Академический Документы

Профессиональный Документы

Культура Документы

Cash Accounts Receivable Prepaid Expenses Inventories Equipment Buildings Land Intangibles

Загружено:

kiubiuИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cash Accounts Receivable Prepaid Expenses Inventories Equipment Buildings Land Intangibles

Загружено:

kiubiuАвторское право:

Доступные форматы

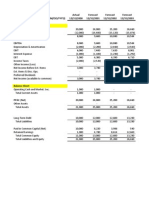

BALANCE SHEET

BALANCE SHEET

COMMON SIZED

GROWT

H RATE

Dec 31st, Dec 31st,

2013

2012

Dec 31st, Dec 31st,

2013

2012

YOY

Cash

550

100

11.0%

2.1%

450.0%

Accounts receivable

200

250

4.0%

5.2%

-20.0%

50

1.0%

0.0%

Inventories

400

250

8.0%

5.2%

60.0%

Current Assets

1,200

600

24.0%

12.5%

100.0%

Equipment

2,000

2,200

40.0%

45.8%

-9.1%

Buildings

1,000

1,200

20.0%

25.0%

-16.7%

Land

600

600

12.0%

12.5%

0.0%

Intangibles

200

200

4.0%

4.2%

0.0%

3,800

4,200

76.0%

87.5%

-9.5%

5,000

4,800

100.0% 100.0%

4.2%

Accounts payable

150

200

3.0%

4.2%

-25.0%

Unearned revenue

200

4.0%

0.0%

Current Liabilities

350

200

7.0%

4.2%

75.0%

1,000

800

20.0%

16.7%

25.0%

350

1,000

7.0%

20.8%

-65.0%

Non-current Liabilities

1,350

1,800

27.0%

37.5%

-25.0%

LIABILITIES

1,700

2,000

34.0%

41.7%

-15.0%

2,500

2,500

50.0%

52.1%

0.0%

800

300

16.0%

6.3%

166.7%

3,300

2,800

66.0%

58.3%

17.9%

5,000

4,800

100.0% 100.0%

4.2%

Prepaid expenses

Non-current Assets

ASSETS

Bank loans

Bonds payable

Contributed capital

Retained earnings

OWNERS's EQUITY

LIABILITIES + OWNERS's

EQUITY

INCOME STATEMENT

FIN

INCOME

STATEMENT

COMMON SIZED

GROWTH

RATE

Dec 31st, Dec 31st,

2013

2012

Dec 31st, Dec 31st,

2013

2012

YOY

Sales Revenue

6,000

5,000

86%

100%

20.0%

Services Revenue

1,000

14%

0%

7,000

5,000

100%

100%

40.0%

(2,000)

(1,500)

-29%

-30%

33.3%

5,000

3,500

71%

70%

42.9%

(3,000)

(2,000)

-43%

-40%

50.0%

Advertising expenses

(400)

(200)

-6%

-4%

100.0%

Insurance

(200)

-3%

0%

1,400

1,300

20%

26%

7.7%

(400)

(500)

-6%

-10%

-20.0%

1,000

800

14%

16%

25.0%

Interest Revenue

50

1%

0%

Interest Expenses

(150)

(200)

-2%

-4%

-25.0%

900

600

13%

12%

50.0%

(225)

(150)

-3%

-3%

50.0%

675

450

10%

9%

50.0%

1,000

1,000

10

11,350

9,800

175

150

2,000

1,500

Total Revenues

Cost of Goods Sold

Gross Profit

Wages

EBITDA

Depreciation

EBIT

EBT

Income Tax expenses

Net Income

Number of Outstanding Shares

Market price per share

Enterprise Value

Total dividends

Purchases

FINANTIAL RATIOS

Measures

Dec 31st, Dec 31st,

2013

2012

Current Ratio

3.43

3.00

Quick Ratio

2.29

1.75

Cash Ratio

1.57

0.50

Net Working Capital

850

400

Debt-to-Equity Ratio

0.52

0.71

Debt-to-Assets Ratio

0.34

0.42

Financial Leverage ratio

1.52

1.71

Short term debt weight on total Debt

21%

10%

Long term debt weight on total Debt

79%

90%

Interest coverage ratio (using EBIT)

6.67

4.00

Interest coverage ratio (using EBITDA)

9.33

6.50

Total Assets Turnover

1.40

1.04

Fixed Assets Turnover

1.84

1.19

Inventory Turnover

6.15

12.00

Days to Sell inventory

58.50

30.00

Average collection period

11.57

9.00

Average payment period

31.50

24.00

Operating Cycle

70.07

39.00

Cash Conversion Cycle

38.57

15.00

Earnings per share

0.68

0.45

Price-earnings ratio

14.81

17.78

Book value per share

3.30

2.80

Price-to-book ratio

3.03

2.86

Dividends per share

0.18

0.15

Payout ratio

26%

33%

Retention ratio

74%

67%

57.14

53.33

EBITDA Multiple

8.11

7.54

Sales Multiple

1.62

1.96

Degree of Operating Leverage

5.00

4.38

Degree of Financial Leverage

1.11

1.33

Degree of Combined Leverage

5.56

5.83

Tax burden

75%

75%

Return on Sales (using Net Income)

9.6%

9.0%

Price-dividends ratio

Return on Assets (using Net Income)

13.5%

9.4%

Return on Equity (using Net Income)

20.5%

16.1%

Вам также может понравиться

- Wall Street Prep DCF Financial ModelingДокумент7 страницWall Street Prep DCF Financial ModelingJack Jacinto100% (1)

- Business ValuationДокумент2 страницыBusiness Valuationahmed HOSNYОценок пока нет

- CA Excel .Problem - Set A.BДокумент65 страницCA Excel .Problem - Set A.BStephen McSweeneyОценок пока нет

- AnandamДокумент12 страницAnandamNarinderОценок пока нет

- Financial Model Forecasting - Case StudyДокумент15 страницFinancial Model Forecasting - Case Study唐鹏飞Оценок пока нет

- Business ValuationДокумент2 страницыBusiness Valuationjrcoronel100% (1)

- The Discounted Free Cash Flow Model For A Complete BusinessДокумент2 страницыThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCОценок пока нет

- Polar Sports, Inc SpreadsheetДокумент19 страницPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Consolidated Income and Cash Flow StatementsДокумент30 страницConsolidated Income and Cash Flow StatementsrooptejaОценок пока нет

- Financial Statement Analysis and InterpretationДокумент69 страницFinancial Statement Analysis and InterpretationCharisa ProvidoОценок пока нет

- Revenue vs Expense Financial Analysis 2004-2013Документ6 страницRevenue vs Expense Financial Analysis 2004-2013Iwan SaputraОценок пока нет

- Financial Statements of SBC 1.1Документ29 страницFinancial Statements of SBC 1.1charnysayonОценок пока нет

- Common-Size FSДокумент4 страницыCommon-Size FSRussia CortesОценок пока нет

- 5-Year Income Projection for Access-so-realДокумент2 страницы5-Year Income Projection for Access-so-realKamille SumaoangОценок пока нет

- Financial Statement AnalysisДокумент55 страницFinancial Statement AnalysisHassanОценок пока нет

- Floxin FinalДокумент2 страницыFloxin FinalAnsari Ahtesham AhmedОценок пока нет

- Ebit EBT Net IncomeДокумент3 страницыEbit EBT Net IncomeKhaleedd MugeebОценок пока нет

- Horizontal and Vertical ActivityДокумент4 страницыHorizontal and Vertical ActivityKarlla ManalastasОценок пока нет

- Horizontal and Vertical AnalysisДокумент4 страницыHorizontal and Vertical AnalysisJasmine ActaОценок пока нет

- GoooooodДокумент4 страницыGoooooodIan RelacionОценок пока нет

- Forever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecemberДокумент4 страницыForever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecembermwauracoletОценок пока нет

- ASghar Ali OD Final ProjectДокумент10 страницASghar Ali OD Final ProjectAbdul HadiОценок пока нет

- Six Years Financial SummaryДокумент133 страницыSix Years Financial Summarywaqas_haider_1Оценок пока нет

- The Discounted Free Cash Flow Model For A Complete BusinessДокумент2 страницыThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BОценок пока нет

- MAS Prob3Документ2 страницыMAS Prob3Mary Grace Vhincelle DeeОценок пока нет

- Cosmopolitan Café Projected FinancialsДокумент6 страницCosmopolitan Café Projected Financialsmohd_shaarОценок пока нет

- Common Size Statement, Comparative Balance SheetДокумент5 страницCommon Size Statement, Comparative Balance SheetshubhcplОценок пока нет

- Knickknac: Cah Is A Big and Multidivisional Company, Working in The Furnishing Sector. The Company'SДокумент2 страницыKnickknac: Cah Is A Big and Multidivisional Company, Working in The Furnishing Sector. The Company'SAkanksha SinghОценок пока нет

- Chloe's ClosetДокумент17 страницChloe's ClosetCheeze cake100% (1)

- Class 2Документ2 страницыClass 2abdul.fattaahbakhsh29Оценок пока нет

- GMM Australia Financial Statement Audit 2018-19 Variance AnalysisДокумент15 страницGMM Australia Financial Statement Audit 2018-19 Variance AnalysislibinОценок пока нет

- FS Analysis PT 2 - AssignmentДокумент13 страницFS Analysis PT 2 - AssignmentKim Patrick VictoriaОценок пока нет

- Shares at Discount With Good RoreДокумент17 страницShares at Discount With Good Roreapi-230818227Оценок пока нет

- WBS WPL PT Palu GadaДокумент10 страницWBS WPL PT Palu GadaLucky AristioОценок пока нет

- Akuntansi Keuangan Lanjutan: Laba Atas Transaksi Antarperusahaan - Persediaan P5-6 DAN P5-7Документ5 страницAkuntansi Keuangan Lanjutan: Laba Atas Transaksi Antarperusahaan - Persediaan P5-6 DAN P5-7doniОценок пока нет

- Daily Revenue For The Month of August, 2012Документ8 страницDaily Revenue For The Month of August, 2012amnahaider11111Оценок пока нет

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Документ9 страницMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruОценок пока нет

- fmДокумент6 страницfmdikshapatil6789Оценок пока нет

- Horizontal & Tend Analysis of The Financial StatementsДокумент3 страницыHorizontal & Tend Analysis of The Financial StatementsumeshОценок пока нет

- Indicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Документ24 страницыIndicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Ved Prakash GiriОценок пока нет

- MS Excel Exercise - FS AnalysisДокумент12 страницMS Excel Exercise - FS Analysispaxbass5Оценок пока нет

- City of Maumelle City-Wide Revenue & Expenditures Summary: General FundДокумент1 страницаCity of Maumelle City-Wide Revenue & Expenditures Summary: General FundPreston LewisОценок пока нет

- CH 3-11Документ18 страницCH 3-11api-281685551100% (1)

- II Fiscal PositionДокумент5 страницII Fiscal PositionApril Mae DensingОценок пока нет

- 4 ModelДокумент3 страницы4 ModelnrellasОценок пока нет

- I Practice of Horizontal & Verticle Analysis Activity IДокумент3 страницыI Practice of Horizontal & Verticle Analysis Activity IZarish AzharОценок пока нет

- I Practice of Horizontal & Verticle Analysis Activity IДокумент3 страницыI Practice of Horizontal & Verticle Analysis Activity IZarish AzharОценок пока нет

- Tri-Star Company Financial Statement AnalysisДокумент10 страницTri-Star Company Financial Statement AnalysisJuliana Angela VillanuevaОценок пока нет

- CAP2 EstadosFinancieros2014Документ17 страницCAP2 EstadosFinancieros2014LuisAlonzoОценок пока нет

- Cortez Exam in Business FinanceДокумент4 страницыCortez Exam in Business FinanceFranchesca CortezОценок пока нет

- Common Size Income StatementДокумент7 страницCommon Size Income StatementUSD 654Оценок пока нет

- Analysis and Interpretation of FS-Part 1Документ2 страницыAnalysis and Interpretation of FS-Part 1Rhea RamirezОценок пока нет

- INR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.0Документ7 страницINR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.057 - Lakshita TanwaniОценок пока нет

- Copia de TAREA en Clases cppcWACCДокумент12 страницCopia de TAREA en Clases cppcWACCluixus89 prroОценок пока нет

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsОт EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsРейтинг: 2 из 5 звезд2/5 (2)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- Glass & Glass Products World Summary: Market Values & Financials by CountryОт EverandGlass & Glass Products World Summary: Market Values & Financials by CountryОценок пока нет

- Convenience Store Revenues World Summary: Market Values & Financials by CountryОт EverandConvenience Store Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Folha TesteДокумент2 страницыFolha TestekiubiuОценок пока нет

- Formula Sheet: G A G J N J NДокумент1 страницаFormula Sheet: G A G J N J NkiubiuОценок пока нет

- Adelphia Questions Case Study AnalysisДокумент1 страницаAdelphia Questions Case Study AnalysiskiubiuОценок пока нет

- TakeoversДокумент27 страницTakeoverskiubiuОценок пока нет

- TakeoversДокумент27 страницTakeoverskiubiuОценок пока нет

- Formula Sheet: G A G J N J NДокумент1 страницаFormula Sheet: G A G J N J NkiubiuОценок пока нет

- Formula Sheet: G A G J N J NДокумент1 страницаFormula Sheet: G A G J N J NkiubiuОценок пока нет

- Formula SheetДокумент1 страницаFormula SheetkiubiuОценок пока нет

- Slides Session 1Документ48 страницSlides Session 1kiubiuОценок пока нет

- Hertz LBO Questions for Potential BuyersДокумент1 страницаHertz LBO Questions for Potential BuyerskiubiuОценок пока нет

- 3rd PartiesДокумент63 страницы3rd PartieskiubiuОценок пока нет