Академический Документы

Профессиональный Документы

Культура Документы

Deer Valley Lodge

Загружено:

Shrey Mangal0 оценок0% нашли этот документ полезным (0 голосов)

4 просмотров2 страницыCase study

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCase study

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

4 просмотров2 страницыDeer Valley Lodge

Загружено:

Shrey MangalCase study

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

1.

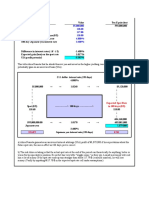

Investment = $2,000,000 + $1,300,000 = $3,300,000

Annual cash inflow = 300 skiers x 40 days x $55/skier-day = $660,000

Annual cash outflow = (200 days x $500/day) = $100,000

Net Cash flows = 660,000-100,000 = $560,000.

PV of cash flows @ 14% = $560,000 x 6.6231= $3,708,953

NPV = $3,708,953 - $3,300,000 = $408,953

The new lift will create value of $408,953, so it is a profitable

investment.

2. After-tax cash flows = $560,000 x (1-0.4)= 560,000 x 0.6 =

$336,000

PV of after-tax cash flows @ 8% = $336,000 x 9.8181 (from table) =

$3,298,897

PV of tax savings = $3,300,000 x .4 x .7059 (from table) = $936,540

NPV after-tax = $3,298,897 + $936,540 - $3,300,000 = $935,438

The investment in the lift is more profitable on an after-tax basis than

on a pretax basis.

3. Subjective factors that might affect this decision include:

Profits on sales of food, rental of equipment, and other items

purchased by the additional skiers.

More satisfied customers because of less crowding on the days

that the additional lift does not result in additional skiers being

attracted to Deer Valley.

If the weather is bad, additional skiers may be less than

estimated.

Вам также может понравиться

- Sunset Boards Case StudyДокумент3 страницыSunset Boards Case StudyMeredith Wilkinson Ramirez100% (2)

- 2 - Ch12 CrustalDeformation Lab Responses 1 PDFДокумент9 страниц2 - Ch12 CrustalDeformation Lab Responses 1 PDFShrey Mangal0% (10)

- 1Документ2 страницы1Shrey Mangal0% (1)

- DeerДокумент2 страницыDeerHelplineОценок пока нет

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsДокумент12 страницSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranОценок пока нет

- Financial statements, cash flows, and taxes solutionsДокумент2 страницыFinancial statements, cash flows, and taxes solutionstakesomethingОценок пока нет

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFДокумент38 страницFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (9)

- Ritz-Carlton Monthly Cash Budget AnalysisДокумент6 страницRitz-Carlton Monthly Cash Budget AnalysisAnsuman MohapatroОценок пока нет

- Solutions Ch2Документ3 страницыSolutions Ch2darkroyan426Оценок пока нет

- Fitzgeraldhyne Rappan - A031221038Документ2 страницыFitzgeraldhyne Rappan - A031221038Fitzgeraldhyne RappanОценок пока нет

- Chapter 2 Financial Statements Cash Flow and TaxesДокумент7 страницChapter 2 Financial Statements Cash Flow and TaxesM. HasanОценок пока нет

- Chapter+2 3Документ14 страницChapter+2 3kanasanОценок пока нет

- FFM 9 Im 12Документ31 страницаFFM 9 Im 12Mariel CorderoОценок пока нет

- AA Chap 14Документ28 страницAA Chap 14Thu NguyenОценок пока нет

- BFF2341 Tri A 2020 Mini Test 2 SolutionДокумент3 страницыBFF2341 Tri A 2020 Mini Test 2 SolutionDuankai LinОценок пока нет

- Compound Interest Explained: Calculating Future and Present Value of AnnuitiesДокумент30 страницCompound Interest Explained: Calculating Future and Present Value of AnnuitiesAshia12Оценок пока нет

- Solutions Manual Corporate Fiance Ross W-75%Документ10 страницSolutions Manual Corporate Fiance Ross W-75%Desrifta FaheraОценок пока нет

- Handouts 5-6 - Review - Exercises and SolutionsДокумент6 страницHandouts 5-6 - Review - Exercises and Solutions6kb4nm24vjОценок пока нет

- Compound Interest Calculations and Financial AnalysisДокумент6 страницCompound Interest Calculations and Financial AnalysisSheikh Roshnee 1731695Оценок пока нет

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsДокумент16 страницSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamОценок пока нет

- Solutions To Selected End-Of-Chapter 6 Problem Solving QuestionsДокумент9 страницSolutions To Selected End-Of-Chapter 6 Problem Solving QuestionsVân Anh Đỗ LêОценок пока нет

- UKM GIBAH Anggota dan KegiatanДокумент13 страницUKM GIBAH Anggota dan KegiatanVanni LimОценок пока нет

- Fnce370 Assign3Документ29 страницFnce370 Assign3smaОценок пока нет

- A) Year 0 Year 1 Year 2 Year 3Документ13 страницA) Year 0 Year 1 Year 2 Year 3Usman KhiljiОценок пока нет

- Managerial Finance Tutorial 7: To Be Submitted Within 3 JuneДокумент7 страницManagerial Finance Tutorial 7: To Be Submitted Within 3 JuneaskdgasОценок пока нет

- Chapter 2Документ3 страницыChapter 2Ikramul HaqueОценок пока нет

- Calculation Part-Financial ManagementДокумент5 страницCalculation Part-Financial ManagementAshwini shenolkarОценок пока нет

- Glasanay BF Q3W5Документ3 страницыGlasanay BF Q3W5Whyljyne Mary GlasanayОценок пока нет

- Cash Budget Fin420 - Ba250 Group 4Документ9 страницCash Budget Fin420 - Ba250 Group 4nuraz3169Оценок пока нет

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Документ8 страницMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630Оценок пока нет

- Latihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Документ7 страницLatihan Soal Chapter 21 - Yoga Cipta Nugraha - 1181002067 - Sesi 12Yoga Cipta NugrahaОценок пока нет

- Outstanding cash balance reductionДокумент4 страницыOutstanding cash balance reductionAn DoОценок пока нет

- CHAPTER IV DONE Doc.1Документ5 страницCHAPTER IV DONE Doc.1Carme ErnacioОценок пока нет

- Midterm Exam SolutionsДокумент6 страницMidterm Exam SolutionsPaulo TorresОценок пока нет

- Answer To Exercises-Capital BudgetingДокумент18 страницAnswer To Exercises-Capital BudgetingAlleuor Quimno50% (2)

- CFIN 3rd Edition by Besley Brigham ISBN Solution ManualДокумент6 страницCFIN 3rd Edition by Besley Brigham ISBN Solution Manualrussell100% (21)

- Lecture Notes Topic 4 Part 2Документ34 страницыLecture Notes Topic 4 Part 2sir bookkeeperОценок пока нет

- Bond Price 100,000Документ22 страницыBond Price 100,000HAMMADHRОценок пока нет

- Solutions To End-Of-Chapter ProblemsДокумент14 страницSolutions To End-Of-Chapter ProblemsTushar MalhotraОценок пока нет

- EE - Assignment Chapter 9-10 SolutionДокумент11 страницEE - Assignment Chapter 9-10 SolutionXuân ThànhОценок пока нет

- Answer To The Question Number 1 (B)Документ14 страницAnswer To The Question Number 1 (B)tonmoyОценок пока нет

- Financial Management Chapter 9 Examples Gitman BookДокумент5 страницFinancial Management Chapter 9 Examples Gitman BookQUSAIN BUKHARIОценок пока нет

- Discounted Cash Flow Activity 1Документ3 страницыDiscounted Cash Flow Activity 1Gabrielle EkhasomhiОценок пока нет

- Null 1Документ2 страницыNull 1Mazen SalahОценок пока нет

- Corporate Finance Week 3 Slide SolutionsДокумент6 страницCorporate Finance Week 3 Slide SolutionsKate BОценок пока нет

- Solution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFДокумент36 страницSolution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFtiffany.kunst387100% (9)

- ACF 103 Revision Qns Solns 20141Документ11 страницACF 103 Revision Qns Solns 20141danikadolorОценок пока нет

- Case 6 - Mki Kel 10Документ12 страницCase 6 - Mki Kel 10YuyuОценок пока нет

- D E+ D X RD+ E D+ E X : Return Richard ExpectДокумент5 страницD E+ D X RD+ E D+ E X : Return Richard ExpectSu Suan TanОценок пока нет

- CVP Solutions and ExercisesДокумент8 страницCVP Solutions and ExercisesGizachew NadewОценок пока нет

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Документ5 страницAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Cost and Financial Management QuizДокумент3 страницыCost and Financial Management QuizNeha ArifОценок пока нет

- Final F09 SolutionДокумент5 страницFinal F09 SolutionWyatt Niblett-wilsonОценок пока нет

- Analyzing Financial Project Cash Flows and Depreciation Tax BenefitsДокумент6 страницAnalyzing Financial Project Cash Flows and Depreciation Tax BenefitsSpandana AchantaОценок пока нет

- F9 - IPRO - Mock 1 - AnswersДокумент12 страницF9 - IPRO - Mock 1 - AnswersOlivier MОценок пока нет

- Group 3 - Compensation Budget Report - Midterm PT GenMathДокумент2 страницыGroup 3 - Compensation Budget Report - Midterm PT GenMathShaff LeighОценок пока нет

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionДокумент9 страницManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaОценок пока нет

- Complete C7Документ15 страницComplete C7tai nguyenОценок пока нет

- Solutions To End-Of-Chapter ProblemsДокумент22 страницыSolutions To End-Of-Chapter ProblemsKalyani GogoiОценок пока нет

- Investment Project Analysis: Payback, ARR, NPV, PI, IRR CalculationsДокумент4 страницыInvestment Project Analysis: Payback, ARR, NPV, PI, IRR Calculationsjagan pawanismОценок пока нет

- Tutorial IIIДокумент5 страницTutorial IIINikhilaОценок пока нет

- Finec 2Документ11 страницFinec 2nurulnatasha sinclairaquariusОценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- LIQUIDITYДокумент1 страницаLIQUIDITYShrey MangalОценок пока нет

- Enterprise Zones 2Документ2 страницыEnterprise Zones 2Shrey MangalОценок пока нет

- UuДокумент1 страницаUuShrey MangalОценок пока нет

- Standard DistributionДокумент1 страницаStandard DistributionShrey MangalОценок пока нет

- EquationДокумент1 страницаEquationShrey MangalОценок пока нет

- 14Документ3 страницы14Shrey MangalОценок пока нет

- AkiraДокумент1 страницаAkiraShrey MangalОценок пока нет

- GroupXX Assign4Документ5 страницGroupXX Assign4Shrey MangalОценок пока нет

- Office Building, or A Warehouse. The Future States of Nature That Will Determine The Profits Payoff Table For This Decision Problem Is Given BelowДокумент1 страницаOffice Building, or A Warehouse. The Future States of Nature That Will Determine The Profits Payoff Table For This Decision Problem Is Given BelowShrey MangalОценок пока нет

- HarkerДокумент4 страницыHarkerShrey MangalОценок пока нет

- ANOVA results disagree with Nashville data due to small sample sizeДокумент1 страницаANOVA results disagree with Nashville data due to small sample sizeShrey MangalОценок пока нет

- 5 45Документ2 страницы5 45Shrey MangalОценок пока нет

- Proble M Number Solution: Answer SheetДокумент11 страницProble M Number Solution: Answer SheetShrey MangalОценок пока нет

- Chose the right answer multiple choicesДокумент7 страницChose the right answer multiple choicesShrey MangalОценок пока нет

- コピーC14 01Документ3 страницыコピーC14 01Shrey MangalОценок пока нет

- Oral authorization is undocumentedДокумент4 страницыOral authorization is undocumentedShrey Mangal0% (1)

- CHP 9 Case F16Документ6 страницCHP 9 Case F16Shrey MangalОценок пока нет

- Budget Variance WorksheetДокумент4 страницыBudget Variance WorksheetShrey MangalОценок пока нет

- Bsbsus501a As 1Документ12 страницBsbsus501a As 1Shrey Mangal29% (7)

- Show All Work To Receive Credit On Each Problem. If No Work Is Provided, No Credit Can Be Given. Label The AnswersДокумент3 страницыShow All Work To Receive Credit On Each Problem. If No Work Is Provided, No Credit Can Be Given. Label The AnswersShrey MangalОценок пока нет

- CH 13 ProbsДокумент8 страницCH 13 ProbsShrey MangalОценок пока нет

- HomeworkДокумент6 страницHomeworkShrey MangalОценок пока нет

- 1Документ2 страницы1Shrey MangalОценок пока нет

- Quiz 6Документ3 страницыQuiz 6Shrey MangalОценок пока нет

- Statistics QuestionДокумент1 страницаStatistics QuestionShrey MangalОценок пока нет

- M1Документ2 страницыM1Shrey MangalОценок пока нет

- 1Документ5 страниц1Shrey MangalОценок пока нет