Академический Документы

Профессиональный Документы

Культура Документы

IAS 16 Notes

Загружено:

shoaib jamshedИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IAS 16 Notes

Загружено:

shoaib jamshedАвторское право:

Доступные форматы

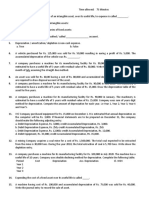

IAS 16 PROPERTY PLANT AND EQUIPMENT EXTRACTS

IAS 16

Initial Recognition

1. Initial recognition at cost (15)

a. Cost(Def) Cash/fair value of the consideration given

b. Elements of cost (16 20)

i. Purchase price

1. Import duties

2. Non-refundable directly attributable taxes

ii. All cost to bring the asset into usable conditions as intended by

management

1. Employee costs

2. Delivery costs

3. Installation and assembly costs

4. Testing costs

5. Legal/Professional costs

iii. Committed Dismantling costs (IAS 37 Ref)

c. Cost Measurement

i. Payment is deferred beyond normal credit terms discounted

price (23)

ii. Exchange (24)

1. Exchange has commercial substance

a. FV of the asset given up can be measured Record

at FV of asset given up

b. FV of asset given up cannot be measured Record

at FV of asset obtained

c. FV of both assets are not available Record at CV

of asset given up

2. Exchange does not have commercial substance Record

at CV of asset given up

Subsequent Recognition

1. Cost Model (29 30) Cost less accumulated depreciation

2. Revaluation Model (31) FV at revaluation date less subsequent accumulated

depreciation

a. Revaluation Increase (39)

Dr

Asset

XX

Cr

OCI

XX

Dr

OCI

XX

Cr

Revaluation Surplus

XX

b. Revaluation Decrease (40)

IAS 16

BILAL ZIA

IAS 16 PROPERTY PLANT AND EQUIPMENT EXTRACTS

Dr

Income Statement

XX

Cr

Asset (NBV)

XX

3. Depreciation (43 54, 59 62) all variable checked annually

a. Depreciable amount

i. Residual value (51) (Def)

b. Depreciation Period

i. Useful life vs Economic life (57) (Def)

c. Depreciation Method Reflect the pattern of consumption

i. Straight line method

ii. Reducing balance method

iii. Number of production units

4. Impairment (63 65) (Def) Recoverable amount (RA) < Carrying value

a. RA = higher (FVLCTS vs VIU) (IAS 36)

De-recognition (67 72)

5. Gain/loss (Net sale proceeds CV) recognized in Income statement

6. Transfer Revaluation surplus to Retained Earnings

IAS 16

BILAL ZIA

Вам также может понравиться

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideОт EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideОценок пока нет

- ACCOUNTANCY - (055) Periodic Test-1 Class - Xi Marks: 40M Time: 90 MinДокумент5 страницACCOUNTANCY - (055) Periodic Test-1 Class - Xi Marks: 40M Time: 90 MinvyshnaviОценок пока нет

- Ias 16Документ44 страницыIas 16Faraz Ahmed QuddusiОценок пока нет

- Day1 IAS-16Документ44 страницыDay1 IAS-16tariq hassaОценок пока нет

- b2-c1 Grande Finale Solving 2023 May (Set 2)Документ17 страницb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82Оценок пока нет

- Declaration - DIR 4Документ17 страницDeclaration - DIR 4Ram IyerОценок пока нет

- 1stF 2nd Yr Intermediate Accounting 1 VerifiedДокумент33 страницы1stF 2nd Yr Intermediate Accounting 1 VerifiedMika MolinaОценок пока нет

- Ma 2 CT 1Документ5 страницMa 2 CT 1emon_paul_009Оценок пока нет

- Acc 101Документ24 страницыAcc 101Shyam RathiОценок пока нет

- Acm 1Документ2 страницыAcm 1Ꮢ.Gᴀɴᴇsн ٭ʏт᭄Оценок пока нет

- Pas 2 Inventories Accounting Standard That Is Useful in Understanding Financial Accounting ReportingДокумент9 страницPas 2 Inventories Accounting Standard That Is Useful in Understanding Financial Accounting ReportingJANISCHAJEAN RECTOОценок пока нет

- Bs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)Документ9 страницBs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)JANISCHAJEAN RECTOОценок пока нет

- 005 - Chapter 03 - IAS 02 InventoriesДокумент3 страницы005 - Chapter 03 - IAS 02 InventoriesHaris ButtОценок пока нет

- E-Book CW (Sup... Store Keeper)Документ59 страницE-Book CW (Sup... Store Keeper)pravin gaidhaneОценок пока нет

- Accounting Sample Questions and AnswersДокумент9 страницAccounting Sample Questions and Answerssanjeev845Оценок пока нет

- Papers of Cost AccountingДокумент8 страницPapers of Cost AccountingTalha BukhariОценок пока нет

- Pas 2 Inventory Practice Exercise For Pas 2 InventoriesДокумент8 страницPas 2 Inventory Practice Exercise For Pas 2 InventoriesSalimОценок пока нет

- Ias 16 PpeДокумент168 страницIas 16 PpeValeria PetrovОценок пока нет

- Test Accounting Kiến thức Những chủ điểm quan trọng trong phần AccountingДокумент20 страницTest Accounting Kiến thức Những chủ điểm quan trọng trong phần AccountingTrần MaiОценок пока нет

- Cost Accounting Objective (MCQ)Документ243 страницыCost Accounting Objective (MCQ)mirjapur0% (1)

- Lecture Notes Chapter 10 (2022) - Student VerДокумент50 страницLecture Notes Chapter 10 (2022) - Student VerThương Đỗ100% (1)

- (IE) Chapter 3 - Project Building and Management 2021Документ53 страницы(IE) Chapter 3 - Project Building and Management 2021Jane VickyОценок пока нет

- Solution DEc-19 CMAДокумент20 страницSolution DEc-19 CMAvertikaОценок пока нет

- Question Paper-S4 - Set 4Документ2 страницыQuestion Paper-S4 - Set 4Titus ClementОценок пока нет

- NCA SummaryДокумент5 страницNCA Summary465jgbgcvfОценок пока нет

- Final Examination Semester I Session 2012/2013Документ10 страницFinal Examination Semester I Session 2012/2013Wan AzamОценок пока нет

- IE Chapter 3 - ProjectДокумент56 страницIE Chapter 3 - Project10-12A1- Nguyễn Chí HiếuОценок пока нет

- Chapter 7Документ15 страницChapter 7YnaОценок пока нет

- ACC212 Final Exam ReviewДокумент5 страницACC212 Final Exam ReviewVictoria PecicОценок пока нет

- IAS2Документ35 страницIAS2Khalid AzizОценок пока нет

- Board of SurveyДокумент30 страницBoard of SurveyIsmael GoolfeeОценок пока нет

- Ipsas 17 Ppe1Документ25 страницIpsas 17 Ppe1Russel SarachoОценок пока нет

- Cafm Paper 10 MCQДокумент50 страницCafm Paper 10 MCQDeep PatelОценок пока нет

- Chemical Process Design - Economic EvaluationДокумент18 страницChemical Process Design - Economic EvaluationMartín Diego MastandreaОценок пока нет

- Cs Cost MCQ Part 11Документ48 страницCs Cost MCQ Part 11dmaxprasangaОценок пока нет

- Assignment 2 (DF160003)Документ10 страницAssignment 2 (DF160003)Wan AzamОценок пока нет

- Guide To Scoring Well On SAT AccountingДокумент4 страницыGuide To Scoring Well On SAT AccountingJames123Оценок пока нет

- BA 2 Short NotesДокумент20 страницBA 2 Short NotesNivneth PeirisОценок пока нет

- IAS16 Amendments-May 2020Документ5 страницIAS16 Amendments-May 2020Kiana FernandezОценок пока нет

- Ind As 16Документ27 страницInd As 16Dinesh TokasОценок пока нет

- Comp ExamsДокумент28 страницComp ExamsTomoko KatoОценок пока нет

- CompexamsДокумент28 страницCompexamsJoshua GibsonОценок пока нет

- Pas 2 InventoryДокумент8 страницPas 2 InventoryMark Lord Morales BumagatОценок пока нет

- p2 - Guerrero Ch17Документ19 страницp2 - Guerrero Ch17JerichoPedragosa100% (2)

- DepreciationДокумент3 страницыDepreciationAdnan ShabeerОценок пока нет

- Inventory Valuation Semester 1Документ36 страницInventory Valuation Semester 1Ankita SinghОценок пока нет

- Department of Mechanical Engineering - Question Bank: MG 2451 Engineering Economics and Cost AnalysisДокумент5 страницDepartment of Mechanical Engineering - Question Bank: MG 2451 Engineering Economics and Cost Analysiskarthiksubramanian94Оценок пока нет

- CA Final Multiple Choice Questions Business & ProfessionДокумент14 страницCA Final Multiple Choice Questions Business & ProfessionRahul SahОценок пока нет

- MSQ Eng DepДокумент8 страницMSQ Eng DepAhsan MunirОценок пока нет

- MCQ - BBA III Semester - BBA3B04 - Corporate Accounting - 0Документ12 страницMCQ - BBA III Semester - BBA3B04 - Corporate Accounting - 0sanz81909Оценок пока нет

- Acca106 Midterm Exam 1st20212022 KeyДокумент28 страницAcca106 Midterm Exam 1st20212022 KeyNicole Anne Santiago SibuloОценок пока нет

- certIFRS Unit 4Документ49 страницcertIFRS Unit 4Abdulaziz FaisalОценок пока нет

- Test Series: October, 2019 Foundation Course Mock Test Paper 1 Paper - 4: Part I: Business Economics Max. Marks: 60Документ16 страницTest Series: October, 2019 Foundation Course Mock Test Paper 1 Paper - 4: Part I: Business Economics Max. Marks: 60Likitha NОценок пока нет

- Problem and Discussion ProblemJIT and BackflushingДокумент18 страницProblem and Discussion ProblemJIT and BackflushingRona Ella BatlaganОценок пока нет

- Handbook - IFRS Financial Accounting 2021 - II OnlineДокумент47 страницHandbook - IFRS Financial Accounting 2021 - II OnlineDany DanielОценок пока нет

- Government Arts and Science College, Idappadi: Parta - (15 X 1 15 Marks) Answer All QuestionsДокумент3 страницыGovernment Arts and Science College, Idappadi: Parta - (15 X 1 15 Marks) Answer All QuestionsMukesh kannan MahiОценок пока нет

- Cost Accounting CompДокумент15 страницCost Accounting CompskirubaarunОценок пока нет

- Personal Statement - JayabayaДокумент1 страницаPersonal Statement - JayabayaAnang KurniawanОценок пока нет

- BMN 506 - Week 2Документ87 страницBMN 506 - Week 2Shubham SrivastavaОценок пока нет

- Thames and Hudson. - Olins, Wally - Brand New - The Shape of Brands To Come-Thames & Hudson (2014) - P15nsk1m01171uj4j1ukk1s6j4Документ164 страницыThames and Hudson. - Olins, Wally - Brand New - The Shape of Brands To Come-Thames & Hudson (2014) - P15nsk1m01171uj4j1ukk1s6j4Raul Diaz MirandaОценок пока нет

- Code For Interview: Amcat Reading Comprehension Previous Papers QuestionsДокумент7 страницCode For Interview: Amcat Reading Comprehension Previous Papers QuestionsPraneetОценок пока нет

- The Innovation of Grocery StoreДокумент5 страницThe Innovation of Grocery StoreNguyễn Hồng VũОценок пока нет

- AllcargotodДокумент12 страницAllcargotodNikhil kumarОценок пока нет

- Deming's Contribution To TQMДокумент7 страницDeming's Contribution To TQMMythily VedhagiriОценок пока нет

- VrioДокумент2 страницыVrioRoxana GabrielaОценок пока нет

- Fixed Asset Guide For Financial ReportingДокумент13 страницFixed Asset Guide For Financial ReportingSyed Nafis JunaedОценок пока нет

- Report On DAReWROДокумент18 страницReport On DAReWROSaeed Agha AhmadzaiОценок пока нет

- Civil Submittals StatusДокумент12 страницCivil Submittals StatusCivil EngineerОценок пока нет

- Accounting and Finance For The International Hospitality Industry PDFДокумент319 страницAccounting and Finance For The International Hospitality Industry PDFGede Panca Ady SapputraОценок пока нет

- No842 Licences For MiningДокумент2 страницыNo842 Licences For MiningimmanuelvinothОценок пока нет

- Yashna Bawa ResumeДокумент1 страницаYashna Bawa ResumeNitinОценок пока нет

- Grills, Railings, Fence: Profile No.: 220 NIC Code:24109Документ10 страницGrills, Railings, Fence: Profile No.: 220 NIC Code:24109Sanyam BugateОценок пока нет

- Internal Assessment HL, Sample D: Business Management Teacher Support MaterialДокумент23 страницыInternal Assessment HL, Sample D: Business Management Teacher Support MaterialZarious RaskminofОценок пока нет

- Sick Leave Form For Rafiullah PDFДокумент1 страницаSick Leave Form For Rafiullah PDFRafiullahОценок пока нет

- CMA - Case Study Blades PTY LTDДокумент6 страницCMA - Case Study Blades PTY LTDRizaNurfadliWirasasmitaОценок пока нет

- Eco QN 6-10Документ28 страницEco QN 6-10Jikan KamuraОценок пока нет

- Rotec: Gas Turbine MaintenanceДокумент10 страницRotec: Gas Turbine MaintenanceThanapaet RittirutОценок пока нет

- 12e.MCQs.C1 For StsДокумент12 страниц12e.MCQs.C1 For StsTrang HoàngОценок пока нет

- M05 Gitman50803X 14 MF C05Документ37 страницM05 Gitman50803X 14 MF C05Levan TsipianiОценок пока нет

- Bear Stearns and The Seeds of Its DemiseДокумент15 страницBear Stearns and The Seeds of Its DemiseJaja JAОценок пока нет

- DownloadДокумент20 страницDownloadGeeta shaghasiОценок пока нет

- 16Документ1 страница16Babu babuОценок пока нет

- 43 - Republic v. PalacioДокумент1 страница43 - Republic v. PalacioJoseph DimalantaОценок пока нет

- E.O Disposal CommitteeДокумент2 страницыE.O Disposal CommitteeJessie MendozaОценок пока нет

- Negligent Misstatement StudentsДокумент17 страницNegligent Misstatement StudentsJasmine NabilaОценок пока нет

- All SD PacДокумент5 страницAll SD PacPat PowersОценок пока нет

- Source Documents & Books of Original Entries (Chapter-3) & Preparing Basic Financial Statements (Chapter-5)Документ11 страницSource Documents & Books of Original Entries (Chapter-3) & Preparing Basic Financial Statements (Chapter-5)Mainul HasanОценок пока нет