Академический Документы

Профессиональный Документы

Культура Документы

Start Up Expenses

Загружено:

api-2632598860 оценок0% нашли этот документ полезным (0 голосов)

46 просмотров4 страницыОригинальное название

start up expenses

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

46 просмотров4 страницыStart Up Expenses

Загружено:

api-263259886Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

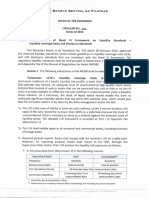

Startup Expenses

The Sweet Shoppe

Sources of Capital

Owners' Investment (name and percent

ownership)

Anne 20% 5,000 $

Sarah 20% 5,000

Alexis 20% 5,000

Brian 20% 5,000

Tyshana 20% 5,000

Total Investment 25,000 $

Bank Loans

Bank 1 10,000 $

Bank 2 5,000

Bank 3 10,000

Bank 4 2,500

Total Bank Loans 27,500 $

Other Loans

n/a - $

n/a -

Total Other Loans - $

Startup Expenses

Buildings/Real Estate

Purchase n/a

Construction n/a

Remodeling n/a

Other n/a

Total Buildings/Real Estate - $

Leasehold Improvements

Paint 200 $

Counter Instalation 1,000

Tile 450

n/a -

Total Leasehold Improvements 1,650 $

Capital Equipment List

Furniture 1,408 $

Equipment 2,279

Fixtures 900

Machinery 22,488

Other n/a

Total Capital Equipment 27,075 $

Location and Admin Expenses

Rent & Related Costs 12,000 $

Utility deposits 300

Legal and accounting fees 1,250

Notes on Preparation

Note: You may want to print this information to use as reference later.To delete these instructions,

click the border of this text box and then press the DELETE key.

Nearly everyone who has ever started a business has underestimated the costs, and then faced the

danger of running with inadequate capital reserves. The key to avoiding this pitfall is to adopt a

rigorous approach to your research and planning.

Our Startup Expenses worksheet will lead you through the process.

EXPENSES - Begin by estimating expenses. What will it cost you to get your business up and

running? The key to accuracy here is attention to detail. For each category of expense, draw up a list

of everything you will need to purchase. This will include both tangible assets (for example,

equipment, inventory) and services (for example, remodeling, insurance). Then determine where you

might purchase these goods or services. Research more than one vendor; i.e.: comparison shop. Do

not look at price alone; terms of payment, delivery, reliability, and service are also important.

CONTINGENCIES - Add a reserve for contingencies. Be sure to explain in your narrative how you

decided on the amount you are putting into this reserve.

WORKING CAPITAL - You cannot open with an empty bank account. You need a cash cushion to

meet expenses while the business gets going. Eventually you should do a 12

projection. This is where you will work out your estimate of working capital needs. For now, either

leave this line blank or put in your best rough guess. After you have done your cash flow, you can

come back and enter the carefully researched figure.

SOURCES - Now that you have estimated how much capital will be needed to start, you should turn

your attention to the top part of this worksheet. Enter the amounts you will put in yourself, how much

will be injected by partners or investors, and how much will be supplied by borrowing.

COLLATERAL - If you will be using this plan to support a bank loan request, use the section near the

bottom to show what assets are offered as collateral to secure the loan, and give your estimate of the

value of these items. Be prepared to offer some proof of your estimates of collateral values.

Prepaid insurance 3,000

Pre-opening salaries n/a

Other n/a

Total Location and Admin Expenses 16,550 $

Opening Inventory

Flour 161 $

Sugar 274

Butter 311

Powdered Sugar 202

Chocolate Chips 523

Total Inventory 1,472 $

Advertising and Promotional Expenses

Advertising 1,000 $

Signage 300

Printing 400

Travel/entertainment 2,000

Other/additional categories n/a

Total Advertising/Promotional Expenses 3,700 $

Other Expenses

Packaging 157 $

Delivery Truck Gas 700

Total Other Expenses 857 $

Reserve for Contingencies 1,000 $

Working Capital 30,000 $

Summary Statement

Sources of Capital

Owners' and other investments 25,000 $

Bank loans 27,500

Other loans -

Total Source of Funds 52,500 $

Startup Expenses

Buildings/real estate - $

Leasehold improvements 1,650

Capital equipment 27,075

Location/administration expenses 16,550

Opening inventory 1,472

Advertising/promotional expenses 3,700

Other expenses 857

Contingency fund 1,000

Working capital 30,000

Total Startup Expenses 82,304 $

Security and Collateral for Loan Proposal

Collateral for Loans Value Description

Real estate $ -

Other collateral -

Other collateral -

Other collateral -

Owners

Your name here

Other owner

Other owner

Loan Guarantors (other than owners)

Loan guarantor 1

Loan guarantor 2

Loan guarantor 3

Notes on Preparation

You may want to print this information to use as reference later.To delete these instructions,

click the border of this text box and then press the DELETE key.

Nearly everyone who has ever started a business has underestimated the costs, and then faced the

danger of running with inadequate capital reserves. The key to avoiding this pitfall is to adopt a

rigorous approach to your research and planning.

Our Startup Expenses worksheet will lead you through the process.

Begin by estimating expenses. What will it cost you to get your business up and

running? The key to accuracy here is attention to detail. For each category of expense, draw up a list

of everything you will need to purchase. This will include both tangible assets (for example,

equipment, inventory) and services (for example, remodeling, insurance). Then determine where you

might purchase these goods or services. Research more than one vendor; i.e.: comparison shop. Do

not look at price alone; terms of payment, delivery, reliability, and service are also important.

Add a reserve for contingencies. Be sure to explain in your narrative how you

decided on the amount you are putting into this reserve.

WORKING CAPITAL - You cannot open with an empty bank account. You need a cash cushion to

meet expenses while the business gets going. Eventually you should do a 12-month cash flow

projection. This is where you will work out your estimate of working capital needs. For now, either

leave this line blank or put in your best rough guess. After you have done your cash flow, you can

come back and enter the carefully researched figure.

Now that you have estimated how much capital will be needed to start, you should turn

your attention to the top part of this worksheet. Enter the amounts you will put in yourself, how much

will be injected by partners or investors, and how much will be supplied by borrowing.

If you will be using this plan to support a bank loan request, use the section near the

bottom to show what assets are offered as collateral to secure the loan, and give your estimate of the

value of these items. Be prepared to offer some proof of your estimates of collateral values.

Вам также может понравиться

- Logo Sweet ShoppeДокумент1 страницаLogo Sweet Shoppeapi-263259886Оценок пока нет

- Marketing Plan - Sweet ShoppeДокумент12 страницMarketing Plan - Sweet Shoppeapi-263259886Оценок пока нет

- Sweet Shoppe Coffee CupsДокумент4 страницыSweet Shoppe Coffee Cupsapi-263259886Оценок пока нет

- Market AnalysisДокумент10 страницMarket Analysisapi-263259886Оценок пока нет

- LetterДокумент1 страницаLetterapi-263259886Оценок пока нет

- Dear Susan GДокумент1 страницаDear Susan Gapi-263259886Оценок пока нет

- FurnitureДокумент1 страницаFurnitureapi-263259886Оценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Letter From SprintДокумент2 страницыLetter From SprintGordonОценок пока нет

- ACT NO. 3952: Act No. 3952 (As Amended) - The Bulk Sales LawДокумент8 страницACT NO. 3952: Act No. 3952 (As Amended) - The Bulk Sales LawAuden Jay Allejos CuramengОценок пока нет

- Deed of Trust (Short Form)Документ5 страницDeed of Trust (Short Form)michaelmonson84100% (2)

- Bank RateДокумент4 страницыBank RateAnonymous Ne9hTRОценок пока нет

- Real Estate Mortage Case DigestДокумент5 страницReal Estate Mortage Case DigestyanyanersОценок пока нет

- IDBI Home Loan DetailsДокумент2 страницыIDBI Home Loan DetailsvinodmcaОценок пока нет

- Calca PlotsДокумент4 страницыCalca PlotsKhumiso LetlhogileОценок пока нет

- International Financial Markets 03Документ32 страницыInternational Financial Markets 03Md. Monirul islamОценок пока нет

- Max New York Life InsuranceДокумент54 страницыMax New York Life InsurancedevveddОценок пока нет

- Circular No 905Документ55 страницCircular No 905chrisОценок пока нет

- Real Estate Mortgage AgreementДокумент3 страницыReal Estate Mortgage AgreementKen BaxОценок пока нет

- Dapar Vs BiascanДокумент2 страницыDapar Vs BiascanCharlotteОценок пока нет

- Property With Parras NotesДокумент9 страницProperty With Parras Notesairish060599100% (1)

- The Federal Reserve - GarrisonДокумент17 страницThe Federal Reserve - Garrisontinman2009Оценок пока нет

- 17 03 80810 DДокумент36 страниц17 03 80810 D9137254Оценок пока нет

- Catch The WaveДокумент71 страницаCatch The WaveAlis SemeniucОценок пока нет

- Debt Defense HandbookДокумент57 страницDebt Defense Handbookjvastine80% (5)

- Euro Credit Risk - Company Presentation - ENДокумент22 страницыEuro Credit Risk - Company Presentation - ENRoberto Di DomenicoОценок пока нет

- PRACTICE COURT ASSIGNMENT SOLUTIONSДокумент5 страницPRACTICE COURT ASSIGNMENT SOLUTIONSjerson_xx6816Оценок пока нет

- BUYING INVESTING & RENTING PROP - Sriram Vittalamurthy PDFДокумент220 страницBUYING INVESTING & RENTING PROP - Sriram Vittalamurthy PDFPrashant Tomar100% (3)

- MSc Financial Markets, Financial Institutions and Banking - Lecture 1 IntroductionДокумент26 страницMSc Financial Markets, Financial Institutions and Banking - Lecture 1 IntroductionLumumba KuyelaОценок пока нет

- Plaintiff-Appellee vs. vs. Defendant-Appellant: en BancДокумент8 страницPlaintiff-Appellee vs. vs. Defendant-Appellant: en Bancpinkblush717Оценок пока нет

- Shama Naseem: ObjectivesДокумент3 страницыShama Naseem: ObjectivesMisbhasaeedaОценок пока нет

- Mcqs On ForexДокумент43 страницыMcqs On ForexRam Iyer90% (10)

- The Abington Journal 04-06-2011Документ28 страницThe Abington Journal 04-06-2011The Times LeaderОценок пока нет

- Pershing Square's Q1 Letter To InvestorsДокумент10 страницPershing Square's Q1 Letter To InvestorsDealBook100% (22)

- CPD Course Certificate 2018 ProConf - 106 PDFДокумент2 страницыCPD Course Certificate 2018 ProConf - 106 PDFNelia PalmerОценок пока нет

- Civ 2 Full Text To Be DigestedДокумент718 страницCiv 2 Full Text To Be DigestedBrenPeñarandaОценок пока нет

- Home Loan Project Final (Arun)Документ64 страницыHome Loan Project Final (Arun)Munjaal RavalОценок пока нет

- Tanzania Mortgage Market Update 30 Sept 18 - FinalДокумент11 страницTanzania Mortgage Market Update 30 Sept 18 - FinalAnonymous FnM14a0Оценок пока нет