Академический Документы

Профессиональный Документы

Культура Документы

Integrated Case Application: Part II Required (A)

Загружено:

T1shaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Integrated Case Application: Part II Required (A)

Загружено:

T1shaАвторское право:

Доступные форматы

INTEGRATED CASE APPLICATION:

PART II

REQUIRED (a):

• External User’s reliance on financial statements

Pinnacle Manufacturing is a privately held company, incurring a large amount

of debt. Since it has a high amount of debt, its financial statements would be

relied upon and used by potential users.

One of Pinnacle’s Division, Machine Tech, which engages in a variety of

machine service and repair operations, is been decided to be sold in order to

focus more on its core operations. In order to sell Machine tech, financial

statements would be extensively relied upon by potential buyers.

Moreover, in Item 4, the board of directors has decided to raise significant

amount of debt to finance the construction of the new manufacturing plant. This

would create more attention towards the financial statements.

• Likelihood of financial difficulties

Pinnacle’s second division Solar Electro incurs changing technology, thus a

more risky business then others with a chance of bankruptcy. Item 1 in the

planning activities, state about the articles concerning about the existence of

Pinnacle’s Solar Electro division.

As indicated in Item 7 in the planning activities, several restrictive

covenants were identified. Two requirements of the covenants were to keep the

current ratio above 2.0 and debt- to –equity below 1.0 at all the times. As

calculated in Part 1, the current ratio has fallen from 2.06 to 1.72. This could

result the loan to be called.

• Management integrity

Client evaluation is an important element of quality control ASA 220 Quality

Control for Audits of Historical Financial Information. When management lacks

integrity, there is a greater likelihood that material errors and irregularities

may occur in the accounting process from which the financial statements are

prepared.

Item 6 in the planning phase, indicates that there is a high turnover

especially at the higher-level position in the internal audit departments. This

turnover may be intentional and increases the risk of fraudulent financial

reporting. For example, the internal auditors who were at a higher position were

fired because the auditor found out about the managements financial interest in

the entity.

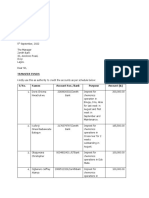

REQUIRED (b):

Item 4: Since Pinnacle Manufacturing is a risky client; the auditors have to

perform more checking of the documents, account, etc. Therefore, the audit risk

for the project will be low. As the auditors would like to be sure that all the

accounts are properly checked and verified.

Item 1: the auditors would be required to obtain sufficient appropriate evidence

in order to determine if the article is material. Therefore, the acceptable audit

risk for this project will be medium.

Item 7: Audit risk will be low since it’s a risky client, the auditors will do

more checking. As the requirements state to keep the current ratio above 2.0 (as

calculated in Part 1 its 1.72) and the Debt- to- Equity should be below 1 (0.84 as

calculated in Part 1). To maintain these requirements, the management can either

increase or decrease current assets to satisfy the criteria thus the auditors

would do more checking on these.

Item 6: Since the management is changing its internal audit personnel, new members

would take time to understand the audit environment and lack experience. While in

the process the auditor can get critical information about the company and when

it’s put forward in the meeting, the auditor gets fired.

So the audit risk would be low since the auditors would not rely on management

representation, as the figures would be high or misrepresented.

Вам также может понравиться

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19От EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Оценок пока нет

- Mock ExamДокумент4 страницыMock ExamSophie ChopraОценок пока нет

- Assignment Discussion Q Ch15 - 20-21-2Документ2 страницыAssignment Discussion Q Ch15 - 20-21-2Cheung HarveyОценок пока нет

- Outline 5 PDFДокумент6 страницOutline 5 PDFfajarОценок пока нет

- Summary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersДокумент46 страницSummary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersIQBAL MAHMUDОценок пока нет

- Pinnacle Manufacturing Part IIДокумент2 страницыPinnacle Manufacturing Part IIapugh1993100% (1)

- Praneel Nag Audit Test 2Документ4 страницыPraneel Nag Audit Test 2Praneel NagОценок пока нет

- Foreign SuppliersДокумент3 страницыForeign SuppliersShahzaib KhanОценок пока нет

- IAR Auditing ConclusionДокумент23 страницыIAR Auditing Conclusionmarlout.sarita100% (1)

- Tugas 5 (Kelompok 5)Документ9 страницTugas 5 (Kelompok 5)Silviana Ika Susanti67% (3)

- RT#2 CAF-9 AA - SolutionДокумент4 страницыRT#2 CAF-9 AA - SolutionWaseim khan Barik zaiОценок пока нет

- Chapter 09 - Answer PDFДокумент9 страницChapter 09 - Answer PDFjhienellОценок пока нет

- F8 - AA - Mock A - 202103Документ14 страницF8 - AA - Mock A - 202103Thandi MazibukoОценок пока нет

- Answers To Questions: Risk Assessment - Part IДокумент12 страницAnswers To Questions: Risk Assessment - Part IIlyn BayaniОценок пока нет

- Atv 2014 Soal PreliminaryДокумент3 страницыAtv 2014 Soal PreliminarySyahid MujahidОценок пока нет

- Suggested Solutions To Chapter 6 Discussion QuestionsДокумент8 страницSuggested Solutions To Chapter 6 Discussion QuestionsGajan SelvaОценок пока нет

- Notes Compleeting Audit and Post Audit ResponsibilitiesДокумент5 страницNotes Compleeting Audit and Post Audit ResponsibilitiesSherlock HolmesОценок пока нет

- AA - March-April-2021Документ9 страницAA - March-April-2021Towhidul IslamОценок пока нет

- M2 Quiz 2Документ11 страницM2 Quiz 2Tiến Thành NguyễnОценок пока нет

- AccaДокумент4 страницыAccaIleo AliОценок пока нет

- R25 Financial Reporting Quality IFT NotesДокумент20 страницR25 Financial Reporting Quality IFT Notesmd mehmoodОценок пока нет

- Extracted Chapter 1Документ103 страницыExtracted Chapter 1PalisthaОценок пока нет

- Tutorial 8 Q & AДокумент3 страницыTutorial 8 Q & Achunlun87Оценок пока нет

- Enterprise TechДокумент4 страницыEnterprise TechNatalie Daguiam100% (2)

- AAA Question PracticeДокумент8 страницAAA Question PracticenishantsayshiОценок пока нет

- Tutorial 3-Audit Risk and Materiality MCQДокумент10 страницTutorial 3-Audit Risk and Materiality MCQcynthiama7777Оценок пока нет

- Quizzes and ExamДокумент194 страницыQuizzes and ExamAngelica PostreОценок пока нет

- M2 Quiz 1Документ6 страницM2 Quiz 1Tiến Thành NguyễnОценок пока нет

- AUDIT AND ASSURANCE - ND-2021 - Suggested AnswersДокумент12 страницAUDIT AND ASSURANCE - ND-2021 - Suggested AnswersMehedi Hasan TouhidОценок пока нет

- ACCA - Audit and Assurance (AA) - September Mock Exam - Answers - 2019Документ20 страницACCA - Audit and Assurance (AA) - September Mock Exam - Answers - 2019Amir ArifОценок пока нет

- Role of Central Statutory Auditor's in A Bank Audit With Special Reference To Core Banking EnvironmentДокумент6 страницRole of Central Statutory Auditor's in A Bank Audit With Special Reference To Core Banking EnvironmentBhaskara Krishna SvsОценок пока нет

- Chapter FiveДокумент14 страницChapter Fivemubarek oumerОценок пока нет

- M2-Acceptance and Risk AssessmentДокумент10 страницM2-Acceptance and Risk AssessmentSanjay PradhanОценок пока нет

- EraInfo Management ReportДокумент12 страницEraInfo Management ReportAnis Bin BadshaОценок пока нет

- BP2313 Audit With Answers)Документ44 страницыBP2313 Audit With Answers)hodgl1976100% (4)

- Key Audit Matters v2Документ6 страницKey Audit Matters v2Aditya Kumar SОценок пока нет

- 15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnДокумент4 страницы15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnSomething ChicОценок пока нет

- Week 3 Discussion Questions and AnswersДокумент6 страницWeek 3 Discussion Questions and AnswersElaine LimОценок пока нет

- Audit Planning and Materiality: Concept Checks P. 209Документ37 страницAudit Planning and Materiality: Concept Checks P. 209hsingting yuОценок пока нет

- Sarboox ScooterДокумент6 страницSarboox ScooterNisa SuriantoОценок пока нет

- Audit and Assurance: Page 1 of 7Документ7 страницAudit and Assurance: Page 1 of 7online lecturesОценок пока нет

- Audit & Assurance: Suggested AnswersДокумент9 страницAudit & Assurance: Suggested AnswersMuhammad HussainОценок пока нет

- Assignmnet 2Документ4 страницыAssignmnet 2chrislupinjrОценок пока нет

- Chapter 5 SДокумент5 страницChapter 5 SSteward LauОценок пока нет

- SMChap 006Документ25 страницSMChap 006yasminemagdi3Оценок пока нет

- Jawaban UTS Auditing IДокумент7 страницJawaban UTS Auditing IInsos Putri Agustina SimanjuntakОценок пока нет

- Auditor Reporting - ACCA GlobalДокумент7 страницAuditor Reporting - ACCA GlobalStavri Makri SmirilliОценок пока нет

- Group Assignment FA1Документ23 страницыGroup Assignment FA1Kieu Cam AnhОценок пока нет

- Auditing and Assurance Services 15th Edition Chapter 3 Homework AnswersДокумент5 страницAuditing and Assurance Services 15th Edition Chapter 3 Homework AnswersPenghui Shi50% (2)

- Acct3044 Final AssignmentДокумент8 страницAcct3044 Final Assignmentkarupa maharajОценок пока нет

- Chapter 8 Completing AuditДокумент6 страницChapter 8 Completing AuditDawit WorkuОценок пока нет

- Full Download Solution Manual For Loose Leaf For Auditing Assurance Services A Systematic Approach 11th Ed Edition PDF Full ChapterДокумент36 страницFull Download Solution Manual For Loose Leaf For Auditing Assurance Services A Systematic Approach 11th Ed Edition PDF Full Chapterhabiletisane1y8k100% (17)

- Solution Manual For Loose Leaf For Auditing Assurance Services A Systematic Approach 11th Ed EditionДокумент36 страницSolution Manual For Loose Leaf For Auditing Assurance Services A Systematic Approach 11th Ed Editionmispend.underage.35dxno100% (38)

- Johnson Medical Case - CPA Core 1Документ5 страницJohnson Medical Case - CPA Core 1bushrasaleem5699Оценок пока нет

- Acctg 16a - Midterm ExamДокумент6 страницAcctg 16a - Midterm ExamChriestal SorianoОценок пока нет

- Certified Expert in Credit Management (CECM)Документ6 страницCertified Expert in Credit Management (CECM)Moutushi ShantaОценок пока нет

- Acca F 8 L3Документ20 страницAcca F 8 L3Fahmi AbdullaОценок пока нет

- Ch4 RisksandMaterialityДокумент10 страницCh4 RisksandMaterialityAnan BasОценок пока нет

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsОт EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsОценок пока нет

- Exercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalДокумент9 страницExercise 5.1: A Werribee Office Cleaners: Cash Receipts JournalDoan Chan PhongОценок пока нет

- Allowable DeductionsДокумент16 страницAllowable DeductionsChyna Bee SasingОценок пока нет

- Las Week 2 EntrepДокумент4 страницыLas Week 2 EntrepJoseph L BacalaОценок пока нет

- Intro To Equinix - IR - Presentation Q3 23 10.29.2023Документ46 страницIntro To Equinix - IR - Presentation Q3 23 10.29.2023alexcmorton2Оценок пока нет

- Airlines' Loyalty ProgramsДокумент1 страницаAirlines' Loyalty ProgramsMaria SmithОценок пока нет

- Mustika RatuДокумент8 страницMustika RatuddОценок пока нет

- Difference Between A Startup, Small Business, and Large CorporationДокумент2 страницыDifference Between A Startup, Small Business, and Large CorporationImene BentahaОценок пока нет

- 2 Human Resource Management PlanningДокумент13 страниц2 Human Resource Management PlanningArwa OumaОценок пока нет

- Effective Supply Chain ManagementДокумент20 страницEffective Supply Chain ManagementZeusОценок пока нет

- Islamic Marketing (Ecie603011)Документ6 страницIslamic Marketing (Ecie603011)Hanny Fitri HalimahОценок пока нет

- Aastha Nema - Quaker OatsДокумент14 страницAastha Nema - Quaker OatsAastha NemaОценок пока нет

- Factor Markets and Income Distribution: Presented By: Sbac-1CДокумент45 страницFactor Markets and Income Distribution: Presented By: Sbac-1CHartin StylesОценок пока нет

- Job Advert - ServicemanДокумент2 страницыJob Advert - ServicemanJoseph buluguОценок пока нет

- Stellarleack Business PlanДокумент14 страницStellarleack Business Planleackyotieno4Оценок пока нет

- Lab Assisst InstructionsДокумент7 страницLab Assisst InstructionsOlumideОценок пока нет

- Corporatepdf06 PDFДокумент3 страницыCorporatepdf06 PDFswathi aradhyaОценок пока нет

- Pardot User Sync Implementation GuideДокумент12 страницPardot User Sync Implementation GuidenethriОценок пока нет

- Analysis 4Документ1 страницаAnalysis 4Axiel Jay DanipogОценок пока нет

- Session 1: Introduction To Sales ManagementДокумент27 страницSession 1: Introduction To Sales ManagementHòa MinhОценок пока нет

- Topic 3 - Tutorial Question - Contract - Part - AДокумент2 страницыTopic 3 - Tutorial Question - Contract - Part - AYuenОценок пока нет

- ESG V3 SyllabusДокумент12 страницESG V3 SyllabusAaronОценок пока нет

- Maaden MSHEM Safety Documents 8Документ143 страницыMaaden MSHEM Safety Documents 8ShadifОценок пока нет

- Request For Proposal Construction & Phase 1 OperationДокумент116 страницRequest For Proposal Construction & Phase 1 Operationsobhi100% (2)

- Get Free Google AdsДокумент18 страницGet Free Google AdsFrance JosephОценок пока нет

- What Is A SWOT AnalysisДокумент23 страницыWhat Is A SWOT AnalysisvssОценок пока нет

- Ijmra PSS881Документ17 страницIjmra PSS881Prakash VadavadagiОценок пока нет

- BTBU - Study PlanДокумент3 страницыBTBU - Study PlanclaraОценок пока нет

- Statement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionДокумент43 страницыStatement of Cash Flows: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasОценок пока нет

- The Champion Legal Ads: 10-14-21Документ48 страницThe Champion Legal Ads: 10-14-21Donna S. SeayОценок пока нет

- Tata Hitachi Construction MachДокумент18 страницTata Hitachi Construction Machmahesh.werulkar 2307016Оценок пока нет