Академический Документы

Профессиональный Документы

Культура Документы

CH 18 SM

Загружено:

api-267019092Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH 18 SM

Загружено:

api-267019092Авторское право:

Доступные форматы

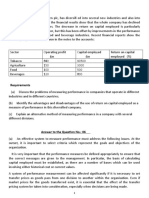

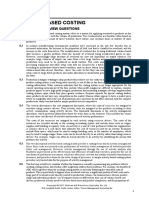

CHAPTER 18

DISCUSSION QUESTIONS

Q18-1. Standard costs are the predetermined costs

of manufacturing products during a specific

period under current or anticipated operating

conditions. Standards aid in planning and

controlling operations.

Q18-2. A few uses of standard costs are:

(a) establishing budgets

(b) controlling costs by motivating employees

and measuring efficiencies

(c) simplifying costing procedures and expediting cost reports

(d) assigning costs to materials, work in

process, and finished goods inventories

(e) forming the basis for establishing contract

bids and for setting sales prices

Q18-3. To set sales prices, executives need cost

information furnished by the accounting

department. Since standard costs represent

the cost that should be attained in a wellmanaged plant operated at normal capacity,

they are ideally suited for furnishing information that will enable the sales department to

price products.

Budgets are used for planning and coordinating future activities and for controlling current activities. When budget figures are based

on standard costs, the accuracy of the resulting budget is strongly influenced by the reliability of the standard costs. With standards

available, production figures can be translated

into the manufacturing costs.

Q18-4. Standards are an integral part of job order

and process cost accumulation, but do not

comprise a system that could be utilized in

lieu of one of the accumulation methods.

Costs may be accumulated with or without the

use of standards.

Q18-5. Criteria to be used when selecting the operational activities for which standards are to be

set include the following:

(a) The activity should be repetitive in nature,

with the repetition occurring in relatively

short cycles.

(b) The input and output (product or service)

of the activity should be measurable and

uniform.

(c) The elements of cost, such as direct

materials, direct labor, and factory overhead, must be defined clearly at the unit

level of activity.

Q18-6. Normal or currently attainable standards are

preferable to theoretical or ideal standards

for (a) performance evaluation and/or

employee motivation, and (b) budgeting and

planning. Theoretical or ideal standards are

not realistically attainable. As a consequence of using such standards, employees

may become discouraged rather than motivated, and budgets or plans are likely to be

distorted and unreliable.

Q18-7. Behavioral issues that need to be considered

when selecting the level of performance to be

incorporated into standards include the following:

(a) The standards must be legitimate. The

standards need not reflect the actual cost

of a single item or cycle. However, they

ideally will represent the cost that should

be incurred in the production of a given

product or the performance of a given

operation.

(b) The standards must be attainable. When

the standards are set too high, the

repeated failure to achieve them will tend

to reduce the motivation for attainment.

The converse is also true. Standards that

are too loose represent an invitation to

relax.

(c) The participant should have a voice or

influence in the establishment of standards and resulting performance measures. Involvement in the formulation of

standards gives the participant a greater

sense of understanding and commitment.

Q18-8. (a) The role of the accounting department in

the establishment of standards is to

determine their ability to be quantified

and to provide dollar values for specific

unit standards.

(b) In the establishment of standards, the

role of the department in which the performance is being measured is to provide

18-1

18-2

information for realistic standards, and to

allow for subsequent performance evaluation for the purpose of detecting problems and improving performance.

(c) The role of the industrial engineering

department in the establishment of standards is to provide reliable measures of

physical activities related to the standards

of performance, and to verify the consistency of the performance between

departments.

Q18-9. The factory overhead variable efficiency variance is a measure of the efficient or inefficient

use of the base that was used in allocating

factory overhead to production. To the extent

that the activity used as an allocation base

drives variable factory overhead, the variable

efficiency variance is a measure of the cost

savings or cost incurrence that is attributable

to the efficient or inefficient use of that activity.

Q18-10. The factory overhead spending variance is a

measure of the efficient or inefficient use of

the various items of factory overhead. It is

caused by differences in the prices paid for

the items of overhead actually used (i.e., the

differences between the actual quantity at the

actual price and the actual quantity at the

standard price for all items of factory overhead) and the differences in the quantities of

the various items of factory overhead actually

used (i.e., the differences between the standard quantity allowed for the actual level of

the activity base at the standard price and the

actual quantity used at the standard price for

all items of factory overhead).

Q18-11. The factory overhead volume variance is a

measure of the under- or over-utilization of

plant facilities. It is the difference between the

total budgeted fixed factory overhead and the

amount charged to (or chargeable to) actual

production based on the standard quantity

allowed for the activity base used to allocate

overhead. The volume variance may be thought

of as the amount of under- or overapplied budgeted fixed factory overhead.

Q18-12. After variances have been determined, management should:

(a) decide whether each variance is sufficiently significant to require investigation

and explanation

(b) investigate and obtain, from the responsible department head, explanations of significant variances

Chapter 18

(c) take corrective action and recognize and

reward desirable performance, where

appropriate

(d) revise standards if needed

Q18-13. (a) Features of tolerance limits include:

(1) A standard cost control system is

established, specifying expected performance levels.

(2) An information system is designed to

highlight the areas most in need of investigation and possible corrective action.

(3) Variance ranges for areas and items

are computed. Management does not

spend time on parts of the operations that

produce satisfactory performance levels

within these ranges.

(4) Managements attention and efforts

are concentrated on significant variances

from expected results, which signal the

presence of unplanned conditions needing investigation.

(b) Tolerance limits have potential benefits

because they may result in more effective

use of management time. The managers

time is not wasted on the process of identifying important problems or in working

on unimportant ones. The manager

should be able to concentrate efforts on

important problems, because the technique highlights them.

(c) It may be difficult to determine which variances are significant. Also, by focusing on

variances above a certain level, other

useful information, such as trends, may

not be noticed at an early stage.

If the evaluation system is in any way

directly tied to the variances, subordinates

may be tempted to cover up negative

exceptions or not report them at all. In

addition, subordinates may not receive

reinforcement for the reduction and maintenance of cost levels, but only reprimands

for those items which exceed the range.

Subordinate morale may suffer because of

the lack of positive reinforcement for work

well done. Using tolerance limits may also

affect supervisory employees in an unsatisfactory manner. Supervisors may feel

that they are not getting a complete

review of operations because they are

always keying on problems. In addition,

supervisors may think that they are

excessively critical of their subordinates.

Chapter 18

A negative impact on supervisory morale

may result.

Q18-14. Overemphasis on price variances can result

in a large number of low cost vendors, high

levels of inventory, and poor quality materials

and parts. Since the emphasis is on price

rather than quality or reliability, purchasing will

likely have a large number of low cost vendors

available, who can be played one against the

other to get the lowest possible prices. In

addition, purchasing will likely purchase

inventory in large quantities to take advantage

of purchase discounts and to reduce the need

to place rush orders that result in premium

prices. Inventory tends to become unnecessarily large, resulting in excessive carrying

costs, and material quality tends to decline,

resulting in poor product quality and/or excessive spoilage, scrap, and rework.

Overemphasis on efficiency variances can

result in long production runs, large work in

process inventories, and attempts to control

quality through inspection alone. Long production runs require fewer machine set ups

18-3

and reduce the amount of inefficiency resulting from the learning required to change production from one product to another. Large

work in process inventories result from long

production runs, and large inventories are

likely to be viewed by department managers

as buffers that can be used to absorb

machine breakdowns, employee absenteeism, and slack demand for the product.

Although carrying large inventories is costly,

the carrying costs do not affect the efficiency

variance, which in turn encourages departmental managers to overproduce. Since efficiency variances measure the use of inputs in

relation to output volume, efforts to control

quality tend to be oriented to inspection

alone. Stopping the process to experiment

with alternative production methods to permanently correct a problem or improve quality

can result in an unfavorable labor efficiency

variance. In contrast, increasing the volume of

production and reworking or discarding

defects has a smaller impact on the efficiency

variance.

18-4

Chapter 18

EXERCISES

E18-1

Quantity

Actual materials purchased

at actual cost .........................

Actual materials purchased

at standard cost ....................

Materials purchase price

variance..................................

4,500 lbs.

Actual materials used at

standard cost ........................

Standard quantity allowed

at standard cost ....................

Materials quantity variance .......

= Amount

$ 60,300

13.50 standard

4,500

$ (.10)

4,000 lbs.

Unit Cost

$13.41 actual

4,000

60,750

$

$ (.09)

Unit Cost

4,000 lbs.

$13.50 standard

3,800

200 lbs.

13.50 standard

13.50 standard

(450) fav.

= Amount

$ 53,640

13.50 standard

4,000

Quantity

Unit Cost

$13.40 actual

4,500

Quantity

Actual materials used at

actual cost .............................

Actual materials used at

standard cost ........................

Materials price usage

variance..................................

54,000

$

(360) fav.

= Amount

$ 54,000

51,300

$ 2,700 unfav.

E18-2

Quantity

Actual materials purchased

at actual cost .........................

Actual materials purchased

at standard cost ....................

Materials purchase price

variance..................................

5,000

Unit Cost

$22.00 actual

5,000

22.50 standard

5,000

Quantity

Actual materials purchased

at standard cost ....................

Actual materials issued at

standard cost ........................

Materials inventory variance .....

$ (.50)

Unit Cost

5,000

$22.50 standard

4,400

600

22.50 standard

22.50 standard

= Amount

$110,000

112,500

$ (2,500) fav.

= Amount

$112,500

99,000

$ 13,500 unfav.

Chapter 18

18-5

E18-2 (Concluded)

Quantity

Actual materials issued at

standard cost ........................

Standard quantity of

materials at standard

cost.........................................

Materials quantity variance .......

Unit Cost

4,400

$22.50 standard

4,300

100

22.50 standard

22.50 standard

= Amount

$99,000

96,750

$ 2,250 unfav.

E18-3

(1)

Actual materials purchased

at actual cost .........................

Actual materials purchased

at standard cost ....................

Materials purchase price

variance..................................

Quantity

6,000

(2)

Materials beginning

inventory ................................

Materials purchased during

month .....................................

Materials available for use.........

Materials issued to

production .............................

Materials ending inventory........

4.00 standard

6,000

$ .20

Unit Cost

7,100

$4.00 standard

6,900

200

4.00 standard

4.00 standard

Quantity

2,000

Unit Cost

$4.12 actual

= Amount

$25,200

24,000

$ 1,200 unfav.

= Amount

$28,400

27,600

$ 800 unfav.

= Amount

$ 8,240

6,000

8,000

4.20 actual

4.18 average

25,200

$33,440

7,100

900

4.18 average

4.18 average

29,678

$ 3,762

Quantity

Actual materials used at

actual average cost...............

Actual materials used at

standard cost ........................

Materials price usage

variance..................................

Unit Cost

$4.20 actual

6,000

Quantity

Actual materials used at

standard cost ........................

Standard quantity allowed

at standard cost ....................

Materials quantity variance .......

7,100

7,100

7,100

Unit Cost

$4.18 average

4.00 standard

$ .18

= Amount

$29,678

28,400

$ 1,278 unfav.

18-6

Chapter 18

E18-3 (Concluded)

(3)

Materials beginning

inventory ................................

Materials purchased during

month .....................................

Materials available for use.........

Materials issued to

production .............................

Materials ending inventory........

Quantity

Actual materials used at

standard cost ........................

Materials price usage

variance..................................

(4)

Materials beginning

inventory ................................

Materials purchased during

month .....................................

Materials available for use.........

Materials issued to

production .............................

Materials ending inventory........

Actual materials used at

standard cost ........................

Materials price usage

variance..................................

= Amount

$4.12 actual

$ 8,240

6,000

8,000

4.20 actual

25,200

$33,440

2,000

5,100

900

4.12 oldest

4.20 newest

4.20 newest

8,240

21,420

$ 3,780

2,000

5,100

7,100

Unit Cost

$4.12 oldest

4.20 newest

7,100

4.00 standard

= Amount

$ 8,240

21,420

$29,660

28,400

$ 1,260 unfav.

Quantity

Unit Cost

= Amount

2,000

$4.12 actual

$ 8,240

6,000

8,000

4.20 actual

25,200

$33,440

6,000

1,100

900

4.20 newest

4.12 oldest

4.12 oldest

25,200

4,532

$ 3,708

Quantity

Actual materials used at

actual cost .............................

Unit Cost

2,000

Quantity

Actual materials used at

actual cost .............................

6,000

1,100

7,100

7,100

Unit Cost

$4.20 newest

4.12 oldest

4.00 standard

= Amount

$25,200

4,532

$29,732

28,400

$ 1,332 unfav.

Chapter 18

18-7

E18-4

Actual labor hours worked ........

Actual labor hours worked ........

Labor rate variance ....................

Actual labor hours worked ........

Standard hours allowed

(1,200 units 1/2 hour

labor) ......................................

Labor efficiency variance ..........

Hours

650

650

650

Rate

= Amount

$ 9.80 actual

$6,370

10.00 standard

6,500

$ (.20)

$ (130) fav.

Hours

650

Rate

= Amount

$10.00 standard

$6,500

600

50

10.00 standard

10.00 standard

6,000

$ 500 unfav.

E18-5

(1)

Actual materials purchased ......

Actual materials purchased ......

Materials purchase price

variance..................................

Actual materials used ................

Actual materials used ................

Materials price usage

variance..................................

Quantity

1,500

1,500

1,500

Quantity

1,350

1,350

Unit Cost

= Amount

$ 3.80 actual

$5,700

4.00 standard

6,000

$ (.20)

1,350

$ (300) fav.

Unit Cost

= Amount

$ 3.80 actual

$5,130

4.00 standard

5,400

$ (.20)

$ (270) fav.

Actual materials used ................

Standard quantity allowed.........

Materials quantity variance .......

Quantity

1,350

1,020

330

Unit Cost

= Amount

$ 4.00 standard

$5,400

4.00 standard

4,080

4.00 standard

$1,320 unfav.

(2)

Actual labor hours worked ........

Actual labor hours worked ........

Labor rate variance ....................

Hours

310

310

310

Rate

= Amount

$12.30 actual

$3,813

12.00 standard

3,720

$ .30

$ 93 unfav.

Hours

310

Rate

= Amount

$12.00 standard

$3,720

Actual labor hours worked.. ......

Standard labor hours

allowed ...................................

Labor efficiency variance ..........

340

(30)

12.00 standard

12.00 standard

4,080

$ (360) fav.

18-8

Chapter 18

E18-6

Actual factory overhead ...................................................................

Standard overhead chargeable to actual production

(11,000 standard hours allowed $12.50 overhead rate)

Overall factory overhead variance ..................................................

Actual factory overhead ...................................................................

Budget allowance based on standard hours allowed:

Variable overhead (11,000 standard machine

hours allowed $4.50 variable overhead rate)......

$49,500

Fixed overhead budgeted ........................................

96,000

Controllable variance ........................................................................

Budget allowance based on standard hours allowed

(from above) ..............................................................................

Standard factory overhead chargeable to production

(11,000 standard hours allowed $12.50 overhead rate)

Volume variance ..............................................................................

Controllable variance.............................

Volume variance ...................................

Overall factory overhead variance .......

$166,000

137,500

$ 28,500 unfav.

$166,000

145,500

$ 20,500 unfav.

$145,500

137,500

$ 8,000 unfav.

$20,500 unfav.

8,000 unfav.

$28,500 unfav.

E18-7

Actual factory overhead ...................................................................

Standard overhead chargeable to actual production

(5,700 standard hours allowed $22 overhead rate)...............

Overall factory overhead variance ..................................................

$130,000

125,400

$ 4,600 unfav.

Actual factory overhead ................................................................... $130,000

Budget allowance based on standard hours:

Variable overhead (5,700 standard hours $6) .....

$34,200

Fixed overhead .........................................................

96,000

130,200

Controllable variance ........................................................................ $ (200) fav.

Budget allowance based on standard hours

(from above) ..............................................................................

Standard factory overhead chargeable to production

(from above) ..............................................................................

Volume variance ..............................................................................

$130,200

125,400

$ 4,800 unfav.

Controllable variance ........................................................................ $

Volume variance ..............................................................................

Overall factory overhead variance .................................................. $

(200) fav.

4,800 unfav.

4,600 unfav.

Chapter 18

18-9

E18-8

Actual factory overhead ...................................................................

Standard overhead chargeable to actual production

(4,200 standard hours allowed $24.80 overhead rate)

Overall factory overhead variance ..................................................

Actual factory overhead ...................................................................

Budget allowance based on actual machine hours:

Variable overhead (4,600 actual machine

hours $5.80 variable overhead rate) ...............

$26,680

Fixed overhead budgeted ........................................

85,500

Spending variance ............................................................................

Budget allowance based on actual machine hours....

Budget allowance based on standard hours allowed:

Variable overhead (4,200 standard machine hours

allowed $5.80 variable overhead rate)............

$24,360

Fixed overhead budgeted ........................................

85,500

Variable efficiency variance .............................................................

Budget allowance based on standard hours allowed

Standard overhead chargeable to actual production

(4,200 standard hours allowed $24.80 overhead rate)

Volume variance ..............................................................................

Spending variance ............................................................................

Variable efficiency variance .............................................................

Volume variance ..............................................................................

Overall factory overhead variance ..................................................

$121,000

104,160

$ 16,840 unfav.

$121,000

112,180

$ 8,820 unfav.

$112,180

109,860

$ 2,320 unfav.

$109,860

104,180

$ 5,700 unfav.

$

8,820

2,320

5,700

$ 16,840

unfav.

unfav.

unfav.

unfav.

18-10

Chapter 18

E18-9

Actual factory overhead ...................................................................

Standard overhead chargeable to actual production

(2,050 standard hours allowed $5 overhead rate).................

Overall factory overhead variance ...............................

Actual factory overhead ...................................................................

Budget allowance based on actual hours:

Variable overhead (1,900 actual hours $1.50).....

$ 2,850

Fixed overhead .........................................................

7,000

Spending variance ............................................................................

$ 10,500

10,250

$

250 unfav.

$ 10,500

9,850

650 unfav.

Budget allowance based on actual hours (from above)

$ 9,850

Budget allowance based on standard hours:

Variable overhead (2,050 standard hours $1.50)

$ 3,075

Fixed overhead .........................................................

7,000

10,075

Variable efficiency variance ............................................................. $ (225) fav.

Budget allowance based on standard hours (from above)

$ 10,075

Standard factory overhead chargeable to production

(from above) ..............................................................................

10,250

Volume variance .............................................................................. $ (175) fav.

Spending variance ............................................................................ $

Variable efficiency variance .............................................................

Volume variance ..............................................................................

Overall factory overhead variance .................................................. $

650

(225)

(175)

250

unfav.

fav.

fav.

unfav.

E18-10

Actual factory overhead ...................................................................

Standard overhead chargeable to actual production (38,000

units 2 standard hours per unit $9 overhead rate)

Overall factory overhead variance ..................................................

E18-10 (Concluded)

$700,000

684,000

$ 16,000 unfav.

Chapter 18

(1)

18-11

Two-variance method:

Actual factory overhead ...................................................................

Budget allowance based on standard hours allowed:

Variable overhead (38,000 units 2 standard

hours per unit $6 variable rate)....................... $456,000

Fixed overhead ........................................................

240,000

Controllable variance ........................................................................

Budget allowance based on standard hours allowed

(from above) ..............................................................................

Standard overhead chargeable to actual production (38,000

units 2 standard hours per unit $9 overhead rate)

Volume variance ..............................................................................

Controllable variance ........................................................................

Volume variance ..............................................................................

Overall factory overhead variance ..................................................

$700,000

696,000

$ 4,000 unfav.

$696,000

684,000

$ 12,000 unfav.

$

4,000 unfav.

12,000 unfav.

$ 16,000 unfav.

(2) Three-variance method:

Actual factory overhead ...................................................................

Budget allowance based on actual hours worked:

Variable overhead (77,500 actual hours

$6 variable rate) ................................................ $465,000

Fixed overhead ........................................................

240,000

Spending variance ............................................................................

Budget allowance based on actual hours worked

(from above) ..............................................................................

Budget allowance based on standard hours allowed

(from above) ..............................................................................

Variable efficiency variance .............................................................

Budget allowance based on standard hours allowed

(from above) ..............................................................................

Standard overhead chargeable to actual production (38,000

units 2 standard hours per unit $9 overhead rate)

Volume variance ..............................................................................

$700,000

705,000

$ (5,000) fav.

$705,000

696,000

$ 9,000 unfav.

$696,000

684,000

$ 12,000 unfav.

Spending variance ............................................................................ $ (5,000) fav.

Variable efficiency variance .............................................................

9,000 unfav.

Volume variance ..............................................................................

12,000 unfav.

Overall factory overhead variance .................................................. $ 16,000 unfav.

18-12

Chapter 18

E18-11

Materials price variance:

Actual

Quantity

Ingredients

(lbs.)

Cocoa beans

325,000

Milk.................. 1,425,000

Sugar .............. 250,000

Standard

Cost

Standard

per lb.

Cost

$.60

$ 195,000

.50

712,500

.40

100,000

$1,007,500

Actual

Cost

$201,500

684,000

97,500

$983,000

Materials

Price Variance

$ 6,500 unfav.

(28,500) fav.

(2,500) fav.

$(24,500) fav.

Materials mix variance:

Actual

Quantity

Ingredients

(Lbs.)

Cocoa beans

325,000

Milk .............. 1,425,000

Sugar .............. 250,000

2,000,000

Standard

Formula

for Actual

Quantity

(Lbs.)*

320,000

1,480,000

200,000

2,000,000

Difference

in Lbs.

5,000

(55,000)

50,000

0

Standard

Cost

per Lb.

$.60

.50

.40

Materials

Mix Variance

$ 3,000 unfav.

(27,500) fav.

20,000 unfav.

$ (4,500) fav.

*Cocoa beans = (800 5,000) 2,000,000

Milk = (3,700 5,000) 2,000,000

Sugar = (500 5,000) 2,000,000

Materials yield variance:

Expected yield: 2,000,000 lbs. input 5,000 lbs. = ................

Actual yield in one-ton batches...............................................

Unfavorable yield in batches ..................................................

Standard cost per one-ton batch.............................................

Materials yield variance............................................................

400

387

13

$ 2,530

$32,890 unfav.

Chapter 18

18-13

E18-12

(1) Materials purchase price variance:

Actual

Standard

Quantity

Cost

Purchased

per

Standard

Ingredients

in Liters

Liter

Cost

Echol ..............

25 000

$.200

$ 5,000

Protex..............

13 000

.425

5,525

Benz ..............

40 000

.150

6,000

CT-40 ..............

7 500

.300

2,250

$18,775

Actual

Cost

$ 5,365

6,240

5,840

2,220

$19,665

Materials

Purchase

Price Variance

$365 unfav.

715 unfav.

(160) fav.

(30) fav.

$890 unfav.

(2) Materials mix variance:

Ingredients

Echol ..............

Protex..............

Benz ..............

CT-40 ..............

Actual

Quantity

Used in

Liters

26 800

12 660

37 400

7 140

84 000

Standard

Formula

for Actual

Quantity

in Liters*

28 000

14 000

35 000

7 000

84 000

Difference

in Liters

(1 200)

(1 340)

2 400

140

0

Standard

Cost per

Liter

$.200

.425

.150

.300

Materials

Mix Variance

$(240.00) fav.

(569.50) fav.

360.00 unfav.

42.00 unfav.

$(407.50) fav.

*Echol = (200 600) 84 000 liters

Protex = (100 600) 84 000 liters

Benz = (250 600) 84 000 liters

CT-40 = (50 600) 84 000 liters

Materials yield variance:

Expected yield: 84 000 liters input 600 liters = ...................

Actual yield in 500-liter batches ..............................................

Unfavorable yield in batches ...................................................

Standard cost per 500-liter batch ............................................

Materials yield variance............................................................

140

136

4

$135

$540 unfav.

18-14

Chapter 18

E18-13

BENJAMIN PRODUCTS COMPANY

Department 2

Factory Overhead Variance Report

For Month Ending June 30

(1)

Budget

Allowable

Normal

Capacity

Direct labor hours ........................................

Capacity ........................................................

(2)

Budget

Allowance

Standard

Hours

6,000

100%

(3)

Actual

Cost

(4)

Controllable

Variance

Unfav. (Fav.)

(3) (2)

$ 60

20

(30)

20

5,100

85%

Variable factory overhead:

Indirect labor .........................................

Manufacturing supplies........................

Repairs ...................................................

Heat, power, and light ...........................

$ 2,400

2,100

800

100

$ 2,040

1,785

680

85

$ 2,100

1,805

650

105

Total variable cost ...........................

$ 5,400

$ 4,590

$ 4,660

Fixed factory overhead:

Supervision ...........................................

Indirect labor .........................................

Manufacturing supplies........................

Maintenance ..........................................

Heat, power, and light ...........................

Machinery depreciation........................

Insurance and taxes .............................

$ 6,000

5,400

1,020

960

120

540

360

$ 6,000

5,400

1,020

960

120

540

360

$ 6,200

5,400

1,020

960

120

540

372

Total fixed cost ................................

$14,400

$14,400

$14,612

Total factory overhead.................................

$19,800

$18,990

$19,272

200

0

0

0

0

0

12

$282

unfav.

Standard factory overhead chargeable to

work in process (5,100 standard hours

$3.30 rate) ...........................................

Volume variance ...........................................

Reconciliation of variances:

Actual factory overhead ......................

Standard factory overhead chargeable

to work in process ..........................

16,830

$ 2,160 unfav.

$19,272

16,830

Overall factory overhead variance ......

$ 2,442 unfav.

Controllable variance............................

Volume variance....................................

Overall factory overhead variance ......

$ 2,442 unfav.

282 unfav.

2,160 unfav.

Chapter 18

18-15

E18-14 APPENDIX

$15,000 budgeted overhead

2,500 budgeted machine hours

$6 overhead rate

$5,000 variable overhead

2,500 budgeted machine hours

$2 variable rate

Actual factory overhead ...................................................................

Standard overhead chargeable to actual production

(2,400 standard hours allowed $6 overhead rate)

Overall factory overhead variance ..................................................

$16,500

14,400

$ 2,100 unfav.

Actual factory overhead ...................................................................

Budget allowance based on actual hours:

Variable overhead (2,700 actual hours $2)..........

$ 5,400

Fixed overhead .........................................................

10,000

Spending variance ............................................................................

$16,500

15,400

$ 1,100 unfav.

Budget allowance based on actual hours (from above) ...............

2,700 actual hours $6 factory overhead rate...............................

Idle capacity variance .......................................................................

$15,400

16,200

$ (800) fav.

2,700 actual hours $6 factory overhead rate (from above)

Standard factory overhead chargeable to production (from

above)

..............................................................................

Efficiency variance............................................................................

$16,200

14,400

$ 1,800 unfav.

Spending variance ............................................................................

Idle capacity variance .......................................................................

Efficiency variance............................................................................

Overall factory overhead variance ..................................................

$ 1,100 unfav.

(800) fav.

1,800 unfav.

$ 2,100 unfav.

18-16

Chapter 18

E18-15 APPENDIX

$16,800 budgeted overhead

1,200 budgeted labor hours

$14 overhead rate

$4,800 variable overhead

1,200 budgeted labor hours

$4 variable rate

Actual factory overhead ...................................................................

Standard overhead chargeable to actual production

(1,170 standard hours allowed $14 overhead rate)...............

Overall factory overhead variance ..................................................

$15,800

Actual factory overhead ...................................................................

Budget allowance based on actual hours:

Variable overhead (1,120 actual hours $4)..........

$ 4,480

Fixed overhead .........................................................

12,000

Spending variance ............................................................................

$15,800

Budget allowance based on actual hours (from above)

1,120 actual hours $14 factory overhead rate.............................

Idle capacity variance .......................................................................

$16,480

15,680

$ 800 unfav.

1,120 actual hours $4 variable factory overhead rate

1,170 standard hours $4 variable factory overhead rate

Variable efficiency variance .............................................................

$ 4,480

4,680

$ (200) fav.

1,120 actual hours $10 fixed factory overhead rate

1,170 standard hours $10 fixed factory overhead rate

Fixed efficiency variance..................................................................

$11,200

11,700

$ (500) fav.

Spending variance ............................................................................

Idle capacity variance .......................................................................

Variable efficiency variance .............................................................

Fixed efficiency variance..................................................................

Overall factory overhead variance ..................................................

$ (680)fav.

800 unfav.

(200)fav.

(500)fav.

$ (580)fav.

16,380

$ (580) fav.

16,480

$ (680)fav.

Chapter 18

18-17

PROBLEMS

P18-1

(1)

Factory overhead per unit:

Variable ($30 2/3) .........................................................

Fixed ($30 1/3) .............................................................

$20

10

$30

Variable factory overhead per unit $20 $5 variable overhead rate

=

=

per direct labor hour

nit

4

Direct labor hours per un

Normal capacity direct labor hours (2,400) Fixed factory overhead rate per

direct labor hour ($10 4) = 2,400 $2.50 = $6,000 fixed factory overhead based

on normal monthly capacity.

(2)

Actual quantity purchased ........

Actual quantity purchased ........

Materials purchase price

variance..................................

Yards

18,000

18,000

Unit Cost

= Amount

$1.38 actual

$24,840

1.35 standard

24,300

18,000

Actual quantity used ..................

Standard quantity allowed.........

Materials quantity variance .......

Yards

9,500

10,000

(500)

Unit Cost

= Amount

$1.35 standard

$12,825

1.35 standard

13,500

1.35 standard

$ (675) fav.

Actual hours worked..................

Actual hours worked..................

Labor rate variance ....................

Hours

2,100

2,100

2,100

Rate

= Amount

$9.15 actual

$19,215

9.00 standard

18,900

$ .15

$315 unfav.

Actual hours worked..................

Standard hours allowed.............

Labor efficiency variance ..........

Hours

2,100

2,000

100

Rate

= Amount

$9.00 standard

$18,900

9.00 standard

18,000

9.00 standard

$ 900 unfav.

$ .03

Actual factory overhead.............................................

Budget allowance based on standard hours allowed:

Variable overhead (2,000 standard hours allowed

$5 variable overhead rate) ...........................

Fixed overhead budgeted.....................................

Controllable variance .................................................

Budget allowance based on standard hours allowed

Overhead charged to production (2,000 $7.50) ....

Volume variance..........................................................

540 unfav.

$16,650

$10,000

6,000

16,000

$ 650 unfav.

$16,000

15,000

$ 1,000 unfav.

18-18

Chapter 18

P18-2

(1)

Materials

Units completed and transferred out

this period ..........................................

Less all units in beginning inventory .....

Equivalent units started and completed

this period ..........................................

Add equivalent units in spoiled units.....

Add equivalent units required to complete

beginning inventory this period.......

Add equivalent units in ending inventory

Equivalent units of production this period

Standard quantity allowed per unit of

product ...............................................

Standard quantity allowed for current

production ..........................................

(2)

Actual material A purchased at

actual cost .............................

Actual material A purchased at

standard cost ........................

Material A purchase price

variance..................................

Direct

Labor

4,600

500

4,600

500

4,600

500

4,600

500

4,100

200

4,100

0

4,100

140

4,100

200

0

600

4,900

500

600

5,200

150

540

4,930

250

600

5,150

3 units

2 units

1/2 hr.

1 hr.

14,700

10,400

2,465

5,150

Quantity

16,000

$ .10

Unit Cost

14,800

$4.50 standard

14,700

100

4.50 standard

4.50 standard

12,000

12,000

12,000

= Amount

$73,600

4.50 standard

16,000

Quantity

Actual material B purchased

at actual cost .........................

Actual material B purchased

at standard cost ....................

Material B purchase price

variance..................................

Unit Cost

$4.60 actual

16,000

Quantity

Actual material A used at

standard cost ........................

Standard quantity of material

A allowed at standard cost ..

Material A quantity variance .....

Unit Cost

$1.95 actual

72,000

$ 1,600 unfav.

= Amount

$66,600

66,150

$ 450 unfav.

= Amount

$23,400

2.00 standard

$ (.05)

Factory

Overhead

24,000

$

(600) fav.

Chapter 18

18-19

P18-2 (Continued)

Quantity

Actual material B used at

standard cost ........................

Standard quantity of material

B allowed at standard cost ..

Material B quantity variance .....

$2.00 standard

10,400

600

2.00 standard

2.00 standard

2,550

Rate

$10.20 actual

2,550

2,550

Hours

Actual labor hours worked at

standard labor rate ...............

Standard labor hours allowed

at standard labor rate ...........

Labor efficiency variance ..........

Unit Cost

11,000

Hours

Actual labor hours worked at

actual labor rate ....................

Actual labor hours worked at

standard labor rate ...............

Labor rate variance ....................

10.00 standard

$.20

Rate

2,550

$10.00 standard

2,465

85

10.00 standard

10.00 standard

Actual factory overhead .....................................................................

Standard overhead chargeable to actual production

(5,150 standard hours allowed $15 overhead rate).................

Overall factory overhead variance ....................................................

Actual factory overhead ....................................................................

Budget allowance based on standard hours:

Variable overhead (5,150 standard hours $5) ............ $25,750

Fixed overhead ................................................................. 50,000

Controllable variance..........................................................................

Budget allowance based on standard hours (from above)

Standard factory overhead chargeable to production

(from above) ...................................................................................

Volume variance ..................................................................................

Controllable variance..........................................................................

Volume variance ..................................................................................

Overall factory overhead variance ....................................................

= Amount

$22,000

20,800

$ 1,200 unfav.

= Amount

$26,010

25,500

$ 510 unfav

= Amount

$25,500

24,650

$ 850 unfav.

$75,000

77,250

$ (2,250) fav.

$75,000

75,750

$ (750) fav.

$75,750

77,250

$ (1,500) fav.

$

(750) fav.

(1,500) fav.

$ (2,250) fav.

18-20

Chapter 18

P18-2 (Concluded)

(3)

Standard cost of units transferred to finished goods:

(4,600 units $37.50 standard cost per unit of product...........

Standard cost of spoiled units charged to factory overhead:

Material A (200 units of product 100% complete 3 units

each $4.50)...........................................................................

Material B (200 units of product 0% complete 2 units

each $2.00)............................................................................

Direct labor (200 units 70% complete 1/2 hr. each $10.00)

Factory overhead (200 units 100% complete 1 hr. each

$15.00) ...................................................................................

Total cost of spoiled units ...........................................................

Work in process, ending inventory:

Material A (600 units of product 100% complete 3 units

each $4.50)............................................................................

Material B (600 units of product 100% complete 2 units

each $2.00)............................................................................

Direct labor (600 units 90% complete 1/2 hr. each $10.00)

Factory overhead (600 units 100% complete 1 hr. each

$15.00) ......................................................................................

Total standard cost of work in process, ending inventory.......

$172,500

2,700

0

700

3,000

6,400

8,100

2,400

2,700

9,000

$ 22,200

P18-3

(1)

January equivalent production:

Material

A

8,000

3,000

5,000

Transferred out ..............................

Less beginning inventory (all units)

Started and finished this period ......

Add beginning inventory (work this

period)

..............................

0

Add ending inventory (work this period) 5,000

Add abnormal spoilage.....................

1,000

11,000 units

Material

B

8,000

3,000

5,000

3,000

0

1,000

9,000 units

Conversion

Costs

8,000

3,000

5,000

2,000

2,000

1,000

10,000 units

Chapter 18

18-21

P18-3 (Continued)

(2)

Actual quantity of Material A

used........................................

Actual quantity of Material A

used........................................

Material A price usage variance

Gallons

Unit Cost

= Amount

50,000

$1.00 actual

$ 50,000

50,000

50,000

1.20 standard

$(.20)

60,000

$ (10,000) fav.

Gallons

Actual quantity of Material A

used........................................

Standard quantity of Material

A allowed ...............................

Material A quantity variance .....

Unit Cost

$1.20 standard

44,000

6,000

1.20 standard

1.20 standard

18,000

Unit Cost

$.75 actual

18,000

= Amount

$60,000

52,800

$ 7,200 unfav.

= Amount

$ 13,500

.70 standard

18,000

Square Feet

Actual quantity of Material B

used........................................

Standard quantity of Material

B allowed ...............................

Material B quantity variance .....

50,000

Square Feet

Actual quantity of Material B

used........................................

Actual quantity of Material B

used........................................

Material B price usage

variance..................................

$.05

Unit Cost

12,600

$

900 unfav.

= Amount

18,000

$.70 standard

$ 12,600

18,000

0

.70 standard

.70 standard

12,600

0

Actual hours worked..................

Actual hours worked..................

Labor rate variance ....................

Hours

10,200

10,200

10,200

Rate

= Amount

$12.00 actual

$122,400

11.50 standard

117,300

$.50

$ 5,100 unfav.

Actual hours worked..................

Standard hours allowed.............

Labor efficiency variance ..........

Hours

10,200

10,000

200

Rate

= Amount

$11.50 standard $117,300

11.50 standard

115,000

11.50 standard $ 2,300 unfav.

18-22

Chapter 18

P18-3 (Concluded)

Actual factory overhead .....................................................................

Budget allowance based on standard hours allowed:

Variable overhead (10,000 equivalent units

1 standard hour per unit $1.80 variable rate)...... $18,000

Fixed overhead budgeted (7,800 labor hours

at normal capacity $5 fixed rate).......................... 39,000

Controllable variance ............................................................

Budget allowance based on standard

hours allowed (above)...................................................................

Standard overhead chargeable to actual production

(10,000 standard hours allowed $6.80 overhead rate)

Volume variance ..................................................................................

$ 60,100

57,000

$ 3,100 unfav.

$ 57,000

68,000

$(11,000) fav.

CGA-Canada (adapted). Reprint with permission.

P18-4

(1)

Units completed and transferred out ......................................

Less beginning inventory (all units) .......................................

Units started and completed this period ................................

Add beginning inventory (work this period) ..........................

Add ending inventory (work this period)................................

Add abnormal spoilage (work this period) .............................

Equivalent units of production this period.............................

Materials

17,000

4,000

13,000

0

2,150

850

16,000

Conversion

Costs

17,000

4,000

13,000

3,200

860

850

17,910

(2)

Quantity

Actual materials purchased at

actual cost .............................

Actual materials purchased at

standard cost ........................

Materials purchase price

variance..................................

60 000 kg

Unit Cost

$3.95 actual

60 000

4.00 standard

60 000

Quantity

Actual materials used at

standard cost ........................

Standard quantity allowed at

standard cost (16,000 3 kg)

Materials quantity variance .......

$(.05)

Unit Cost

= Amount

$237,000

240,000

$ (3,000) fav.

= Amount

50 000 kg

$4.00 standard

$200,000 unfav.

48 000

2 000 kg

4.00 standard

4.00 standard

192,000

$ 8,000 unfav.

Chapter 18

18-23

P18-4 (Concluded)

Hours

Actual labor hours at actual

rate .........................................

Actual labor hours at standard

rate .........................................

Labor rate variance ....................

Rate

= Amount

9,000

$12.00 actual

$108,000

9,000

9,000

11.00 standard

$ 1.00

99,000

$ 9,000 unfav.

Hours

Actual labor hours at standard

rate .........................................

Standard labor hours allowed

at standard rate (17,910

equivalent units 1/2 hour

per unit)..................................

Labor efficiency variance ..........

Rate

9,000

$11.00 standard

8,955

45

11.00 standard

11.00 standard

Actual factory overhead .....................................................................

Budget allowance based on actual hours:

Variable overhead ($6 rate 9,000 actual hours) ......... $54,000

Budgeted fixed factory overhead ................................... 80,000

Factory overhead spending variance ...............................................

Budget allowance based on actual hours

(computed above)..........................................................................

Budget allowance based on standard hours:

Variable overhead ($6 rate 17,910 equivalent

units 1/2 standard hour per unit) ........................... $53,730

Budgeted fixed factory overhead ................................... 80,000

Factory overhead variable efficiency variance ................................

Budget allowance based on standard hours (computed above)

Factory overhead chargeable to production at standard

($14 rate 17,910 equivalent units 1/2 standard hour)

Factory overhead volume variance ...................................................

= Amount

$ 99,000

98,505

$

495 unfav.

$134,900

134,000

$

900 unfav.

$134,000

133,730

$

270 unfav.

$133,730

125,370

$ 8,360 unfav.

CGA-Canada (adapted). Reprint with permission.

18-24

Chapter 18

P18-5

(1)

Materials

Units completed and transferred out this period .................. 32,000

Less all units in beginning inventory ....................................

5,000

Equivalent units started and completed this period ............. 27,000

Add equivalent units required to complete beginning

inventory this period......................................................

0

Add equivalent units in ending inventory ..............................

2,000

Equivalent units of production this period............................. 29,000

Standard quantity allowed per unit of product ...................... 3 units

Standard quantity allowed for current production ................ 87,000

(2)

Actual materials purchased

at actual cost .........................

Actual materials purchased

at standard cost ....................

Materials purchase price

variance..................................

Quantity

100,000

6.00 standard

$

.54

Unit Cost

100,000

$ 6.00 standard

92,000

8,000

6.00 standard

6.00 standard

Unit Cost

92,000

$ 6.00 standard

87,000

5,000

6.00 standard

6.00 standard

Hours

Actual labor hours worked at

actual labor rate ....................

Actual labor hours worked at

standard labor rate ...............

Labor rate variance ....................

$ 6.54 actual

100,000

Quantity

Actual materials issued at

standard cost ........................

Standard quantity of materials

at standard cost ....................

Materials quantity variance .......

Unit Cost

100,000

Quantity

Actual materials purchased at

standard cost ........................

Actual materials issued at

standard cost ........................

Materials inventory variance .....

Rate

Conversion

Costs

32,000

5,000

27,000

3,000

1,600

31,600

1/4 hr.

7,900 hrs.

= Amount

$654,000

600,000

$ 54,000 unfav.

= Amount

$600,000

552,000

$ 48,000 unfav.

= Amount

$552,000

522,000

$ 30,000 unfav.

= Amount

8,000

$10.60 actual

$ 84,800

8,000

8,000

10.00 standard

$ .60

80,000

$ 4,800 unfav.

Chapter 18

18-25

P18-5 (Concluded)

Hours

Actual labor hours worked at

standard labor rate ...............

Standard labor hours allowed

at standard labor rate ...........

Labor efficiency variance ..........

Rate

8,000

$10.00 standard

7,900

100

10.00 standard

10.00 standard

Actual factory overhead .....................................................................

Standard overhead chargeable to actual production

(7,900 standard hours allowed $10 overhead rate ..................

Overall factory overhead variance ....................................................

Actual factory overhead .....................................................................

Budget allowance based on actual hours:

Variable overhead (8,000 actual hours $2) ................. $16,000

Fixed overhead (8,500 budgeted hours $8)................ 68,000

Spending variance ..............................................................................

Budget allowance based on actual hours (from above)....

Budget allowance based on standard hours:

Variable overhead (7,900 standard hours $2) ............ $15,800

Fixed overhead ................................................................. 68,000

Variable efficiency variance ...............................................................

= Amount

$80,000

79,000

$ 1,000 unfav.

$75,000

79,000

$ (4,000) fav.

$75,000

84,000

$ (9,000) fav.

$84,000

83,800

$ 200 unfav.

Budget allowance based on standard hours (from above)

Standard factory overhead chargeable to production

(from above) ...................................................................................

Volume variance ..................................................................................

$83,800

Spending variance ..............................................................................

Variable efficiency variance ...............................................................

Volume variance ..................................................................................

Overall factory overhead variance ....................................................

$ (9,000) fav.

200 unfav.

4,800 unfav.

$ (4,000) fav.

79,000

$4,800 unfav.

18-26

Chapter 18

P18-6

(1)

Standard cost of production:

Quantity

dozens

Lot

22

1,000

23

1,700

24

1,200 (direct materials)

960 (direct labor and

factory overhead)

Standard Cost

per dozen

$53.10

53.10

26.40

26.70

Total

Standard Cost

$ 53,100

90,270

31,680

25,632

$200,682

(2)

Actual quantity purchased ........

Actual quantity purchased ........

Materials purchase price

variance..................................

(3)

Yards

95,000

95,000

95,000

(a)

Actual quantity used ..............

Standard quantity allowed:

1,000 24 yards ....................

1,700 24 yards ....................

1,200 24 yards ....................

Standard cost per yard ..........

Materials quantity variance ...

(b)

Actual hours worked ..............

Standard hours allowed:

1,000 3 hours......................

1,700 3 hours......................

960 3 hours.........................

Standard cost per hour..........

Labor efficiency variance ......

(c)

Actual labor rate .....................

Standard labor rate.................

Actual hours worked ..............

Labor rate variance ................

Unit Cost

= Amount

$1.12 actual

$106,400

1.10 standard

104,500

$ .02

Lot 22

24,100

Lot 23

40,440

$ 1,900 unfav.

Lot 24

28,825

24,000

40,800

28,800

100

(360)

25

$1.10

$1.10

$1.10

$110 unfav. $(396) fav.

$27.50 unfav.

Lot 22

2,980

Lot 23

5,130

Lot 24

2,890

3,000

5,100

2,880

(20)

30

10

$4.90

$4.90

$4.90

$(98) fav.

$ 147 unfav.

$49 unfav.

Lot 23

Lot 24

Lot 22

$5.00

$5.00

$5.00

4.90

4.90

4.90

$ .10

$ .10

$ .10

2,980

5,130

2,890

$ 298 unfav. $ 513 unfav. $ 289 unfav.

Chapter 18

18-27

P18-6 (Concluded)

(4) Actual factory overhead ..................................................

Budget allowance based on standard hours

allowed:

Variable overhead ($4 60% (3,000 +

5,100 + 2,880 standard hours)) ................................ $26,352

Fixed overhead budgeted (($576,000 12)

40%) ........................................................................ 19,200

Controllable variance.......................................................

Budget allowance based on standard hours allowed ..

Standard overhead chargeable to production

(10,980 standard hours $4.00) ................................

Volume variance ...............................................................

$45,600

45,552

$

48 unfav.

$45,552

43,920

$ 1,632 unfav.

18-28

Chapter 18

P18-7

CLAFFY MANUFACTURING COMPANY

Department 2

Factory Overhead Variance Report

For Month Ending February 28

(1)

(2)

(3)

(4)

Budget

Budget

Budget

Allowance Allowance Allowance

Normal

Standard

Actual

Actual

Capacity

Hours

Hours

Cost

Processing time in hours ...............

6,000

5,700

5,840

Capacity ............................................

100%

95%

97.33%

Variable factory overhead:

Indirect labor..............................

Manufacturing supplies ...........

Repairs ......................................

Heat, power, and light ...............

Total variable cost ..............

Fixed factory overhead:

Supervision................................

Indirect labor..............................

Manufacturing supplies............

Maintenance...............................

Heat, power, and light...............

Machinery depreciation ...........

Insurance and taxes ................

Total fixed cost....................

Total factory overhead ....................

(5)

(6)

Variable

Efficiency Spending

Variance Variance

Unfav.

Unfav.

(Fav.)

(Fav.)

(3) (2)

(4) (3)

$ 2,000

2,400

1,000

300

$ 5,700

$ 1,900

2,280

950

285

$ 5,415

$ 1,947

2,336

973

292

$ 5,548

$ 1,920

2,325

1,050

325

$ 5,620

$ 47

56

23

7

$(27)

(11 )

77

33

$ 4,000

6,200

2,000

1,100

1,400

4,500

900

$20,100

$25,800

$ 4,000

6,200

2,000

1,100

1,400

4,500

900

$20,100

$25,515

$ 4,000

6,200

2,000

1,100

1,400

4,500

900

$20,100

$25,648

$ 4,000

6,200

2,000

1,080

1,400

4,500

970

$20,150

$25,770

0

0

0

0

0

0

0

0

0

0

(20 )

0

0

70

Standard factory overhead

chargeable to work in

process (5,700 standard

hours $4.30 rate).......................................

24,510

Volume variance .................................................

$1,005 unfav.

$133

$122

unfav.

unfav.

$29,160

$18,000

720 Unfav.

28,800

Standard overhead chargeable

to work in process

(4,800 std. hrs. $6) ........................

$

$29,520

$30,000

Volume variance .....................................

$18,000

$29,850

$18,300

$ 3,000

1,700

3,000

6,500

1,800

1,000

600

400

$18,000

$ 3,000

1,700

3,200

6,500

1,800

1,000

700

400

$11,550

Total

variable overhead$12,000$11,520 $11,160

............................

Fixed factory overhead:

Supervision .................... $ 3,000

$ 3,000

Supplies..........................

1,700

1,700

Machinery maintenance .

3,000

3,000

Depreciation of machinery

6,500

6,500

Insurance........................

1,800

1,800

Property tax ...................

1,000

1,000

Gas heating....................

600

600

Electricity

(lighting).......

400

400

...........................

Total

fixed overhead......

...........................

Total...........................

factory overhead.........

$11,300

$ 3,255

2,325

930

4,650

$ 3,360

2,400

960

4,800

$ 3,300

2,600

950

4,700

$ 3,500

2,500

1,000

5,000

(3)

Variable factory overhead:

Indirect labor..................

Supplies..........................

Machinery repairs..........

Electric

power ................

............................

(2)

Machine hours......................

Capacity utilized ..................

(1)

$30,000

$18,700

$ 3,100

1,650

3,200

6,500

1,900

1,100

845

405

Fav.

$(360)

0

0

0

0

0

0

0

0

Unfav.

$840

100

(50)

200

0

100

100

245

5

$145

(125)

30

90

Actual

Cost

$(105)

(75)

(30)

(150)

Spending

Variance

(5) (3)

Variable

Efficiency

Variance

(3) - (2)

$ 3,400

2,200

960

4,740

(7)

(6)

(5)

COFFMAN MANUFACTURING COMPANY

Department X

Factory Overhead Variance Report

For Month Ending January 31

(4)

Actual

Budget

Budget

Budget

Quantity

Allowance Allowance Allowance of Input at

Normal

Standard

Actual

Standard

Capacity

Hours

Hours

Unit Cost

5,000

4,800

4,650

100%

96%

93%

P18-8

Unfav.

$690

0

0

200

0

0

0

100

0

$ 45

275

20

50

Spending

Quantity

Variance

(4) (3)

(8)

Unfav.

$150

100

(50)

0

0

100

100

145

5

$100

(400)

10

40

Spending

Price

Variance

(5) - (4)

(9)

Chapter 18

18-29

18-30

Chapter 18

P18-8 (Concluded)

Reconciliation of variances:

Actual factory overhead .....................................................................

Standard overhead chargeable to work in process ...................

Overall factory overhead variance...............................................

$30,000

28,800

$ 1,200 unfav.

Spending variance:

Spending quantity variance ................................. $690 unfav.

Spending price variance.......................................

150 unfav.

Variable efficiency variance ...............................................................

Volume variance ..................................................................................

Overall factory overhead variance ....................................................

$840 unfav.

(360) fav.

720 unfav.

$ 1,200 unfav.

P18-9 APPENDIX

Equivalent production for September.

Transferred out ..........................................................................

Less beginning inventory.........................................................

Started and finished this period..............................................

Add beginning inventory (work this period) ..........................

Add ending inventory (work this period)................................

Equivalent units of product......................................................

Actual quantity used ..................

Actual quantity used ..................

Materials price usage variance .

Actual quantity used ..................

Standard quantity allowed

(37,000 2) ............................

Materials quantity variance .......

Actual hours worked..................

Actual hours worked..................

Labor rate variance ....................

Actual hours worked..................

Standard hours allowed

(41,500 1/2) .........................

Labor efficiency variance ..........

Materials

42,000

10,000

32,000

0

5,000

37,000

Conversion

42,000

10,000

32,000

5,000

4,500

41,500

Pieces

76,000

76,000

76,000

Unit Cost

= Amount

$.50 actual

$ 38,000

.48 standard

36,480

$.02

$ 1,520 unfav.

Pieces

76,000

Unit Cost

= Amount

$.48 standard $ 36,480

74,000

2,000

.48 standard

.48 standard

35,520

$

960 unfav.

Hours

22,500

22,500

22,500

Rate

= Amount

$8.00 actual

$180,000

7.60 standard

171,000

$.40

$ 9,000 unfav.

Hours

22,500

Rate

= Amount

$7.60 standard $171,000

20,750

1,750

7.60 standard

7.60 standard

157,700

$ 13,300 unfav.

Chapter 18

18-31

P18-9 APPENDIX (Concluded)

Actual factory overhead .....................................................................

Budget allowance based on actual hours worked:

Variable cost (22,500 actual hours

$1.40 variable overhead rate) .................................... $31,500

Fixed cost budgeted ........................................................ 8,000