Академический Документы

Профессиональный Документы

Культура Документы

T.D.S. / Tcs Tax Challan: DD MM Yy

Загружено:

ar8ku9sh0aИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

T.D.S. / Tcs Tax Challan: DD MM Yy

Загружено:

ar8ku9sh0aАвторское право:

Доступные форматы

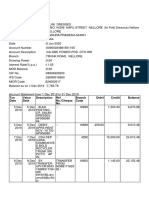

ZENTDS - A KDK Software Product

T.D.S. / TCS TAX CHALLAN Single Copy (to be sent to the ZAO)

Tax Applicable (Tick one)

CHALLAN TAX AT SOURCE FROM

Assessment

Year

NO./ ITNS 281 (0020) COMPANY DEDUCTEES [] (0021) NON-COMPANY DEDUCTEES []

Tax Deduction Account No. (T.A.N.)

Full Name

Complete Address with City & State

Phone No. Pin

Type of Payment Code A

Payable by Tax Payer 200 FOR USE IN RECEIVING BANK

Regular Assessment (Raised by I.T.deptt.) 400 Debit to A/c / Cheque credited on

DETAILS OF PAYMENTS

Amount (In Rs. Only)

DD MM YY

Income Tax SPACE FOR BANK SEAL

Fee under sec. 234E

Surcharge

Education Cess

Interest

Penalty

Total

Total (in words):

CRORES LACS THOUSANDS HUNDERDS TENS UNITS

Paid Dated

Drawn on

(Name of the Bank and Branch)

Date: Signature of the Person making payment Rs.

Taxpayers Counterfoil (To be filled up by tax payer) SPACE FOR BANK SEAL

TAN

Received from .

For Rs.

Rs. (in Words)

Drawn on

(Name of the Bank and Branch)

on account of Tax from

For the Assessment Year Rs.

Remarks

Вам также может понравиться

- TDS ChallanДокумент1 страницаTDS ChallanJayОценок пока нет

- TDS ChallanДокумент1 страницаTDS ChallanJainsanjaykumarОценок пока нет

- Challan 280Документ1 страницаChallan 280Jayesh BajpaiОценок пока нет

- Challan No. ITNS 281Документ1 страницаChallan No. ITNS 281jagdish412301Оценок пока нет

- ImportantДокумент1 страницаImportantWilliam SureshОценок пока нет

- Itns-281 TDS ChallanДокумент1 страницаItns-281 TDS Challanvirendra36999100% (2)

- Income Tax - Bank Remittance CHALLANДокумент1 страницаIncome Tax - Bank Remittance CHALLANvivek anandanОценок пока нет

- For Payment From July 2005 OnwardsДокумент1 страницаFor Payment From July 2005 Onwardsvijay123*75% (4)

- ITNS 280: Challan No. Challan No. ITNS 281Документ1 страницаITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticОценок пока нет

- Challanitns 280Документ1 страницаChallanitns 280saritabh05Оценок пока нет

- Income Tax Challan - 280Документ1 страницаIncome Tax Challan - 280Subrata SarkarОценок пока нет

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearДокумент1 страницаChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaОценок пока нет

- Tds ChallanДокумент2 страницыTds Challannilesh vithalaniОценок пока нет

- Challan No. ITNS 280Документ2 страницыChallan No. ITNS 280RAHUL AGARWALОценок пока нет

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanДокумент3 страницы(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuОценок пока нет

- Challan No./ ITNS 282: Tax Applicable (Tick One)Документ2 страницыChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smОценок пока нет

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankДокумент3 страницыChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaОценок пока нет

- T.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneДокумент5 страницT.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneSachin KumarОценок пока нет

- TDS-ChallanFormatДокумент1 страницаTDS-ChallanFormatAnand_Gupta_6499Оценок пока нет

- Single (Copy To Be Sent The ZAO)Документ1 страницаSingle (Copy To Be Sent The ZAO)James GonzalezОценок пока нет

- PrintTDSChallan (281) 2020-2021 PDFДокумент1 страницаPrintTDSChallan (281) 2020-2021 PDFAmeyОценок пока нет

- Tax Payment Challan 280Документ2 страницыTax Payment Challan 280analystbankОценок пока нет

- Form 281 Candeur Constructions - 92bДокумент1 страницаForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariОценок пока нет

- Zero Zero Three Zero Two Zero: DD MM YyДокумент1 страницаZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonОценок пока нет

- Form 16 BДокумент1 страницаForm 16 BSurendra Kumar BaaniyaОценок пока нет

- Itns 285Документ2 страницыItns 285Anurag SharmaОценок пока нет

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseДокумент10 страницT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARОценок пока нет

- Self Assessment Tax Challan NiДокумент1 страницаSelf Assessment Tax Challan NiNitin KarwaОценок пока нет

- ITNS 280: Challan No. Challan No. ITNS 281Документ1 страницаITNS 280: Challan No. Challan No. ITNS 281Saravana KumarОценок пока нет

- Challan 280Документ2 страницыChallan 280Rahul SinglaОценок пока нет

- Challan No. ITNS 281 : Assessment YearДокумент1 страницаChallan No. ITNS 281 : Assessment YearTpm UmasankarОценок пока нет

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsДокумент2 страницыChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshОценок пока нет

- Draft Challan IchhaДокумент1 страницаDraft Challan IchhaSneha SharmaОценок пока нет

- Sri Ram SilksДокумент1 страницаSri Ram SilksMathanagopal KОценок пока нет

- TCS TenduДокумент1 страницаTCS TenduSwetha KarthickОценок пока нет

- Tds/Tcs Tax Challan: AADP12345KДокумент3 страницыTds/Tcs Tax Challan: AADP12345KC.A. Ankit JainОценок пока нет

- Ganraj ConstructionДокумент2 страницыGanraj ConstructionSUNIL GAIKWADОценок пока нет

- ChallanFormДокумент1 страницаChallanFormmanpreet singhОценок пока нет

- Challan No. ITNS 280: Tax Applicable Assessment YearДокумент1 страницаChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarОценок пока нет

- GST FormatДокумент3 страницыGST FormatAnmol GoyalОценок пока нет

- Ashima Kalra 194 CДокумент1 страницаAshima Kalra 194 CSudhanshu JaiswalОценок пока нет

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersДокумент1 страницаAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaОценок пока нет

- ChallanДокумент1 страницаChallanShilesh GargОценок пока нет

- Challan PDFДокумент1 страницаChallan PDFShilesh GargОценок пока нет

- ChallanДокумент1 страницаChallanYash KavteОценок пока нет

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Документ1 страницаAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanОценок пока нет

- It 000130629196 2021 00Документ1 страницаIt 000130629196 2021 00muhammad faiqОценок пока нет

- Form 16 AДокумент2 страницыForm 16 AParminderSinghОценок пока нет

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Документ3 страницыD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarОценок пока нет

- ChallanДокумент1 страницаChallanabhi7991Оценок пока нет

- 322 PartaДокумент2 страницы322 Partaritik tiwariОценок пока нет

- Itax Form 2006Документ4 страницыItax Form 2006AliMuzaffarОценок пока нет

- Form No 16Документ2 страницыForm No 16scorpio.vinodОценок пока нет

- It 000151339382 2023 00Документ1 страницаIt 000151339382 2023 00shaheenmagamartОценок пока нет

- Form 16 Excel FormatДокумент4 страницыForm 16 Excel FormatAUTHENTIC SURSEZОценок пока нет

- ChallanFormДокумент1 страницаChallanFormmanpreet singhОценок пока нет

- Best CompaniesДокумент6 страницBest Companiesar8ku9sh0aОценок пока нет

- Accounting Questions and AnswerДокумент43 страницыAccounting Questions and Answerar8ku9sh0aОценок пока нет

- GST IntroductionДокумент14 страницGST Introductionar8ku9sh0aОценок пока нет

- Shri Hanuman Bahuk PDFДокумент25 страницShri Hanuman Bahuk PDFar8ku9sh0a100% (2)

- Income Tax Planning For The Financial Year 2016-2017 (A.Y.2017-2018) SL NOДокумент6 страницIncome Tax Planning For The Financial Year 2016-2017 (A.Y.2017-2018) SL NOar8ku9sh0aОценок пока нет

- Deduction of Housing Loan Repayment and InterestДокумент7 страницDeduction of Housing Loan Repayment and Interestar8ku9sh0aОценок пока нет

- Replacement Certificate ApplicationДокумент5 страницReplacement Certificate ApplicationNajmul HasanОценок пока нет

- SM 13216inrДокумент1 страницаSM 13216inrImran SayeedОценок пока нет

- StatementДокумент3 страницыStatementMarcus GreenОценок пока нет

- Colorcroma LogoДокумент1 страницаColorcroma LogolahiruОценок пока нет

- Key Fact StatementДокумент2 страницыKey Fact StatementBNREDDY PSОценок пока нет

- EgrasДокумент2 страницыEgrasAvnish BhasinОценок пока нет

- LESCO - Web BillДокумент1 страницаLESCO - Web Billfazal ahmadОценок пока нет

- Annex 7-DISBURSEMENT VOUCHERДокумент5 страницAnnex 7-DISBURSEMENT VOUCHERVermon JayОценок пока нет

- The Impact of GST On Construction Industry: June 2019Документ12 страницThe Impact of GST On Construction Industry: June 2019AVS YASHWINОценок пока нет

- FAQ in Day To Day BankingДокумент17 страницFAQ in Day To Day BankingKuwar WaliaОценок пока нет

- Sales Invoice Official ReceiptДокумент3 страницыSales Invoice Official ReceiptNathaniel Niño TangОценок пока нет

- Question - Chapter 6. Basis of AssessmentДокумент5 страницQuestion - Chapter 6. Basis of AssessmentTâm TốngОценок пока нет

- Filed Visa Plaid Complaint 0Документ23 страницыFiled Visa Plaid Complaint 0ForkLogОценок пока нет

- Contract Based Appointment On Different Posts Under Special Survey ProgrammeДокумент2 страницыContract Based Appointment On Different Posts Under Special Survey ProgrammeMОценок пока нет

- 05 PartnershipДокумент20 страниц05 Partnershipjustine reine cornicoОценок пока нет

- Jodie PresentДокумент2 страницыJodie PresentFiorence Atmaja100% (1)

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceДокумент5 страницTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalancedileepОценок пока нет

- Invoice #1 - 179-PNQDELQP114822102306294-oFXДокумент1 страницаInvoice #1 - 179-PNQDELQP114822102306294-oFXManish NairОценок пока нет

- Accounting VoucherДокумент1 страницаAccounting VoucherPadarabinda ParidaОценок пока нет

- AR0817Документ20 страницAR0817Roderic SobionoОценок пока нет

- GA502263-Tax Invoice (Client Copy)Документ1 страницаGA502263-Tax Invoice (Client Copy)Nelly HОценок пока нет

- The Promissory Note As A Substitute For MoneyДокумент30 страницThe Promissory Note As A Substitute For MoneyricetechОценок пока нет

- Inter Tax FinalДокумент4 страницыInter Tax FinalJil Macasaet0% (1)

- LGC and MRPAAO Quiz 10feb2023 PrintedДокумент5 страницLGC and MRPAAO Quiz 10feb2023 Printedivy jane estrellaОценок пока нет

- SoC Non ComfortДокумент3 страницыSoC Non ComfortShanmugam ThiyagarajanОценок пока нет

- SAP STD Invoice FormatДокумент2 страницыSAP STD Invoice FormatVASEEMОценок пока нет

- Mr. Mohamed Shabaaz PO 2297, KHOBAR 31952 31952 AL KHOBAR Saudi ArabienДокумент5 страницMr. Mohamed Shabaaz PO 2297, KHOBAR 31952 31952 AL KHOBAR Saudi ArabienMohammed Mukram AliОценок пока нет

- Law On Negotiable InstrumentДокумент20 страницLaw On Negotiable InstrumentLhyn Cantal Calica100% (1)

- Quotation For Hydraulic PumpДокумент1 страницаQuotation For Hydraulic Pumpmuhammad ali umarОценок пока нет

- Flowchart of Tax Refund RemediesДокумент8 страницFlowchart of Tax Refund RemedieschenezОценок пока нет