Академический Документы

Профессиональный Документы

Культура Документы

BIR Form 2551M

Загружено:

Jun CasonoАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BIR Form 2551M

Загружено:

Jun CasonoАвторское право:

Доступные форматы

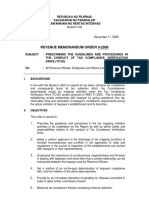

(To be filled up by the BIR)

DLN: PSIC:

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 For the Calendar Fiscal 3 For the month 4 Amended Return 5 Number of sheets attached

2 Year ended

Part I B a c k g r o u n d I n f o r m a t i o n

6 TIN 7 RDO Code 8 Line of Business/

Occupation

9 Taxpayer's Name (For Individual)Last Name, First Name, Middle Name/(For Non-individual) Registered Name 10 Telephone Number

11 Registered Address 12 Zip Code

13 Are you availing of tax relief under Special Law

or International Tax Treaty?

Yes No If yes, specify

Part II C o m p u t a t i o n o f T a x

Taxable Transaction/ A T C Taxable Amount Tax Rate Tax Due

Industry Classification

14A 14B 14C 14D 14E

15A 15B 15C 15D 15E

16A 16B 16C 16D 16E

17A 17B 17C 17D 17E

18A 18B 18C 18D 18E

19 Total Tax Due 19

20 Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 (See Schedule 1) 20A

20B Tax Paid in Return Previously Filed, if this is an Amended Return 20B

21 Total Tax Credits/Payments (Sum of Items 20A & 20B) 21

22 Tax Payable (Overpayment) (Item 19 less Item 21) 22

23 Add: Penalties Surcharge Interest Compromise

23A 23B 23C 23D

24 Total Amount Payable/(Overpayment) (Sum of Items 22 and 23D) 24

If overpayment, mark one box only: To be Refunded To be issued a Tax Credit Certificate

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25 26

Tax Agent Acc. No./Atty's Roll No.(if applicable)

Part III Details of Payment

Drawee Bank/ Date

Particulars Agency Number MM DD YYYY Amount

27 Cash/Bank 27A

27B 27C 27D

Debit Memo

28 Check 28A

28B 28C 28D

29 Tax Debit 29A 29B 29C

Memo

30 Others 30A

30B 30C 30D

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

BIR FORM 2551M (ENCS)-PAGE 2

Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

President/Vice President/Principal Officer/Accredited Tax Agent/

(RO's Signature/

Stamp of

Bank Teller's Initial)

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

Date of Issuance Date of Expiry TIN of Signatory

Receiving Office/AAB

and Date of Receipt

2551M

September 2005 (ENCS)

Monthly Percentage

Tax Return

BIR Form No.

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Yes No (MM/YYYY) (MM/YYYY)

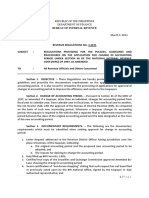

Schedule 1

Total (To Item 20A)

ALPHANUMERIC TAX CODE (ATC)

ATC Percentage Tax On: Tax Rate ATC Percentage Tax On: Tax Rate

PT 010 Persons exempt from VAT under Sec. 109v (Sec. 116) 3% PT 103 3) On royalties, rentals of property, real or personal, profits

PT 040 Domestic carriers and keepers of garages 3% from exchange and all other gross income

PT 041 International Carriers 3%

PT 104 4) On net trading gains within the taxable year on foreign currency,

PT 060 Franchises on gas and water utilities 2%

debt securities, derivatives, and other financial instruments

PT 070 Franchises on radio/TV broadcasting companies whose Tax on Other Non-Bank Financial Intermediaries not performing quasi-banking functions

annual gross receipts do not exceed P 10 M 3% 1) On interest, commissions and discounts from lending activities

Tax on banks and non-bank financial intermediaries performing quasi as well as income from financial leasing, on the basis of remaining

banking functions maturities of instruments from which such receipts are derived

1) On interest, commissions and discounts from lending PT 113 Maturity period is five (5) years or less

activities as well as income from financial leasing, on

PT 114

Maturity period is more than five (5) years

the basis of remaining maturities of instruments from PT 115 2)

From all other items treated as gross income under the code

which such receipts are derived PT 120 Life Insurance premium

PT 105 Maturity period is five (5) years or less 5% Agents of Foreign Insurance Companies

PT 101 Maturity period is more than five (5) years 1% PT 130 a) Insurance Agents

PT 102 2) On dividends and equity shares and net income of PT 132 b) Owners of property obtaining insurance directly

subsidiaries 0% with foreign insurance companies

BIR Form No. 2551M Percentage Tax Return

Guidelines and Instructions

Tax Withheld Claimed as Tax Credit

Applied

Period Covered

Name of Withholding Agent Income Payments Tax Withheld

10 Telephone Number

Tax Due

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

BIR FORM 2551M (ENCS)-PAGE 2

Treasurer/Assistant Treasurer

(Signature Over Printed Name)

(RO's Signature/

Stamp of

Bank Teller's Initial)

Title/Position of Signatory

TIN of Signatory

Receiving Office/AAB

and Date of Receipt

2551M

September 2005 (ENCS)

Tax Rate

7%

7%

5%

1%

5%

5%

10%

5%

BIR Form No. 2551M Percentage Tax Return

Guidelines and Instructions

Tax Withheld Claimed as Tax Credit

Applied

Вам также может понравиться

- BIR Form 2551MДокумент6 страницBIR Form 2551MDeiv PaddyОценок пока нет

- 2551QДокумент2 страницы2551QCris David Moreno79% (14)

- 82202BIR Form 1702-MXДокумент9 страниц82202BIR Form 1702-MXRen A EleponioОценок пока нет

- CPA UNDERTAKES TO COOPERATE WITH BIRДокумент1 страницаCPA UNDERTAKES TO COOPERATE WITH BIRLimuel Balestramon RazonalesОценок пока нет

- New Form 2550 M - Monthly VAT Return P 1-2Документ3 страницыNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Procedures Alphalist deДокумент2 страницыProcedures Alphalist deAngelo LabiosОценок пока нет

- Minalas Corp 2016 Tax AuditДокумент11 страницMinalas Corp 2016 Tax AuditEmerson Peralta0% (2)

- 2550m FormДокумент1 страница2550m FormAileen Jarabe80% (5)

- REMINDER LETTER Late Filing of Vat ReturnДокумент2 страницыREMINDER LETTER Late Filing of Vat ReturnHanabishi Rekka100% (1)

- How to File Form 2316, Annex C and Annex F by Feb. 28Документ4 страницыHow to File Form 2316, Annex C and Annex F by Feb. 28Ivan Benedicto100% (1)

- Purchase of ink rollerДокумент1 страницаPurchase of ink rollerJeremiah TrinidadОценок пока нет

- Certification of Expenses Not Requiring Receipts: Name of Employee Employee No. Office Division Particulars Amount (PHP)Документ1 страницаCertification of Expenses Not Requiring Receipts: Name of Employee Employee No. Office Division Particulars Amount (PHP)jan jerkin cardino100% (2)

- Annex "D": Submission of E-Mail Addresses and Mobile Numbers (For Corporations)Документ2 страницыAnnex "D": Submission of E-Mail Addresses and Mobile Numbers (For Corporations)royette ladica100% (1)

- SEC Requirements For Accreditation of CPAs in Public PracticeДокумент2 страницыSEC Requirements For Accreditation of CPAs in Public PracticemelissaОценок пока нет

- 1604-CF FormДокумент2 страницы1604-CF Formjenie_rojen200423100% (2)

- Government Money Payments Chart - BirДокумент3 страницыGovernment Money Payments Chart - BirVan Caz89% (9)

- 1601e Form PDFДокумент3 страницы1601e Form PDFLee GhaiaОценок пока нет

- Expanded Withholding Taxes On Government Income PaymentsДокумент172 страницыExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezОценок пока нет

- PCAB Contractor Registration Application GuideДокумент5 страницPCAB Contractor Registration Application GuideDyna Endaya100% (2)

- ATC HandbookДокумент15 страницATC HandbookPrintet08Оценок пока нет

- Compilation Report For Compilers of FSДокумент1 страницаCompilation Report For Compilers of FSWilliam Andrew Gutiera Bulaqueña100% (1)

- CPA Compilation ReportДокумент2 страницыCPA Compilation ReportMike YaunaОценок пока нет

- Rmo No 9-06 TCVD Tax MappingДокумент16 страницRmo No 9-06 TCVD Tax MappingGil PinoОценок пока нет

- Appendix 49 - Instructions - RPPCVДокумент1 страницаAppendix 49 - Instructions - RPPCVCENTRAL OFFICE ACCOUNTINGОценок пока нет

- Bir Form 1601-CДокумент4 страницыBir Form 1601-Csanto tomas proper barangay100% (1)

- Nput Vat On Mixed TransactionsДокумент15 страницNput Vat On Mixed TransactionsBSACCBLK1COLEEN CALUGAYОценок пока нет

- Tax Exemption Certificate RequestДокумент1 страницаTax Exemption Certificate RequestJannyManlaОценок пока нет

- AnswerДокумент21 страницаAnswerStephanie EspalabraОценок пока нет

- GSIS AAO Form for City TreasurerДокумент7 страницGSIS AAO Form for City TreasurerCarlo P. Caguimbal0% (1)

- PHC-BOA UpdatesДокумент67 страницPHC-BOA UpdatesMaynard Mirano100% (1)

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Документ4 страницыAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagОценок пока нет

- Statement of Management ResponsibilityДокумент1 страницаStatement of Management ResponsibilityLecel Llamedo100% (1)

- BIR REliefДокумент32 страницыBIR REliefJayRellvic Guy-ab67% (6)

- Accomplishment Report 1Документ12 страницAccomplishment Report 1Kate PotinganОценок пока нет

- Certification Statement of Management's Responsibility (Itr)Документ1 страницаCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- CPA's Notes to Financial StatementsДокумент17 страницCPA's Notes to Financial Statementsbadette Paningbatan100% (1)

- Sworn Application For Tax Clearance Annex C 1 RufДокумент1 страницаSworn Application For Tax Clearance Annex C 1 RufellenОценок пока нет

- Introduction to Government Accounting and the Philippine Budget ProcessДокумент20 страницIntroduction to Government Accounting and the Philippine Budget ProcessLaong laan100% (1)

- List of AABs Under RDO 48Документ2 страницыList of AABs Under RDO 48James Ibrahim Alih100% (1)

- Cash Disbursement Journal TemplateДокумент2 страницыCash Disbursement Journal TemplateJeov100% (1)

- Application For Certificate of Tax ExemptionДокумент3 страницыApplication For Certificate of Tax ExemptionSusan Pascual100% (2)

- RR 2-98 Section 2.57 (B) - CWTДокумент3 страницыRR 2-98 Section 2.57 (B) - CWTZenaida LatorreОценок пока нет

- Processing of Cash Advance and LiquidationДокумент2 страницыProcessing of Cash Advance and Liquidationrey menaje100% (1)

- 2019 PFRS Pas PicДокумент4 страницы2019 PFRS Pas PicAron Vicente100% (1)

- Audit Engagement Letter1Документ3 страницыAudit Engagement Letter1Sandra SEОценок пока нет

- Bank Confirmation FormДокумент1 страницаBank Confirmation FormJerikka Anne Dizon BenavidesОценок пока нет

- Audit of Prepayments and Intangible AssetsДокумент4 страницыAudit of Prepayments and Intangible AssetsGille Rosa Abajar100% (1)

- Certification-COA Cell Card All 2021Документ12 страницCertification-COA Cell Card All 2021Maricris BiscarraОценок пока нет

- Letter of Request For Data FixДокумент1 страницаLetter of Request For Data FixTANCITY INC100% (1)

- 2016 Bir Form 2316 TransmittalДокумент1 страница2016 Bir Form 2316 Transmittalsegundo sanchezОценок пока нет

- Roles and responsibilities of officer positions and committees in a professional organizationДокумент18 страницRoles and responsibilities of officer positions and committees in a professional organizationRheneir MoraОценок пока нет

- BIR Ruling No. 095-95 - Consignment Sales - Issuance of Sales InvoiceДокумент2 страницыBIR Ruling No. 095-95 - Consignment Sales - Issuance of Sales InvoiceCkey ArОценок пока нет

- Government AccountingДокумент60 страницGovernment AccountingKath Chu100% (2)

- Bir Form 2307 2307Документ12 страницBir Form 2307 2307Edwin Siruno LopezОценок пока нет

- Change in Accounting PeriodДокумент4 страницыChange in Accounting PeriodCris Lloyd AlferezОценок пока нет

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Документ4 страницыMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Eric LeguardaОценок пока нет

- 2551MДокумент4 страницы2551MLecel LlamedoОценок пока нет

- Bir Form Percentage TaxДокумент3 страницыBir Form Percentage TaxEc MendozaОценок пока нет

- Form 1600Документ4 страницыForm 1600KialicBetito50% (2)

- MONTHLY PERCENTAGE TAX RETURNДокумент2 страницыMONTHLY PERCENTAGE TAX RETURNGeox SalasОценок пока нет

- Certificate of Clearance for Maternity Leave ApplicationДокумент1 страницаCertificate of Clearance for Maternity Leave ApplicationJun CasonoОценок пока нет

- This Replaced Form 1, Master List & STS Form 2-Family Background and ProfileДокумент22 страницыThis Replaced Form 1, Master List & STS Form 2-Family Background and ProfileJun CasonoОценок пока нет

- Certification Motor LoanДокумент1 страницаCertification Motor LoanJun CasonoОценок пока нет

- Isae vs. Quisumbing FinalДокумент11 страницIsae vs. Quisumbing FinalJun CasonoОценок пока нет

- OPT Form 1Документ1 страницаOPT Form 1Jun CasonoОценок пока нет

- Periodical Test Grading Sheet FormДокумент6 страницPeriodical Test Grading Sheet FormJun CasonoОценок пока нет

- Form 137-EДокумент1 страницаForm 137-EJun Casono100% (1)

- Gantt Chart in 4 Grading PeriodsДокумент1 страницаGantt Chart in 4 Grading PeriodsJun Casono100% (1)

- Consolidated Class ProgramДокумент11 страницConsolidated Class ProgramJun CasonoОценок пока нет

- Request Form 137-EДокумент1 страницаRequest Form 137-EJun CasonoОценок пока нет

- STS Form 2A Department of Education Region - Division of - District ofДокумент2 страницыSTS Form 2A Department of Education Region - Division of - District ofJun Casono100% (2)

- Summary Report On Early Childhood Development Checklist ECCD For Kindergarten Blank FormДокумент1 страницаSummary Report On Early Childhood Development Checklist ECCD For Kindergarten Blank FormJun Casono94% (99)

- Disbursement Voucher FormДокумент2 страницыDisbursement Voucher FormJun Casono100% (3)

- Barangay Officials Information Sheet FormДокумент1 страницаBarangay Officials Information Sheet FormJun Casono87% (23)

- Application Form For Municipal Fisherfolk RegistrationДокумент1 страницаApplication Form For Municipal Fisherfolk RegistrationJun Casono85% (34)

- Let Application RequirementsДокумент1 страницаLet Application RequirementsJun CasonoОценок пока нет

- Diecastcollectorissue 295 May 2022Документ82 страницыDiecastcollectorissue 295 May 2022Martijn HinfelaarОценок пока нет

- System Features: 4.1 Query For A BookДокумент4 страницыSystem Features: 4.1 Query For A BookGowtham SaiОценок пока нет

- Ascension EIS Fund Tax Efficient ReviewДокумент16 страницAscension EIS Fund Tax Efficient Reviewsky22blueОценок пока нет

- IFRS 11 and 12 CPD September 2013Документ64 страницыIFRS 11 and 12 CPD September 2013Nicolaus CopernicusОценок пока нет

- Ukay-Ukay: The Philippine Culture As Sustainable FashionДокумент11 страницUkay-Ukay: The Philippine Culture As Sustainable FashionElОценок пока нет

- Summary of A Talk - How To Write Up Properly.Документ2 страницыSummary of A Talk - How To Write Up Properly.Avinaash VeeramahОценок пока нет

- Design and Manufacturing of Zig-Zag Bar Bending MachineДокумент58 страницDesign and Manufacturing of Zig-Zag Bar Bending MachineSachin T100% (1)

- Relevant CostingДокумент5 страницRelevant CostingBeatriz Basa DimainОценок пока нет

- Pranayam Resident Welfare Association (Regd.) : Cam Cum Utility InvoiceДокумент1 страницаPranayam Resident Welfare Association (Regd.) : Cam Cum Utility InvoiceDeepak VermaОценок пока нет

- Adesemi Was The StartДокумент3 страницыAdesemi Was The StartNasrin AkterОценок пока нет

- s3879661 A1 Slides mktg1420-1Документ15 страницs3879661 A1 Slides mktg1420-1Huy Quang100% (1)

- Printmedia 100813115605 Phpapp02Документ24 страницыPrintmedia 100813115605 Phpapp02Sudesh BanareОценок пока нет

- KohlerДокумент25 страницKohlertousif AhmedОценок пока нет

- Chapter 3 PlanningДокумент29 страницChapter 3 PlanningDagm alemayehuОценок пока нет

- Business Law Assignment Questions (Class E) - January 2024 IntakeДокумент5 страницBusiness Law Assignment Questions (Class E) - January 2024 Intakewtote404Оценок пока нет

- GN Cement Industry 05022021 RevДокумент97 страницGN Cement Industry 05022021 RevNetaji Dasari100% (1)

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitДокумент71 страницаIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuОценок пока нет

- Relationship Between Job Satisfaction and Turnover IntentionДокумент33 страницыRelationship Between Job Satisfaction and Turnover IntentionSamuel Embiza TadesseОценок пока нет

- Chapter 6 Instructor - Managing A Global BusinessДокумент22 страницыChapter 6 Instructor - Managing A Global BusinessYusuf ÇubukОценок пока нет

- Strategic Management MainДокумент20 страницStrategic Management MainAdityaОценок пока нет

- The Waldorf Hilton Hotel Job Offered Contract LetterДокумент3 страницыThe Waldorf Hilton Hotel Job Offered Contract LetterHIsham Ali100% (2)

- Supplemental Budget 2021Документ2 страницыSupplemental Budget 2021SK Alma VillaОценок пока нет

- Ss3 EconomicsДокумент27 страницSs3 EconomicsAdio Babatunde Abiodun CabaxОценок пока нет

- Affidavit repair shop undertakingДокумент2 страницыAffidavit repair shop undertakingZeaОценок пока нет

- ISO Clause 8Документ8 страницISO Clause 8Shailesh GuptaОценок пока нет

- Market Segmentation and Targeting StrategiesДокумент34 страницыMarket Segmentation and Targeting StrategiesAroop SanyalОценок пока нет

- Environmental Sustainability, Research, IOT, and Future DevelopmentДокумент4 страницыEnvironmental Sustainability, Research, IOT, and Future DevelopmentEditor IJTSRDОценок пока нет

- Emad Farahzadi MAY2023Документ3 страницыEmad Farahzadi MAY2023Kourosh NematyОценок пока нет

- SF PLT Admin Center PDFДокумент46 страницSF PLT Admin Center PDFSuzana BedОценок пока нет

- c9001 Chartered Financial Modeling Professional CFMP Brochure 1Документ11 страницc9001 Chartered Financial Modeling Professional CFMP Brochure 1Shit A Brick “Om Tegank”Оценок пока нет