Академический Документы

Профессиональный Документы

Культура Документы

Mizuho Corporate Bank

Загружено:

Miir ViirАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mizuho Corporate Bank

Загружено:

Miir ViirАвторское право:

Доступные форматы

Mizuho Corporate Bank

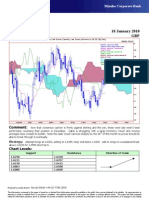

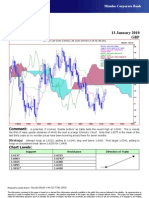

Technical Analysis 25 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

16Sep09 - 02Mar10

Pr

EUR=EBS , Last Quote, Candle

25Jan10 1.4167 1.4173 1.4134 1.4163

1.51

EUR= , Bid, Tenkan Sen 9

25Jan10 1.4304

EUR= , Bid, Kijun Sen 26

25Jan10 1.4304 1.5

EUR= , Bid, Senkou Span(a) 52

01Mar10 1.4304

EUR= , Bid, Senkou Span(b) 52

01Mar10 1.4585 1.49

EUR= , Bid, Chikou Span 26

21Dec09 1.4162

1.48

1.47

1.46

1.45

1.44

1.43

1.42

1.41

1.4

28Sep09 12Oct 26Oct 09Nov 23Nov 07Dec 21Dec 04Jan 18Jan 01Feb 15Feb 01Mar

Comment: Stabilising and a small bounce from the 50% Fibonacci retracement from April 2009’s low (not

October 2008’s low). One-month at-the-money implied volatility appears to have based around 10.00% and should

now squeeze up to 13.50%. Note that on the ECB’s Effective Exchange Rate the Euro is only very fractionally over

the mean of the last two years. Over the next few weeks we feel the Euro should stabilise and form a new interim

low. Other currencies should also do something similar.

Strategy: Attempt small longs at 1.4160/1.4100; stop below 1.4000. Add to longs on a sustained break above

1.4225 for 1.4400.

Chart Levels:

Support Resistance Direction of Trade

1.4112 1.4173

1.4086 1.4182

1.4029* 1.4220*

1.4000** 1.4311

1.3900 1.4415

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

Вам также может понравиться

- World Transfer Pricing 2016Документ285 страницWorld Transfer Pricing 2016Hutapea_apynОценок пока нет

- Is Mers in Your MortgageДокумент9 страницIs Mers in Your MortgageRicharnellia-RichieRichBattiest-Collins67% (3)

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Eur-Usd-04 January 2010 DailyДокумент1 страницаEur-Usd-04 January 2010 DailyMiir ViirОценок пока нет

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 19 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- AUG-05 Mizuho Technical Analysis EUR USDДокумент1 страницаAUG-05 Mizuho Technical Analysis EUR USDMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- GBP Usd 01 19 2010Документ1 страницаGBP Usd 01 19 2010Miir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Gbp-Usd-05 January 2010 DailyДокумент1 страницаGbp-Usd-05 January 2010 DailyMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- AUG-10 Mizuho Technical Analysis GBP USDДокумент1 страницаAUG-10 Mizuho Technical Analysis GBP USDMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Technical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 04 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Esquema Prueba Viga Vpt-1aДокумент1 страницаEsquema Prueba Viga Vpt-1aVictor HerreraОценок пока нет

- Gbp-Usd-04 January 2010 DailyДокумент1 страницаGbp-Usd-04 January 2010 DailyMiir ViirОценок пока нет

- AUG-02 Mizuho Technical Analysis EUR JPYДокумент1 страницаAUG-02 Mizuho Technical Analysis EUR JPYMiir ViirОценок пока нет

- Technical Analysis 15 September 2010 JPY: CommentДокумент1 страницаTechnical Analysis 15 September 2010 JPY: CommentPlan B EconomicsОценок пока нет

- Technical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsДокумент1 страницаTechnical Analysis 05 January 2010 JPY: Comment: Strategy: Chart LevelsMiir ViirОценок пока нет

- Mizuho Corporate BankДокумент1 страницаMizuho Corporate BankMiir ViirОценок пока нет

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PДокумент1 страницаBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuОценок пока нет

- S.No Item Description Bar Description Bar Dia in MM Cut Length (M) Total Length (M) WT/M (KG) Total WT (KG) Shape No. of BarsДокумент6 страницS.No Item Description Bar Description Bar Dia in MM Cut Length (M) Total Length (M) WT/M (KG) Total WT (KG) Shape No. of BarsshailendraОценок пока нет

- AUG-10 Mizuho Technical Analysis EUR JPYДокумент1 страницаAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirОценок пока нет

- MyFXForecastsforTHURSDAY July29thДокумент2 страницыMyFXForecastsforTHURSDAY July29thapi-26441337Оценок пока нет

- AUG-04 Mizuho Technical Analysis EUR JPYДокумент1 страницаAUG-04 Mizuho Technical Analysis EUR JPYMiir ViirОценок пока нет

- MyFXForecastsforMONDAY August2ndДокумент2 страницыMyFXForecastsforMONDAY August2ndapi-26441337Оценок пока нет

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Документ7 страницBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraОценок пока нет

- ANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieДокумент1 страницаANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieSandu Denis-SorinОценок пока нет

- AUG-09 Mizuho Technical Analysis EUR JPYДокумент1 страницаAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirОценок пока нет

- Pak Maruap RevisiДокумент1 страницаPak Maruap RevisiMochamad Ridwan AfandiОценок пока нет

- Ars-Pak Maruap SilabanДокумент1 страницаArs-Pak Maruap SilabanMochamad Ridwan AfandiОценок пока нет

- MyFXForecastsforWEDNESDAY August18thДокумент2 страницыMyFXForecastsforWEDNESDAY August18thapi-26441337Оценок пока нет

- Notes: Unless Otherwise Specified Do Not Scale Drawing 5 1Документ5 страницNotes: Unless Otherwise Specified Do Not Scale Drawing 5 1AzEe StandardОценок пока нет

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewДокумент3 страницыMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337Оценок пока нет

- Mathematics SyllabusДокумент5 страницMathematics Syllabusmaya. mathОценок пока нет

- My LATESTFXForecastsfor MAY13Документ2 страницыMy LATESTFXForecastsfor MAY13api-26441337Оценок пока нет

- Instalatii EtajДокумент1 страницаInstalatii EtajOana RusuОценок пока нет

- Longines TimingДокумент6 страницLongines TimingArturo Moya BustillosОценок пока нет

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelДокумент1 страницаAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraОценок пока нет

- My Latest FXForecastsfor JULY5Документ2 страницыMy Latest FXForecastsfor JULY5api-26441337Оценок пока нет

- Secondary Connection: Accomodation Lane Landmark ExistingДокумент1 страницаSecondary Connection: Accomodation Lane Landmark ExistingEljoy C. AgsamosamОценок пока нет

- Stair 1Документ2 страницыStair 1Edan John HernandezОценок пока нет

- TV Glorietta DysonДокумент1 страницаTV Glorietta DysonJean Lindley JosonОценок пока нет

- Arquitectonico PaДокумент1 страницаArquitectonico PaPedro MárquezОценок пока нет

- AUG 11 UOB Global MarketsДокумент3 страницыAUG 11 UOB Global MarketsMiir ViirОценок пока нет

- Westpack AUG 11 Mornng ReportДокумент1 страницаWestpack AUG 11 Mornng ReportMiir ViirОценок пока нет

- AUG 11 DBS Daily Breakfast SpreadДокумент6 страницAUG 11 DBS Daily Breakfast SpreadMiir ViirОценок пока нет

- AUG 10 UOB Asian MarketsДокумент2 страницыAUG 10 UOB Asian MarketsMiir ViirОценок пока нет

- AUG 10 UOB Global MarketsДокумент3 страницыAUG 10 UOB Global MarketsMiir ViirОценок пока нет

- AUG-10 Mizuho Technical Analysis EUR JPYДокумент1 страницаAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirОценок пока нет

- AUG-10 Mizuho Technical Analysis GBP USDДокумент1 страницаAUG-10 Mizuho Technical Analysis GBP USDMiir ViirОценок пока нет

- AUG 10 Danske EMEADailyДокумент3 страницыAUG 10 Danske EMEADailyMiir ViirОценок пока нет

- AUG 10 DBS Daily Breakfast SpreadДокумент8 страницAUG 10 DBS Daily Breakfast SpreadMiir ViirОценок пока нет

- Danske Daily: Key NewsДокумент4 страницыDanske Daily: Key NewsMiir ViirОценок пока нет

- JYSKE Bank AUG 10 Corp Orates DailyДокумент2 страницыJYSKE Bank AUG 10 Corp Orates DailyMiir ViirОценок пока нет

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDДокумент5 страницMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirОценок пока нет

- AUG 10 Danske FlashCommentFOMC PreviewДокумент7 страницAUG 10 Danske FlashCommentFOMC PreviewMiir ViirОценок пока нет

- Westpack AUG 10 Mornng ReportДокумент1 страницаWestpack AUG 10 Mornng ReportMiir ViirОценок пока нет

- AUG-09 Mizuho Technical Analysis EUR JPYДокумент1 страницаAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirОценок пока нет

- AUG-09-DJ European Forex TechnicalsДокумент3 страницыAUG-09-DJ European Forex TechnicalsMiir ViirОценок пока нет

- JYSKE Bank AUG 09 Market Drivers CurrenciesДокумент5 страницJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirОценок пока нет

- ScotiaBank AUG 09 Daily FX UpdateДокумент3 страницыScotiaBank AUG 09 Daily FX UpdateMiir ViirОценок пока нет

- Jyske Bank Aug 09 em DailyДокумент5 страницJyske Bank Aug 09 em DailyMiir ViirОценок пока нет

- JYSKE Bank AUG 09 Corp Orates DailyДокумент2 страницыJYSKE Bank AUG 09 Corp Orates DailyMiir ViirОценок пока нет

- Cost & Management Accounting: Cia-IiiДокумент9 страницCost & Management Accounting: Cia-IiiARYAN GARG 19212016Оценок пока нет

- Income Tax Case List Exam Related PurposeДокумент9 страницIncome Tax Case List Exam Related PurposeShubham PhophaliaОценок пока нет

- PWB VR VUer 6 NW SG2 CДокумент5 страницPWB VR VUer 6 NW SG2 CManeendra ManthinaОценок пока нет

- Bank of Mauritius Act Amended Fa 2022Документ57 страницBank of Mauritius Act Amended Fa 2022Bhavna Devi BhoodunОценок пока нет

- Foreword: Equity Markets and Valuation Meth-OdsДокумент124 страницыForeword: Equity Markets and Valuation Meth-OdsPaul AdamОценок пока нет

- Internship Report (Rida)Документ46 страницInternship Report (Rida)Tania AliОценок пока нет

- FDIДокумент15 страницFDIpankajgaur.iabm30982% (11)

- Quotation - Hemas, SERVICE AND REPAIRS PDFДокумент2 страницыQuotation - Hemas, SERVICE AND REPAIRS PDFW GangenathОценок пока нет

- Analisis Studi Kelayakan Bisnis Pada Kelompok UsahДокумент11 страницAnalisis Studi Kelayakan Bisnis Pada Kelompok UsahPermana Bagas SatriaОценок пока нет

- Tan FinalДокумент89 страницTan FinalAjit singhОценок пока нет

- 2023 WSO IB Working Conditions SurveyДокумент46 страниц2023 WSO IB Working Conditions SurveyHaiyun ChenОценок пока нет

- Deposits Training DocumentДокумент29 страницDeposits Training DocumentKarthikaОценок пока нет

- 2023-DOA Leasing BG-SBLC CreditДокумент18 страниц2023-DOA Leasing BG-SBLC Creditelite.immo.80Оценок пока нет

- 5 Must Have Clauses in Property Sale AgreementДокумент3 страницы5 Must Have Clauses in Property Sale AgreementRajat KatyalОценок пока нет

- Appendix 1.1 (Cir1124 - 2021)Документ2 страницыAppendix 1.1 (Cir1124 - 2021)Vemula PraveenОценок пока нет

- Managerial Accounting Und Erst A DingsДокумент98 страницManagerial Accounting Und Erst A DingsDebasish PadhyОценок пока нет

- Finance Car Leasing Final ProjectДокумент21 страницаFinance Car Leasing Final ProjectShehrozAyazОценок пока нет

- Part A Answer All The Question 4 1 4Документ3 страницыPart A Answer All The Question 4 1 4jeyappradhaОценок пока нет

- An Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)Документ37 страницAn Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)samson naantongОценок пока нет

- Letter of Guarantee-Individual (1008-09-2018-05)Документ10 страницLetter of Guarantee-Individual (1008-09-2018-05)JIA YINGОценок пока нет

- SYBFM Equity Market II Session I Ver 1.1Документ80 страницSYBFM Equity Market II Session I Ver 1.111SujeetОценок пока нет

- Deliverables: Professional ExperienceДокумент1 страницаDeliverables: Professional ExperienceArjav jainОценок пока нет

- State Life Insurance Corporation of PakistanДокумент6 страницState Life Insurance Corporation of PakistanjahanloverОценок пока нет

- Redemption of Shares NotesДокумент14 страницRedemption of Shares Notesms.AhmedОценок пока нет

- RexДокумент17 страницRexErick KinotiОценок пока нет

- Accounting For Debt Srvice FundДокумент10 страницAccounting For Debt Srvice FundsenafteshomeОценок пока нет

- Ithrees's Whole Ion Finalyzed To PrintДокумент82 страницыIthrees's Whole Ion Finalyzed To PrintMohamed FayasОценок пока нет

- The Perfomance of Mutual FundДокумент125 страницThe Perfomance of Mutual Fundavinash singh50% (2)