Академический Документы

Профессиональный Документы

Культура Документы

New Banking Value Chain

Загружено:

api-276166864Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

New Banking Value Chain

Загружено:

api-276166864Авторское право:

Доступные форматы

IntroductoryEdition

valuestream

Consumer Banking

JAN 2015

by Davis Chai

banking architecture

NEW PRODUCT-CHANNEL DEVELOPMENT

FEATURES:

Decoding Banking Value Chain

Fintechs Role in Banking Value Chain

If Fintech is a Bank

New Value Stream

Banks used to own the creation and destruction of service channels. These channels complements

their respective banking products and services. Its understandable that with million dollar vested

interest, these channel must serve to enhance and protect the customer base and revenue stream.

But that is changing in the face of mobile and internet ubiquity. Smart phones placed channels right

on the hand of customer. Banks does not own customer phones. How then are they to control their

revenue stream? In the new channel environment banks merely contribute to its growing relevance

to the customer - they are not the owner or sole provider of it. By using Product-Channel Value Maps,

we will explore how technology have enabled Finteh and consumers to be an active participant of

banking content and services. We will also explore how Fintechs have chosen to take advantge of

this change. Smartphone is only one of several emerging technology that will shape financial services. The evolution of banking product-channel will be continuous and disruptive.

This and other article from this author is written using S.T.A.F STrategy-Driven Architecture Framework.

TECHNOLOGY AND BANKING

GROWING RELEVANCE OF MOBILE TECHNOLOGY

ence and speed functionality. However, it is not as

highly associated with low-risk factor as compared

with branch or deskop banking. With sufficient investment and developments, mobile technology

will mature and become as secure and functional as

branch banking. As the development hit a tipping

point, mobile technology will have other advantage

and functionality not offered through traditional

banking. This is when mobile technology becomes

a critical product-channel component.

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

First, lets touch a bit on why and how mobile became

an important product-channel factor. Over the years,

the core financial needs remained more or less the

same (deposits, lending, payments, fund transfers,

credits, etc). The consumption patterns and approach

however is changing. More and more financial services will be rendered and consumed using highly connected mobile devices. From a customer standpoint,

it is the continuous exposure, conditioning, learning

and reinforcement that lead to mainstream adoption

of mobile tech. In each learning cycle, customer will

continuously associate and dissociate a channel to

an underlying resource factor throughout the use of

technologies. In tandem, banking enterprises will attempt to capture more of customer share by investing

in their part of the mobile space. It is this continuous

and self-reinforcing cycle by both producer and consumers that accelerated the adoption of emerging

product-channels. For example, mobile banking and

payment services are highly associated with conveni-

TECH PLAYERS CHANGING BANKING PRODUCTCHANNEL LANDSCAPE

Over the years, technology have offered the means

to increasingly bridge the gap between consumer

needs and producer capabilities.

Non-banking players have taken advantage of the

situation in different ways. Take Facebook for instance, its core capability is user identification and

social interaction. They are able to build a profile of

who a person is, what a person likes, where a per-

CustomerLearningFramework

Associative/

DissociativeFactors

(Learning)

Convenience/

Inconvenience

Factors

(Convenience)

A R T I C L E S :

V I S I T

Commitment/

ExitFactors

(Relationship)

Adoption/

RejectionFactor

(Transition)

FINANCIALVALUE

CHAIN

ResourceFactors

S . T . A . F

EnergyFactor

ValueFactor

Risk/PainFactor

M O R E

TimeFactor

MobileBankingSpeed&Convenience

F O R

Bank

A

App

PC&LaptopBankingSecurity&Privacy

BranchBankingSecurity&Fully

FunctionalBanking

Tellers

Bank

B

App

SelfService

Kiosk

AutoTellers

DisplayBoards

DepositMachine

Others

eBaybuy

andSell

Mobile

Cheque

Facebook

Pay

Linkedto

Google

Facebook Wallet

Sell

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

To understand the change required on the existing

product-channel maps, lets first define the existing map using system-based analysis to determine

the architecture and structure of existing banking

V I S I T

Consumers have always demanded for instant access to

transparent and competitive financial services. In the ab-

DECODING THE BANKING CHANNEL-PRODUCT

VALUE CHAIN

A R T I C L E S :

CONSUMERS WANT CHANGE AND IMPROVEMENT

In the wake of MAGICS (Mobile, Analytics, Gamification, IoT, Cloud and Social), consumer expects and

willingly embrace the coming changes to their own

benefit. In banking services, consumers will expect

this to improve the use of their resources (resource

factors). Banks and most companies in other industries now foresee the need to remodel themselves

to either take advantage of the change or shape

the change. Most bank, being heavily regulated,

and overly bureaucratic, are forced into the first position. Some banks, on the other hand, have failed

to respond effectively to the new wave of change.

S . T . A . F

Fintech have been quick to take advantage of emerging

technologies by developing services that competes and

complements traditional banking. All these development shows that existing banking product-channel is

about to be redefined.

sence of choices and in the presence of constraining regulations, those demand remain unfilled.

M O R E

son lives and travels to, track the time and date of each

life events. In this case the personal and social lifestyle is

accessible by Facebook. ICIC bank for instance, is taking

advantge of Facebooks capability by offering customers the ability to transfer money to customers facebook

account. Take another example, Google, with its search

dominance, have access to a persons information needs.

Together with other services it brings within its own ecosystem, Google can easily determine a persons information desire and potentially derive a persons needs out

of their search actions. This capability puts Google in an

advantagous position.

F O R

BANKING VALUE CHAIN

BANKING VALUE CHAIN

product-channel practice.

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

Using STAF (STrategy-driven Architecture Framework),

we will separate existing banking product-channel

system into 6 distinct value systems:

Financial Core Services - the actual core financial

needs of any individual ranging from total net worth

to short term liquidity needs.

Value Representation systems - system that represents the customers value in that bank which then

enables him/her to extract and use these stored value

BANKING VALUE CHAIN (BANK PERSPECTIVE)

V I S I T

Value Communication System - systems that allows

bank to communicate or trigger communication flow

(e.g. to alert customer of a transaction posting and

encourage customer to call back in case of potential

fraud) with customers.

S . T . A . F

A R T I C L E S :

To customer or end-user, the financial service offered

by banking institution is that of value consumption.

The banking service that we consume is part of a larger web of interconnected value systems. For instance,

such technology as Auto teller machines (ATM) and

NFC payment systems are part of a value exchange

system. At the core is the Value Holding system such as

your banking account, cash on hand and other liabilities. Each set of value holding components are linked

to a set of banking products within the Financial Core

Services systems. In the outer facing side of the value

system, the value extraction system enables access to

funding sources held within a certain Value Holding

system.

M O R E

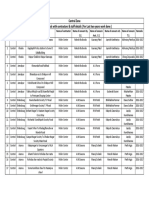

1. Banking Value Chain from a bank perspective

2. Banking Value Chain from a customer perspective

Value Exchange Systems - systems that allow values to be exchanged instead of consumed (i.e. mostly

from people-to-people or people-to-institution perspective).

F O R

To understand what changes is happening or required in each of the value systems we first take a

dip into the current development of value system:

Value Holding systems - system that stores and tracks

customers credit value within the bank

Value Extraction systems - system that allows the actual stored value to be consumed. These are often systems owned by the bank and positioned in convenient locations such as merchants and branches.

NEW CHANNEL OR PRODUCT DEVELOPMENT

The insights obtained through channel interaction

with customer and other research avenues will enable the bank to offer product to the right customer,

at the right price and at the right place and moment.

To achieve true customer oriented services, it is not

4

enough just to have CRM capabilities to engage the

customer. Much of the product and service access

channels needs to be relooked into.

This first perspective takes an inside-out view of

the market. It mostly deals with what capabilities a

banking enterprise needs to build in order to serve

the customer. These capabilities, following the earlier value system sequece, are:

Core financial service capabilities - core services

or products required by a customer one that takes

their value and lifestyle needs into account. For example, credit-linked current and checking account.

Value holding capabilities - the ability to store customer value. Also ability for the bank to anticipate,

expand, optimize and milk it.

Value Representation capabilities - the ability for

banks to offer effective representation of customers

value aligned to customer expectations and true

customer value (or potential value). For example

segment specific credit/debit cards with loyalty rewards.

Value Extraction capabilities - the ability to offer

value extraction beyond the 5 As (anyone, anytime,

any place, any device and any financial instruments)

so that it fits the evolving lifestyle and business

needs of individual customer. For example, cash

withdrawal using any existing banking channel

such as ATM, internet banking, branch banking, etc.

Value Exchange capabilities - the ability to allow

B2B, B2C, C2C value exchanges using bank as the

trusted and reliable source of intermediary.

Value Communication capabilities - ability to

communicate these values that a bank brings effectively and in line with latest communication trends.

BANKING VALUE CHAIN (CUSTOMER PERSPECTIVE)

FINTECHS ROLE IN THE VALUE CHAIN

Current development in the value chain is influenced by

whats happening in the technology space (i.e. MAGICS).

Fintechs in using technology as the driver of their emergence will suit our mapping needs.

FINTECH & VALUE REPRESENTATION SYSTEM (VREP)

The financial value that we hold is currently predominantly represented by cards and cash. It was over many years

of investment and improvements that lead to the widespread usability and recognition of cards. Banks supplied

the upstream processing terminals that allowed cards to

function. It is natural that each bank guards the data and

information acquired through the terminals with full se-

ing. It is now possible to virtualize existing physical VREP cards into our mobile device. Through the

use of mobile device (e.g. digital wallets) we can

now perform transactions with emerging VEXT

systems such as mPOS and online shopping portals. By doing so, Fintech is intermediating the financial intermediary. All physical cards can now

be collectively represented in a digital form (see

diagram in this page). With aggregation at the

end-user device level, data and information is now

being captured further downstream. Acting in the

interest of the customer, Fintech employs analytics to empower the individual customers (see Fintechs Value system architecture for further clarity).

There is also the derived VREP systems such a reward points and gift vouchers.These are the typical

form of secondary VREP. Most secondary VREPs are

centrally owned and managed by an authoritative

issuing party who is partnership with established

merchants and banking institutions. With aggregation, Fintech now offers a way for the secondary

VREP to be more digital and less geographically

bound.

FINTECH & VALUE EXTRACTION SYSTEM (VEXT)

Existing Value Extraction System (VEXT) evolved

V I S I T

However, much of the notable innovation in recent years

in the banking and financial service space is outside of

the value systems offered by banks. Partly to avert being

regulated, these new offerings mostly target customers

consumption trends. Their value proposition is mostly

about empowering and enriching the financial service

consumption experience. This is most welcome by consumers, especially when all these newly inspired capabilities comes free of charge. In that sense, it is a customer

driven development. In reality it is Fintechs way of avoiding the high-entry barriers imposed on financial services

market.

Telephony

BranchBanking

ValueExtractionSystem

ValueExchangeSystem

ValueExtractionsystem

ValueRepresentation

System

ValueHoldingSystem

FinancialCoreServices

InternetTransfer

GIRO

InternetTransfer

Certificates

DigitalCurrency

Deposits

MobileTransfer

SWIFT

Cash

Bancassurance

TellerMachines

FAST

TellerMachines

SavingsA/C

Investments

SMSTransfer

Moneygram

SMSTransfer

MembershipCards

FD/CD

Remittance

BankBranches

WesternUnion

BankBranches

ChequeTerminal

POSTerminals

MPOSTerminals

FundTransfer

OrPayments

DebitCards

ChequeBook

Contract

Loans

ChequeTerminal

AccountBook

Policy

Cards

POSTerminals

CreditCards

LoanA/C

Payments

MPOSTerminals

A R T I C L E S :

SnailMail

S . T . A . F

SMS

M O R E

BankOwned

ValueCommunication

OnlinePortal

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

FINTECH & BANKING VALUE CHAIN

Collateralized

Accout

RewardPointsA/C

F O R

CurrentA/C

CardA/C

crecy. Data and information, thus, drifted upstream to the

individual banking service producers.

However, payment systems and VREP systems is converg-

from the need to distribute physical cash and

transacting using passive plastic cards. Most of

these systems are themselves simple in nature

and does not have any intelligence built-in. It cer5

FINTECH & BANKING VALUE CHAIN

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

tainly is not built with empowering customer in mind.

Further, all the transactional data is only visible to the

banking community.

Since physical cash becomes less relevant, most of

the transactions will take place in the virtual space.

As we increasingly associate convenience with mobile based technologies, smartphone is an obvious

device to allow Value Extraction to take place. Instead

of using physical cards, value extraction is now possible and can even occur between 2 end user devices.

The days, where someone is required to queue up in

bank branches to dispense cash or bank-in cheques,

are numbered. Fintech entered to provide alternative

and complementary value extraction capabilities.

Their selling point is simple, they are able to bypass

the limitation of existing value extraction system.

With mobile devices and digital banking, the new

VEXT system is in our pocket. We can now perform all

kinds of banking transaction using mobile phones.

Riding on the cashless generation wave, Square for

instance, is providing SquareCash which allows cash

to be transferred free of charge from person to person. It uses existing debit cards to extract funds out of

a persons account.

A R T I C L E S :

V I S I T

Consider self-checkout transaction over a retail counter. With digital wallet and digital cards, the customer

simply scan the barcode for each product and arrive

to a total instead of having to queue and pay for services. Customer simply choose to check out at the

readily available kiosk at any point in time, anywhere

within the retail shop by paying on their device POS

app. This is not only highly efficient but also highly safe way of transacting as customers data never

leaves customers hand.

FINTECH & VALUE HOLDING SYSTEM (VHOLD)

In its current state our financial information is highly

fragmented as it resides within multiple banking

system in multiple banks. There is no way that a person can optimize and manage the financial position

let alone view it in real-time.

With Fintechs PFM offeringsyour multi-account financial position is now visible through mobile devices. By aggregating information from multiple

bank accounts, the first step in personal financial

management is now complete. For a bank, the aggregated customer financial info is used to serve banking segmentation and market positioning needs. For

Fintech, its sole use of the information is to attract

more customer into subscribing its service. It is then

natural for Fintech to extend PFMs functionality and

go down the path of customer empowerment. For

instance, most PFM have built-in functionality that

informs, monitors and manages customers financial position.

F O R

M O R E

S . T . A . F

Providing customer with an

overall view of

their own financial position is

just the beginning. This will

then be followed

by further customer decision

support capabilities such as

value sourcing,

value

benchmarking

and

value de-risking.

For instance, the

aggregation tool

6

This bank is omni-channel from day one. It would

Value Exchange has long been dominated by the established banking intermediary such as Swift, GIRO and

MEPS. While the systems play an important role in earlier

part of the banking service, it is increasingly at odds with

the value demanded by todays digital lifestyle such as

the rise of 5 As (anyone, anytime, any place, any device

and any financial instruments). To counter that, some innovative banks have started to combine mobile technology and banking VEXC systems. Banks in UK is already

allowing money transfer using phone numbers as identifiers via SMS messaging. Another example, the recent

development in Singapore using FAST is a similar concept that allows almost instantaneous payment service

between both consumers and merchants. SMS money

transfer and FAST is an innovative development by players from the banking industry - not a fintech setup.

be highly proactive in providing recommendations and in prescribing financial fixes. There will

be no physical branches - the bank only exist in the

digital world. Its customer base is the global and

highly connected netizens. It uses analytics heavily to drive traffic and reward clicking behaviors as

a way to propagate customer value and increase

revenue rather than using old school method such

as mass marketing methods. The business is highly scalable and thus are not limited with its choice

of value propagating campaigns that can increase

traffics manifold. Its market base is far more wider

and diverse than any traditional bank. It utilizes social networks to generate funding and ideas. New

service or products pops up almost daily to ignite

the consumption behavior of customers. Customer can preplan their spending and perform impact

analysis on their financial position. This can be

done right before and after spending. Alternative

spending option can be sought, the Fintech bank

app will provide guidance.

Fintech such as PayPal and Square aims to change that

by providing innovative payment solution. Yet, charging

model remains funamentally the same as they too impose a percentage charge plus a small flat fee each time

a transaction is performed. Other players such as Dwolla

V I S I T

FINTECH & VALUE EXCHANGE SYSTEM (VEXC)

A R T I C L E S :

If the collective fintech capabilities were combined and is treated as a single banking entity, its

value mapping would look like this (see diagram

below):

S . T . A . F

IF FINTECH WERE A BANK

M O R E

As VHOLD information and intelligence continue to shift

downstream towards customer owned device rather

than bank owned device, data will predominantly be

owned by - the regulators (e.g. licensed credit scoring

companies) and Fintechs or customer themselves. Banks

will gradually be limited to transactional information

passes the banking system.

charges a flat fee of US$0.25 per payment transaction. This interest in lowering transaction fee is

also fuelled by growing number of online transactions through global retail giants such as Amazon,

eBay and Alibaba.

F O R

can notify a customer of cashflow improvement opportunity by taking advantage of lower interest bearing financial instrument through an value sourcing and value

optimization.

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

NEW VALUE FUNCTION

NEW VALUE FUNCTION

F O R

M O R E

S . T . A . F

A R T I C L E S :

V I S I T

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

NEW VALUE MAP

The musing from above section gives us a glimpsee

into what the new value map should look like (if not

already).

As cost of transaction shrinks, the fee-based earnings in

banks dwindle. Banks are forced to seek alternative and

complementary earning avenues. In the absence of viable fee based opportunity, banks have aggressively

pursued traditional banking initiatives such as lending and deposit taking. On the side of the coin, as the

cost per transaction continue to shrink, the cost itself is

becoming less relevant. Customer are not necessarily

moved by the marginal cost differences. This is clearly

seen in the retail space whereby rarely would a shopper ask about the cost of swiping a credit card. Rather,

the mindset of customer is on value, and how transacting with a party brings value. This brings us back to the

next point of our discussion - the new value map.

Hence, it is not only in the traditional value systemthat

financial services players will compete in aggressively.

While banks, in their own defence, will be pushing the

capability limits of existing value system, both Fintechs

and more innovative banks will attempt to dominate

the New Financial Value system.

The new value system space is an emerging and everchanging landscape. It threatens to limit the revenue

potential of those banks dependant solely on old value

map.

The new value systems have several common characteristics:

1. It is instantaneous or near-instantaneous (real-time)

2. It relies heavily on intelligence and analytics

3. It provides insights and foresights

4. It recommends and drive actions

5. It is highly mobile (i.e. 5 As)

There will be a lot of emphasis on utility value and enduse experience. For the following discussion and from

an architectural viewpoint, the new value map will have

the following capabilities:

AGGREGATE, CAPTURE & CATEGORIZE

First, the service provider needs to be in a good position to aggregate data and value. By occupying favorable market position in the data and value space, it can

8

then aggregate data from multiple disconnected

sources. Once aggregation is achieved, data capture

and categorization can be applied to provide useful

insight.

Fintechs have done so to various degrees. PFM technology aggregates data from multiple bank account

and account statements. It then analyzes monthly

cash flow based on budget needs set by users. Others such as e-wallet services intercepts at the VEXT

level. It has the potential compartmentalizes buying

and spending into categories and uses those data to

inform and change spending behaviors. Crowdfunding have taken the position as not only a source of

funding for individual or businesses but it also facilitates knowledge and ideas exchange - i.e. Indiegogo

and Kickstarter.

BENCHMARK, ANALYZE AND DISCOVER

This capability to provide insights into the value

stream requires analytics. Analytics provides the opportunity for the consumer of financial services to

discover new value opportunities. With emergence

of Fintech, these capabilities have also been applied

at the mass consumption scale and customized to

the individual customer level.

The payment space also present an opportunity for

Fintech to analyse the spending habit of the individual customer.The spend pattern and categories

then be used to set benchmark and baseline values.

By performing baseline analysis into both customer

spend and categorical spend, the end customers

spend effectiveness are then tabulated. This leads to

the discovery of the median of gaps which leads to

the next capability.

Not all Fintech provide this service. This service may

be deemed more suitable for data and value aggregation services such as in the case of e-Wallet and

PFM. In the case of e-wallet of digital cards, the service is more timely and of higher utility value as it

can make recommendations at the point of transaction. Billguard, a PFM provider, offers an innovative

twist in this space by scouting for deals and saving

opportunities. This is being done based on past similar category spending.

ASSIST AND RECOMMEND ACTION

Billguard offers fraud analysis that is both crowd-edited and centrally sourced. Other more rudimentary

Fintech offerings informs of spend limits and saving

FinancialCoreService

Analysis&

Benchmarking

Aggregation&

Categorization

ValueHoldingSystem

Openfolio is a collaborative platform in the investment

V I S I T

The old value map is still valid even when we

consider Fintechs innovation. The biggest alteration to the lanscape is the addition of consumer

tech that placed customer at the forefront of the

value map. Each layer of the new value capabilities, adds-up to create a new combined capabilites. The first two: analytics and data capture, is

key foundational capabilites. The last tow capabilities are the ones that will differentiate innovative banks and Fintechs from traditional players.

Combined together, the 4 capabilities form the

new value stream and it can be mapped across

the entire financial value chain.

Fintechs such as Payment service provide can

appear more attractive by moving beyond aggregating and simplifying transactions. They

could also provide assistive functions along with

crowd wisdom such as what BillGuard has done.

9

A R T I C L E S :

In years to come, customers digital life is but an interconnection of value webs. Value webs forms and disperses

as soon as the value is no longer shared by its participants. Platform that offers the best value shall be the

core intermediary - likely a participant with the analytical, social, graphical, speed and agility that is unheard of

in the existing banking system. Sharing and collaborative capabilities are key in all financial relationships (in

B2B, B2C or C2C environments). For example, Snapchats

collaboration with Square to provide Snapcash - money

transfer capability integrated with Chat. This value web

means that banks themselves is very likely not the value

exchange core but a mere participant themselves. We

will explore more of the competitive landscape in Part 3

of this series of discussion.

NEW VALUE STREAM ON THE VALUE MAP

S . T . A . F

Billguard provides recommendation on where to spend for better

savings through coupons and other discount offering off the web.

Billguard also leverages on community edited information to inform customer of fraudulent transaction. This is

sharing and collaboration by a PFM provider.

M O R E

SHARE AND COLLABORATION

ValueExtraction&Value

RepresentationSystem

Assist&Recommend

Action

The power of assistive technology

will enter a new phase with wearable technology becoming mainstream.

ValueExchangeSystem

Collaboration&Sharing

For example, current generation of

ewallet is still limited to imitating

and simplifying payment acquisition - both for the consumer and

for the merchant. No doubt there

will be benefits in customer and

loyalty management when these

transactions become more digital,

however, it falls short of the new

value map functionality - such as

spend benchmarking, social collaboration amongst fellow spenders, crowd-purchasing to lower

cost and maintain credit score exposure, etc.

space. It provides a platform to compare, benchmark, discuss and share information about portfolio investments. However, Openfolio does not

actively prescribe actions or recommend adjustments to investment portfolios.

F O R

targets. Technology is offering new ways that will trigger

and drive actions. This is leading to benefits realization or

pain avoidance beyond the traditional constraint of time

and space. It could also lead to benefits discovery.

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

NEW VALUE STREAM

The alerting prior to transacting is far more useful than

alerting after transaction (i.e. in the case of PFM). Banks

on their part, can definitely take advantage of their regulatory expertise and relationship to play a bigger role

in role in promoting personalized and highly valueadded financial services. For example, banks could use

transaction and customer data it already have to provide recommendation and assistive functions both at

the financial account level as well as at the transaction

level. Banks may be tempted to provide these values

directly on their sites, but they could also think outside

of their boundaries and monitise on other expertise

such as fraud detection and offer it as a service (e.g. via

mobile apps) to assist in any customer transactions or

through partnerships with other providers.

CONCLUSION

Its not enough to merely have a mobile driven product

or organizational vision. The fundamental game changer here is first in acknowledging the growing class of

empowered end-user and customer and secondly, accept that Fintech is a growing opportunity for established financial service companies - not a threat. Some

banks in my region is trying to spur the growth of Fintech by creating investments funds. Others have gone

to acquire Fintechs to complement its offering.

All new and old offering alike, be it through acquisition

or self-development, should consider the targeted offering based on the discussed Value Map (i.e. combined

Banking Product-Channel Value Chain and the Value

Stream) in order to have be more effective.

F O R

M O R E

S . T . A . F

A R T I C L E S :

V I S I T

W W W . A R C H I T E C T U R E - F R A M E W O R K . W E E B L Y. C O M

DRIVERS OF NEW VALUE STREAM

10

Вам также может понравиться

- Business Process Management Plan A Complete Guide - 2020 EditionОт EverandBusiness Process Management Plan A Complete Guide - 2020 EditionОценок пока нет

- Digital WalletДокумент19 страницDigital WalletJoselin ReañoОценок пока нет

- Integrated Business Planning A Complete Guide - 2020 EditionОт EverandIntegrated Business Planning A Complete Guide - 2020 EditionОценок пока нет

- Accenture FinTech Challenges AdoptionДокумент10 страницAccenture FinTech Challenges AdoptionArmahedi MahzarОценок пока нет

- ,,,,sap SBN Hana Reporting CapabilitiesДокумент34 страницы,,,,sap SBN Hana Reporting CapabilitiesSai BodduОценок пока нет

- Mobile Money Payment Toolkit For Utility Service Providers PDFДокумент64 страницыMobile Money Payment Toolkit For Utility Service Providers PDFRediet TsigeberhanОценок пока нет

- Spjimr Fintech BrochureДокумент15 страницSpjimr Fintech BrochureHitesh SharmaОценок пока нет

- The Agile Architecture Revolution: How Cloud Computing, REST-Based SOA, and Mobile Computing Are Changing Enterprise ITОт EverandThe Agile Architecture Revolution: How Cloud Computing, REST-Based SOA, and Mobile Computing Are Changing Enterprise ITОценок пока нет

- ERP in FinanceДокумент4 страницыERP in Financearun139Оценок пока нет

- Crystalbridge - The Data Transformation Platform HarmonizeДокумент5 страницCrystalbridge - The Data Transformation Platform HarmonizeNityaОценок пока нет

- Oracle Fusion Cloud Service Desc 1843611Документ207 страницOracle Fusion Cloud Service Desc 1843611VIkramОценок пока нет

- 2020 08 State of The GRC MarketДокумент88 страниц2020 08 State of The GRC MarketBilel BouraouiОценок пока нет

- Cloud Transformation JourneyДокумент21 страницаCloud Transformation JourneyDao Trung DungОценок пока нет

- Multi TenancyДокумент7 страницMulti TenancyhemaОценок пока нет

- B1H Modelling HANAДокумент25 страницB1H Modelling HANAsurajsharmag100% (1)

- CAA800 ABAB PLatform PresentationДокумент17 страницCAA800 ABAB PLatform PresentationFritz RolleОценок пока нет

- Accounts Receivable and Credit Collection ReportДокумент27 страницAccounts Receivable and Credit Collection Reportbob2nkongОценок пока нет

- 01-Fusion PRC OverviewДокумент9 страниц01-Fusion PRC OverviewSreenivas PОценок пока нет

- Government As A PlatformДокумент41 страницаGovernment As A PlatformDenisse AleОценок пока нет

- Achieving Regulatory Compliance With Automated Data Flow (ADF)Документ3 страницыAchieving Regulatory Compliance With Automated Data Flow (ADF)kumaravelTL0% (1)

- Purpose in This Section Indicated The Purpose of The Accelerator .Документ18 страницPurpose in This Section Indicated The Purpose of The Accelerator .خليل الكرامةОценок пока нет

- Gbe03759 Usen 03 - GBE03759USEN PDFДокумент20 страницGbe03759 Usen 03 - GBE03759USEN PDFAhmed CHATTAOUIОценок пока нет

- Rules Engine Deep DiveДокумент63 страницыRules Engine Deep Divevinoth4iОценок пока нет

- SAP Project Budgeting & Planning For SAP S/4HANA Cloud (2YG) Id: 2ygДокумент13 страницSAP Project Budgeting & Planning For SAP S/4HANA Cloud (2YG) Id: 2ygtataxpОценок пока нет

- KPMG Infrastructure Report For PSRДокумент94 страницыKPMG Infrastructure Report For PSRi06lealeОценок пока нет

- SWG Reusable Client Proposal For ERM (Enterprise Record Management), Financial Services, Banking Industry, July 2011, US EnglishДокумент77 страницSWG Reusable Client Proposal For ERM (Enterprise Record Management), Financial Services, Banking Industry, July 2011, US EnglishSurya Prakash PandeyОценок пока нет

- Solution Architecture Proposal Requirements Package ShuberДокумент35 страницSolution Architecture Proposal Requirements Package Shuberapi-388786616Оценок пока нет

- Module 19 Business ObjectsДокумент15 страницModule 19 Business ObjectsRealVasyaPupkinОценок пока нет

- Best Practices Writing Production-Grade PySpark JobsДокумент11 страницBest Practices Writing Production-Grade PySpark JobsRahul DasОценок пока нет

- Skill Matrix Version 1Документ1 страницаSkill Matrix Version 1lam nguyenОценок пока нет

- Backbase Deployment GuideДокумент16 страницBackbase Deployment GuidedondarwinОценок пока нет

- EY Blockchain How This Technology Could Impact The CfoДокумент12 страницEY Blockchain How This Technology Could Impact The CfoAndreea GeorgianaОценок пока нет

- 8 Magic Quadrant For Business Analytics Services, WorldwideДокумент12 страниц8 Magic Quadrant For Business Analytics Services, WorldwideKatie PriceОценок пока нет

- Introduction To Apis: William El Kaim Oct. 2016 - V 2.2Документ85 страницIntroduction To Apis: William El Kaim Oct. 2016 - V 2.2Mike DurhamОценок пока нет

- How To Work With Semantic Layers in HanaДокумент162 страницыHow To Work With Semantic Layers in HanaIcs MonoОценок пока нет

- Top 10 BPO Companies in IndiaДокумент4 страницыTop 10 BPO Companies in IndiaUdaya ChandranОценок пока нет

- Fusion Receivables Versus EBSДокумент32 страницыFusion Receivables Versus EBSAvaneeshОценок пока нет

- Cargill WorkshopДокумент6 страницCargill WorkshopUyen VuОценок пока нет

- Oracle Fusion - Revenue GenerationДокумент6 страницOracle Fusion - Revenue GenerationabhijitОценок пока нет

- Bluemix MicroService ApproachДокумент16 страницBluemix MicroService ApproachAditya BhuyanОценок пока нет

- Market Strategy FrameworksДокумент8 страницMarket Strategy FrameworksAnkith naiduОценок пока нет

- Robotic Process Automation RPA in Insurance UiPathДокумент9 страницRobotic Process Automation RPA in Insurance UiPathsridhar_eeОценок пока нет

- Whos Who in Payments 2020 Complete Overview of Key Payment Providers 2Документ129 страницWhos Who in Payments 2020 Complete Overview of Key Payment Providers 2Khinci Keyen100% (1)

- Hybris Performance Tuning Gorilla Group 1Документ12 страницHybris Performance Tuning Gorilla Group 1nabilovic01Оценок пока нет

- This Appendix Covers The Following Topics:: Profile OptionsДокумент25 страницThis Appendix Covers The Following Topics:: Profile Optionssurinder_singh_69Оценок пока нет

- KPMG UK - Fintech Focus Report - 2020Документ40 страницKPMG UK - Fintech Focus Report - 2020Varun R100% (1)

- 2241 Extending The Reach of LSA++ Using The New Artifacts From Release 7.40 of The SAP Business Warehouse Application PDFДокумент33 страницы2241 Extending The Reach of LSA++ Using The New Artifacts From Release 7.40 of The SAP Business Warehouse Application PDFTaeksoo SongОценок пока нет

- Proposal BIДокумент7 страницProposal BINik Syukriah Amin100% (1)

- W Robotic Process Automation: Why RPA Is Needed?Документ4 страницыW Robotic Process Automation: Why RPA Is Needed?Vikram ThoratОценок пока нет

- 1.2TCO and ROIДокумент12 страниц1.2TCO and ROIasepОценок пока нет

- SAP HANA Cloud Option The Value of Customer Choice 1624466985Документ13 страницSAP HANA Cloud Option The Value of Customer Choice 1624466985Kangeyan DhanapalanОценок пока нет

- Reading Sample Sappress 978 SAP CATS PDFДокумент44 страницыReading Sample Sappress 978 SAP CATS PDFmayur999Оценок пока нет

- What Is InfoProvider in BWДокумент2 страницыWhat Is InfoProvider in BWQassam_BestОценок пока нет

- 03 PavlovicДокумент40 страниц03 PavlovicgridsimtechОценок пока нет

- Oracle Cloud MarketplaceДокумент10 страницOracle Cloud Marketplacebrunohf1208Оценок пока нет

- BI171 Requirements SAMPLEДокумент69 страницBI171 Requirements SAMPLEMaksym PetrenkoОценок пока нет

- SAP Certification ExamsДокумент4 страницыSAP Certification ExamsVishal Ashok Chand0% (1)

- LIM Gr7 Q4W3Документ9 страницLIM Gr7 Q4W3Eto YoshimuraОценок пока нет

- Project Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantДокумент40 страницProject Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantTefera AsefaОценок пока нет

- Philippine Housing Industry: Regulatory ReviewДокумент42 страницыPhilippine Housing Industry: Regulatory ReviewAl MarzolОценок пока нет

- Feuerhahn Funeral Bullet 17 March 2015Документ12 страницFeuerhahn Funeral Bullet 17 March 2015brandy99Оценок пока нет

- Weill Cornell Medicine International Tax QuestionaireДокумент2 страницыWeill Cornell Medicine International Tax QuestionaireboxeritoОценок пока нет

- W 26728Документ42 страницыW 26728Sebastián MoraОценок пока нет

- Hydraulics Experiment No 1 Specific Gravity of LiquidsДокумент3 страницыHydraulics Experiment No 1 Specific Gravity of LiquidsIpan DibaynОценок пока нет

- BirdLife South Africa Checklist of Birds 2023 ExcelДокумент96 страницBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajОценок пока нет

- MCS 033 NotesДокумент7 страницMCS 033 NotesAshikОценок пока нет

- Test 1Документ9 страницTest 1thu trầnОценок пока нет

- IndianJPsychiatry632179-396519 110051Документ5 страницIndianJPsychiatry632179-396519 110051gion.nandОценок пока нет

- Science Project FOLIO About Density KSSM Form 1Документ22 страницыScience Project FOLIO About Density KSSM Form 1SarveesshОценок пока нет

- Skype OptionsДокумент2 страницыSkype OptionsacidwillОценок пока нет

- Bootstrap DatepickerДокумент31 страницаBootstrap DatepickerdandczdczОценок пока нет

- Psychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFДокумент56 страницPsychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFdiemdac39kgkw100% (9)

- Ignorance Is The Curse of God. Knowledge Is The Wing Wherewith We Fly To Heaven."Документ3 страницыIgnorance Is The Curse of God. Knowledge Is The Wing Wherewith We Fly To Heaven."Flori025Оценок пока нет

- Logo DesignДокумент4 страницыLogo Designdarshan kabraОценок пока нет

- Assessment NCM 101Документ1 страницаAssessment NCM 101Lorainne Angel U. MolinaОценок пока нет

- Maule M7 ChecklistДокумент2 страницыMaule M7 ChecklistRameez33Оценок пока нет

- Engineeringinterviewquestions Com Virtual Reality Interview Questions Answers PDFДокумент5 страницEngineeringinterviewquestions Com Virtual Reality Interview Questions Answers PDFKalyani KalyaniОценок пока нет

- All Zone Road ListДокумент46 страницAll Zone Road ListMegha ZalaОценок пока нет

- Harbin Institute of TechnologyДокумент7 страницHarbin Institute of TechnologyWei LeeОценок пока нет

- TN Vision 2023 PDFДокумент68 страницTN Vision 2023 PDFRajanbabu100% (1)

- Wwe SVR 2006 07 08 09 10 11 IdsДокумент10 страницWwe SVR 2006 07 08 09 10 11 IdsAXELL ENRIQUE CLAUDIO MENDIETAОценок пока нет

- Special Warfare Ma AP 2009Документ28 страницSpecial Warfare Ma AP 2009paulmazziottaОценок пока нет

- Echeverria Motion For Proof of AuthorityДокумент13 страницEcheverria Motion For Proof of AuthorityIsabel SantamariaОценок пока нет

- Hypnosis ScriptДокумент3 страницыHypnosis ScriptLuca BaroniОценок пока нет

- Pediatric ECG Survival Guide - 2nd - May 2019Документ27 страницPediatric ECG Survival Guide - 2nd - May 2019Marcos Chusin MontesdeocaОценок пока нет

- Gamboa Vs Chan 2012 Case DigestДокумент2 страницыGamboa Vs Chan 2012 Case DigestKrissa Jennesca Tullo100% (2)

- La Fonction Compositionnelle Des Modulateurs en Anneau Dans: MantraДокумент6 страницLa Fonction Compositionnelle Des Modulateurs en Anneau Dans: MantracmescogenОценок пока нет