Академический Документы

Профессиональный Документы

Культура Документы

Ratio Final Project

Загружено:

api-2670126280 оценок0% нашли этот документ полезным (0 голосов)

85 просмотров12 страницОригинальное название

ratio final project

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

85 просмотров12 страницRatio Final Project

Загружено:

api-267012628Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 12

Will Tumberger

May 14, 2014

Principals of Finance

Professor Keyes

PepsiCo Inc. Ratio Analysis

PepsiCo Inc. is an American multinational food and beverage corporation headquartered

in Purchase New York, United States, with attention in the manufacturing, marketing, and

distribution of grain based snack foods, beverages, and other products. This firm was formed in

1965 with the merger of the Pepsi-Cola Company and Frito-Lay. PepsiCo has since extended

from its namesake product Pepsi to a larger array of food and drink brands, the largest of which

includes an attainment of Tropicana in 1998 and a union with Quaker Oats in 2001which also

added the Gatorade brand to its portfolio.

As of January 22, 2012 PepsiCo's product lines have produced retail sales of more than

$1 billion each and the company's yields were distributed across more than 200 countries,

resulting in yearly net revenues of $43.3 billion. Their biggest customers are big wholesale

companies like Wal-Mart. Concentrated on net revenue; PepsiCo is the second most leading food

and beverage industry in the world. Within North America, PepsiCo is classified (by net

revenue) as the largest food and beverage business.

Indra Nooyi is an Indian-born naturalized American who has been the chief executive of

PepsiCo since 2006, According to Forbes, she is consistently ranked among the World's 100

Most Powerful Women. The company employs roughly 274,000 people globally as of 2013.

The corporation's beverage distribution and bottling is steered by PepsiCo as well as by licensed

bottlers in certain regions. PepsiCo is a SIC 2080 (beverage) company. These businesses are

listed by the U.S. Securities and Exchange Commision as being the Beverages Industry and

given the Standard Industrial Classification number of 2080. Aside from PepsiCo, other

companies in this industry include:

The Coca-Cola Compay

Anheuser-Busch

Dr. Pepper Snapple Group

Jones Soda Co

Polar Beverages

Seagram Co Ltd

Viking Distillery Inc

Molson Coors Brewing Company

Iceberg Corp of America

The legendary brand rivalry of Pepsi and Coca-Cola has been going on for more than half

a century. Coca-Cola is a major contributor in the cola market share over Pepsi, but Pepsis

multiple business lines haul in more cash. The difference in the industry leaves Coca-Cola with

42% and Pepsi with 31% of the total market share. Annual revenue within Pepsi is 65.4 Billion

and 48 Billion with Coca-Cola. Coca-Cola also spends around 2 billion just on advertisement

spending with Pepsi only spending 1.1 Billion. The reasons behind Pepsis major successes over

Coca-Cola contribute to the fact that although Pepsis beverage brands may not be as strong its

snack food industry is enormous. These businesses include:

Tropicana

Sobe

Fritos

Mountain Dew

Gatorade

Quaker

Life

Sierra Mist

Tostitos

7up

Naked Juice

Aquafina

Lipton

Liquidity Ratios:

Current Ratio

PepsiCo has a current ratio of 1.095; previous years include a 2011 ratio of 0.96 and 2010

at 1.105. Since the current ratio is just above 1 Pepsi is capable of paying off its obligations. In

2011 the ratio of 0.96 suggests that during that year setbacks in the firms ability to pay back its

short term liabilities with its short term assets was not up to par. The industry average is 1.5 for

the current ratio so Pepsi is just shallow of meeting that average. Pepsis main competitor Coca-

Cola has maintained a better overall current ratio in the years from 2012 to 2010 with their

current being 1.09, 1.04, and 1.16. Even though currently these two companies share the same

current ratio standing, Coca-Cola seems to have a healthier balanced average. Although it may

seem like Pepsi is not as productive in its current ratio standings as the industry average has it set

to be, 1.09 is a healthy number telling stockholders that they are efficiently using their current

assets and do not have problems within their short term financing facilities.

Quick Ratio

The quick ratios of Pepsi in 2012 through 2010 are 0.88, 0.74, and 0.89. The quick ratio

industry average is listed as 1.1. One can make the judgment from these ratios that Pepsi may be

struggling to maintain or grow new sales. Also added they could be paying bills too quickly or

collecting receivables too slowly. With Coca-Colas higher ratios starting from 2012 at 0.97, the

previous year at 0.92, and finally 2010 at 1.02, an investor can see that the companies may be

heading in separate directions as far as financial stability, with Coca-Cola being at or nearing

where they would like and Pepsi falling short of expectations. Also to put into perspective is that

of the timing of asset purchases, compensation and collection policies, allowances for bad debt,

and even capital raising efforts that can all influence the calculation of the quick ratio. For these

reasons, liquidity relationships are significant among companies within this industry.

Asset Management Ratios:

Inventory Turnover

The inventory turnover for Pepsi measures the rate at which it can purchase and resell

products to customers. Pepsis turnover ratios from 2012 to 2010 show its stable rate of 18.28,

17.37, and in 2010 with 17.15, and the Industry Average of 11.6. Coca-Cola falls behind in this

area with lower but still abundant ratios of 14.71 in 2012, 15.05 in 2011, and 13.25 in 2010.

These ratios for Pepsi indicate that this company is appreciating solid sales and is also able to

refill cash quickly and has a lower threat of becoming stuck with obsolete inventory, meaning

that will not carry inventory that is useless and unsellable.

Days Sales Outstanding

DSO is important because the speed at which a company collects cash is significant to its

efficiency and overall profitability. The faster Pepsi collects cash, the faster it can reinvest that

cash to make more overall sales. When comparing the DSO between Pepsi and Coca-Cola they

are just about even when it comes to collecting cash. From 2012 to 2010 Pepsi has maintained a

stable average around 39 days. In 2011 Pepsi had a quicker DSO at 37.9 days. 2012 and 2010 the

DSO was at 39 days, meaning that in 2011 the management of credit and the expenditure of

receivables may have been just a bit more efficient. Coca-Cola on the other hand has steadily

lowered their DSO from 46 days in 2010 all the way down to 36 days in 2012. Coca-Cola has

dramatically become more efficient throughout the 3 year span, making it able to handle and

distribute cash a few days quicker than Pepsi. Because of the seasonality changes in sales some

analysts use a day-to-day average of sales based on a 30 to 90 day period using the average

receivable number to get a closer look at a more current DSO.

Fixed Asset Turnover

The fixed asset turnover for Pepsi in 2012 was 3.42, 2011 with 3.37, and 2010 with 3.03.

Although this ratio is a rough measure of the productivity of the companys fixed assets, which

are property, plant, and equipment, it is intended to reflect Pepsis efficiency in managing these

assets. Simply put, the higher the yearly turnover rate, the better. There is no exact number that

determines whether a company is doing a good job of generating revenue from its investments in

fixed assets, so comparing this with its main competitor Coca-Cola is a must. In 2012 Coca-

Colas turnover was 3.31, 3.11 in 2011, and 2.38 in 2010. Comparing the two it can be noticed

that Pepsi is more stable within the efficiency of its fixed assets and on average yields a higher

ratio as well.

Total Asset Turnover

In 2012 the Soft Drink industry average total asset turnover was .66. Pepsi was well

above this average with 0.87 as well as an average of 0.91 and 0.84 in 2011 and 2010. Coca-Cola

fell short of the Industry average in 2012 with a ratio of 0.55 along with 0.58 and 0.48 for 2011

and 2010. This means that Pepsi is doing a much better job at earning money from their assets

than Coca-Cola is. With Coca-Cola below the average it is understood that they are not doing a

quality job of selling their products and making money from their brand. With Pepsi involved in

so many other companies worldwide they have a better opportunity at making money from assets

when their brands are successful, Coca-Cola is not able to catch up because of its smaller spread

within different brands.

Debt Management Ratios:

Total Debts to Assets

Pepsi has a drastically higher debt to asset ratio than Coca-Cola specifically in years 2012

and 2011. Pepsis ratio in 2012 was 0.315 meaning that 31% of the assets of the firm were

funded using borrowed money. This shows that Pepsi is using a large amount of outside funding

to finance their assets. Although Coca-Colas ratio is lower with 0.17 in years 2012 and 2011 as

well as a 2010 ratio of 0.19, it does not increase much each year, along with Pepsis ratios

including 0.28 in 2011 and 0.29 in 2010. This shows that both corporations have been borrowing

more money to help fund their business.

Times Interest Earned

The times interest earned for Pepsi has not differentiated much from 2012 back to 2010.

The ratio calculated in 2012 shows 10.23, 2011 shows 11.32, and in 2010 it was back to 10.11.

In comparison to Coca-Colas TIE it seems that Pepsi is overleveraged compared the

competition. Coca-Colas TIE is very high compared to Pepsi at 30.74 in 2012, 28.47 in 2011

and 20.38 in 2010. But these high numbers can also indicate that Coca-Cola may be too safe and

is disregarding opportunities to expand earnings though leverage, which is the use of borrowed

money or even fixed assets to magnify profit potential. Based on what is known about Coca-

Colas total debts to assets ratio in comparison to Pepsis, it can be implied that Pepsi is better

off because of the companys ability to borrow money and spread it through its many other

successful brands. Coca-Cola may be holding back on this therefore giving the extremely high

TIE ratio.

Profitability Ratios:

Operating Margin

With the industry average operating margin at 36% Pepsi falls short with their ratios of

2012 through 2010 at 14.05%, 14.57%, and 15.79%. Coca-Cola is closer but also falls short

beginning with 2012 to 2010 at 25.42%, 25.51%, and 42.54%. In this measure of efficiency the

higher operating margin is associated with how profitable a companys core business is.

Understanding Pepsis operating margin shows that in 2012 for every $1 in sales, Pepsi made

$0.14 in operating earnings as opposed to Coca-Cola with their much greater $0.25 per $1. Both

of these companies are below the industry standard mainly because of the amount and price of

products they sell and distribute. These products are low cost (Pepsis costs are a bit higher than

Coca-Cola) but are abundant so the main goal for these firms in volume and promotion to garner

more sales.

Profit Margin

Pepsi and Coca-Cola are both extremely consistent when it comes to profit margin. Pepsi

had margins of 54%, 54%, and 53% for the 3 years while Coca-Cola had margins of 61%, 64%,

and 64%. What this accounts for is that for every $1 Pepsi makes off its products, it brings in

$0.54 for profit. Interestingly enough Pepsi had higher sales figures than Coca-Cola for the 3

years but the lower gross profit margin shows that Pepsi has a much higher cost of goods sold

than Coca-Cola does.

Return on Assets

This ratio is an indicator of how a company effectively generates profits off their assets.

It is said that the higher the firms earnings in proportion to its assets shows a company is using

their assets to their full profitability. Over the past 3 years Pepsi has not done much in changing

their return on assets. They are 8.28% in 2012, 8.84% in 2011, and 9.27% in 2010. Coca-Cola is

more effective with an ROA of 10.47% to 10.73% to 16.16%, from 2012 going down to 2010.

Falling ROA is a question of concern with Pepsi slowly decreasing year after year. These poor

values from Pepsi could be due to the outstanding liabilities that are not accounted for when

calculating this ratio and when accounted for could indicate a higher profit margin level.

Basic Earning Power

The basic earning power of Pepsi starting at 2012 down to 2010 is 12.33%, 13.30%, and

13.40%. Coca-Colas margins from 2012 to 2010 are 14.16%, 14.85%, and 20.49%. It seems as

if Pepsi is losing earning power annually with its poor performance within the companys return

on assets. Pepsi is not a short term stock option for a day trader. This is a company that on

average is slow growing because it has been around for so long making its long term earnings

power an indication that it may be a good investment. Even though its earning power is lower in

comparison to Coca-Cola, the margins are not big enough for Coca-Cola to ultimately take over

the market.

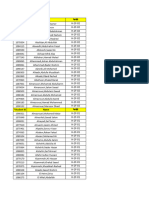

The chart below was taken from an article in the Business Insider. This is a visual aid to

the rising stock values of both Pepsi and Coca-Cola throughout the years.

Return on Common Equity

Pepsi has a similar ROE as Coca-Cola, with their 2012 margin at 27.56%, 2011 at

31.12%, and 2010 at 29.71%. Similarly Coca-Cola at 2012 was 27.51%, 2011 at 27.13%, and

2010 at 38.02% with the industry average at 32.40%. Pepsis somewhat stable ROE suggests

they are constant in generating profit without needing much capital. This is also a good indicator

of Pepsis management at positioning the shareholders capital. Even though a constant rising

ROE is better, their ability to stay even is much better in the eyes of the shareholder than it

would be if they were to fall.

Market Value Ratios:

Price/Earnings

If there is one number that people look at more than any other is the price to earnings

ratio. With Pepsis relationship between the stock price and the companys earnings the margins

starting with 2012 and ending at 2010 looks like this; 18.02, 15.03, and 16.04. Coca-Colas

margins are as listed as well; 19.03, 14.02, and 19.02. With Pepsis increasing P/E ratio the

market has high hopes for this stocks future. The question to ask is what is the right P/E for

Pepsi? Unfortunately that is the risk involved because there is no absolute correct answer. This

answer depends on what the buyer is willing to pay for Pepsis earnings. Purchasing stock in

Pepsi based on the growing P/E ratio of this firm means the buyer believes this company has

respectable long term forecasts over and beyond its existing position.

Market/Book

Pepsi has a market/book margin of 0.96 almost identical to that of its competitor Coca-

Cola with a margin of 0.95. Understanding that if the ratio is above 1 the stock is undervalued; if

it is less than 1, the stock is overvalued Pepsi seems to fall under the category of being

overvalued but not by much. Along with Coca-Cola these companies are seen as being

overvalued and are likely to experience a price drop and return to a level which better reflects its

financial status. Looking at these margins and understanding Pepsis small but steady growth

within its P/E I would consider this companys price to decline but only in small increments and

then grow slowly because its past P/E values suggest this in its past patterns.

Summary of Findings:

From the first soda created in 1898, todays PepsiCo has a gigantic range of 22 beverage,

snack, and food trademarks making it one of Americas best enterprises. PepsiCo is shifting with

the times, it doesnt want to be recognized as just another soda or snack food. PepsiCo is

devoting itself to Performance with Purpose, the belief that what is good for business can and

should be good for society. The fact that the Coca-Cola vs. Pepsi battle has stormed for ages

shows that people have certainly had a thirst for its products. Pepsi may be an old company, but

it has clearly developed especially under the current management brought about by Indra Nooyi,

The CEO of Pepsi. The companys product expansion and reinvention are frontward thinking

efforts to develop the long term trajectory of this corporation. Based on all of the market ratios

conducted and the analysis of Pepsis market value I believe that this company will remain

steady and continue to grow slowly within the market. As a marketing major myself I envy

Pepsis ability to establish and grow strong global brands, this creates a company that is diverse

and also increases its overall value as long as they continue to grow with the ever-changing

marketplace. It is interesting to evaluate the different financial aspects that have profound effects

on a companys market value and overall growth throughout the many years of Pepsis lifetime. I

added the stock chart found from Business Insider because the growth and competition between

Pepsi and Coca-Cola is fascinating to learn about. These companies have such strong global

brands that the future growth of both companies should be interesting as well as the rivalry itself.

Along with Pepsi and Coca-Cola, the beverage and soft drink industry as a whole will continue

to grow steadily through the years. These long term corporations keep coming up with new and

inventive ideas as well as exciting brands to quench anyones thirst. It was interesting doing

research on the P/E ratios of both companies, Pepsi seems to be growing slowly and I dont think

there will be any huge jumps but with advertising and the media in todays world there is always

the possibility that a new brand could push any company to make great strides within the market.

As someone who does not know all there is to know about the stock market and with just the

basics learned in principals of finance I would be interested in investing in this company. They

are a long term company that is trust worthy and as a beginner in understanding the stock market

I think it would be a safe company to invest in and more importantly learn from.

Recommendation:

If I were an analyst looking into Pepsi as a future investment or if I was currently holding

stock within this company I would definitely hold on to the stock I had in Pepsi. There is not

much risk since they are not only a long term stock, but they are one of the top successful

companies in the United States for a reason. It is a company I would wait and see for a

considerable amount of time to see where they are heading as a whole as well as what new

brands and products they come to claim as their own.

Works Cited

"1. Introduction - Soft Drink Industry SAR Analysis." 1. Introduction - Soft Drink Industry SAR

Analysis. N.p., n.d. Web. 15 May 2014.

Bhasin, Kim. "COKE VS. PEPSI: The Story Behind The Neverending 'Cola Wars'" Business Insider.

Business Insider, Inc, 04 Jan. 2013. Web. 15 May 2014.

"PepsiCo Home | PepsiCo.com." PepsiCo Home | PepsiCo.com. N.p., n.d. Web. 14 May 2014.

"Pepsico, Inc." Yahoo! Finance. N.p., n.d. Web. 15 May 2014.

Вам также может понравиться

- Financial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Документ17 страницFinancial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Shloak AgrawalОценок пока нет

- Coca Cola Financial AnalysisДокумент8 страницCoca Cola Financial AnalysisFredrick LiyengaОценок пока нет

- Coke PepsiДокумент4 страницыCoke Pepsisardarkoushik13Оценок пока нет

- Welc0Me To OUR Presentation: Topic: Financial Ratios Analysis ofДокумент26 страницWelc0Me To OUR Presentation: Topic: Financial Ratios Analysis ofChoudhary OsamaОценок пока нет

- Coca Cola: Topic: Financial Ratios Analysis ofДокумент26 страницCoca Cola: Topic: Financial Ratios Analysis ofradislamy-1Оценок пока нет

- Assignment 9-Shawanna LumseyДокумент14 страницAssignment 9-Shawanna LumseyShawanna ButlerОценок пока нет

- IJRPR5968Документ4 страницыIJRPR5968Harender SolankiОценок пока нет

- Coca Cola Co SWOT AnalysisДокумент45 страницCoca Cola Co SWOT AnalysiselvademonlizОценок пока нет

- TCCC Gri Report2013Документ91 страницаTCCC Gri Report2013Keisuke YasudaОценок пока нет

- Comparative Study of Two CompaniesДокумент8 страницComparative Study of Two CompaniesTayyab Farooq100% (1)

- Coca ColaДокумент15 страницCoca ColaJaswinder DhaliwalОценок пока нет

- Coca Cola AssignmentДокумент16 страницCoca Cola AssignmentFatima RizwanОценок пока нет

- Pepsi Co. Executive Summary: Pepsico Inc. Is An AmericanДокумент19 страницPepsi Co. Executive Summary: Pepsico Inc. Is An AmericanAhmed HamdanОценок пока нет

- Ratio Analysis of Coca-ColaДокумент26 страницRatio Analysis of Coca-ColaWajid Ali71% (7)

- Business MemoДокумент2 страницыBusiness MemotuphamanhstorageОценок пока нет

- Acccob2 Reflection #1Документ8 страницAcccob2 Reflection #1asiacrisostomoОценок пока нет

- Coca Cola Inc and Pepsico IncДокумент8 страницCoca Cola Inc and Pepsico IncmosesОценок пока нет

- Cola WarsДокумент13 страницCola Warsmokshgoyal2597100% (1)

- Port PepsiДокумент13 страницPort PepsiSRV TECHSОценок пока нет

- Executive Summary of Coca-ColaДокумент5 страницExecutive Summary of Coca-Colaapi-35451317750% (8)

- Market Share Coca-Cola: Portfolio DiversificationДокумент4 страницыMarket Share Coca-Cola: Portfolio Diversificationrehan shaikhОценок пока нет

- How To Use Dupont Analysis For Financial Analysis: Soft-Drink ExampleДокумент7 страницHow To Use Dupont Analysis For Financial Analysis: Soft-Drink ExampleAMBWANI NAREN MAHESHОценок пока нет

- Pepsi and Coke Financial ManagementДокумент11 страницPepsi and Coke Financial ManagementNazish Sohail100% (1)

- Awards & Recognition: Brewing A Better World TogetherДокумент133 страницыAwards & Recognition: Brewing A Better World TogetherHaMunОценок пока нет

- Coca-Cola in 2011: in Search of A New ModelДокумент11 страницCoca-Cola in 2011: in Search of A New ModelMustika ZakiahОценок пока нет

- Pepsi PaperДокумент6 страницPepsi Paperapi-241248438Оценок пока нет

- Coca Cola Financial Statement AnalysisДокумент30 страницCoca Cola Financial Statement AnalysistenglumlowОценок пока нет

- Pepsi-Co Ethics and Compliance PaperДокумент7 страницPepsi-Co Ethics and Compliance PaperAlvis OBanion Jr.Оценок пока нет

- Core Business: Consumable Food and LiquorДокумент6 страницCore Business: Consumable Food and Liquorshahanabbas123Оценок пока нет

- Project of Coca Cola 110406035123 Phpapp01Документ77 страницProject of Coca Cola 110406035123 Phpapp01varunvarshney1988Оценок пока нет

- An Analysis On Pepsico Inc.Документ7 страницAn Analysis On Pepsico Inc.mohidul islamОценок пока нет

- Goals of CocaДокумент7 страницGoals of Coca2K19/UMBA/25 VIDHI SARAFFОценок пока нет

- Financial Ratios NestleДокумент23 страницыFinancial Ratios NestleSehrash SashaОценок пока нет

- ProjectДокумент18 страницProjectIshika TyagiОценок пока нет

- Financial Analysis of Tesco PLCДокумент7 страницFinancial Analysis of Tesco PLCSyed Toseef Ali100% (1)

- Enduring Value: 2012 Annual Report - Executive Summary: Our Financial, Environmental, Social and Governance PerformanceДокумент16 страницEnduring Value: 2012 Annual Report - Executive Summary: Our Financial, Environmental, Social and Governance PerformancekirkhereОценок пока нет

- Analysis of PepsiCoДокумент21 страницаAnalysis of PepsiCoViet Bui QuocОценок пока нет

- IntroductionДокумент4 страницыIntroductionadriancanlas243Оценок пока нет

- S.M Pepsico MatrixДокумент12 страницS.M Pepsico MatrixjawadОценок пока нет

- Coca ColaДокумент22 страницыCoca ColajustlinhОценок пока нет

- Coca Cola - Portfolio ProjectДокумент15 страницCoca Cola - Portfolio Projectapi-249694223Оценок пока нет

- AnmoljamwalДокумент44 страницыAnmoljamwalAnmol JamwalОценок пока нет

- Financial Analysis of Coca-Cola: Financial Successes and FailuresДокумент3 страницыFinancial Analysis of Coca-Cola: Financial Successes and FailuresStefan Hehe100% (1)

- Liquidity Ratio Current Ratio Current Assets/Current Liabilities Coca Cola Year ( 000) 2008 2009Документ5 страницLiquidity Ratio Current Ratio Current Assets/Current Liabilities Coca Cola Year ( 000) 2008 2009Michael FernandezОценок пока нет

- Introduction of The Brand:: Pepsico Inc. Is An American Multinational Brand Producing Food, Snack andДокумент9 страницIntroduction of The Brand:: Pepsico Inc. Is An American Multinational Brand Producing Food, Snack andmridulkatiyar06_5470Оценок пока нет

- Coca ColaДокумент22 страницыCoca ColaM V N SREE VINAYОценок пока нет

- Annual Report: 4100 Coca-Cola Plaza Charlotte, NC 28211Документ134 страницыAnnual Report: 4100 Coca-Cola Plaza Charlotte, NC 28211Phụng LêОценок пока нет

- Coca ColaДокумент62 страницыCoca ColaRaman Chamber100% (2)

- What Is The CocaДокумент5 страницWhat Is The CocaGhumonto SafiurОценок пока нет

- Acc!@@Документ2 страницыAcc!@@kjoel.ngugiОценок пока нет

- A Description of Each Company's Progress in The Last Year.: Strong BrandДокумент13 страницA Description of Each Company's Progress in The Last Year.: Strong Brandmark2070Оценок пока нет

- Bps Coca Cola PaperДокумент21 страницаBps Coca Cola Paperapi-252651948Оценок пока нет

- "You Can't Beat The Real Thing": - Coca-Cola Slogan (1990)Документ10 страниц"You Can't Beat The Real Thing": - Coca-Cola Slogan (1990)kennyОценок пока нет

- Example of Dupont Analysis: Ref:Thefinancialintern - WordpreДокумент13 страницExample of Dupont Analysis: Ref:Thefinancialintern - WordpreHoNestLiArОценок пока нет

- Guide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)От EverandGuide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)Оценок пока нет

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017От EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017Оценок пока нет

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)От EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Оценок пока нет

- Analele Stiintifice Ale Universitatii A. I. Cuza, Iasi, Nr.1, 2009Документ186 страницAnalele Stiintifice Ale Universitatii A. I. Cuza, Iasi, Nr.1, 2009emilmaneaОценок пока нет

- Form BДокумент3 страницыForm BAnakor AnselmОценок пока нет

- Esquema Hidráulico Trailla 631GДокумент2 страницыEsquema Hidráulico Trailla 631GJose Carlos Annicchiarico BritoОценок пока нет

- Searle Institution Seminario 2006 04dДокумент22 страницыSearle Institution Seminario 2006 04dchepiruloОценок пока нет

- Max Bupa Premium Reeipt SelfДокумент1 страницаMax Bupa Premium Reeipt SelfsanojcenaОценок пока нет

- Everyman Essay Questions PDFДокумент3 страницыEveryman Essay Questions PDFrosmery15Оценок пока нет

- UNWTO Barom23 03 September EXCERPTДокумент7 страницUNWTO Barom23 03 September EXCERPTbianca andreeaОценок пока нет

- PPSA Reviewer PDFДокумент15 страницPPSA Reviewer PDFKobe Lawrence VeneracionОценок пока нет

- ISL100 Sec2266Документ2 страницыISL100 Sec2266alhati63Оценок пока нет

- Spiritual Gifts Test - New Hope Christian FellowshipДокумент5 страницSpiritual Gifts Test - New Hope Christian Fellowshiprupertville12Оценок пока нет

- Park Point Residences BrochureДокумент34 страницыPark Point Residences BrochureJonathan Filoteo100% (1)

- Practice Skills Assessment Type AДокумент13 страницPractice Skills Assessment Type Asybell8Оценок пока нет

- Pre Mock CircularДокумент2 страницыPre Mock CircularMuhammad HamidОценок пока нет

- Renovation of Onups Ward BuildingДокумент37 страницRenovation of Onups Ward BuildingpaulomirabelОценок пока нет

- Ponce Vs Legaspi GR 79184Документ2 страницыPonce Vs Legaspi GR 79184Angelee Therese AlayonОценок пока нет

- Akuntansi Manajemen Lingkungan, Alat Bantu Untuk Meningkatkan Kinerja Lingkungan Dalam Pembangunan BerkelanjutanДокумент21 страницаAkuntansi Manajemen Lingkungan, Alat Bantu Untuk Meningkatkan Kinerja Lingkungan Dalam Pembangunan BerkelanjutanfahruОценок пока нет

- P01-20190315-Kementerian Perumahan-Bomba R4 PDFДокумент7 страницP01-20190315-Kementerian Perumahan-Bomba R4 PDFAffendi Hj AriffinОценок пока нет

- Topic 1 Database ConceptsДокумент62 страницыTopic 1 Database ConceptsNowlghtОценок пока нет

- G.R. No. 122058. May 5, 1999 Ignacio R. Bunye Vs SandiganbayanДокумент2 страницыG.R. No. 122058. May 5, 1999 Ignacio R. Bunye Vs SandiganbayanDrimtec TradingОценок пока нет

- Insight For Today: Identify The Enemy, Part OneДокумент2 страницыInsight For Today: Identify The Enemy, Part OneAlbert Magno CaoileОценок пока нет

- Social Studies PDFДокумент14 страницSocial Studies PDFPhilBoardResults100% (1)

- PGPM Ex BrochureДокумент13 страницPGPM Ex Brochureprakhar singhОценок пока нет

- Hist 708 Syllabus RevisedДокумент11 страницHist 708 Syllabus Revisedapi-370320558Оценок пока нет

- Lec 32714 yДокумент42 страницыLec 32714 yPakHoFungОценок пока нет

- Seeds of The Nations Review-MidtermsДокумент9 страницSeeds of The Nations Review-MidtermsMikaela JeanОценок пока нет

- Isaac BackusДокумент25 страницIsaac BackusBrian AunkstОценок пока нет

- Early 19th Century Rudolph Valentino: George Raft Appeared With Carole LombardДокумент3 страницыEarly 19th Century Rudolph Valentino: George Raft Appeared With Carole LombardRM ValenciaОценок пока нет

- Untitled DocumentДокумент1 страницаUntitled Documentguille.reyОценок пока нет

- 07-Resolution-Philippine Long Distance Telephone Co. v. City of Davao GR No 143867Документ24 страницы07-Resolution-Philippine Long Distance Telephone Co. v. City of Davao GR No 143867Rio BarrotОценок пока нет

- Quarto Vs Marcelo G.R. No. 169042, 5 October 2011: Brion, JДокумент2 страницыQuarto Vs Marcelo G.R. No. 169042, 5 October 2011: Brion, JDaf MarianoОценок пока нет