Академический Документы

Профессиональный Документы

Культура Документы

GL Master V12 - Additional GL Accounts

Загружено:

Vivek KumarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GL Master V12 - Additional GL Accounts

Загружено:

Vivek KumarАвторское право:

Доступные форматы

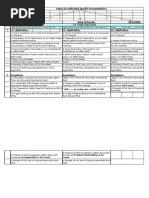

VIL VEL VIL USA VSF VERONICA Account group (Revised Schedule VI in GL master)

SAKNR - 1000

SAKNR -

2000

SAKNR -

3000

SAKNR -

4000

SAKNR -

5000 KTOKS

40761 40405 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40758 40408 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40757 40409 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40756 40410 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40703 40413 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40755 40414 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40655 40415 40415 SAP NEW SAP NEW STATUTORY DUES PAYABLE

40654 40416 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40651 40417 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40762 SAP NEW NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40759 SAP NEW NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

SAP NEW SAP NEW NA NA NR STATUTORY DUES PAYABLE

40602 40427 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40657 40432 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40601 40446 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40601 ADTA 40468 NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

40601 HRSC SAP NEW NA SAP NEW SAP NEW STATUTORY DUES PAYABLE

NA NA 42131 NA NA STATUTORY DUES PAYABLE

NA NA 42118 NA NA STATUTORY DUES PAYABLE

NA NA 42119 NA NA STATUTORY DUES PAYABLE

NA NA 42121 NA NA STATUTORY DUES PAYABLE

NA NA 42122 NA NA STATUTORY DUES PAYABLE

NA NA 42123 NA NA STATUTORY DUES PAYABLE

NA NA 42128 NA NA STATUTORY DUES PAYABLE

40603 SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

40603 SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

40603-EDCU SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

40603-HSEC SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

40653 40421 NA NA NA STATUTORY DUES PAYABLE

40753 40421 OTHR NA NA NA STATUTORY DUES PAYABLE

40413 40425 NA NA NR STATUTORY DUES PAYABLE

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

40760 40403 SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW STATUTORY DUES PAYABLE

NA 40473 NA NA NA STATUTORY DUES PAYABLE

NA 40474 NA NA NA STATUTORY DUES PAYABLE

27110 SAP NEW NA NA NR ADVANCE FROM CUSTOMERS

14202 14202 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

VIL VEL VIL USA VSF VERONICA Account group (Revised Schedule VI in GL master)

SAKNR - 1000

SAKNR -

2000

SAKNR -

3000

SAKNR -

4000

SAKNR -

5000 KTOKS

NA 14222 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 14221 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 14224 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 14231 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

14202-EPDP NA NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

14240 NA NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

14241 NA NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

14510 NA NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA SAP NEW NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 27112 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

27135 NA NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 14201 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 14201 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 14201 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

NA 14201 NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

14510 NA NA NA NA SECURITY DEPOSITS FROM CUSTOMERS

42206 42206 NA NA NA SHORT TERM PROVISIONS FOR EMPLOYEE BENEFITS

40504 42208 NA NA NA SHORT TERM PROVISIONS FOR EMPLOYEE BENEFITS

40504 SICK 42208 SICK NA NA NA SHORT TERM PROVISIONS FOR EMPLOYEE BENEFITS

42201 42211 NA SAP NEW SAP NEW PROPOSED DIVIDEND

42103 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

42107 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

42114 42115 NA SAP NEW SAP NEW INCOME TAX PROVISION

42114-0910 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

42114-1011 42113 NA SAP NEW SAP NEW INCOME TAX PROVISION

42114-1112 42113 1213 NA SAP NEW SAP NEW INCOME TAX PROVISION

42117 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

42101 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

42102 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

42116 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

42152 NA NA SAP NEW SAP NEW INCOME TAX PROVISION

NA NA 42130 SAP NEW SAP NEW INCOME TAX PROVISION

42114 1213 NA NA NA NA INCOME TAX PROVISION

42207 40413 DVDN NA SAP NEW SAP NEW TAX ON PROPOSED DIVIDEND

40414 NA NA SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

VIL VEL VIL USA VSF VERONICA Account group (Revised Schedule VI in GL master)

SAKNR - 1000

SAKNR -

2000

SAKNR -

3000

SAKNR -

4000

SAKNR -

5000 KTOKS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

SAP NEW SAP NEW SAP NEW SAP NEW SAP NEW OTHER PROVISIONS

20210 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20210-REVL SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20220 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20220-REVL SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20320 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20320-REVL SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20310 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20310-REVL SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20501 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20501 REVL SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

SAP NEW SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20610 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20710 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20810 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

20730 SAP NEW NA NA NR GROSS BLOCK : FIXED ASSETS

22320 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22310 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22501 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

SAP NEW SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22610 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22710 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22810 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22220 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22730 SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22320-REVL SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22310-REVL SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22501 REVL SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

22220 REVL SAP NEW NA NA NR ACCUMULATED DEPRECIATION : FIXED ASSETS

P&L

state.

Acct

Balance

sheet

acct

Short Text (English) Long Text (English)

GVTYP XBILK TXT20 TXT50

1320 X TDS PBLE ON ROYALTY TDS PAYABLE ON ROYALTY

1320 X TDS PBLE COMM/BROK TDS ON COMMISSION/BROKERAGE

1320 X TDS PBLE ON RENT TDS PAYABLE ON RENT

1320 X TDS PBLE PROF TDS PAYABLE ON PROFESSIONALS

1320 X TDS PBLE INTEREST TDS PAYABLE INTEREST

1320 X TDS PBLE CONTRACTORS TDS PAYABLE CONTRACTORS

1320 X TDS PBLE-SALARY TDS PAYABLE-SALARY

1320 X PROF TAX PAYABLE PROF TAX PAYABLE

1320 X P.F.PAYABLE-SALARY P.F.PAYABLE-SALARY

1320 X TDS PAYABLE SEC 195 TDS PAYABLE 195

1320 X TCS PAYABLE TCS PAYABLE

1320 X TCS PAYABLE - OFFSET TCS PAYABLE - OFFSET

1320 X C.S.T.PAYABLE C.S.T.PAYABLE

1320 X LABOUR WELFARE FUND LABOUR WELFARE FUND

1320 X VAT PAYABLE VAT PAYABLE

1320 X ADD VAT PAYABLE ADDITIONAL VAT PAYABLE

1320 X SC ON VAT PAYABLE SURCHARGE ON VAT PAYABLE

1320 X FEDERAL UNEMPL TAX FEDERAL UNEMPLOYMENT TAX

1320 X FICA TAX PAYABLE FICA TAX PAYABLE

1320 X FEDERAL W/H TAX PBLE FEDERAL W/H TAX PAYABLE

1320 X STATE W/H TAX PBLE STATE W/H TAX PAYABLE

1320 X SUTA TAX PAYABLE SUTA TAX PAYABLE

1320 X FUTA TAX PAYABLE FUTA TAX PAYABLE

1320 X S D I PAYABLE S D I PAYABLE

1320 X EXCISE PBLE BASIC EXCISE DUTY PAYABLE - BASIC

1320 X EXCISE PBLE E CESS EXCISE DUTY PAYABLE - EDUCATION CESS

1320 X EXCISE PBLE SHE CESS EXCISE DUTY PAYABLE - SECONDARY & HIGHER EDU CESS

1320 X CENVAT CLRG (SALES) CENVAT CLEARING (SALES)

1320 X ESI PAYABLE SALARY ESI PAYABLE SALARY

1320 X ESI PBLE (OTHERS) ESI PAYABLE (OTHERS)

1320 X BONUS PROVISION BONUS PROVISION

1320 X VAT WCT PAYABLE VAT WORKS CONTRACT TAX PAYABLE

1320 X BASIC ST PAYABLE BASIC SERVICE TAX PAYABLE

1320 X ECESS ON ST PAYABLE EDUCATION CESS ON SERVICE TAX PAYABLE

1320 X S & HECESS ON ST PAYABLE SECONDARY & HIGHER EDU CESS ON SERVICE TAX PAYABLE

1320 X ENTRY TAX PAYABLE ENTRY TAX PAYABLE

1320 X SPECIAL TAX PAYABLE 1% SPECIAL TAX PAYABLE 1%

1320 X SPECIAL TAX PAYABLE 0.50% SPECIAL TAX PAYABLE 0.50%

1330 X ADV FROM CUSTOMERS ADVANCE FROM CUSTOMERS

1340 X DEALERSHIP DEPO DEALERSHIP DEPOSIT A/C

P&L

state.

Acct

Balance

sheet

acct

Short Text (English) Long Text (English)

GVTYP XBILK TXT20 TXT50

1340 X PFD DEPOSIT PROCESS FOOD DEPOSIT

1340 X MANGO PULP DEPOSIT MANGO PULP DEPOSIT

1340 X MACHINE DEPOSIT MACHINE DEPOSIT

1340 X PAD PETTY DEPOSIT PAD PETTY DEPOSIT

1340 X EXPORT DEALER DEPO EXPORT DEALER DEPOSIT

1340 X SECURITY DEPO C & F SECURITY DEPOSIT - C & F

1340 X SECURITY DEPO DIST SECURITY DEPOSIT - DISTRIBUTOR

1340 X SECURITY DEPO (HP) SECURITY DEPOSIT (HP LEASE)

1340 X DEPO TAKEN (CRATE) DEPOSITS TAKEN (CRATE)

1340 X DEPO TAKEN (DEEP FR) DEPOSITS TAKEN (DEEP FREEZE)

1340 X DEPOSITS OTHERS DEPOSITS OTHERS

1340 X CANOPY DEPOSIT CANOPY DEPOSIT

1340 X DATA LOGER DEPOSIT DATA LOGER DEPOSIT

1340 X FOW DEPOSIT INT-FREE FOW DEPOSIT A/C (INT-FREE)

1340 X P CART DEPO INT FREE PUSHCART DEPOSIT INT FREE

1340 X SECURITY DEPO (HP-FIN DIV) SECURITY DEPOSIT (HP - FINANCE DIVISION)

1350 X GRAT PROV CURT GRATUITY PROVISION - CURRENT

1350 X LEAVE SAL PBLE CURT LEAVE SALARY PAYABLE - CURRENT

1350 X SICK LEAVE SAL PROV SICK LEAVE SALARY PROVISION

1360 X PROPOSED DIVIDEND PROPOSED DIVIDEND

1370 X PROV IT ASST Y 94-95 PROVISION FOR I.T. 94-95

1370 X PROV IT ASST Y 96-97 PROVISION FOR I T 96-97

1370 X PROV IT ASST Y 07-08 PROV FOR I. TAX ASS.Y-07-08

1370 X PROV IT ASST Y 10-11 PROV FOR I. TAX ASS.Y-2010-11

1370 X PROV IT ASST Y 11-12 PROV FOR I. TAX ASS.Y-2011-12

1370 X PROV IT ASST Y 12-13 PROV FOR I. TAX ASS.Y-1213

1370 X PROV IT ASST Y 91-92 PROV FOR I TAX A.Y 1991-92

1370 X PROV IT ASST Y 92-93 PROVISION FOR TAX 1992-93

1370 X PROV IT ASST Y 93-94 PROVISION FOR I.T. 93-94

1370 X PROV IT ASST Y 90-91 PROV FOR I.TAX A.Y 1990-91

1370 X PROV IT ASST Y.97-98 PROVISION FOR I.TAX A.Y.97-98

1370 X INCOME TAXES PAYABLE INCOME TAXES PAYABLE

1370 X PROV IT ASST Y.13-14 PROV FOR I TAX AY 2013-14

1380 X TDS PBLE DIVIDEND TDS PAYABLE ON DIVIDEND

1390 X OTHER PROVISIONS OTHER PROVISIONS

1390 X COMMISSION PAYABLE COMMISSION PAYABLE ON SALE

1390 X REBATE PAYABLE REBATE PAYABLE

1390 X INIT UPLD EXPENSE INITIAL UPLOAD EXPENSE

1390 X INIT UPLD CUSTOMER INITIAL UPLOAD CUSTOMER

1390 X INIT UPLD VENDOR INIT UPLD VENDOR

P&L

state.

Acct

Balance

sheet

acct

Short Text (English) Long Text (English)

GVTYP XBILK TXT20 TXT50

1390 X INIT UPLD I_A_L INITIAL UPLOAD INCOME_ASSETS_LIABILITIES

1390 X INIT UPLD FA INITIAL UPLOAD FIXED ASSETS

1390 X INIT UPLD CWIP INITIAL UPLOAD CAPITAL WORK IN PROGRESS

1390 X INIT UPLD EXCISE INITIAL UPLOAD EXCISE BALANCE

1390 X INIT UPLD OTHER INITIAL UPLOAD OTHER

2000 X LAND - FREEHOLD LAND - FREEHOLD

2000 X LAND-FREEHOLD-REV LAND-FREEHOLD-REVALUATION

2000 X LAND - LEASEHOLD LAND - LEASEHOLD

2000 X LAND-LEASEHOLD-REV LAND-LEASEHOLD-REVALUATION

2000 X BUILDING - OTHERS BUILDING - OTHERS

2000 X BUILDING OTHERS-REV BUILDING - OTHERS-REVALUATION

2000 X FACTORY BUILDING FACTORY BUILDING

2000 X FACTORY BUILDING-REV FACTORY BUILDING-REVALUATION

2000 X PLANT & MACHINERY PLANT & MACHINERY

2000 X PLANT & MACH-REV PLANT & MACHINERY-REVALUATION

2000 X FITTING & INSTALL. FITTING & INSTALLATION

2000 X FURNITURE & FIXTURES FURNITURE & FIXTURES

2000 X OFFICE EQUIPMENTS OFFICE EQUIPMENTS

2000 X VEHICLES VEHICLES

2000 X COMPUTER & PERIFERAL COMPUTER & PERIFERAL

2010 X ACC DEP-BUILDING OTH ACCUMULATED DEPRECIATION-BUILDING - OTHERS

2010 X ACC DEP-FACT. BUILD. ACCUMULATED DEPRECIATION-FACTORY BUILDING

2010 X ACC DEP-PLANT & MACH ACCUMULATED DEPRECIATION-PLANT & MACHINERY

2010 X ACC DEP-FITT & INST ACCUMULATED DEPRECIATION-FITTING & INSTALL.

2010 X ACC DEP-FUR & FIXT ACCUMULATED DEPRECIATION-FURNITURE & FIXTURES

2010 X ACC DEP-OFFICE EQUIP ACCUMULATED DEPRECIATION-OFFICE EQUIPMENTS

2010 X ACC DEP VEHICLES ACCUMULATED DEPRECIATION-VEHICLES

2010 X ACC AMORT-LHOLD LAND ACCUMULATED AMORTISATION-LEASEHOLD LAND

2010 X ACC DEP-COMP & PERIF ACCUMULATED DEPRECIATION-COMPUTER & PERIFERAL

2010 X ACC DEP REV-BLDG OTH ACCU DEPRECIATION ON REVALUATION-BUILDING - OTHERS

2010 X ACC DEP REV-FAC BLDG ACCU DEPRECIATION ON REVALUATION-FACTORY BUILDING

2010 X ACC DEP REV-PL MACH ACCU DEPRECIATION ON REVALUATION-PLANT & MACHINERY

2010 X ACC DEP REV LH LAND ACCU DEPRECIATION ON REVALUATION-LEASEHOLD LAND

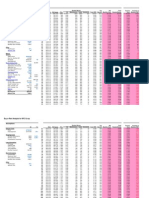

Objective :- Accounts to be created in SAP for TC which cannot be mapped with profit center/cost center.

Control :- Accounts appearing in this sheet have been deleted from "chart of accounts" worksheet.

Company 1 Company 2

Legacy account

number 1

Legacy account

number 2 TC number 1

2000 NA 40439 NA 0648

2000 NA 40439 NA 2446

2000 NA 40440 NA 0648

2000 NA 40440 NA 2446

2000 NA 40440 NA 0648

2000 NA 40440 NA 2446

2000 NA 40515 NA 0648

2000 NA 40515 NA 2446

1000 NA 40506 NA BOBC

1000 NA 40506 NA IDBI

1000 NA 40506 NA IDBN

1000 NA 40508 NA BOBC

1000 NA 40508 NA IDBI

1000 NA 40508 NA IDBN

1000 NA 40509 NA BOBC

1000 NA 40509 NA IDBI

1000 NA 40509 NA IDBN

1000 NA 40515 NA BOBC

1000 NA 40515 NA IDBI

1000 NA 40515 NA IDBN

2000 NA 14201 NA CADP

2000 NA 14201 NA DATA

2000 NA 14201 NA FODP

2000 1000 14201 14201 MCDP

2000 NA 14201 NA PUDP

1000 NA 14532 NA NCUR

1000 NA 14532 NA CURT

1000 2000 14410 14401 NCUR

1000 2000 14410 14401 CURT

1000 2000 14410 14401 STBR

1000 2000 15111 15101 NA

1000 2000 15112 15101 NA

NA 2000 NA 15101 NA

1000 2000 15211 15101 NA

1000 2000 15212 15101 NA

1000 NA 24213 NA NA

1000 NA 42206 NEW NCUR

1000 NA 40504 NEW NCUR

2000 NA 40445 NA QUTD

2000 NA 40445 NA UQTD

1000 2000 42206 42206 CURT

1000 NA 40504 42208 CURT

1000 2000 NEW 42208 NA

2000 1000 40421 40653 AAAA

2000 1000 40421 40753 OTHR

Accounts to be created in SAP for TC which cannot be mapped with profit center/cost center.

Accounts appearing in this sheet have been deleted from "chart of accounts" worksheet.

TC number 2

Account to be

created in SAP Account description in SAP

NA 129005 FD INTEREST PAYABLE IDBI-0648

NA 129010 FD INTEREST PAYABLE BOB-2446

NA 131065 BROKERAGE PAYABLE IDBI-648

NA 131070 BROKERAGE PAYABLE BOB-2446

NA 131075 POSTAGE PAYABLE-648

NA 131080 POSTAGE PAYABLE-2446

NA 129015 FD PAYABLE-648

NA 129020 FD PAYABLE-2446

NA 129025 FD INTEREST PAYABLE BOB-2441

NA 129030 FD INTEREST PAYABLE IDBI-657

NA 129035 FD INTEREST PAYABLE IDBI-6330

NA 131085 BROKERAGE PAYABLE BOB-2441

NA 131090 BROKERAGE PAYABLE IDBI-657

NA 131095 BROKERAGE PAYABLE IDBI-6330

NA 131100 POSTAGE PAYABLE BOB-2441

NA 131105 POSTAGE PAYABLE IDBI-657

NA 131110 POSTAGE PAYABLE IDBI-6330

NA 129040 FD PAYABLE BOB-2441

NA 129045 FD PAYABLE IDBI-657

NA 129050 FD PAYABLE IDBI-6330

NA 134055 CANOPY DEPOSIT

NA 134060 DATA LOGER DEPOSIT

NA 134065 FOW DEPOSIT A/C (INT-FREE)

MCDP 134010 MACHINE DEPOSIT A/C (INT-FREE)

NA 134070 PUSHCART DEPOSIT INT FREE

NA 112000 VERONICA CONS P LTD - NON CURRENT

NA 121000 VERONICA CONS P LTD - CURRENT

AAAA 113000 FIXED DEPOSITS - NON CURRENT

CURT 126000 FIXED DEPOSITS - CURRENT

STBR 119000 FIXED DEPOSITS - SHORT TERM BORROWINGS

BNUS, GRUT, AAAA 115000 DEFERRED TAX ASSETS 43B

DUBT 115005 DEFERRED TAX ASSETS OTHER TIMING DIFF

DTDP 115010 DEFERRED TAX ASSETS DEPRECIATION

NA 114000 DEFERRED TAX LIABILITY DEPRECIATION

NA 114005 DEFERRED TAX LIABILITY OTHER TIMING DIFF

NA 211000 DIMUNITION IN INVEST - QUOTED

NA 116000 GRATUITY PROVISION - NON CURRENT

NA 116005 LEAVE SALARY PAYABLE - NON CURRENT

NA 205040 DIMUNITION IN INVEST - QUOTED

NA 205045 DIMUNITION IN INVEST -UNQUOTED

AAAA 135000 GRATUITY PROVISION - CURRENT

AAAA 135005 LEAVE SALARY PAYABLE - CURRENT

SICK 135010 SICK LEAVE SALARY PROVISION

NA 132140 ESI PAYABLE SALARY

NA 132145 ESI PAYABLE (OTHERS)

Account group

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

OTHER LIABILITIES

OTHER LIABILITIES

OTHER LIABILITIES

OTHER LIABILITIES

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

OTHER LIABILITIES

OTHER LIABILITIES

OTHER LIABILITIES

OTHER LIABILITIES

OTHER LIABILITIES

OTHER LIABILITIES

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

SECURITY DEPOSITS FROM CUSTOMERS

SECURITY DEPOSITS FROM CUSTOMERS

SECURITY DEPOSITS FROM CUSTOMERS

SECURITY DEPOSITS FROM CUSTOMERS

SECURITY DEPOSITS FROM CUSTOMERS

UNSECURED LONG TERM BORROWINGS FROM RELATED PARTIES

UNSECURED SHORT TERM BORROWINGS FROM RELATED PARTIES

UNSECURED LONG TERM BORROWINGS AS FIXED DEPOSITS

CURRENT MATURITIES OF FIXED DEPOSITS

UNSECURED SHORT TERM BORROWINGS AS FIXED DEPOSITS

DEFERRED TAX ASSETS

DEFERRED TAX ASSETS

DEFERRED TAX ASSETS

DEFERRED TAX LIABILITY

DEFERRED TAX LIABILITY

INVESTMENT IN EQUITY INSTRUMENTS (QUOTED)

LONG TERM PROVISION FOR EMPLOYEE BENEFITS

LONG TERM PROVISION FOR EMPLOYEE BENEFITS

NON TRADE INVESTMENTS

NON TRADE INVESTMENTS

SHORT TERM PROVISIONS FOR EMPLOYEE BENEFITS

SHORT TERM PROVISIONS FOR EMPLOYEE BENEFITS

SHORT TERM PROVISIONS FOR EMPLOYEE BENEFITS

STATUTORY DUES PAYABLE

STATUTORY DUES PAYABLE

Reconciliation

Account

K

K

K

K

K

D

D

D

D

D

Account

group

1000

1010

1020

1030

1040

1050

1060

1070

1080

1090

1100

1110

1120

1130

1140

1150

1160

1170

1180

1190

1200

1210

1220

1230

1240

1250

1260

1270

1280

1290

1300

1310

1320

1330

1340

1350

1360

1370

1380

1390

2000

2010

2020

2030

2035

2040

2050

2060

2065

2070

2080

2090

2100

2110

2120

2130

2140

2150

2160

2170

2180

2190

2200

2210

2220

2230

2240

2250

2260

2270

2280

2290

2300

2310

3000

3010

3020

3030

3040

3050

3060

3070

3080

3090

3100

3110

3120

3130

3140

3150

3160

3170

4000

4010

4020

4030

4040

4050

4060

4070

4080

4090

4100

4110

4120

4130

4140

4150

4160

4170

4180

4190

4200

4210

4220

4230

4240

4250

4260

4270

4280

4290

4300

4310

4320

4330

4340

4350

4360

4370

4380

4390

4400

4410

4420

4430

4440

Level 3 (30 Char)

PAID UP SHARE CAPITAL

CAPITAL RESERVE

SECURITIES PREMIUM

GENERAL RESERVE

REVALUATION RESERVE

SURPLUS

APPROPRIATIONS

DEFERRRED GOVERNMENT GRANT

SECURED LONG TERM BORROWINGS FROM BANKS

SECURED LONG TERM BORROWINGS FROM FI

SECURED LONG TERM BORROWINGS FROM OTHERS

LONG TERM FINANCE LEASE OBLIGATIONS

UNSECURED LONG TERM BORROWINGS FROM RELATED PARTIES

UNSECURED LONG TERM BORROWINGS AS FIXED DEPOSITS

DEFERRED TAX LIABILITY

DEFERRED TAX ASSETS

LONG TERM PROVISION FOR EMPLOYEE BENEFITS

OTHER LONG TERM PROVISIONS

SECURED SHORT TERM BORRWINGS AS WORKING CAPITAL

UNSECURED SHORT TERM BORROWINGS AS FIXED DEPOSITS

UNSECURED SHORT TERM BORROWINGS AS ICD

UNSECURED SHORT TERM BORROWINGS FROM RELATED PARTIES

SUNDRY CREDITORS

CURRENT MATURITIES OF LONG TERM DEBTS - BANKS

CURRENT MATURITIES OF LONG TERM DEBTS - FINANCIAL INSTITUTIONS

CURRENT MATURITIES OF LONG TERM DEBTS - OTHERS

CURRENT MATURITIES OF FIXED DEPOSITS

INTEREST ACCRUED

UNPAID DIVIDENDS

UNPAID MATURED DEPOSITS AND INTEREST ACCRUED THEREON

PAYABLE FOR CAPITAL GOODS

OTHER LIABILITIES

STATUTORY DUES PAYABLE

ADVANCE FROM CUSTOMERS

SECURITY DEPOSITS FROM CUSTOMERS

SHORT TERM PROVISIONS FOR EMPLOYEE BENEFITS

PROPOSED DIVIDEND

INCOME TAX PROVISION

TAX ON PROPOSED DIVIDEND

OTHER PROVISIONS

GROSS BLOCK : FIXED ASSETS

ACCUMULATED DEPRECIATION : FIXED ASSETS

CAPITAL WORK IN PROGRESS

GROSS BLOCK : INTANGIBLE ASSETS

ACCUMULATED DEPRECIATION : INTANGIBLE ASSETS

TRADE INVESTMENTS

NON TRADE INVESTMENTS

CAPITAL ADVANCES

TRADE/SECURITY DEPOSITS

LONG TERM LOANS AND ADVANCES TO RELATED PARTY

OTHER LONG TERM LOANS AND ADVANCES

OTHER NON CURRENT ASSETS

INVENTORIES

INVESTMENT IN EQUITY INSTRUMENTS (QUOTED)

INVESTMENT IN MUTUAL FUNDS

INVESTMENT IN GOVERNMENT SECURITIES

TRADE RECEIVABLES

BALANCES WITH BANKS - CURRENT ACCOUNTS

BALANCES WITH BANKS - UNPAID DIVIDEND ACCOUNTS

CHEQUES, DRAFTS ON HAND

CASH BALANCE ON HAND

DEPOSITS PLEDGED WITH BANK

MARGIN MONEY DEPOSITS

INTEREST RECEIVABLE

EXPORT BENEFITS RECEIVABLE

UNAMORTISED BOROWING COST

ADVANCES RECOVERABLE IN CASH OR KIND OR FOR VALUE TO BE RECEIVED

SHORT TERM LOANS & ADVANCES TO RELATED PARTIES

LOANS TO EMPLOYEES

PREPAID EXPENSESS

DEPOSITS WITH GOVERNMENT AUTHORITIES

INTER CORPORATE LOANS/DEPOSITS

ADVANCE INCOME TAX LESS PROVISION (CURRENT TAX)

LOANS IN CURRENT ACCOUNT

SALE OF ICE CREAM & FROZEN DESSERTS (FG)

SALE OF PROCESSED FOOD (FG)

SALE OF DAIRY PRODUCTS (FG)

SALE OF OTHERS (FG)

SALE OF ICE CREAM & FROZEN DESSERTS (TG)

SALE OF PROCESSED FOOD (TG)

SALE OF DAIRY PRODUCTS (TG)

SALE OF OTHERS (TG)

SALE OF SERVICES

EXPORT LICENCE INCENTIVE / DEPB LICENCE

MISCELLANEOUS OPERATING REVENUE

INTEREST RECEIVED

DIVIDEND INCOME

NET GAIN (LOSS) ON FOREIGN CURRENCY TRANSLATIONA AND TRANSACTGION

SHARE OF PROFIT/(LOSS) OF PARTNERSHIP FIRMS

PROFIT ON SALE OF FIXED ASSETS (NET)

EXCESS PROVISION WRITTEN BACK / ANOUNT WRITTEN OFF IN EARLIER YEARS RECOVERED

MISCELLANEOUS NON OPERATING REVENUE

RAW & PACKING MATERIAL CONSUMPTION

PURCHASE OF ICE CREAM & FROZEN DESSERTS

PURCHASE OF PROCESSED FOOD

PURCHASE OF DAIRY PRODUCTS

PURCHASE OF OTHER MATERIALS

(INCREASE)/DECREASE IN STOCK FINISHED GOODS/SEMI FINISHED GOODS

SALARY & WAGES

CONTRIBUTION TO PROVIDENT & OTHER FUNDS

STAFF WALFARE EXPENSES

INTEREST EXPENSES

OTHER BORROWING COSTS

OTHER FINANCIAL CHARGES

AMORTISATION OF ANCILLIARY BORROWING COSTS

NET (GAIN) / LOSS ON FOREIGN CURRENCY TRANSACTION AND TRANSLATION

DEPRECIATION & AMORTISATION

IMPAIREMENT LOSS

LESS: RECOUPMENT FROM REVALUATION RESERVE / DEFERRED GOVERNMENT GRANT

JOB CHARGES

POWER, FUEL & OTHER UTILITIES CONSUMPITON

STORES & SPARES CONSUMPTION

REPAIRS - BUILDING

REPAIRS - MACHINERY

OCTROI & CUSTOM DUTY EXPENSES

RENT

RATES & TAXES

INSURANCE

PAYMENT TO AUDITORS

FREIGHT & FORWARDING

FIXED ASSET WRITTEN OFF

PROVISION FOR BAD DEBTS/ADVANCES

BAD DEBTS/ADVANCES

DIMINUITION IN VALUE OF INVESTMENTS

NET LOSS ON FOREIGN CURRENCY TRANSLATIONA AND TRANSACTIONS

OTHER EXPENSES

DONATION

VEHICLE REPAIRS & PETROL EXPENSES

SITTING FEES

TRAVELLING EXPENSES

RESEARCH & DEVELOPMENT EXPENSES

ENTRY TAX & SALES TAX ASSESSMENT DUES

SALES COMMISSION

ADVERTISEMENT & SALES PROMOTION

ROYALTY

PRIOR YEAR EXPENSE/INCOME

SHORT / EXCESS PROV OF I TAX

LIABILITIES

ASSETS

REVEUNE

EXPENDITURE

Account from Account to GL gap

100000 100999 1000

101000 101999 1000

102000 102999 1000

103000 103999 1000

104000 104999 1000

105000 105999 1000

106000 106999 1000

107000 107999 1000

108000 108999 1000

109000 109999 1000

110000 110999 1000

111000 111999 1000

112000 112999 1000

113000 113999 1000

114000 114999 1000

115000 115999 1000

116000 116999 1000

117000 117999 1000

118000 118999 1000

119000 119999 1000

120000 120999 1000

121000 121999 1000

122000 122999 1000

123000 123999 1000

124000 124999 1000

125000 125999 1000

126000 126999 1000

127000 127999 1000

128000 128999 1000

129000 129999 1000

130000 130999 1000

131000 131999 1000

132000 132999 1000

133000 133999 1000

134000 134999 1000

135000 135999 1000

136000 136999 1000

137000 137999 1000

138000 138999 1000

139000 139999 1000

200000 200999 1000

201000 201999 1000

202000 202999 1000

203000 203499 500

203500 203999 500

204000 204999 1000

205000 205999 1000

206000 206499 500

206500 206999 500

207000 207999 1000

208000 208999 1000

209000 209999 1000

210000 210999 1000

211000 211999 1000

212000 212999 1000

213000 213999 1000

214000 214999 1000

215000 215999 1000

216000 216999 1000

217000 217999 1000

218000 218999 1000

219000 219999 1000

220000 220999 1000

221000 221999 1000

222000 222999 1000

223000 223999 1000

224000 224999 1000

225000 225999 1000

226000 226999 1000

227000 227999 1000

228000 228999 1000

229000 229999 1000

230000 230999 1000

231000 231999 1000

300000 300999 1000

301000 301999 1000

302000 302999 1000

303000 303999 1000

304000 304999 1000

305000 305999 1000

306000 306999 1000

307000 307999 1000

308000 308999 1000

309000 309999 1000

310000 310999 1000

311000 311999 1000

312000 312999 1000

313000 313999 1000

314000 314999 1000

315000 315999 1000

316000 316999 1000

317000 317999 1000

400000 400999 1000

401000 401999 1000

402000 402999 1000

403000 403999 1000

404000 404999 1000

405000 405999 1000

406000 406999 1000

407000 407999 1000

408000 408999 1000

409000 409999 1000

410000 410999 1000

411000 411999 1000

412000 412999 1000

413000 413999 1000

414000 414999 1000

415000 415999 1000

416000 416999 1000

417000 417999 1000

418000 418999 1000

419000 419999 1000

420000 420999 1000

421000 421999 1000

422000 422999 1000

423000 423999 1000

424000 424999 1000

425000 425999 1000

426000 426999 1000

427000 427999 1000

428000 428999 1000

429000 429999 1000

430000 430999 1000

431000 431999 1000

432000 432999 1000

433000 433999 1000

434000 434999 1000

435000 435999 1000

436000 436999 1000

437000 437999 1000

438000 438999 1000

439000 439999 1000

440000 440999 1000

441000 441999 1000

442000 442999 1000

443000 443999 1000

444000 444999 1000

400030

400045

400065

400085

400095

304055

304060

305030

305035

306030

306035

307035

307040

131060

441160

441165

441170

433065

433080

224005

118110

118120

118125

118130

118135

122035

131000

131005

131010

131060

132025

209010

209015

209020

224020

224025

224030

224090

224095

224100

224105

224110

224115

224165

224170

224175

224200

317005

408030

439010

122110

208135

224010

224015

433130

405185

215185

215085

118035

118115

215135

118095

215215

118085

118145

215115

215225

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

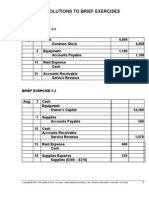

Balance of DTA/DTL to be uploaded with year to be entered in "Assignment" column for bifurcation between various years.

DTA/DTL to be open item managed accounts. (For all accounts which are need year wise bifurcation need to be open item managed)

Only following accounts will be created yearwise : Provision for income tax, TDS receivable, Advance tax/Self

assessment tax, Advance fringe tax & MAT credit. (In case of TDS receivable, section codes would be entered in line

item so there is no need to create separate g/l account)

Interest % wise balances can be uploaded in case of inter corporate deposits. (In vendor line item)

Vendor balances would be uploaded and corresponding reconciliation account would be automatically updated. If

profit center wise balance is available then the vendor balances can be uploaded profit center wise.

Dummy vendor code to be created for transferring balance from "bill awaited" account (40211) to dummy vendor account.

Service tax Output : 1 tax code would be created for basic service tax and different tax codes would be created for

RCM. (Service tax category needs to be entered at the transactional level based on which reporting requirements

can be fulfilled. Category needs to be entered in sales document in case of output and invoice verification in case of

Service tax Input : 1 tax code would be created for basic service tax and different tax codes would be created for

RCM.

Service tax receivable : At the time of booking incoming invoice service tax category would be selected and based on

VAT/CST PAYABLE : Different TC would be uploaded based on profit center & business place. (profit centers &

business place to be included in line itme while uploading)

VAT/CST ADDITIONAL TAX PAYABLE : Different TC would be uploaded based on profit center & business place.

(profit centers & business place to be included in line itme while uploading)

Assets: Following set of accounts to be created. Asset classes would be linked to g/l accounts (1 to 1)

1. APC account

2. Accumulated depreciation account

3. Profit/loss on sale of asset

4. APC on revaluation

5. Accumulated depreciation on revaluation

6. CY depreciation/Amortisation

7. Any other account for revaulation adjustment (68951)

8. CWIP

9. Profit/loss on sale of scrap

Main cash accounts as per master sheet submitted.

Petty cash accounts to be freezed.

In case of VIL : Bank balances including FD & margin are currently operated with Subledgers. SAP will have

different gl account for each type of account. So either create separate gl account for each subledger in legacy and

then map gl to gl or map each subledger with SAP GL account. Call to be taken by Vadilal Users.

All bank related gl accounts to be mapped with bank master. (Red marked gl accounts to be added in COA)

VAT RECEIVABLE : Different TC would be uploaded based on profit center & business place. (profit centers &

business place to be included in line itme while uploading)

VAT ADDITIONAL TAX RECEIVABLE : Different TC would be uploaded based on profit center & business place.

(profit centers & business place to be included in line itme while uploading)

Groups companies accounts would be created as either vendors/customers and would be linked to reconciliaiton

accounts. (Inter corporate deposit taken, other intercompany payable, inter corporate deposit given or other

intercompany receivables, loans to subsidiaires, loans from holding company)

All inter unit accounts should be knocked off internally.

Sales account to be mapped as per the SAP gl accounts. (Those can be uploaded profit center wise)

In MM only two set of accounts would be created : Stock & consumption accounts. So all legacy gl accounts which

relate to expenditure on stock need to be shown in inventory value at the time of legacy data upload.

GL for interest expense : 1. Interest on C/c / WCDL 2. Interest on T/l 3. Interest on PCFC/EEFC/EPC 4. Interest -

FD 5. Interest to vendors 6. Interest on ICD 7. Interest - others

For each bank account for which reconciliaiton is to be done, 4 other gl accounts would have to be created.

(Incoming : Cheques received but not deposited, Incoming : Cheques deposited but not cleared, Outgoing : Cheques

not issued, Outgoing : Cheques issued but not cleared.

Balance of DTA/DTL to be uploaded with year to be entered in "Assignment" column for bifurcation between various years.

DTA/DTL to be open item managed accounts. (For all accounts which are need year wise bifurcation need to be open item managed)

Dummy vendor code to be created for transferring balance from "bill awaited" account (40211) to dummy vendor account.

Objective :-

Control :-

Legacy account no To be grouped in Company Nature

11603 11601 1000

11902 11901 1000

11902 11901 2000

11903 11901 1000

40111 NEW 1000 Sundry creditors

40111 NEW 2000 Sundry creditors

40112 NEW 1000 Sundry creditors

40113 NEW 1000 Sundry creditors

40114 NEW 1000 Sundry creditors

40116 NEW 1000 Sundry creditors

40114 NEW 3000 Sundry creditors

27115 NEW 3000 Sundry debtors

27204 NEW 1000 Sundry debtors

27111 NEW 1000 Sundry debtors

27110 NEW 1000 Sundry debtors

27110 NEW 2000 Sundry debtors

27111 NEW 2000 Sundry debtors

27112 NEW 2000 Sundry debtors

27113 NEW 2000 Sundry debtors

27135 NEW 1000 Sundry debtors

27130 NEW 1000 Sundry debtors

27202 NEW 1000 Sundry debtors

27203 NEW 1000 Sundry debtors

27201 NEW 1000 Sundry debtors

30780 NEW 1000 Sundry debtors

39218 NEW 1000 Sundry debtors

40403 NEW 2000 Service tax payable

40406 NEW 2000 Service tax payable

40760 NEW 1000 Service tax payable

40603 NEW 1000 Excise duty payable

40603 NEW 1000 Excise duty payable

40603 NEW 1000 Excise duty payable

NEW NEW 1000 Excise duty recovered

NEW NEW 1000 Excise duty recovered

NEW NEW 1000 Excise duty recovered

NEW NEW 1000 Excise duty paid

NEW NEW 1000 Excise duty paid

NEW NEW 1000 Excise duty paid

GL accounts which have been created in legacy but need not be created in SAP, hence clubbed.

1. Include NEW accounts for SAP mapping

2. Accounts appearing in column " Legacy account no" have been deleted from chart of accounts worksheet.

30506 NEW 1000 Input Excise on CG - 50% receivable

30503 NEW 1000 Input Excise

30530 NEW 1000 Input Service Tax

30535 NEW 1000

Input service tax refund receivable on

export services

30838 NEW 2000 Input Service Tax

26211 NEW 2000 Stock

26219 NEW 2000 Stock

26221 NEW 2000 Stock

26101 NEW 1000 Stock

26102 NEW 1000 Stock

26201 NEW 1000 Stock

26210 NEW 1000 Stock

26301 NEW 1000 Stock

26310 NEW 1000 Stock

26401 NEW 1000 Stock

26410 NEW 1000 Stock

40705 40703 1000

40407 40408 2000

40764 40755 1000

41223 41220 2000

41224 41220 2000

41225 41220 2000

41256 41220 2000

41261 41260 1000

41262 41260 1000

41263 41260 1000

41264 41260 1000

41265 41260 1000

41266 41260 1000

41267 41260 1000

14419 12314 1000

12438 12314 1000

12316 12314 1000

12317 12314 1000

12321 12314 1000

12360 12314 1000

12367 12314 1000

12368 12314 1000

12369 12314 1000

12370 12314 1000

12391 12314 1000

14535 12314 1000

30522 30501 1000

30523 30501 1000

39202 30686 1000

31120 30614 2000

30921 30614 2000

30202 30114 1000 RECONCILIATION ACCOUNT

30113 30109 2000 RECONCILIATION ACCOUNT

30153 30151 2000

31122 NEW 2000 Group companies to be clubbed in reconciliaiton account (Other intercompany receivables)

31129 NEW 2000 Group companies to be clubbed in reconciliaiton account (Other intercompany receivables)

31153 NEW 2000 Group companies to be clubbed in reconciliaiton account (Other intercompany receivables)

30935 NEW 1000 Group companies to be clubbed in reconciliaiton account (Other intercompany receivables)

60002 60001 2000

64856 64855 1000

64857 64855 1000

64858 64855 1000

64859 64855 1000

64864 64855 1000

64865 64855 1000

64866 64855 1000

64867 64855 1000

64893 64855 1000

64896 64855 1000

64898 64855 1000

60162 60161 2000

60215 60161 2000

60130 60145 1000

60131 60145 1000

60180 60145 1000

62626 62606 1000

62607 62606 1000

62609 62606 1000

62610 62606 1000

62611 62606 1000

62612 62606 1000

62613 62606 1000

62614 62606 1000

62615 62606 1000

62617 62606 1000

62618 62606 1000

62619 62606 1000

62621 62606 1000

62622 62606 1000

62623 62606 1000

62624 62606 1000

62625 62606 1000

64392 64391 1000

64102 64101 1000

64103 64101 1000

64104 64101 1000

64107 64101 1000

64510 64870 1000

64894 64870 1000

64870 64878 1000

64879 64878 1000

64900 64878 1000

64861 64860 1000

64904 64901 1000

64905 64901 1000

61509 61510 1000

64907 64906 1000

65000 64953 3000

11902 11901 3000

11903 11901 3000

14223 14202 2000

14204 14224 2000

62849 62411 2000

Account grouping

SUNDRY CREDITORS

SUNDRY CREDITORS

SUNDRY CREDITORS

SUNDRY CREDITORS

SUNDRY CREDITORS

SUNDRY CREDITORS

SUNDRY CREDITORS

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

TRADE RECEIVABLES

LONG TERM LOANS AND ADVANCES TO RELATED PARTY

LONG TERM LOANS AND ADVANCES TO RELATED PARTY

STATUTORY DUES PAYABLE

STATUTORY DUES PAYABLE

STATUTORY DUES PAYABLE

STATUTORY DUES PAYABLE

STATUTORY DUES PAYABLE

STATUTORY DUES PAYABLE

SALE OF PRODUCTS (FINISHED GOODS)

SALE OF PRODUCTS (FINISHED GOODS)

SALE OF PRODUCTS (FINISHED GOODS)

SALE OF PRODUCTS (FINISHED GOODS)

SALE OF PRODUCTS (FINISHED GOODS)

SALE OF PRODUCTS (FINISHED GOODS)

GL accounts which have been created in legacy but need not be created in SAP, hence clubbed.

1. Include NEW accounts for SAP mapping

2. Accounts appearing in column " Legacy account no" have been deleted from chart of accounts worksheet.

DEPOSITS WITH GOVERNMENT AUTHORITIES

DEPOSITS WITH GOVERNMENT AUTHORITIES

DEPOSITS WITH GOVERNMENT AUTHORITIES

DEPOSITS WITH GOVERNMENT AUTHORITIES

DEPOSITS WITH GOVERNMENT AUTHORITIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

INVENTORIES

OTHER LONG TERM LOANS AND ADVANCES

OTHER LONG TERM LOANS AND ADVANCES

OTHER LONG TERM LOANS AND ADVANCES

OTHER LONG TERM LOANS AND ADVANCES

Reason of grouping Reconciliation Account

New SAP g/l accounts K

New SAP g/l accounts K

New SAP g/l accounts K

New SAP g/l accounts K

New SAP g/l accounts K

New SAP g/l accounts K

New SAP g/l accounts K

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts D

New SAP g/l accounts ( loan given by VIL to VIL USA) D

New SAP g/l accounts ( loan given by VIL to VSF) D

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess) - Recovered

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess) - Recovered

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess) - Recovered

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess) - Paid

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess) - Paid

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess) - Paid

GL accounts which have been created in legacy but need not be created in SAP, hence clubbed.

1. Include NEW accounts for SAP mapping

2. Accounts appearing in column " Legacy account no" have been deleted from chart of accounts worksheet.

New SAP g/l accounts for normal (Basic + E Cess + S & HECess) & 50%

on CG receivable (Basic + E Cess + S & HECess)

New SAP g/l accounts for normal (Basic + E Cess + S & HECess) & 50%

on CG receivable (Basic + E Cess + S & HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess) - service tax on export services

New SAP g/l accounts - 3 g/l accounts to be created (basic + E Cess + S

& HECess)

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

New stock accounts to be created as per to-be

OTHER LONG TERM LOANS AND ADVANCES

OTHER LONG TERM LOANS AND ADVANCES

OTHER LONG TERM LOANS AND ADVANCES

OTHER LONG TERM LOANS AND ADVANCES

62607

62609

62610

62611

62612

62613

62614

62615

62617

62618

62621

62622

62624

Вам также может понравиться

- CCF Investment Memorandum of UnderstandingДокумент31 страницаCCF Investment Memorandum of UnderstandingEvariste GaloisОценок пока нет

- BHEL GE Gas Treasury Risk ControlsДокумент36 страницBHEL GE Gas Treasury Risk ControlsAnjali DubeyОценок пока нет

- Accruals & PrepaidДокумент20 страницAccruals & Prepaidmeliana sariОценок пока нет

- Covering Letter To Bank or Building SocietyДокумент3 страницыCovering Letter To Bank or Building SocietyNick SiddallОценок пока нет

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarДокумент9 страницForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaОценок пока нет

- US Internal Revenue Service: I1099div 07Документ3 страницыUS Internal Revenue Service: I1099div 07IRSОценок пока нет

- Accounting T Codes91011245389659Документ18 страницAccounting T Codes91011245389659Jayanth MaydipalleОценок пока нет

- Consultant Application FormДокумент2 страницыConsultant Application FormRaazia MirОценок пока нет

- Affidavit of Non-Use: Please Read Carefully Prior To Completing FormДокумент1 страницаAffidavit of Non-Use: Please Read Carefully Prior To Completing FormDainette WoodsОценок пока нет

- General Power of AttorneyДокумент2 страницыGeneral Power of AttorneyJose AntonyОценок пока нет

- Gratuity Form FДокумент2 страницыGratuity Form Fचेतांश सिंह कुशवाह100% (1)

- Letter of Credit ErrorДокумент3 страницыLetter of Credit Errorraju_srinu06Оценок пока нет

- Letter of Credit Bank Specific !Документ17 страницLetter of Credit Bank Specific !JOEMEETSMONUОценок пока нет

- Security DepositДокумент25 страницSecurity DepositAbdul Musaver Aziz KhanОценок пока нет

- SS 05 Monetary and Fiscal Policy, International Trade, and Currency Exchange Rates AnswersДокумент93 страницыSS 05 Monetary and Fiscal Policy, International Trade, and Currency Exchange Rates Answersjus100% (1)

- Cheque BounceДокумент5 страницCheque BounceLucky VinnakotaОценок пока нет

- Buy Vs Rent Analysis For NYC Co-OpДокумент9 страницBuy Vs Rent Analysis For NYC Co-OpJordan BeeberОценок пока нет

- Proof of Shipment Under Letter of Credit Transactions - Expectation of BanksДокумент7 страницProof of Shipment Under Letter of Credit Transactions - Expectation of BanksRohan MarkОценок пока нет

- DRHP AU Small FinanceДокумент572 страницыDRHP AU Small FinanceParth ParikhОценок пока нет

- New Employee Joining Form1Документ28 страницNew Employee Joining Form132587412369Оценок пока нет

- Complete Due Diligence Questionnaire (DDQДокумент8 страницComplete Due Diligence Questionnaire (DDQIrelena RomeroОценок пока нет

- Reliance CAF SIP Insure ArnДокумент8 страницReliance CAF SIP Insure ArnARVINDОценок пока нет

- TreasuryДокумент53 страницыTreasuryLuis RosendoОценок пока нет

- Withholding Tax: Configuration DocumentДокумент19 страницWithholding Tax: Configuration DocumentMohammed Nawaz ShariffОценок пока нет

- XXX-XX-0934: Daniels 9 1957Документ7 страницXXX-XX-0934: Daniels 9 1957luis gonzalezОценок пока нет

- City and County of San FranciscoДокумент6 страницCity and County of San FranciscoSFGovОценок пока нет

- Treasury Audit 260614Документ10 страницTreasury Audit 260614Manish JindalОценок пока нет

- Print KYC FormДокумент75 страницPrint KYC FormDeepak Kumar VermaОценок пока нет

- ASND Anti Bribery Corruption PolicyДокумент14 страницASND Anti Bribery Corruption PolicyElisha WankogereОценок пока нет

- Retainer Letter Legal RepresentationДокумент2 страницыRetainer Letter Legal RepresentationDan Len100% (1)

- Client Request FormДокумент1 страницаClient Request FormDenald Paz100% (1)

- Account Opening FormДокумент3 страницыAccount Opening FormJoseph VJОценок пока нет

- Form F NominationДокумент2 страницыForm F NominationSatish Sati100% (1)

- SoDChecker Version0 4Документ45 страницSoDChecker Version0 4ravin.jugdav678Оценок пока нет

- Personal Financial StatementДокумент4 страницыPersonal Financial StatementKent WhiteОценок пока нет

- International Terms of PaymentДокумент3 страницыInternational Terms of PaymentMónicaPintoОценок пока нет

- Guide To The Letter of CreditДокумент49 страницGuide To The Letter of CreditSudershan ThaibaОценок пока нет

- Financial Statement GeneratorДокумент27 страницFinancial Statement GeneratorPrasad KaruturiОценок пока нет

- Documents During Car Sale1Документ11 страницDocuments During Car Sale1Paras ShardaОценок пока нет

- Goldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesДокумент122 страницыGoldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesActivate VirginiaОценок пока нет

- The Standards For Exchange Business in The UAE (Version 1.10) - 01.03.2018 For Issue (Clean)Документ156 страницThe Standards For Exchange Business in The UAE (Version 1.10) - 01.03.2018 For Issue (Clean)Māhmõūd ĀhmēdОценок пока нет

- Financial Accounting & Controlling: Run ServerДокумент106 страницFinancial Accounting & Controlling: Run ServergundasatishОценок пока нет

- (Your Company Name) (Your State or Jurisdiction)Документ7 страниц(Your Company Name) (Your State or Jurisdiction)Perimenopause Symptoms100% (1)

- Complete TSP Withdrawal ChecklistДокумент5 страницComplete TSP Withdrawal ChecklistMatt SmithОценок пока нет

- Duty Drawback SchemeДокумент3 страницыDuty Drawback SchemeganariОценок пока нет

- Dimensions of Cash Flow Management: Prof. N. C. KarДокумент74 страницыDimensions of Cash Flow Management: Prof. N. C. KarAshokОценок пока нет

- CPA Financial Statement Documentation WPsДокумент569 страницCPA Financial Statement Documentation WPsChinh Le DinhОценок пока нет

- Corporate Debt Restructuring - Issues and Way ForwardДокумент18 страницCorporate Debt Restructuring - Issues and Way ForwardAlok KumarОценок пока нет

- GGДокумент7 страницGGVincent CastilloОценок пока нет

- Master Document: Address Date of Birth Full NameДокумент4 страницыMaster Document: Address Date of Birth Full NameAnonymous LXHlHv2RWОценок пока нет

- Pastel Accounting Year End ProceduresДокумент6 страницPastel Accounting Year End ProceduresJomo SimbayaОценок пока нет

- IRS Pub 2194 - Disaster Relief Tax AddendumДокумент136 страницIRS Pub 2194 - Disaster Relief Tax AddendumdonlucekОценок пока нет

- Annual Return To Report Transactions With Foreign TrustsДокумент6 страницAnnual Return To Report Transactions With Foreign TrustsCarmita Keepitmovin FosterОценок пока нет

- A Small Briefing On CSI PayrollДокумент6 страницA Small Briefing On CSI PayrollAjay PandeyОценок пока нет

- EXPORTДокумент12 страницEXPORTBeatriz VieiraОценок пока нет

- Outbound CT-e: Prerequisites Object For SAP Note 3324837Документ3 страницыOutbound CT-e: Prerequisites Object For SAP Note 3324837Davi EliasОценок пока нет

- Seq. No. Item No. Co Business Unit BuopobjacctobjopsubsubopДокумент4 страницыSeq. No. Item No. Co Business Unit BuopobjacctobjopsubsubopbalrampatidarОценок пока нет

- Brazilian Pix Payments in Finance Transaction ID and Tree UpdatesДокумент6 страницBrazilian Pix Payments in Finance Transaction ID and Tree UpdatesRodrigoPepelascovОценок пока нет

- ComputationДокумент2 страницыComputationThe KingОценок пока нет

- Account - Invoice - 2023-04-14T140531.736Документ11 страницAccount - Invoice - 2023-04-14T140531.736ferri fahdОценок пока нет

- Nikhil - Dunning ProcedureДокумент4 страницыNikhil - Dunning ProcedureVivek KumarОценок пока нет

- Automatic Dunning Payments Summary NotesДокумент8 страницAutomatic Dunning Payments Summary NotesVivek KumarОценок пока нет

- Asset Data TransferДокумент14 страницAsset Data TransferDesmond ChinОценок пока нет

- India Localization With Respect To SD: T.MuthyalappaДокумент77 страницIndia Localization With Respect To SD: T.MuthyalappadavinkuОценок пока нет

- Enter Accrual/Deferral Document in SAPДокумент13 страницEnter Accrual/Deferral Document in SAPVivek KumarОценок пока нет

- CIN ManualДокумент34 страницыCIN ManualVivek KumarОценок пока нет

- FI Fixed AssetДокумент81 страницаFI Fixed AssetVivek Kumar0% (1)

- Advance From CustomerДокумент2 страницыAdvance From CustomerVivek KumarОценок пока нет

- Course Toc Fixed AssetsДокумент3 страницыCourse Toc Fixed AssetsVivek KumarОценок пока нет

- At R 0100 Asset Management CourseДокумент111 страницAt R 0100 Asset Management CourseVivek KumarОценок пока нет

- Valuation of Open Item in Foreign CurrencyДокумент12 страницValuation of Open Item in Foreign CurrencyVivek KumarОценок пока нет

- Real Estate: (Regulation & Development)Документ17 страницReal Estate: (Regulation & Development)Vivek KumarОценок пока нет

- Accural - IndexДокумент16 страницAccural - IndexVivek KumarОценок пока нет

- Foreign Currency RevaluationДокумент5 страницForeign Currency RevaluationVivek KumarОценок пока нет

- Sap Report Painter Step by Step TutorialДокумент90 страницSap Report Painter Step by Step TutorialDenis Delismajlovic88% (8)

- SAP Year End Closing StepsДокумент2 страницыSAP Year End Closing Stepsanon_786775012Оценок пока нет

- Enter Accrual/Deferral Document With Winshuttle Transaction™Документ15 страницEnter Accrual/Deferral Document With Winshuttle Transaction™Sathish ManukondaОценок пока нет

- LSMW OverviewДокумент32 страницыLSMW OverviewLino SchellinckОценок пока нет

- A Exchange Sec 58Документ6 страницA Exchange Sec 58Vivek KumarОценок пока нет

- Dunning ProcedureДокумент6 страницDunning ProcedureKarunesh Srivastava100% (1)

- End To End LiveДокумент14 страницEnd To End LiveVivek KumarОценок пока нет

- Dunning ProcedureДокумент6 страницDunning ProcedureKarunesh Srivastava100% (1)

- Tabel Referensi CFSДокумент170 страницTabel Referensi CFSRandy ArdiansyahОценок пока нет

- CDP-Course-4Документ64 страницыCDP-Course-4Keith Clarence BunaganОценок пока нет

- ACCOUNTINGДокумент10 страницACCOUNTINGAyaw Ko NaОценок пока нет

- Advanced financial accounting intercompany inventory transactionsДокумент19 страницAdvanced financial accounting intercompany inventory transactionseferem100% (1)

- Financial Statement & Ratio Analysis: Dr.S.Kishore Assistant Professor, Department of MBA, AITS-TirupatiДокумент35 страницFinancial Statement & Ratio Analysis: Dr.S.Kishore Assistant Professor, Department of MBA, AITS-Tirupatirisbd appliancesОценок пока нет

- Davangere distillery industry profileДокумент53 страницыDavangere distillery industry profilePrachi Rungta AnvekarОценок пока нет

- Cost Accounting Guide to Spoilage, Rework and ScrapДокумент6 страницCost Accounting Guide to Spoilage, Rework and ScrapMarc Benedict TalamayanОценок пока нет

- JSW SteelsДокумент41 страницаJSW SteelsAthiraОценок пока нет

- Dann Corporation Working Balance Sheet Decemeber 31, 2016Документ12 страницDann Corporation Working Balance Sheet Decemeber 31, 2016Ne BzОценок пока нет

- Business Finance: JollibeeДокумент25 страницBusiness Finance: JollibeespaghettiОценок пока нет

- Soal Dan Jawaban Tugas Lab 1 - Accounting EquationДокумент5 страницSoal Dan Jawaban Tugas Lab 1 - Accounting EquationPUTRI YANIОценок пока нет

- Discussion Problems With SolutionsДокумент9 страницDiscussion Problems With SolutionsRaveeda AnwarОценок пока нет

- In This Document: Purpose Questions and AnswersДокумент11 страницIn This Document: Purpose Questions and AnswersSsnathan Hai100% (1)

- A Growth and Value Opportunity: Agreed-Upon Procedures EngagementsДокумент20 страницA Growth and Value Opportunity: Agreed-Upon Procedures EngagementsMuhammadОценок пока нет

- Accountancy question paper Class 12 downloadДокумент19 страницAccountancy question paper Class 12 downloadMitesh SethiОценок пока нет

- Ratio AnalysisДокумент56 страницRatio Analysisvishi takhar80% (10)

- Cfas NotesДокумент15 страницCfas NotesGio BurburanОценок пока нет

- JLW Annual Report 2011-2012Документ10 страницJLW Annual Report 2011-2012Junior League of WashingtonОценок пока нет

- FinanceДокумент48 страницFinancetinie@surieqОценок пока нет

- Test IДокумент4 страницыTest IAvon Jade RamosОценок пока нет

- Leveraged Buyout LBO Model For Private Equity FirmsДокумент22 страницыLeveraged Buyout LBO Model For Private Equity Firmsgesona4324Оценок пока нет

- BBPДокумент60 страницBBPshekarОценок пока нет

- Your Marketing PresentationДокумент25 страницYour Marketing PresentationrachanaОценок пока нет

- Karkits CorporationДокумент6 страницKarkits CorporationKimОценок пока нет

- RTP June 2018 QnsДокумент14 страницRTP June 2018 QnsbinuОценок пока нет

- NCERT Class XI Accountancy Part IIДокумент333 страницыNCERT Class XI Accountancy Part IInikhilam.com67% (3)

- GME Stock ValuationДокумент1 страницаGME Stock ValuationOld School ValueОценок пока нет

- Self Study Solutions Chapter 3Документ27 страницSelf Study Solutions Chapter 3flowerkmОценок пока нет

- Practice Problems, CH 12 SolutionДокумент7 страницPractice Problems, CH 12 SolutionscridОценок пока нет

- Emu Farming Business PlanДокумент26 страницEmu Farming Business PlanUmair SiyabОценок пока нет