 16Документ25 страницChapter 16Semh ZavalaОценок пока нет

- UMGC Finance HW #4Документ9 страницUMGC Finance HW #4Kimora BrockОценок пока нет

- Real Estate Excel Functions TutorialДокумент14 страницReal Estate Excel Functions Tutorialajohnson79100% (2)

- 2019-09-21T174353.577Документ4 страницы2019-09-21T174353.577Mikey MadRat100% (1)

- Week 8 Capital Budgeting ApplicationsДокумент6 страницWeek 8 Capital Budgeting ApplicationsFayzan RafiqОценок пока нет

- Net Present Value and Other Investment RulesДокумент38 страницNet Present Value and Other Investment RulesBussines LearnОценок пока нет

- Financial CalculatorДокумент58 страницFinancial CalculatorAngela HarringtonОценок пока нет

- CCIM Financial Calculator V 7 1Документ60 страницCCIM Financial Calculator V 7 1rclemente01Оценок пока нет

- Making Capital Investment DecisionsДокумент42 страницыMaking Capital Investment Decisionsgabisan1087Оценок пока нет

- Chapter 15Документ39 страницChapter 15Semh ZavalaОценок пока нет

- LeasingДокумент10 страницLeasinggabisan1087Оценок пока нет

- NPV (Discount Rate, Range of Values) +investmentДокумент7 страницNPV (Discount Rate, Range of Values) +investmentNgân NguyễnОценок пока нет

- 8.1. Investment Criteria: Year Cash Flow PVДокумент11 страниц8.1. Investment Criteria: Year Cash Flow PVMichelle Miranda HernándezОценок пока нет

- Inputs For Valuation Current InputsДокумент6 страницInputs For Valuation Current InputsÃarthï ArülrãjОценок пока нет

- FcffevaДокумент6 страницFcffevaShobhit GoyalОценок пока нет

- She-Ra Newell Assignment 2-Pickins Mining CompanyДокумент5 страницShe-Ra Newell Assignment 2-Pickins Mining CompanyWarda AhsanОценок пока нет

- S16 - Scenario Manager - NPVДокумент9 страницS16 - Scenario Manager - NPVSRISHTI ARORAОценок пока нет

- Apple TTMДокумент25 страницApple TTMQuofi SeliОценок пока нет

- What Is Leveraged Buyout Model Aka LBO Model?Документ5 страницWhat Is Leveraged Buyout Model Aka LBO Model?bhumiklalka999Оценок пока нет

- Chapter 9 Case Question FinanceДокумент3 страницыChapter 9 Case Question FinanceBhargavОценок пока нет

- KR Valuation 28 Sept 2019Документ54 страницыKR Valuation 28 Sept 2019ket careОценок пока нет

- Beatrice Peabody ExcelДокумент4 страницыBeatrice Peabody Excelseth litchfieldОценок пока нет

- Bond Pricing - Dynamic ChartДокумент4 страницыBond Pricing - Dynamic Chartapi-3763138Оценок пока нет

- S16 - Scenario Manager - NPV - ClassДокумент11 страницS16 - Scenario Manager - NPV - ClassABHAY VEER SINGHОценок пока нет

- Bond Pricing - System of Five Bond VariablesДокумент2 страницыBond Pricing - System of Five Bond Variablesapi-3763138Оценок пока нет

- Financial StatДокумент11 страницFinancial StatYaqin YusufОценок пока нет

- Financial StatДокумент11 страницFinancial StatYaqin YusufОценок пока нет

- Financial StatДокумент11 страницFinancial StatYaqin YusufОценок пока нет

- Year 0 1 Costs Benefits Cost of Capital Terminal ValueДокумент4 страницыYear 0 1 Costs Benefits Cost of Capital Terminal ValueSanjna ChimnaniОценок пока нет

- NPV Using General Discounting Nominal RateДокумент3 страницыNPV Using General Discounting Nominal RatekayteeminiОценок пока нет

- Discount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Документ13 страницDiscount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Futuresow support zone BangladeshОценок пока нет

- Time Value of Money: Professor XXX Course Name/numberДокумент34 страницыTime Value of Money: Professor XXX Course Name/numbersumuewuОценок пока нет

- Example Sensitivity AnalysisДокумент4 страницыExample Sensitivity Analysismc lim100% (1)

- Solar Energy Cash Flow Canadian Solar Share XLS Stripped 01Документ40 страницSolar Energy Cash Flow Canadian Solar Share XLS Stripped 01Bhaskar Vijay SinghОценок пока нет

- Inputs For Valuation Current InputsДокумент6 страницInputs For Valuation Current Inputsapi-3763138Оценок пока нет

- Bond ValuationДокумент17 страницBond ValuationMatthew RyanОценок пока нет

- Rate 7% 15 40 75 Forever $ (5,500.00) PV $ 50,093.53 $ 73,324.40 $ 78,079.98 $ 78,571.43Документ18 страницRate 7% 15 40 75 Forever $ (5,500.00) PV $ 50,093.53 $ 73,324.40 $ 78,079.98 $ 78,571.43Arpi OrujyanОценок пока нет

- Part 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Документ7 страницPart 1 (Weight: 50%) : Show Your Calculations and Results Similar To Table 6.1 and 6.2 (Book Example)Arpi OrujyanОценок пока нет

- CCIM Financial Calculator V 6.0Документ63 страницыCCIM Financial Calculator V 6.0Wade KellyОценок пока нет

- Datos Generales: Unidades ProducidasДокумент10 страницDatos Generales: Unidades ProducidasJavier Lopez RodriguezОценок пока нет

- FCF Ch10 Excel Master StudentДокумент32 страницыFCF Ch10 Excel Master StudentTosa EndrawanОценок пока нет

- FM Assaignment Second SemisterДокумент9 страницFM Assaignment Second SemisterMotuma Abebe100% (1)

- Scenario Summary: Changing Cells: Result CellsДокумент9 страницScenario Summary: Changing Cells: Result CellsatpugajoopОценок пока нет

- MSFT Valuation 28 Sept 2019Документ51 страницаMSFT Valuation 28 Sept 2019ket careОценок пока нет

- Lease Financing AssignmentДокумент8 страницLease Financing AssignmentAshraful IslamОценок пока нет

- How Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next YearДокумент7 страницHow Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next Yearamaresh mahapatraОценок пока нет

- Sypder Group10Документ8 страницSypder Group10ChallaKoundinyaVinayОценок пока нет

- Scenario Summary: Changing Cells: Result CellsДокумент5 страницScenario Summary: Changing Cells: Result CellsNitin JoyОценок пока нет

- NPV & IrrДокумент58 страницNPV & IrrAira DacilloОценок пока нет

- Revised ModelДокумент27 страницRevised ModelAnonymous 0CbF7xaОценок пока нет

- Busi 331 Project 1 Marking Guide: HandbookДокумент28 страницBusi 331 Project 1 Marking Guide: HandbookDilrajSinghОценок пока нет

- Compare Project A & B On The Following 5 Decison Criteria: Output AreaДокумент11 страницCompare Project A & B On The Following 5 Decison Criteria: Output AreaMeghana ErapagaОценок пока нет

- Project NPV Sensitivity AnalysisДокумент54 страницыProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Growing Market ModelДокумент12 страницGrowing Market ModeljanuarОценок пока нет

- Assignment Dataset 1Документ19 страницAssignment Dataset 1Chip choiОценок пока нет

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyОт EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyОценок пока нет

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachОт EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachРейтинг: 3 из 5 звезд3/5 (3)

- Estimating Growth Rates (Teaching Model)Документ4 страницыEstimating Growth Rates (Teaching Model)api-3763138Оценок пока нет

- SchwartzMoon (2000) Rational Pricing Internet CpyДокумент14 страницSchwartzMoon (2000) Rational Pricing Internet Cpyapi-3763138Оценок пока нет

- Stiglitz Weiss 1981 Implementation by Kurt HessДокумент20 страницStiglitz Weiss 1981 Implementation by Kurt Hessapi-3763138Оценок пока нет

- Δr=α b−r Δt+σε Δt: Simulation of short-term interest ratesДокумент19 страницΔr=α b−r Δt+σε Δt: Simulation of short-term interest ratesapi-3763138Оценок пока нет

- Relative Value Models (Feb04)Документ18 страницRelative Value Models (Feb04)api-3763138Оценок пока нет

- Contact - Main 2006Документ89 страницContact - Main 2006api-3763138Оценок пока нет

- Endowment - Warrant - Valuer (McVerry) DДокумент244 страницыEndowment - Warrant - Valuer (McVerry) Dapi-3763138Оценок пока нет

- Longstaff Schwartz (95) Risky Debt (P)Документ18 страницLongstaff Schwartz (95) Risky Debt (P)api-3763138Оценок пока нет

- Refresh Worksheet ListДокумент14 страницRefresh Worksheet Listapi-3763138Оценок пока нет

- Spline Basis Function Approximating Discount Function Fitting Bond UniverseДокумент5 страницSpline Basis Function Approximating Discount Function Fitting Bond Universeapi-3763138Оценок пока нет

- Degree Polynomial:: Generic Yield Interpolation ChartДокумент9 страницDegree Polynomial:: Generic Yield Interpolation Chartapi-3763138Оценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Term Structure JP Morgan Model (Feb04)Документ7 страницTerm Structure JP Morgan Model (Feb04)api-3763138Оценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Bond Pricing - Dynamic ChartДокумент4 страницыBond Pricing - Dynamic Chartapi-3763138Оценок пока нет

- RV YTM Model PDFДокумент47 страницRV YTM Model PDFAllen LiОценок пока нет

- Bond Pricing - System of Five Bond VariablesДокумент2 страницыBond Pricing - System of Five Bond Variablesapi-3763138Оценок пока нет

- Bond Price With Excel FunctionsДокумент6 страницBond Price With Excel Functionsapi-3763138Оценок пока нет

- Bond Duration - Dynamic ChartДокумент3 страницыBond Duration - Dynamic Chartapi-3763138Оценок пока нет

- Converts PrimerДокумент6 страницConverts Primerjunjun07_01Оценок пока нет

- Input All Yellow Shaded AreasДокумент6 страницInput All Yellow Shaded Areasapi-3763138Оценок пока нет

- Put - Call Parity Model: Synthetic SecuritiesДокумент3 страницыPut - Call Parity Model: Synthetic Securitiesapi-3763138Оценок пока нет

- Bond Convexity - Dynamic ChartДокумент3 страницыBond Convexity - Dynamic Chartapi-3763138Оценок пока нет

- PvtdiscrateДокумент4 страницыPvtdiscrateapi-3763138Оценок пока нет

- Bond Duration - Price Sensitivity Using DurationДокумент3 страницыBond Duration - Price Sensitivity Using Durationapi-3763138Оценок пока нет

- Inputs: Before Restructuring After RestructuringДокумент4 страницыInputs: Before Restructuring After Restructuringapi-3763138Оценок пока нет

- OptltДокумент3 страницыOptltapi-3763138Оценок пока нет