Академический Документы

Профессиональный Документы

Культура Документы

Ratios of CUMI LTD

Загружено:

BalujagadishОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ratios of CUMI LTD

Загружено:

BalujagadishАвторское право:

Доступные форматы

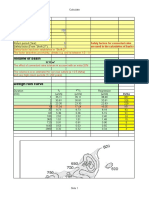

CALCULATION OF CURRENT RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Current Asset

Current Liabilities

Current Ratio

2009-10

3282.58

1246.51

2.63

2010-11

3907.31

1442.76

2.7

2011-12

4374.04

2618.92

1.6

2012-13

4467.35

2840.60

1.57

2013-14

4706.96

2114.17

2.23

Average

2.15

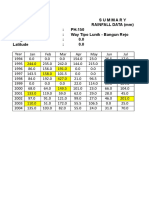

CALCULATION OF QUICK RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Quick Asset

Current Liabilities

Quick Ratio

2009-10

2091.04

1246.51

1.67

2010-11

2359.27

1442.76

1.63

2011-12

2497.21

2618.92

0.95

2012-13

2667.78

2840.60

0.93

2013-14

2845.61

2114.17

1.35

Average

1.31

CALCULATION OF ABSOLUTE LIQUIDITY RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Absolute Liquidity

Asset

Current Liabilities

Absolute

Liquidity Ratio

2009-10

61.32

1246.51

0.049

2010-11

78.16

1442.76

0.054

2011-12

104.23

2618.92

0.039

2012-13

88.72

2840.60

0.031

2013-14

116.28

2114.17

0.055

Average

0.046

CALCULATION OF INVENTORY TURNOVER RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Sales

Inventory

Inventory

Turnover Ratio

2009-10

7310.00

1191.54

6.13

2010-11

9125.66

1548.04

5.89

2011-12

11253.73

1876.88

5.99

2012-13

11008.92

1799.57

6.11

2013-14

11485.98

1861.35

6.17

Average

6.05

CALCULATION OF DEBTORS TURNOVER RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Sales

Debtors

Debtors

Turnover

Ratio

Debt

Collection

Period

2009-10

7310.00

1600.22

4.57

80

2010-11

9125.66

1772.18

5.14

71

2011-12

11253.73

1847.16

6.09

60

2012-13

11008.92

2023.65

5.44

67

11485.98

2266.20

5.07

72

5.26

70

2013-14

Average

CALCULATION OF CREDITORS TURNOVER RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Purchase

Creditors

Creditors

Turnover Ratio

2009-10

3141.37

690.20

4.55

2010-11

3999.05

917.39

4.35

2011-12

4283.01

791.30

5.41

2012-13

4171.12

913.89

4.56

2013-14

4590.85

845.92

5.43

Average

4.86

CALCULATION OF WORKING CAPITAL TURNOVER RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Sales

Net Working Capital

Working Capital

Turnover Ratio

2009-10

7310.00

2036

3.59

2010-11

9125.66

1165

7.83

2011-12

11253.73

1755

6.41

2012-13

11008.92

1662

6.62

2013-14

11485.98

2593

4.43

Average

5.77

CALCULATION OF TOTAL ASSET TURNOVER RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Sales

Total Asset

Total Asset

Turnover Ratio

2009-10

7310.00

7542.29

0.97

2010-11

9125.66

7990.47

1.14

2011-12

11253.73

9968.64

1.13

2012-13

11008.92

10188.15

1.08

2013-14

11485.98

10471.03

1.10

Average

1.08

CALCULATION OF FIXED ASSET TURNOVER RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Sales

Fixed Asset

Fixed Asset

Turnover Ratio

2009-10

7310.00

3457.22

2.11

2010-11

9125.66

3732.12

2.44

2011-12

11253.73

3853.29

2.92

2012-13

11008.92

4141.33

2.66

2013-14

11485.98

4146.54

2.77

Average

2.58

CALCULATION OF PROPRIETARY RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Shareholders

fund

Total Asset

Proprietary

Ratio

2009-10

4288.64

7542.29

0.57

2010-11

5282.24

7990.47

0.66

2011-12

6365.94

9968.64

0.64

2012-13

6845.41

10188.15

0.67

2013-14

7335.70

10471.03

0.70

Average

0.65

CALCULATION OF GROSS PROFIT RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Gross Profit

Net Sales

Gross Profit

Ratio

2009-10

4168.63

7310.00

51%

2010-11

5479.85

9125.66

60%

2011-12

6970.72

11253.73

62%

2012-13

6837.8

11008.92

62%

2013-14

6895.13

11485.98

60%

Average

59%

CALCULATION OF NET PROFIT RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Profit Before

Tax

Net Sales

Net Profit Ratio

2009-10

841.70

7310.00

11%

2010-11

1643.36

9125.66

18%

2011-12

1893.93

11253.73

17%

2012-13

1080.35

11008.92

10%

2013-14

1024.14

11485.98

9%

Average

13%

CALCULATION OF OPERATING RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Total Operating

Expenses

Net Sales

Operating Ratio

2009-10

6780.70

7310.00

92%

2010-11

7440.79

9125.66

81%

2011-12

9054.83

11253.73

80%

2012-13

9480.56

11008.92

86%

2013-14

10035.57

11485.98

87%

Average

85%

CALCULATION OF RETURN ON EQUITY

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Profit

Tax

After

Equity Capital

Return on

Equity

2009-10

580

4288.64

13.52%

2010-11

1243

5282.24

23.53%

2011-12

1467

6365.94

23.04%

2012-13

745

6845.41

10.88%

2013-14

728

7335.70

9.92%

Average

14.29%

CALCULATION OF RETURN ON CAPITAL EMPLOYED

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Profit

Tax

After

Capital Employed

Return on CE

2009-10

580

7126.99

7.69%

2010-11

1243

7569.89

16.42%

2011-12

1467

7349.72

19.96%

2012-13

745

7382.63

10.88%

2013-14

728

8356.86

9.92%

Average

14.29%

CALCULATION OF RETURN ON ASSET

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Profit

Tax

After

Total Asset

Return on Asset

2009-10

580

7542.29

7.69%

2010-11

1243

7990.47

15.56%

2011-12

1467

9968.64

14.72%

2012-13

745

10188.15

7.31%

2013-14

728

10471.03

6.95%

Average

10.45%

CALCULATION OF EARNINGS PER SHARE (EPS)

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Profit

Tax

After

No. of Shares

EPS

2009-10

580

93.36

6.21

2010-11

1243

93.47

13.30

2011-12

1467

187.39

7.83

2012-13

745

187.47

3.97

2013-14

728

187.76

3.88

Average

7.04

CALCULATION OF DEBT EQUITY RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Total Debt

Net Worth

Debt Equity

Ratio

2009-10

4500.16

6470.85

0.69

2010-11

4150.98

8165.11

0.51

2011-12

3637.62

7832.65

0.46

2012-13

3342.74

7590.74

0.44

2013-14

3135.33

8063.54

0.39

Average

0.41

CALCULATION OF PROPRIETORY RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Proprietors Fund

Total Asset

Proprietory

Ratio

2009-10

4288.64

7542.29

0.57

2010-11

5282.24

7990.47

0.66

2011-12

6365.94

9968.64

0.64

2012-13

6845.41

10188.15

0.67

2013-14

7335.70

10471.03

0.70

Average

0.65

CALCULATION OF TOTAL ASSET TO DEBT RATIO

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Total Asset

Long Term Debt

Total Asset to

Debt Ratio

2009-10

7542.29

2824.41

2.67

2010-11

7990.47

1584.36

5.04

2011-12

9968.64

983.78

10.13

2012-13

10188.15

537.22

18.96

2013-14

10471.03

1021.16.

10.25

Average

9.41

CALCULATION OF RETURN ON INVESTMENT

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Net Profit Before

Interest,Tax,Dividend

Capital Employed

Return on

Investment

2009-10

841.70

7126.99

11.66%

2010-11

1812.09

7569.89

23.94%

2011-12

2198.90

7349.72

29.92%

2012-13

1528.36

7382.63

20.70%

2013-14

1450.41

8356.86

17.35%

Average

20.71%

CALCULATION OF DIVIDEND PER SHARE (DPS)

(2009-10 to 2013-14)

TABLE 3.2.1

Year

Dividend Paid

No. of Shares

DPS

2009-10

212.74

93.36

2.28

2010-11

365.45

93.47

3.90

2011-12

310.11

187.39

1.65

2012-13

286.94

187.47

1.53

2013-14

279.96

187.76

1.49

Average

2.17

Вам также может понравиться

- Table of Datfva AnalysisДокумент12 страницTable of Datfva AnalysisManoj PrabaОценок пока нет

- 4.1 Data Analysis and Interpretation: 4.1current RatioДокумент22 страницы4.1 Data Analysis and Interpretation: 4.1current RationawazОценок пока нет

- Tax GDP Ratios, India: Venkatesh AthreyaДокумент4 страницыTax GDP Ratios, India: Venkatesh AthreyaVigneshVardharajanОценок пока нет

- Correlation AnalysisДокумент8 страницCorrelation AnalysisHema MaliniОценок пока нет

- Pertemuan 4 - Contoh Perhitungan Tanpa NgelinkДокумент13 страницPertemuan 4 - Contoh Perhitungan Tanpa NgelinkNabila HusniatiОценок пока нет

- Date Sbi Magnum Income Fund (Nav) Return (%) Deviation (D) 2 Nifty Return (%)Документ15 страницDate Sbi Magnum Income Fund (Nav) Return (%) Deviation (D) 2 Nifty Return (%)Dhananjay GuptaОценок пока нет

- Pulau PinangДокумент14 страницPulau PinangNoelle LeeОценок пока нет

- Run 2Документ1 страницаRun 2a.azeemОценок пока нет

- STK Aer ReportДокумент50 страницSTK Aer Reportapi-272976211Оценок пока нет

- State Finances44Документ12 страницState Finances44M CharlesОценок пока нет

- Nested Anova RevisedДокумент6 страницNested Anova RevisedRanjeet Dongre100% (1)

- Data On Fiscal Situation of KeralaДокумент23 страницыData On Fiscal Situation of KeralaM CharlesОценок пока нет

- Bab 1 Pendahuluan: Perencanaan Desain Pengolahan Air Minum Di Sungai Cilaki A, Kabupaten GarutДокумент9 страницBab 1 Pendahuluan: Perencanaan Desain Pengolahan Air Minum Di Sungai Cilaki A, Kabupaten Garutdeandra auliana izmahОценок пока нет

- Financial Management Assignment: MarchДокумент8 страницFinancial Management Assignment: MarchSurya KiranОценок пока нет

- Chi-Square Test & ANOVAДокумент7 страницChi-Square Test & ANOVA21ACO56 RAM PRANAV T PОценок пока нет

- Tugas 3 J. Erwin R. TambunanДокумент2 страницыTugas 3 J. Erwin R. TambunanJAGAR ERWIN RIZNANDO TAMBUNANОценок пока нет

- Ratios Ispat Industries Limited JSW Steel Limited SharestatisticsДокумент7 страницRatios Ispat Industries Limited JSW Steel Limited SharestatisticsAbhishek DhanukaОценок пока нет

- Chapter 10Документ7 страницChapter 10karthu48Оценок пока нет

- Course: Soil Mechanics II Code: CVNG 2009 Lab: Consolidation Name: Adrian Rampersad I.D:809001425Документ16 страницCourse: Soil Mechanics II Code: CVNG 2009 Lab: Consolidation Name: Adrian Rampersad I.D:809001425Adrian Mufc RampersadОценок пока нет

- IRSA2022 - 18-19july, 2022 - Destarita - 1047 - 00015 - 170522Документ84 страницыIRSA2022 - 18-19july, 2022 - Destarita - 1047 - 00015 - 170522Denra StaritaОценок пока нет

- Sip Projects (Mutual Funds) SampleДокумент5 страницSip Projects (Mutual Funds) SamplegirishОценок пока нет

- Inventory Turnover Ratio: Times Years 12.49 2012 9.8 2013 11.46 2014Документ12 страницInventory Turnover Ratio: Times Years 12.49 2012 9.8 2013 11.46 2014Pavitra RajasegaranОценок пока нет

- Selected Indicators: Governor Secretariat: 09 July 2014 Bangladesh BankДокумент1 страницаSelected Indicators: Governor Secretariat: 09 July 2014 Bangladesh Bankleo_monty007Оценок пока нет

- Rain Water Basin DesignДокумент11 страницRain Water Basin DesignSturza AnastasiaОценок пока нет

- SR DM 05Документ42 страницыSR DM 05Sumit SumanОценок пока нет

- Table Hydrometer TestДокумент3 страницыTable Hydrometer TestSue JinsueОценок пока нет

- Week9 Time Series AnalysisДокумент8 страницWeek9 Time Series AnalysisPrasiddha PradhanОценок пока нет

- SPSS - BW AsigesДокумент6 страницSPSS - BW AsigesBAGAS PUTRA PRATAMAОценок пока нет

- Bucharest (Dragged) 3Документ1 страницаBucharest (Dragged) 3Maxwell_RhodeszОценок пока нет

- Valve TablesДокумент10 страницValve TablesnotperfectisgoodОценок пока нет

- Table PvifДокумент10 страницTable PviftinaОценок пока нет

- Valvetables PDFДокумент10 страницValvetables PDFrraditaОценок пока нет

- Tabel PV PDFДокумент10 страницTabel PV PDFnova anita sekarwatiОценок пока нет

- 1 4 2 Methodology 5 3 Data Collection 6 4 Regression Analysis 7 5 Findings and Interpretation 6 Conclusion 7 Annexures 8 ReferencesДокумент7 страниц1 4 2 Methodology 5 3 Data Collection 6 4 Regression Analysis 7 5 Findings and Interpretation 6 Conclusion 7 Annexures 8 ReferencesSonal GuptaОценок пока нет

- Node X Y Z Node X Y Z: Out in 2 3Документ2 страницыNode X Y Z Node X Y Z: Out in 2 3ARUN K RAJОценок пока нет

- Budget at A Glance 2022 23Документ7 страницBudget at A Glance 2022 23Longjam RubychandОценок пока нет

- Cash & Bank BalanceДокумент12 страницCash & Bank BalanceTanu TanejaОценок пока нет

- Monthly Total Rain BannuДокумент1 страницаMonthly Total Rain BannuFawad AhmadОценок пока нет

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutДокумент2 страницыKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasОценок пока нет

- Presentation 1Документ18 страницPresentation 1Sushil MeenaОценок пока нет

- Capital and Liabilities:: Comparative Balance Sheet of HDFC Bank From 2015-2016 To 2017-2018Документ1 страницаCapital and Liabilities:: Comparative Balance Sheet of HDFC Bank From 2015-2016 To 2017-2018ij EducationОценок пока нет

- Well No Depth (FT) Temperature at Depth (°F) Well #1 9100 225 Well #2 8100 209.6 Well #3 9500 232Документ31 страницаWell No Depth (FT) Temperature at Depth (°F) Well #1 9100 225 Well #2 8100 209.6 Well #3 9500 232Deny Fatryanto EkoОценок пока нет

- OCTOBER 2011 Local Climatological Data: NOAA, National Climatic Data CenterДокумент8 страницOCTOBER 2011 Local Climatological Data: NOAA, National Climatic Data CenterTom JonesОценок пока нет

- Transport Research Board: Based On Highway Capacity Manual 2000Документ69 страницTransport Research Board: Based On Highway Capacity Manual 2000Waruna JayasooriyaОценок пока нет

- 562 Ijar-16777Документ5 страниц562 Ijar-16777Utkarsh BajpaiОценок пока нет

- 13 FC Go (BTR 1,2,23,24) PDFДокумент26 страниц13 FC Go (BTR 1,2,23,24) PDFAE PR KarimnagarОценок пока нет

- Manufacturing ExpenditureДокумент8 страницManufacturing ExpenditureKranti SagarОценок пока нет

- Result-Summery PDFДокумент1 страницаResult-Summery PDFIrshad ShaikhОценок пока нет

- In Line Mol Mixer For Shock Liming at Juice SulphitorДокумент8 страницIn Line Mol Mixer For Shock Liming at Juice SulphitorisepcontrolОценок пока нет

- Balance Sheet 2009-10Документ1 страницаBalance Sheet 2009-10Jyothi Kruthi PanduriОценок пока нет

- Aftab Auto: Year 2012 2013 2014 2015 2016Документ11 страницAftab Auto: Year 2012 2013 2014 2015 2016Yazdan Ibon KamalОценок пока нет

- Ejercicio Van - TirДокумент8 страницEjercicio Van - Tirluis alberto quispe vasquezОценок пока нет

- Power Generation ForecastingДокумент19 страницPower Generation ForecastingTram NguyenОценок пока нет

- (Rajeev Sachan) Executive EngineerДокумент14 страниц(Rajeev Sachan) Executive EngineerReshmaandsazidОценок пока нет

- Hidro Hilman 2 Lagi11Документ50 страницHidro Hilman 2 Lagi11Siti MulyantikaОценок пока нет

- LuckДокумент1 страницаLuckzubairkhan08Оценок пока нет

- Item No. Description Quantity UnitДокумент6 страницItem No. Description Quantity UnitJasper SorianoОценок пока нет

- Selected Economic IndicatorsДокумент1 страницаSelected Economic IndicatorsAyaz MahmudОценок пока нет

- List of Reinforcement For Slab On PileДокумент2 страницыList of Reinforcement For Slab On PilepanduОценок пока нет

- Operations Management 2Документ39 страницOperations Management 2BalujagadishОценок пока нет

- Module V - Operations Management: Dr.A.Abirami / OmДокумент10 страницModule V - Operations Management: Dr.A.Abirami / OmBalujagadishОценок пока нет

- Bus 2C 12 Operations Management: Dr.A.Abirami / OmДокумент17 страницBus 2C 12 Operations Management: Dr.A.Abirami / OmBalujagadishОценок пока нет

- Operations Management 1Документ30 страницOperations Management 1BalujagadishОценок пока нет

- Module Iv - Operations Management: Dr.A.Abirami / OmДокумент20 страницModule Iv - Operations Management: Dr.A.Abirami / OmBalujagadishОценок пока нет

- Case Study F BatchДокумент2 страницыCase Study F BatchBalujagadishОценок пока нет

- Case Study D BatchДокумент2 страницыCase Study D BatchBalujagadishОценок пока нет

- Responsibility CentersДокумент12 страницResponsibility CentersBalujagadishОценок пока нет

- TQM Case StudyДокумент31 страницаTQM Case StudyBalujagadishОценок пока нет

- Case Study E BatchДокумент2 страницыCase Study E BatchBalujagadishОценок пока нет

- Final Project (Midhun)Документ91 страницаFinal Project (Midhun)BalujagadishОценок пока нет

- Resume Anju PDFДокумент3 страницыResume Anju PDFBalujagadishОценок пока нет

- Mtbe Module 5 QPДокумент1 страницаMtbe Module 5 QPBalujagadishОценок пока нет

- POM - AnswersДокумент3 страницыPOM - AnswersBalujagadishОценок пока нет

- Training EvaluationДокумент23 страницыTraining EvaluationBalujagadishОценок пока нет

- Rupesh - KS: P.O, Cherthala, Alappuzha Rupeshkaimal @Документ3 страницыRupesh - KS: P.O, Cherthala, Alappuzha Rupeshkaimal @BalujagadishОценок пока нет

- Questions and Answers RatiosДокумент14 страницQuestions and Answers RatiosBalujagadishОценок пока нет

- Dissertation Details, Dissertation DetailsДокумент18 страницDissertation Details, Dissertation DetailsBalujagadishОценок пока нет

- Indira GandhiДокумент72 страницыIndira GandhiBalujagadishОценок пока нет

- Business Ethics Previous 4 Years QPДокумент3 страницыBusiness Ethics Previous 4 Years QPBalujagadishОценок пока нет

- Cover Letter UnniCover - LetterДокумент1 страницаCover Letter UnniCover - LetterBalujagadishОценок пока нет

- Theories of Business EthicsДокумент13 страницTheories of Business EthicsBalujagadish100% (1)

- Mahatma GandhiДокумент27 страницMahatma GandhiPrasanna KumarОценок пока нет