Академический Документы

Профессиональный Документы

Культура Документы

Kmptruewealth

Загружено:

api-200319437Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Kmptruewealth

Загружено:

api-200319437Авторское право:

Доступные форматы

True Wealth & Savings

WHAT IT MEANS TO BE WEALTHY

Would you be able to recognize a rich person just by looking at

him? Probably! Most people can easily imagine how a wealthy

person would look like he or she wears fine clothes and expensive jewelry, drives a nice car, owns a big house, eats at fancy restaurants, goes on vacation abroad and hangs out with the famous

and powerful people in society. Kadalasan, mayaman nga ang

ganitong klaseng tao. But not all of them are! Some of them

could be experiencing financial difficulties just like many ordinary

Filipinos. Marami ang mukhang mayaman lang o rich ang arrival pero naghihirap din pala sa pera katulad ng maraming Pinoy. There are also people who can afford an extravagant lifestyle

5

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

only because they are earning well in their present job or in their

business. But once they lose their job or their business fails they

cannot continue their lavish way of life and may be forced to live

simply or even poorly. Hindi maituturing na tunay na mayaman

ang mga ganitong tao.

You are truly wealthy only if you can continue to live comfortably the lifestyle you desire even if you never work another day in

your life. In other words, you are wealthy if you can retire in comfort permanently. This is what true financial wealth is all about;

patuloy kang mamumuhay ng maayos at maginhawa kahit hindi ka

na nagtatrabaho at parelax-relax na lang. This ideal situation is

also referred to as financial independence or financial freedom.

Ang paborito kong tawag dito ay financial peace of mind, dahil

wala nang gugulo sa iyong isipan pagdating sa pera.

Our definition of true wealth means that a company Vice President

who earns P150,000 monthly, owns a big house in an executive

village, drives a sports utility vehicle, owns the latest gadgets and

gizmos, frequently visits a trendy night club and regularly plays at

the casino is not considered wealthy if he cannot sustain this lifestyle the moment he stops working. He may even be forced to sell

his possessions just to survive.

Ikumpara mo si VP kay Mang Pandoy (hindi siya yung poster boy

ni FVR) na simple lang ang ligaya sa buhay. Mang Pandoy is an

ordinary and hardworking employee who spends his money wisely

and always sets aside part of his monthly salary for his savings.

Through the years he was able to accumulate a big amount of

money. Mang Pandoy is confident that once he stops working he

would be able sustain his simple and stress-free lifestyle. Sino sa

tingin mo ang matatawag na tunay na mas mayaman?

6

True Wealth and Savings

If your idea of being rich is owning vacation houses in Baguio,

Tagaytay and Boracay, maintaining a fleet of luxury vehicles, and

having money to burn on a monthly trip abroad for shopping then

good luck na lang. Baka tunaw na lahat ng yelo sa North Pole

hindi mo pa rin ito maabot. Achieving true wealth has a lot to do

with the lifestyle you choose and not just about how much money

you earn. Earning millions doesnt automatically make you rich,

especially if you are also spending millions to support your extravagant lifestyle. Regardless of how much you are earning now,

you are capable of achieving true wealth if you choose how to live

your life wisely. Mas simpleng buhay, mas maliit ang kailangang

ipundar para yumaman.

To know if you are financially stable right now, try to imagine

what would happen if you suddenly stop receiving your salary.

Will your family survive without having to alter your way of life

and for how long? If you can live comfortably for the rest of your

life with little financial stress then congratulations; tunay ka na

mayaman at pwede mo nang ibigay sa iba itong libro dahil hindi

mo ito kailangan. However, if you need to drastically lower your

standard of living to ensure your familys long-term survival or

you are not even sure if you can survive at all, then you are far

from being financially secure. Keep reading because you have a

lot of work to do to improve your financial situation.

THE IMPORTANCE OF SAVINGS

A healthy amount of savings is the foundation on which you will

build your personal wealth. Without any savings it is impossible

for you to achieve financial security. Pwera na lang kung ikaw ang

solong tagapagmana ng daan-daang milyon ng mga magulang mo.

7

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

But you cant be too sure. What if your parents decide to give

most of their wealth to charity? Magkakamot ka na lang ng ulo.

Building wealth requires that you consistently save (and invest)

money for many, many years; starting now until you can retire in

comfort. Even if you have no intention of becoming wealthy, you

should still save for three important reasons.

1. Survive a financial crisis.

Sooner or later every family has to face some sort of financial

crisis. This financial crisis could be in the form of an accident,

illness, job loss, failure of a business or sudden death of the

familys breadwinner. The amount of savings you have will ultimately determine how well you can survive a financial crisis.

Maari mong malampasan ang pinansyal na krisis kahit wala

kang sapat na ipon pero maaring mauwi ito sa panghabangbuhay na pagkabaon sa utang.

Sometimes the lack of savings can even make the situation

worse, like a family member dying unnecessarily due to lack of

funds for proper medical treatment. Saving for the rainy

days will spare your family from huge financial losses and

ensure your survival when a crisis strikes. Adequate savings

will give you peace of mind and help you sleep better at night

knowing that you will be able to handle a financial emergency

that comes your way.

&

8

Kapag may isinuksok, may madudukot.

True Wealth and Savings

2. Improve the lives and well-being of the family.

It is nearly impossible to buy anything of high value if you do

not have any savings. While its true that money cannot buy

happiness, it can certainly buy things that will improve the

quality of life of your family. Sufficient savings can help you

buy a nice decent house, a car, pay for your childrens quality

education or allow you to invest in a business. It also allows

you to treat your family to occasional simple pleasures like vacations that are good for bonding. Nakakabuti din sa pagsasama ng mag-asawa ang pagkakaroon ng sapat na ipon. Many

couples quarrel and even separate due to money problems.

With enough savings you will have one less thing to argue

about; it helps keep the relationship healthy.

I really dont understand why some people insist that they

dont want to be rich. Para bang masama ito. Ang sabi naman

ng iba, maraming problema kung mayaman ka. They probably

dont understand what true wealth means. Theres nothing bad

or evil about being wealthy. Financial stability will solve more

problems than it creates, if any. It is all right to aspire and

work hard to build wealth and achieve financial security so you

can let your family enjoy the good, but not extravagant, life. It

is not greed; TLC (tender loving care) yan para sa pamilya.

3. Enjoy your golden years.

With great advances in medical and health care and greater

awareness about fitness and healthy living, many of us can expect to live to a ripe old age. Kawawa ka kung iaasa mo lang

sa gobyerno ang panggastos mo kapag retired ka na. The

money youll get from SSS or GSIS will barely feed you and

you could find yourself working way past the age of 65 or to9

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

tally dependent on your children if you do not prepare well for

your retirement. Saving regularly while you are still working

will help you avoid being forced to continue earning for a living after you retire. To ensure that your golden years will

shine and let you do the things you enjoy, start saving today the

funds you will need for the future. Kung magtatrabaho ka man

pagkatapos magretiro ito ay dahil gusto mo at hindi dahil kailangan mo!

For many Pinoys, financial security will be hard to achieve

while in their 40s or 50s. But that should not stop you from

hoping and working to make your retirement financially stable.

Isa sa dahilan kaya ka nagpapakahirap magtrabaho ngayon ay

para maranasan mo ang maginhawang pamumuhay sa iyong

pagtanda. Starting to save early will allow you to retire early,

giving you more time to enjoy the fruits of your hard work.

Patriotic reason to save

Aside from the obvious personal reasons, peoples savings are

also important to the countrys sustainable economic development and financial stability. Long term savings can provide financing to companies to expand their operation which promotes

economic growth. Kung mas maraming iniipon na pera ang mga

tao, mas marami ang pwedeng ipahiram sa mga kumpanya para

palawakin ang kanilang operasyon. Ang paglakas ng negosyo ay

maari ring magbigay ng mas maraming trabaho sa mga Pinoy.

Voluntary savings are also the most frequent source of microfinancing, which helps the ordinary people, especially the poor,

start businesses that increase their income and keep them out of

poverty. The more you save, the more you help the countrys

economy and the more people you help escape poverty. Kaya

mag-impok na!

10

True Wealth and Savings

THE STEPS TO TRUE WEALTH

Unlike some people who are born rich, the average Filipino will

have to exert a great deal of effort to achieve true wealth; it will

take a lot of sacrifices and it will take many years to attain. But do

not be discouraged because it can be done during your lifetime.

With discipline, unwavering determination, relentless drive, sipag

at tiyaga, positive attitude and adequate knowledge about personal finance you can do it. Kaya mo, Pinoy!

It all begins with believing that regardless of what you have right

now and regardless of how much you earn, you have the ability to

achieve financial freedom. Kumbinsihin mo rin ang iyong sarili na

ang dami ng pera ay walang kinalaman sa halaga ng iyong pagkatao. Being rich doesnt mean you are more worthy as a person.

May ibang mayayaman dyan na kung umasta akala mo hari at

reyna ng mundo. They act as if they have more rights and privileges than ordinary people. Huwag mong pansinin ang mga to,

masisira lang ang araw mo. Instead, concentrate on what you

need to do to achieve the financial freedom they enjoy and promise

yourself not to behave like them once you have it.

&

Aanhin mo ang palasyo kung

ang nakatira ay kuwago.

Here are the 12 steps to build your personal wealth and turn your

dream of financial independence to reality.

1.

Understand and overcome the obstacles to building wealth.

2.

Know what you want and dream big.

11

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

3.

Find out where you are and what you have.

4.

Make saving a lifelong habit.

5.

Spend your money wisely.

6.

Get out and stay out of debt.

7.

Find ways to earn more, to save more.

8.

Prepare for lifes financial challenges.

9.

Plan for a hassle-free and comfortable retirement.

10. Grow your money through smart investing.

11. Take care of your health to enjoy your wealth.

12. Share your blessings and receive more riches.

Starting today, memorize these steps. Always keep them in mind

so you will stay focused in your quest for financial independence.

Itaga mo ito sa bato: makakamit mo ang tunay na yaman kung palagi mong susundin ang mga hakbang na ito. Pangako yan! I

strongly recommend that you read through all the steps even if you

think you already know it because you will probably pick-up some

new information and valuable insights.

Wealth building should be an enjoyable pursuit. Do not allow it to

become a burden because you will just give up. And never turn it

into an obsession. Kapag puro na lang pagpupundar ng yaman

ang iyong aatupagin, makakalimutan mo na kung paano mamuhay

ng tama kasama ang iyong mga mahal sa buhay. Enjoy the fruits

of your hard work once in a while.

To make your flight to financial freedom enjoyable, do not equate

your success or failure in life with how much money you have.

12

True Wealth and Savings

Wealth and success dont always go together. You can achieve

one without the other. Pero kaya mo rin namang makamit pareho

ang dalawang ito! Its really all up to you.

Your journey begins

13

Вам также может понравиться

- Kmpstep 03Документ10 страницKmpstep 03api-200319437Оценок пока нет

- Kmpstep 02Документ14 страницKmpstep 02api-200319437Оценок пока нет

- Kmpstep 01Документ12 страницKmpstep 01api-200319437Оценок пока нет

- Project HTMLДокумент3 страницыProject HTMLapi-200319437Оценок пока нет

- Presentation 1Документ8 страницPresentation 1api-200319437Оценок пока нет

- KmpforewordДокумент3 страницыKmpforewordapi-200319437Оценок пока нет

- Irs AccountingДокумент3 страницыIrs Accountingapi-200319437Оценок пока нет

- 52 Things You Can Do To Improve Your Work A Week at A TimeДокумент22 страницы52 Things You Can Do To Improve Your Work A Week at A Timeapi-200319437Оценок пока нет

- Presentation 1Документ14 страницPresentation 1api-200319437Оценок пока нет

- My Maid Invest1Документ28 страницMy Maid Invest1api-200319437Оценок пока нет

- Kmpstep 04Документ16 страницKmpstep 04api-200319437Оценок пока нет

- The Ultimate Truth - IntegrityДокумент6 страницThe Ultimate Truth - IntegrityLaszlo Manuel Pinter100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Instant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full ChapterДокумент32 страницыInstant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full Chapteralicenhan5bzm2z100% (3)

- Full Download Understanding Business Ethics 3rd Edition Stanwick Test BankДокумент35 страницFull Download Understanding Business Ethics 3rd Edition Stanwick Test Bankleuterslagina100% (22)

- Ysmael vs. Executive Secretary - DigestДокумент2 страницыYsmael vs. Executive Secretary - DigestVince Llamazares LupangoОценок пока нет

- How To Have A BEAUTIFUL MIND Edward de BДокумент159 страницHow To Have A BEAUTIFUL MIND Edward de BTsaqofy Segaf100% (1)

- Eschatology in The Old Testament PDFДокумент175 страницEschatology in The Old Testament PDFsoulevansОценок пока нет

- B. Performance Standard The Learners Should Be Able To Participate in Activities ThatДокумент9 страницB. Performance Standard The Learners Should Be Able To Participate in Activities ThatBenmar L. OrterasОценок пока нет

- Mitul IntreprinzatoruluiДокумент2 страницыMitul IntreprinzatoruluiOana100% (2)

- Lecture 3 SymposiumДокумент20 страницLecture 3 SymposiumMakkОценок пока нет

- Course Code: DMGT402: COURSE TITLE: Management Practices & Organizational BehaviorДокумент1 страницаCourse Code: DMGT402: COURSE TITLE: Management Practices & Organizational Behaviortanvirpal singh DhanjuОценок пока нет

- Ought To, Should, Must and Have ToДокумент2 страницыOught To, Should, Must and Have Topinay athena100% (1)

- Lawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NiДокумент4 страницыLawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NibawihpuiapaОценок пока нет

- Financial Reporting Standards SummaryДокумент5 страницFinancial Reporting Standards SummaryKsenia DroОценок пока нет

- United Nations Industrial Development Organization (Unido)Документ11 страницUnited Nations Industrial Development Organization (Unido)Ayesha RaoОценок пока нет

- Elements of Consideration: Consideration: Usually Defined As The Value Given in Return ForДокумент8 страницElements of Consideration: Consideration: Usually Defined As The Value Given in Return ForAngelicaОценок пока нет

- Apg-Deck-2022-50 - Nautical Charts & PublicationsДокумент1 страницаApg-Deck-2022-50 - Nautical Charts & PublicationsruchirrathoreОценок пока нет

- Janice Perlman, FavelaДокумент3 страницыJanice Perlman, FavelaOrlando Deavila PertuzОценок пока нет

- Writ of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Документ2 страницыWrit of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Judicial_FraudОценок пока нет

- BE1 - 1. Skripta (Kolokvij)Документ5 страницBE1 - 1. Skripta (Kolokvij)PaulaОценок пока нет

- 2023 Whole Bible Reading PlanДокумент2 страницы2023 Whole Bible Reading PlanDenmark BulanОценок пока нет

- Excerpt of "The Song Machine" by John Seabrook.Документ9 страницExcerpt of "The Song Machine" by John Seabrook.OnPointRadioОценок пока нет

- Base Rates, Base Lending/Financing Rates and Indicative Effective Lending RatesДокумент3 страницыBase Rates, Base Lending/Financing Rates and Indicative Effective Lending Ratespiscesguy78Оценок пока нет

- City of Baguio vs. NiñoДокумент11 страницCity of Baguio vs. NiñoFD BalitaОценок пока нет

- Written Reflection Module 2 1Документ3 страницыWritten Reflection Module 2 1api-444179714Оценок пока нет

- Guruswamy Kandaswami Memo A.y-202-23Документ2 страницыGuruswamy Kandaswami Memo A.y-202-23S.NATARAJANОценок пока нет

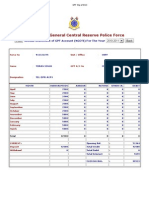

- Annual GPF Statement for NGO TORA N SINGHДокумент1 страницаAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- Liberal Arts Program: Myanmar Institute of TheologyДокумент6 страницLiberal Arts Program: Myanmar Institute of TheologyNang Bu LamaОценок пока нет

- Security AgreementДокумент5 страницSecurity AgreementGanesh TarimelaОценок пока нет

- B2B AssignmentДокумент7 страницB2B AssignmentKumar SimantОценок пока нет

- The Boy in PajamasДокумент6 страницThe Boy in PajamasKennedy NgОценок пока нет

- The 5000 Year Leap Study Guide-THE MIRACLE THAT CHANGED THE WORLDДокумент25 страницThe 5000 Year Leap Study Guide-THE MIRACLE THAT CHANGED THE WORLDMichele Austin100% (5)