Академический Документы

Профессиональный Документы

Культура Документы

Harrisburg Tax Ordinance

Загружено:

PennLive0 оценок0% нашли этот документ полезным (0 голосов)

3K просмотров7 страницHarrisburg tax ordinance

Оригинальное название

Harrisburg tax ordinance

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документHarrisburg tax ordinance

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

3K просмотров7 страницHarrisburg Tax Ordinance

Загружено:

PennLiveHarrisburg tax ordinance

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

ep te BS le oletatien erie cn mise

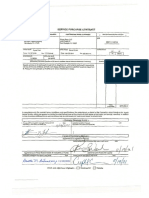

BILLNO, 2014

Moved by:

‘An Ordinance providing for residential and commercial 10-Year Tax Abatement and

Exemption programs inthe City of Harisburg for qualifying improvements and new

construction; designating the City’s boundaries to be the qualifying boundaries for deteriorated

neighborhoods in a residential property program; designating the City’s boundaries asthe

qualifying boundavies for a commercial property program: providing for tax abatement and

‘exemption schedules for qualifying improvements to and new construction of residential and

commercial properties throughout Harrisburg; providing incentives for additional exemptions for

jab creation; ensuring minority business participation, prevailing wage and residential

participation in qualifying improvement and new construction projects; authorizing an

‘administrator ofthese programs; ensuring due process of applicant by authorizing the creation

of a board of review; amending Chapter 5-503 of the Codified Ordinances ofthe City of

Harrisburg to provide for these new programs, including the repeal of sections inconsistent with

these new programs; and related matters.

STATEMENT OF PURPOSE: The purpose ofthis legislation isto improve the quality of life of the

residents of Harrisburg by fostering economic development, construction activity, permanent

job creation and the availabilty of safe quality housing stock

WHEREAS, the Improvement of Deteriorating Real Property or Areas Tax Exemption

‘Act, 72 PS, § 4711-101 er seg. grants local taxing authorities the power to exempt from real

property taxation, within certain limitations, the assessed valuation of improvements made to

certain dwelling Units located in a deteriorated neighborhood as designated by a local taxing

‘authority and new residential construction builtin a deteriorated area as designated by the

‘municipal governing body’ and

WHEREAS, the Local Economic Revitalization Tax Assistance Act, 72 P.S. §4722

seq grants local taxing authorities the power to exempt from real property taxation, within

certain limitations, the assessed valuation of improvements made to ceriin industrial

commercial or other business properties located ina designated deteriorated area as designated

by the municipal governing body; and

WHEREAS, the City of Harrisburg finds thatthe tax exemptions authorized by the

Improvement of Deteriorating Real Property or Areas Tax Exemption Act and the Local

Economie Revitalization Act can have a positive impact upon economic development throughout

the City; and

WHEREAS, the City of Harrisburg, held « public hearing on October 22, 2014 forthe

purpose of determining the boundaries ofthe City to be designated a deteriorated neighborhood

‘and a deteriorated area; and

WHEREAS, the City of Harisburg, with due consideration having been given to the

recommendations and comments made at such public hearing for ay local taxing authorities and

by other knowledgeable and interested public and private agencies and individuals regarding the

‘establishment ofthe boundaries and related maters and upon consideration of the purposes to be

fostered by implementation ofan abatement program, designates the entire City of Harrisburg as

deteriorated pursuant tothe roquirements and guidelines established by the Improvement of

Deteriorating Real Property or Areas Tax Exemption Act and the Local Eeonomie Revitalization

‘Act; and

WHEREAS, the City of Harrisburg, has determined that it is inthe best interest ofthe

City to implement the tax exemptions authorized by the Improvement of Deteriorating Real

Property or Areas Tax Exemption Act and the Local Economie Revitalization Act throughout the

Citys and

NOW, THEREFORE, BE IT ORDAINED BY THE COUNCIL OF THE CITY

(OF HARRISBURG, AND IT IS HEREBY ORDAINED BY AUTHORITY OF THE SAME, as

follows:

SECTION 1. Chapter $-508 ofthe Codified Ordinances ofthe City of Harisburg,

entitled Tax Abatement and Exemptions, is amended by repeating the provisions thereof in its

entirety and by substituting the foregoing provisions as follows:

CHAPTER 5-508

5503.1. DEFINITIONS

‘As used inthis chapter, unless otherwise expressly stated or clearly indicated by the context, the

following terms shall have the meanings indicate:

01. “BUSINESS IMPROVEMENT” means repair, new construction of reconstruction of any

‘business property, including alterations and additions, having the effect of rehabilitating a

deteriorated business property so that it becomes habitable or attains higher standards of heath

‘economie use or amenity, or is being brought into compliance with laws, ordinances or

regulations governing such standards; however, ordinary upkeep and maintenance shall not be

‘deemed a business improvement. New construction or erection ofa structure as business

property upon vacant land or land prepared to receive such structure within a designated

deteriorated area shall be deemed a business improvement, Inthe event of a dispute, the term

usiness improvement” shall have the same meaning as the term “deteriorated property” as

defined in the Local Economic Revitalization Tax Assistance Act

(02, “BUSINESS PROPERTY" means any industrial, commercial or other business property

‘owned by an individual, association, corporation, or other entity and includes, but isnot limited

to, any portion ofa propery utilized for industrial, commercial or other business use and shall

include any property which has both residential and business uses. It shall not include vacant

land of land principally utilized as surface parking facilities.

1

2

3

3

95

96

7

98

99

100

201

302

103

104

105

106

107

108

103

110

au

12

13

1a

115

116

a7

118

119

20

2

12

123

24

225

126

ur

8

129

130

aa

12

a3

134

as

136

03, _ DETERIORATED BUSINESS PROPERTY" means any business property located in a

deteriorated neighborhood or deteriorated area or any business property which has been the

subject of an onder by a government agency requiring the unit to be vacated, condemned or

«demolished by eason of noncompliance with laws, ordinances or regulations. "Deterioated

‘business property” may also include any business property owned by the Harrisburg

Redevelopment Authority.

04, “DETERIORATED RESIDENTIAL PROPERTY" means a dwelling unit located in a

deteriorated neighborhood or a deteriorated area ora dwelling unit which has been, or upon

request is, certified by the Bureau of Codes Enforcement as unfit for human habitation for tent

‘withholding or other health or welfare purposes or has been the subject of an order by the Bureau

‘of Codes Enforcement requiring the unit to be vacated, condemned or demolished by reason of

noncompliance with laws, ordinances or regulations. "Deteriorated residential property" may

also include any residential property owned by the Harrisburg Redevelopment Authority. Inthe

event of a dispute the term “deteriorated residential property” shall have the same meaning as

the term “deteriorated property” as defined inthe Improvement of Deterorating Real Propecty or

‘Areas Tax Exemption Act

05, “DETERIORATING AREA" means an area within the corporate limits ofthe City which

the City, pursuant to public hearings), determines to meet one or more criteria fr the

Вам также может понравиться

- Letter To Chapman Regarding The ElectionДокумент2 страницыLetter To Chapman Regarding The ElectionPennLiveОценок пока нет

- Letter Regarding PASS ProgramДокумент3 страницыLetter Regarding PASS ProgramPennLive100% (1)

- Quinn's Resignation LetterДокумент2 страницыQuinn's Resignation LetterPennLiveОценок пока нет

- Correspondence From Conference To Institution Dated Nov 10 2023Документ13 страницCorrespondence From Conference To Institution Dated Nov 10 2023Ken Haddad100% (2)

- Calling For Rep. Zabel To ResignДокумент2 страницыCalling For Rep. Zabel To ResignPennLiveОценок пока нет

- 23 PA Semifinalists-NatlMeritProgramДокумент5 страниц23 PA Semifinalists-NatlMeritProgramPennLiveОценок пока нет

- Wheeler's Letter To LeadersДокумент2 страницыWheeler's Letter To LeadersPennLiveОценок пока нет

- Senate Subpoena To Norfolk Southern CEOДокумент1 страницаSenate Subpoena To Norfolk Southern CEOPennLiveОценок пока нет

- Do Democrats Hold The Majority in The Pa. House of Representatives?Документ12 страницDo Democrats Hold The Majority in The Pa. House of Representatives?PennLiveОценок пока нет

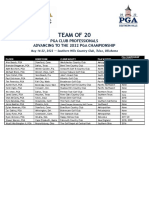

- 2022 Team of 20 GridДокумент1 страница2022 Team of 20 GridPennLiveОценок пока нет

- Letter To FettermanДокумент1 страницаLetter To FettermanPennLiveОценок пока нет

- Atlantic Seaboard Wine Association 2022 WinnersДокумент11 страницAtlantic Seaboard Wine Association 2022 WinnersPennLiveОценок пока нет

- Description of Extraordinary OccurrenceДокумент1 страницаDescription of Extraordinary OccurrencePennLiveОценок пока нет

- Ishmail Thompson Death FindingsДокумент1 страницаIshmail Thompson Death FindingsPennLiveОценок пока нет

- Regan Response To Cumberland County GOP ChairmanДокумент1 страницаRegan Response To Cumberland County GOP ChairmanPennLiveОценок пока нет

- Project Milton in Hershey, 2022Документ2 страницыProject Milton in Hershey, 2022PennLiveОценок пока нет

- Letter To Senator ReganДокумент2 страницыLetter To Senator ReganPennLiveОценок пока нет

- Cumberland County Resolution Opposing I-83/South Bridge TollingДокумент2 страницыCumberland County Resolution Opposing I-83/South Bridge TollingPennLiveОценок пока нет

- Letter To Auditor General Timothy DeFoorДокумент2 страницыLetter To Auditor General Timothy DeFoorPennLiveОценок пока нет

- Corman Letter Response, 2.25.22Документ3 страницыCorman Letter Response, 2.25.22George StockburgerОценок пока нет

- TWW PLCB LetterДокумент1 страницаTWW PLCB LetterPennLiveОценок пока нет

- Letter Regarding PPE and UkraineДокумент2 страницыLetter Regarding PPE and UkrainePennLiveОценок пока нет

- Pa. House Leaders' Letter Requesting Release of PSSA ResultsДокумент3 страницыPa. House Leaders' Letter Requesting Release of PSSA ResultsPennLiveОценок пока нет

- Letter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyДокумент1 страницаLetter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyPennLiveОценок пока нет

- Greene-Criminal Complaint and AffidavitДокумент6 страницGreene-Criminal Complaint and AffidavitPennLiveОценок пока нет

- Redistricting ResolutionsДокумент4 страницыRedistricting ResolutionsPennLiveОценок пока нет

- Jake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoДокумент5 страницJake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoPennLiveОценок пока нет

- Gov. Tom Wolf's LetterДокумент1 страницаGov. Tom Wolf's LetterPennLiveОценок пока нет

- James Franklin Penn State Contract 2021Документ3 страницыJames Franklin Penn State Contract 2021PennLiveОценок пока нет

- Envoy Sage ContractДокумент36 страницEnvoy Sage ContractPennLiveОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)