Академический Документы

Профессиональный Документы

Культура Документы

Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs Fall

Загружено:

Aviva GroupОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs Fall

Загружено:

Aviva GroupАвторское право:

Доступные форматы

News release

Embargoed: 00:01 hrs Thursday April 2, 2015

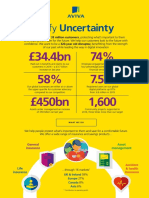

INFLATION DROP GIVES OVER-55s AN EXTRA 1,032 A YEAR IN

DISPOSABLE INCOME AS ESSENTIAL COSTS FALL

Standard of living improves for the over-55s as they have more disposable income

Over-55s are better off by 86 a month

Spending on essentials is down by 7% year-on-year while average incomes have

risen by 3%

Extra disposable income has boosted monthly savings by 22% and cut unsecured

borrowing

24% say that ill-health worries them the most about ageing

Falling inflation has given over-55s back their financial freedom and boosted saving

habits as essential spending has fallen by 7% in a year, according to research from

Aviva.

UK inflation reached a 15 year low of 0.5% in December, driving down over-55s outlay

on basics such as food and utilities. At the same time, Avivas Real Retirement research

(Q4 2014) shows the average income among over-55s experienced a 3% annual uplift.

Yearly disposable income has risen by 1,032 (6%) since Q4 2013 and by 1,440 (9%)

compared to Q4 2011. This has led to a significant rise in over-55s standard of living and

helped to boost savings, as well as reduce unsecured debt.

Standard of living rises as over-55s gain an extra 86 in monthly disposable

income

In Q4 2014, over-55s received an average of 1,924 in monthly income - a 3% increase

year-on-year and a rise of 8% since 2011.

/mfs

INFLATION DROP GIVES OVER-55s AN EXTRA 1,032 A YEAR

PAGE 2 OF 5

While average incomes have risen, over-55s monthly expenditure on essentials

(incorporating food, housing, utilities and transport) has fallen from 460 in Q4 2013 to

427, resulting in monthly savings of 33 (or 396 per year).

This has been driven by a fall in spending on food. Over-55s average monthly food bill

reached a record high of 210 in Q4 2013: since then, it has fallen to 196, suggesting

over-55s are seeing the benefits of falling food prices.*

Avivas research uses disposable income (the difference between income and essential

expenditure) as a measure for standard of living. It shows over-55s had an average of

1,496 in monthly disposable income in Q4 2014: a rise of 6% year-on-year and 9%

higher than Q4 2011s figure of 1,376.

Over-55s now have an additional 86 in monthly disposable income compared to last

year, adding up to an extra 1,032 per year. Compared with Q4 2011, their disposable

income has risen by 120 a month or 1,440 annually.

Table 1: Over-55s average monthly income, essentials expenditure and disposable

income

Average monthly

income (mean)

Average monthly

essential expenditure

(mean)

Average monthly

disposable income

(mean)

Q4 2014

1,924

427

1,496

Q3 2014

1,895

416

1,479

Q4 2013

1,870

460

1,410

Q4 2011

1,787

410

1,376

Annual change

54 (3%)

-33 (-7%)

86 (6%)

Three year

change

137 (8%)

17 (4%)

120 (9%)

Note: All numbers are rounded to nearest 1

Over-55s use boost in spending power to tackle debt and increase savings pots

This boost in disposable income has given over-55s the confidence to spend more on

luxury items and recreation. Monthly spending on entertainment, holidays and recreation

has risen steadily since Q4 2011, when the average monthly spend was just 59. This

rose to 63 in Q4 2013 and increased by an additional 14% to 72 per month in Q4 2014.

/mfs

INFLATION DROP GIVES OVER-55s AN EXTRA 1,032 A YEAR

PAGE 3 OF 5

However, over-55s are also using their improved financial freedom to reduce their debts

and grow their savings pots. Average monthly savings stood at 214 in Q4 2014: an

increase of 39 (22%) year-on-year from 175 in Q4 2013 and 80 (60%) increase from

134 in Q4 2011.

At the same time, over-55s unsecured debt has fallen significantly since 2011 as they

have found more income at their disposal. The average debt has dropped from 2,812 in

Q4 2011 to 1,527 in Q4 2014: a 46% reduction. In the past year alone, over-55s have

successfully reduced their average unsecured debt by 10% (down from 1,703 in Q4

2013).

The amount owed on credit cards has decreased significantly, almost halving from

1,033 in Q4 2011 to 551 in Q4 2014. In the past year over-55s have cut their credit

card debt by 23% from 713 in Q4 2013.

Table 2: Average total debt and savings among over-55s

Average monthly savings

(mean)

Average unsecured debt

among over-55s (mean)

Q4 2014

214

1,527

Q3 2014

196

1,697

Q4 2013

175

1,703

Q4 2011

134

2,812

Annual change

39 (22%)

-176 (-10%)

Three year change

80 (60%)

-1,285 (-46%)

Despite improving finances, concerns over the cost of care soar

With over-55s standard of living improving significantly over the past year and inflation

falling to new lows, 52% still see the rising cost of living as a threat to their finances in the

next five years, but is down from 76% a year ago (Q4 2013).

However, concerns over the cost of care in old age have soared in the past year. Only

4% of over-55s saw the need to pay for care for themselves or their partner as a threat to

their finances in Q4 2013, virtually unchanged from Q4 2011 (2%).

But since 2013, fears about the cost of care have spiralled, with 19% of over-55s citing

this as a threat in Q4 2014.

/mfs

INFLATION DROP GIVES OVER-55s AN EXTRA 1,032 A YEAR

PAGE 4 OF 5

These financial worries are clearly rooted in peoples general concerns about the healthrelated aspects of growing older. A quarter of over-55s (24%) say that ill-health worries

them the most about ageing, while 23% are most concerned about losing their mental

faculties, for example through dementia. Over one in ten (12%) worry most about being

dependent on other people.

Clive Bolton, Avivas managing director of retirement solutions, said:

The rise in disposable income is a welcome sign that over-55s standard of living is on

the up. It is a testament to their resilience and adaptability that they have come through

the recession in such a strong position. After years of cutting back and struggling to make

ends meet, their financial circumstances are clearly improving and they are finding more

breathing space from month to month. This extra freedom is helping them to reduce their

debts and increase their savings pots, two habits that will stand them in good stead

during retirement.

Planning ahead is the best way for over-55s to arm themselves against any unexpected

costs in retirement. It is never too early to start building up a healthy savings pot, and

whittling away any debts will help to free up extra funds in retirement. If and when

inflation rises, careful planning will help to ensure more people can take this in their

stride.

-ENDS-

* The Office of National Statistics Consumer Prices Index shows there was a 1.9% fall in food

prices in the year to December 2014

If you are a journalist and would like further information, please contact:

Aviva Press Office: Diane Mangan: 07800 691 714 or diane.mangan@aviva.co.uk

The Wriglesworth Consultancy: Andy Lane or Rachel Morrod: 0207 427 1400 or

aviva@wriglesworth.com

Methodology:

The Real Retirement research series is produced by Aviva and ICM Unlimited. The Q4 2014

findings involve 1,197 UK consumers aged over 55, with 21,597 in total having contributed to the

research since February 2010. Wherever possible, the same data parameters have been used for

analysis for the duration of the series, but some additions or changes have been made as other

tracking topics become apparent.

/mfs

INFLATION DROP GIVES OVER-55s AN EXTRA 1,032 A YEAR

PAGE 5 OF 5

Notes to editors:

Aviva provides 29 million customers with insurance, savings and investment products.

We are one of the UKs leading insurers and one of Europes leading providers of life and

general insurance. Our shares are listed on the London Stock Exchange and we are a

member of the FTSE100 index.

We have operations in 16 countries and provide life, general and health insurance and asset

management under our well recognised brand.

We are committed to serving our customers well in order to build a stronger, sustainable

business, which makes a positive contribution to society, and for which our people are proud

to work.

The Aviva media centre at www.aviva.com/media/ includes images, company and product

information and a news release archive

For an interactive introduction to what we do and how we do it, please click here

http://www.aviva.com/library/reports/this-is-aviva/

For broadcast-standard video, please visit http://www.aviva.com/media/video/

Follow us on twitter: www.twitter.com/avivaplc/

Вам также может понравиться

- Aviva 2018 Interim Results AnnouncementДокумент10 страницAviva 2018 Interim Results AnnouncementAviva GroupОценок пока нет

- Aviva PLC 2016 Results InfographicДокумент2 страницыAviva PLC 2016 Results InfographicAviva GroupОценок пока нет

- Aviva 2018 Key Metrics InfographicДокумент1 страницаAviva 2018 Key Metrics InfographicAviva GroupОценок пока нет

- Aviva PLC - at A Glance March 2018Документ2 страницыAviva PLC - at A Glance March 2018Aviva GroupОценок пока нет

- Aviva 2017 Interim Results Analyst PresentationДокумент64 страницыAviva 2017 Interim Results Analyst PresentationAviva GroupОценок пока нет

- Aviva HY16 Results Summary - InfographicДокумент1 страницаAviva HY16 Results Summary - InfographicAviva GroupОценок пока нет

- Aviva 2017 Interim Results AnnouncementДокумент131 страницаAviva 2017 Interim Results AnnouncementAviva GroupОценок пока нет

- 2017 Preliminary Results AnnouncementДокумент143 страницы2017 Preliminary Results AnnouncementAviva GroupОценок пока нет

- Aviva PLC Capital Markets DayДокумент2 страницыAviva PLC Capital Markets DayAviva GroupОценок пока нет

- Enabling Europe To Compete in The Global World of FinTechДокумент2 страницыEnabling Europe To Compete in The Global World of FinTechAviva GroupОценок пока нет

- Aviva PLC 2016 ResultsДокумент71 страницаAviva PLC 2016 ResultsAviva GroupОценок пока нет

- 2015 Half Year Results Interview With Group CEO Mark WilsonДокумент4 страницы2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupОценок пока нет

- Aviva PLC 2016 Interims Results AnnouncementДокумент127 страницAviva PLC 2016 Interims Results AnnouncementAviva GroupОценок пока нет

- Aviva at A Glance InfographicДокумент2 страницыAviva at A Glance InfographicAviva GroupОценок пока нет

- Aviva 2015 Results InfographicДокумент1 страницаAviva 2015 Results InfographicAviva GroupОценок пока нет

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptДокумент4 страницыMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupОценок пока нет

- Aviva 2015 Preliminary AnnouncementДокумент10 страницAviva 2015 Preliminary AnnouncementAviva GroupОценок пока нет

- What Are We in Business For? Being A Good AncestorДокумент22 страницыWhat Are We in Business For? Being A Good AncestorAviva GroupОценок пока нет

- Aviva 2015 Full Year Results TranscriptДокумент3 страницыAviva 2015 Full Year Results TranscriptAviva GroupОценок пока нет

- Aviva Half Year 2015 AnnouncementДокумент163 страницыAviva Half Year 2015 AnnouncementAviva GroupОценок пока нет

- Aviva Half Year 2015 Analyst PresentationДокумент30 страницAviva Half Year 2015 Analyst PresentationAviva GroupОценок пока нет

- Aviva Q1 IMS 2015 PDFДокумент17 страницAviva Q1 IMS 2015 PDFAviva GroupОценок пока нет

- Aviva Q1 IMS 2015 PDFДокумент17 страницAviva Q1 IMS 2015 PDFAviva GroupОценок пока нет

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsДокумент4 страницыAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupОценок пока нет

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonДокумент7 страниц2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupОценок пока нет

- Aviva 2014 Results PresentationДокумент26 страницAviva 2014 Results PresentationAviva GroupОценок пока нет

- Aviva PLC 2014 Preliminary Results AnnouncementДокумент9 страницAviva PLC 2014 Preliminary Results AnnouncementAviva GroupОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)